Regarding the legitimacy of ZHONG YANG FINANCIAL GROUP forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is ZHONG YANG FINANCIAL GROUP safe?

Business

Risk Control

Is ZHONG YANG FINANCIAL GROUP markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Zhong Yang Securities Limited

Effective Date:

2016-03-04Email Address of Licensed Institution:

cs@zyzq.com.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.zyzq.com.hkExpiration Time:

--Address of Licensed Institution:

香港干諾道西118號1101室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Zhong Yang Financial Group Safe or Scam?

Introduction

Zhong Yang Financial Group is an online brokerage firm based in Hong Kong, specializing in trading a variety of financial instruments including foreign exchange, commodities, and futures. As the forex market continues to grow, traders are increasingly drawn to the potential for profit. However, the proliferation of brokers also means that traders must exercise caution, as not all firms operate with integrity. This article aims to provide a comprehensive analysis of Zhong Yang Financial Group, assessing its legitimacy and safety for potential clients. Our investigation is based on a review of regulatory information, company history, trading conditions, customer feedback, and risk assessments.

Regulation and Legitimacy

The regulatory status of a brokerage is one of the most critical factors in determining its safety. Zhong Yang Financial Group is regulated by the Securities and Futures Commission (SFC) of Hong Kong, which is known for its stringent oversight of financial institutions. The presence of regulation suggests that the broker adheres to specific operational standards and practices. However, traders should be aware that being regulated does not guarantee the absence of risk.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities and Futures Commission (SFC) | BGT 529 | Hong Kong | Verified |

The SFC regulates firms to ensure they maintain high standards of conduct, including client fund protection and transparency. However, there have been reports of complaints against Zhong Yang Financial Group on platforms such as WikiFX, raising concerns about its operational practices. The existence of such complaints necessitates a cautious approach when considering this broker. Traders should actively seek additional information regarding the broker's compliance history and any past regulatory issues.

Company Background Investigation

Zhong Yang Financial Group was founded in 2015 and has since established itself within the competitive landscape of online trading. The company operates under the name Zhong Yang Securities Limited and is headquartered at Room 1101, 118 Connaught Road West, Hong Kong. The ownership structure appears to be transparent, with key executives having backgrounds in finance and trading.

The management team consists of experienced professionals who have worked in various capacities within the financial services industry. This experience can lend credibility to the firm. However, transparency in operations is crucial; potential clients should assess the availability of information regarding the company's financial health and operational practices. A lack of clear communication or reluctance to provide information can be a red flag.

Trading Conditions Analysis

When evaluating whether Zhong Yang Financial Group is safe, it is essential to consider its trading conditions. The broker offers a range of financial instruments, but the overall cost structure can significantly impact profitability. It is vital to understand the spreads, commissions, and any additional fees associated with trading.

| Fee Type | Zhong Yang Financial Group | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies (e.g., 0.1 for Gold) | 0.5 - 1.0 |

| Commission Model | $20 per contract | $10 - $15 |

| Overnight Interest Range | 8% annual | 5% - 7% |

While the spreads appear competitive, the commission structure may be higher than average, which could deter some traders. Additionally, the overnight interest rates seem elevated, which could lead to higher costs for positions held overnight. Traders should carefully consider these factors when assessing the overall trading environment provided by Zhong Yang Financial Group.

Client Fund Safety

Client fund safety is paramount when determining if Zhong Yang Financial Group is safe. The broker claims to implement measures such as segregated accounts to protect client funds. Segregation of client funds is crucial, as it ensures that client money is kept separate from the broker's operating funds, thus providing a layer of protection in case of insolvency.

Moreover, the broker should ideally offer investor protection schemes, which can provide compensation in the event of a broker's failure. However, there is limited information available on whether Zhong Yang Financial Group provides such protections. Historical issues related to fund withdrawals and client complaints about difficulties in accessing their funds raise concerns about the broker's operational integrity. Traders should be cautious and consider these factors when deciding whether to deposit funds with this broker.

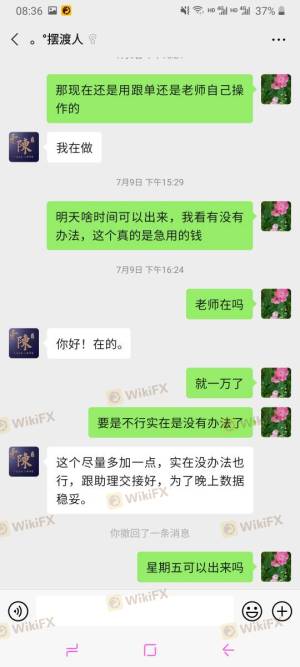

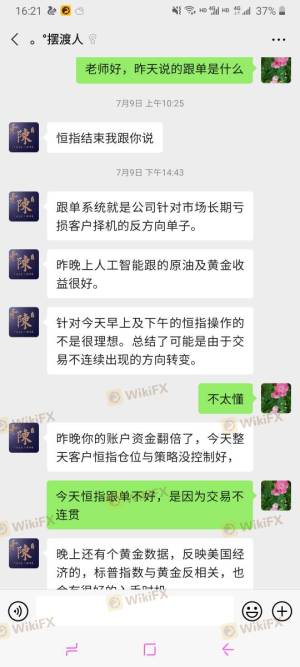

Customer Experience and Complaints

Customer feedback is a vital component in evaluating whether Zhong Yang Financial Group is safe or potentially a scam. Reviews on various platforms reveal a mix of experiences, with some users reporting positive interactions while others have raised serious concerns. Common complaints include difficulties in withdrawing funds, alleged manipulation of trading software, and unresponsive customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Fund Withdrawal Issues | High | Slow response, unresolved |

| Software Manipulation | High | No acknowledgment |

| Lack of Support | Medium | Limited channels available |

Several users have shared alarming experiences, including instances where they were unable to access their accounts after raising concerns. For example, one user reported losing significant amounts due to alleged liquidation caused by the broker's actions. Such complaints should not be taken lightly, as they indicate potential systemic issues within the brokerage.

Platform and Trade Execution

The performance of a trading platform is crucial for a positive trading experience. Zhong Yang Financial Group offers a proprietary trading platform, but user reviews suggest varying levels of satisfaction regarding its performance. Key aspects to evaluate include order execution speed, slippage, and the overall user interface.

Traders have reported experiencing slippage during high volatility periods, which can significantly impact trading outcomes. Additionally, some users have indicated that the platform may not be as user-friendly as competitors, which could hinder the trading experience, particularly for novice traders. Any signs of platform manipulation, such as delays in order execution or unexpected account restrictions, should raise red flags.

Risk Assessment

Using Zhong Yang Financial Group carries inherent risks that traders must consider. While the broker is regulated, the presence of numerous complaints and reports of operational issues necessitates a thorough risk assessment.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Complaints against the broker raise concerns. |

| Operational Risk | High | Reports of fund withdrawal issues and software manipulation. |

| Market Risk | Medium | Standard market risks associated with trading. |

To mitigate risks, traders should conduct extensive research, consider starting with a small investment, and maintain a diversified portfolio. Additionally, keeping abreast of any changes in the broker's regulatory status or operational practices is essential.

Conclusion and Recommendations

In conclusion, while Zhong Yang Financial Group is a regulated brokerage operating in Hong Kong, there are significant concerns that potential clients should consider. The presence of numerous complaints, particularly regarding fund withdrawals and customer service, raises questions about the broker's reliability.

Traders should approach this broker with caution, especially those who are new to trading or lack experience in navigating potential risks. For those seeking alternatives, it may be advisable to explore other well-reviewed brokers with a proven track record of client satisfaction and transparent operations.

Overall, the question of "Is Zhong Yang Financial Group safe?" remains complex. While it is a regulated entity, the reported issues suggest that traders should exercise due diligence before deciding to engage with this broker.

Is ZHONG YANG FINANCIAL GROUP a scam, or is it legit?

The latest exposure and evaluation content of ZHONG YANG FINANCIAL GROUP brokers.

ZHONG YANG FINANCIAL GROUP Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ZHONG YANG FINANCIAL GROUP latest industry rating score is 5.63, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.63 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.