vanexfx 2025 Review: Everything You Need to Know

Abstract

The vanexfx review shows an offshore forex broker from Vanuatu that has received major criticism about its legitimacy and reputation. Multiple sources report that vanexfx offers very low spreads—down to 0.1 pips—and maximum leverage up to 1:500, which could help high-leverage traders with lots of capital. The broker requires a minimum deposit of $3000, though. This high amount may scare away smaller retail traders or beginners. User feedback has been mostly negative. People report problems getting their money back and say the company lacks transparency. The trading conditions look good for experienced and wealthy traders, but you should be careful because it operates offshore with weak regulation and poor customer support. This review uses public information and user feedback to give future clients a balanced view of whether vanexfx fits their trading needs.

Notice

Vanexfx is registered in Vanuatu and follows different rules than major financial centers. The information in this review comes from public data and user feedback from various sources. Details might differ because of different reporting across regions and time periods. This evaluation sticks to the collected information and shows both good aspects, like competitive trading conditions, and bad aspects, including reported problems with customer support and legitimacy. All analysis aims to provide a neutral, data-driven view of vanexfx.

Scoring Framework

Broker Overview

Vanexfx is an offshore forex broker registered in Vanuatu. This location is known for looser rules compared to major financial centers. The broker promises competitive trading conditions like very low spreads and high leverage, but its background worries many traders. Problems with its legitimacy and reputation continue, as shown by many user complaints about trouble getting money back and lack of transparency. The company mainly targets traders with lots of money who are ready to take big risks. With a $3000 minimum deposit, vanexfx clearly aims for experienced and well-funded traders, which might push away beginners.

Vanexfx also has controversial regulatory standing but uses the MetaTrader 5 platform. This is a well-known trading interface that offers many features and automated trading options. The broker claims to offer many trading instruments, though specific types are not clearly listed in available information. Vanexfx operates under the Vanuatu Financial Services Commission , but this oversight seems weak based on user experiences. This vanexfx review shows that while some trading conditions look good for experienced traders, major concerns about legal credibility and customer service could outweigh these benefits for many people.

-

Regulatory Region:

Vanexfx is registered in Vanuatu and operates under the Vanuatu Financial Services Commission . Various reports confirm this information.

Deposit and Withdrawal Methods:

The available information does not detail specific deposit and withdrawal methods. This information was not provided in the abstract.

Minimum Deposit Requirement:

You need $3000 to open an account, which may not work for all traders. Vanexfx review reports confirm this requirement.

Bonuses and Promotions:

Available sources do not mention bonus promotions or additional incentives. This information was not provided in the abstract.

Tradable Assets:

The broker advertises access to many trading instruments. However, exact asset categories are not specified and need more clarification from various market reviews.

Cost Structure:

Vanexfx highlights competitive pricing with spreads as low as 0.1 pips. Commission fee details are not provided, which leaves potential costs unclear according to vanexfx review reports.

Leverage:

The broker offers maximum leverage up to 1:500, which is perfect for traders wanting significant market exposure. Vanexfx review data confirms this information.

Platform Selection:

The main trading platform is MetaTrader 5 , known for comprehensive charting, analysis tools, and automated trading support. Technical specifications on vanexfx provide this information.

Regional Restrictions:

The summary does not provide information about regional account restrictions. This information was not provided in the abstract.

Customer Service Languages:

Available documentation does not clearly outline which languages customer service supports. This information was not provided in the abstract.

Detailed Score Analysis

2.6.1 Account Conditions Analysis

The account conditions at vanexfx cause major problems. This broker needs a $3000 minimum deposit, which is much higher than many established brokers charge. The high deposit requirement makes it hard for traders with less money to access, limiting clients to those with lots of capital. There is also not enough detailed information about different account types, and no mention of commission fees, which is important for checking if an account works for you. User feedback in multiple reports shows frustration with the complicated account opening process and limited flexibility with fund access. Compared to other brokers in similar offshore locations, vanexfx's account conditions are less helpful, which leads to a lower score. This vanexfx review data analysis shows that the high deposit barrier and lack of transparency about extra charges create major problems for what could otherwise be competitive trading conditions from the broker.

Vanexfx uses the MetaTrader 5 platform. This is a well-known and strong trading interface that offers many features like advanced charting, automated trading, and enhanced technical analysis tools. However, while MT5 is a quality platform, vanexfx fails to provide detailed descriptions of additional research tools, educational resources, or comprehensive market analysis reports for clients. The limited information about available research and analytical tools makes it hard for traders to fully judge how these resources compare to leading industry competitors. Some user evaluations point out that while the platform works well for executing trades, there is a clear lack of extra tools that can support detailed market research or educational programs. This shortage of resources may hurt both new and experienced traders who want to improve their trading strategy. The overall feeling in multiple vanexfx review pieces shows that despite the solid foundation from MT5, the accompanying tools and resources need more improvement to meet market standards.

2.6.3 Customer Service and Support Analysis

Customer service and support at vanexfx has gotten constant negative attention. Direct user feedback shows that the broker's response times are slow, and solving issues—especially those related to fund withdrawals—has been very poor. Many clients report that trying to get help or clarification on operational issues results in long communication delays, which makes the uncertainty about the broker's legitimacy worse. There is also a lack of clear information about available communication channels and whether multilingual support exists. Such gaps greatly impact overall user satisfaction, especially for a broker operating in a high-risk offshore environment. Compared to others, the customer service problems highlighted in various vanexfx review articles suggest that the broker's support system is underdeveloped, ultimately leading to a low score in this important area. The combined evidence points to customer support problems that could leave traders feeling unsupported during urgent times or market volatility.

2.6.4 Trading Experience Analysis

The trading experience from vanexfx shows mixed results. On one hand, the broker promotes an attractive trading environment by offering very low spreads—down to 0.1 pips—and high maximum leverage of 1:500, which can attract active traders wanting significant market exposure. Using the MT5 platform adds more credibility by providing a stable and feature-rich trading interface with advanced security and functionality. However, the overall trading experience suffers from ongoing concerns about the broker's legal standing and operational transparency. Some users worry that the platform's strength could be hurt by underlying issues related to fund security and dispute resolution processes. Basically, while the technical aspects of trade execution and order management are good, the surrounding environment—including negative views reported in numerous vanexfx review sources—greatly hurts the overall trading experience. So for traders weighing the benefits of tight spreads and high leverage against potential legitimacy concerns, the decision becomes one of balancing competitive terms with the risks of an offshore, less regulated broker.

2.6.5 Trustworthiness Analysis

When looking at trustworthiness, vanexfx faces big challenges. Although the broker is regulated by the Vanuatu Financial Services Commission , many sources question how effective and reputable this regulatory body is. The lack of clear transparency about financial disclosures and corporate governance makes these issues worse. User testimonials repeatedly show a lack of trust, citing cases of difficulty getting funds back and unsatisfactory responses during dispute resolution. The repeated negative mentions and warnings found in various vanexfx review platforms strengthen the feeling that the broker operates in a high-risk gray area within the offshore market. Also, the limited public information about the broker's operational history and risk management measures leaves potential clients with major uncertainties. Together, these factors create a situation where trust in vanexfx is seriously damaged. For traders whose capital security is most important, these issues present a serious red flag and strong reasons to be very careful when thinking about working with this broker.

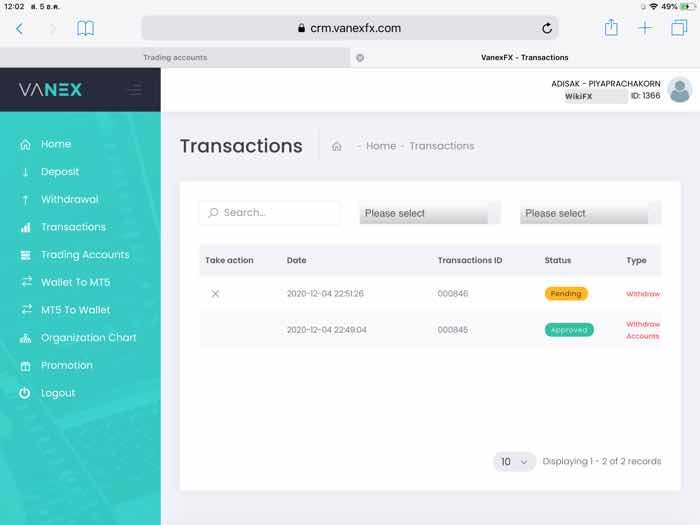

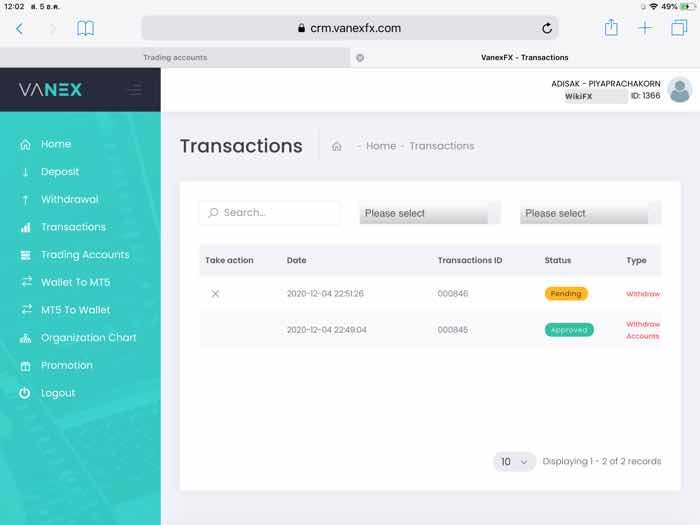

2.6.6 User Experience Analysis

User experience with vanexfx shows notable dissatisfaction among many clients. The overall feeling, as captured in various feedback and vanexfx review summaries, shows that users face several friction points during their journey with the broker. The website interface and platform navigation work but have not been clearly praised for ease-of-use or modern design. The registration and verification processes are reported to be difficult, potentially delaying account activation and trading start. Users also report problems with fund transfers, citing slow processing times and lack of responsive support from customer service channels. Even though the MT5 platform provides a solid technical base, these operational problems hurt the overall user experience. As a result, the end-to-end experience—from onboarding to routine transactions—appears worse than industry standards. The recurring issues highlighted in multiple vanexfx review pieces show the importance of a more streamlined and user-friendly operational framework to improve overall satisfaction and trust.

Conclusion

In summary, vanexfx presents itself as an offshore forex broker that offers attractive trading conditions with low spreads and high leverage. However, significant concerns overshadow these advantages. The high minimum deposit of $3000, combined with persistent negative user feedback about customer support and fund security, suggests that the broker may not work for all traders. Vanexfx is mainly designed for high-net-worth individuals and experienced traders who can afford to take considerable risk. As this vanexfx review shows, potential clients should proceed with extreme caution and do thorough research before working with this broker.