Regarding the legitimacy of JUNO forex brokers, it provides ASIC, VFSC and WikiBit, (also has a graphic survey regarding security).

Is JUNO safe?

Pros

Cons

Is JUNO markets regulated?

The regulatory license is the strongest proof.

ASIC Inst Forex Execution (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

JUNO MARKETS PTY LTD

Effective Date: Change Record

2022-07-14Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

'ANGEL PLACE' L 17 123 PITT ST SYDNEY NSW 2000Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Juno Markets Limited

Effective Date:

2023-09-29Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Juno Markets A Scam?

Introduction

Juno Markets is an online forex and CFD broker that positions itself within the competitive landscape of the Asian trading market. Founded in 2014, the broker claims to provide a robust trading environment with various account types and access to multiple financial instruments. As the forex market attracts a multitude of traders, both novice and experienced, it becomes increasingly vital for them to carefully assess the credibility of brokers like Juno Markets. The potential for scams and unethical practices in the industry necessitates a thorough investigation into a broker's regulatory status, operational history, and client feedback. This article aims to provide an objective analysis of Juno Markets, utilizing a structured approach that encompasses regulatory review, company background, trading conditions, customer safety, and overall risk assessment.

Regulation and Legitimacy

The regulatory framework governing a broker is a crucial determinant of its legitimacy and reliability. Juno Markets is regulated by the Vanuatu Financial Services Commission (VFSC), which is known for its relatively lenient regulatory environment compared to more stringent jurisdictions like the UK‘s FCA or Australia’s ASIC. The following table summarizes the essential regulatory details for Juno Markets:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| VFSC | 40099 | Vanuatu | Verified |

While Juno Markets holds a license from the VFSC, it is important to note that this regulatory body does not impose the same level of oversight and investor protection as higher-tier regulators. The VFSC primarily focuses on the registration of financial entities rather than enforcing strict compliance standards. This lack of rigorous oversight raises concerns about the broker's operational integrity and the potential risks for traders. Furthermore, Juno Markets has faced scrutiny in the past, with alerts issued by regulators in various countries, cautioning investors about the broker's activities. These factors collectively contribute to a perception of risk associated with trading through Juno Markets.

Company Background Investigation

Juno Markets Limited is incorporated in Vanuatu, a jurisdiction often associated with offshore financial services. The company has been operational since 2014 and has since aimed to cater to a global audience, particularly focusing on Asian markets. The ownership structure of Juno Markets is not transparently disclosed, which is a common concern among offshore brokers. The management team comprises individuals with backgrounds in finance and trading, but specific details regarding their professional history and qualifications are limited. This opacity can be concerning for potential clients, as it raises questions about the broker's accountability and governance.

Moreover, the level of transparency in terms of company operations and financial disclosures is critical for building trust with clients. Juno Markets appears to provide some basic information on its website, but the lack of comprehensive disclosures about its financial health and operational practices could be a red flag for prospective traders. In a market where trust is paramount, the absence of clear and accessible information can deter potential clients from engaging with the broker.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value proposition. Juno Markets provides various account types, including STP and ECN accounts, which cater to different trading preferences. However, the fee structure and trading costs associated with these accounts warrant careful examination. The following table outlines the key trading costs associated with Juno Markets:

| Fee Type | Juno Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 - 1.2 pips |

| Commission Structure | $4 per lot (ECN) | $2 - $3 per lot |

| Overnight Interest Range | Varies by account | Varies by broker |

The spreads offered by Juno Markets are generally higher than the industry average, particularly for the standard STP accounts. While the ECN accounts offer lower spreads, they come with a commission that may not be competitive compared to other brokers. Additionally, traders should be cautious of any hidden fees or unusual cost structures that could impact their trading profitability. Understanding the total cost of trading is essential for making informed decisions, as high trading costs can significantly erode potential profits.

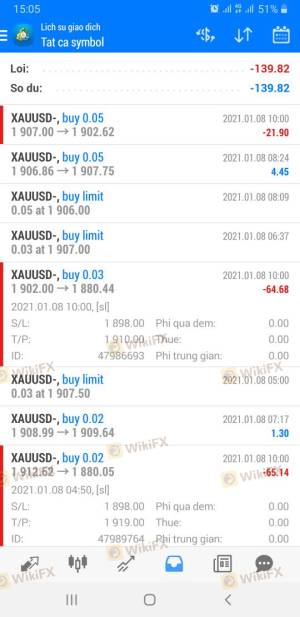

Customer Funds Security

The security of client funds is a paramount concern for any trader. Juno Markets asserts that it implements various measures to safeguard client assets, including the use of segregated accounts. However, the effectiveness of these measures is contingent upon the regulatory framework in which the broker operates. As an offshore broker, Juno Markets is not bound by strict capital adequacy requirements, which means that the level of protection for client funds may not be as robust as those offered by brokers regulated in stricter jurisdictions.

Furthermore, Juno Markets does not appear to offer any investor compensation schemes, which are often a critical component of client protection in regulated environments. Historical issues related to fund security have been reported, including complaints from clients regarding withdrawal difficulties and fund mismanagement. Such incidents raise significant concerns about the broker's ability to ensure the safety of client investments.

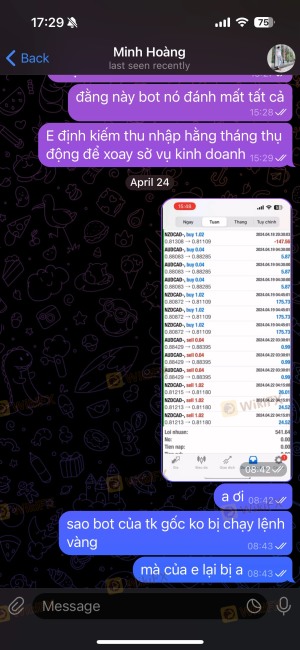

Customer Experience and Complaints

Customer feedback is a valuable source of information when assessing a broker's reliability. Juno Markets has received mixed reviews from its clients, with some praising its trading conditions and customer service, while others express dissatisfaction with the responsiveness and effectiveness of the support team. The following table summarizes the primary types of complaints received by Juno Markets:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Account Mismanagement | Medium | Limited follow-up |

| Customer Service Issues | High | Inconsistent support |

Several users have reported significant delays in processing withdrawals, leading to frustration and distrust. Additionally, there are accounts of clients feeling sidelined when addressing their concerns with the support team. These patterns of complaints suggest that while some clients may have positive experiences, there are notable areas of concern that potential traders should consider before opening an account.

Platform and Trade Execution

The trading platform provided by Juno Markets is primarily the widely recognized MetaTrader 4 (MT4). This platform is favored by many traders for its user-friendly interface and robust analytical tools. However, the performance of the platform, including order execution quality, slippage, and rejection rates, is critical for traders. Feedback indicates that while MT4 is generally stable, some users have experienced issues with order execution during volatile market conditions.

The potential for slippage and order rejections can significantly impact trading outcomes, especially for those employing high-frequency trading strategies. Traders should be cautious and consider testing the platform with a demo account to gauge its performance before committing real funds.

Risk Assessment

Trading with Juno Markets presents a range of risks that potential clients should be aware of. The following risk assessment summarizes critical areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation poses risks |

| Fund Security Risk | High | Lack of investor compensation scheme |

| Customer Service Risk | Medium | Mixed reviews on support responsiveness |

| Trading Cost Risk | Medium | Higher spreads may impact profitability |

To mitigate these risks, traders should conduct thorough due diligence, consider starting with a smaller investment, and utilize risk management strategies such as setting stop-loss orders.

Conclusion and Recommendations

In conclusion, while Juno Markets is not definitively a scam, several factors raise concerns about its reliability and safety for traders. The broker's offshore regulation, combined with a lack of robust investor protection measures, presents significant risks for potential clients. Additionally, mixed customer feedback regarding service quality and withdrawal issues further complicates the broker's standing in the market.

For traders seeking a reliable and secure trading environment, it may be prudent to consider alternatives that are regulated by top-tier authorities and offer comprehensive client protection. Brokers such as AvaTrade, IG, or Forex.com may provide a more secure trading experience with greater transparency and support. Ultimately, traders should weigh their options carefully and prioritize safety and reliability in their trading endeavors.

Is JUNO a scam, or is it legit?

The latest exposure and evaluation content of JUNO brokers.

JUNO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

JUNO latest industry rating score is 5.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.