Regarding the legitimacy of BRILLIANT PRECIOUS METALS forex brokers, it provides HKGX and WikiBit, (also has a graphic survey regarding security).

Is BRILLIANT PRECIOUS METALS safe?

Business

License

Is BRILLIANT PRECIOUS METALS markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

UnverifiedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

皇御貴金屬有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.bib79.comExpiration Time:

--Address of Licensed Institution:

九龍佐敦庇利金街8號百利金商業中心25樓2501室Phone Number of Licensed Institution:

35792688Licensed Institution Certified Documents:

Is Brilliant Precious Metals Safe or a Scam?

Introduction

Brilliant Precious Metals is a forex broker that positions itself within the precious metals trading market, primarily focusing on gold and silver. As the allure of trading precious metals grows, traders need to be cautious in evaluating the credibility of brokers like Brilliant Precious Metals. The potential for scams in the forex market is significant, making it essential for traders to conduct thorough research before committing their funds. This article investigates the safety and legitimacy of Brilliant Precious Metals by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks.

Regulation and Legitimacy

The regulatory environment is a critical factor in determining whether a broker is safe for trading. Brilliant Precious Metals claims to be licensed by the China Hong Kong Gold and Silver Exchange Society (CGSE). However, there are concerns regarding the legitimacy of this regulation, with reports suggesting that it may be a clone or counterfeit. The following table summarizes the core regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CGSE | 079 | Hong Kong | Suspicious Clone |

The quality of regulation is paramount, as it provides a safety net for traders. A well-regulated broker is subject to strict oversight, ensuring compliance with industry standards. Unfortunately, the claims made by Brilliant Precious Metals regarding its regulatory status raise red flags. Users have reported difficulties in withdrawing funds, which is often a sign of fraudulent activity. Therefore, it is crucial for potential investors to consider these concerns when evaluating if Brilliant Precious Metals is safe.

Company Background Investigation

Brilliant Precious Metals has been operational for approximately 5 to 10 years, but details about its ownership structure and management team are scarce. A transparent company should provide clear information about its history, ownership, and the backgrounds of its management team. This lack of transparency can be a warning sign for potential investors.

The absence of publicly available information regarding the qualifications and experience of the management team further complicates the assessment of the broker's legitimacy. In a market where trust is essential, the inability to verify the credentials of those running the firm can lead to skepticism. Ultimately, a company with a solid track record and transparent operations is more likely to be trustworthy. Therefore, the opacity surrounding Brilliant Precious Metals raises questions about whether Brilliant Precious Metals is safe for traders.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a traders experience and profitability. Brilliant Precious Metals claims to offer competitive spreads and various trading options. However, it is essential to scrutinize the fee structure and any unusual charges that may apply. The following table compares the core trading costs associated with Brilliant Precious Metals against industry averages:

| Fee Type | Brilliant Precious Metals | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.5 pips | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | 1.75% buy / 0.15% sell | 1.5% - 2.0% |

While the spreads offered appear competitive, the lack of clarity regarding commission structures raises concerns. Traders should be wary of hidden fees that could erode their profits. Moreover, the reported difficulties in withdrawing funds may indicate that the broker employs restrictive practices that could further complicate trading conditions. Therefore, potential clients should carefully consider whether Brilliant Precious Metals is safe based on these trading conditions.

Client Fund Security

The safety of client funds is paramount when evaluating a broker's reliability. Brilliant Precious Metals claims to implement various measures to protect client funds, such as segregated accounts and strict confidentiality protocols. However, the effectiveness of these measures remains questionable given the broker's regulatory status and user reports of funds being frozen or inaccessible.

Historically, there have been instances of traders experiencing issues with fund withdrawals, which raises concerns about the broker's commitment to safeguarding client assets. It is vital for traders to ensure that their funds are secure and that the broker has a robust system in place for fund protection. Without a solid track record in this area, potential clients may find it challenging to trust that Brilliant Precious Metals is safe for their investments.

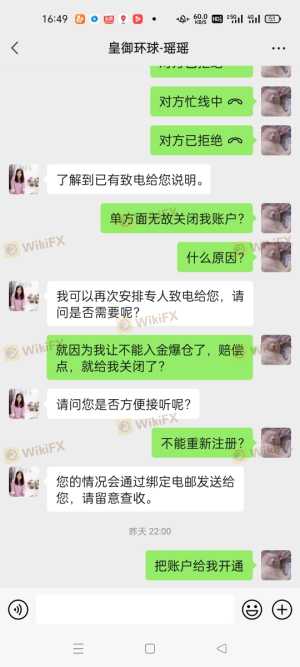

Customer Experience and Complaints

Customer feedback is a valuable source of information when assessing a broker's reliability. Reviews of Brilliant Precious Metals reveal a mixed bag of experiences, with many users reporting significant challenges, particularly regarding fund withdrawals. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Account Freezes | High | Poor |

| Customer Service Issues | Medium | Average |

The severity of these complaints suggests a troubling pattern that potential clients should consider. For instance, users have reported being unable to access their accounts or facing unreasonable delays in processing withdrawals. This raises a significant concern about the broker's operational integrity. If a broker cannot effectively manage client concerns, it may indicate deeper issues within the company. Therefore, it is essential for traders to weigh these experiences carefully when determining if Brilliant Precious Metals is safe.

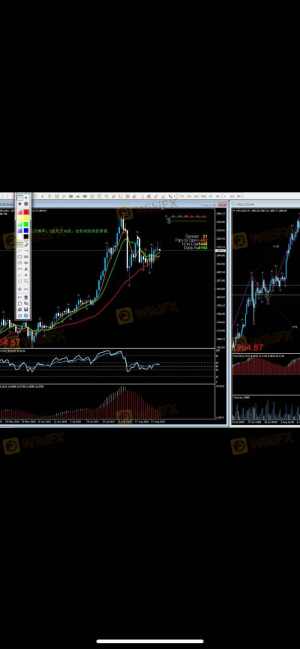

Platform and Trade Execution

The trading platform's performance and reliability can significantly affect a trader's experience. Brilliant Precious Metals utilizes the MT4 platform, which is widely recognized for its functionality and user-friendliness. However, reports of slippage and order rejections have surfaced, raising concerns about the platform's execution quality.

Traders have noted instances where orders were not executed at the expected prices, leading to potential losses. Such occurrences can be indicative of a broker manipulating prices or failing to provide adequate liquidity. Therefore, it is crucial for traders to assess whether Brilliant Precious Metals is safe based on the platform's performance and the broker's ability to execute trades reliably.

Risk Assessment

Using Brilliant Precious Metals involves inherent risks that potential investors should consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Claims of clone regulation raise concerns. |

| Fund Accessibility | High | Reports of withdrawal issues are prevalent. |

| Customer Support | Medium | Mixed reviews on responsiveness and quality. |

| Trading Execution Issues | High | Instances of slippage and order rejections. |

To mitigate these risks, potential clients should conduct thorough due diligence, including reviewing user experiences and regulatory status. Additionally, it may be wise to consider alternative brokers with a stronger reputation and better regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence suggests that Brilliant Precious Metals may not be a safe choice for traders. The lack of transparency regarding its regulatory status, combined with numerous complaints about fund withdrawals and customer service, raises significant concerns. While the broker may offer competitive trading conditions, the potential risks associated with trading through Brilliant Precious Metals warrant caution.

For traders seeking a reliable forex broker, it may be advisable to consider alternatives with stronger regulatory frameworks and better customer feedback. Brokers such as APMEX, JM Bullion, or Money Metals Exchange have established reputations and provide a more secure trading environment. Ultimately, ensuring the safety of your investments should be the top priority when selecting a forex broker.

Is BRILLIANT PRECIOUS METALS a scam, or is it legit?

The latest exposure and evaluation content of BRILLIANT PRECIOUS METALS brokers.

BRILLIANT PRECIOUS METALS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BRILLIANT PRECIOUS METALS latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.