Banex Capital 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive banex capital review reveals concerning patterns that potential traders should carefully consider before opening an account. Based on extensive user feedback and market analysis, Banex Capital has received predominantly negative evaluations, with multiple reports of fraudulent behavior and withdrawal restrictions that raise serious red flags about the broker's legitimacy. The platform offers some appealing features including leverage up to 1:300 and access to the MT5 trading platform, which provides robust trading capabilities for forex and CFD instruments.

However, these potential advantages are significantly overshadowed by extremely high spreads reaching 40 pips and numerous user complaints regarding deposit seizures and withdrawal limitations. Our analysis indicates that Banex Capital primarily targets high-risk tolerance traders, but even experienced investors should exercise extreme caution when considering this broker. Multiple legal cases have been filed against the company in Dubai, with traders reporting that the broker altered terms mid-process and seized deposited funds without proper justification. The lack of clear regulatory information further compounds concerns about trader protection and fund security.

While the broker claims to offer transparent trading conditions and superior execution, user experiences paint a drastically different picture of unreliable service and questionable business practices.

Important Notice

Regional Entity Differences: Banex Capital's regulatory status remains unclear across different jurisdictions, and traders in various regions may face significantly different levels of legal protection. The absence of verifiable regulatory oversight means that dispute resolution mechanisms and compensation schemes may not be available to affected traders. Our assessment does not include on-site investigations or direct testing of the platform's services, and readers should conduct their own due diligence before making any investment decisions.

Review Methodology: This evaluation is based primarily on user feedback, market analysis, and publicly available information.

Rating Framework

Broker Overview

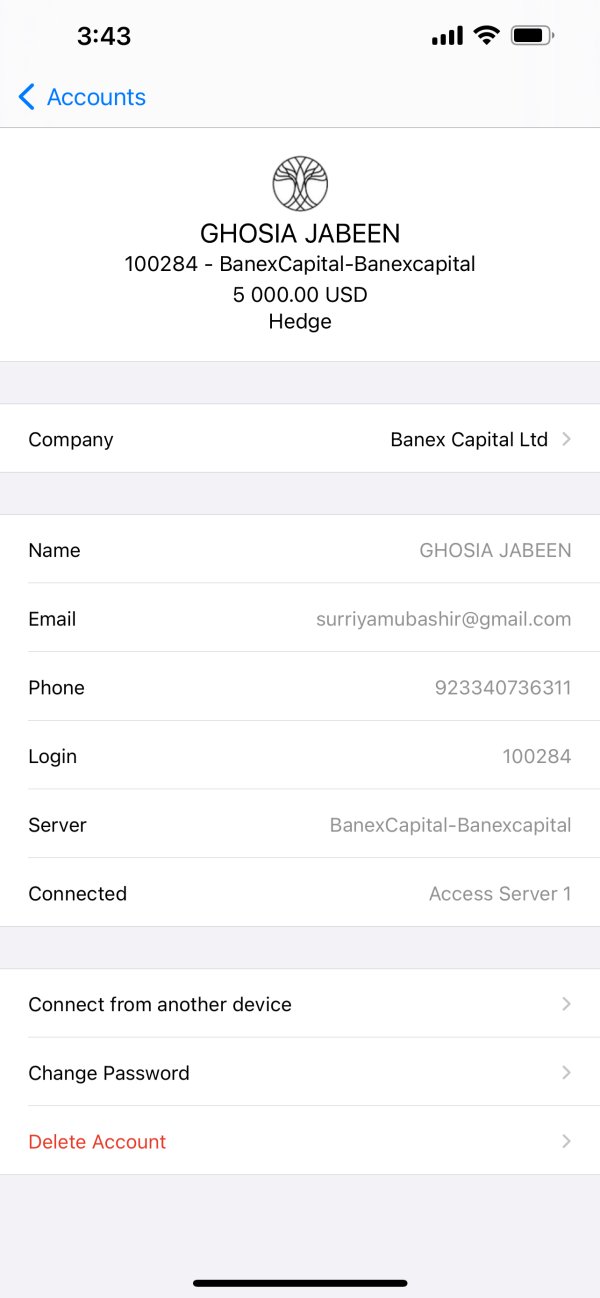

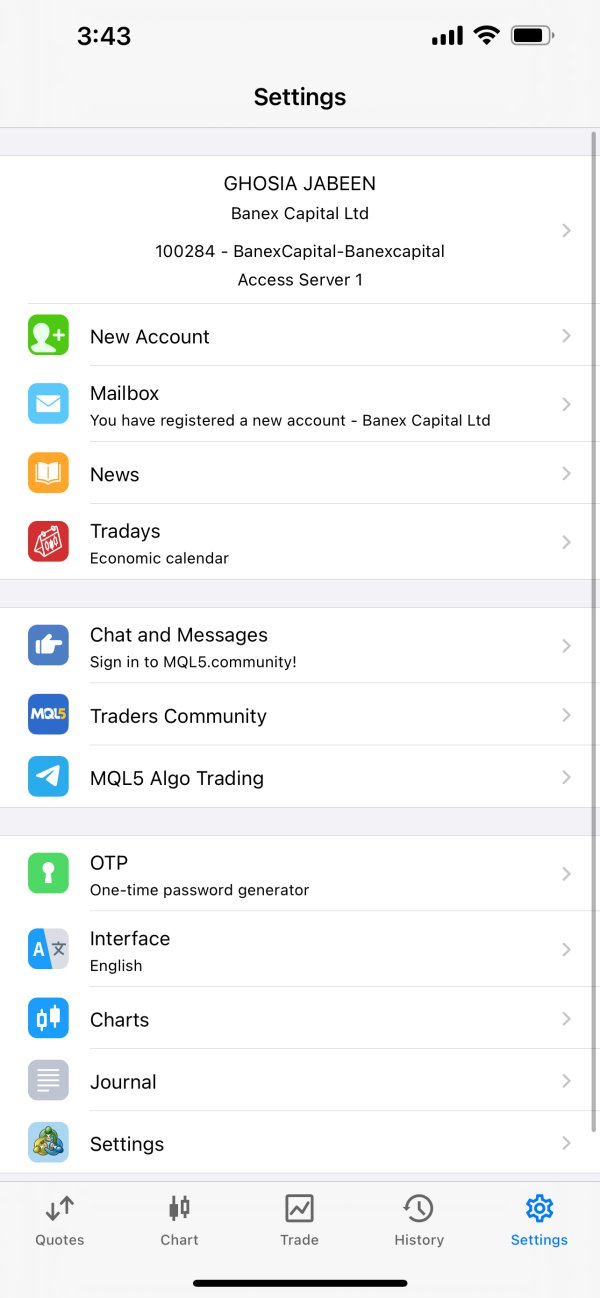

Banex Capital operates as an online investment platform specializing in forex and CFD trading services. The company positions itself as offering "superior execution and trading conditions" while providing access to various financial instruments including currency pairs, indices, commodities, and stock CFDs. However, the broker's actual performance and reputation tell a markedly different story from its marketing claims. The platform's business model centers around providing high leverage trading opportunities through the popular MT5 platform, which is widely recognized in the industry for its advanced charting capabilities and automated trading features.

Banex Capital claims to serve retail investors seeking exposure to global financial markets, though user experiences suggest the broker may not be delivering on its promises of transparent and reliable service. According to available information, Banex Capital offers leverage ratios up to 1:300, which can be attractive to traders seeking significant market exposure with relatively small capital requirements. The broker provides access to multiple asset classes including forex pairs, CFDs on indices, commodities trading, and stock-based instruments, potentially appealing to traders who prefer diversified trading strategies. However, this banex capital review must emphasize that the broker's regulatory status remains unclear, with no verifiable information about oversight from recognized financial authorities.

This regulatory ambiguity, combined with numerous negative user reports, raises substantial concerns about the broker's legitimacy and the safety of client funds deposited with the platform.

Regulatory Oversight: Current available information does not specify any recognized regulatory authorities overseeing Banex Capital's operations, which represents a significant concern for trader protection and fund security. Specific information about available payment methods has not been detailed in available resources, though user complaints suggest significant issues with withdrawal processing and fund accessibility.

Deposit and Withdrawal Methods: The exact minimum deposit amount required to open an account with Banex Capital has not been clearly specified in available documentation. Information regarding bonus structures or promotional campaigns is not detailed in current available resources, though user reports mention problematic bonus hedging deals that led to disputes.

Minimum Deposit Requirements: The platform offers access to forex currency pairs, CFDs on various indices, commodity trading instruments, and stock-based CFDs across multiple global markets. Spreads reportedly start from 40 pips, which is significantly higher than industry standards.

Promotional Offers: Commission policies and additional fee structures remain unclear based on available information. Maximum leverage offered reaches 1:300, providing substantial market exposure but also significantly increasing risk levels for retail traders.

Tradeable Assets: Trading is conducted through the MT5 platform, which offers comprehensive charting tools, automated trading capabilities, and advanced order management features. Specific information about regional limitations or restricted territories has not been detailed in available resources.

Cost Structure: Available language support options for customer service have not been specified in current documentation. This banex capital review highlights the concerning lack of transparency regarding basic operational details that reputable brokers typically provide clearly to potential clients.

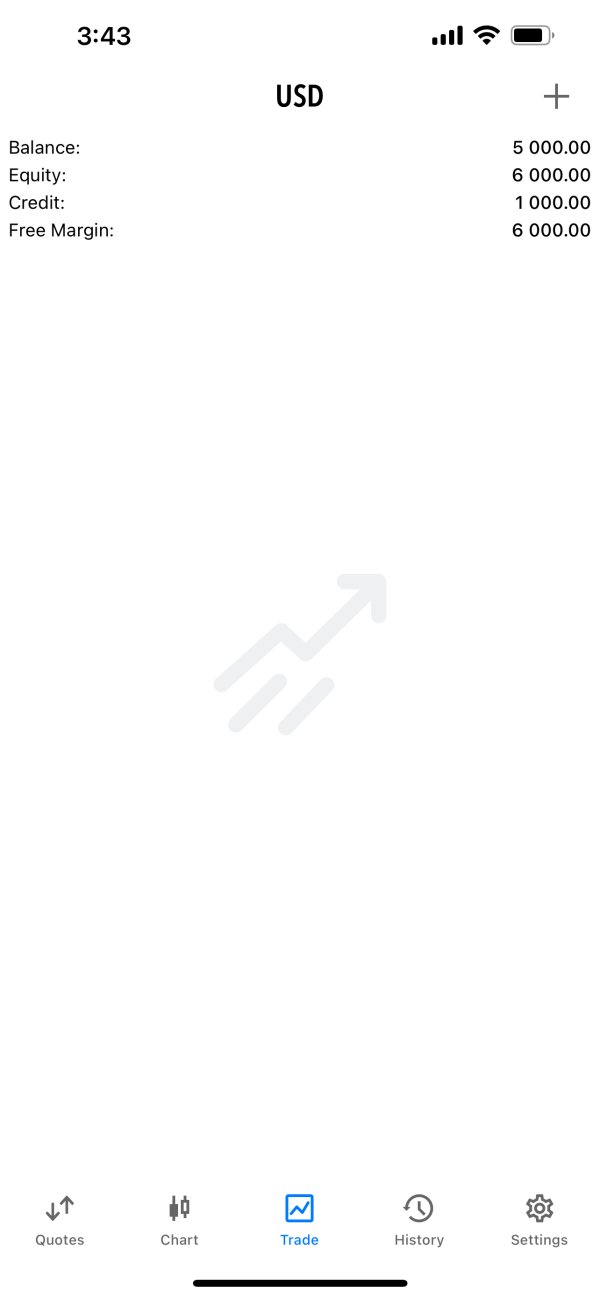

Account Conditions Analysis

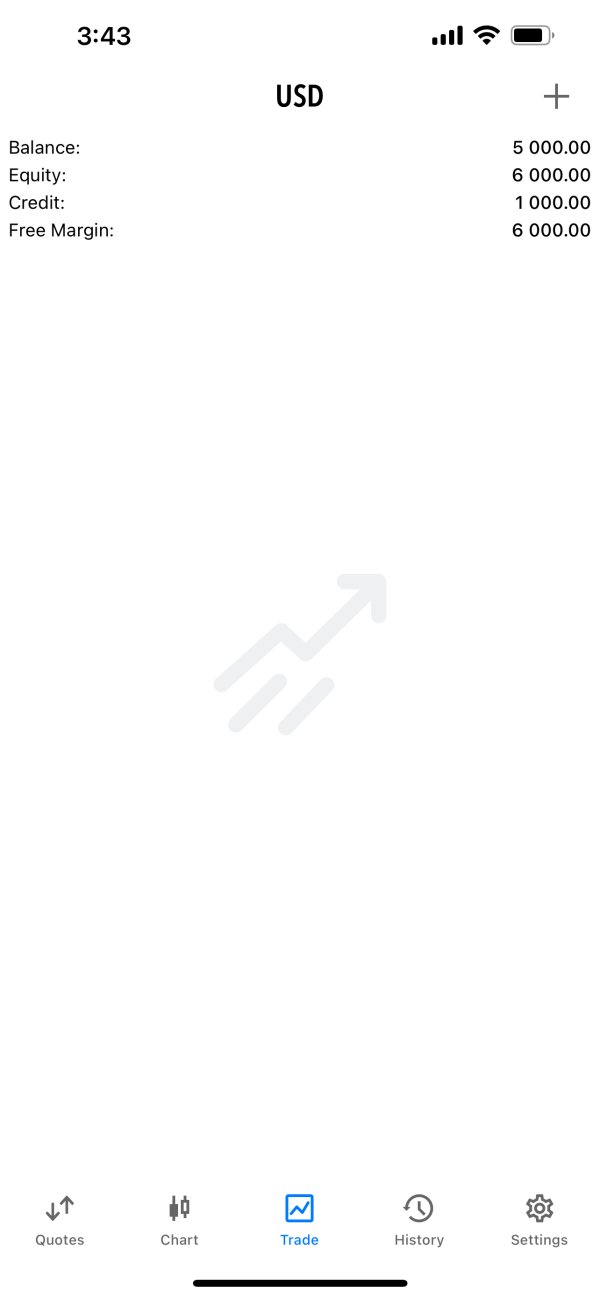

The account conditions offered by Banex Capital present several concerning aspects that potential traders should carefully evaluate. While specific account type variations have not been clearly detailed in available information, the fundamental trading conditions raise significant red flags about the broker's competitiveness and reliability. The most alarming aspect of Banex Capital's account conditions is the extremely high spread structure, with reports indicating spreads starting from 40 pips.

This pricing represents a substantial deviation from industry standards, where competitive brokers typically offer spreads ranging from 0.1 to 3 pips on major currency pairs. Such elevated costs can severely impact trading profitability and make consistent gains extremely difficult to achieve. The absence of clear information regarding minimum deposit requirements creates additional uncertainty for potential clients.

Reputable brokers typically provide transparent details about account funding requirements, allowing traders to make informed decisions about their investment commitments. This lack of clarity from Banex Capital suggests poor operational transparency. User feedback consistently highlights problems with account management, particularly regarding withdrawal processes and fund accessibility.

Multiple reports indicate that the broker has implemented unauthorized restrictions on client accounts and altered terms of service without proper notification, which violates standard industry practices and trader expectations. The account opening process details remain unclear, with no specific information about verification requirements, documentation needs, or approval timeframes. This opacity contrasts sharply with established brokers who provide clear guidance about account setup procedures.

According to user reports referenced in this banex capital review, the broker's account conditions have been subject to arbitrary changes, particularly regarding bonus terms and withdrawal policies, creating an unstable and unpredictable trading environment for clients.

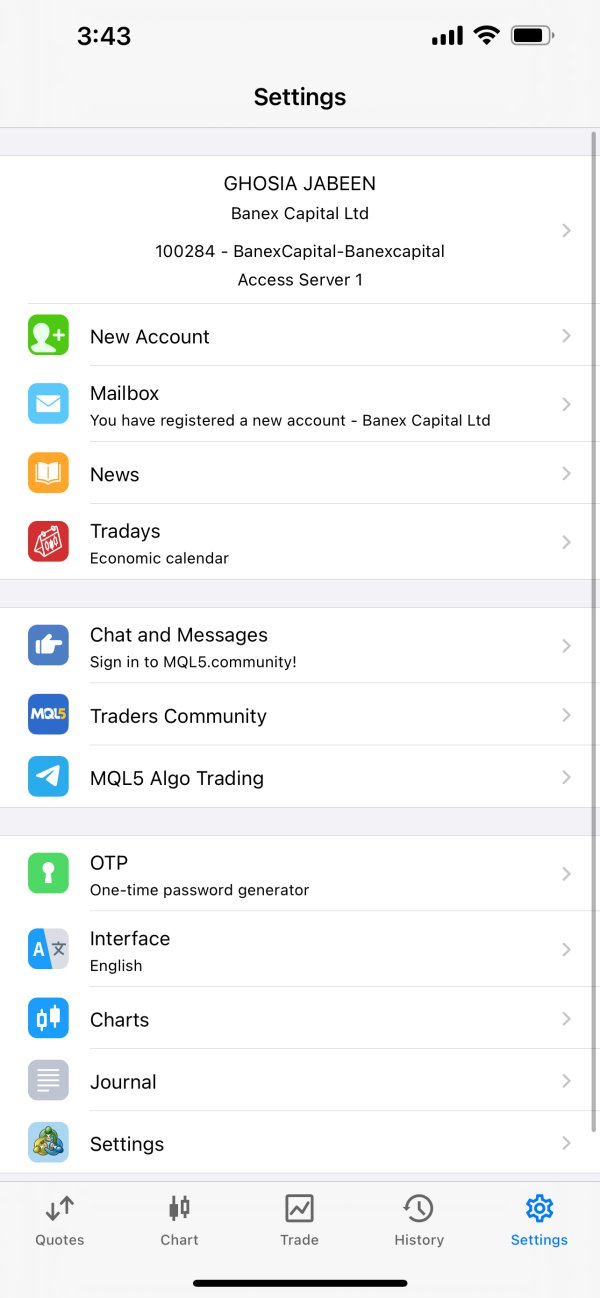

Banex Capital provides access to several trading tools and resources, though the quality and reliability of these offerings appear inconsistent based on user feedback and available information. The platform's resource portfolio includes basic market analysis tools, but falls short of comprehensive educational and research support expected from reputable brokers. The broker offers access to economic calendars and earnings calendars, which are essential tools for fundamental analysis and market timing.

These resources can help traders track important economic events and corporate announcements that may impact market movements. However, user feedback suggests that the accuracy and timeliness of this information may be questionable. Trading calculators are available to help users assess position sizing, margin requirements, and potential profit or loss scenarios.

While these tools are standard offerings in the industry, their effectiveness depends on accurate real-time data and reliable platform performance, areas where Banex Capital appears to face challenges. The platform claims to provide daily market reviews from their analyst team, positioning this as an exclusive benefit for clients. However, the quality and independence of this analysis remain unclear, and users have expressed skepticism about the practical value of these market commentaries.

The MT5 platform integration provides access to advanced charting tools, technical indicators, and automated trading capabilities through Expert Advisors. This represents one of the stronger aspects of Banex Capital's offering, as MT5 is a well-established and feature-rich trading platform widely respected in the industry. However, educational resources appear limited, with no comprehensive trading courses, webinars, or structured learning materials mentioned in available information.

This gap in educational support can be particularly problematic for novice traders who require guidance to develop their trading skills and market understanding effectively.

Customer Service and Support Analysis

Customer service quality represents one of the most significant weaknesses in Banex Capital's operations, with numerous user complaints highlighting serious deficiencies in support responsiveness and problem resolution capabilities. The broker's customer service performance has generated substantial negative feedback from traders who have experienced difficulties with various aspects of their trading experience. Multiple user reports indicate extremely poor response times when clients attempt to contact customer support regarding account issues, withdrawal problems, or technical difficulties.

This lack of timely communication creates frustration and uncertainty for traders who require immediate assistance with time-sensitive trading matters or urgent account concerns. The quality of customer service interactions appears consistently problematic, with users reporting that support representatives lack the knowledge or authority to resolve complex issues effectively. Many complaints specifically mention that customer service agents provide unclear or contradictory information, particularly regarding withdrawal procedures and account restrictions.

Withdrawal-related support issues represent a particularly concerning pattern, with multiple users reporting that customer service becomes unresponsive or provides evasive answers when clients attempt to process fund withdrawals. Some users have described situations where support representatives initially approved withdrawal requests but subsequently imposed arbitrary restrictions or additional requirements. The availability of customer support channels has not been clearly specified in available information, though user experiences suggest that communication options may be limited.

Professional brokers typically offer multiple contact methods including phone, email, live chat, and comprehensive FAQ sections, though Banex Capital's support infrastructure appears inadequate. Language support capabilities remain unclear, which can create additional barriers for international clients who require assistance in their native language. The absence of multilingual support can significantly impact user experience and problem resolution effectiveness for non-English speaking traders.

Trading Experience Analysis

The overall trading experience provided by Banex Capital has received predominantly negative feedback from users, with multiple factors contributing to an unsatisfactory and potentially problematic trading environment. Platform performance issues, combined with unfavorable trading conditions, create significant challenges for traders attempting to execute their strategies effectively. Platform stability appears to be a recurring concern, with users reporting occasional technical problems that can disrupt trading activities.

While the MT5 platform itself is generally reliable, the broker's implementation and server infrastructure may be contributing to performance issues that affect order execution and platform responsiveness during critical trading periods. Order execution quality represents a significant weakness, with user reports indicating problems with slippage and requoting that can negatively impact trading results. Professional traders require precise order execution to implement their strategies effectively, and execution problems can lead to substantial losses, particularly in volatile market conditions.

The extremely high spread structure, starting from 40 pips, fundamentally undermines the trading experience by creating prohibitive transaction costs. These elevated spreads make it extremely difficult for traders to achieve profitability, as positions must move substantially in their favor just to overcome the initial cost disadvantage. Mobile trading experience details have not been specifically addressed in available information, though modern traders increasingly rely on mobile platforms for market monitoring and trade management.

The absence of clear mobile trading capabilities or performance information represents a potential limitation for active traders. The trading environment is further compromised by concerns about the broker's reliability and trustworthiness, which can create psychological stress for traders who worry about fund security and withdrawal accessibility. This uncertainty can significantly impact trading decision-making and overall user satisfaction with the platform experience.

This banex capital review emphasizes that the combination of high costs, execution problems, and reliability concerns creates a challenging trading environment that most professional traders would find unacceptable.

Trust and Reliability Analysis

Trust and reliability represent the most critical weaknesses in Banex Capital's operations, with substantial evidence suggesting serious concerns about the broker's legitimacy and business practices. Multiple indicators point to significant reliability issues that should cause potential clients to exercise extreme caution when considering this broker. The absence of verifiable regulatory oversight represents a fundamental trust issue, as legitimate brokers typically operate under the supervision of recognized financial authorities.

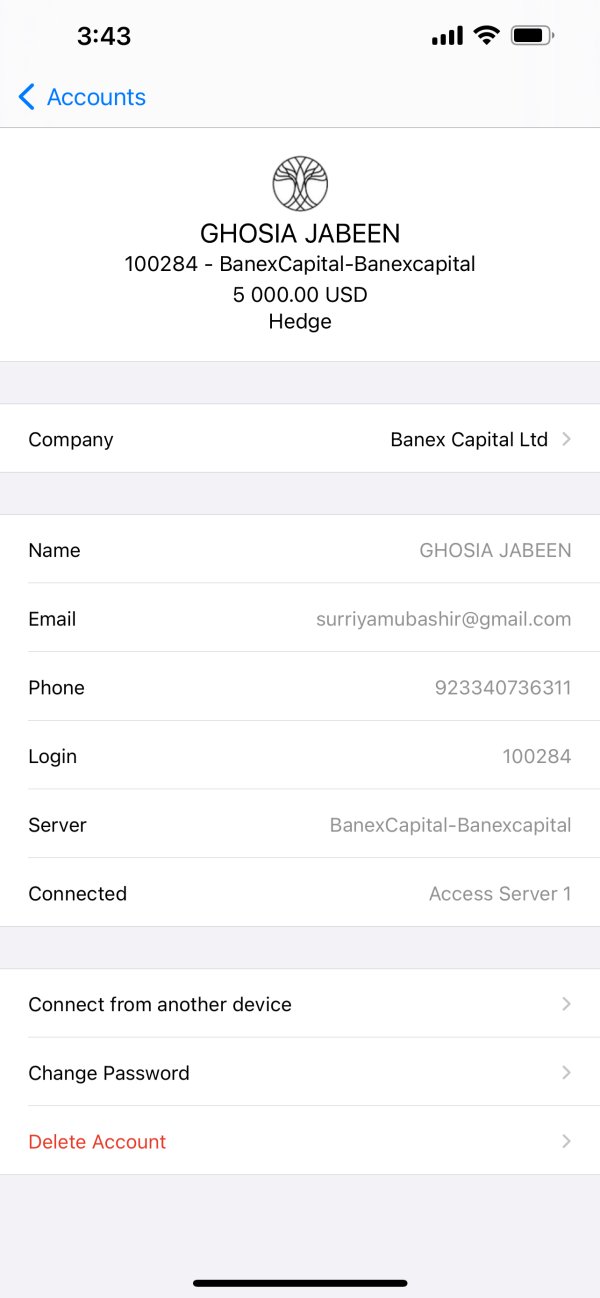

Regulatory compliance provides essential protections for traders, including segregated client funds, dispute resolution mechanisms, and compensation schemes that may not be available with unregulated brokers. User reports of fraudulent behavior create severe concerns about the broker's business practices and ethical standards. Multiple complaints describe situations where the broker allegedly altered terms of service without proper notification, imposed arbitrary restrictions on client accounts, and seized deposited funds without adequate justification.

Legal litigation cases filed against Banex Capital in Dubai provide concrete evidence of serious disputes between the broker and its clients. These legal proceedings suggest that informal complaint resolution mechanisms have failed, requiring affected traders to pursue formal legal action to recover their funds or resolve disputes. Fund security measures have not been clearly detailed in available information, raising questions about client money protection and segregation practices.

Reputable brokers typically provide transparent information about fund safety measures, including segregated accounts, insurance coverage, and banking relationships with established financial institutions. Company transparency remains extremely limited, with minimal publicly available information about corporate structure, management team, or operational history. This opacity contrasts sharply with legitimate brokers who typically provide comprehensive company information to build trust with potential clients.

The pattern of negative events and user complaints suggests systemic problems rather than isolated incidents, indicating fundamental issues with the broker's business model and operational practices that extend beyond minor customer service problems.

User Experience Analysis

Overall user satisfaction with Banex Capital appears extremely low based on available feedback and reported experiences from traders who have interacted with the platform. The predominant sentiment among users reflects deep dissatisfaction with multiple aspects of the broker's services, creating a concerning pattern of negative experiences. User interface design and platform usability appear adequate when functioning properly, primarily due to the MT5 platform's established design and functionality.

However, the broker's implementation and customization of the platform may introduce complications that impact the overall user experience and trading efficiency. The registration and account verification process details remain unclear in available documentation, though user experiences suggest that these procedures may become problematic when clients attempt to withdraw funds or modify account settings. Transparent and efficient onboarding processes are essential for positive user experiences with financial service providers.

Fund management operations represent the most significant source of user dissatisfaction, with widespread complaints about withdrawal difficulties and deposit-related problems. Users consistently report that withdrawal processes are unnecessarily complicated, delayed, or subject to arbitrary restrictions that were not clearly disclosed during account opening. Common user complaints center around withdrawal limitations, deposit seizures, and altered terms of service that negatively impact client accounts.

These issues create substantial frustration and financial stress for affected traders who may find their funds inaccessible when needed. The typical user profile for Banex Capital appears to include high-risk tolerance traders attracted by high leverage offerings, though even experienced traders with substantial risk appetite have reported negative experiences with the broker's services and business practices. User feedback consistently emphasizes the need for improved transparency in withdrawal procedures, clearer communication about account terms, and more reliable customer support to address problems effectively.

The current user experience appears to fall well below industry standards for professional forex and CFD brokers. Recommendations for improvement include implementing transparent withdrawal policies, providing clear account terms, and establishing reliable customer support systems that can address user concerns promptly and effectively.

Conclusion

This comprehensive banex capital review reveals significant concerns that should cause potential traders to carefully reconsider using this broker's services. While the platform offers high leverage ratios and access to the established MT5 trading platform, these limited advantages are substantially outweighed by serious operational and reliability issues. The broker may only be suitable for extremely high-risk tolerance traders who are willing to accept substantial uncertainty regarding fund security and withdrawal accessibility.

However, even experienced traders with significant risk appetite should exercise extreme caution given the numerous red flags identified in this analysis. The primary advantages include access to 1:300 leverage and MT5 platform functionality, while the major disadvantages encompass extremely high spreads starting from 40 pips, withdrawal restrictions, deposit seizure reports, lack of regulatory oversight, and multiple legal disputes. These fundamental problems create an unacceptable risk profile for most professional traders seeking reliable and transparent broker services.