OmegaPro 2025 Review: Everything You Need to Know

Summary

This comprehensive omegapro review looks at a trading platform that has caused debate in the forex community. OmegaPro says it is a UK-based forex broker that offers multiple types of assets including forex, commodities, indices, and stocks, plus a cloud mining investment platform. Our analysis shows concerning gaps in regulatory transparency and growing user complaints about withdrawal issues.

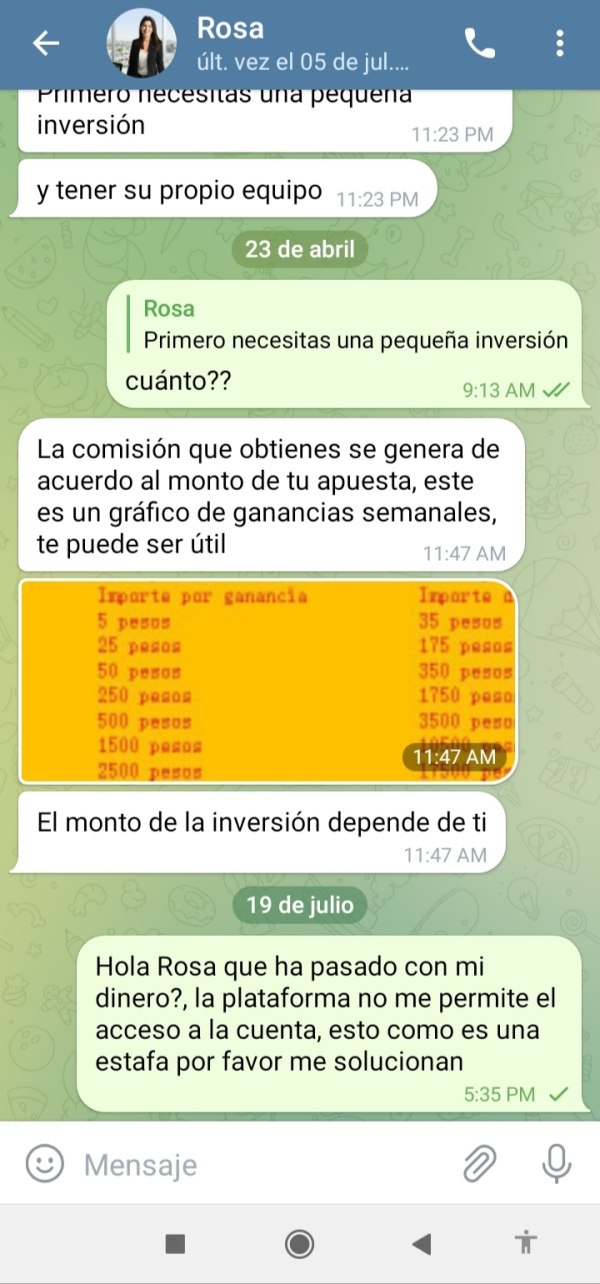

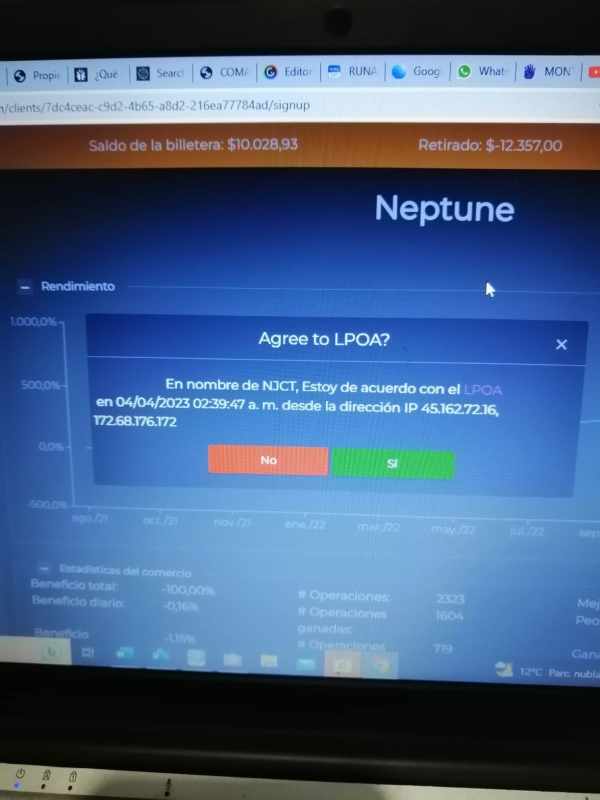

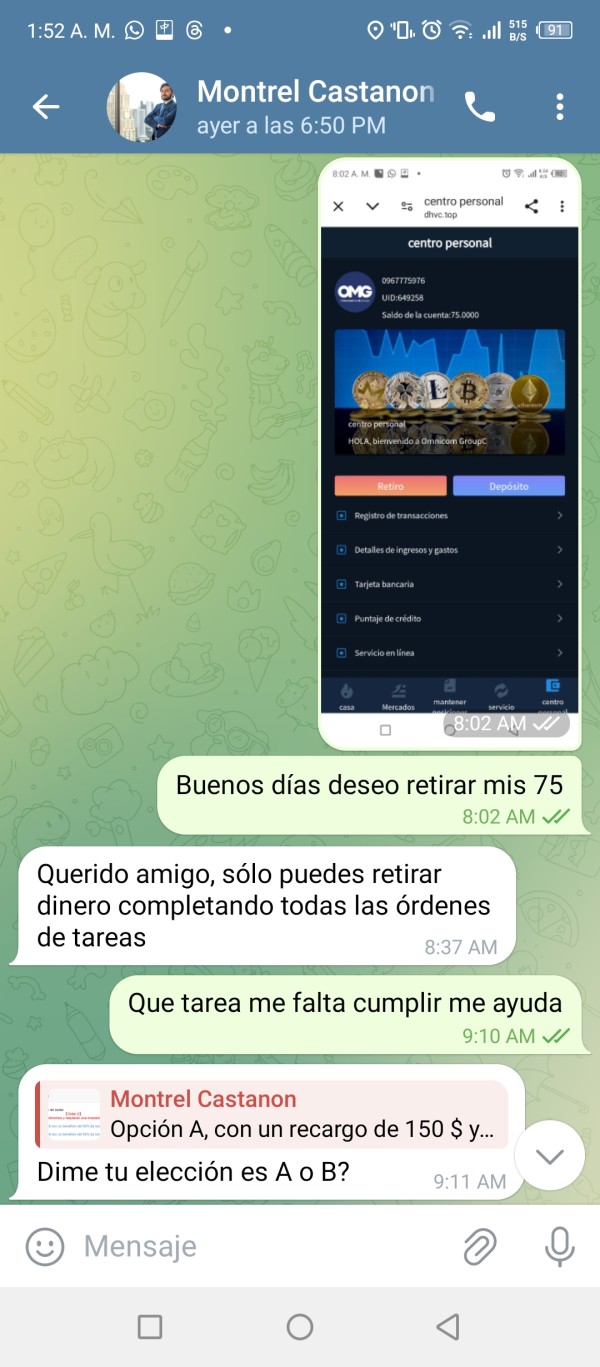

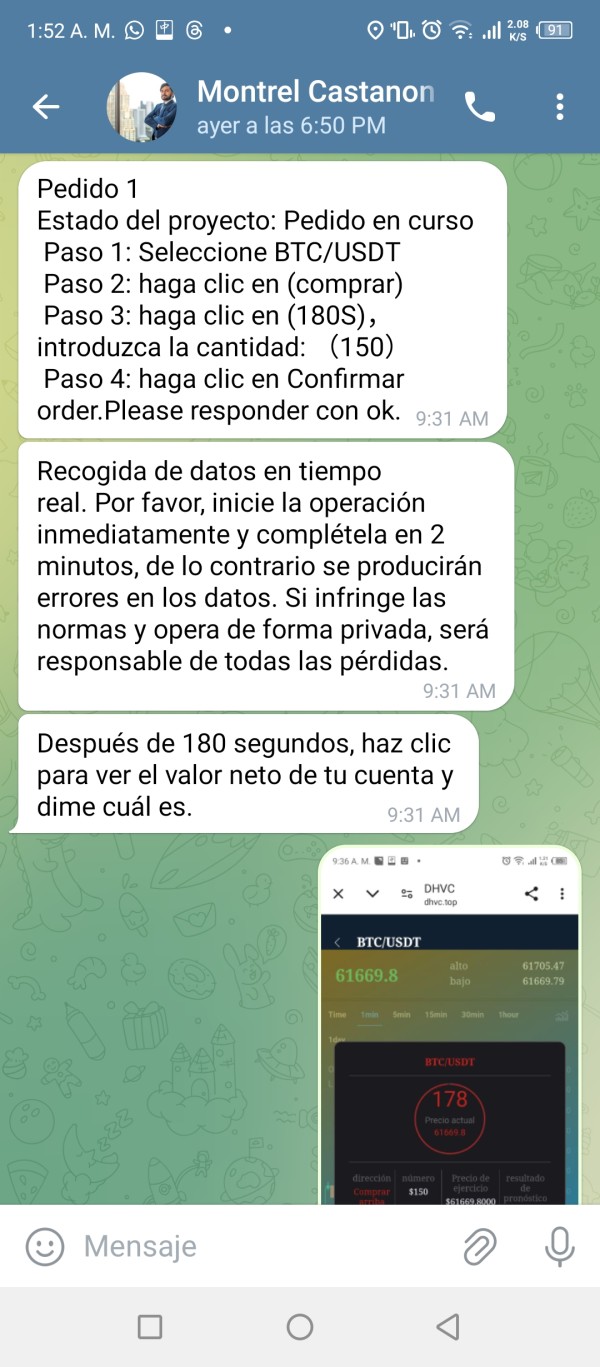

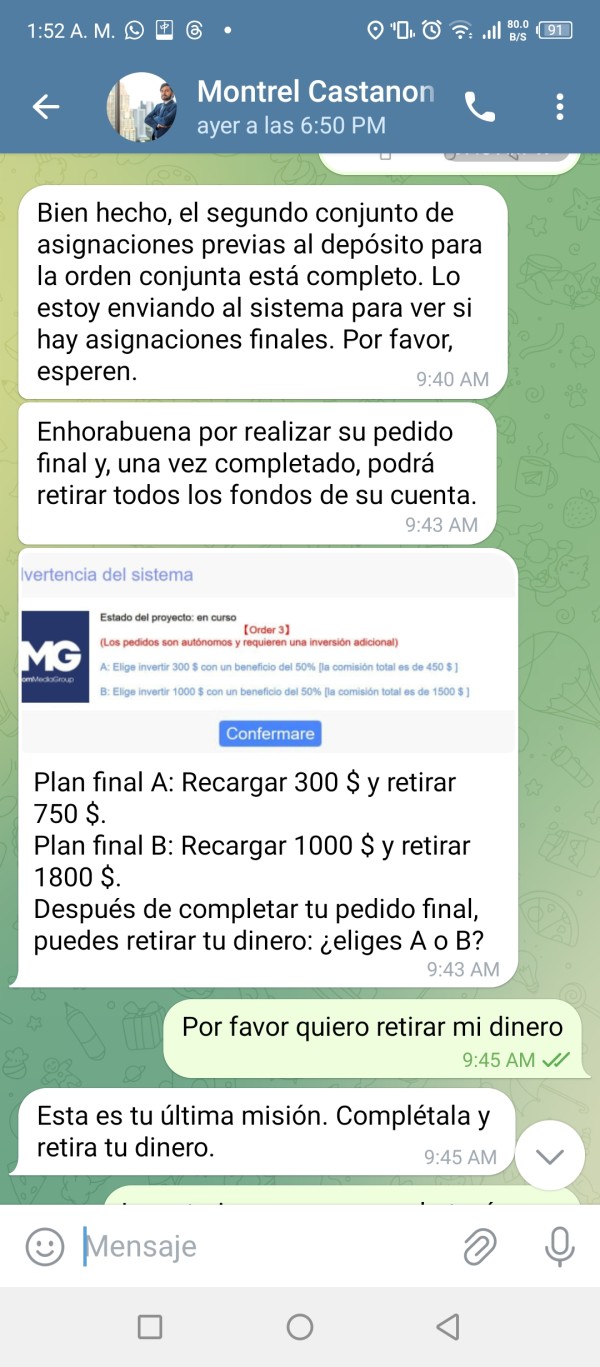

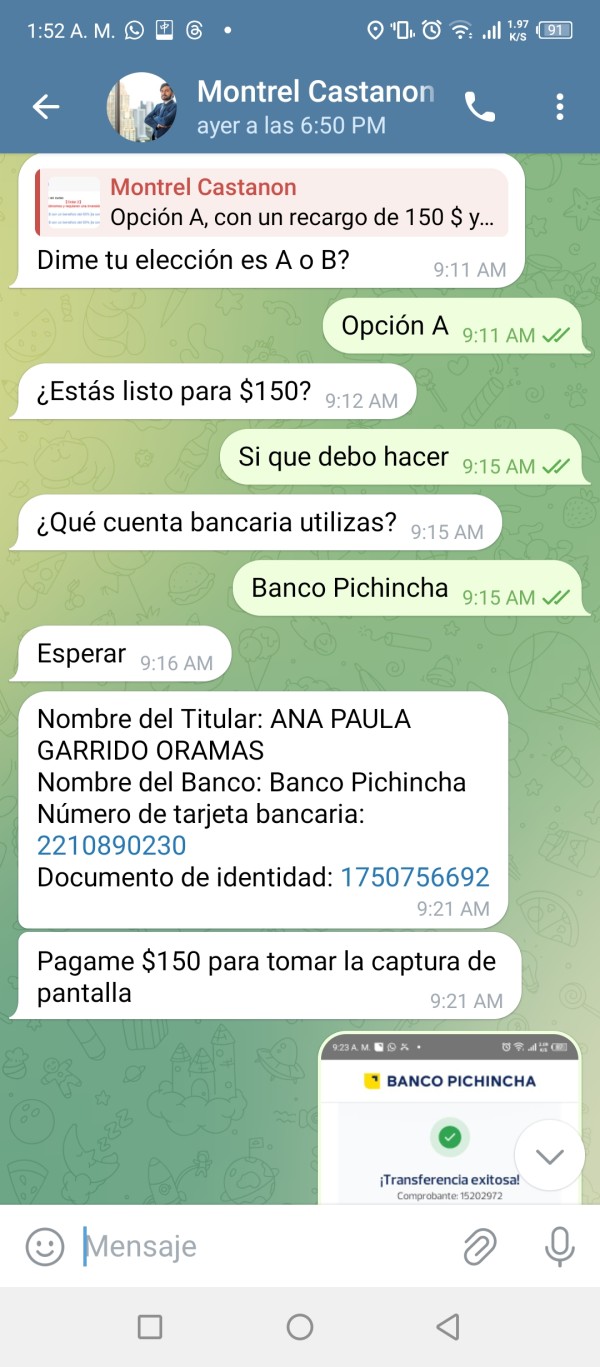

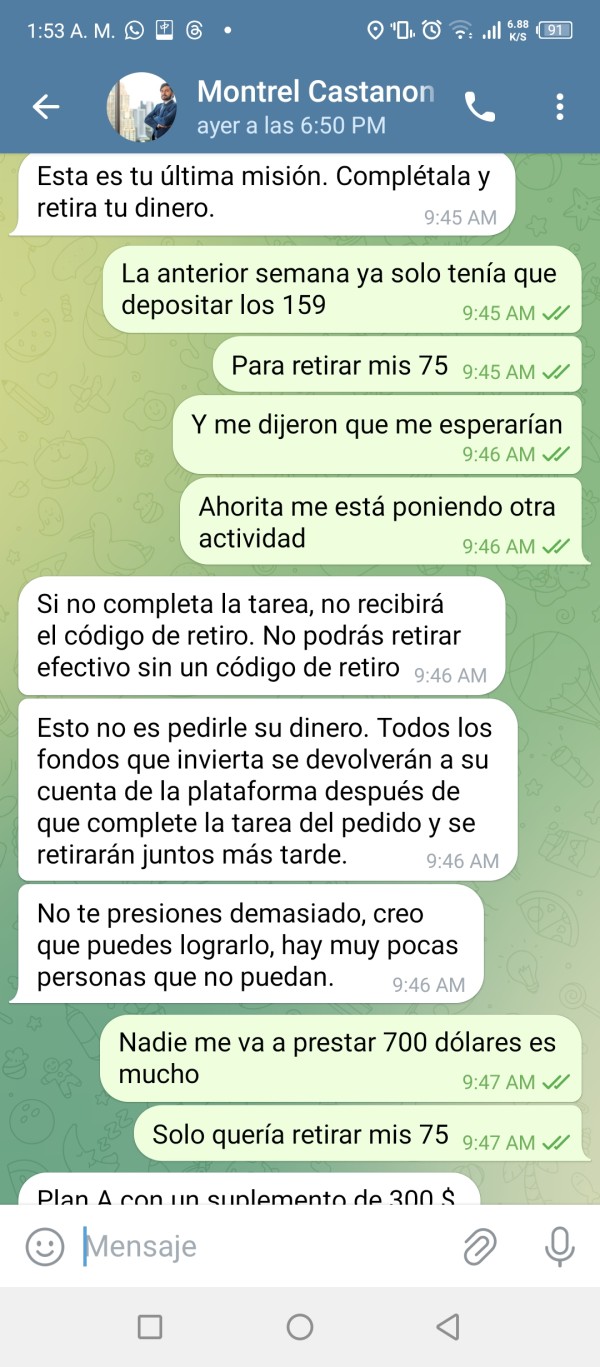

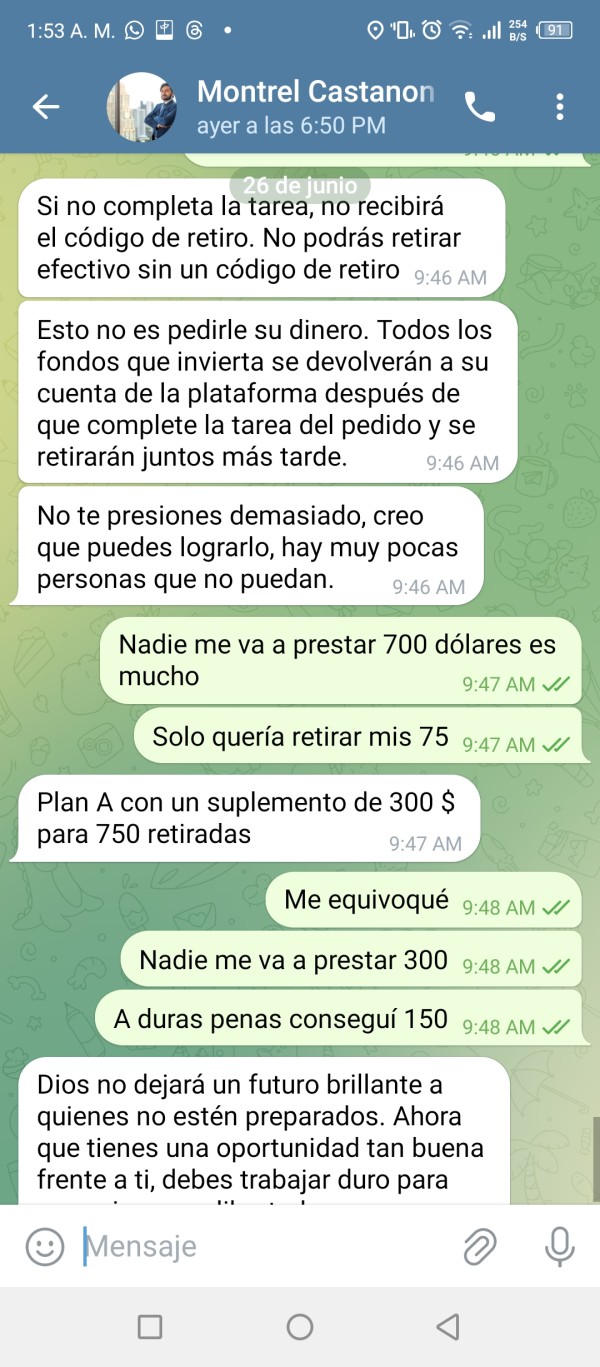

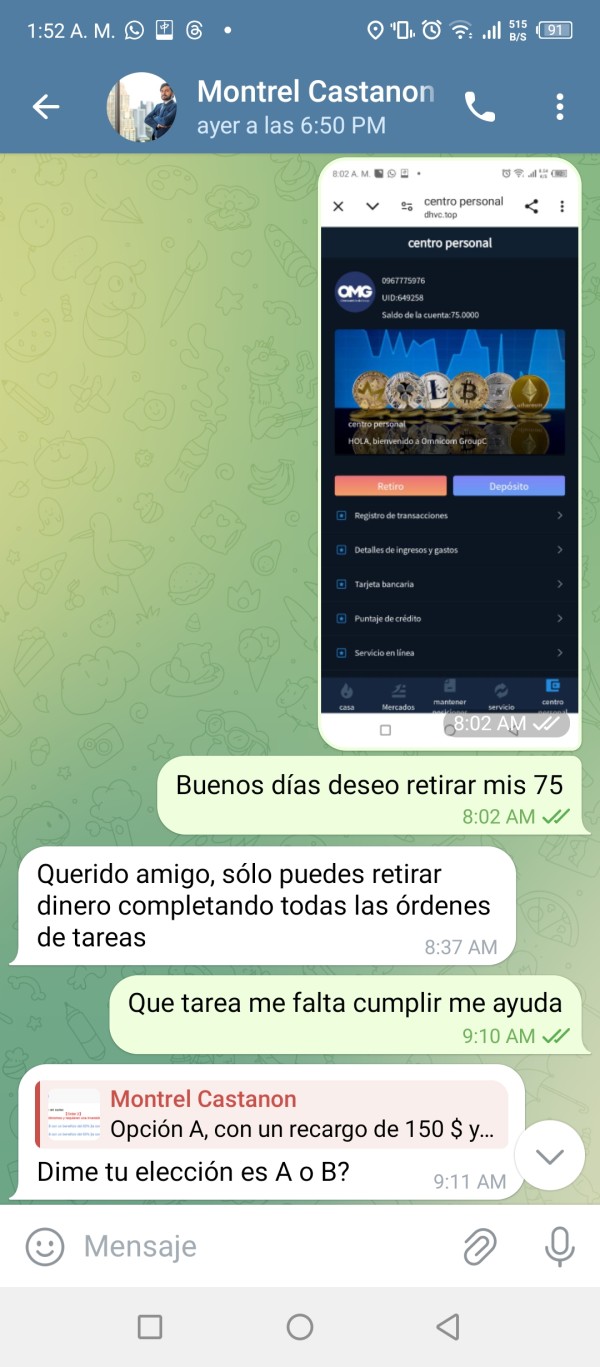

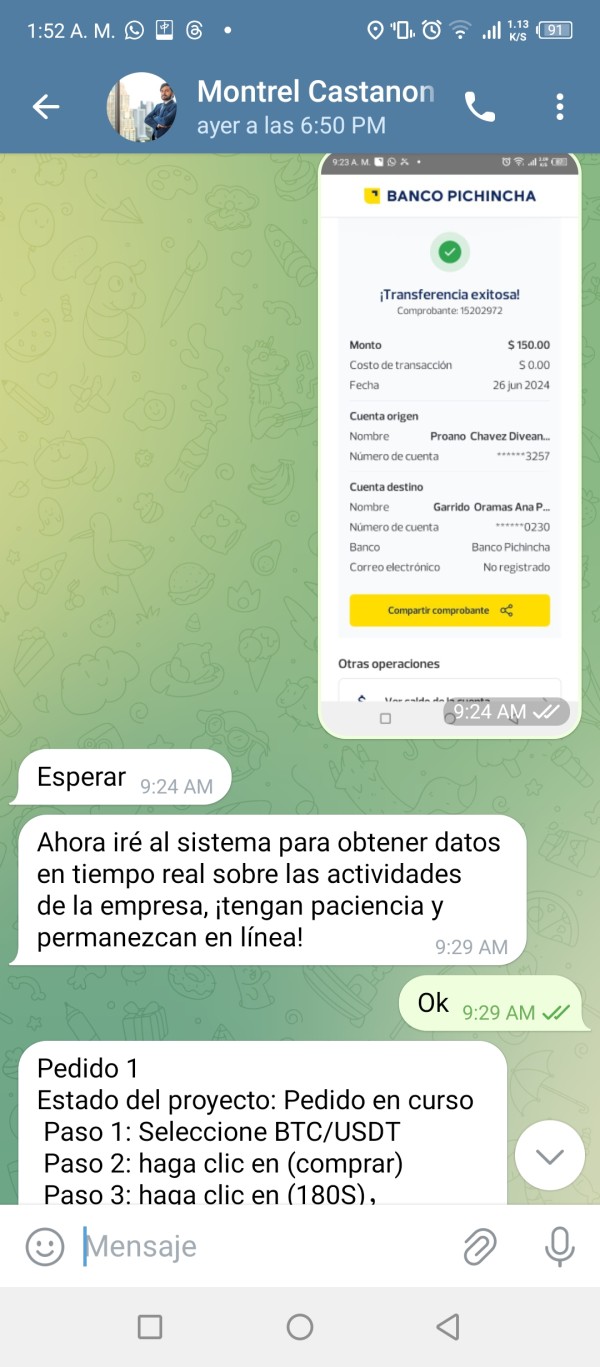

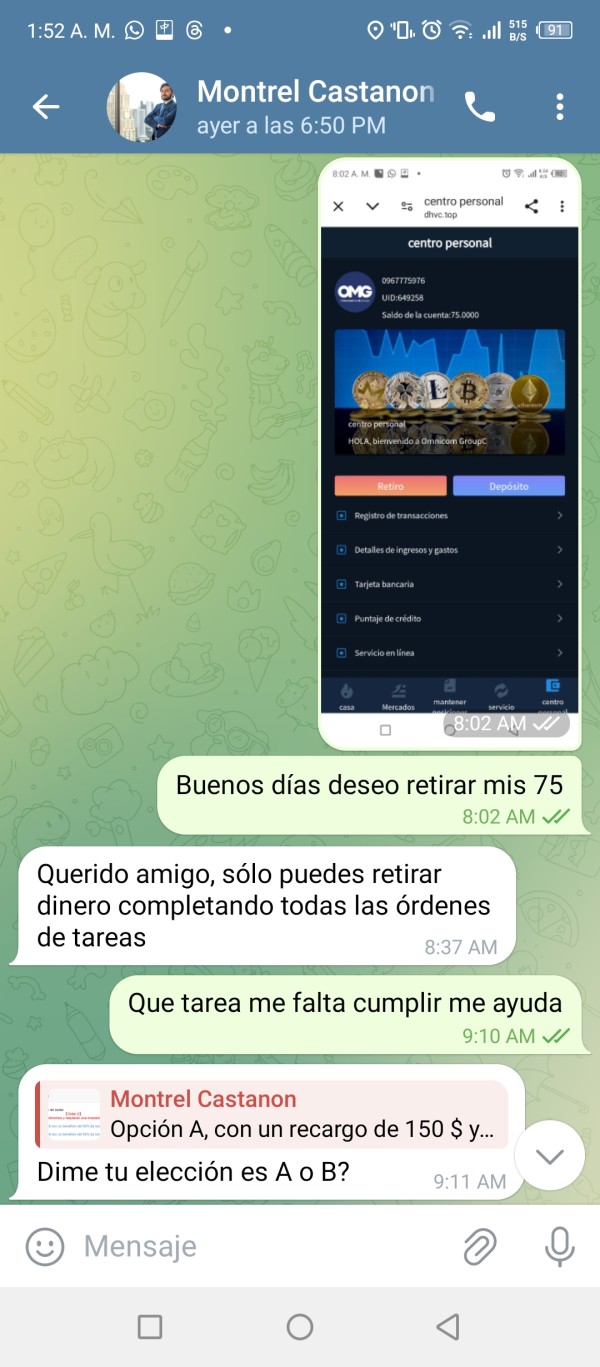

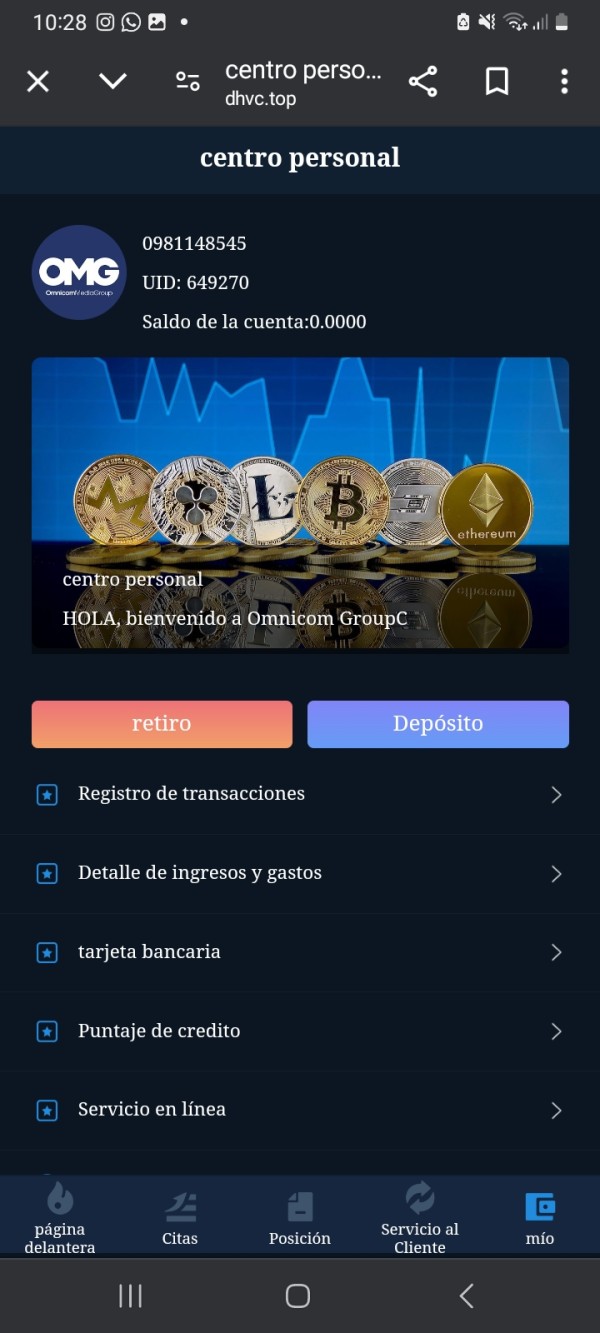

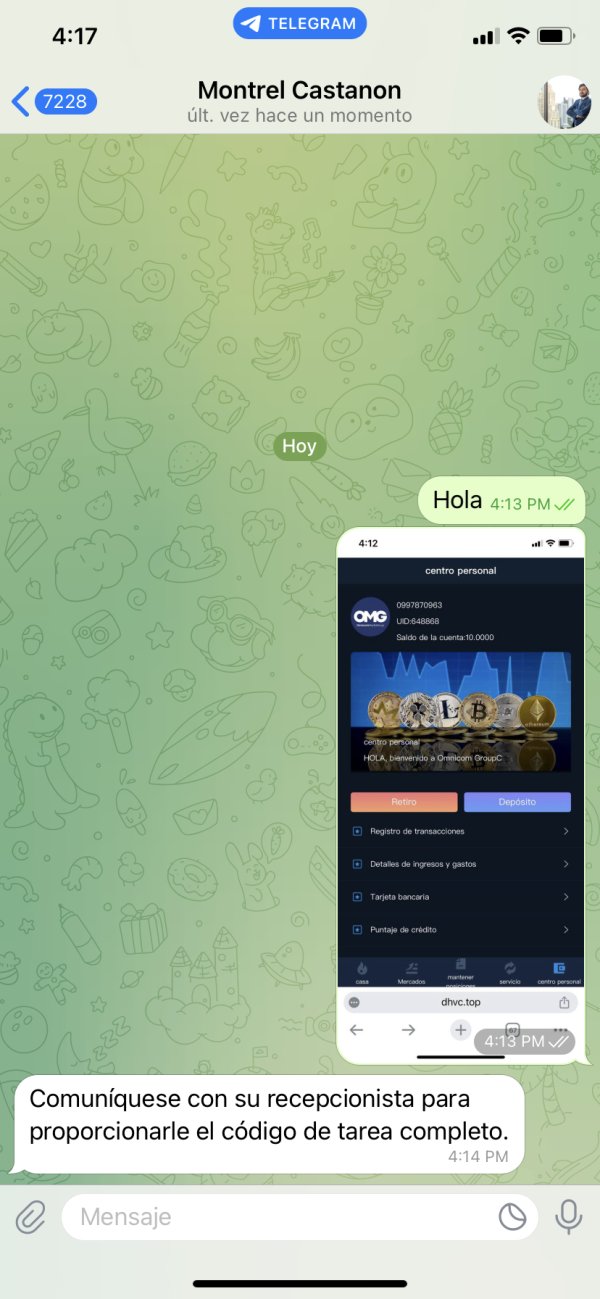

The platform works through a hybrid model that mixes traditional forex trading with multi-level marketing (MLM) elements and cryptocurrency mining opportunities. While OmegaPro claims to provide "safe and lucrative investments regardless of market condition," multiple review websites and user testimonials suggest a more complex reality. According to ComplaintsBoard and other review platforms, users have reported difficulties accessing their funds and concerns about the platform's legitimacy.

OmegaPro targets investors seeking diversified investment channels, particularly those interested in forex trading combined with cryptocurrency mining opportunities. However, potential users should exercise extreme caution due to the absence of clear regulatory information and numerous red flags identified by industry watchdogs. The platform's MLM structure and promises of consistent returns regardless of market conditions are particularly concerning for experienced traders and regulatory experts.

Important Notice

Regional Entity Differences: While OmegaPro claims to operate from the United Kingdom through OmegaPro Ltd, our investigation found no verifiable regulatory information from major UK financial authorities. Users should be aware that claimed jurisdictions may not reflect actual regulatory oversight or consumer protections.

Review Methodology: This evaluation is based on available user feedback, industry reports, and publicly accessible information. The analysis does not constitute financial advice, and readers should conduct independent research before making investment decisions. Given the concerning nature of available information, this review aims to highlight potential risks rather than promotional aspects.

Rating Overview

Broker Overview

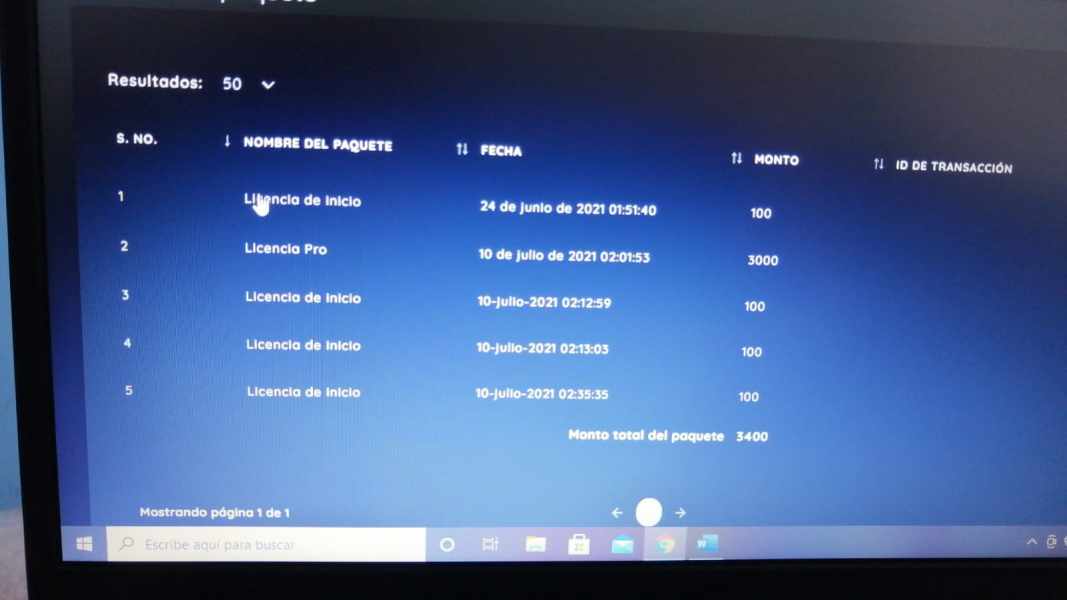

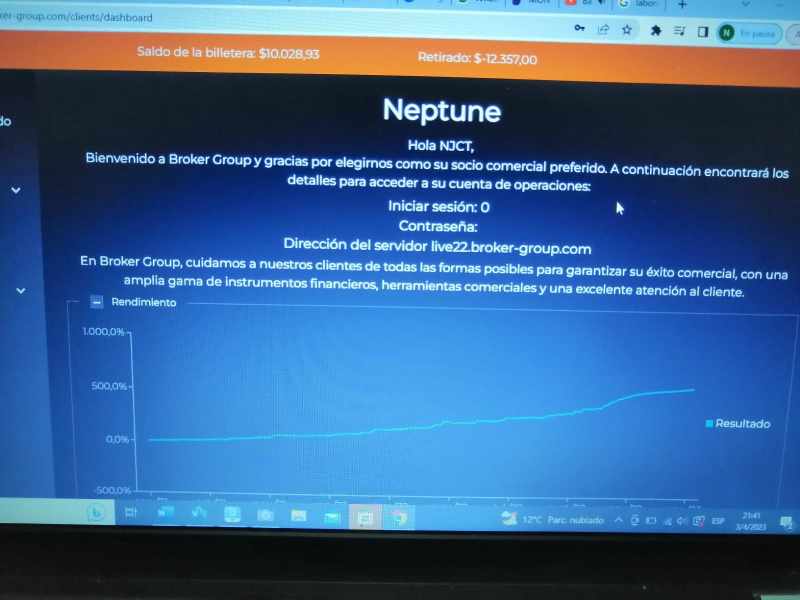

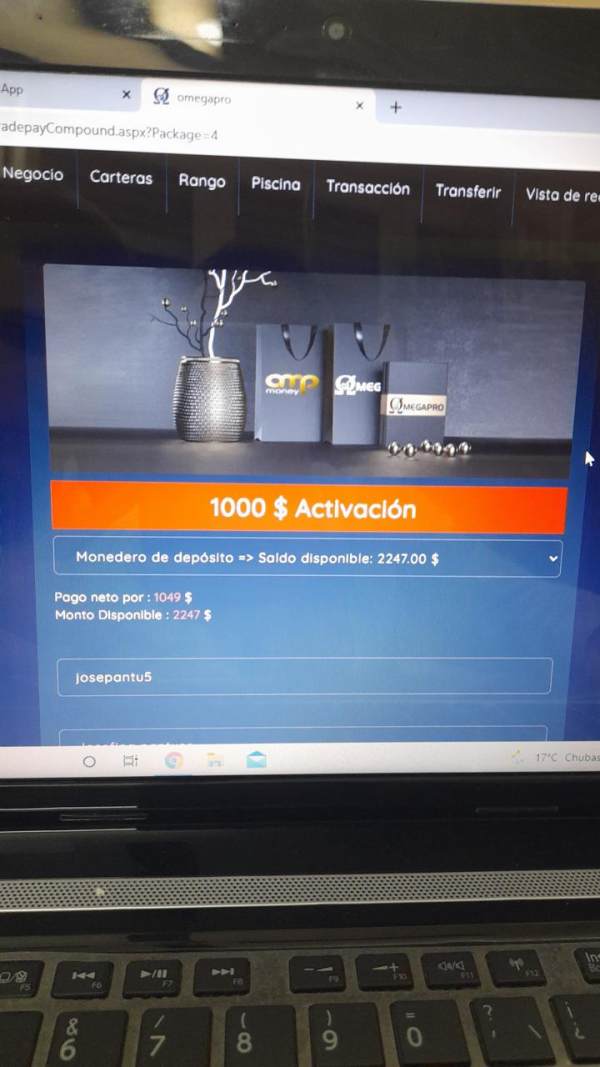

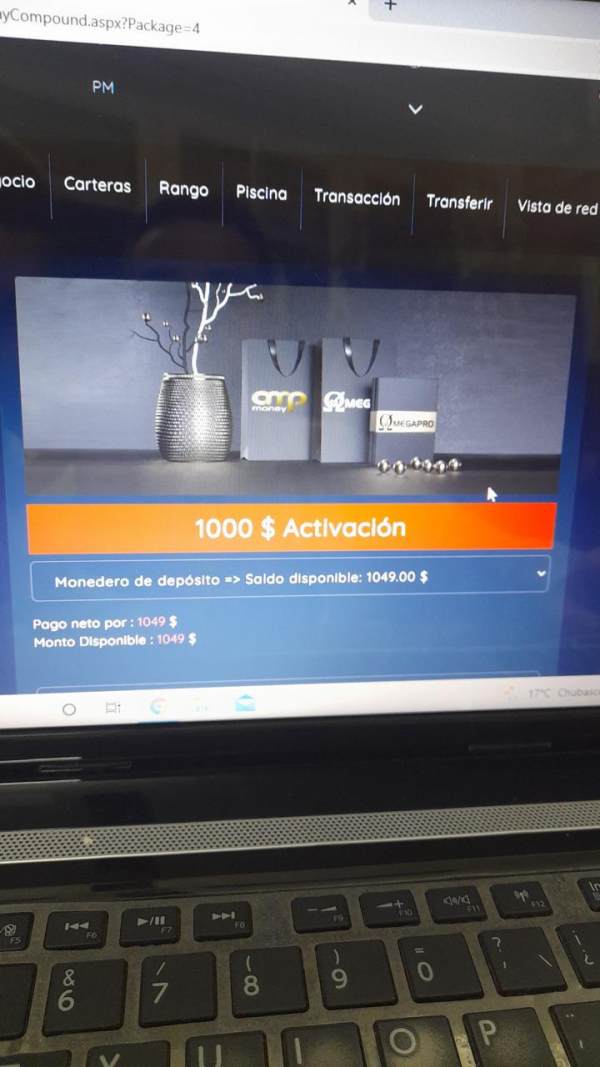

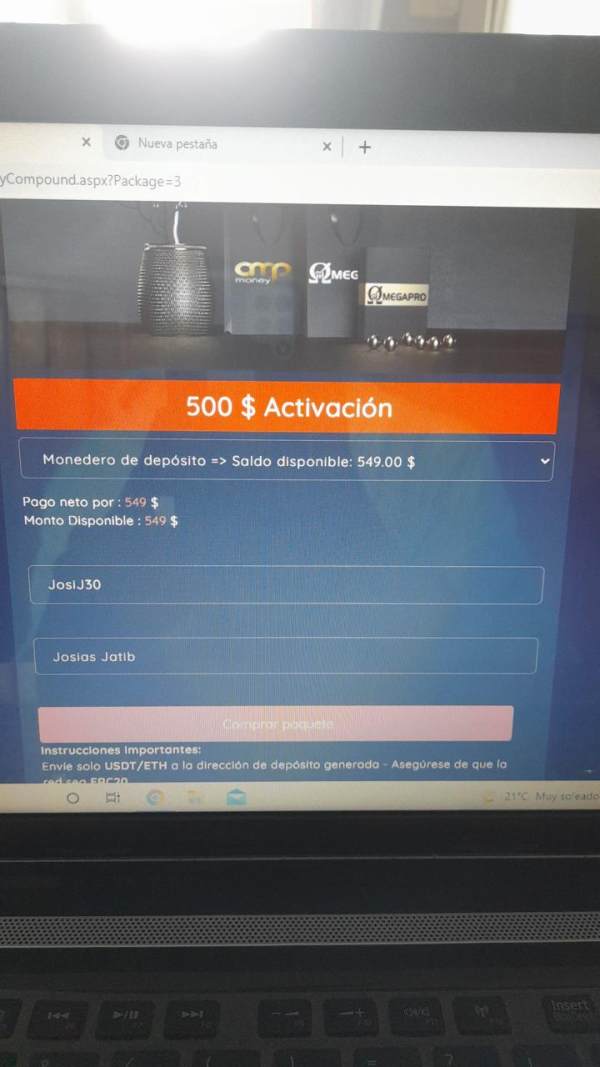

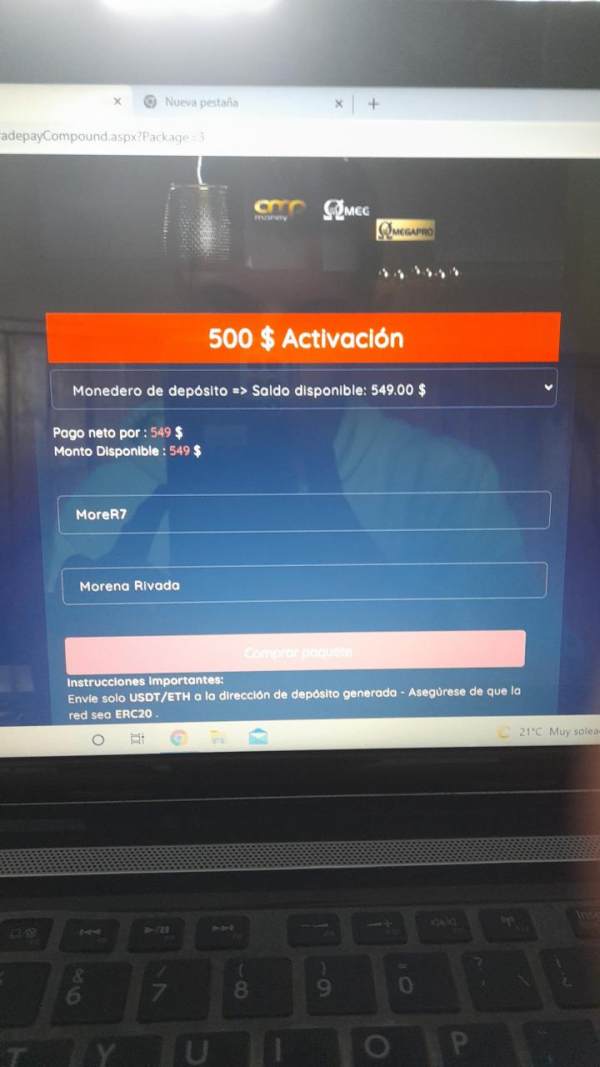

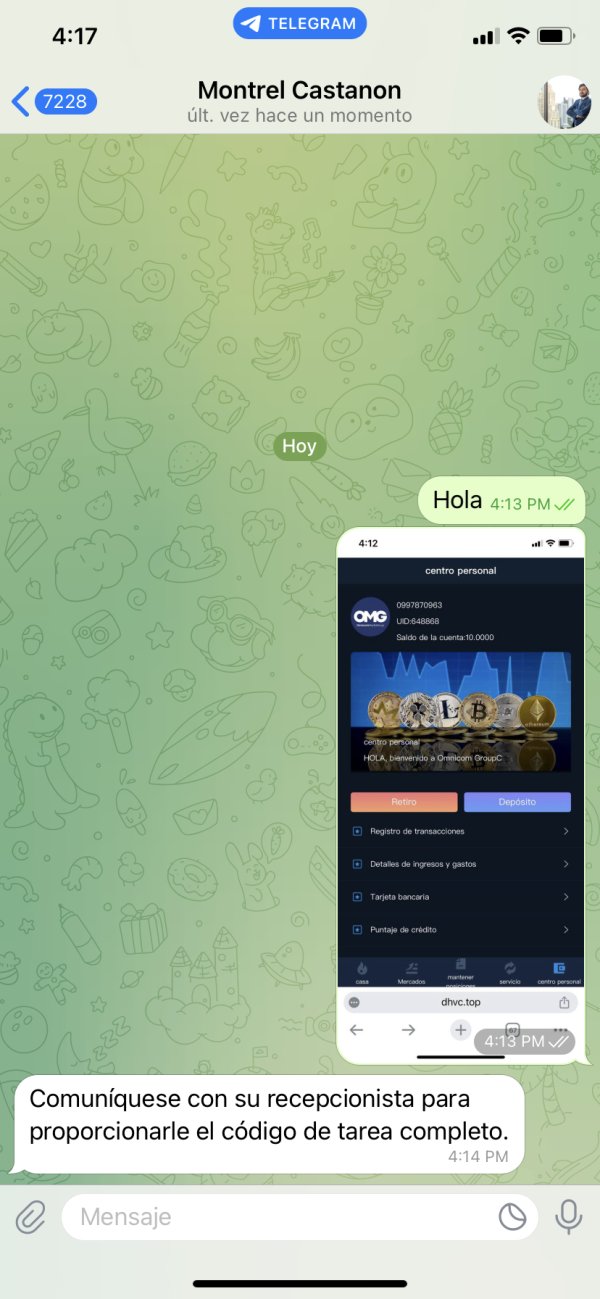

OmegaPro Ltd positions itself as an innovative financial services company that merges traditional forex trading with modern fintech solutions and multi-level marketing opportunities. According to the platform's official materials, the company aims to "assist you in growing your fortune" through what they describe as a "premium FX & cloud mining investment platform." The company claims to offer trading opportunities across multiple asset classes while simultaneously providing cryptocurrency mining investment options.

The platform's business model represents a departure from traditional forex brokerage services by incorporating MLM elements and promising consistent returns regardless of market volatility. OmegaPro states its mission is to "offer a consistent ROI to all our traders & investors and to provide that service on the highest level possible." However, such promises of guaranteed returns in volatile markets like forex and cryptocurrency raise immediate red flags for industry professionals familiar with legitimate trading platforms.

According to available information, OmegaPro provides access to currency pairs, commodities, indices, and stocks through what they describe as a "cutting-edge platform with extensive infrastructure." The company emphasizes convenience and claims to multiply investments "in no time," though specific details about trading conditions, spreads, or execution methods remain unclear in publicly available materials. The absence of detailed regulatory information and specific trading terms represents a significant concern for potential users seeking transparent and regulated trading environments.

Regulatory Status: Our investigation found no verifiable regulatory information for OmegaPro from recognized financial authorities. Despite claims of UK operation, no FCA registration or other major regulatory oversight could be confirmed through official channels.

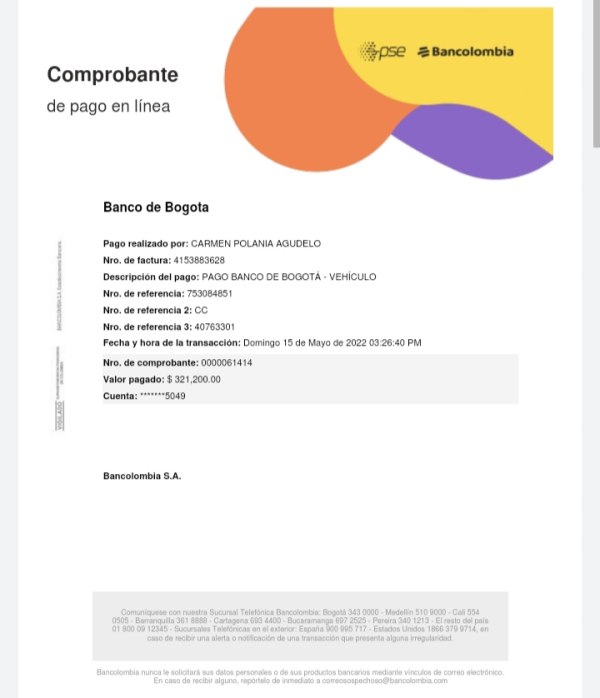

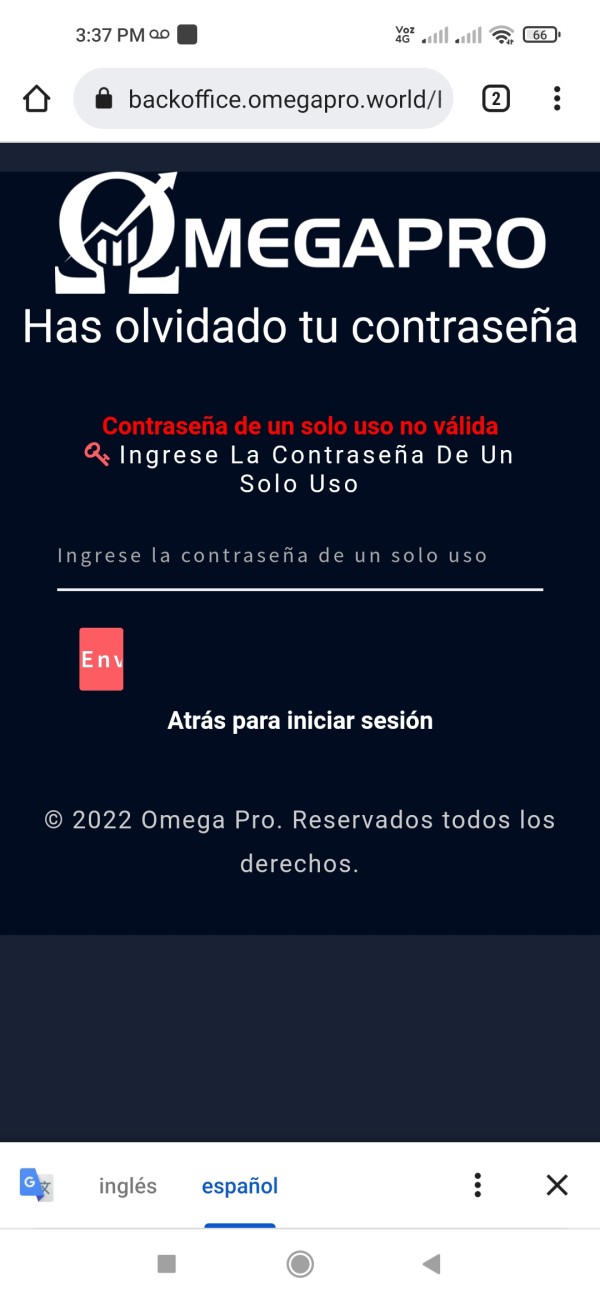

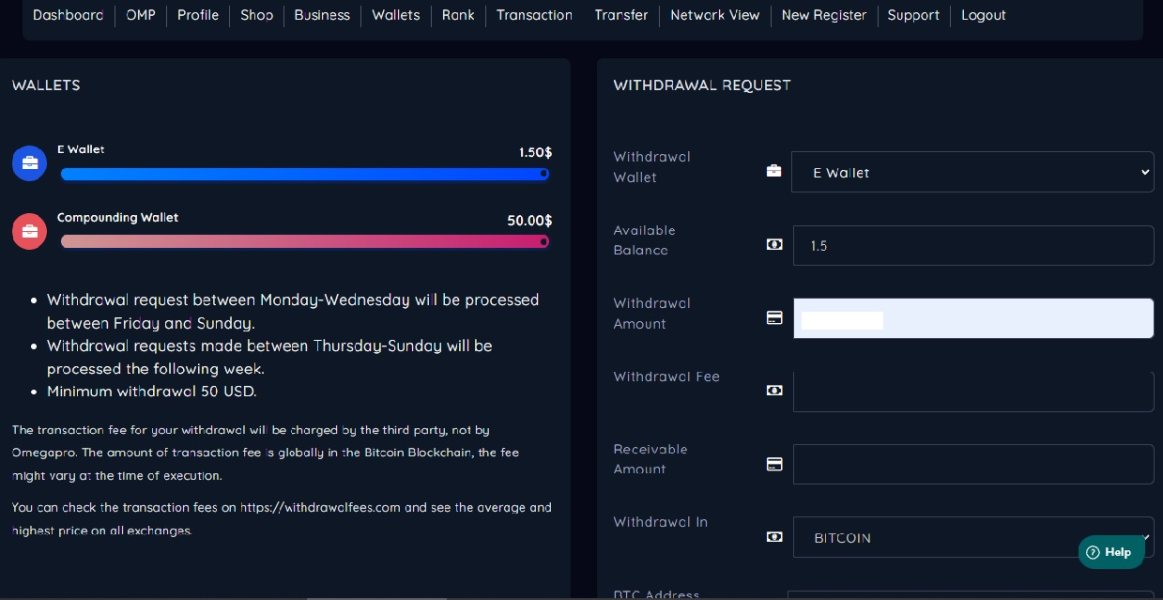

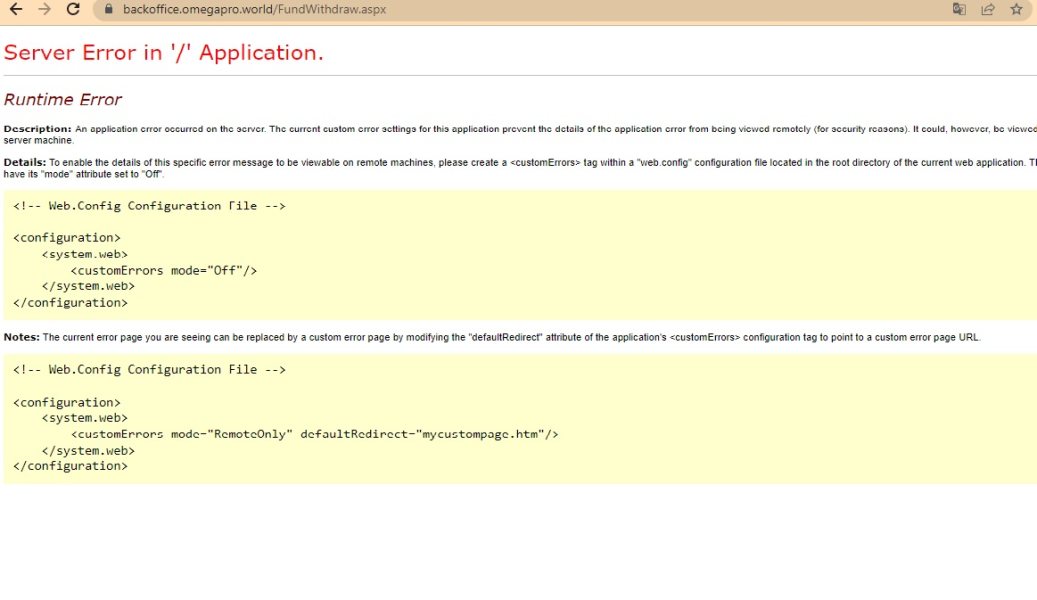

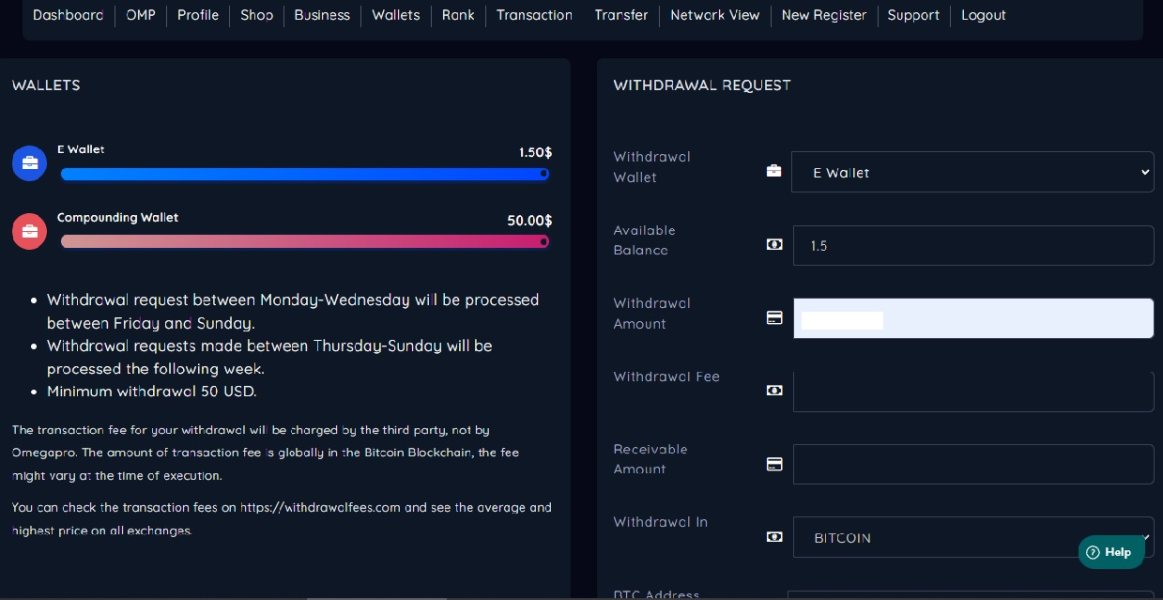

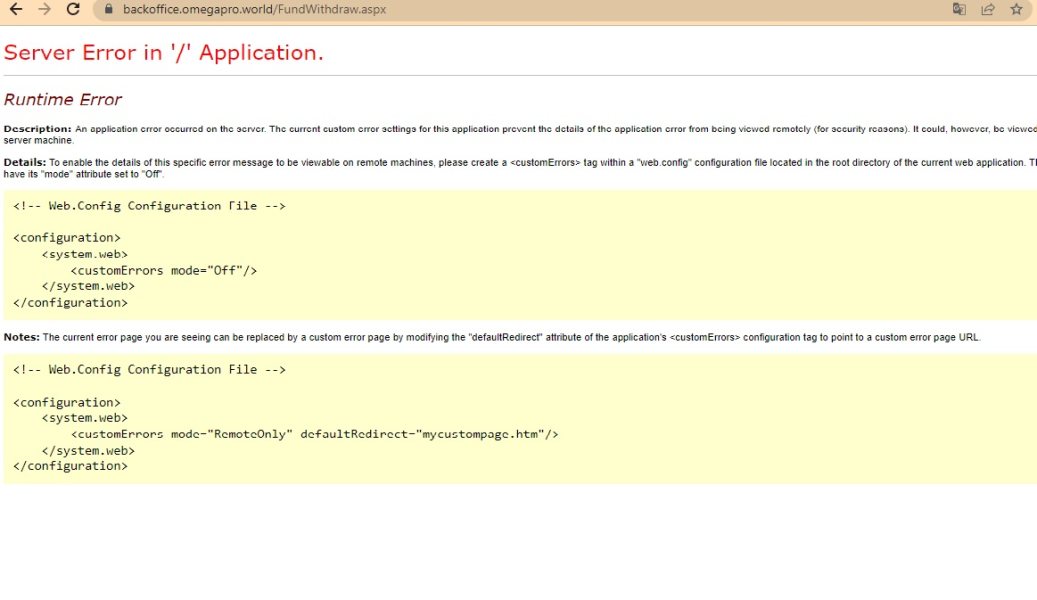

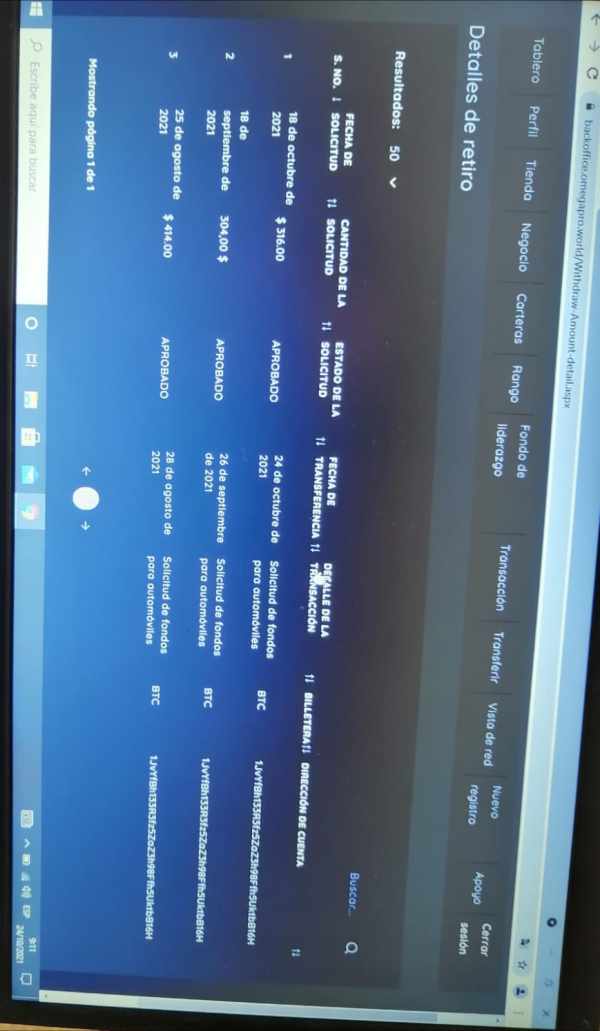

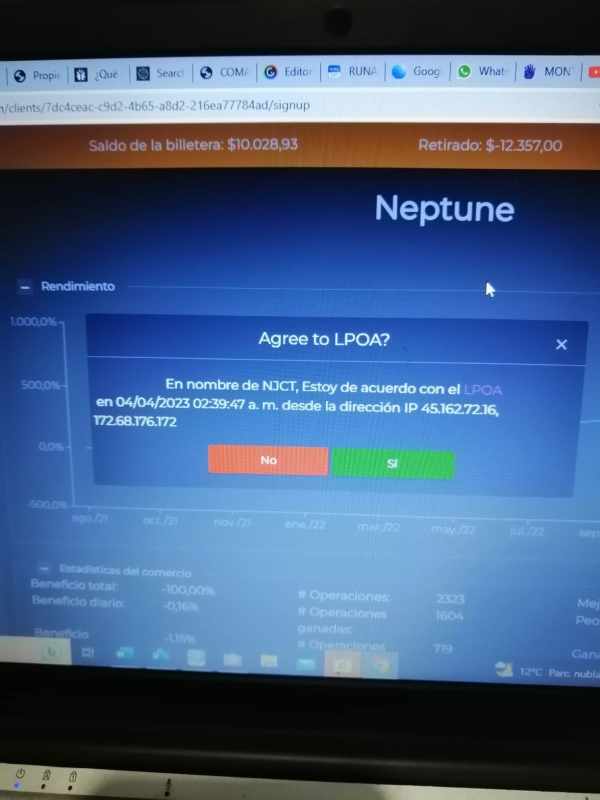

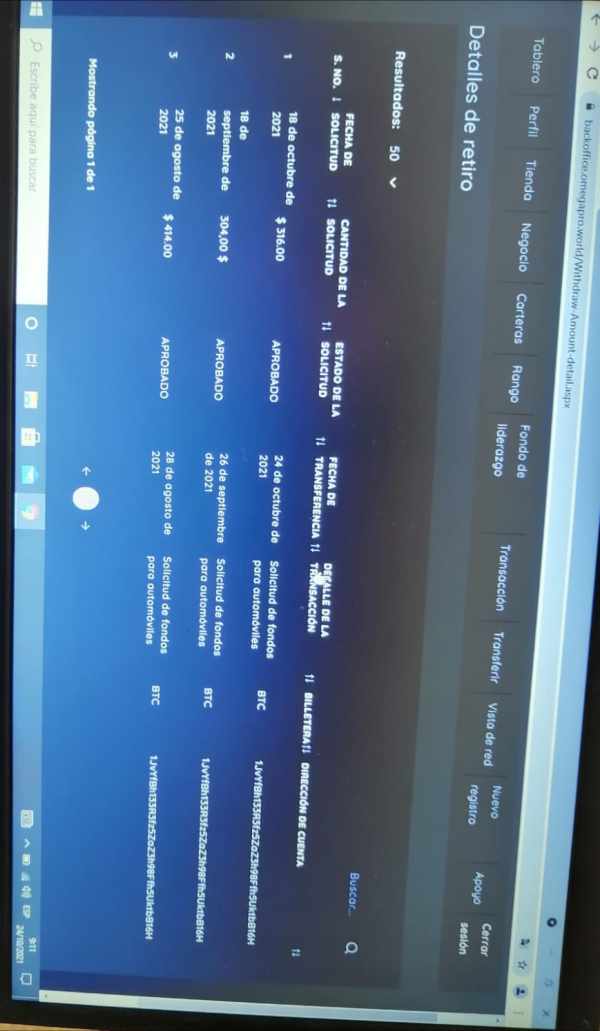

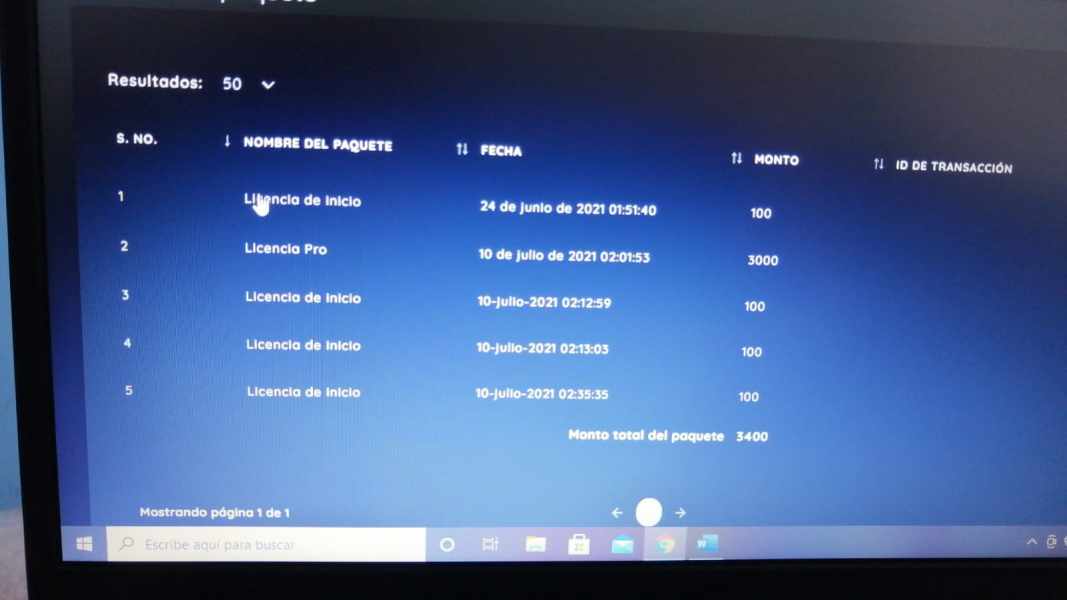

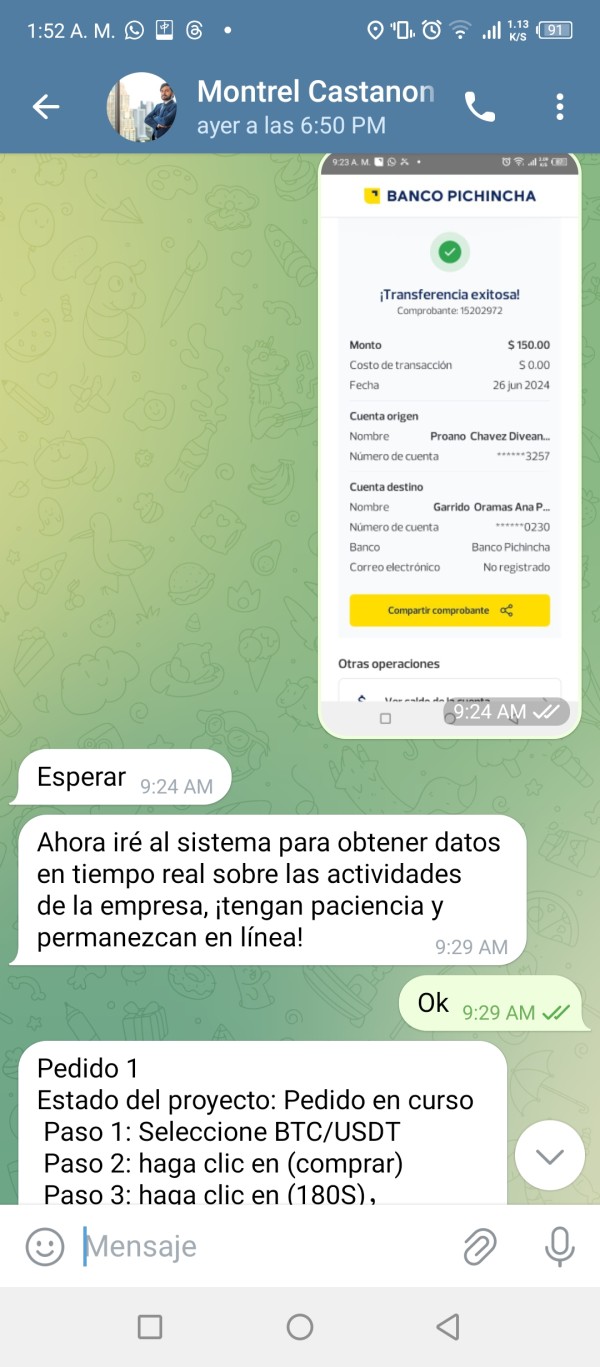

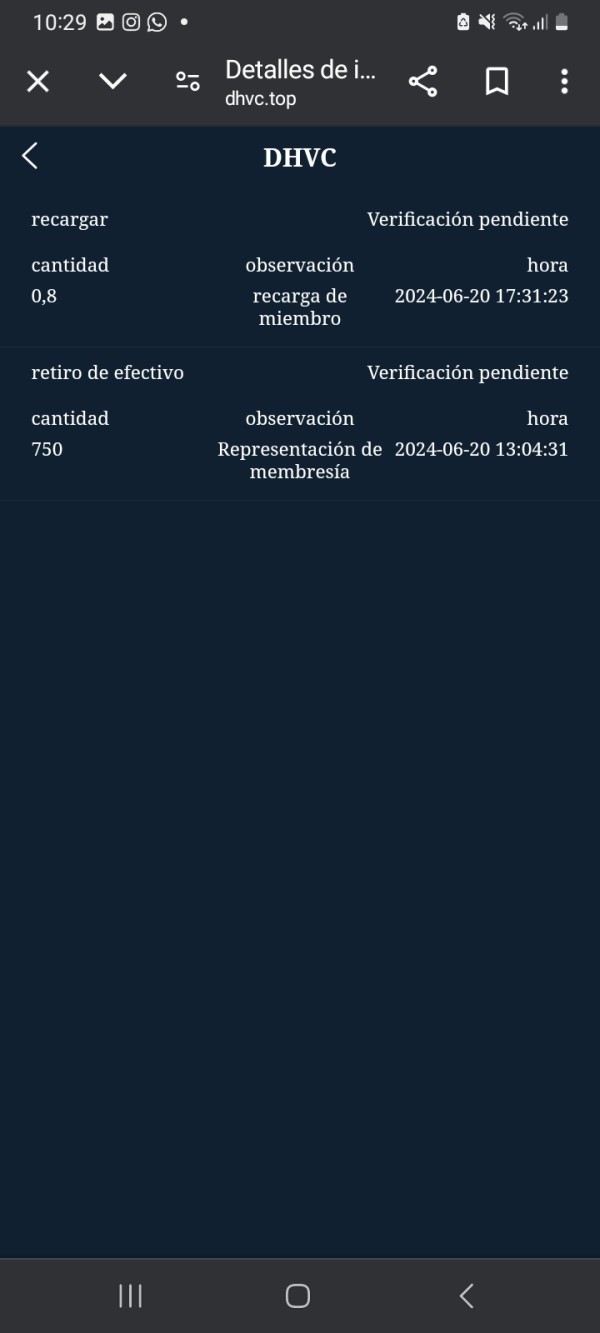

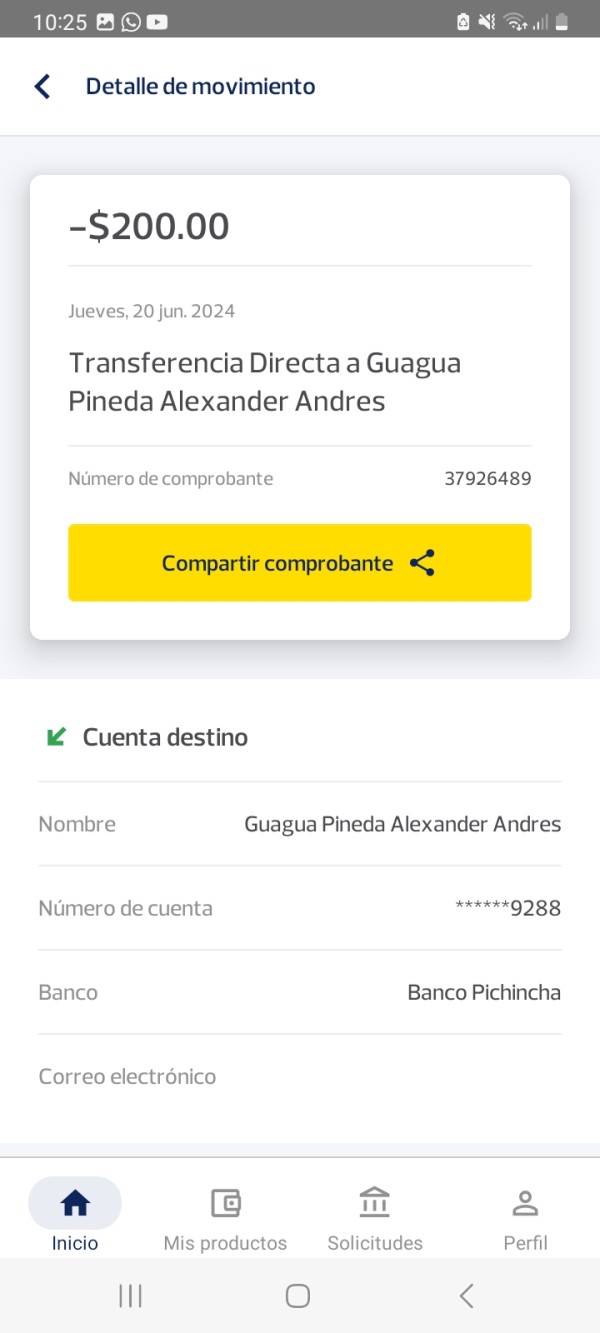

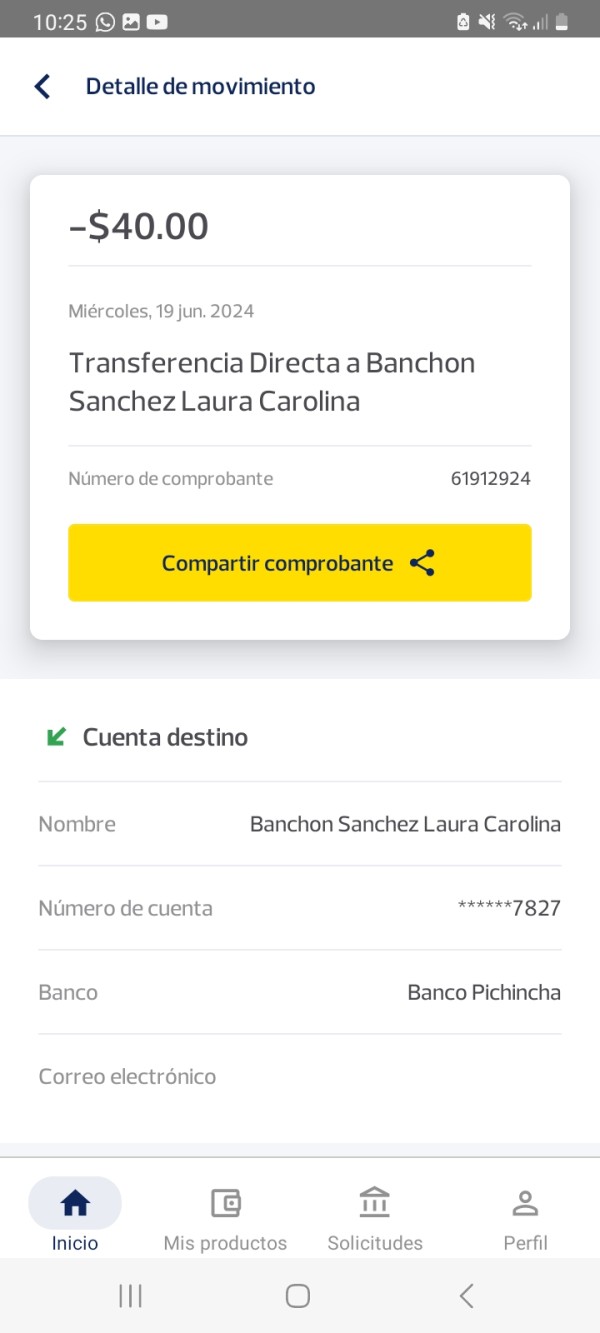

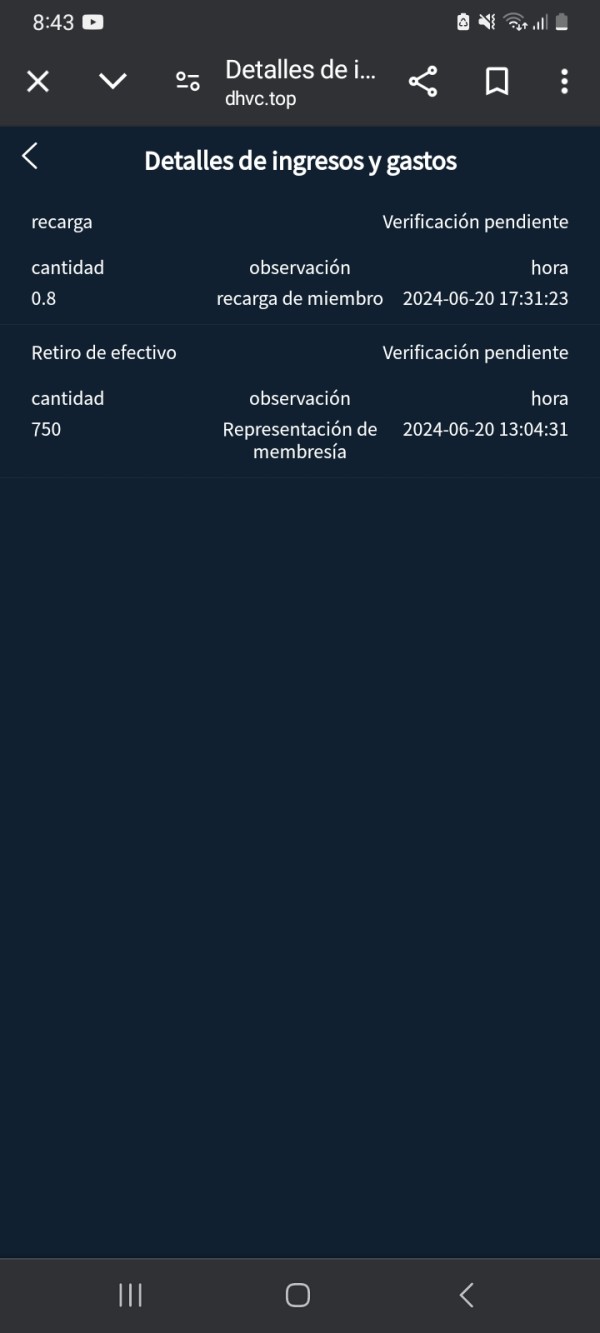

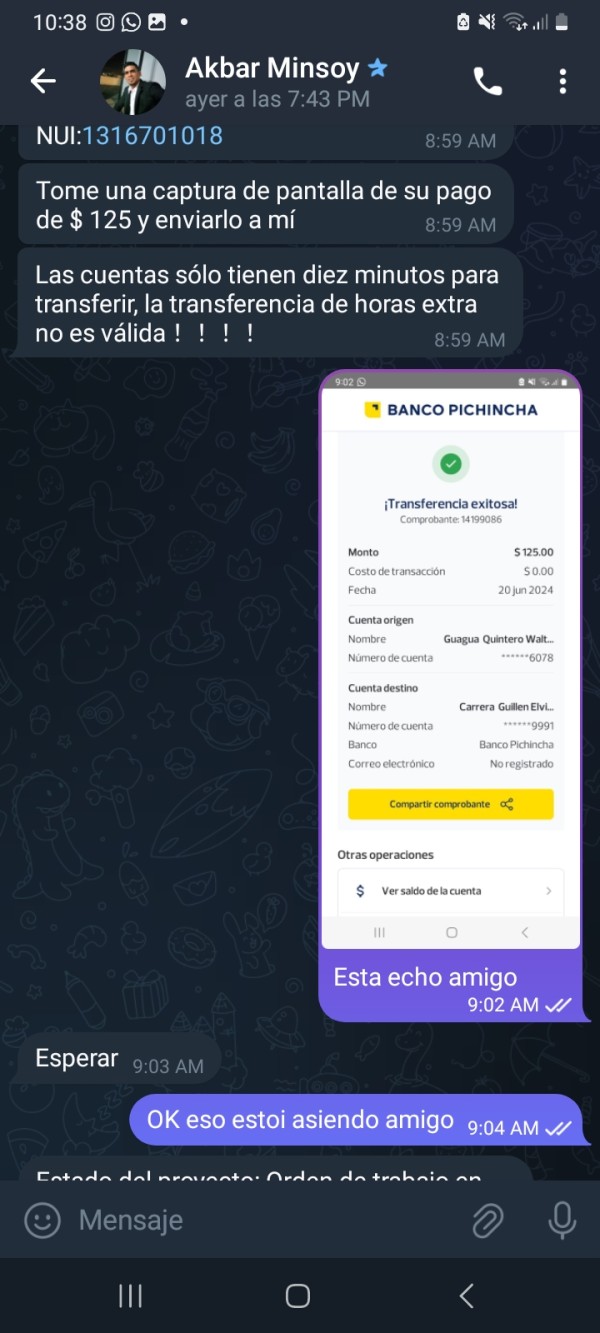

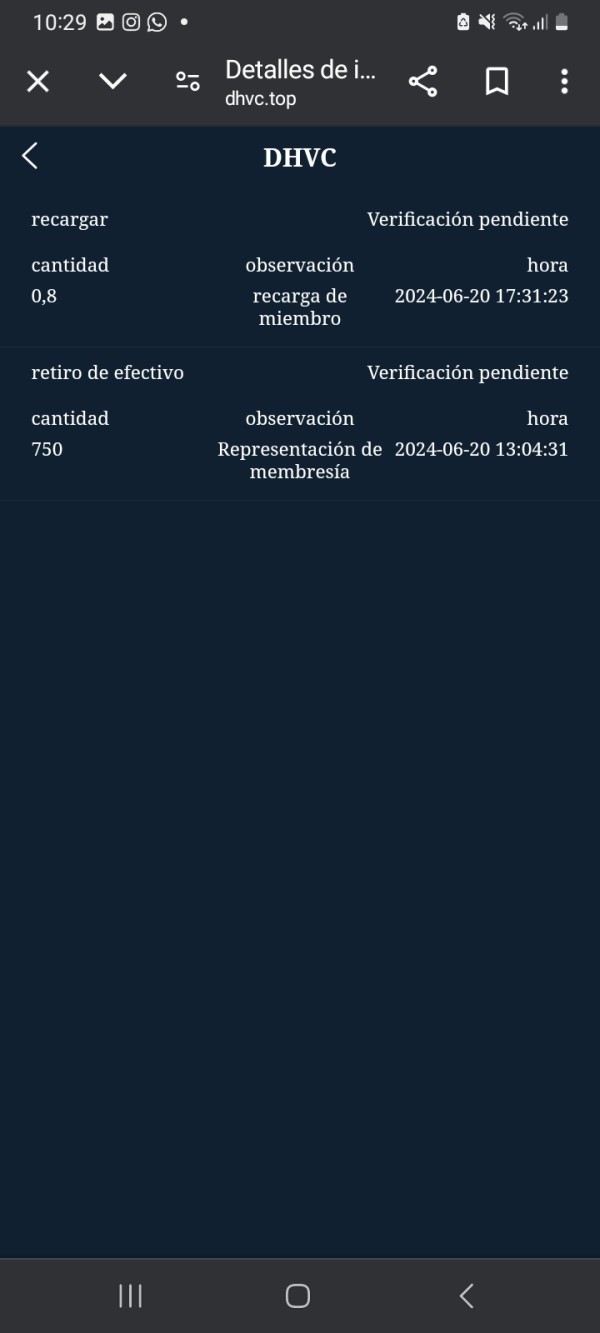

Deposit and Withdrawal Methods: Specific information about funding methods remains unclear in available documentation. User complaints suggest significant difficulties with withdrawal processes, with multiple reports of users being unable to access their invested funds.

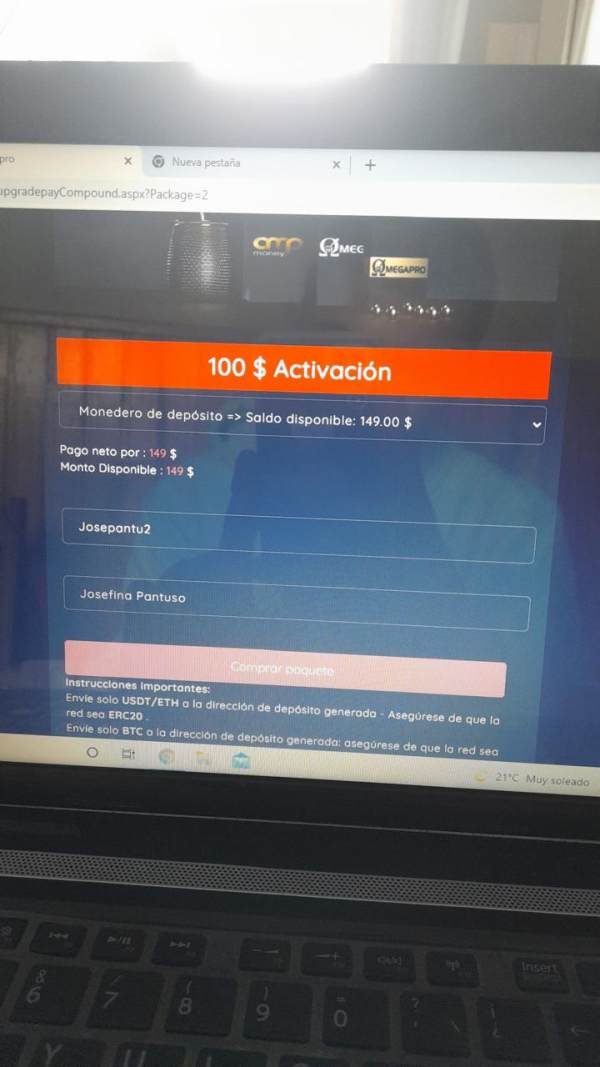

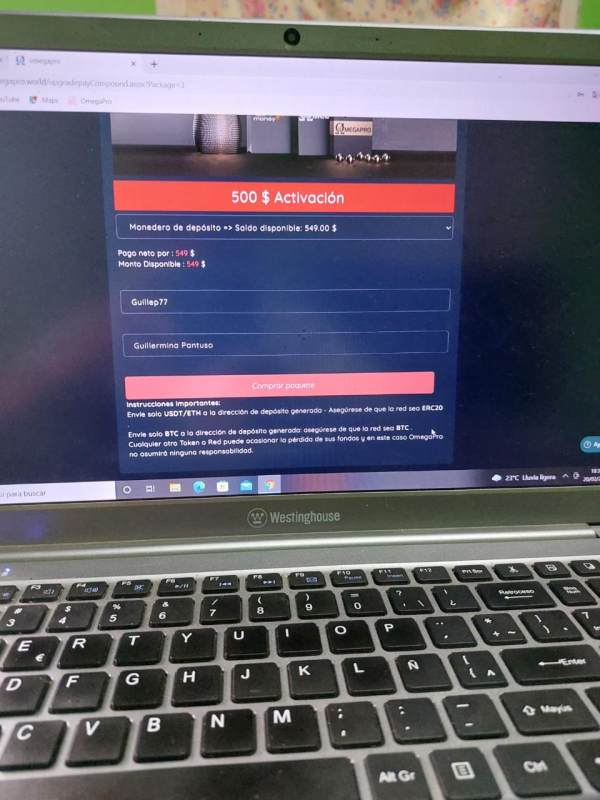

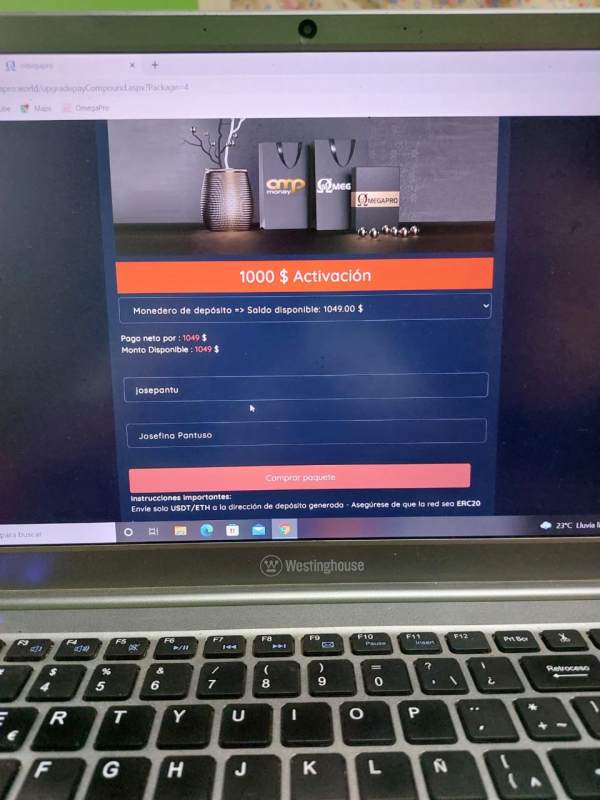

Minimum Deposit Requirements: Exact minimum deposit amounts are not clearly specified in available materials, though the MLM structure suggests varying investment tiers may be available.

Bonuses and Promotions: The platform appears to focus on MLM-style recruitment incentives rather than traditional trading bonuses, though specific promotional details are not clearly documented.

Available Assets: The platform claims to offer forex currency pairs, commodities, indices, and stocks, along with cryptocurrency mining investment opportunities. However, specific instruments and market coverage details remain unspecified.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs is notably absent from available materials, making cost comparison with legitimate brokers impossible.

Leverage Options: No specific leverage ratios or margin requirements are detailed in accessible documentation, representing a significant transparency gap.

Platform Options: While the company mentions using a "cutting-edge platform," specific details about whether they offer MT4, MT5, or proprietary platforms are not clearly stated.

This omegapro review finds that the lack of detailed trading specifications represents a major concern for serious traders seeking transparent operating conditions.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

The account conditions offered by OmegaPro present significant transparency issues that concern experienced traders and industry analysts. Unlike established forex brokers that provide detailed account specifications, OmegaPro's available documentation lacks crucial information about account types, minimum balance requirements, and specific trading conditions. This absence of fundamental account details makes it impossible for potential clients to make informed decisions about their trading setup.

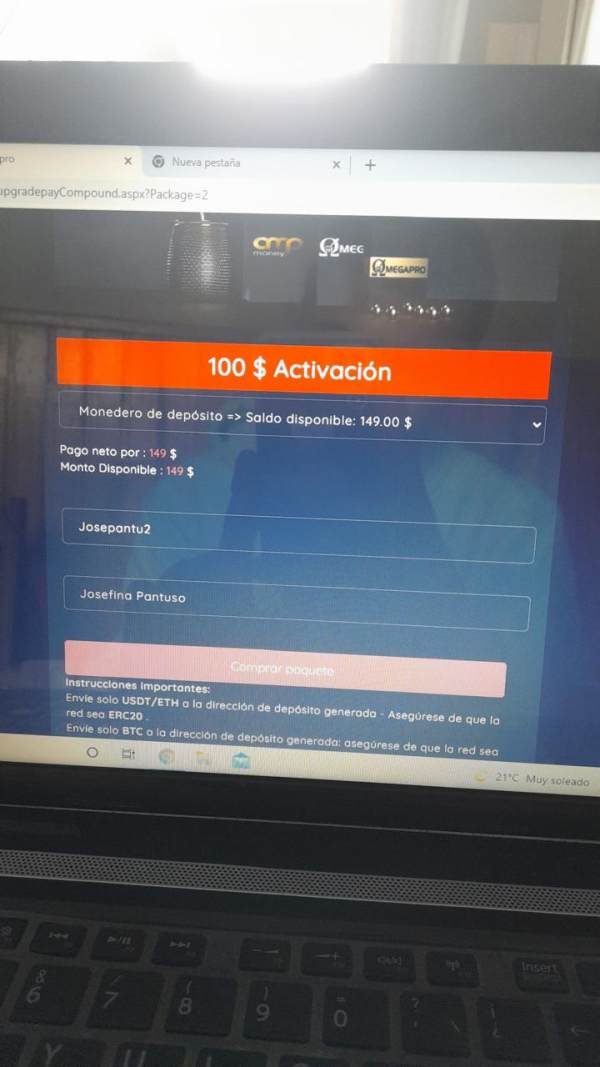

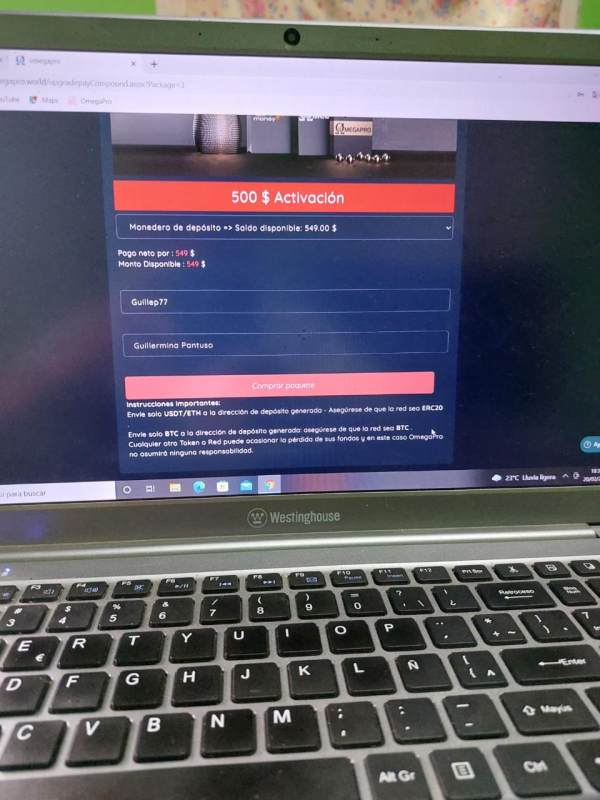

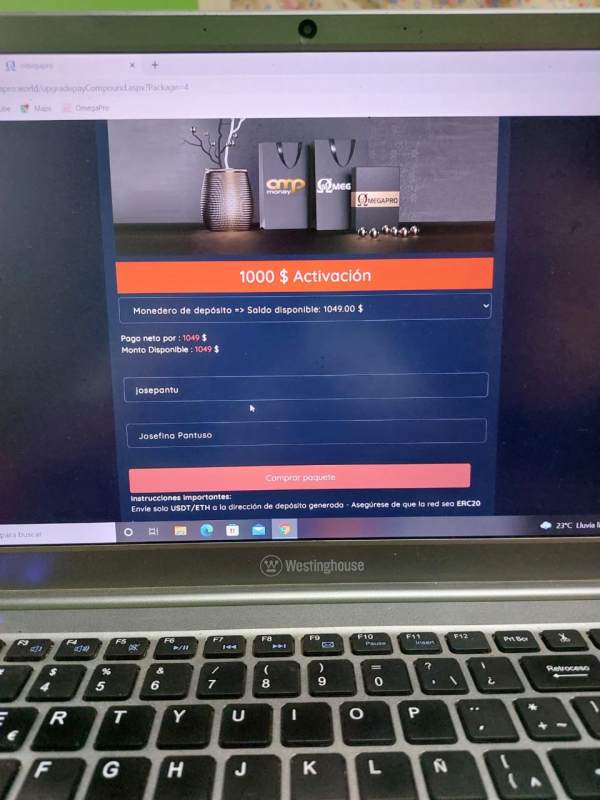

Traditional forex brokers typically offer multiple account tiers with clearly defined spreads, commission structures, and minimum deposit requirements. However, OmegaPro's focus appears to be more on investment packages and MLM recruitment rather than conventional trading accounts. The platform's emphasis on "multiplying investments" and promising returns "regardless of market condition" suggests a structure more aligned with investment schemes than traditional forex trading accounts.

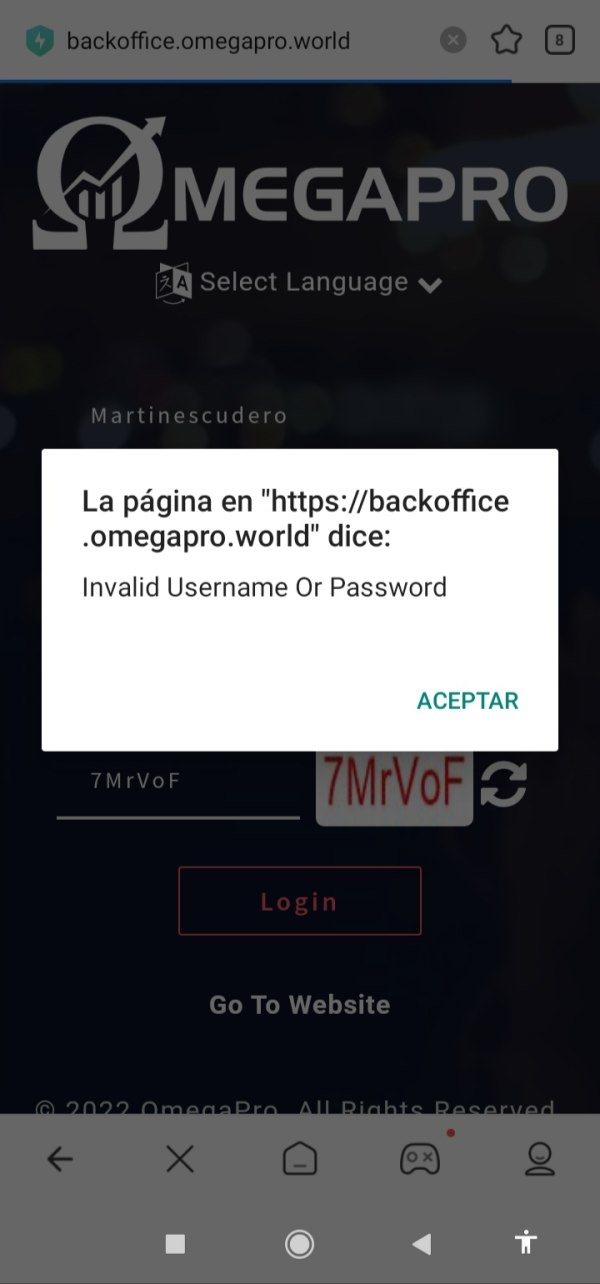

The lack of information about account verification processes, Islamic account options, or professional account classifications further undermines the platform's credibility. Legitimate brokers provide comprehensive account documentation to ensure regulatory compliance and client transparency. User feedback suggests that account opening may be straightforward, but the subsequent ability to access funds and execute normal account functions appears problematic based on withdrawal complaints.

This omegapro review identifies the unclear account structure as a primary concern, particularly for traders accustomed to transparent, regulated brokerage services with clearly defined terms and conditions.

OmegaPro's trading tools and resources present a mixed picture, with the platform claiming to offer "cutting-edge" technology while lacking specific details about analytical capabilities and trading instruments. The company emphasizes its technological infrastructure and mentions providing access to multiple asset classes including forex, commodities, indices, and stocks, which suggests a reasonable breadth of trading opportunities.

The platform's unique selling proposition appears to be the combination of traditional forex trading with cryptocurrency mining investment options. This hybrid approach could potentially offer diversification benefits for investors seeking exposure to both traditional and digital asset markets. However, the lack of detailed information about specific analytical tools, charting capabilities, or research resources makes it difficult to assess the actual quality of trading support provided.

Unlike established brokers that typically offer comprehensive market analysis, economic calendars, and educational resources, OmegaPro's focus seems primarily directed toward the investment and MLM aspects of their business model. The absence of detailed information about automated trading support, API access, or advanced order types suggests the platform may not cater to sophisticated trading strategies or professional traders.

While the multi-asset approach and claimed technological infrastructure earn some points, the overall lack of transparency about specific tools and the emphasis on guaranteed returns rather than trading education significantly limit the platform's appeal for serious traders seeking comprehensive analytical resources.

Customer Service and Support Analysis (Score: 3/10)

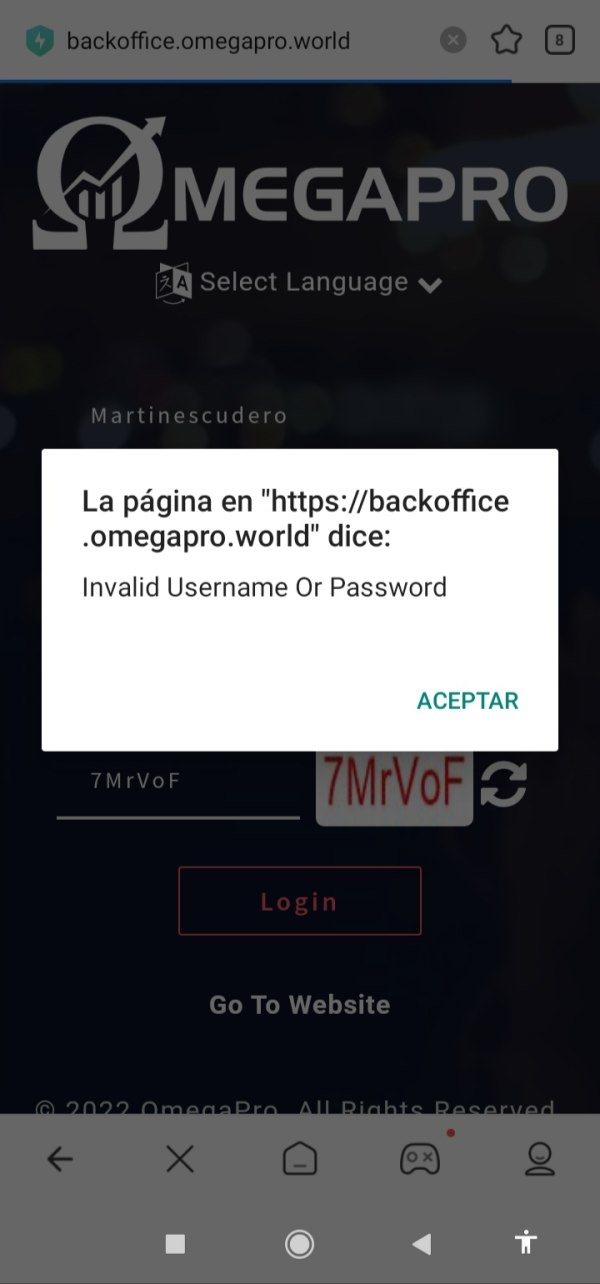

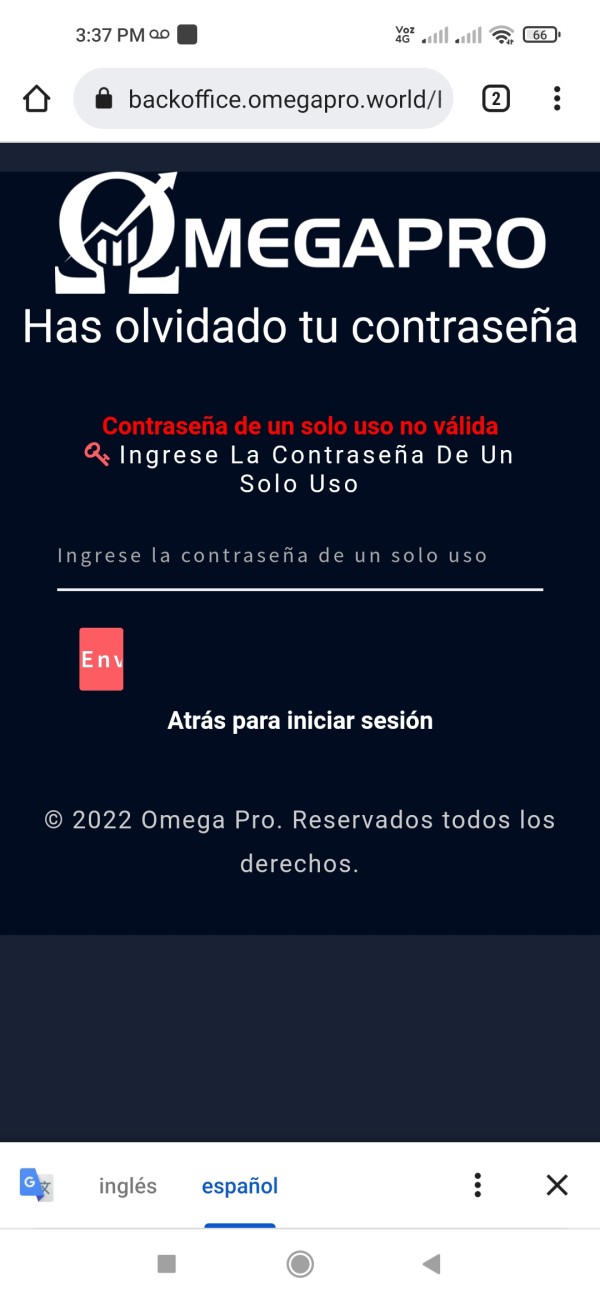

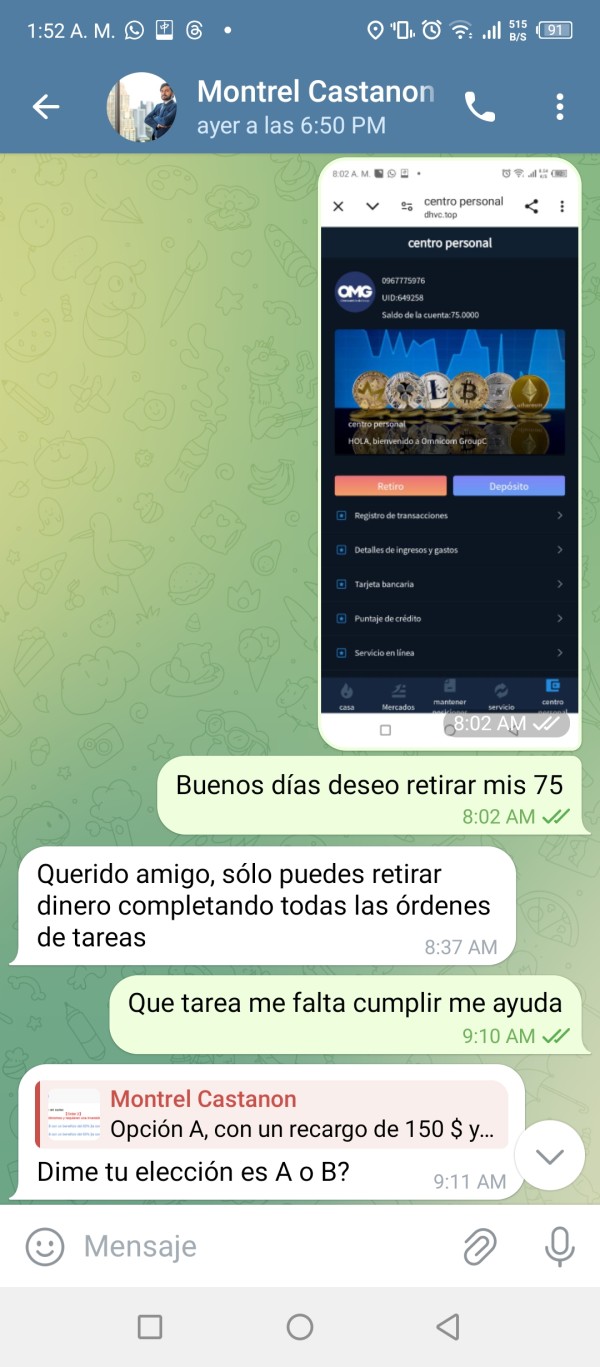

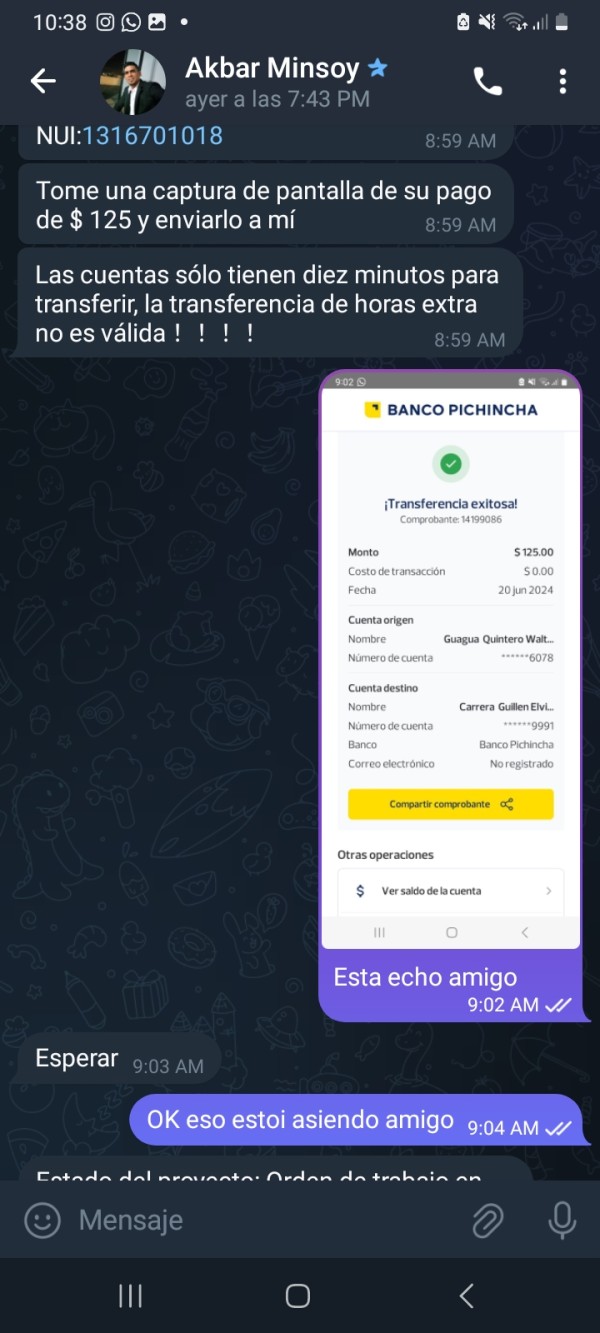

Customer service represents one of the most concerning aspects of the OmegaPro platform, with multiple user complaints highlighting significant issues with support responsiveness and problem resolution. According to reports from ComplaintsBoard and other review platforms, users have experienced considerable difficulties when attempting to resolve account issues, particularly regarding fund withdrawals.

The lack of clearly published customer service channels, response time guarantees, or multilingual support information raises immediate red flags about the platform's commitment to client service. Legitimate forex brokers typically provide multiple contact methods including live chat, phone support, and email assistance with clearly stated availability hours and response time commitments.

User testimonials suggest that when problems arise, particularly concerning fund access, the customer service response is inadequate or non-existent. This pattern of poor support, especially regarding financial transactions, represents a critical failure for any financial services platform. The inability to resolve withdrawal issues effectively has led to numerous complaints and negative reviews across multiple platforms.

The absence of transparent complaint resolution procedures and the lack of clear escalation paths for unresolved issues further compound these service quality concerns. Professional trading platforms typically maintain detailed support documentation and clear procedures for handling client concerns, particularly those involving fund access and account functionality.

Trading Experience Analysis (Score: 5/10)

The trading experience on OmegaPro appears to be significantly hampered by transparency issues and user complaints about platform functionality. While the company claims to offer a sophisticated trading environment with access to multiple asset classes, user feedback suggests a more problematic reality regarding actual trading execution and platform reliability.

The platform's emphasis on guaranteed returns and market-independent profits raises serious questions about the nature of the trading environment. Legitimate forex trading inherently involves market risk, and platforms promising consistent profits regardless of market conditions typically operate more as investment schemes than genuine trading platforms. This fundamental disconnect between claimed services and market realities creates concerns about the authenticity of the trading experience.

User reports indicate difficulties not only with fund withdrawals but also with overall platform functionality and trade execution. The lack of detailed information about order execution speeds, slippage rates, or platform uptime statistics makes it impossible to assess the technical quality of the trading environment objectively.

Mobile trading capabilities and platform accessibility across different devices remain unclear based on available documentation. Modern traders expect seamless multi-device functionality and reliable mobile platforms, but OmegaPro's technical specifications and mobile offerings are not adequately documented for proper evaluation.

This omegapro review finds that the trading experience appears to prioritize investment packaging over genuine market access and professional trading functionality.

Trust and Reliability Analysis (Score: 2/10)

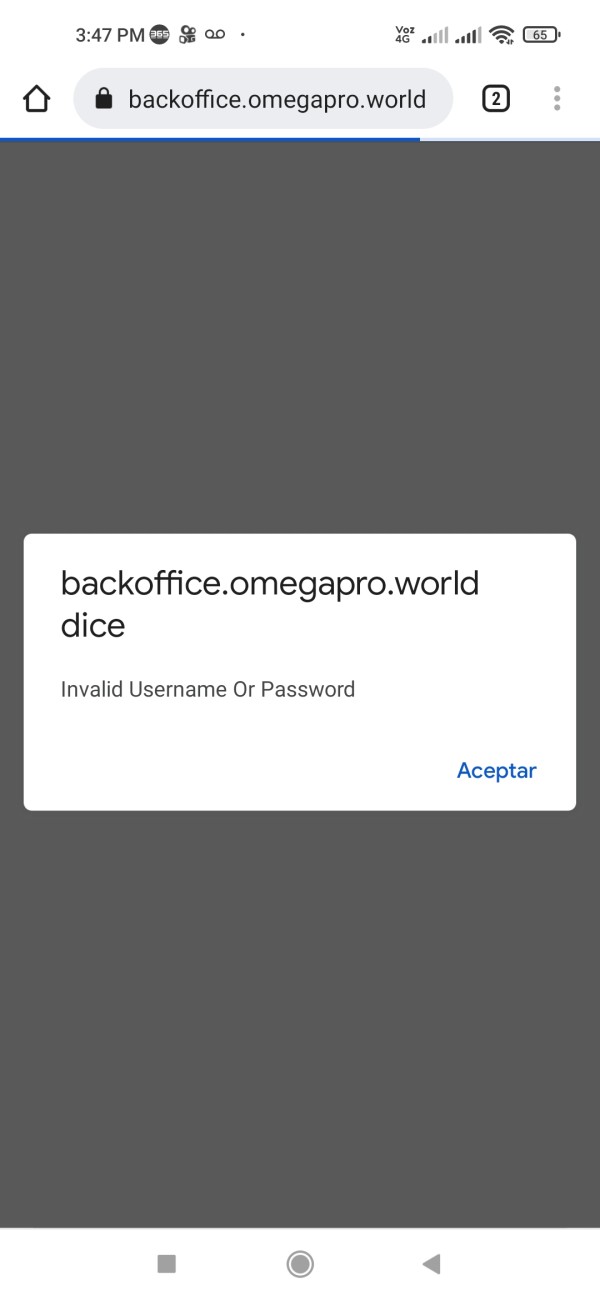

Trust and reliability represent the most critical weaknesses in OmegaPro's offering, with multiple factors contributing to significant concerns about the platform's legitimacy and safety. The absence of verifiable regulatory oversight from recognized financial authorities creates immediate trust issues, particularly given the platform's claims of UK operation without corresponding FCA registration or acknowledgment.

The combination of MLM elements, guaranteed return promises, and withdrawal difficulties reported by users creates a pattern consistent with problematic investment schemes rather than legitimate forex brokers. Established financial services companies typically maintain transparent regulatory relationships, clear business models, and reliable fund access procedures. OmegaPro's deviation from these industry standards raises substantial red flags.

Multiple review websites and user complaint platforms contain negative feedback about the company's practices, particularly regarding fund withdrawal difficulties. This pattern of user complaints, combined with the lack of regulatory transparency, suggests significant reliability concerns. The platform's promises of consistent returns "regardless of market condition" contradict fundamental principles of legitimate forex trading and market dynamics.

The company's web presence and domain status have also raised concerns among industry watchdogs, with some review sites specifically warning about potential deceptive practices. The lack of clear corporate transparency, detailed regulatory information, and verifiable business credentials further undermines trust in the platform's legitimacy and long-term viability.

User Experience Analysis (Score: 4/10)

User experience with OmegaPro appears to be characterized by initial accessibility followed by significant problems, particularly regarding fund management and customer support interactions. While the platform may offer straightforward registration processes typical of MLM-structured companies, the overall user journey becomes problematic when users attempt to access their investments or resolve account issues.

The platform's interface design and ease of use remain unclear based on available documentation, though the company claims to have developed user-friendly infrastructure. However, user satisfaction appears to be significantly impacted by the fundamental issues surrounding fund withdrawals and customer service responsiveness. Even well-designed interfaces cannot compensate for underlying operational problems that prevent users from accessing their money.

The verification and onboarding process specifics are not clearly documented, making it difficult to assess the initial user experience quality. However, based on user feedback patterns, the primary user experience problems emerge after initial registration and investment, particularly when users attempt to withdraw funds or require customer support assistance.

Common user complaints center around communication difficulties with the platform, unclear procedures for fund access, and lack of transparency about account operations. These fundamental user experience failures significantly impact overall satisfaction and platform usability, regardless of any positive aspects of the initial registration or interface design.

The targeting of users seeking diversified investment opportunities may initially attract clients, but the subsequent user experience appears to fall far short of expectations based on available feedback and complaint patterns.

Conclusion

This comprehensive omegapro review reveals a platform with significant concerns that outweigh any potential benefits. While OmegaPro presents itself as an innovative combination of forex trading and cryptocurrency mining opportunities, the absence of regulatory transparency, user complaints about withdrawal difficulties, and promises of guaranteed returns create substantial red flags for potential investors.

The platform may appeal to users seeking diversified investment channels and those attracted to MLM-style opportunities, but the risks appear to significantly outweigh potential benefits. The lack of clear regulatory oversight, combined with concerning user feedback patterns, suggests that OmegaPro operates outside the standards expected of legitimate financial services providers.

The main advantages include access to multiple asset classes and a potentially innovative approach to combining traditional and digital investments. However, these are overshadowed by critical disadvantages including unclear regulatory status, withdrawal difficulties reported by users, lack of transparency in operations, and business model elements that raise legitimacy concerns. For traders and investors seeking reliable, regulated financial services, numerous established alternatives offer better transparency, regulatory protection, and user satisfaction rates.