Swiss Capital 2025 Review: Everything You Need to Know

Executive Summary

This swiss capital review gives you a complete look at Swiss Capital. Swiss Capital is an asset management company based in Switzerland that works under Swiss financial market supervision law. The company helps people buy and sell different types of investments like forex, commodities, and stock indices. They offer flexible leverage options and advanced trading platforms for traders around the world who want diverse investment opportunities.

Swiss Capital follows Swiss rules, but our review shows mixed results. The broker does well with its regulatory framework and ability to trade multiple assets. However, they don't share clear information about their fees, account rules, and detailed services, which makes it hard for potential clients to fully evaluate them.

This review helps traders understand what Swiss Capital offers objectively. Our analysis covers account conditions, trading tools, customer support, and overall user experience based on the information we could find.

Important Notice

Regional Variations: Swiss Capital operates as a Swiss asset management company under Swiss financial market supervision law. Traders should know that rules and services may be different depending on where they live. Different regions may have specific requirements that could affect what services local clients can get.

Review Methodology: This evaluation uses publicly available information and market analysis. Some parts of our assessment rely on general industry standards because detailed information was limited. Traders should do their own research and check current terms directly with Swiss Capital before making trading decisions.

Rating Framework

Broker Overview

Swiss Capital works as a regulated asset management company in Switzerland's financial system. It operates under Swiss financial market supervision law. The company helps people buy and sell investments and focuses on giving access to global financial markets through advanced trading platforms.

We don't have specific details about when the company started, but Swiss Capital's regulatory standing shows they want to work within established financial rules. The broker's business model centers on giving multi-asset trading opportunities to global clients. They focus especially on forex markets, commodities trading, and stock indices.

This approach shows the company's strategy to serve traders with different investment preferences and risk levels. Swiss Capital's compliance under Swiss law provides legitimacy, though traders should note that specific details may vary based on where they live and local rules. The broker provides what they describe as advanced trading technology, though specific platform names or technical details aren't available in the documentation we found.

Swiss Capital's focus on flexible leverage options shows they understand different trader needs, from conservative investors to those seeking higher risk-reward ratios. This swiss capital review finds that while the broker has a legitimate regulatory framework, potential clients may need to contact the company directly to get complete details about specific trading conditions and platform capabilities.

Regulatory Jurisdiction: Swiss Capital operates under Swiss financial market supervision law. This provides regulatory oversight within the Swiss financial framework, which generally maintains high standards for financial services.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal options isn't available in our sources. You'll need to ask the broker directly for complete payment method details.

Minimum Deposit Requirements: Minimum deposit amounts aren't specified in available documentation. This leaves potential clients without clear entry-level investment requirements.

Bonus and Promotions: Current promotional offerings and bonus structures aren't mentioned in available sources. This suggests either no such programs exist or you need to consult the broker directly.

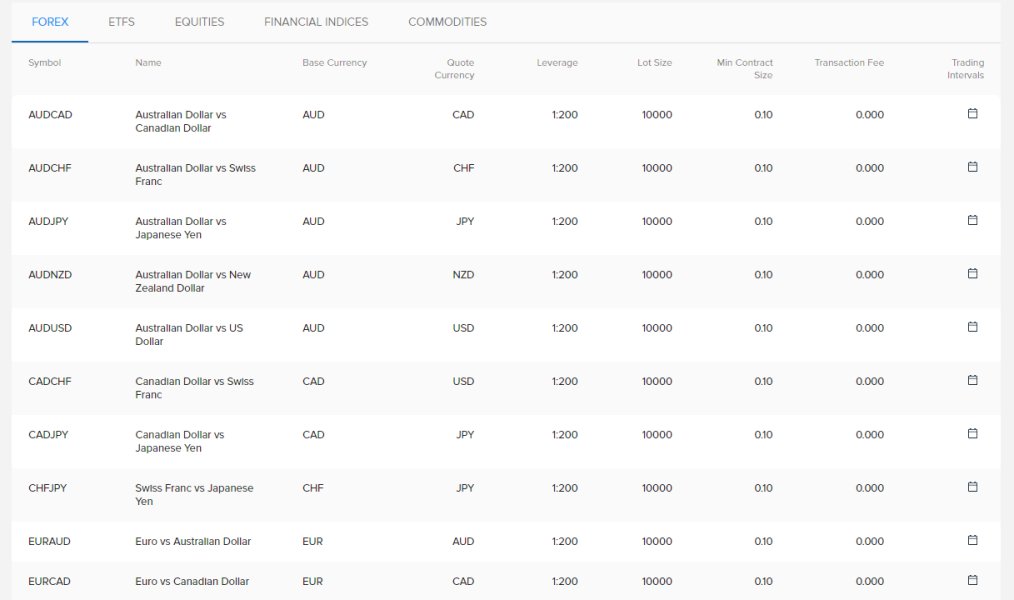

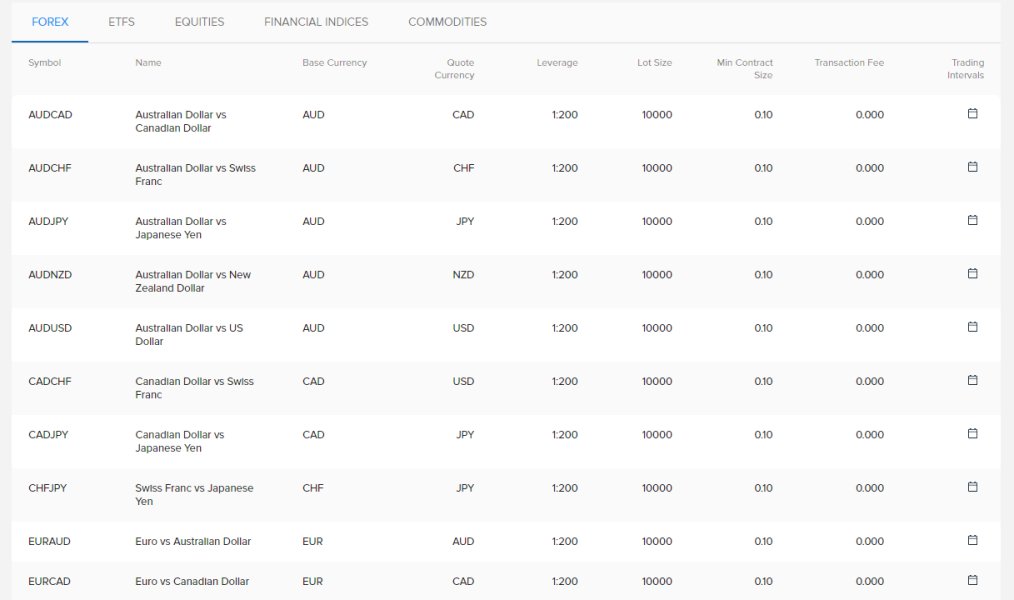

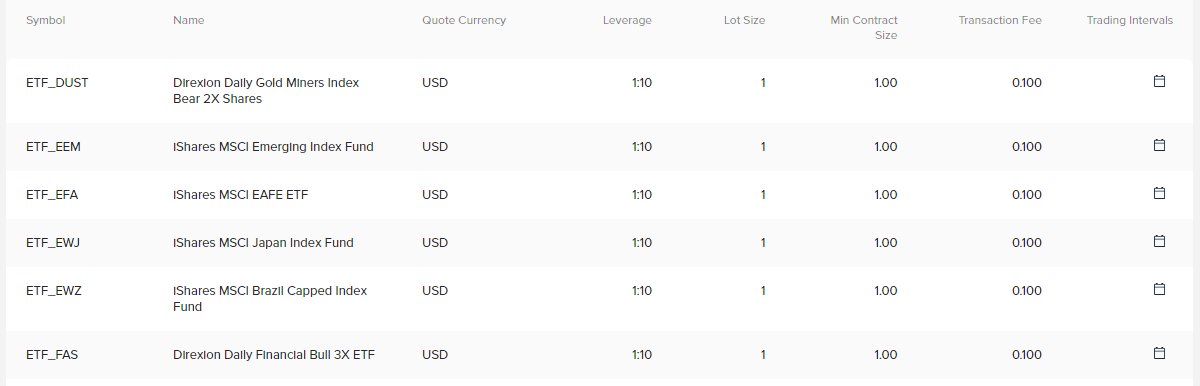

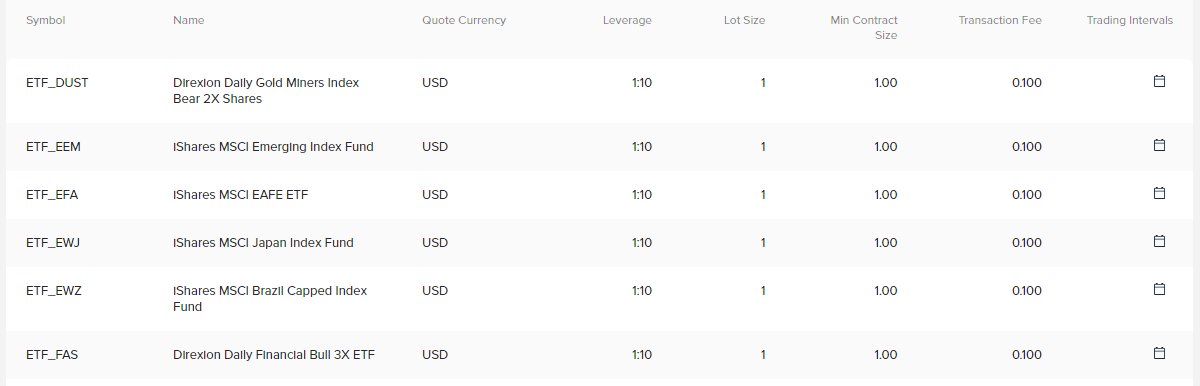

Tradeable Assets: Swiss Capital offers access to forex markets, commodities, and stock indices. This provides diverse investment opportunities across major asset classes.

Cost Structure: Specific information about commissions, spreads, and other trading costs isn't detailed in available sources. This represents a significant information gap for potential clients seeking transparent pricing.

Leverage Ratios: The broker advertises flexible leverage options. However, specific ratios and their application across different asset classes aren't specified in available documentation.

Platform Options: Swiss Capital provides advanced trading platforms. Specific platform names, features, or technical capabilities aren't detailed in available sources.

Geographic Restrictions: Regional limitations and availability aren't specified in available documentation.

Customer Service Languages: Supported languages for customer service aren't mentioned in available sources.

This swiss capital review notes that the limited availability of specific details may require potential clients to contact Swiss Capital directly. You'll need to get comprehensive information about their services and conditions from them.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

Swiss Capital's account conditions get a mixed evaluation because of limited transparency in available information. The broker operates under Swiss regulatory oversight, which typically ensures certain standards for client account management. However, the lack of specific details about account types, minimum deposits, and fee structures creates uncertainty for potential traders.

We can't find clear information about different account tiers or specialized account options. This makes it difficult to assess whether Swiss Capital serves various trader segments, from beginners to professional investors. Most competitive brokers today offer multiple account types with varying features, commission structures, and minimum deposit requirements to accommodate different trading styles and capital levels.

Without specific details about account opening procedures, verification requirements, or special account features like Islamic accounts, potential clients face uncertainty about accessibility and suitability. The regulatory framework suggests standard compliance procedures, but the lack of transparent information about practical account management represents a significant drawback. This swiss capital review finds that while regulatory compliance provides some assurance about account safety and legal framework, the limited transparency about specific account conditions places Swiss Capital at a disadvantage compared to brokers offering comprehensive account information upfront.

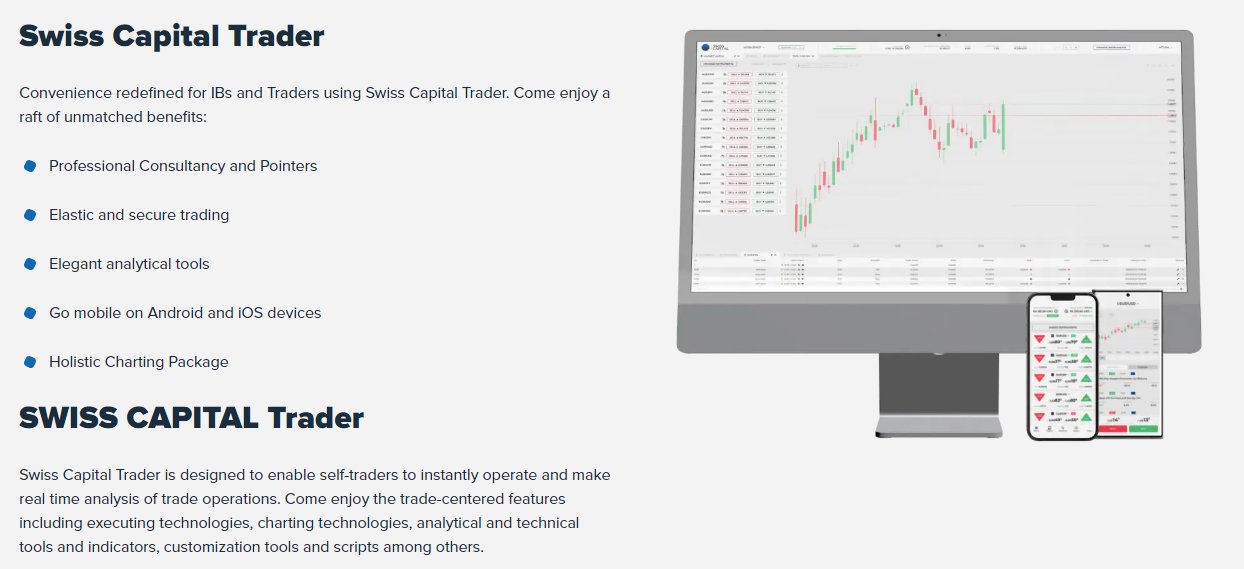

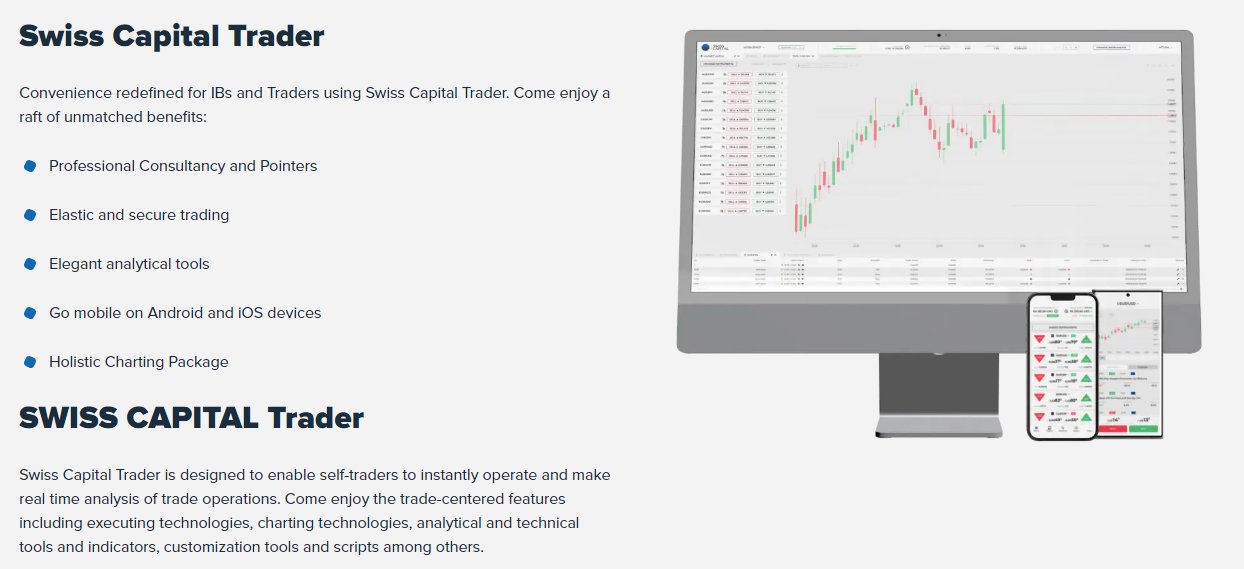

Swiss Capital shows strength in its technology offerings. They provide what they describe as advanced trading platforms that can handle multiple asset classes including forex, commodities, and stock indices. This multi-asset capability suggests sophisticated infrastructure that can support diverse trading strategies and portfolio diversification needs.

The broker's platform technology appears designed to accommodate various trading approaches. It works for both short-term forex trading and longer-term commodity and index investing. This versatility is particularly valuable for traders seeking to implement cross-asset strategies or those who prefer to consolidate their trading activities with a single broker rather than maintaining multiple accounts across different platforms.

However, we lack specific information about research tools, market analysis resources, educational materials, or automated trading support. This limits our ability to fully assess how comprehensive Swiss Capital's offering really is. Modern traders typically expect access to market research, technical analysis tools, economic calendars, and educational resources as standard components of their trading environment.

We don't have details about mobile trading capabilities, API access for algorithmic trading, or integration with third-party analysis tools. These information gaps could be crucial for certain trader segments. Despite these limitations, the emphasis on advanced platform technology and multi-asset support suggests Swiss Capital has invested in core trading infrastructure.

Customer Service and Support Analysis (Score: 7/10)

Swiss Capital offers 24/5 customer support, which matches standard industry practice for forex and multi-asset brokers. This coverage schedule accommodates most global trading sessions while allowing for weekend maintenance and staff rest periods. The 24/5 availability suggests they recognize the international nature of financial markets and the need for support across different time zones.

However, our evaluation is limited by the absence of specific information about support channels, response times, service quality metrics, or multilingual capabilities. Modern traders typically expect multiple contact options including live chat, email, phone support, and increasingly, social media channels for quick queries and updates.

We lack information about specialized support for different account types, technical assistance quality, or escalation procedures for complex issues. This makes it difficult to assess the practical effectiveness of Swiss Capital's customer service. Additionally, without details about the languages supported or regional support availability, international clients can't determine whether they will receive service in their preferred language.

While the 24/5 commitment shows basic understanding of trader needs, the limited transparency about service quality, channels, and capabilities prevents a higher rating. Effective customer service in forex and multi-asset trading requires not just availability but also knowledgeable staff capable of handling both technical platform issues and trading-related inquiries.

Trading Experience Analysis (Score: 7/10)

The trading experience evaluation for Swiss Capital centers on the broker's advanced trading platform technology and flexible leverage offerings. The multi-asset capability spanning forex, commodities, and stock indices suggests a comprehensive trading environment that can support diverse investment strategies and portfolio approaches.

Swiss Capital's emphasis on flexible leverage options shows they understand different trader risk preferences and capital management strategies. This flexibility can be particularly valuable for traders who use varying leverage levels across different asset classes or who adjust their risk exposure based on market conditions and personal trading plans.

However, our assessment is limited by the absence of specific information about platform stability, execution speeds, order types available, or mobile trading capabilities. These technical aspects significantly impact daily trading experience and can be decisive factors for active traders who require reliable, fast execution and comprehensive order management tools.

Without details about platform features such as charting capabilities, technical indicators, news feeds, or integration with external analysis tools, it's challenging to evaluate how well Swiss Capital's platform serves different trading styles. We also lack information about slippage rates, execution quality during volatile market conditions, or platform uptime statistics, which further limits our ability to assess the practical trading experience.

This swiss capital review recognizes the positive aspects of advanced technology and flexible leverage while noting that comprehensive trading experience evaluation requires more detailed technical and performance information than currently available.

Trustworthiness Analysis (Score: 8/10)

Swiss Capital's trustworthiness rating is based on its operation under Swiss financial market supervision law, which represents a significant positive factor. Switzerland maintains a reputation for strict financial regulation and high standards for financial service providers, which adds credibility to Swiss Capital's regulatory standing.

The Swiss regulatory framework typically includes requirements for capital adequacy, client fund segregation, and operational transparency that provide foundational protection for client interests. This regulatory oversight suggests that Swiss Capital operates within established legal frameworks designed to protect trader funds and ensure fair business practices.

However, our evaluation is limited by the absence of specific information about additional safety measures such as investor compensation schemes, detailed fund segregation policies, or third-party auditing arrangements. Modern traders increasingly seek transparency about how their funds are protected beyond basic regulatory requirements.

We lack available information about company financial statements, ownership structure, or industry awards and recognition. This makes it difficult to assess Swiss Capital's broader reputation within the financial services industry. Additionally, without access to client feedback or independent reviews, it's challenging to evaluate practical trustworthiness from a user experience perspective.

While the Swiss regulatory framework provides a strong foundation for trust, the limited transparency about additional safety measures and company background prevents a higher rating in this crucial area.

User Experience Analysis (Score: 6/10)

The user experience evaluation for Swiss Capital is limited by the lack of available information about practical aspects of client interaction with the broker's services. While the regulatory framework and multi-asset platform suggest professional operation, the absence of specific details about user interface design, account management processes, and client feedback creates uncertainty about practical usability.

Without information about the registration and verification process, potential clients can't assess how straightforward it is to begin trading with Swiss Capital. Modern traders expect efficient, digital-first onboarding processes with clear documentation requirements and reasonable verification timeframes.

We lack details about fund deposit and withdrawal procedures, processing times, and associated fees. This represents a significant information gap that directly impacts user experience. Efficient, transparent money management processes are crucial for trader satisfaction and operational effectiveness.

Additionally, we don't have available client testimonials, user reviews, or feedback about common issues and their resolution. This makes it difficult to understand real-world user satisfaction levels. Most traders rely on peer experiences and reviews when evaluating potential brokers.

While Swiss Capital's regulatory standing and advanced platform technology suggest professional operation, the limited transparency about user-facing processes and absence of client feedback prevent a higher user experience rating. Potential clients may need to engage directly with Swiss Capital to assess whether the practical user experience meets their expectations and requirements.

Conclusion

This swiss capital review reveals a broker with solid regulatory foundations but limited transparency in operational details. Swiss Capital operates under Swiss financial market supervision law, providing regulatory credibility and suggesting adherence to established financial service standards. The broker's multi-asset platform covering forex, commodities, and stock indices, combined with flexible leverage options, indicates capability to serve diverse trading needs.

However, the significant lack of specific information about fees, account conditions, platform details, and user experiences creates uncertainty for potential clients. While regulatory compliance provides important foundational trust, modern traders typically require comprehensive transparency about costs, services, and operational procedures before committing to a broker relationship.

Swiss Capital appears most suitable for traders who prioritize regulatory oversight and are willing to engage directly with the broker to obtain detailed information about services and conditions. The multi-asset capability may appeal to investors seeking portfolio diversification through a single platform, though the absence of transparent pricing information requires careful due diligence before proceeding.