Is BANEX CAPITAL safe?

Pros

Cons

Is Banex Capital Safe or Scam?

Introduction

Banex Capital positions itself as a modern online trading platform, claiming to offer a wide range of financial instruments, including forex, commodities, and CFDs. As the forex market continues to attract both seasoned traders and newcomers, the importance of thoroughly assessing the legitimacy and safety of brokers cannot be overstated. A broker's regulatory status, financial practices, and customer feedback are crucial indicators of its reliability. This article aims to provide a comprehensive evaluation of Banex Capital, utilizing various sources and analytical frameworks to determine whether it is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical aspects to consider when assessing its safety. A properly regulated broker is subject to stringent oversight, which helps protect investors from fraud and malpractice. Unfortunately, Banex Capital does not appear to be regulated by any reputable financial authority.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulation raises significant concerns. Regulatory bodies like the Financial Conduct Authority (FCA) in the UK impose strict guidelines to ensure the safety of client funds, including the requirement for segregated accounts and negative balance protection. Banex Capital's lack of licensing indicates that it operates outside these protections, making it a potentially high-risk environment for traders. The firm's claims of being based in the UK or UAE are unverified, and its operations seem to be based in Saint Lucia, a jurisdiction known for lax regulatory oversight. This lack of regulatory compliance is a significant red flag when asking, "Is Banex Capital safe?"

Company Background Investigation

Banex Capital was established in April 2022, making it a relatively new player in the online trading space. The company claims to offer a sophisticated trading platform and a variety of financial instruments. However, details about its ownership structure and management team are scarce. A reputable broker typically provides transparent information about its executives and corporate governance, but Banex Capital fails to do so.

The company's website lacks essential legal documents, such as terms and conditions or a privacy policy, which are typically available on legitimate trading platforms. This lack of transparency raises questions about the company's accountability and operational integrity. Without a well-defined corporate structure or experienced management team, it becomes increasingly difficult to trust Banex Capital as a legitimate trading platform.

Trading Conditions Analysis

When evaluating a broker, understanding its fee structure and trading conditions is essential. Banex Capital claims to offer competitive trading conditions; however, reports suggest otherwise. The spreads on major currency pairs can be as high as 40 pips, which is significantly above the industry average.

| Fee Type | Banex Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 40 pips | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

Such high spreads can severely impact trading profitability, especially for day traders who rely on tight spreads to execute their strategies. Additionally, there is little clarity regarding any potential hidden fees, as the company does not provide comprehensive information about costs associated with deposits, withdrawals, or inactivity. This lack of transparency raises further concerns about the overall trading conditions at Banex Capital, prompting traders to ask, "Is Banex Capital safe?"

Client Fund Security

The safety of client funds is paramount when choosing a broker. Regulated brokers are required to segregate client funds from their operational funds, which provides an additional layer of security. However, Banex Capital does not offer such assurances.

Without proper client fund segregation, investors risk losing their money in the event of the broker's insolvency or mismanagement. Furthermore, Banex Capital does not provide any negative balance protection, which means traders could potentially lose more than their initial deposit. Reports of withdrawal issues and delays have surfaced, with clients struggling to access their funds. This history of complaints raises serious concerns about the safety of client funds and whether traders should trust Banex Capital with their investments.

Customer Experience and Complaints

Customer feedback is a vital component in assessing a broker's reliability. Numerous complaints have been reported regarding Banex Capital, particularly concerning withdrawal difficulties and unresponsive customer service. Many users have experienced significant delays when attempting to withdraw their funds, with some reports indicating that requests are outright denied.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Poor Customer Service | Medium | Slow Response |

These patterns of complaints suggest a troubling trend that potential investors should take seriously. For instance, one user reported being unable to withdraw funds after multiple attempts, leading to frustration and distrust. Such experiences highlight the risks associated with trading on platforms like Banex Capital, reaffirming the question, "Is Banex Capital safe?"

Platform and Trade Execution

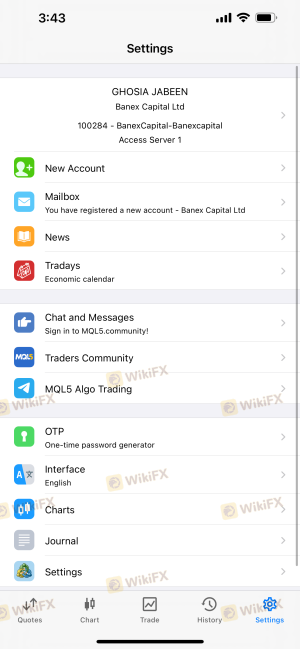

A broker's trading platform is crucial for a smooth trading experience. Banex Capital offers the MetaTrader 5 (MT5) platform, which is known for its advanced features and user-friendly interface. However, the quality of execution, including slippage and order rejection, is equally important. Reports suggest that traders have experienced issues with order execution, including slippage during volatile market conditions.

The lack of transparency regarding order execution quality raises concerns about potential manipulation or unfair practices. Traders should be cautious and seek platforms that provide reliable execution and transparency in their operations.

Risk Assessment

Trading with Banex Capital presents several risks that potential investors should consider. The lack of regulation, high trading costs, and withdrawal issues contribute to a high-risk environment.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker, no client protections |

| Financial Risk | High | High spreads and unclear fee structure |

| Withdrawal Risk | High | Reports of difficulty accessing funds |

Given these risks, traders are advised to approach Banex Capital with extreme caution. It is essential to conduct thorough research and consider alternative, regulated brokers to mitigate these risks.

Conclusion and Recommendations

In conclusion, the evidence suggests that Banex Capital is not a safe trading option. Its lack of regulation, high trading costs, and numerous customer complaints raise significant concerns about its legitimacy. Potential investors should be wary of the risks involved and consider seeking alternatives that offer regulatory oversight and transparent operations.

For those looking for reliable trading platforms, consider brokers that are well-regulated and have positive reputations in the trading community. Always prioritize safety and transparency when making investment decisions, as the forex market can be rife with scams and untrustworthy brokers. As such, the question remains: "Is Banex Capital safe?" The overwhelming evidence indicates it is not.

Is BANEX CAPITAL a scam, or is it legit?

The latest exposure and evaluation content of BANEX CAPITAL brokers.

BANEX CAPITAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BANEX CAPITAL latest industry rating score is 2.05, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.05 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.