Monstrade 2025 Review: Everything You Need to Know

Executive Summary

Monstrade is an unregulated forex broker that has gotten mostly negative attention from traders. This monstrade review shows a worrying pattern of user complaints and warning signs that potential traders should think about carefully. The company operates from Serbia without any regulatory oversight, and it offers trading services across multiple asset classes including forex, commodities, cryptocurrencies, indices, stocks, ETFs, and bonds.

The broker's key features include leverage up to 1:500 and access to over 12,000 trading instruments through the MT5 platform. Spreads start from 0.6 pips, but the specific commission structures are not clear from the information we found. According to ForexBrokerz, Monstrade has received a concerning 1/5 rating, which shows significant problems with operations and trustworthiness.

The main target audience seems to be traders who want high-leverage opportunities across different markets. However, multiple review platforms including Trustpilot and specialized forex review sites have documented many user complaints about the broker's practices. These complaints range from customer service issues to more serious claims about business conduct, making this broker unsuitable for most retail traders who want reliable trading conditions.

Important Disclaimer

This monstrade review is based on publicly available information, user feedback, and third-party assessments as of 2025. Monstrade operates from Serbia as an unregulated entity, which may present different risks depending on where you live and your local regulatory protections.

Trading with unregulated brokers carries built-in risks including potential loss of capital protection, limited options in disputes, and possible legal challenges. The information presented reflects available data and user experiences, though individual trading experiences may be different. Readers should do their own research and consider talking with financial advisors before using any unregulated trading platform.

Rating Overview

Broker Overview

Monstrade operates as an online trading platform that gives access to multiple financial markets through the MetaTrader 5 platform. The company is registered in Serbia and operates under the entity Monstrade Dooel Skopje, which is based in North Macedonia. Despite offering a wide range of trading instruments, the broker's lack of regulatory oversight has become a major concern among industry watchers and users.

The broker's business model focuses on giving high-leverage trading opportunities across different asset classes. With over 12,000 available instruments, Monstrade positions itself as a complete trading solution for retail traders. The platform supports trading in major forex pairs, commodities like gold and oil, popular cryptocurrencies, global stock indices, individual stocks, ETFs, and government bonds. This extensive offering suggests an attempt to attract traders with different interests and strategies.

However, according to scambrokersreviews.com, Monstrade has been operating for less than two years, which raises questions about the company's track record and stability. The relatively recent start, combined with the lack of regulatory authorization, creates a challenging environment for trader confidence. ForexBrokerz's detailed assessment resulted in a 1/5 rating, citing multiple red flags that potential users should consider before opening accounts.

Regulatory Status: Monstrade operates without regulatory oversight, registered in Serbia with operations in North Macedonia. This unregulated status means traders don't have the protection typically provided by financial authorities such as the FCA, CySEC, or ASIC.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods was not detailed in available sources, though this represents a transparency concern for potential users seeking clear banking information.

Minimum Deposit Requirements: The exact minimum deposit requirement is not clearly stated in available documentation, which may indicate flexible account opening terms or lack of standardized account structures.

Bonuses and Promotions: No specific bonus or promotional programs were mentioned in available sources, suggesting either absence of such offerings or limited marketing disclosure.

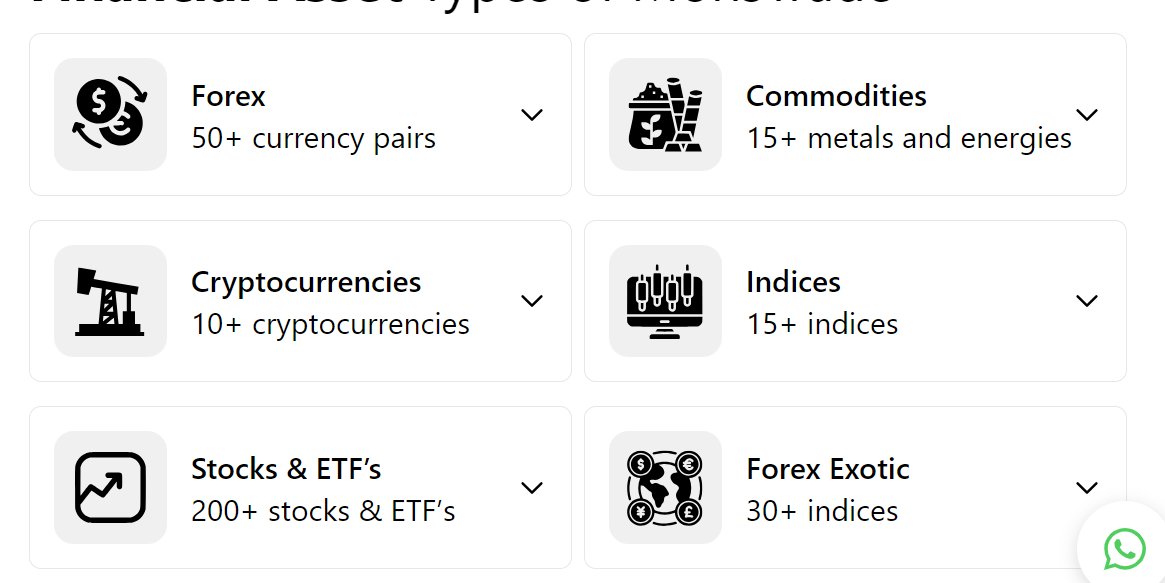

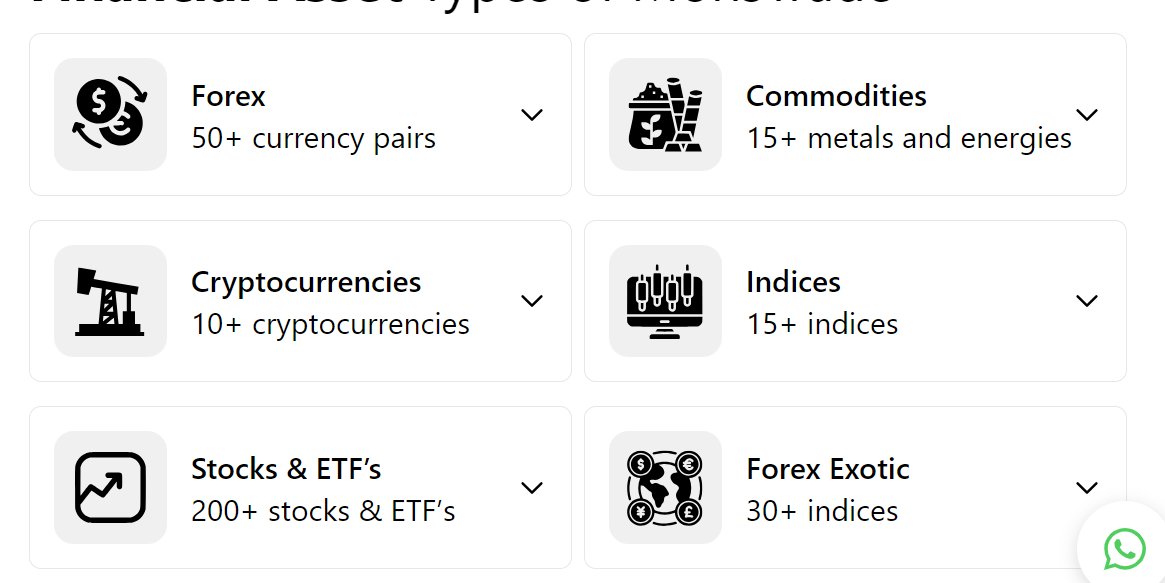

Available Trading Assets: The platform provides access to forex pairs, commodities, cryptocurrencies, stock indices, individual stocks, ETFs, and bonds, totaling over 12,000 instruments across multiple asset classes.

Cost Structure: Spreads begin at 0.6 pips according to available information, though commission structures and additional fees remain unclear from public sources. This lack of fee transparency raises concerns about total trading costs.

Leverage Ratios: Maximum leverage reaches 1:500, which while attractive to some traders, represents significant risk especially when combined with the broker's unregulated status.

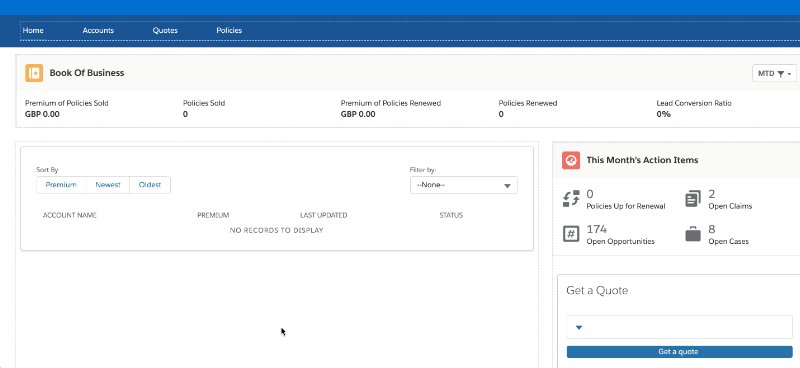

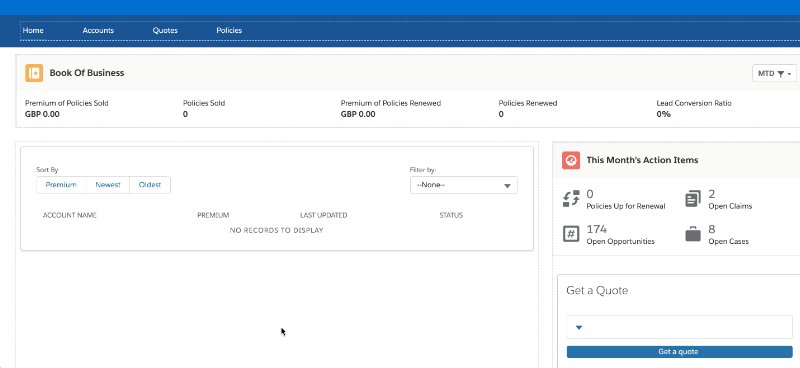

Trading Platform Options: Monstrade provides access through the MetaTrader 5 platform, offering standard charting tools, technical indicators, and automated trading capabilities.

Geographic Restrictions: Specific geographic limitations were not detailed in available sources, though unregulated status may affect availability in certain jurisdictions.

Customer Support Languages: Available customer support languages were not specified in accessible documentation.

This monstrade review highlights significant information gaps that potential traders should address through direct inquiry before considering account opening.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

Monstrade's account conditions get a below-average rating mainly because of limited transparency and negative user feedback. The broker fails to clearly communicate basic account information such as minimum deposits, account types, and specific terms, which creates uncertainty for potential traders. This lack of transparency is especially concerning given the broker's unregulated status.

User feedback suggests difficulties with account management and unclear terms of service. The absence of detailed account specifications in publicly available information indicates either poor marketing communication or deliberate hiding of trading conditions. For retail traders seeking straightforward account opening processes and clear terms, these limitations present significant obstacles.

The combination of unregulated status and limited account information transparency makes it challenging for traders to make informed decisions about account suitability. Without clear fee structures, account minimums, or specific account benefits, potential users cannot properly compare Monstrade's offerings against regulated alternatives.

According to this monstrade review analysis, the broker's account conditions fail to meet industry standards for transparency and user-friendly terms, contributing to the overall negative assessment from review platforms and user communities.

Despite other shortcomings, Monstrade shows strength in trading tools and available resources. The broker's offering of over 12,000 trading instruments represents one of the most complete selections in the retail trading space. This extensive range covers major and minor forex pairs, precious metals, energy commodities, cryptocurrencies, global indices, individual stocks from multiple exchanges, ETFs, and government bonds.

The MetaTrader 5 platform provides strong technical analysis capabilities, including advanced charting tools, multiple timeframes, and a complete library of technical indicators. The platform's algorithmic trading support allows for Expert Advisor implementation, appealing to traders interested in automated strategies.

However, the quality and reliability of execution across such a broad instrument range remains questionable given user complaints and the broker's unregulated status. While the variety is impressive, the actual trading conditions, liquidity provision, and execution quality for these instruments lack verification from regulatory oversight.

The educational resources and research materials availability were not detailed in available sources, suggesting potential gaps in trader support beyond basic platform tools. For traders prioritizing instrument variety and platform functionality over regulatory protection, this represents Monstrade's strongest offering area.

Customer Service and Support Analysis (3/10)

Customer service represents one of Monstrade's most significant weaknesses according to available user feedback and review assessments. Multiple sources indicate poor customer service experiences, with users reporting difficulties in reaching support representatives and inadequate problem resolution.

The lack of clearly stated customer service channels, operating hours, and multilingual support options in available documentation suggests either limited service infrastructure or poor communication of available services. For an international broker serving diverse markets, this represents a critical operational deficiency.

User complaints documented on various review platforms indicate extended response times and unsatisfactory resolution of trading-related issues. The combination of unregulated status and poor customer service creates a particularly challenging environment for traders experiencing problems or requiring assistance.

According to scam recovery websites, some users have sought third-party assistance in resolving disputes with Monstrade, indicating severe breakdown in standard customer service channels. This pattern of user dissatisfaction with support services significantly impacts the broker's overall reliability assessment and trader confidence.

Trading Experience Analysis (5/10)

The trading experience with Monstrade presents a mixed picture based on available information and user feedback. The MetaTrader 5 platform provides a familiar and generally stable trading environment with standard functionality expected by retail traders. The platform's technical capabilities support various trading strategies and offer complete market analysis tools.

Spreads starting from 0.6 pips appear competitive within industry standards, though the lack of detailed pricing information across different instruments and account types limits complete cost assessment. User reports suggest potential issues with execution quality and possible slippage, though specific performance data was not available in reviewed sources.

The high leverage up to 1:500 appeals to traders seeking amplified market exposure, though this also significantly increases risk, particularly given the broker's unregulated status. The extensive instrument selection provides trading opportunities across multiple asset classes, potentially supporting diverse trading strategies.

However, user complaints regarding platform performance and execution quality, combined with the broker's poor overall reputation, suggest inconsistent trading experiences. The absence of regulatory oversight means no standardized execution quality monitoring or dispute resolution mechanisms are in place.

This monstrade review indicates that while basic trading functionality exists, the overall experience is compromised by reliability concerns and lack of regulatory protections that ensure fair trading conditions.

Trust and Safety Analysis (2/10)

Trust and safety represent Monstrade's most critical weakness, earning the lowest rating in this assessment. The broker's unregulated status immediately raises significant concerns about trader fund safety and business conduct oversight. Without regulatory supervision, traders lack standard protections including segregated client funds, compensation schemes, and regulatory dispute resolution.

ForexBrokerz identified five red flags associated with Monstrade, indicating multiple areas of concern regarding the broker's operations and business practices. The 1/5 rating from this specialized review platform reflects serious doubts about the broker's reliability and trustworthiness.

User complaints documented across multiple platforms suggest issues ranging from poor service to more serious allegations about business conduct. The combination of recent establishment (less than two years according to some sources) and unregulated status creates a high-risk environment for trader capital.

The lack of transparent ownership information, regulatory filings, and independent auditing further undermines confidence in the broker's operational integrity. Without regulatory oversight, traders have limited recourse in case of disputes or operational problems.

Third-party assessment platforms consistently rate Monstrade poorly on trust metrics, with some categorizing it among brokers to avoid. This consensus across multiple independent review sources strongly indicates significant trust and safety concerns that potential traders should carefully consider.

User Experience Analysis (4/10)

Overall user experience with Monstrade appears mostly negative based on available feedback and review assessments. User satisfaction levels remain low across multiple evaluation criteria, with particular concerns about customer service responsiveness and problem resolution effectiveness.

The broker's website and account opening process details were not extensively documented in available sources, though user feedback suggests potential complications in these areas. The lack of clear information about basic services and terms contributes to user frustration and uncertainty about platform capabilities.

Interface design and platform usability benefit from the MetaTrader 5 foundation, providing familiar functionality for experienced traders. However, the overall user journey appears compromised by service quality issues and communication gaps that affect trader confidence and satisfaction.

User complaints documented on review platforms indicate various operational issues that impact daily trading activities. The pattern of negative feedback across multiple sources suggests systematic problems rather than isolated incidents, indicating fundamental user experience challenges.

The combination of limited transparency, poor customer service, and unregulated status creates an environment where users feel vulnerable and unsupported. For traders prioritizing reliable service and positive user experience, Monstrade's current offering falls significantly short of industry standards and user expectations.

Conclusion

This comprehensive monstrade review reveals a broker with significant limitations that outweigh its few strengths. While Monstrade offers an extensive selection of trading instruments and high leverage ratios that may appeal to some traders, the fundamental issues of regulatory absence, poor customer service, and negative user feedback create an unsuitable environment for most retail traders.

The broker's unregulated status represents the most critical concern, removing standard trader protections and regulatory oversight that ensure fair business practices. Combined with consistently poor ratings from independent review platforms and documented user complaints, Monstrade presents substantial risks that far exceed potential benefits for typical retail traders.

Traders seeking reliable trading conditions, regulatory protection, and quality customer service should consider regulated alternatives that provide appropriate oversight and trader safeguards. The risks associated with unregulated brokers like Monstrade are particularly significant given the documented concerns about business practices and user experiences.