Juno Markets Review 2025: Everything You Need to Know

Executive Summary

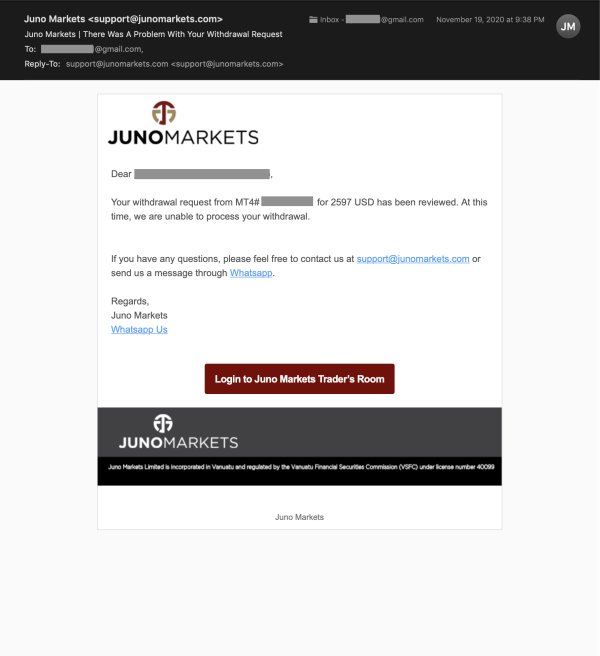

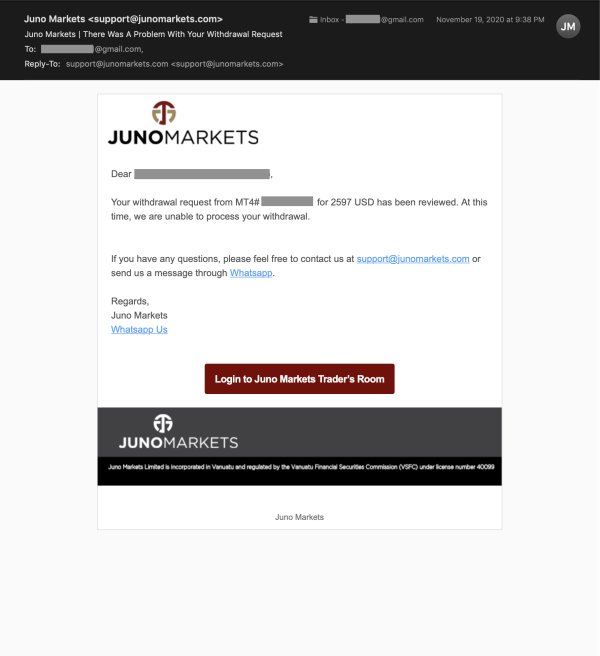

Juno Markets is a regulated forex broker. It operates under the supervision of the Vanuatu Financial Services Commission (VFSC) with license number 40099. This juno markets review shows a brokerage that has served traders since 2014, offering flexible trading conditions across multiple asset classes. The broker stands out through competitive leverage ratios of up to 1:500 (with some sources indicating up to 1:1000), commission structures starting from $0, and a policy of no inactivity or withdrawal fees.

The platform serves small and medium-sized investors who want exposure to forex and CFD markets. With a trust score of 86 out of 99 according to available assessments, Juno Markets positions itself as a good option for traders looking for regulated access to global financial markets. The broker supports multiple trading platforms including MetaTrader 4 and their own Juno Auto Trader, while offering diverse funding options ranging from traditional bank transfers to cryptocurrency payments.

Key highlights include low minimum deposit requirements starting from $100 (with some sources indicating as low as $25), variable spreads, and a simple account opening process that typically takes 1-3 days. The broker's asset portfolio spans forex pairs, indices, stocks, commodities, and cryptocurrencies, providing traders with complete market access through various account types designed to meet different trading preferences and experience levels.

Important Disclaimers

Juno Markets operates as an international broker registered in Vanuatu under the regulatory framework of the Vanuatu Financial Services Commission. Traders should know that regulatory protections and user safeguards may differ from those offered by brokers operating under major financial jurisdictions such as the FCA, ASIC, or CySEC. The regulatory environment in Vanuatu may provide different levels of investor protection and compensation schemes compared to more established financial centers.

This complete evaluation is based on publicly available information, official broker documentation, and combined user feedback from various trading community platforms. All assessments reflect conditions as of early 2025, and traders are advised to verify current terms and conditions directly with the broker before making investment decisions.

Rating Framework

Broker Overview

Juno Markets was established in 2014. The company has positioned itself as a specialized forex and multi-asset broker headquartered in Port Vila, Vanuatu. The company operates under the regulatory oversight of the Vanuatu Financial Services Commission, holding license number 40099. Over its ten-year presence in the financial markets, Juno Markets has developed a business model focused on providing accessible trading conditions for retail investors while maintaining regulatory compliance within its jurisdiction.

The broker's operational framework centers on STP (Straight Through Processing) and ECN (Electronic Communication Network) execution models. These models are designed to provide traders with direct market access and competitive pricing. This approach aims to reduce conflicts of interest between the broker and its clients while ensuring efficient order execution. According to available reports, Juno Markets has built its reputation on offering transparent trading conditions without hidden fees, particularly emphasizing their no-commission structure on certain account types and the absence of inactivity fees.

Juno Markets' trading infrastructure revolves around established platforms including MetaTrader 4, widely recognized as an industry standard, alongside their own Juno Auto Trader platform. The broker's asset coverage extends beyond traditional forex pairs to include contracts for difference (CFDs) on indices, individual stocks, commodities, and cryptocurrencies. This variety allows traders to build complete portfolios while accessing global markets through a single trading account. The company's regulatory status under VFSC provides a framework for international operations while maintaining compliance with applicable financial services regulations.

Regulatory Jurisdiction: Juno Markets operates under the regulatory authority of the Vanuatu Financial Services Commission (VFSC) with license number 40099. This regulatory framework provides oversight for the broker's operations while allowing for international client acceptance under Vanuatu's financial services legislation.

Funding Methods: The broker supports diverse payment options including traditional bank wire transfers, major credit and debit cards, electronic wallet services, and cryptocurrency deposits. This variety accommodates different trader preferences and geographical requirements for funding trading accounts.

Minimum Deposit Requirements: Account opening requires a minimum deposit of $100 according to most sources, though some reports indicate options as low as $25. This makes the platform accessible to beginning traders with limited initial capital.

Promotional Offerings: Specific bonus structures or promotional campaigns are not detailed in available information sources. This suggests the broker may focus on competitive trading conditions rather than deposit bonuses.

Tradeable Assets: The platform provides access to major and minor forex currency pairs, stock indices CFDs, individual equity CFDs, commodity contracts including precious metals and energy products, and cryptocurrency CFDs covering major digital assets. This wide range gives traders many options for building their portfolios.

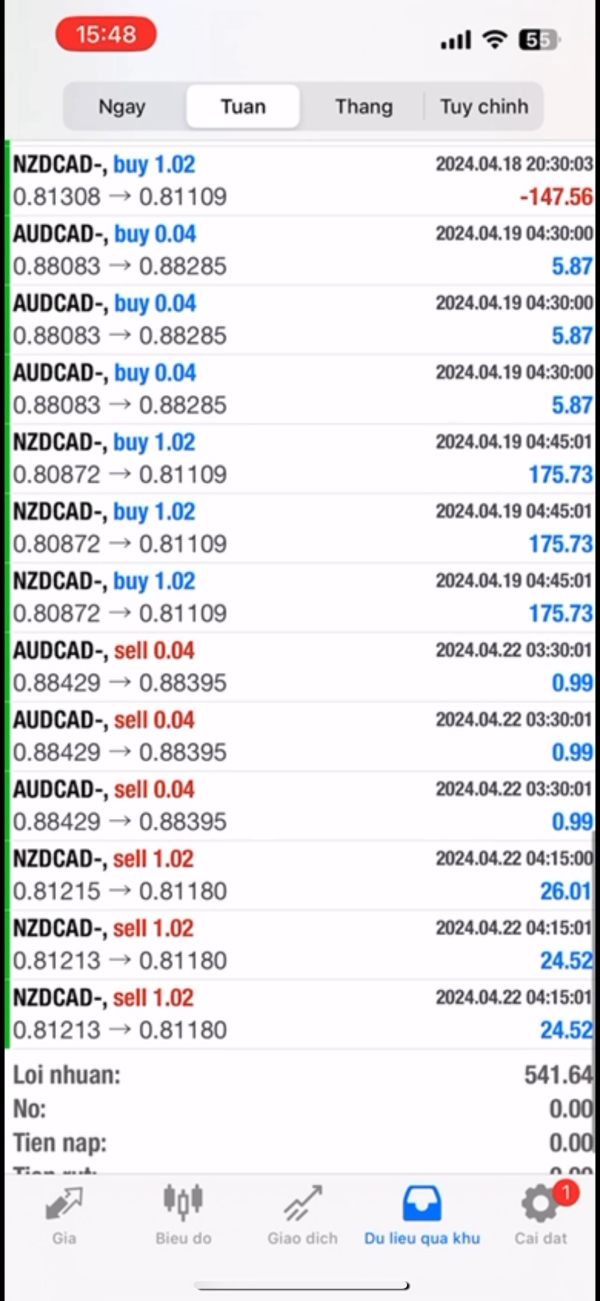

Cost Structure: Trading costs feature variable spreads with commission structures starting from $0 depending on account type. The broker emphasizes transparent pricing with no withdrawal fees or account inactivity charges, potentially reducing overall trading costs for active and inactive traders alike.

Leverage Ratios: Maximum leverage reaches 1:500 according to primary sources, with some reports indicating availability up to 1:1000. This allows traders to amplify their market exposure while requiring appropriate risk management strategies.

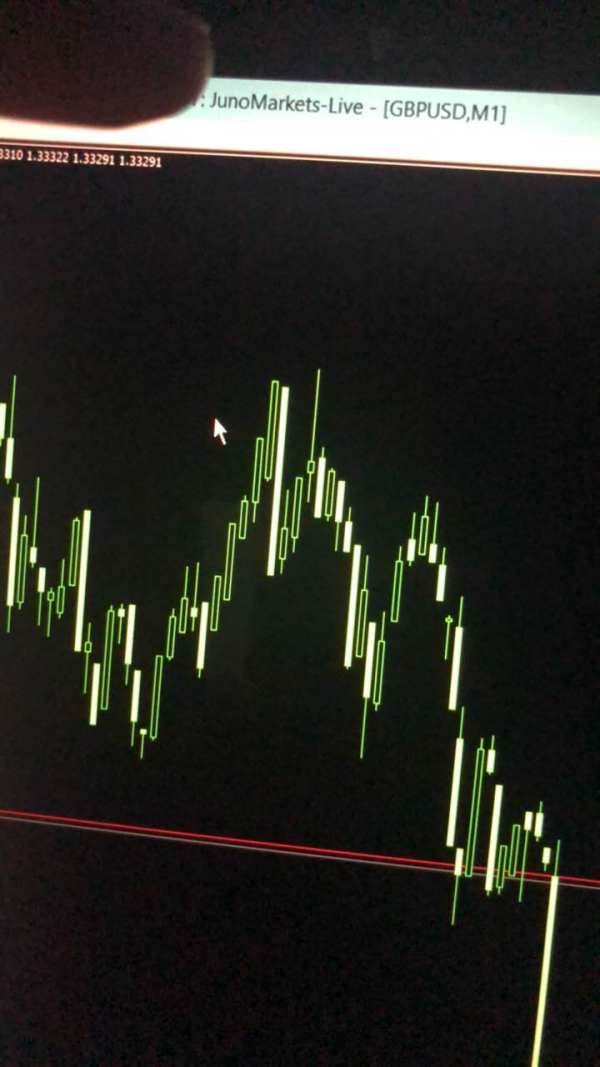

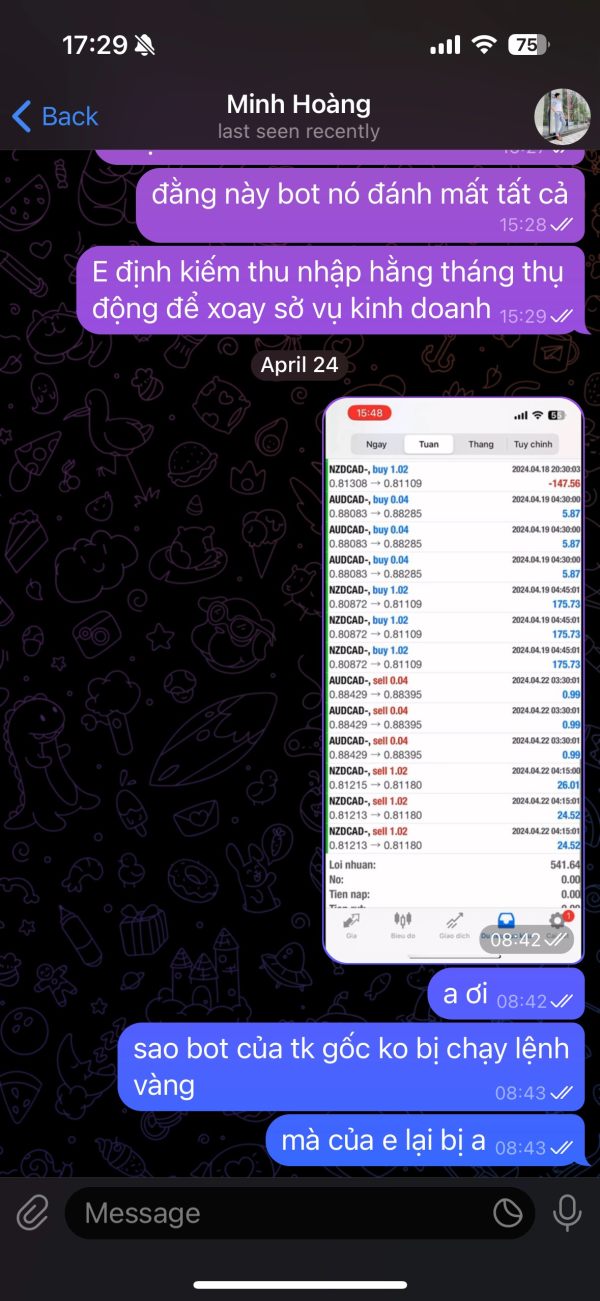

Platform Options: Trading execution is available through MetaTrader 4, providing access to advanced charting tools, automated trading capabilities, and complete market analysis features. Additionally, the proprietary Juno Auto Trader platform offers specialized automated trading functionality.

Geographic Restrictions: Specific regional limitations are not detailed in available information. However, international brokers typically maintain restrictions based on local regulatory requirements.

Customer Support Languages: Available information does not specify the range of languages supported by customer service teams. This could be important for international traders who prefer support in their native language.

Detailed Rating Analysis

Account Conditions Analysis (Score: 8/10)

Juno Markets shows strong performance in account condition offerings. The broker earns recognition for accessible entry requirements and flexible trading terms. The broker's minimum deposit threshold of $100 positions it competitively within the retail forex market, allowing new traders to begin with relatively modest capital commitments. This juno markets review finds that the account opening process, completed within 1-3 business days, provides reasonable timeframes for verification and activation procedures.

The commission structure starting from $0 represents a significant advantage for cost-conscious traders. This is particularly true for those employing high-frequency trading strategies or working with smaller account balances. The absence of withdrawal fees and inactivity charges further enhances the value proposition, as many competitors impose such costs that can erode trading profits over time. Multiple account types accommodate different trading styles and experience levels, though specific details about tier-based features require direct broker consultation.

Leverage availability up to 1:500 provides substantial flexibility for position sizing while remaining within reasonable risk parameters for retail traders. The variable spread structure allows for potentially competitive pricing during high liquidity periods, though specific spread ranges would require real-time platform analysis. Overall, the account conditions reflect a broker designed to accommodate both beginning and intermediate traders seeking straightforward, cost-effective market access.

The platform's tool ecosystem centers on MetaTrader 4 integration. This provides traders with access to one of the industry's most complete trading environments. MT4's extensive charting capabilities, technical indicator library, and automated trading support through Expert Advisors create a robust foundation for various trading strategies. The addition of Juno Auto Trader represents an effort to provide proprietary automated trading solutions, though specific features and performance capabilities are not detailed in available information.

Asset diversity across forex, indices, stocks, commodities, and cryptocurrencies enables portfolio diversification and cross-market trading opportunities. This breadth allows traders to capitalize on various market conditions and economic events affecting different asset classes. However, specific research and analysis resources, such as daily market commentary, economic calendars, or fundamental analysis reports, are not prominently featured in available documentation.

Educational resource availability remains unclear from current information sources. This represents a potential area for improvement. Many successful brokers provide complete educational content including webinars, tutorials, and market analysis to support trader development. The automated trading support through both MT4 Expert Advisors and the proprietary Juno Auto Trader suggests technical capability, though detailed documentation about implementation and strategy development would enhance the offering.

Customer Service and Support Analysis (Score: 6/10)

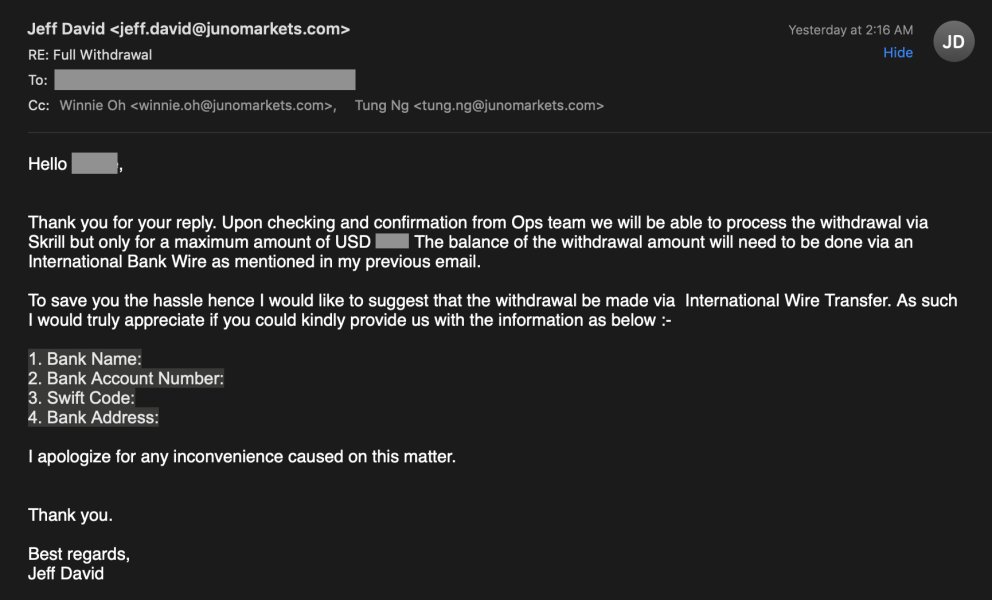

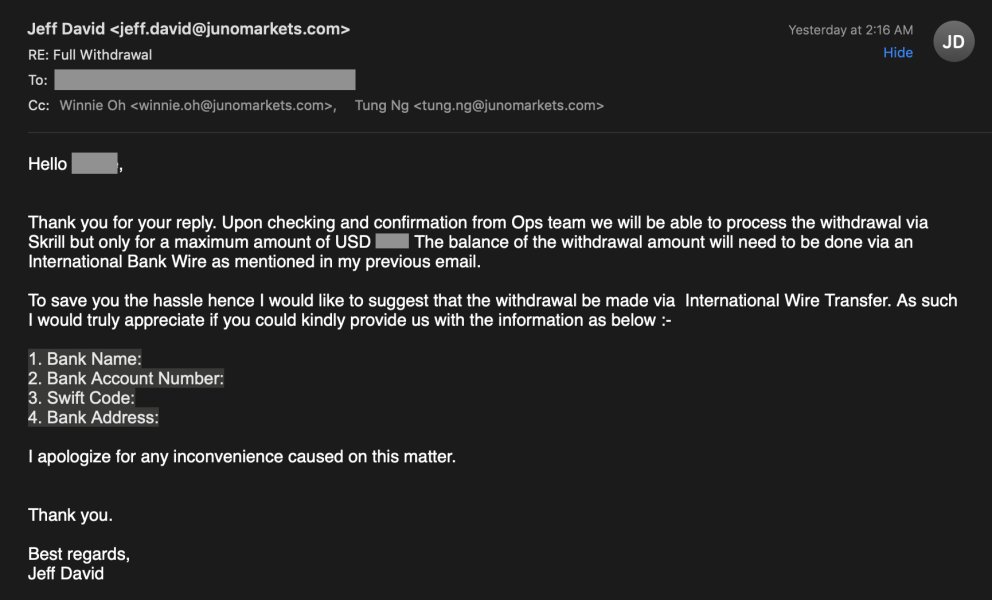

Customer service evaluation remains limited due to insufficient specific information about support channels, response times, and service quality metrics. The availability of multiple payment methods suggests infrastructure capability for handling diverse client needs. However, this doesn't directly indicate customer service quality. Without detailed user feedback about support experiences, assessment relies primarily on structural indicators rather than performance metrics.

Response time benchmarks, availability hours, and communication channel diversity are not specified in available sources. This makes it difficult to compare against industry standards. Professional forex brokers typically offer multiple contact methods including live chat, email, and telephone support with extended or 24/5 availability to accommodate global trading hours.

Multi-language support capabilities remain unspecified, which could impact service quality for international clients. Given the broker's international focus and Vanuatu registration, language support breadth would be particularly relevant for client satisfaction. The absence of detailed service quality feedback or resolution case studies limits complete evaluation of this crucial broker component.

Trading Experience Analysis (Score: 8/10)

Trading execution quality appears solid based on the STP/ECN business model. This model typically provides direct market access and competitive pricing. The low spread emphasis suggests favorable trading conditions, though specific spread ranges and stability during volatile market periods require real-time evaluation. Order execution speed and slippage characteristics are not detailed in available information but represent critical factors for active trading strategies.

Platform stability and performance metrics are not specifically addressed in source materials. However, MetaTrader 4's established reliability provides a strong foundation. The platform's complete functionality supports various trading styles from scalping to swing trading, with advanced charting tools and automated trading capabilities. Mobile trading experience details are not provided, though MT4 typically includes mobile platform access.

The juno markets review indicates competitive trading conditions through low spreads and zero-commission options. This potentially enhances profitability for active traders. However, specific performance data such as execution speed benchmarks, server uptime statistics, or slippage analysis would strengthen the evaluation. The diverse asset range enables complete market participation, supporting traders who prefer multi-market strategies or portfolio diversification approaches.

Trust and Reliability Analysis (Score: 8/10)

Regulatory oversight through the Vanuatu Financial Services Commission provides a framework for operational compliance and client protection. However, the level of protection may differ from major financial jurisdictions. License number 40099 offers verification capability for traders seeking to confirm regulatory status. The trust score of 86 out of 99 from available assessments suggests positive market perception and operational reliability.

Fund security measures and client money protection protocols are not specifically detailed in available information. These represent important considerations for potential clients. Established brokers typically maintain segregated client accounts and additional security measures to protect trader funds. Company transparency regarding financial reporting, management structure, and operational updates would enhance trust assessment.

The broker's ten-year operational history since 2014 shows market persistence and business continuity. These are positive indicators for long-term reliability. Industry reputation appears favorable based on available trust scoring, though specific recognition from industry publications or regulatory commendations are not mentioned. Negative incident history or regulatory actions are not referenced in source materials, suggesting absence of major compliance issues.

User Experience Analysis (Score: 7/10)

Overall user satisfaction appears positive based on the 86/99 trust score. This indicates general market acceptance and user approval. The straightforward account opening process taking 1-3 days suggests reasonable efficiency in client onboarding procedures. Multiple payment options accommodate diverse user preferences and geographical requirements, enhancing accessibility for international clients.

Interface design and platform usability details are not specifically addressed. However, MetaTrader 4 provides a familiar environment for experienced forex traders. The learning curve for new users would depend largely on their familiarity with MT4 and trading concepts generally. Registration and verification processes appear streamlined based on the reported timeframes.

Funding and withdrawal experiences are not detailed through specific user feedback. However, the absence of withdrawal fees represents a positive structural element. Common user complaints or satisfaction highlights are not available in current information sources, limiting complete user experience assessment. The broker's target market of small to medium-sized investors suggests positioning toward retail trader needs and preferences.

Conclusion

This complete juno markets review reveals a regulated forex broker offering competitive trading conditions suitable for various trader profiles. Juno Markets shows particular strength in account accessibility through low minimum deposits, cost-effective commission structures, and flexible leverage options. The combination of VFSC regulation, established platform technology, and diverse asset access creates a solid foundation for retail forex and CFD trading.

The broker appears most suitable for small to medium-sized investors seeking regulated market access with competitive costs and straightforward trading conditions. Beginning traders may appreciate the low entry requirements and established platform technology, while more experienced traders can benefit from the high leverage options and diverse asset range.

Primary advantages include competitive commission structures starting from $0, absence of withdrawal and inactivity fees, high leverage availability, and complete asset coverage across multiple markets. However, limitations include potentially limited educational resources, insufficient customer service details, and regulatory protection that may differ from major financial jurisdictions. Prospective traders should carefully evaluate their specific needs against the broker's offerings and consider conducting additional due diligence before committing significant capital.