Accumarkets 2025 Review: Everything You Need to Know

Executive Summary

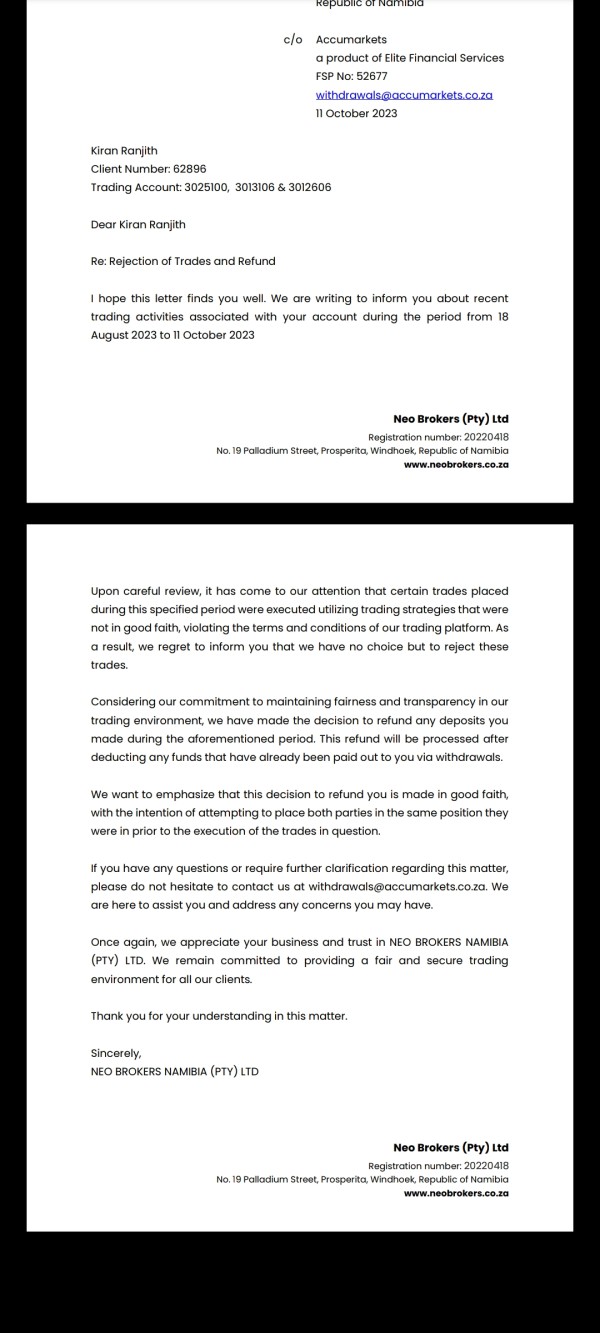

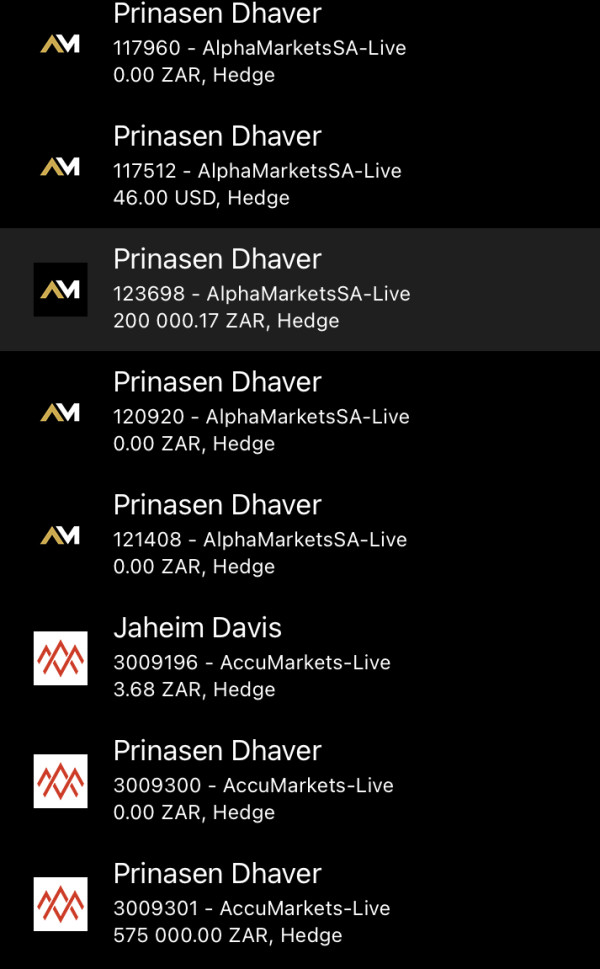

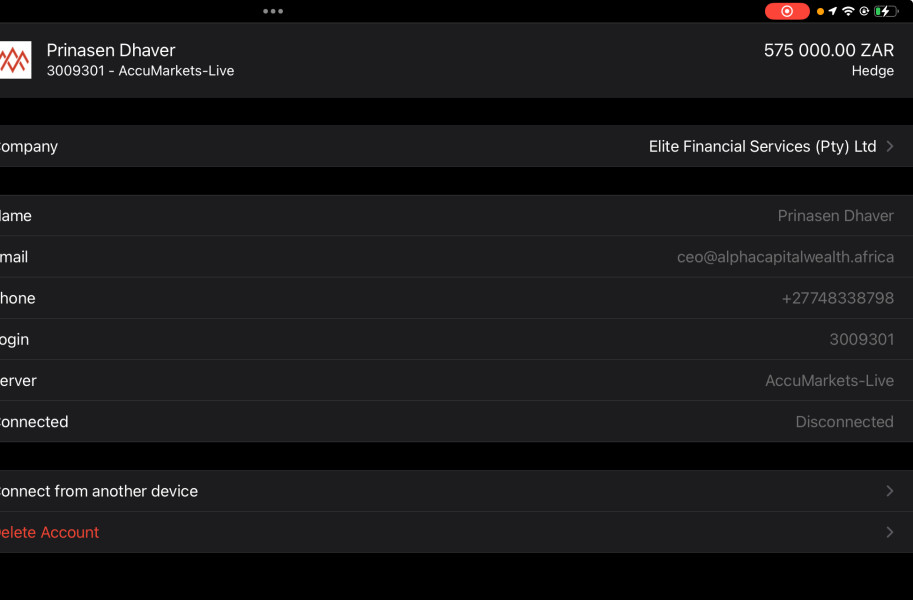

Accumarkets is a new forex broker that started in 2022. The company mainly targets retail traders in South Africa and other regions around the world. This accumarkets review shows some good features like a low minimum deposit of R50 and high leverage up to 1:1000, but the overall rating is negative because of recent bad reviews and fraud claims. The broker follows rules from South Africa's Financial Services Conduct Authority (FSCA). However, it doesn't have regulatory oversight from other international authorities.

The platform uses MetaTrader 5 as its main trading system and lets traders access forex, indices, and precious metals. User feedback shows problems with customer service response times, transparency issues, and trust concerns that have come up recently. Accumarkets has a 3-star rating on Trustpilot and a trust score of 57 from Scam Detector, which creates a mixed picture for potential traders. The low entry barrier helps beginners get started easily. But the trust and reliability problems need careful thought before putting money into an account.

Important Notice

Regional Entity Differences: Accumarkets works mainly under South Africa's Financial Services Conduct Authority (FSCA) regulation. The company has limited regulatory coverage in other global regions outside of South Africa. Traders from other countries should know they might have less regulatory protection and may need to check specific terms that apply to their area.

Review Methodology: This review uses publicly available information, user feedback from different review platforms, and official company statements. We did not directly test the platform for this assessment, so information accuracy depends on how reliable the sources were when we wrote this review.

Overall Rating Framework

Broker Overview

Accumarkets started in the forex trading world in 2022 as a South Africa-based online trading platform. The company wants to provide accessible forex trading services, especially for retail traders who want low-barrier entry into financial markets. Even though it's relatively new, Accumarkets has tried to find its place by offering competitive leverage ratios and minimal deposit requirements, which appeals to traders who might be left out by higher capital requirements at more established brokers.

The broker's business model focuses on providing online forex trading services through the popular MetaTrader 5 platform. This accumarkets review finds that the company focuses mainly on the South African market while keeping some international presence around the world. The platform offers trading in multiple asset classes including forex pairs, indices, and precious metals, giving traders diversification opportunities within a single trading environment. However, the limited operational history and emerging regulatory framework present both opportunities and risks for potential clients who might want to join.

Regulatory Regions: Accumarkets operates under South Africa's Financial Services Conduct Authority (FSCA) supervision. This regulatory framework ensures compliance with local financial standards and consumer protection measures in the South African market.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods was not detailed in available materials. The platform does mention deposit and withdrawal services on their official website though.

Minimum Deposit Requirements: The broker sets an accessible minimum deposit requirement of R50. This makes it particularly attractive for new traders or those with limited initial capital to begin their trading journey.

Bonus and Promotions: Detailed information about current bonus offerings and promotional campaigns was not specified in the available documentation we reviewed.

Tradeable Assets: Accumarkets provides access to multiple asset classes including foreign exchange pairs, stock indices, and precious metals trading. This offers traders diversification opportunities across different market sectors.

Cost Structure: Specific information about spreads, commissions, and other trading costs was not detailed in available sources. This raises concerns about transparency in fee structures for potential traders.

Leverage Ratios: The platform offers leverage up to 1:1000, which appeals to traders seeking higher position sizes relative to their account balance. However, this also increases risk exposure significantly for all users.

Platform Options: Trading is conducted exclusively through the MetaTrader 5 platform. This provides comprehensive charting tools, technical indicators, and automated trading capabilities, though the lack of platform diversity may limit some traders' preferences.

Regional Restrictions: While primarily focused on South African traders, specific geographical restrictions for international clients were not clearly outlined in available materials we found.

Customer Service Languages: Information about specific language support for customer service was not detailed in the accessible documentation.

This accumarkets review notes that the limited availability of detailed operational information may concern traders who prioritize transparency in their broker selection process.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

Accumarkets presents a mixed picture in terms of account conditions, earning a score of 6 out of 10. The broker's most attractive feature is its exceptionally low minimum deposit requirement of R50, which significantly lowers the barrier to entry for new traders compared to many established brokers that require hundreds or thousands of dollars.

This accessibility makes it particularly appealing to traders in emerging markets or those beginning their trading journey with limited capital available. However, this accumarkets review reveals significant gaps in account type information that potential users should know about. The available materials do not clearly outline different account tiers, their specific features, or any premium account benefits that might be available to larger depositors.

The absence of detailed account structure information makes it difficult for traders to understand what services and features they can expect at different deposit levels. The account opening process details were not specified in available sources, which raises questions about verification requirements, documentation needed, and the time frame for account activation. Additionally, there was no mention of specialized account types such as Islamic accounts for traders requiring Sharia-compliant trading conditions.

While the low minimum deposit is commendable, the lack of comprehensive account information prevents a higher rating in this category.

The tools and resources category receives an average rating of 5 out of 10. This rating comes primarily from limited information about the breadth of analytical and educational offerings available to traders. Accumarkets provides access to MetaTrader 5, which is widely regarded as a professional-grade trading platform offering comprehensive charting capabilities, technical indicators, and automated trading support through Expert Advisors (EAs).

MetaTrader 5 includes advanced features such as multiple timeframe analysis, extensive technical indicator libraries, and algorithmic trading capabilities that work well. The platform supports both manual and automated trading strategies, which can benefit traders at various skill levels who want different approaches. However, the evaluation is limited by the apparent lack of proprietary trading tools or enhanced analytical resources beyond the standard MT5 offerings.

Research and analysis resources were not detailed in available materials, suggesting that traders may need to rely on third-party sources for market analysis, economic calendars, and trading signals. Educational resources, which are crucial for trader development, were also not mentioned in the accessible information we could find. The absence of webinars, tutorials, or educational content represents a significant gap for traders seeking to improve their skills.

While MT5 provides a solid foundation for trading activities, the lack of supplementary tools and educational support limits the overall value proposition for traders seeking comprehensive broker services.

Customer Service and Support Analysis (4/10)

Customer service and support represents one of Accumarkets' weaker areas, earning a below-average score of 4 out of 10. User feedback indicates significant concerns about response times and service quality, with multiple reports suggesting that customer service representatives are slow to respond to inquiries and may lack the expertise to resolve complex issues effectively.

The available information does not clearly outline the customer service channels available to traders, such as live chat, email support, or telephone assistance. This lack of transparency about support options creates uncertainty for traders who may need assistance with account issues, technical problems, or trading-related questions that come up. The absence of clearly defined support hours also makes it difficult for international traders to understand when they can expect assistance.

User reviews have highlighted frustrations with problem resolution, suggesting that even when customer service representatives respond, they may not have the authority or knowledge to address complex account or trading issues properly. The limited multilingual support information also raises concerns for international clients who may not be comfortable communicating in English. These service limitations significantly impact the overall trading experience and contribute to the negative sentiment expressed in various user reviews.

Improvement in customer service infrastructure and training appears necessary to enhance trader satisfaction and build trust in the platform.

Trading Experience Analysis (6/10)

The trading experience category achieves an above-average score of 6 out of 10. This rating comes primarily from the stability and functionality of the MetaTrader 5 platform that users can access. Users generally report satisfactory experiences with platform stability, noting that the MT5 environment provides reliable access to markets and executes trades without significant technical disruptions.

MetaTrader 5 offers comprehensive charting capabilities with multiple timeframes, extensive technical analysis tools, and customizable indicators that enhance the trading experience for all users. The platform supports various order types including market orders, pending orders, and stop-loss/take-profit configurations, providing traders with flexible position management options. The automated trading capabilities through Expert Advisors add value for traders interested in algorithmic strategies.

However, this accumarkets review notes that specific performance metrics such as average execution speeds, slippage rates, and requote frequencies were not available in the source materials we reviewed. The absence of detailed execution statistics makes it difficult to assess the quality of trade execution compared to industry standards. Additionally, mobile trading experience information was not specified, though MT5 typically provides mobile applications for iOS and Android devices.

User feedback regarding liquidity and spread stability appears mixed, with some traders expressing satisfaction while others report inconsistencies in their experience. The lack of detailed cost structure information also impacts the ability to fully evaluate the trading environment's competitiveness.

While the platform foundation is solid, more transparency in execution metrics would strengthen confidence in the trading experience.

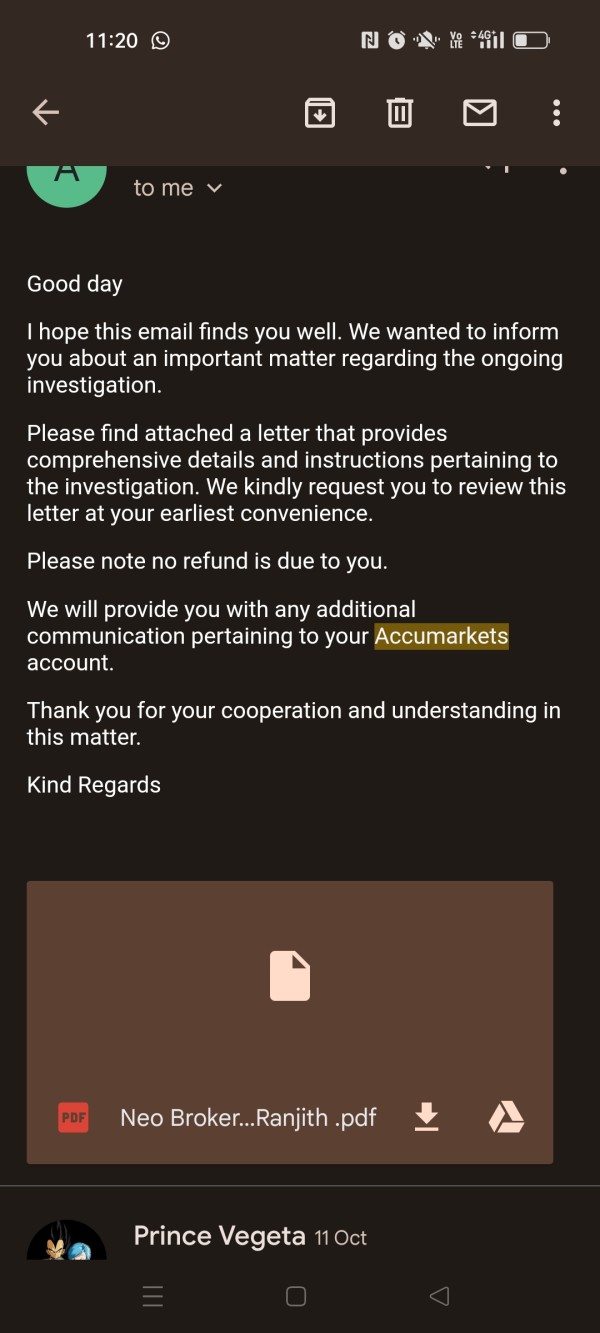

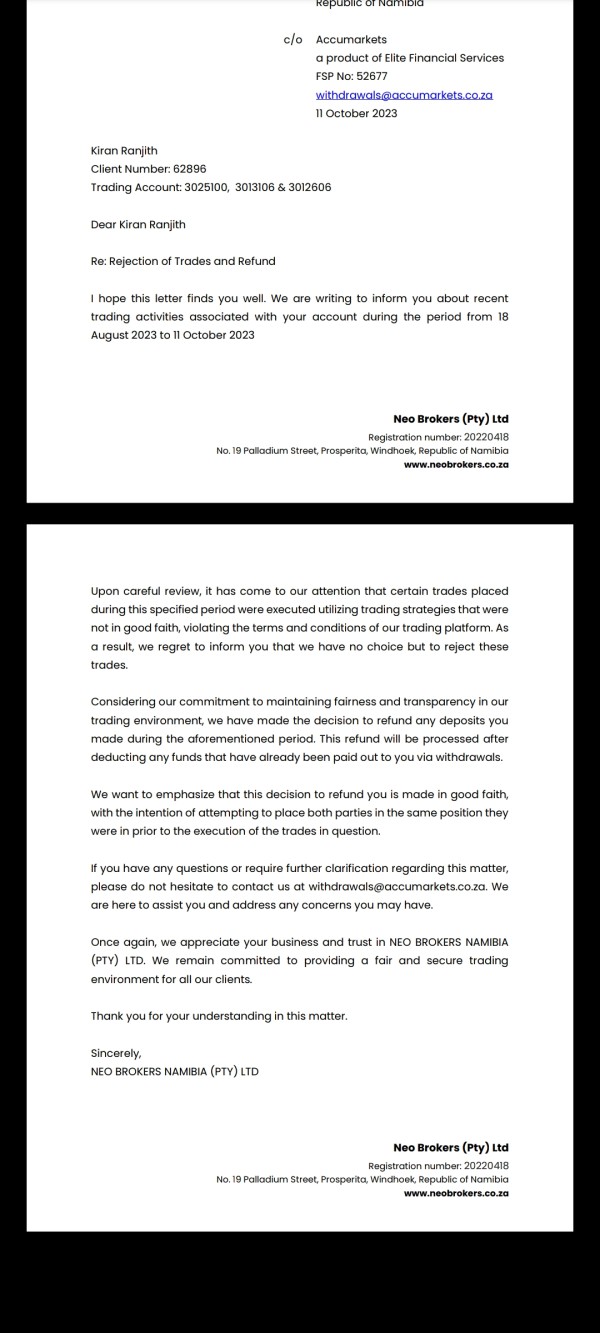

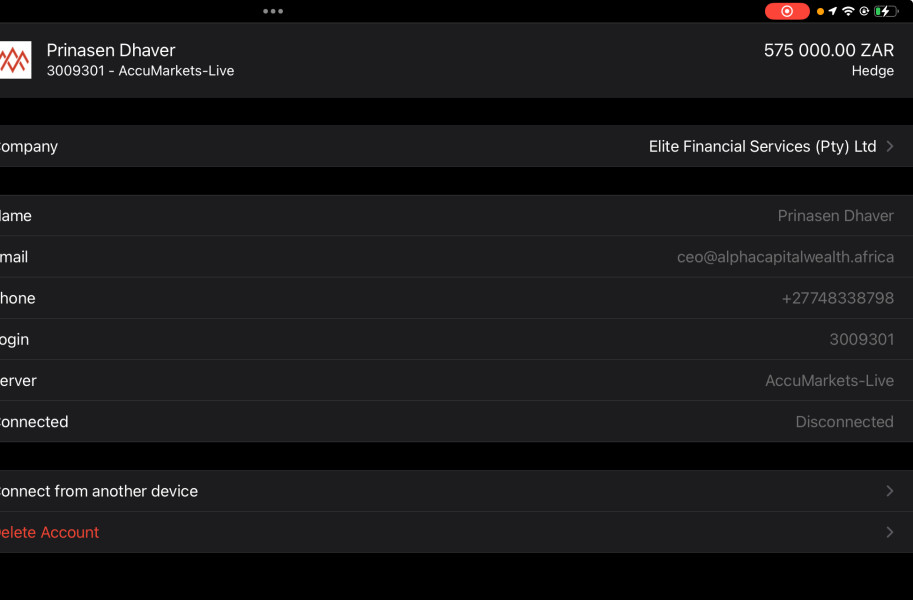

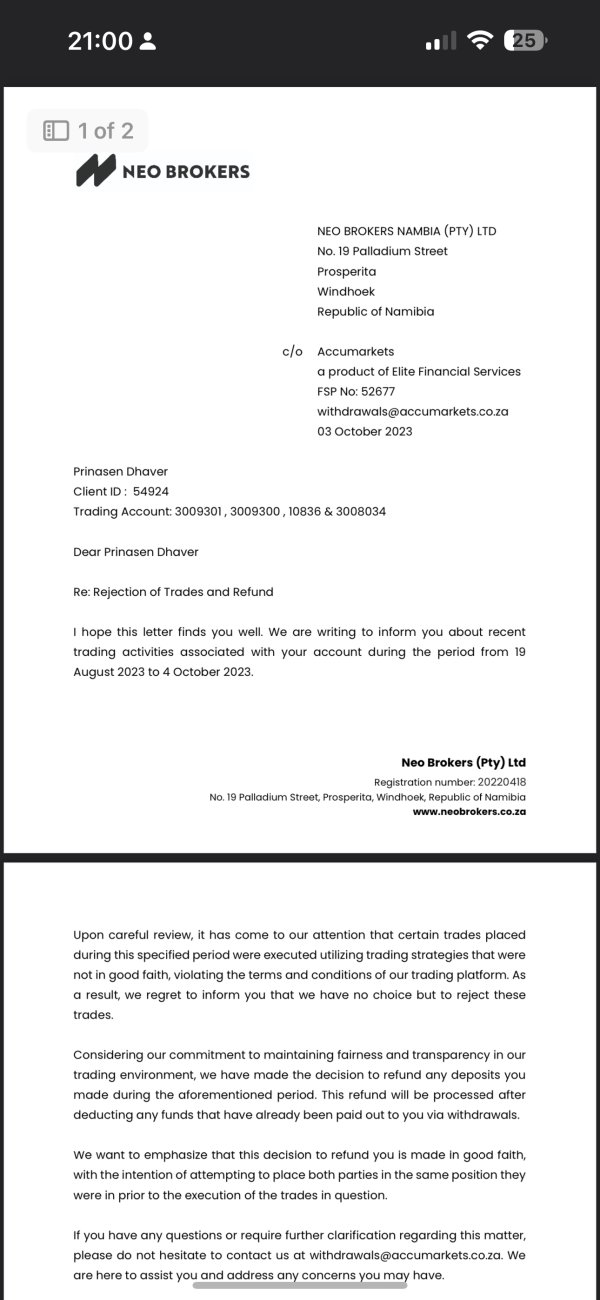

Trustworthiness Analysis (3/10)

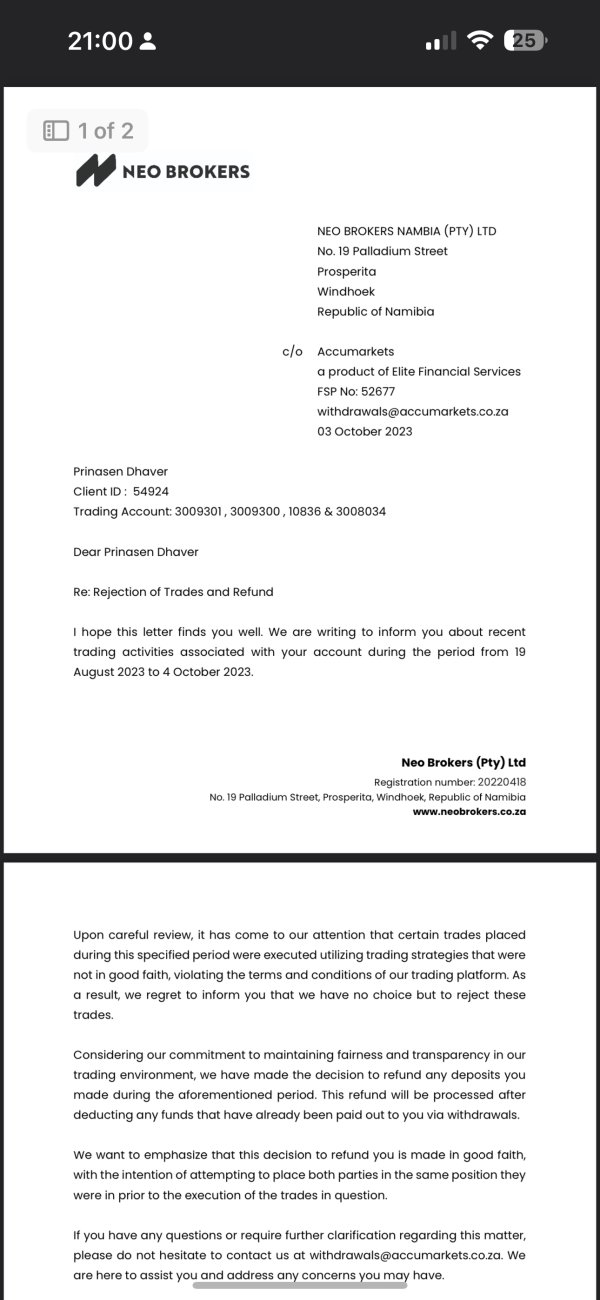

Trustworthiness represents Accumarkets' most significant challenge, earning a poor score of 3 out of 10. The broker's regulatory status under South Africa's Financial Services Conduct Authority provides some regulatory oversight, but the absence of additional international regulatory licenses limits confidence, particularly for traders outside South Africa.

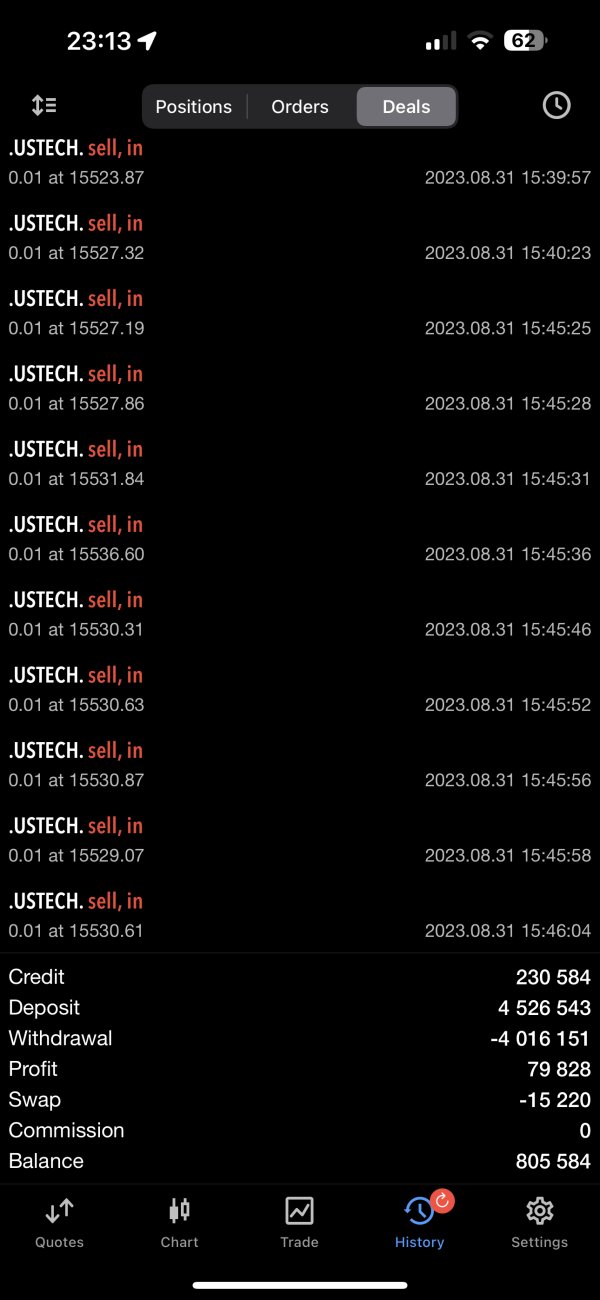

The Trustpilot rating of 3 stars and Scam Detector trust score of 57 indicate moderate to low confidence levels among users and third-party evaluation services. These ratings suggest that while the broker may not be an outright scam, significant trust issues exist that potential traders should carefully consider before opening accounts. Recent fraud allegations and negative user experiences have further damaged the broker's reputation in the trading community.

Transparency concerns emerge from the limited disclosure of operational details such as fee structures, execution statistics, and fund safety measures. The absence of detailed information about client fund segregation, insurance coverage, or other protective measures raises questions about capital security for potential users. Additionally, the company's relatively recent establishment in 2022 means it lacks the operational track record that would typically build confidence among traders.

The negative sentiment expressed in user reviews, combined with limited transparency and regulatory coverage, creates significant trust concerns. Traders considering Accumarkets should carefully weigh these trust factors against any potential benefits and consider whether the risk profile aligns with their comfort level and trading objectives.

User Experience Analysis (5/10)

User experience receives an average rating of 5 out of 10, reflecting mixed feedback from the trading community. While the MetaTrader 5 platform provides a familiar and generally user-friendly interface for traders experienced with the platform, newcomers may face a learning curve in mastering its comprehensive feature set.

The low minimum deposit requirement of R50 creates a positive initial experience for new traders, allowing them to begin trading without significant capital commitment. This accessibility factor contributes positively to the overall user experience, particularly for traders in emerging markets or those with limited initial funds available.

However, user satisfaction appears significantly impacted by customer service issues and transparency concerns that have emerged over time. Traders have expressed frustration with slow response times, difficulty resolving account issues, and lack of clear information about trading conditions and fees. These operational challenges detract from the positive aspects of platform accessibility and low entry barriers.

The absence of detailed information about account verification processes, fund deposit and withdrawal procedures, and resolution timeframes creates uncertainty that impacts user confidence. Additionally, the limited educational resources and analytical tools beyond the standard MT5 offerings may disappoint traders seeking comprehensive broker support.

User feedback suggests that while the basic trading functionality meets expectations, the surrounding services and support infrastructure require significant improvement to enhance overall satisfaction. The mixed reviews and moderate ratings reflect these contrasting experiences between platform functionality and service quality.

Conclusion

This comprehensive accumarkets review reveals a broker with both appealing features and significant concerns that potential traders must carefully consider. While Accumarkets offers attractive entry-level conditions including a low R50 minimum deposit and high leverage up to 1:1000, these benefits are overshadowed by substantial trust and service issues that impact the overall value proposition.

The broker appears most suitable for high-risk tolerance traders who prioritize accessibility over comprehensive service quality, particularly those beginning their trading journey with limited capital. However, the poor trustworthiness rating, customer service challenges, and limited transparency make it difficult to recommend for traders seeking a reliable, long-term trading partnership.

The main advantages include exceptionally low barriers to entry and access to the professional MetaTrader 5 platform, while the primary disadvantages center on trust concerns, limited customer support quality, and insufficient operational transparency. Potential traders should carefully weigh these factors and consider whether the risks align with their trading objectives and risk management strategies.