Oron Limited 2025 Review: Everything You Need to Know

Executive Summary

Oron Limited is a new forex broker. The company has created major controversy and received negative reviews from traders since starting in 2023. This oron limited review shows a troubling pattern of user distrust and credibility problems that potential traders should think about carefully.

The broker works from Saint Lucia under registration number 2023-00278. It offers trading across many financial instruments including forex, cryptocurrencies, stocks, indices, energy commodities, and other assets. Despite this diverse product offering, Oron Limited lacks transparency about specific trading conditions, fee structures, and platform details. These details are typically essential for smart trading decisions.

Our analysis shows that Oron Limited mainly targets users who want diverse trading opportunities across various asset classes. But the broker's negative reputation raises serious concerns about its reliability and trustworthiness. The company's registration under Saint Lucia's International Business Company (IBC) framework provides limited regulatory oversight compared to major financial centers. This adds another layer of risk for potential clients.

Many red flags have been identified in available reports and user testimonials. Traders are strongly advised to be extremely careful when considering Oron Limited as their trading partner. The lack of detailed trading conditions, combined with ongoing allegations of fraudulent activities, makes this broker unsuitable for most retail traders seeking a secure and transparent trading environment.

Important Notice

Regional Entity Differences: Oron Limited operates under Saint Lucia's regulatory framework as an International Business Company (IBC). This regulatory structure is very different from the strict oversight provided by major financial regulators such as the UK's Financial Conduct Authority (FCA), Australia's Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC). Traders should understand that Saint Lucia's IBC registration offers limited consumer protection compared to these established regulatory bodies.

Review Methodology Disclaimer: This evaluation is based on available information summaries and publicly accessible reports about Oron Limited. The assessment does not include direct platform testing, live trading experience, or comprehensive user experience analysis. Readers should conduct additional research and consider multiple sources before making any trading decisions.

Rating Framework

Broker Overview

Oron Limited appeared in the forex brokerage landscape in 2023 as a Saint Lucia-registered financial services provider. The company operates under registration number 2023-00278 and maintains its headquarters in Saint Lucia, positioning itself within the offshore financial services sector. Despite being relatively new to the market, Oron Limited has tried to establish itself as a multi-asset broker offering access to various financial markets including foreign exchange, cryptocurrency trading, equity markets, commodity trading, and energy derivatives.

The broker's business model focuses on providing retail traders access to global financial markets through its trading infrastructure. Oron Limited markets itself as offering complete trading solutions across forex pairs, digital currencies, stock indices, individual equities, precious metals, energy commodities, and agricultural products. However, the company's approach to market positioning has been overshadowed by many credibility concerns and user complaints that have emerged since its launch.

According to available information, Oron Limited operates under the regulatory framework of Saint Lucia's International Business Company (IBC) structure. This regulatory environment provides much less oversight compared to major financial centers and offers limited consumer protection mechanisms. The specific trading platforms used by Oron Limited remain unspecified in available documentation, creating additional uncertainty about the technological infrastructure and trading environment provided to clients. This oron limited review highlights the importance of understanding these operational limitations before considering any engagement with the broker.

Regulatory Jurisdiction: Oron Limited operates under Saint Lucia's International Business Company (IBC) regulatory framework. This provides minimal oversight compared to established financial regulatory bodies in major markets.

Deposit and Withdrawal Methods: Available information summaries do not specify the payment methods, processing times, or fees associated with funding accounts or withdrawing profits from Oron Limited.

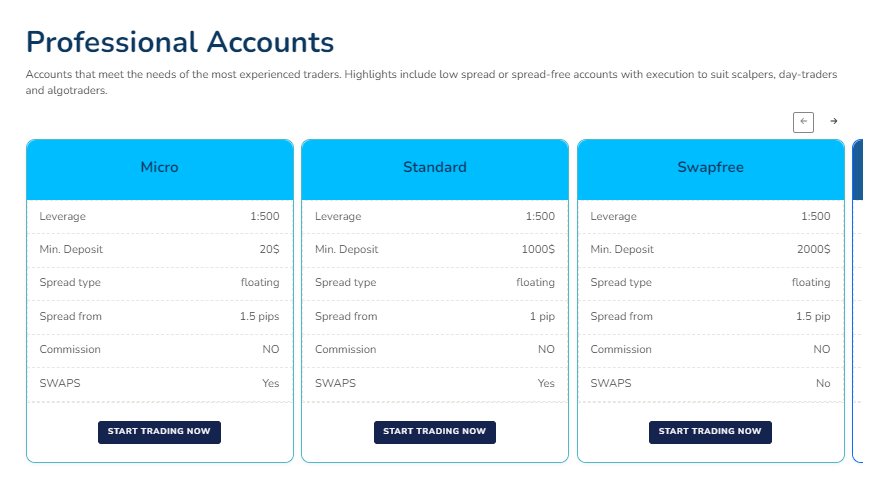

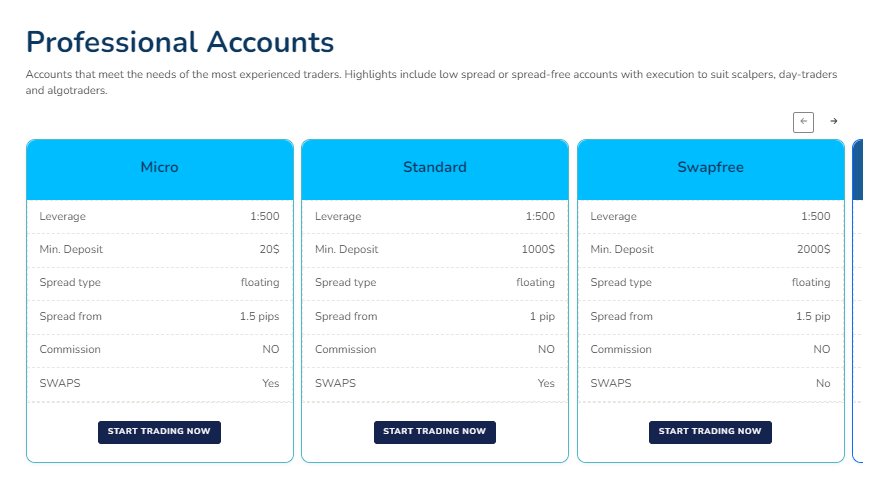

Minimum Deposit Requirements: Specific minimum deposit amounts required to open trading accounts with Oron Limited are not mentioned in available documentation.

Bonus and Promotional Offers: No information about welcome bonuses, deposit incentives, or promotional campaigns is available in current documentation about Oron Limited.

Tradeable Assets: The broker offers access to multiple asset classes. These include foreign exchange pairs, cryptocurrency markets, stock indices, individual equities, energy commodities, and precious metals trading opportunities.

Cost Structure: Detailed information about spreads, commission rates, overnight financing charges, and other trading costs is not specified in available materials about Oron Limited.

Leverage Ratios: Maximum leverage ratios available to retail and professional clients are not disclosed in accessible documentation.

Platform Options: Specific trading platform software or proprietary systems used by Oron Limited are not identified in available information sources.

Geographic Restrictions: Information about countries or regions where Oron Limited services are restricted or unavailable is not provided in current documentation.

Customer Service Languages: The range of languages supported by Oron Limited's customer service team is not specified in available materials.

This oron limited review emphasizes the concerning lack of transparency about these fundamental trading conditions. Potential clients typically require this information for informed decision-making.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

Oron Limited's account conditions present major transparency challenges that greatly impact the overall user experience and decision-making process. The broker fails to provide essential information about account types, minimum deposit requirements, or specific features available to different client categories. This lack of disclosure makes it impossible for potential traders to understand what they can expect when opening an account with the company.

The absence of clearly defined account opening procedures raises additional concerns about the broker's operational standards and commitment to regulatory compliance. Most reputable brokers provide detailed information about their account structures, including standard, premium, and VIP account tiers with corresponding benefits and requirements. Oron Limited's failure to communicate these basic details suggests either inadequate business processes or intentional hiding of terms that might be unfavorable to clients.

User feedback about account conditions remains largely negative. Multiple reports express concerns about account security, unclear terms of service, and difficulties in understanding the actual conditions applied to their trading accounts. The lack of information about special account features, such as Islamic accounts for clients requiring Sharia-compliant trading conditions, further shows the broker's limited service offering and poor attention to diverse client needs.

This oron limited review concludes that the broker's approach to account conditions falls far below industry standards. This makes it difficult for traders to make informed decisions about account opening and ongoing trading relationships.

The trading tools and resources offered by Oron Limited remain largely unspecified. This creates major uncertainty about the quality and completeness of the trading environment provided to clients. While the broker claims to offer access to multiple asset classes, the specific analytical tools, charting capabilities, and research resources available to traders are not detailed in accessible documentation.

Most established brokers provide complete suites of trading tools including advanced charting packages, technical analysis indicators, economic calendars, market research reports, and automated trading capabilities. The absence of detailed information about such tools from Oron Limited suggests either a limited technological infrastructure or inadequate communication about available resources. This lack of transparency makes it challenging for traders to assess whether the platform meets their analytical and trading requirements.

Educational resources, which are crucial for trader development and success, appear to be absent or inadequately promoted by Oron Limited. Reputable brokers typically offer webinars, tutorials, market analysis, and educational content to support their clients' trading journey. The apparent absence of such resources indicates a limited commitment to client success and professional development.

User feedback about the quality and availability of trading tools remains mixed. Some users express frustration about the limited functionality while others cannot provide specific assessments due to unclear platform specifications. The lack of information about automated trading support, API access, or third-party platform integration further limits the broker's appeal to sophisticated traders requiring advanced trading capabilities.

Customer Service and Support Analysis (Score: 2/10)

Customer service quality represents one of the most concerning aspects of Oron Limited's operations. Persistent negative feedback and unresolved complaints characterize the user experience. Available reports indicate that clients have experienced major difficulties in obtaining adequate support for account-related issues, trading problems, and general inquiries about the broker's services.

The specific communication channels available for customer support, including phone, email, live chat, or ticket systems, are not clearly specified in available documentation. This lack of transparency about support accessibility creates additional barriers for clients seeking assistance and suggests inadequate customer service infrastructure. Response times for support inquiries remain unspecified, making it impossible for potential clients to understand what level of service they can expect.

Multiple user testimonials reference poor service quality. Complaints range from unresponsive support staff to inadequate resolution of trading-related issues. The presence of scam allegations and fraud complaints further undermines confidence in the broker's commitment to client satisfaction and ethical business practices. These negative experiences have contributed to the broker's poor reputation within the trading community.

The absence of information about multilingual support capabilities suggests limited accessibility for international clients. Unclear support hours and availability further compound the service quality concerns. The combination of these factors indicates a customer service operation that falls far below industry standards and fails to meet basic client expectations for professional support.

Trading Experience Analysis (Score: 3/10)

The trading experience offered by Oron Limited remains largely undefined due to insufficient information about platform specifications, execution quality, and overall trading environment. This lack of transparency makes it extremely difficult for potential clients to assess whether the broker can provide a satisfactory trading experience that meets their specific requirements and expectations.

Platform stability and execution speed, which are crucial factors for successful trading, are not addressed in available documentation about Oron Limited. Most traders require reliable platform performance, fast order execution, and minimal slippage to implement their trading strategies effectively. The absence of specific information about these technical aspects raises concerns about the broker's technological infrastructure and commitment to providing professional trading conditions.

Order execution quality, including fill rates, rejection rates, and execution speed metrics, remains unspecified in available materials. These factors greatly impact trading profitability and user satisfaction, making their absence from broker documentation particularly concerning. The lack of information about trading environment features such as one-click trading, partial fills, or advanced order types further limits understanding of the platform's capabilities.

Mobile trading capabilities, which are essential for modern traders requiring flexibility and accessibility, are not detailed in available information about Oron Limited. The absence of mobile app specifications or mobile platform features suggests either limited mobile support or inadequate communication about available mobile trading solutions.

User feedback about trading experience remains limited and mixed. Some negative reports exist about overall platform functionality but insufficient detail is available to provide comprehensive assessment. This oron limited review emphasizes the concerning lack of transparency about fundamental trading experience factors that potential clients require for informed decision-making.

Trust and Reliability Analysis (Score: 1/10)

Trust and reliability represent the most significant concerns regarding Oron Limited. Multiple red flags indicate serious credibility issues that potential clients should carefully consider. The broker's registration under Saint Lucia's International Business Company (IBC) framework provides minimal regulatory oversight compared to established financial centers, creating inherent risks for client fund security and regulatory protection.

The presence of multiple scam allegations and fraud complaints creates severe trust concerns that cannot be overlooked when evaluating Oron Limited as a potential trading partner. These allegations, combined with negative user testimonials, suggest systematic issues with the broker's business practices and ethical standards. The company's handling of these negative reports and complaints appears inadequate, further undermining confidence in its commitment to transparent and ethical operations.

Fund security measures, which are crucial for client protection, are not detailed in available documentation about Oron Limited. Reputable brokers typically maintain segregated client accounts, provide deposit insurance, and implement robust security protocols to protect client funds. The absence of clear information about such protective measures raises major concerns about fund safety and regulatory compliance.

Company transparency, including detailed information about management, operational procedures, and business practices, appears limited based on available documentation. This lack of transparency makes it difficult for potential clients to conduct adequate research and assess the broker's credibility and long-term viability.

The combination of regulatory limitations, scam allegations, and poor transparency creates a trust profile that falls far below industry standards. This makes Oron Limited unsuitable for most traders seeking reliable and secure trading partnerships.

User Experience Analysis (Score: 2/10)

Overall user satisfaction with Oron Limited remains consistently low based on available feedback and testimonials from the trading community. Multiple users have expressed major concerns about various aspects of their experience with the broker, ranging from platform functionality to customer service quality and overall business practices.

Interface design and platform usability information is not available in current documentation. This makes it impossible to assess the quality of the user interface and overall platform experience. Modern traders expect intuitive, responsive, and feature-rich platforms that facilitate efficient trading and account management. The absence of specific information about these aspects suggests either inadequate platform development or poor communication about available features.

Registration and account verification processes are not detailed in available materials. This creates uncertainty about the ease and efficiency of account opening procedures. Streamlined onboarding processes are essential for positive user experiences, and the lack of clear information about these procedures may indicate operational inefficiencies or unnecessarily complex requirements.

Fund management experiences, including deposit and withdrawal processes, processing times, and associated fees, remain unspecified in available documentation. These operational aspects greatly impact user satisfaction and overall broker evaluation, making their absence particularly concerning for potential clients.

Common user complaints include concerns about account security, service quality, and overall business practices. The pattern of negative feedback suggests systematic issues with the broker's operations and client relationship management. Users consistently express frustration with various aspects of their experience, indicating widespread dissatisfaction with Oron Limited's service delivery.

The broker appears most suitable for traders seeking access to multiple asset classes. However, the numerous negative factors and user complaints make it unsuitable for most retail traders who prioritize security, transparency, and reliable service. Potential improvements should focus on enhanced transparency, improved customer service, and better communication about trading conditions and platform features.

Conclusion

This comprehensive oron limited review reveals a broker that faces major credibility challenges and trust issues. These make it unsuitable for most retail traders. While Oron Limited positions itself as a multi-asset broker offering access to forex, cryptocurrencies, stocks, indices, and commodities, the numerous red flags and negative user experiences greatly outweigh any potential benefits.

The broker's primary advantage lies in its claimed offering of diversified trading opportunities across multiple asset classes. However, this potential benefit is severely undermined by the lack of transparency about trading conditions, platform specifications, and fundamental business practices that traders require for informed decision-making.

The main disadvantages include persistent scam allegations, extremely poor user feedback, minimal regulatory oversight under Saint Lucia's IBC framework, lack of transparency about trading conditions and costs, and inadequate customer service quality. These factors combine to create a risk profile that exceeds acceptable levels for most traders seeking secure and reliable trading partnerships.

Based on this analysis, Oron Limited is not recommended for retail traders who prioritize security, transparency, and professional service quality. Potential traders should consider established brokers with stronger regulatory oversight, transparent business practices, and positive user feedback when selecting a trading partner for their financial market activities.