Executive Summary

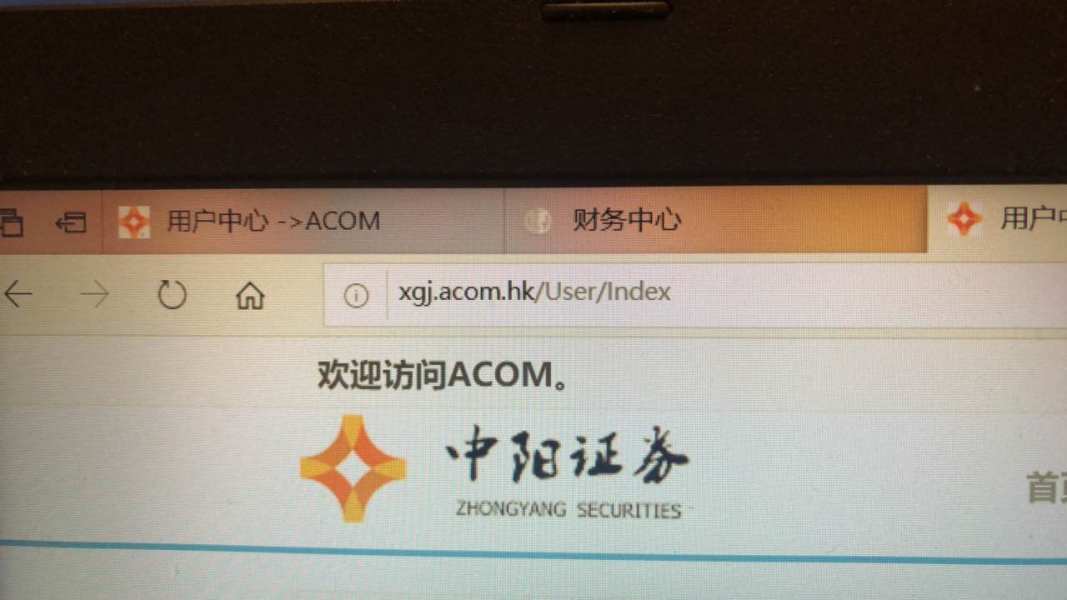

This zhong yang financial group review gives you a complete look at a Hong Kong-based financial services company. The Hong Kong Monetary Authority watches over this company. The company used to be called Zhong Yang Financial Group Limited, but now it goes by TOP Financial Group Ltd, and it offers many different trading services like forex, stocks, futures, and options to clients around the world.

Our review shows a neutral rating because we don't have much public information about their trading conditions, what users think, or detailed service details. The broker does well because Hong Kong's financial system regulates it and because it lets you trade many different types of investments. However, we can't give a stronger rating because they don't share clear pricing information, user reviews, or detailed information about how they operate.

This platform works best for traders who want to invest in Hong Kong markets and for people who want to trade different types of investments under good regulatory oversight. You should do careful research before choosing this broker because there isn't much information available about their trading conditions and what users actually experience.

Important Notice

Traders need to know that rules change depending on where you live, and Zhong Yang Financial Group hasn't clearly shared their specific licensing information. People from different countries should check if this broker can legally offer services in their area before they start trading.

This review uses only the limited public information we could find, and because we don't have detailed user feedback or complete trading condition information, our review might not cover everything. People thinking about using this broker should ask them directly for detailed information about what they need and whether the broker follows the rules in their area.

Rating Framework

Broker Overview

Zhong Yang Financial Group works as an online trading company based in Hong Kong. The company changed its structure and now operates as TOP Financial Group Ltd. It focuses on giving complete financial services to international clients who want to trade in Asian and global markets through one platform.

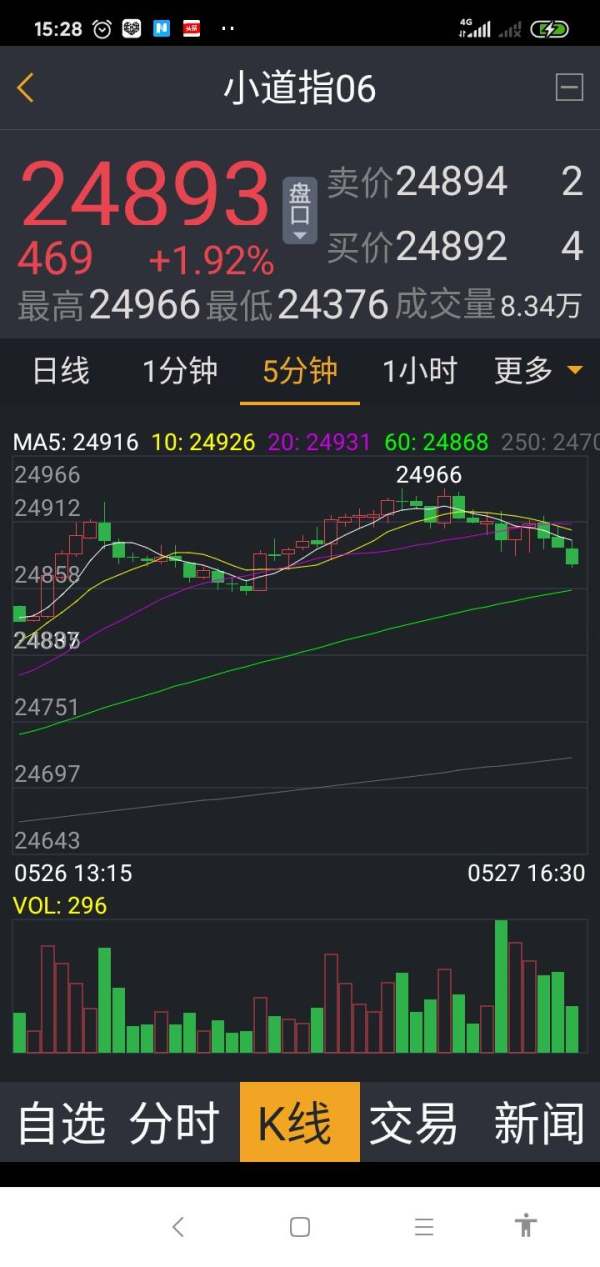

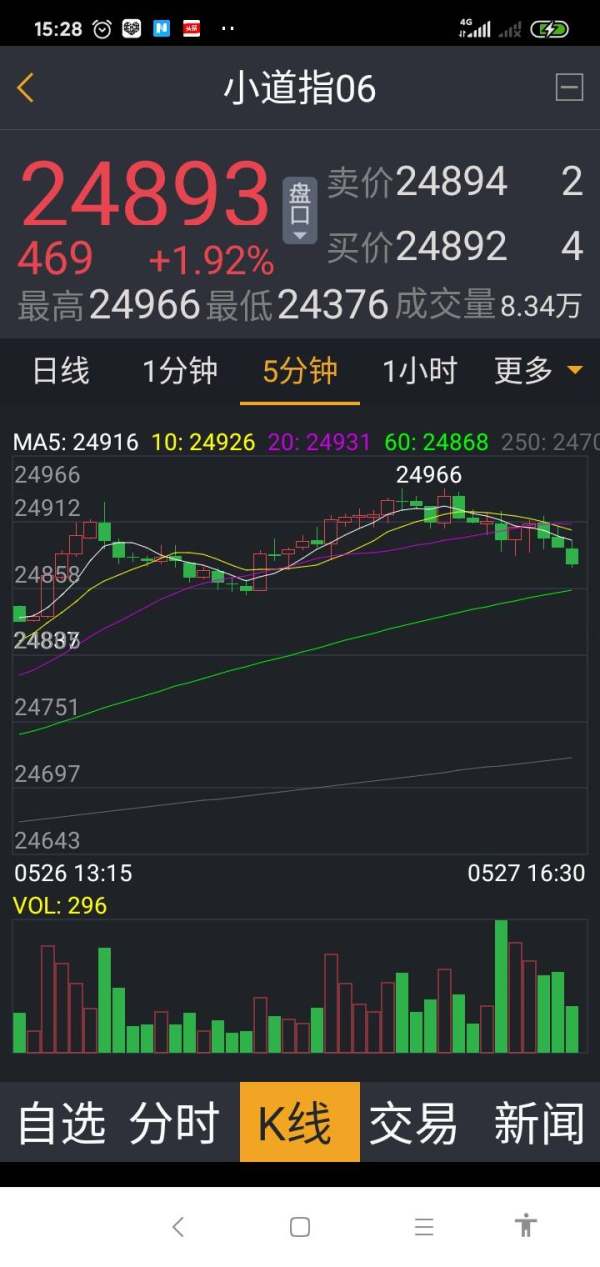

The company's financial records show it has stayed in business and managed money well. They had cash and similar assets worth $24,522,035 in September 2023, which was more than the $15,966,421 they had in March 2023. The company makes money by helping people trade different types of investments while following Hong Kong's financial rules.

This broker calls itself a multi-asset trading provider, which means clients can trade foreign currencies, stocks, futures contracts, and options. This variety lets traders use different investment strategies across many market areas. But they don't share specific details about their technology, what trading platforms they use, or how they execute trades in their public information, so people interested in using them would need to ask directly.

Regulatory Jurisdiction: The company operates under Hong Kong Monetary Authority supervision, which gives it regulatory oversight that meets Hong Kong's financial services standards.

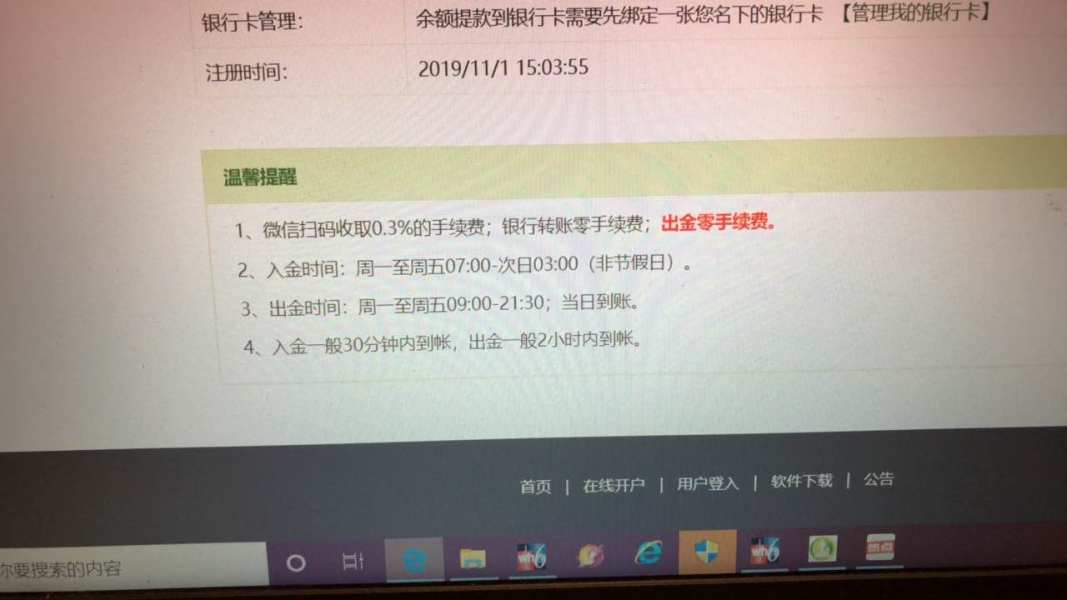

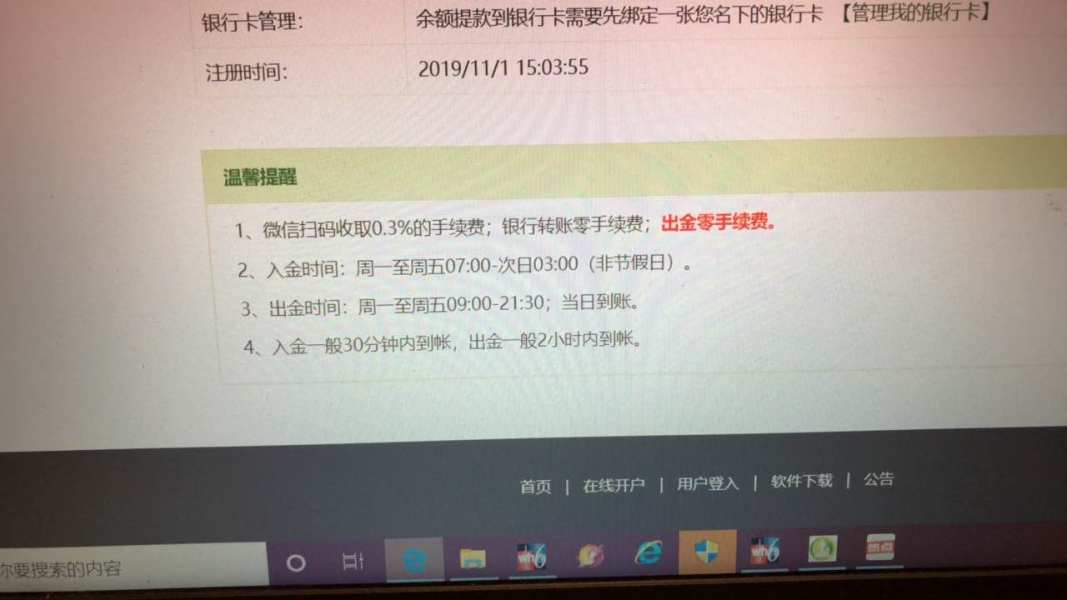

Deposit and Withdrawal Methods: They haven't shared specific information about how they process payments, what currencies they support, or how long transactions take.

Minimum Deposit Requirements: The exact minimum deposit amounts for different account types aren't listed in the information we reviewed.

Promotional Offers: They don't detail current bonus structures, welcome packages, or promotional trading incentives in their public information.

Tradeable Assets: The platform lets you trade multiple asset classes including foreign exchange pairs, stocks, futures contracts, and options, which gives you many options for different trading strategies.

Cost Structure: You need to ask them directly about spreads, commission rates, overnight financing charges, and other trading costs because this zhong yang financial group review found limited transparency in their public pricing information.

Leverage Ratios: They don't specify maximum leverage offerings and margin requirements for different asset classes in the materials we reviewed.

Platform Options: They haven't detailed specific trading platform software, mobile applications, and technological features in their available documentation.

Geographic Restrictions: They don't clearly outline service availability limitations and restricted jurisdictions in accessible materials.

Customer Support Languages: You need to check directly with the broker about available support languages and communication channels.

Detailed Rating Analysis

Account Conditions Analysis

Looking at account conditions for Zhong Yang Financial Group is hard because they don't share detailed information publicly. Important things like different account types, minimum deposit requirements, and specific features aren't disclosed, so we can't fully evaluate what accounts they offer.

We don't have information about different account levels, what benefits each one has, or what you need to qualify for them, so potential clients can't make smart decisions about which account type would work best for their trading goals. They also don't clearly explain account opening procedures, what documents you need, or how long verification takes, which makes the assessment process even harder.

They don't clearly explain account-specific features like dedicated support levels, research access, or premium tools, so it's difficult to evaluate what value they offer to different types of clients. This zhong yang financial group review can't give a clear rating for account conditions because we don't have enough information, which shows that people interested in this broker need to contact them directly for complete account information.

Zhong Yang Financial Group does well by offering access to many trading instruments including forex, stocks, futures, and options. This multi-asset approach gives traders chances to diversify their portfolios and use various trading strategies across different market sectors, which helps sophisticated investors a lot.

But our evaluation is limited because we don't have detailed information about specific trading tools, analytical resources, and educational materials that might be available to clients. Modern traders usually need advanced charting capabilities, technical analysis tools, fundamental research, and educational resources to make smart trading decisions.

We don't have information about automated trading support, API access for algorithmic trading, or third-party tool integration, so we can't assess how well the platform works for different types of traders. Also, without details about research quality, market analysis provision, or educational program availability, it's hard to evaluate the complete support they offer to clients beyond basic trading execution.

Customer Service and Support Analysis

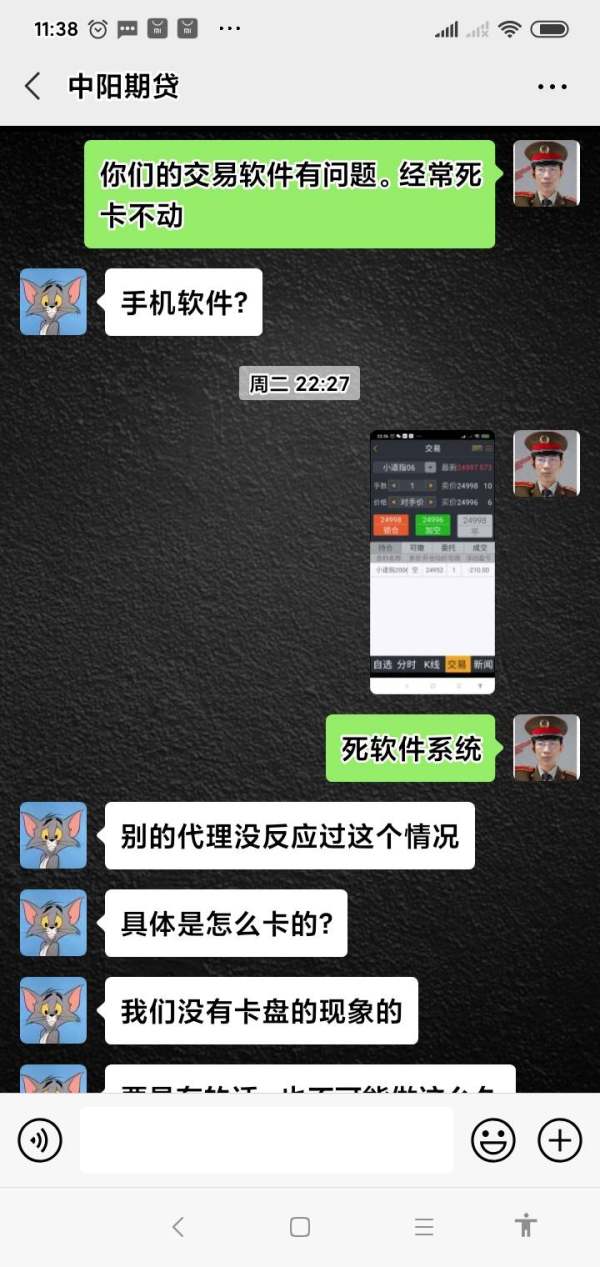

We can't properly assess customer service capabilities because we don't have information about support infrastructure, response times, and service quality metrics. Important details about customer support channels, including phone support, live chat availability, email response systems, and help desk hours, aren't disclosed in the materials we reviewed.

We don't have information about multilingual support capabilities, regional support teams, or specialized assistance for different account types, so it's impossible to evaluate how well the broker serves its international client base. We also don't have data about typical response times, issue resolution procedures, or customer satisfaction metrics, so we can't meaningfully assess service quality.

Professional trading environments need reliable, knowledgeable support that can address technical issues, account inquiries, and trading-related questions quickly. The lack of transparency about support team qualifications, availability schedules, and communication channels raises questions about the broker's commitment to customer service excellence that need direct verification.

Trading Experience Analysis

Evaluating the trading experience needs detailed information about platform performance, execution quality, and user interface design, but none of these are properly addressed in available documentation. Important factors such as order execution speed, price slippage rates, platform stability during high-volatility periods, and overall system reliability remain unspecified.

We don't have information about mobile trading capabilities, platform customization options, and user interface design, so it's difficult to assess how well the broker serves modern traders who need flexible, responsive trading environments. Also, without details about order types supported, risk management tools available, or trading automation features, the evaluation stays incomplete.

User experience elements such as platform learning curves, navigation efficiency, and feature accessibility are crucial for trader satisfaction but can't be evaluated without access to user feedback or detailed platform demonstrations. This zhong yang financial group review can't provide a complete assessment of trading experience because we don't have enough information about these critical operational aspects.

Trust and Safety Analysis

The regulatory oversight provided by the Hong Kong Monetary Authority creates a foundation of credibility for Zhong Yang Financial Group, as Hong Kong maintains recognized standards for financial services regulation. This regulatory framework provides basic assurance about operational compliance and financial oversight, which helps the broker's trustworthiness profile.

But our evaluation is limited because we don't have detailed information about client fund protection measures, segregated account policies, and specific regulatory compliance procedures. Modern traders need transparency about how their funds are protected, whether client money is segregated from operational funds, and what protections exist in various scenarios.

We don't have available information about the company's track record, any regulatory actions or sanctions, and transparency about ownership structure, so we can't provide a complete trust assessment. Also, without access to third-party audits, financial strength ratings, or detailed disclosure documents, the evaluation relies mainly on the regulatory framework rather than comprehensive operational transparency.

User Experience Analysis

The assessment of user experience is severely limited by the absence of client feedback, user testimonials, and detailed information about the customer journey from account opening through ongoing trading activities. Important elements such as account opening efficiency, verification procedures, and onboarding processes remain undocumented in available sources.

We don't have information about user interface design, platform intuitive features, or accessibility for traders with different experience levels, so it's impossible to evaluate how well the broker serves its diverse client base. We also don't have data about common user complaints, satisfaction surveys, or retention rates, so we can't meaningfully analyze client satisfaction levels.

Modern trading environments need seamless integration of various functions including account management, trading execution, research access, and support services. We don't have detailed information about how these elements work together in the user experience, and we have limited feedback from actual users, so we can't provide a complete evaluation of this critical dimension.

Conclusion

This zhong yang financial group review shows a broker with potential strengths in regulatory framework and asset diversity, but significant limitations in transparency and available information. The company's supervision under the Hong Kong Monetary Authority provides a credible regulatory foundation, while its multi-asset trading capabilities offer potential value for diversification-seeking investors.

But the lack of detailed information about trading conditions, user experiences, and operational specifics prevents a complete evaluation and results in an overall neutral assessment. People interested in Hong Kong market exposure and multi-asset trading may find value in this broker, but should conduct thorough research and direct inquiry to get essential information about trading conditions, costs, and service quality before making any commitments.

The main recommendation for potential clients is to contact the broker directly to get detailed information about all aspects of their services, particularly regarding trading costs, platform capabilities, and customer support quality, as these critical elements remain unclear based on publicly available information.