Regarding the legitimacy of ACCUMARKETS forex brokers, it provides FSCA and WikiBit, (also has a graphic survey regarding security).

Is ACCUMARKETS safe?

Pros

Cons

Is ACCUMARKETS markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

ELITE FINANCIAL SERVICES (PTY) LTD

Effective Date:

2022-10-14Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

4 CANAL CLOSE 2 CENTURY FALLS ROAD CENTURY CITY 7441Phone Number of Licensed Institution:

010 +27100454160Licensed Institution Certified Documents:

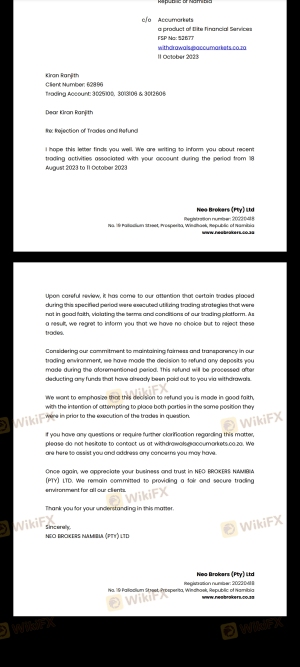

Is Accumarkets A Scam?

Introduction

Accumarkets is a forex broker based in South Africa, claiming to provide a platform for trading various financial instruments, including forex pairs, indices, and commodities. As the forex market expands, traders are increasingly seeking reliable platforms to invest their capital. However, with the rise in online trading, the number of fraudulent brokers has also increased, making it essential for traders to exercise caution and conduct thorough evaluations before committing their funds. This article aims to assess the legitimacy of Accumarkets by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risks associated with using this broker. Our investigation is based on a review of various online sources, including user feedback, regulatory information, and expert analyses.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. Accumarkets claims to be regulated by the Financial Sector Conduct Authority (FSCA) in South Africa; however, there are significant concerns regarding its compliance with regulatory standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSCA | 52677 | South Africa | Exceeded |

The FSCA is responsible for overseeing financial services in South Africa, ensuring that brokers operate within the legal framework and adhere to strict guidelines. However, reports indicate that Accumarkets has exceeded the scope of its FSCA license, raising concerns about its accountability and operational transparency. Unregulated brokers pose a higher risk to investors, as they are not subject to the same level of scrutiny as regulated firms. This lack of oversight can lead to potential fraudulent activities, including price manipulation and mismanagement of client funds.

Company Background Investigation

Accumarkets is operated by Elite Financial Services (Pty) Ltd, a relatively new entity in the financial industry, established in 2022. The company's brief history raises questions about its stability and experience in the market. The ownership structure is not well-documented, and details about the management team are scarce.

The absence of comprehensive information about the company's leadership and their professional backgrounds is concerning. Transparency is a hallmark of reputable brokers, and potential clients should be wary of firms that do not provide clear insights into their management. Furthermore, the lack of a verified physical address or operational history may indicate a lack of commitment to maintaining a trustworthy business.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions and fee structures is crucial. Accumarkets offers a range of financial instruments, but its overall fee structure and trading conditions warrant scrutiny.

| Fee Type | Accumarkets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 pips | 1.0 - 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Not disclosed | Varies |

While the spreads offered by Accumarkets appear competitive, the absence of a clear commission structure and the lack of information regarding overnight interest rates raise red flags. Traders should be cautious of hidden fees that could erode their profits. Transparency in fee disclosure is vital for building trust with clients, and Accumarkets' vague policies may indicate potential pitfalls for traders.

Client Funds Safety

The safety of client funds is paramount when choosing a broker. Accumarkets claims to implement various security measures; however, the lack of regulatory oversight raises concerns about the effectiveness of these measures.

Accumarkets does not provide detailed information regarding the segregation of client funds, investor protection schemes, or negative balance protection policies. These are crucial components that protect traders in the event of broker insolvency or financial mismanagement. Furthermore, there have been no documented incidents of fund security issues, but the absence of transparency regarding safety measures is a significant concern.

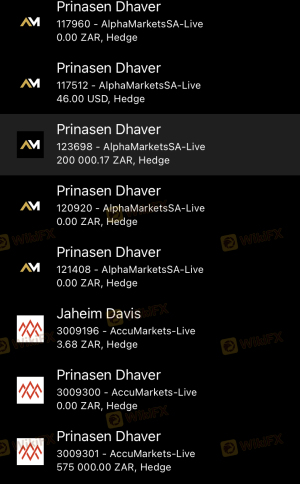

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. Reviews of Accumarkets reveal a mixed bag of experiences, with several users reporting issues related to fund withdrawals and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Support | Medium | Average |

| Account Closure Issues | High | Poor |

Common complaints include delays in processing withdrawals, lack of communication from customer support, and account closures without clear explanations. These patterns are consistent with red flags typically associated with scam brokers. One notable case involved a trader who was unable to withdraw funds after several attempts, leading to frustration and allegations of fraud.

Platform and Trade Execution

The trading platform offered by Accumarkets is a crucial aspect of the trading experience. Users have reported varying levels of satisfaction regarding platform performance, stability, and execution quality.

While Accumarkets claims to provide a user-friendly trading interface, there are concerns regarding order execution quality, slippage, and instances of rejected orders. Such issues can significantly impact trading outcomes, especially for active traders who rely on timely execution. Additionally, any signs of platform manipulation or discrepancies in pricing can erode trust and lead to significant financial losses for traders.

Risk Assessment

Using Accumarkets comes with several inherent risks that potential clients should carefully consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases fraud potential. |

| Financial Risk | Medium | Lack of transparency in fees and conditions. |

| Operational Risk | High | Issues with withdrawals and customer support. |

To mitigate these risks, traders should conduct thorough research and consider using more established and regulated brokers. It is crucial to prioritize brokers with a proven track record of reliability and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that Accumarkets raises several red flags that warrant caution. The lack of proper regulation, transparency issues, and negative customer experiences indicate potential risks associated with this broker. While it is not definitively labeled as a scam, the concerns surrounding its operations make it a less than ideal choice for traders seeking a secure and reliable trading environment.

For traders looking for safer alternatives, it is advisable to consider well-regulated brokers with strong reputations in the industry. Brokers regulated by authorities such as the FCA, ASIC, or NFA provide a higher level of security and oversight, ensuring a more trustworthy trading experience. Always conduct thorough research and consider your risk tolerance before engaging with any trading platform.

Is ACCUMARKETS a scam, or is it legit?

The latest exposure and evaluation content of ACCUMARKETS brokers.

ACCUMARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ACCUMARKETS latest industry rating score is 2.22, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.22 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.