Radar Brokers 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive radar brokers review examines a new company in the forex trading space. The company has created major concerns among traders and industry watchers. Radar Brokers started in 2022 and has its headquarters in Vanuatu, presenting itself as a multi-asset trading provider that offers access to stocks, global indices, derivatives, funds, and bonds. Our analysis shows major red flags that potential clients should think about carefully.

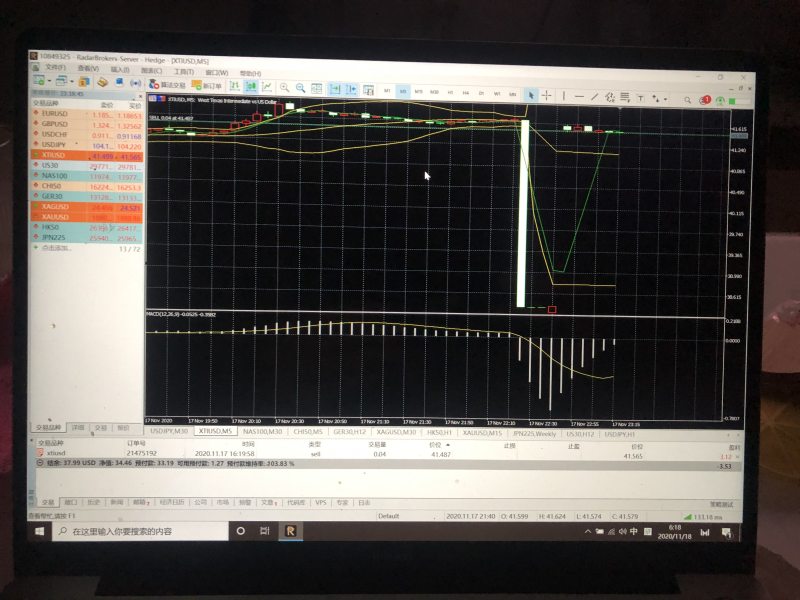

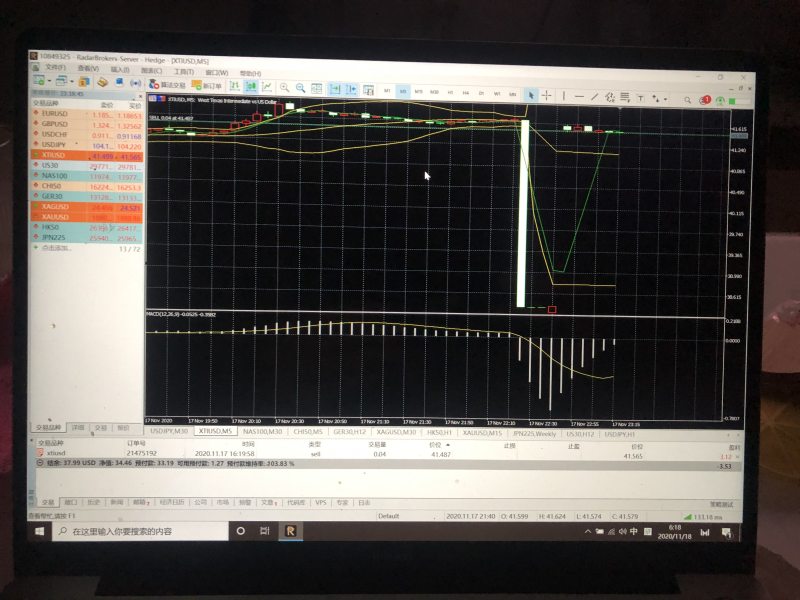

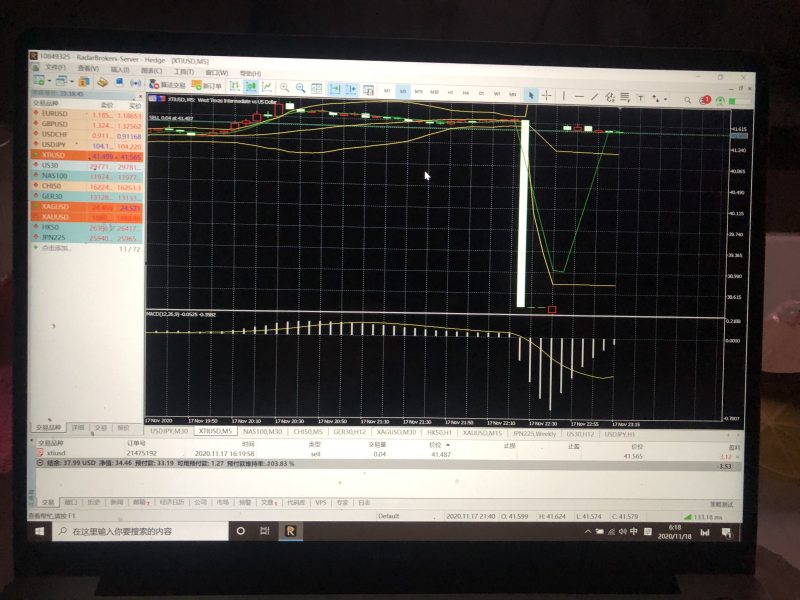

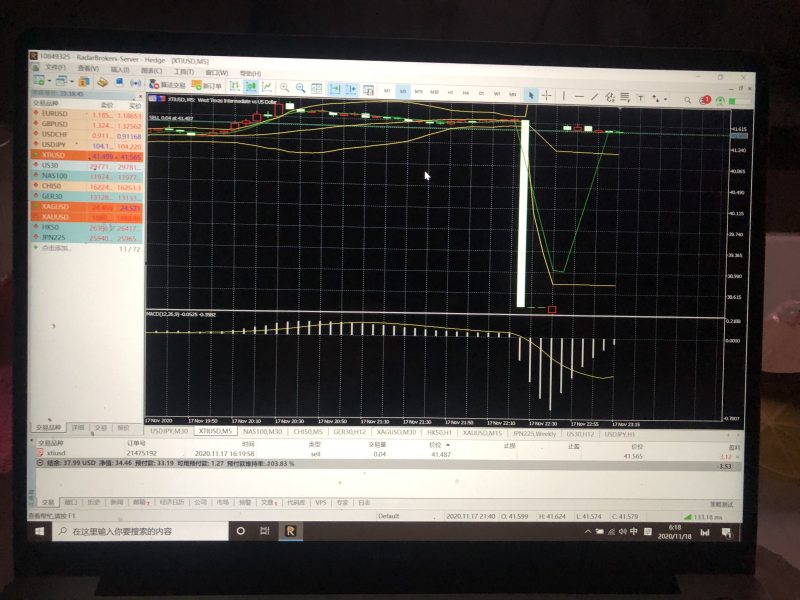

The broker works under claimed regulation from the Vanuatu Financial Services Commission. However, verification details are not clear. Radar Brokers offers two main trading platforms: their own Radar Trader platform and the well-known MetaTrader 5. Despite these technology offerings, the broker has received an extremely concerning user rating of 1.00 out of 10, which shows severe user dissatisfaction.

This review targets traders seeking diversified asset exposure through multiple platform options. We strongly advise extreme caution given the major transparency and trust issues we found. The lack of clear regulatory documentation, combined with overwhelmingly negative user feedback, positions Radar Brokers as a high-risk choice for serious traders.

Important Notice

Regional Entity Variations: Radar Brokers operates under VFSC regulation. This may offer different investor protections compared to major regulatory jurisdictions such as the FCA, CySEC, or ASIC. Traders should understand that Vanuatu-based regulation typically provides limited recourse options and may not include compensation schemes available in more established regulatory frameworks.

Review Methodology Disclosure: This evaluation is based on publicly available information, user feedback from various trading communities, and regulatory filings where accessible. We have not conducted direct testing of the platform or services. Potential clients should perform their own due diligence before engaging with this broker.

Rating Framework

Broker Overview

Radar Brokers emerged in the competitive forex landscape in 2022. The company positioned itself as a comprehensive trading solutions provider from its Vanuatu headquarters. The company has tried to stand out by offering access to multiple asset classes beyond traditional forex pairs, including stocks, global indices, derivatives, funds, and bonds. This multi-asset approach targets traders seeking portfolio diversification through a single platform provider.

The broker's business model centers on providing retail traders with access to global financial markets through their own technology stack. According to available information, Radar Brokers has invested in developing their own trading platform while also offering the industry-standard MetaTrader 5 platform to accommodate different trader preferences. This dual-platform strategy suggests an attempt to serve both novice traders who prefer familiar interfaces and more advanced users seeking specialized tools.

However, the broker's operational foundation raises major concerns. The choice of Vanuatu as a regulatory jurisdiction, while legal, often shows a preference for lighter regulatory oversight compared to major financial centers. The company's brief operational history, combined with limited transparent information about its management team and financial backing, creates additional uncertainty for potential clients. The extremely low user rating of 1.00 out of 10 suggests that early adopters have encountered major issues that prospective traders should carefully consider before committing funds to this platform.

Regulatory Jurisdiction: Radar Brokers claims regulation under the Vanuatu Financial Services Commission. However, specific license details remain unclear in available documentation. This regulatory choice provides limited investor protection compared to major jurisdictions.

Deposit and Withdrawal Methods: Specific information regarding supported payment methods, processing times, and associated fees is not detailed in available resources. This represents a major transparency gap for potential clients.

Minimum Deposit Requirements: The exact minimum deposit threshold has not been disclosed in accessible materials. This makes it difficult for traders to plan their initial investment strategy.

Bonus and Promotional Offerings: Current promotional activities, welcome bonuses, or ongoing incentive programs are not documented in available sources. This suggests either absence of such programs or poor marketing transparency.

Available Trading Assets: The broker provides access to stocks, global indices, derivatives, funds, and bonds. This indicates a multi-asset approach beyond traditional forex offerings.

Cost Structure and Fees: Detailed information about spreads, commission structures, overnight financing rates, and other trading costs remains unavailable in public documentation. This creates uncertainty about total trading expenses.

Leverage Specifications: According to available data, Radar Brokers offers maximum leverage of 1:1. This is extremely conservative compared to industry standards and may limit trading strategies for many forex traders.

Platform Options: Traders can access markets through two primary platforms: the proprietary Radar Trader system and the established MetaTrader 5 platform. This provides some flexibility in trading interface preferences.

Geographic Restrictions: Specific information about restricted countries or regional service limitations is not clearly documented in available materials.

Customer Support Languages: The range of supported languages for customer service communications has not been specified in accessible resources.

This radar brokers review highlights major information gaps that potential clients should address through direct inquiry before account opening.

Account Conditions Analysis

The account structure offered by Radar Brokers presents several concerning gaps in transparency. These gaps significantly impact our evaluation. Unlike established brokers who typically offer tiered account types with clear distinctions between basic, premium, and VIP services, Radar Brokers has not provided detailed information about their account hierarchy or the specific benefits associated with different deposit levels.

The absence of clear minimum deposit requirements represents a fundamental transparency issue. Most reputable brokers prominently display this information as it directly impacts accessibility for new traders. This lack of clarity suggests either poor marketing practices or potential flexibility that could lead to inconsistent treatment of clients. Additionally, without understanding the minimum investment threshold, traders cannot properly plan their risk management strategies or compare costs with alternative providers.

Account opening procedures and verification requirements remain undocumented in available sources. Modern forex brokers typically outline their KYC processes, required documentation, and verification timelines to help clients understand the onboarding experience. The absence of this information raises questions about the broker's compliance procedures and operational sophistication.

Special account features, such as Islamic accounts for Sharia-compliant trading, have not been mentioned in available documentation. Given the global nature of forex trading and the importance of religious compliance for many traders, this omission suggests limited service customization. The extremely low user rating of 1.00 partially reflects these transparency issues, as traders consistently report frustration with unclear terms and conditions.

When compared to established competitors who offer detailed account specifications, transparent fee structures, and clear upgrade paths, Radar Brokers falls significantly short of industry standards. This radar brokers review recommends that potential clients demand complete account documentation before considering any deposit.

Radar Brokers' approach to trading tools and educational resources reveals a mixed picture. The picture shows technological capability hampered by poor documentation and user satisfaction issues. The broker's decision to offer both their proprietary Radar Trader platform and the industry-standard MetaTrader 5 demonstrates some understanding of trader preferences, as this dual approach can accommodate both newcomers who prefer familiar interfaces and experienced traders seeking specialized functionality.

The proprietary Radar Trader platform represents the broker's attempt to differentiate their service offering. However, specific details about its features, analytical tools, and unique capabilities remain largely undocumented. Without clear information about charting packages, technical indicators, automated trading support, or order management features, traders cannot properly evaluate whether this platform meets their strategic requirements.

MetaTrader 5 integration provides some reassurance, as this platform offers robust analytical tools, expert advisor support, and comprehensive market analysis capabilities. However, the quality of MT5 implementation can vary significantly between brokers, particularly regarding execution speed, available instruments, and custom indicator support.

Research and market analysis resources appear to be another area of concern. Established brokers typically provide daily market commentary, economic calendars, fundamental analysis, and educational webinars to support trader decision-making. The absence of documented research capabilities suggests that Radar Brokers may not offer comprehensive analytical support, forcing traders to seek third-party resources.

Educational materials and trader development programs have not been detailed in available information. Given the broker's brief operational history and focus on multi-asset trading, comprehensive educational resources would be particularly valuable for helping traders navigate different market sectors effectively. The lack of visible educational commitment may contribute to the extremely poor user satisfaction ratings observed across review platforms.

Customer Service and Support Analysis

The customer service framework at Radar Brokers presents major concerns. These concerns directly correlate with the broker's exceptionally poor user rating of 1.00 out of 10. Effective customer support serves as a critical differentiator in the competitive forex industry, where traders require rapid assistance for technical issues, account inquiries, and trading problems that can directly impact financial outcomes.

Available documentation fails to specify the customer service channels offered by Radar Brokers. This leaves potential clients uncertain about how to access support when needed. Most reputable brokers clearly advertise their support options, including live chat, telephone hotlines, email ticketing systems, and sometimes video consultation services. The absence of this fundamental information suggests either poor service infrastructure or inadequate transparency in service promotion.

Response time commitments and service level agreements remain undocumented. This creates uncertainty about support quality expectations. Professional forex brokers typically guarantee response times for different inquiry types, with urgent trading issues receiving priority handling. Without these commitments, traders cannot rely on timely assistance during critical market situations.

Multilingual support capabilities have not been specified, which is particularly concerning for a broker attempting to serve global markets. International traders expect customer service in their native languages. The absence of language support information suggests limited international service capabilities.

The extremely low user satisfaction rating strongly indicates systemic customer service failures. User feedback from various sources suggests that clients have experienced difficulties reaching support staff, receiving inadequate responses to inquiries, and encountering unresolved account issues. These service failures can have serious implications for traders who need urgent assistance with deposits, withdrawals, or trading platform problems.

Without documented escalation procedures, complaint handling processes, or service quality monitoring systems, Radar Brokers appears to lack the customer service infrastructure necessary for professional forex brokerage operations.

Trading Experience Analysis

The trading experience offered by Radar Brokers reveals a concerning disconnect between technological promises and actual user satisfaction. While the broker provides access to two distinct trading platforms, the overwhelmingly negative user feedback suggests major implementation or execution issues that severely impact the practical trading experience.

Platform stability and execution speed represent fundamental requirements for successful forex trading. In forex trading, milliseconds can determine trade profitability. Despite offering both the proprietary Radar Trader platform and MetaTrader 5, user reports indicate potential issues with platform reliability. The 1.00 user rating suggests that traders have experienced major technical problems, possibly including platform crashes, connection issues, or slow order processing that can be devastating in volatile market conditions.

Order execution quality remains a critical concern without documented information about slippage rates, requote frequency, or execution speed statistics. Professional brokers typically provide execution quality reports or third-party audits to demonstrate their commitment to fair trading conditions. The absence of such transparency, combined with negative user feedback, raises questions about whether traders receive the price execution they expect when placing orders.

The extremely conservative leverage offering of 1:1 significantly limits trading strategies and may frustrate traders accustomed to higher leverage ratios common in forex markets. While conservative leverage can protect inexperienced traders, it also restricts the capital efficiency that many forex strategies require. This limitation may contribute to user dissatisfaction, particularly among experienced traders seeking standard industry leverage options.

Mobile trading capabilities and cross-platform synchronization have not been detailed in available documentation. Modern traders expect seamless transitions between desktop, web, and mobile platforms, with real-time synchronization of positions, orders, and account information. The lack of clear mobile trading information suggests potential limitations in platform accessibility.

The combination of unclear execution policies, limited leverage, and overwhelmingly negative user feedback indicates that Radar Brokers may not provide the professional trading environment that serious forex traders require.

Trust Factor Analysis

The trust and security profile of Radar Brokers presents the most concerning aspects of this radar brokers review. The profile shows multiple red flags that should give potential clients serious pause. Trust forms the foundation of any successful broker-client relationship, particularly in forex trading where clients must deposit significant funds and rely on fair execution of their trading strategies.

Regulatory oversight through the Vanuatu Financial Services Commission provides minimal investor protection compared to major regulatory jurisdictions. While VFSC regulation is legitimate, it typically offers limited recourse options for clients experiencing disputes and may not include the compensation schemes available through regulators like the FCA, CySEC, or ASIC. The lack of specific license details or verification information further undermines confidence in the regulatory status.

Client fund protection measures have not been documented in available sources. This creates uncertainty about segregation policies, insurance coverage, or trustee arrangements that protect client deposits. Reputable brokers typically maintain client funds in segregated accounts at tier-one banks and provide clear documentation about fund protection protocols. The absence of such information represents a major trust deficit.

Corporate transparency remains extremely limited, with minimal information available about the company's management team, financial backing, or operational structure. Established brokers typically provide detailed information about their leadership, corporate history, and financial stability to build client confidence. The lack of such transparency makes it difficult to assess the company's long-term viability or commitment to client service.

The exceptionally poor user rating of 1.00 out of 10 strongly suggests that early clients have experienced serious issues that have damaged trust in the platform. Such uniformly negative feedback often indicates problems with fund withdrawals, unfair trading practices, or inadequate customer service that directly impacts client confidence.

Industry reputation and third-party validation remain absent, with no documented awards, certifications, or positive recognition from established industry organizations. The combination of regulatory concerns, transparency issues, and negative user feedback creates a trust profile that falls well below industry standards for professional forex brokers.

User Experience Analysis

The user experience delivered by Radar Brokers represents perhaps the most damaging aspect of their service offering. This is evidenced by the catastrophic user satisfaction rating of 1.00 out of 10. This extraordinarily poor rating suggests systemic failures across multiple touchpoints that collectively create an unsatisfactory client experience.

Interface design and platform usability appear to be major problem areas, despite the availability of both proprietary and MetaTrader 5 platforms. User feedback suggests that the platforms may suffer from technical issues, poor design implementation, or inadequate functionality that frustrates traders attempting to execute their strategies effectively. The disconnect between having access to professional-grade platforms and achieving user satisfaction indicates potential customization or integration problems.

Account registration and verification processes likely contribute to user frustration, given the lack of transparent documentation about requirements and procedures. Modern traders expect streamlined onboarding experiences with clear timelines and minimal friction. The absence of documented procedures, combined with negative feedback, suggests that new clients may encounter unexpected delays or complications during account setup.

Fund management experiences represent a critical user experience component that appears to be problematic. While specific deposit and withdrawal methods remain undocumented, user satisfaction issues often stem from unclear fee structures, slow processing times, or complicated withdrawal procedures. The extremely poor rating suggests that clients have encountered major difficulties managing their account funds.

Platform learning curves and support resources may contribute to user frustration, particularly for traders attempting to navigate the proprietary Radar Trader platform without adequate documentation or training materials. The absence of visible educational resources means that users must discover platform features independently, potentially leading to suboptimal trading experiences.

The consistently negative feedback pattern suggests that Radar Brokers has failed to meet basic user expectations across multiple service areas. For traders considering this platform, the overwhelming user dissatisfaction indicates a high probability of encountering major operational difficulties that could impact both trading success and account management efficiency.

Conclusion

This comprehensive radar brokers review reveals a broker that falls significantly short of industry standards across virtually every evaluation criterion. While Radar Brokers offers some appealing features, including multi-asset trading capabilities and dual platform options, these advantages are overwhelmed by serious concerns about transparency, regulatory oversight, and user satisfaction.

The broker may appeal to traders specifically seeking exposure to diverse asset classes through a single provider. However, such traders should carefully weigh these benefits against the substantial risks identified in our analysis. The combination of unclear regulatory status, limited transparency, and catastrophic user feedback creates a risk profile that exceeds acceptable levels for most serious traders.

Primary advantages include access to multiple asset categories beyond traditional forex and the availability of both proprietary and MetaTrader platforms. However, these benefits are significantly outweighed by critical disadvantages including extremely poor user satisfaction, unclear regulatory protection, limited transparency, conservative leverage restrictions, and inadequate customer service infrastructure that collectively create an unsatisfactory trading environment for most market participants.