Regarding the legitimacy of VANEXFX forex brokers, it provides VFSC and WikiBit, (also has a graphic survey regarding security).

Is VANEXFX safe?

Business

License

Is VANEXFX markets regulated?

The regulatory license is the strongest proof.

VFSC Derivatives Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

VANEX LIMITED

Effective Date:

2022-12-23Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is VanexFX A Scam?

Introduction

VanexFX is a brokerage firm that positions itself within the forex trading market, offering a variety of trading instruments, including forex pairs, commodities, and indices. As the financial landscape becomes increasingly complex, traders must exercise caution when selecting a broker. The potential for scams and unregulated entities makes it imperative for investors to thoroughly assess the legitimacy and reliability of any trading platform. This article aims to provide a comprehensive evaluation of VanexFX, examining its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and associated risks. The analysis is based on various credible sources and reviews, ensuring a balanced perspective on whether VanexFX is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory framework governing brokers is crucial for ensuring the safety and security of client funds. VanexFX claims to be regulated by the Vanuatu Financial Services Commission (VFSC), but this assertion warrants scrutiny. The lack of a robust regulatory environment in Vanuatu raises concerns about the quality and reliability of such oversight.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| VFSC | 41695 | Vanuatu | Offshore Regulated |

The VFSC is known for its lenient regulatory standards, often attracting brokers that may not meet the stringent requirements of more reputable jurisdictions like the UK‘s Financial Conduct Authority (FCA) or Australia’s Australian Securities and Investments Commission (ASIC). This raises red flags about the level of investor protection offered by VanexFX. Furthermore, several reviews indicate that VanexFX may not be listed under the VFSCs registered entities, suggesting a possible misrepresentation of its regulatory status. Overall, the regulatory quality associated with VanexFX is questionable, and potential investors should be cautious.

Company Background Investigation

VanexFX operates under the name Vanex Global Co., Ltd, which is reportedly registered in Thailand. The company was established in 2018, but its history is relatively short, and it lacks a track record of reliability. The ownership structure of VanexFX is not transparently disclosed, which raises concerns about accountability and governance.

The management team‘s background is also critical in assessing the firm’s credibility. However, there is limited information available regarding the qualifications and expertise of the individuals leading VanexFX. This lack of transparency can be indicative of a broader issue within the company. Potential clients should be wary of firms that do not provide clear information about their leadership and operational history, as it may suggest a lack of commitment to ethical business practices.

Trading Conditions Analysis

The trading conditions offered by VanexFX include a range of instruments with competitive spreads and high leverage options. However, the overall fee structure and any unusual costs associated with trading should be carefully examined.

| Fee Type | VanexFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips | 1.0 pips |

| Commission Model | None | $3 - $7 per lot |

| Overnight Interest Range | Varies | Varies |

VanexFX advertises spreads starting from 0.1 pips, which is significantly lower than the industry average. While low spreads can be attractive, it is essential to consider the overall trading costs, including potential hidden fees. Additionally, the absence of a commission structure may raise questions about how the broker compensates itself, which could lead to conflicts of interest. Traders should be aware that exceptionally low spreads may come with trade execution issues or other hidden costs that could impact profitability.

Client Fund Safety

The safety of client funds is a primary concern for any trader. VanexFX claims to implement various measures to protect client deposits, including segregated accounts. However, the effectiveness of these measures is contingent upon the regulatory framework under which the broker operates.

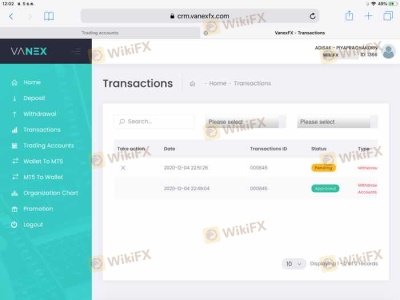

The lack of robust regulations means that there is minimal oversight regarding fund protection policies. Furthermore, there have been no documented cases of investor compensation schemes, which are typically offered by well-regulated brokers to protect clients in the event of insolvency. Historical complaints and reports indicate that users have faced difficulties withdrawing funds, raising significant concerns about the broker's commitment to safeguarding client assets.

Customer Experience and Complaints

Customer feedback is invaluable when assessing the reliability of a broker. Reviews of VanexFX reveal a mixed bag of experiences, with numerous complaints highlighting issues related to withdrawal processes and customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support | Medium | Limited Availability |

Common complaints include delays in processing withdrawals and inadequate customer support. Some users have reported that their requests for fund withdrawals were met with unnecessary delays or outright denials, which is a significant red flag for any financial service provider. The companys customer support has also been criticized for being unresponsive, which can exacerbate frustrations for traders facing issues.

Platform and Trade Execution

The trading platform offered by VanexFX is MetaTrader 5 (MT5), known for its robust features and user-friendly interface. However, the performance and reliability of the platform are crucial for successful trading experiences.

Traders have reported mixed experiences regarding order execution quality, with some noting instances of slippage and rejections during high volatility periods. Such issues can significantly impact trading outcomes, especially for those employing scalping or day trading strategies. While MT5 is generally regarded as a reliable platform, traders should remain vigilant for any signs of manipulation or unfair trading practices.

Risk Assessment

Engaging with VanexFX entails certain risks that potential traders must consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Fund Safety Risk | High | Lack of investor protection mechanisms. |

| Execution Risk | Medium | Potential slippage and order rejections. |

Given the regulatory environment and the broker's operational history, the overall risk associated with trading through VanexFX is high. Traders are advised to conduct thorough due diligence and consider the implications of trading with an unregulated entity. Risk mitigation strategies, such as limiting exposure and diversifying investments, should be employed.

Conclusion and Recommendations

In conclusion, the evidence suggests that VanexFX presents several red flags that warrant caution. The lack of robust regulation, questionable fund safety measures, and numerous customer complaints indicate that traders should approach this broker with skepticism. While the trading conditions may appear attractive at first glance, the potential risks associated with engaging with VanexFX far outweigh the benefits.

For traders seeking a reliable and secure trading environment, it is advisable to consider alternative brokers that are well-regulated and have a proven track record of customer satisfaction. Brokers such as OANDA, IG, or Forex.com offer more robust protections and better overall trading experiences. Ultimately, due diligence is crucial in the forex trading landscape, and choosing a reputable broker can significantly enhance the likelihood of a successful trading journey.

Is VANEXFX a scam, or is it legit?

The latest exposure and evaluation content of VANEXFX brokers.

VANEXFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VANEXFX latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.