Hero FX 2025 Review: Everything You Need to Know

Executive Summary

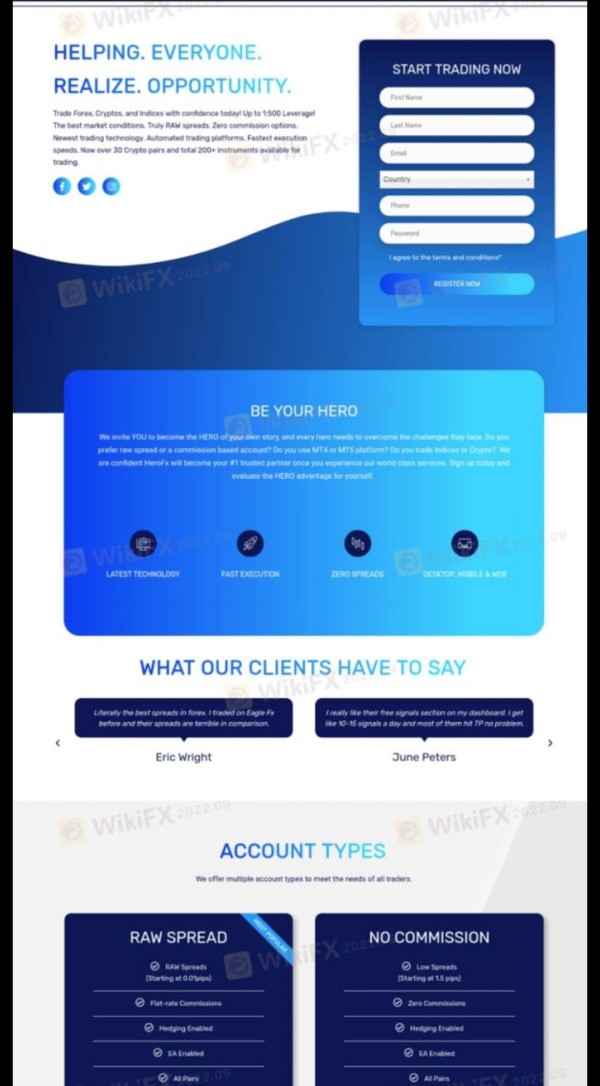

Hero FX is an offshore forex broker that started in 2020. This broker offers good trading conditions but gets mixed reviews from users. This hero fx review shows a broker that draws traders with its zero-commission trading options, spreads starting from 0.01 pips, and leverage up to 1:500. The platform gives access to over 100 trading tools across forex, stock CFDs, and cryptocurrencies through the popular MetaTrader 4 platform.

Hero FX targets traders who want low trading costs and different trading tools. But the broker works without clear rules watching over it, which creates important things for potential clients to think about. User reviews show two different sides - some traders like the platform's quick customer support responses and good spreads, while others worry about withdrawal processes. The broker's offshore status means traders must carefully check the legal rules in their area before opening an account.

The broker offers attractive trading conditions. But the lack of clear regulatory information and mixed user experiences about fund withdrawals need careful thought. This complete analysis aims to give traders the important information they need to make a smart decision about Hero FX's fit for their trading needs.

Important Notice

Hero FX operates as an offshore forex broker. This may create regulatory risks because of limited oversight in certain areas. Traders should fully understand the legal and regulatory rules that apply in their region before working with offshore brokers. The absence of major regulatory authority supervision means that standard investor protection measures may not apply.

This hero fx review is based on publicly available information and user feedback collected from various trading forums and review platforms. Our evaluation aims to provide an objective analysis of the broker's services, but traders should do their own research and consider talking with financial advisors before making investment decisions.

Rating Framework

Broker Overview

Hero FX was started in 2020 and works as an offshore forex broker based in the British Virgin Islands. The company positions itself as a provider of competitive trading conditions for global traders, focusing on low-cost trading solutions and diverse asset offerings. As an offshore entity, Hero FX mainly serves international clients seeking access to forex and CFD markets without the limits typically linked with heavily regulated areas.

The broker's business model centers around providing multiple account types designed to fit different trading preferences. It especially emphasizes zero-commission options and raw spread accounts. Hero FX has built its reputation on offering institutional-grade trading conditions to retail traders, though this approach comes with the natural risks linked with offshore operations.

According to available information, Hero FX uses the MetaTrader 4 platform as its primary trading interface. This provides traders with access to over 100 trading instruments spanning multiple asset classes. The broker's offerings include major and minor forex pairs, stock CFDs, and cryptocurrency trading options. While specific regulatory information remains unclear, the company operates under British Virgin Islands jurisdiction, which provides a legal framework for its offshore operations but may offer limited investor protection compared to major regulatory authorities.

Regulatory Status: Hero FX's regulatory information is not clearly shown in available sources. It operates mainly as an offshore broker under British Virgin Islands jurisdiction. This lack of major regulatory oversight represents a significant consideration for potential clients.

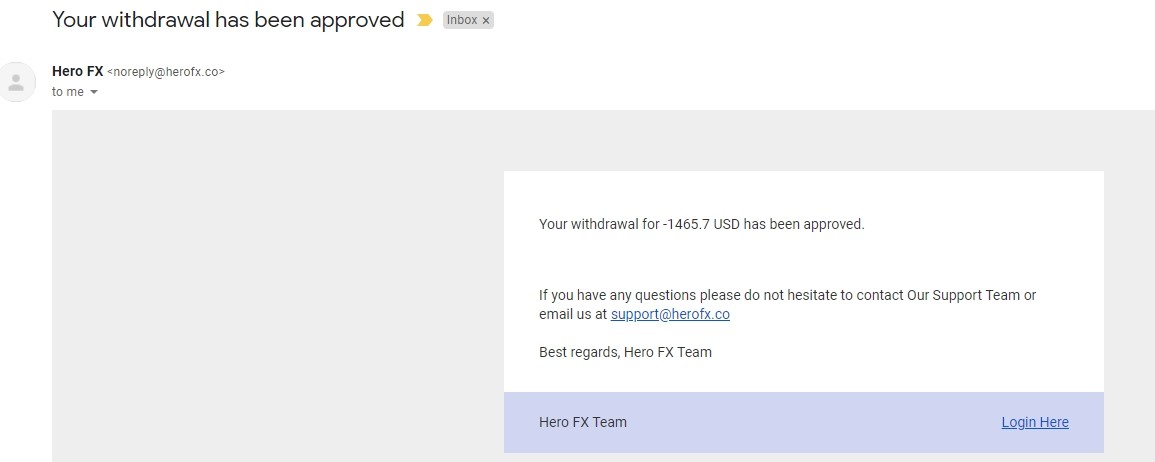

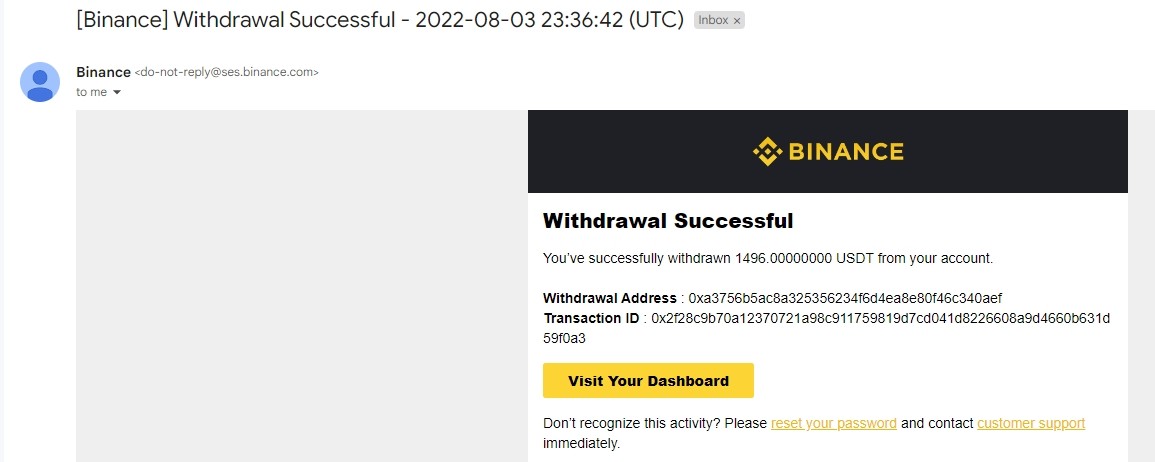

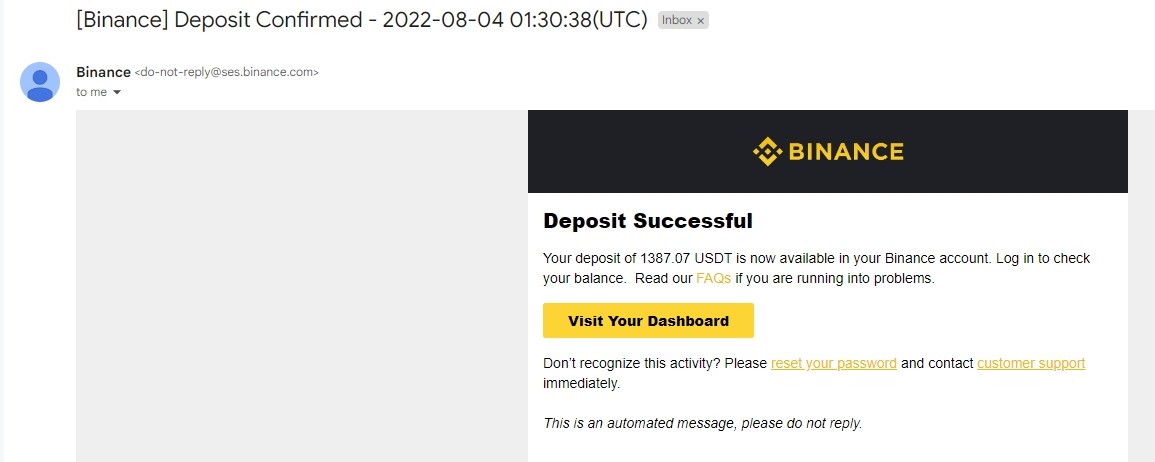

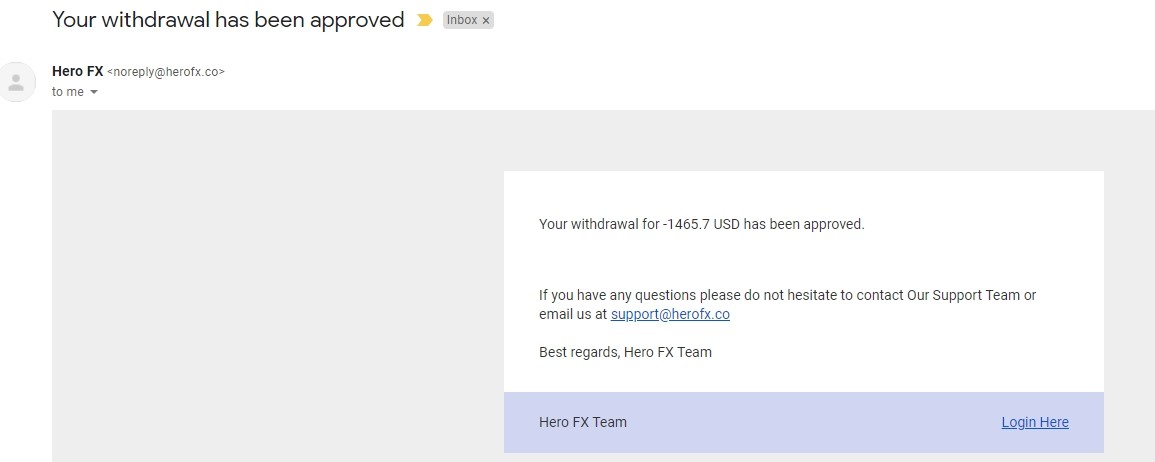

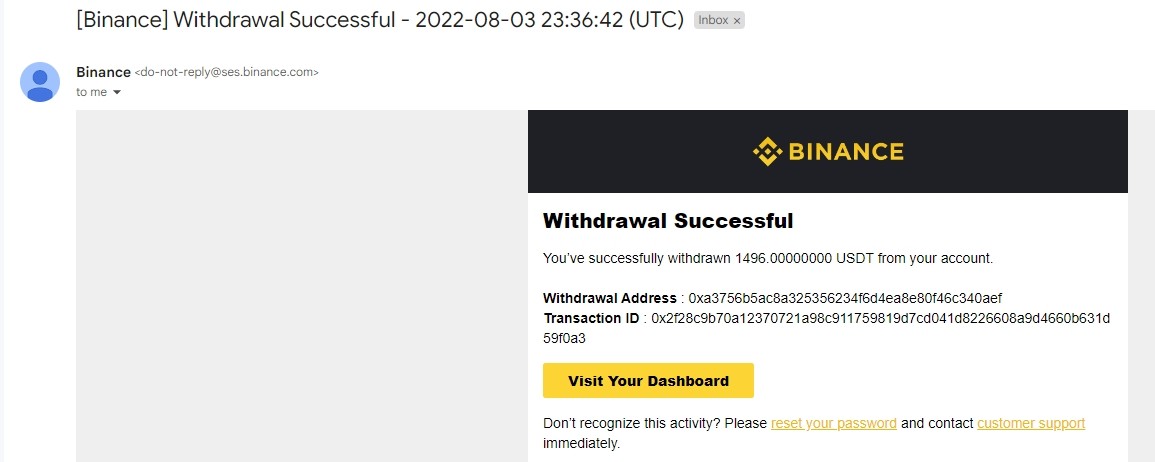

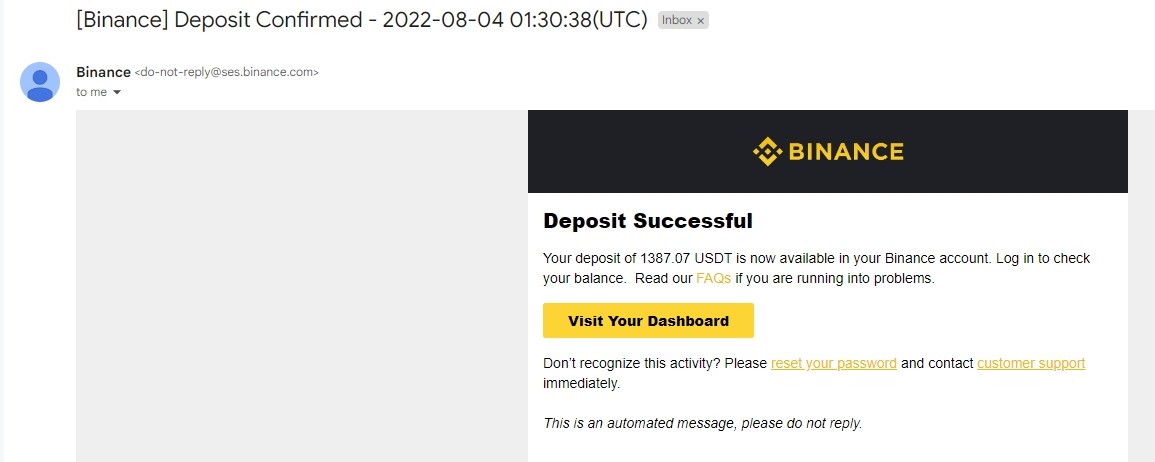

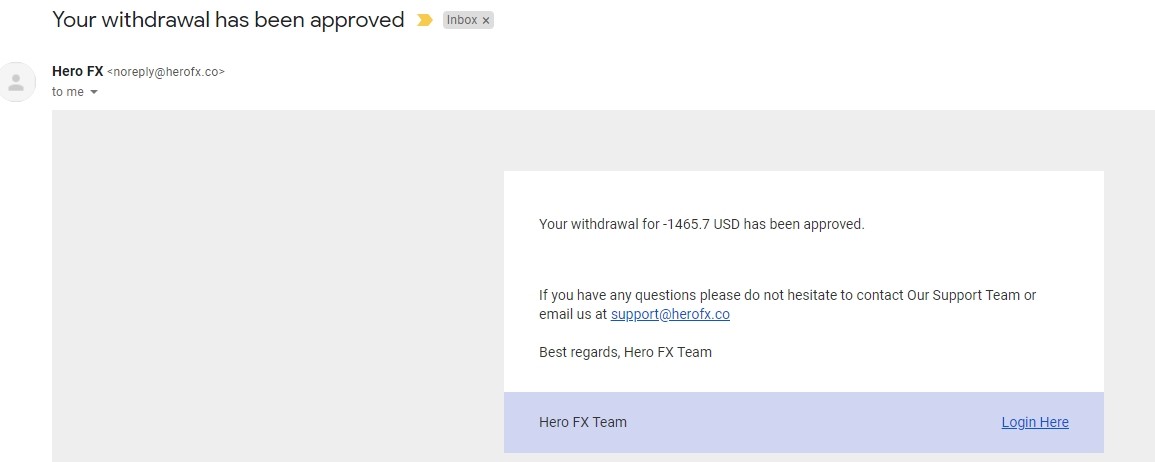

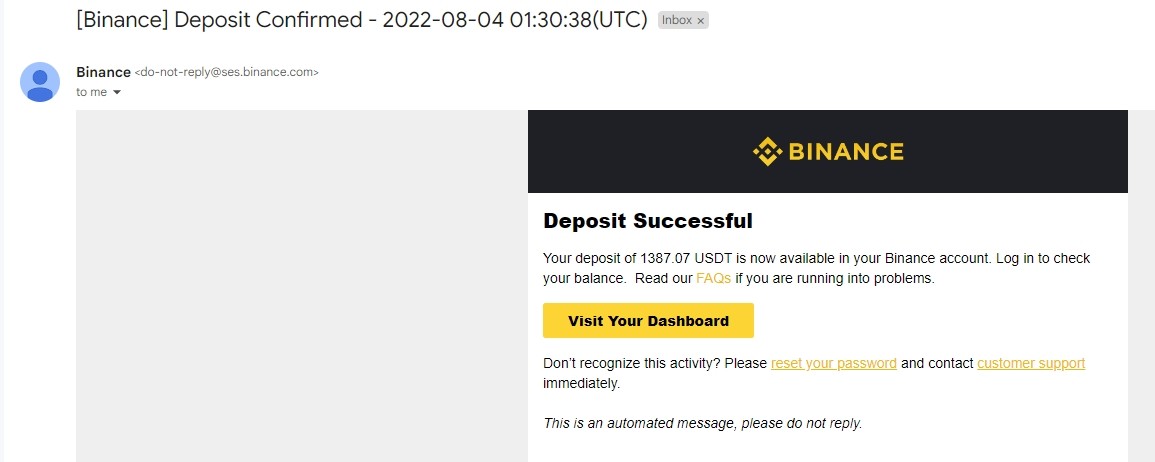

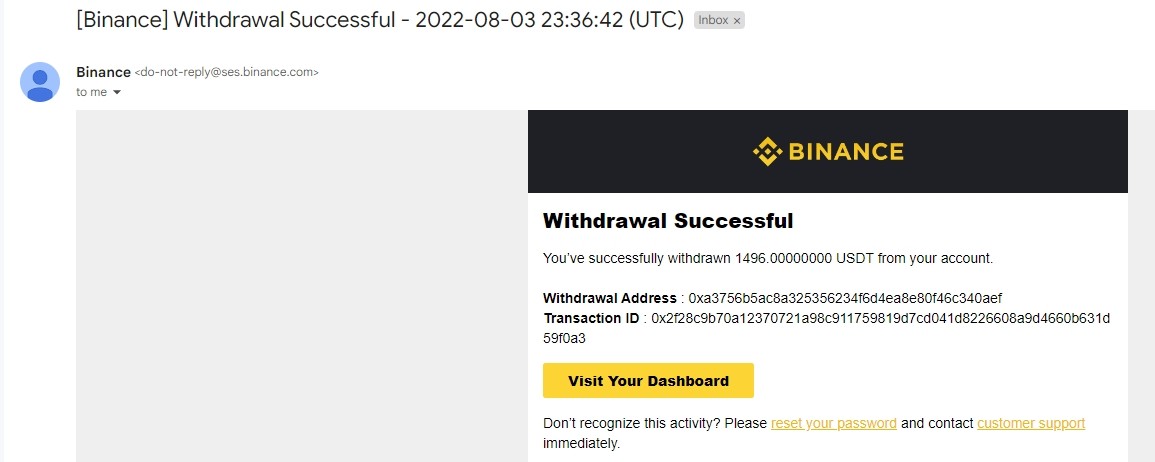

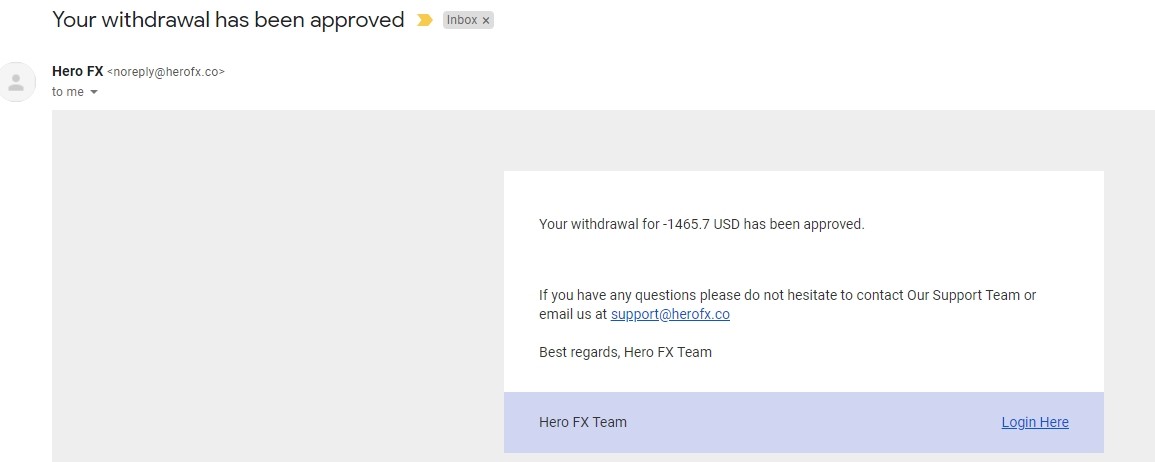

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in current sources. User feedback suggests some clients have experienced withdrawal processing concerns.

Minimum Deposit Requirements: The minimum deposit requirement for Hero FX accounts is not specified in available documentation.

Bonus and Promotions: Current promotional offerings and bonus structures are not detailed in accessible materials.

Tradeable Assets: Hero FX provides access to over 100 trading instruments, including major and minor forex pairs, stock CFDs, and cryptocurrency options. This offers traders diverse market exposure across multiple asset classes.

Cost Structure: The broker offers competitive pricing with spreads starting from 0.01 pips and zero-commission trading options available on specific account types. This makes it attractive for cost-conscious traders.

Leverage Options: Maximum leverage reaches 1:500. This provides significant trading power for those seeking high-leverage opportunities, though this also increases risk exposure.

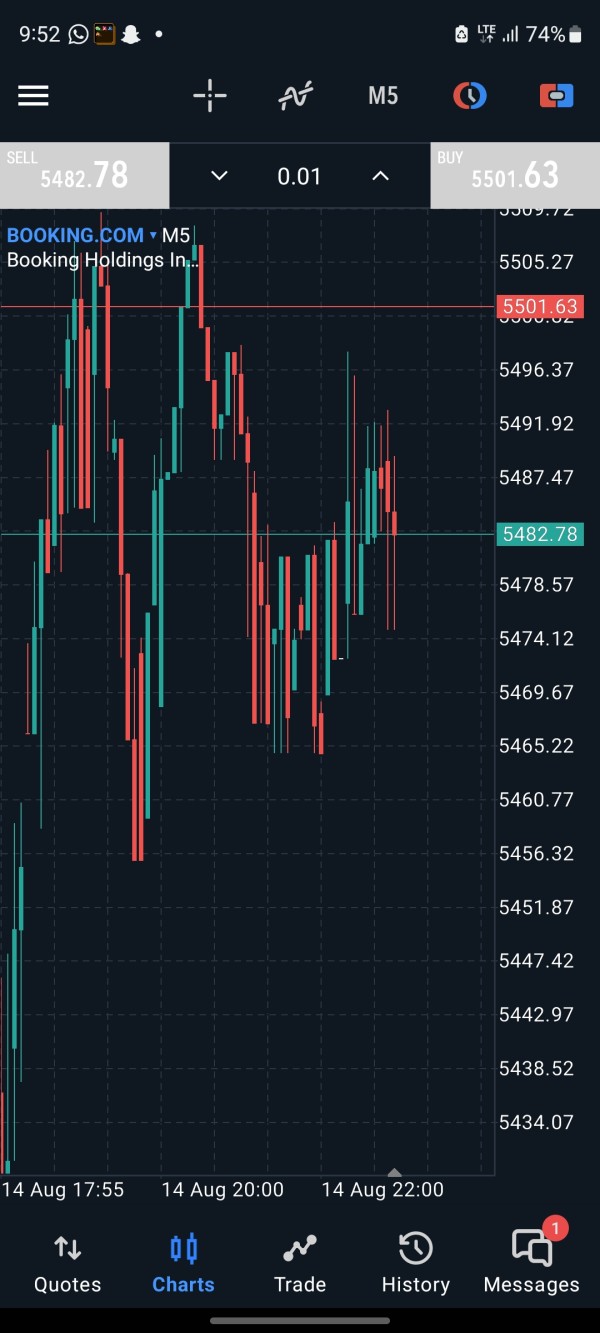

Platform Options: Trading is done through MetaTrader 4 (MT4). This is a widely recognized and feature-rich platform offering comprehensive technical analysis tools and automated trading capabilities.

Geographic Restrictions: Specific regional restrictions are not detailed in available sources.

Customer Support Languages: Supported languages for customer service are not specified in current documentation. User feedback indicates responsive live chat support.

This comprehensive hero fx review section highlights both the available information and notable gaps in publicly accessible details about the broker's operations.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

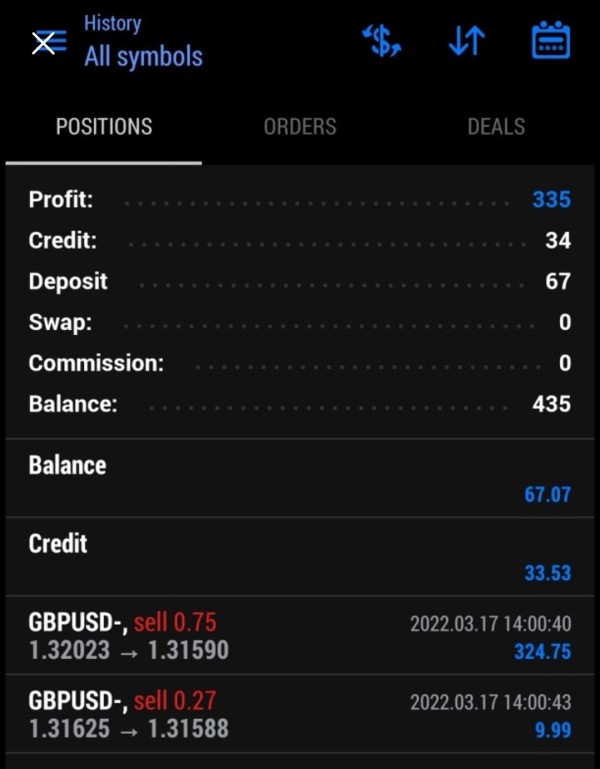

Hero FX offers two primary account types designed to cater to different trading preferences: RAW SPREAD and NO COMMISSION accounts. The RAW SPREAD account provides institutional-grade pricing with minimal markups on spreads, while the NO COMMISSION account eliminates trading fees entirely, making it particularly attractive for high-frequency traders and those seeking to minimize transaction costs.

The broker's competitive edge lies in its spreads starting from 0.01 pips. This positions it well against many competitors in the offshore broker space. However, the absence of clearly stated minimum deposit requirements in available documentation creates uncertainty for potential clients planning their initial investment. This lack of transparency regarding account opening requirements represents a notable weakness in the broker's information disclosure.

User feedback indicates that the zero-commission account structure is particularly well-received by active traders who appreciate the cost savings on frequent transactions. The account opening process details are not fully available, which may create problems for new clients seeking clarity about requirements and procedures.

Special account features such as Islamic accounts for Sharia-compliant trading are not mentioned in available sources. This potentially limits the broker's appeal to certain demographic segments. When compared to regulated brokers, Hero FX's zero-commission and ultra-low spread offerings represent significant competitive advantages, though these benefits must be weighed against the regulatory uncertainties inherent in offshore operations. This hero fx review assessment reflects the mixed nature of the account conditions - attractive pricing offset by information transparency concerns.

Hero FX shows strong performance in the tools and resources category by providing access to over 100 trading instruments across multiple asset classes. The broker's instrument selection spans major and minor forex pairs, stock CFDs, and cryptocurrency options, offering traders comprehensive market exposure that rivals many established competitors. This diversity allows clients to implement sophisticated portfolio strategies and capitalize on opportunities across different market sectors.

The MetaTrader 4 platform serves as the foundation for Hero FX's trading tools. It provides traders with access to advanced charting capabilities, technical indicators, and automated trading options through Expert Advisors (EAs). MT4's proven reliability and extensive functionality make it an excellent choice for both novice and experienced traders seeking professional-grade trading tools.

However, specific information about proprietary research and analysis resources is not detailed in available sources. This represents a potential weakness compared to full-service brokers that provide comprehensive market analysis and trading insights. Educational resources, including webinars, tutorials, and market commentary, are also not specifically mentioned in accessible documentation.

The absence of detailed information about automated trading support beyond standard MT4 functionality suggests that Hero FX may not offer enhanced algorithmic trading features or proprietary trading tools that some competitors provide. User feedback generally reflects satisfaction with the breadth of available trading instruments and the stability of the MT4 platform.

Despite these limitations in documented educational and research resources, the combination of diverse trading instruments and the robust MT4 platform provides a solid foundation for effective trading operations. This earns Hero FX a strong rating in this category.

Customer Service and Support Analysis (6/10)

Customer service represents a mixed area for Hero FX. User experiences vary significantly across different service aspects. While specific customer service channels are not fully detailed in available sources, user feedback provides insights into the broker's support capabilities and responsiveness.

Positive user testimonials highlight quick response times through live chat support. One reviewer noted that their issues were resolved in less than five minutes with prompt team responses. This suggests that Hero FX maintains responsive front-line support for immediate client needs and technical assistance.

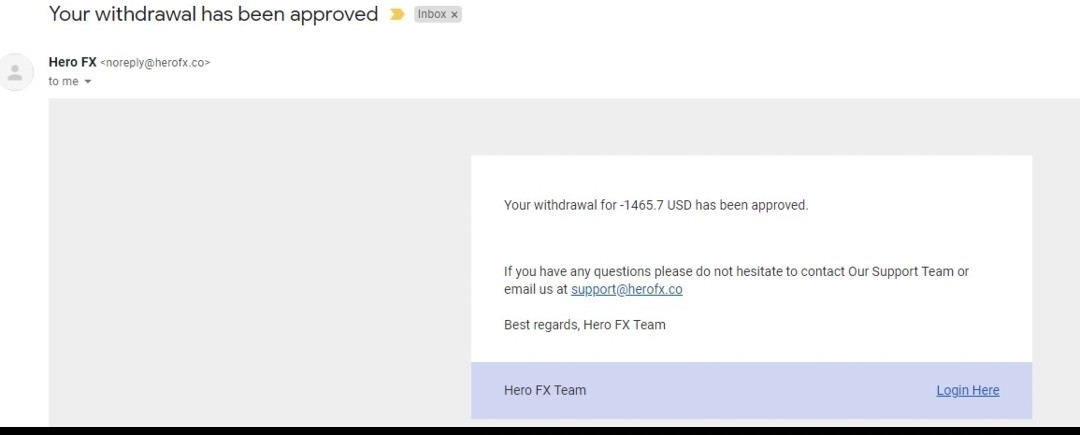

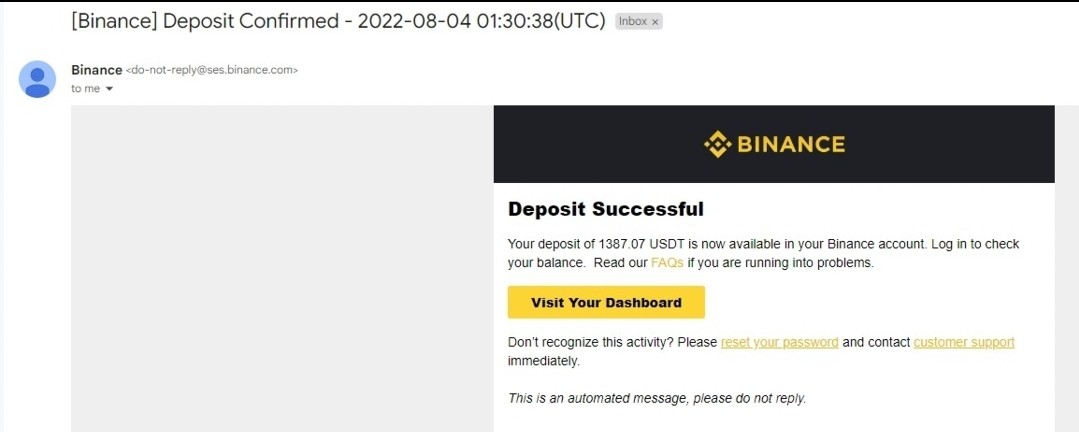

However, concerning feedback regarding withdrawal processes indicates potential weaknesses in the broker's operational support systems. Some users have reported delays and complications with fund withdrawals, which represents a critical customer service issue that can significantly impact client satisfaction and trust. These withdrawal-related concerns suggest that while initial support may be responsive, more complex operational issues may not receive the same level of efficient resolution.

The absence of detailed information about supported languages, service hours, and escalation procedures creates uncertainty about the comprehensiveness of Hero FX's customer support infrastructure. Multi-language support capabilities are not specified, potentially limiting accessibility for international clients who prefer support in their native languages.

Response time consistency and service quality appear to vary based on the nature of client inquiries. Routine questions receive prompt attention while financial operations may experience delays. The lack of documented problem resolution cases and comprehensive service protocols suggests that Hero FX's customer support, while showing positive elements, requires improvement in operational consistency and transparency to achieve higher ratings in this critical area.

Trading Experience Analysis (8/10)

Hero FX delivers a solid trading experience through its MetaTrader 4 platform implementation. User feedback generally indicates positive experiences regarding platform stability and execution quality. The MT4 platform provides traders with comprehensive technical analysis tools, multiple timeframes, and extensive charting capabilities that support both manual and automated trading strategies.

Order execution quality receives favorable reviews from users. This suggests that Hero FX maintains adequate liquidity and processing systems to handle client orders efficiently. The combination of low spreads starting from 0.01 pips and zero-commission options creates an attractive trading environment that minimizes transaction costs and enhances overall profitability potential for active traders.

Platform stability appears robust based on user feedback. Traders report consistent access and reliable performance during market hours. The MT4 platform's proven track record and widespread adoption provide additional confidence in the trading infrastructure's reliability and functionality.

The trading environment benefits from competitive spreads and good liquidity conditions. This enables traders to execute strategies effectively across the broker's diverse instrument range. The availability of leverage up to 1:500 provides flexibility for traders seeking enhanced market exposure, though this also increases risk considerations.

However, mobile trading experience details are not specifically addressed in available sources. This represents a potential information gap given the importance of mobile accessibility in modern trading. Technical performance data from independent testing is also not available, limiting objective assessment of execution speeds and slippage rates.

Despite these documentation limitations, the combination of competitive trading conditions, stable platform performance, and positive user feedback regarding execution quality supports a strong rating for Hero FX's overall trading experience. This hero fx review recognizes the broker's success in providing a functional and cost-effective trading environment, while noting areas where additional transparency would be beneficial.

Trust and Reliability Analysis (4/10)

Trust and reliability represent significant concerns for Hero FX. This is primarily due to the absence of clear regulatory oversight from major financial authorities. Operating as an offshore broker without transparent regulatory credentials creates inherent risks for client funds and dispute resolution, as standard investor protection measures typically associated with regulated brokers may not apply.

The lack of detailed information about fund security measures raises important questions about asset protection. This includes segregated client accounts, insurance coverage, or third-party fund custody arrangements. Without clear regulatory supervision, clients must rely primarily on the broker's internal policies and procedures, which may not provide the same level of security as regulated environments.

User complaints regarding withdrawal processes further impact the broker's reliability assessment. Reports of withdrawal delays and complications suggest potential operational issues that could affect client access to their funds. This represents a critical trust factor that influences overall broker credibility.

Company transparency is limited. There is minimal disclosure about corporate structure, ownership details, or operational procedures. The absence of industry awards, third-party certifications, or recognition from established financial organizations further limits objective assessment of the broker's standing within the industry.

The broker's relatively recent establishment in 2020 means it lacks a long-term track record. This could provide additional confidence about operational stability and reliability. While some users express satisfaction with their trading experience, the fundamental regulatory and transparency concerns prevent a higher trust rating.

Third-party evaluations and independent audits are not documented in available sources. This limits external validation of the broker's operational standards and financial stability. These combined factors result in a below-average trust rating, reflecting the inherent risks associated with offshore brokers lacking comprehensive regulatory oversight.

User Experience Analysis (7/10)

Overall user satisfaction with Hero FX presents a mixed picture. Generally positive ratings are tempered by specific operational concerns. User feedback indicates appreciation for the broker's competitive trading conditions and responsive initial customer support, suggesting that the basic trading experience meets many client expectations.

The MetaTrader 4 platform interface receives positive feedback for its user-friendly design and comprehensive functionality. Traders familiar with MT4 can quickly adapt to Hero FX's implementation, benefiting from the platform's intuitive navigation and extensive feature set. The platform's widespread adoption and proven reliability contribute positively to the overall user experience.

However, fund operation experiences significantly impact user satisfaction. Withdrawal delays represent the primary source of negative feedback. These operational issues create friction in the client relationship and can overshadow positive aspects of the trading experience, particularly for users who encounter difficulties accessing their funds.

Registration and account verification processes are not detailed in available sources. This creates uncertainty about the onboarding experience for new clients. Clear and efficient account opening procedures are essential for positive first impressions, and the lack of available information represents a potential user experience weakness.

The most common user complaints center on withdrawal processing. This indicates that while Hero FX may excel in providing attractive trading conditions, the operational infrastructure for fund management requires improvement. Users seeking reliable access to their funds may find these concerns particularly problematic.

User demographic analysis suggests that Hero FX appeals primarily to cost-conscious traders seeking low-commission options and competitive spreads. However, the withdrawal concerns may deter users who prioritize operational reliability over cost savings. Improvement recommendations focus on enhancing withdrawal processing procedures and providing greater transparency about operational timelines to build stronger user confidence and satisfaction.

Conclusion

Hero FX presents a complex profile as an offshore forex broker offering competitive trading conditions alongside notable operational concerns. The broker's strengths lie in its attractive cost structure, featuring zero-commission options and spreads starting from 0.01 pips, combined with access to over 100 trading instruments across multiple asset classes. These competitive advantages make Hero FX particularly appealing to cost-conscious traders seeking diverse market exposure and high leverage options up to 1:500.

However, significant concerns regarding regulatory oversight and withdrawal processing create important considerations for potential clients. The absence of major regulatory supervision and user reports of withdrawal difficulties represent substantial risks that must be carefully weighed against the broker's attractive trading terms.

Hero FX is most suitable for experienced traders who understand offshore broker risks and prioritize low trading costs over regulatory protection. The broker may appeal to high-frequency traders and those seeking competitive spreads, provided they can accept the inherent uncertainties associated with offshore operations and potential withdrawal complications.

The main advantages include ultra-competitive pricing, diverse trading instruments, and responsive initial customer support. The primary disadvantages center on regulatory uncertainty and operational reliability concerns. Potential clients should carefully consider their risk tolerance and prioritize regulatory protection versus cost savings when evaluating Hero FX as their trading partner.