FIBO Group 2025 Review: Everything You Need to Know

Executive Summary

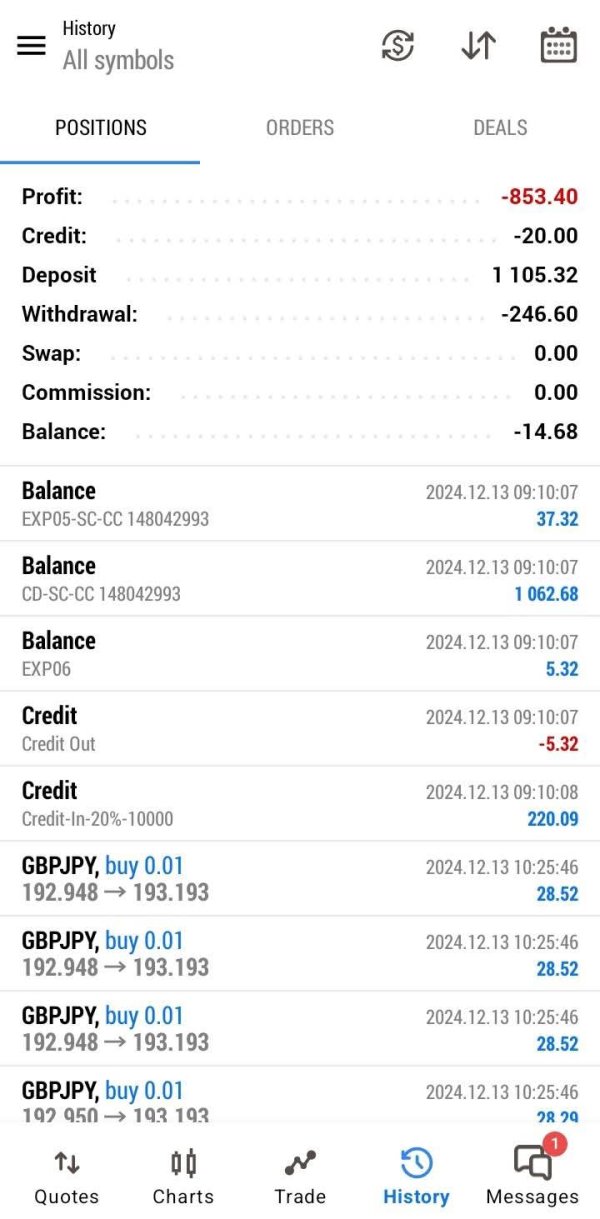

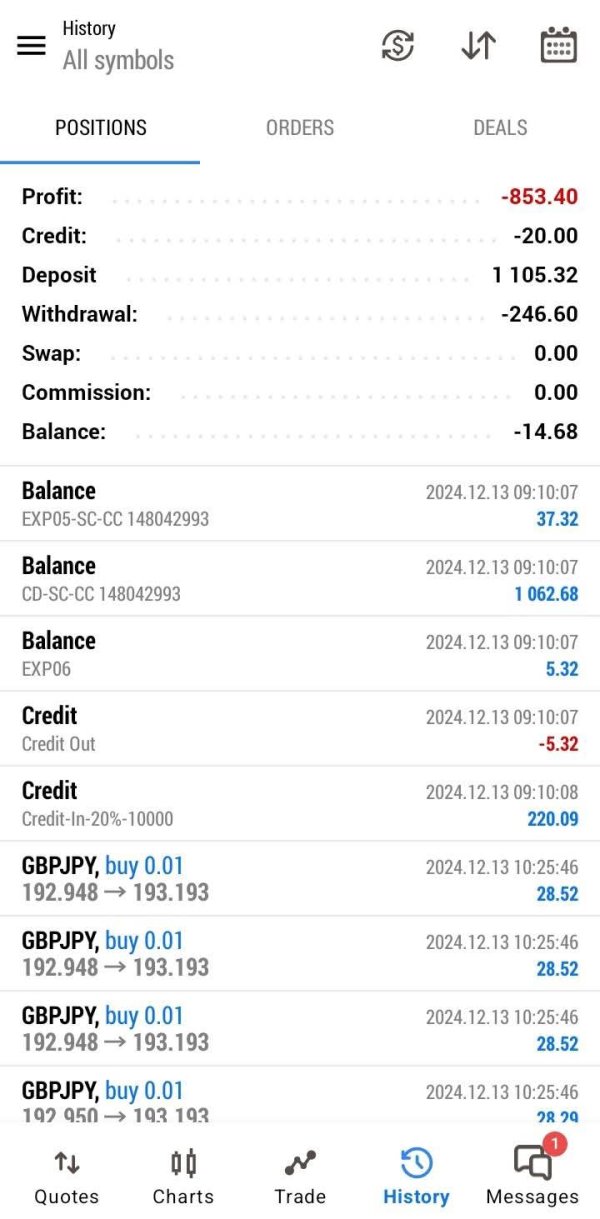

FIBO Group stands out as a transparent and reliable forex and CFD broker that has been serving traders since 1998. This comprehensive fibo group review shows a broker that puts customer satisfaction first through its NDD (No Dealing Desk) business model, ensuring direct market execution without potential conflicts of interest. The broker operates from the British Virgin Islands. It maintains regulatory oversight across multiple jurisdictions.

Two key features make FIBO Group special in the competitive brokerage landscape: flexible leverage options ranging from 1:30 to 1:1000 and comprehensive platform offerings including both MetaTrader 4 and MetaTrader 5. These features help traders with different risk levels and technical needs, from careful retail traders to more aggressive institutional clients.

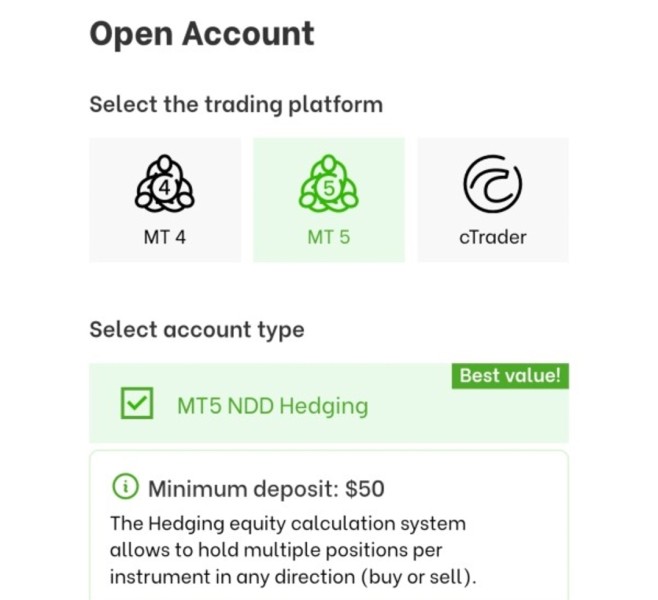

The broker mainly targets individual and institutional investors seeking exposure to forex and CFD markets. With a minimum deposit requirement of just US$50, FIBO Group makes itself accessible to newcomers while keeping the advanced tools and resources that experienced traders demand. According to available reports, the broker keeps high customer satisfaction levels. However, specific numbers vary across different review platforms.

Important Disclaimers

Regional Entity Differences: FIBO Group operates under different regulatory frameworks across various jurisdictions. The broker is supervised by FSC (Financial Services Commission) in the British Virgin Islands, CySEC (Cyprus Securities and Exchange Commission) in Cyprus, and FCA (Financial Conduct Authority) in the United Kingdom. Trading conditions, available instruments, and investor protections may vary significantly depending on which entity serves your region.

Review Methodology: This evaluation is based on publicly available information, user feedback from various platforms, and regulatory filings as of 2024-2025. Information may be subject to updates, and specific terms may change. Potential traders should verify current conditions directly with FIBO Group before making trading decisions.

Rating Framework

Broker Overview

Company Foundation and Background

FIBO Group was established in 1998. This positions it among the more experienced players in the online forex brokerage industry. The company is headquartered in the British Virgin Islands and operates as a No Dealing Desk (NDD) broker, which means client orders are executed directly in the interbank market without the broker acting as a counterparty. This business model significantly reduces potential conflicts of interest between the broker and its clients, as FIBO Group profits from spreads and commissions rather than client losses.

The NDD execution model ensures that client orders receive transparent market pricing and execution speeds that depend on market liquidity rather than broker manipulation. According to industry reports, this approach has contributed to FIBO Group's reputation for reliability and has helped maintain high customer satisfaction levels throughout its operational history.

Platform and Asset Offerings

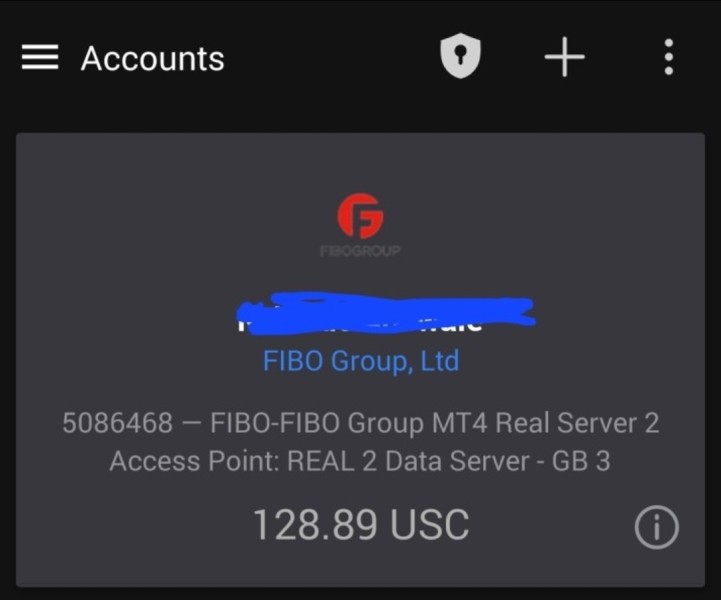

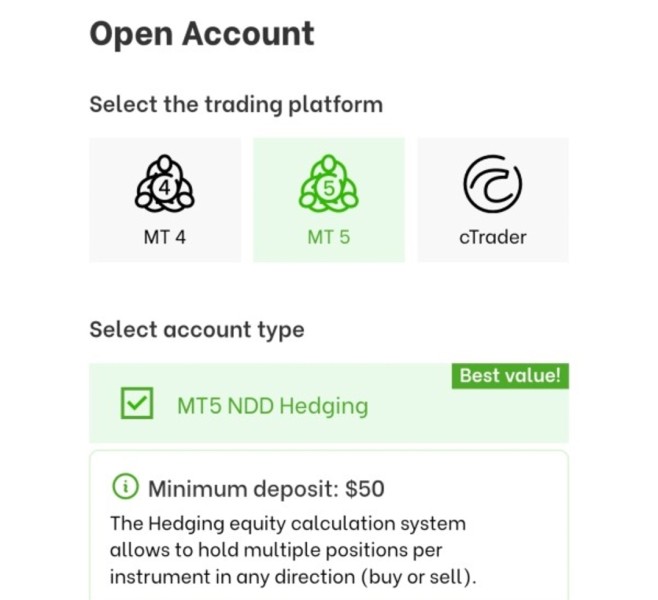

FIBO Group provides access to the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. These are two of the most widely adopted trading interfaces in the forex industry. MT4 remains popular among forex-focused traders for its stability and extensive community support, while MT5 offers enhanced features for multi-asset trading and more sophisticated order types. Both platforms support automated trading through Expert Advisors (EAs) and provide comprehensive charting capabilities with numerous technical indicators.

The broker's primary asset classes include forex pairs and Contracts for Difference (CFDs). However, specific instrument counts are not detailed in available documentation. The regulatory framework under FSC, CySEC, and FCA oversight ensures compliance with international trading standards and provides varying levels of investor protection depending on the client's jurisdiction. This fibo group review notes that the multi-regulatory approach enhances the broker's credibility across different markets.

Regulatory Jurisdictions: FIBO Group maintains regulatory compliance across three key jurisdictions. The FSC license covers operations in the British Virgin Islands, providing the primary regulatory framework. CySEC oversight applies to European clients, ensuring compliance with MiFID II regulations and investor compensation schemes. FCA regulation covers UK operations, though post-Brexit arrangements may affect European client access.

Funding Methods: Specific deposit and withdrawal methods are not detailed in available sources. This requires direct verification with the broker for current options and processing times.

Minimum Capital Requirements: The US$50 minimum deposit positions FIBO Group among the more accessible brokers for retail traders. This low barrier to entry makes the platform suitable for beginners testing live trading conditions without significant capital commitment.

Promotional Offerings: As of December 31, 2021, FIBO Group offered an RDO-5% bonus promotion. Current promotional terms should be verified directly with the broker, as bonus conditions and availability change frequently.

Trading Instruments: The broker focuses on forex and CFD trading. However, comprehensive instrument lists are not available in reviewed sources. Traders should confirm specific currency pairs, indices, commodities, and other CFD offerings through the broker directly.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not specified in available materials. This represents a significant information gap for this fibo group review. Cost transparency is crucial for trader decision-making and should be clarified through direct broker contact.

Leverage Specifications: FIBO Group offers leverage ratios of 1:30 and 1:1000. This provides options for both conservative and aggressive trading approaches. The 1:30 ratio aligns with European regulatory requirements, while 1:1000 caters to traders in jurisdictions with more flexible leverage regulations.

Platform Access: Both MT4 and MT5 platforms support various trading strategies, from scalping to long-term position trading. The platforms include mobile applications for iOS and Android devices, enabling trading flexibility across different environments.

Geographic Restrictions: Specific country restrictions are not detailed in available sources. However, regulatory limitations likely apply based on local financial services regulations.

Customer Support Languages: Multi-language support details are not specified in reviewed materials. However, the broker's international presence suggests multiple language options.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

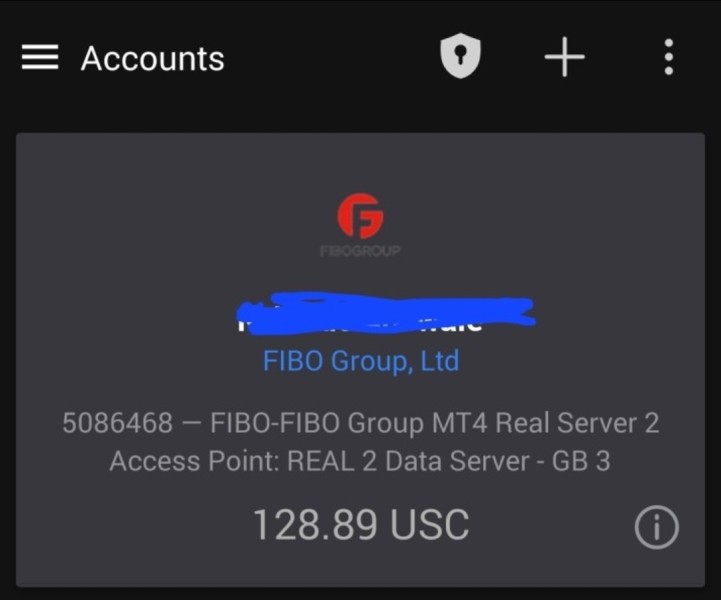

FIBO Group's account structure demonstrates accessibility with its US$50 minimum deposit requirement. This makes it one of the more approachable brokers for retail traders entering the forex market. This low threshold allows newcomers to experience live trading conditions without substantial financial commitment, which is particularly valuable for educational purposes and strategy testing.

The dual leverage offering of 1:30 and 1:1000 provides flexibility for different trader profiles and regulatory requirements. The 1:30 ratio complies with European ESMA regulations, ensuring access for EU-based traders, while the 1:1000 option caters to traders in jurisdictions with more lenient leverage restrictions. However, this fibo group review identifies a significant information gap regarding specific account types, their features, and any associated benefits or restrictions.

The account opening process details are not comprehensively documented in available sources. This makes it difficult to assess the efficiency and user-friendliness of onboarding procedures. Additionally, information about specialized account features such as Islamic accounts for Sharia-compliant trading is not available in reviewed materials, which may limit the broker's appeal to certain demographic segments.

FIBO Group's platform offering centers on the industry-standard MT4 and MT5 trading platforms. These provide robust functionality for both manual and automated trading strategies. These platforms include comprehensive charting packages with numerous technical indicators, multiple timeframes, and support for Expert Advisors, meeting the technical requirements of most trading approaches.

According to available information, the broker supplements its platform offerings with additional research materials and educational content, including YouTube-based educational videos. This multi-channel approach to trader education demonstrates commitment to client development, though specific details about the depth and quality of educational resources are not extensively documented.

The platforms support various order types and risk management tools essential for professional trading, including stop-loss and take-profit orders, trailing stops, and pending order functionality. However, this review notes that information about proprietary tools, market analysis services, or advanced research capabilities is limited in available sources, suggesting potential areas for enhanced transparency in the broker's marketing materials.

Customer Service and Support Analysis (6/10)

Available information indicates that FIBO Group maintains relatively high customer satisfaction levels. However, specific metrics and detailed feedback are not comprehensively documented in reviewed sources. The broker's longevity in the market since 1998 suggests sustained client relationships and adequate support services, but quantitative data about response times, resolution rates, and service quality is limited.

The multi-jurisdictional regulatory framework implies multiple customer service centers to serve different regions, potentially offering localized support in various languages and time zones. However, specific information about available communication channels, operating hours, and language support is not detailed in available materials, making it difficult to assess the comprehensive quality of customer service offerings.

Without detailed user feedback about specific support experiences, complaint resolution processes, or service quality metrics, this fibo group review can only note that general customer satisfaction appears positive based on available reports. More detailed analysis would require additional user testimonials and service quality data.

Trading Experience Analysis (7/10)

The MT4 and MT5 platform combination provides traders with familiar and reliable trading environments that have been tested across millions of users globally. These platforms offer stable performance characteristics and comprehensive functionality for various trading strategies, from scalping to long-term position trading.

Platform stability and execution speed are crucial factors for trading success, particularly for strategies requiring precise timing. While specific performance metrics are not available in reviewed sources, the NDD execution model suggests that order processing depends primarily on market liquidity rather than broker intervention, potentially providing more transparent execution conditions.

The platforms include extensive charting capabilities with multiple technical indicators, drawing tools, and analytical functions that support both fundamental and technical analysis approaches. Mobile platform availability ensures trading flexibility, allowing position management and market monitoring from various locations. However, detailed user feedback about platform performance, execution quality, and mobile app functionality is not comprehensively available in reviewed materials.

Trust and Regulation Analysis (8/10)

FIBO Group's multi-jurisdictional regulatory oversight through FSC, CySEC, and FCA significantly enhances its credibility and trustworthiness. This regulatory framework provides multiple layers of oversight and different levels of investor protection depending on the client's jurisdiction, demonstrating the broker's commitment to compliance and transparency.

The NDD business model further enhances trust by eliminating potential conflicts of interest between the broker and its clients. Since FIBO Group profits from spreads and commissions rather than client losses, the broker's success aligns with client trading success, creating a more transparent relationship structure.

The broker's 25+ year operational history since 1998 provides evidence of business sustainability and market credibility. Longevity in the competitive brokerage industry suggests adequate risk management, regulatory compliance, and customer service standards. However, specific information about client fund segregation, insurance coverage, and negative balance protection policies is not detailed in available sources, representing areas where additional transparency would strengthen the trust assessment.

User Experience Analysis (7/10)

FIBO Group appears to cater to both individual and institutional investors, with account structures that accommodate different experience levels and capital requirements. The low minimum deposit of US$50 makes the platform accessible to beginners, while the availability of higher leverage options and professional platforms serves more experienced traders.

The combination of MT4 and MT5 platforms provides familiar interfaces for traders with previous MetaTrader experience, reducing the learning curve for platform adoption. These platforms offer customizable workspaces, multiple chart layouts, and extensive personalization options that can accommodate different trading styles and preferences.

However, detailed user feedback about the overall experience, including account opening procedures, verification processes, deposit and withdrawal experiences, and ongoing account management, is not comprehensively available in reviewed sources. User interface design, website navigation, and customer portal functionality are also not detailed, making it difficult to provide a complete assessment of the user experience journey from initial contact through ongoing trading activities.

Conclusion

FIBO Group emerges from this comprehensive analysis as a well-regulated and established forex and CFD broker with a solid foundation built over 25+ years of market operation. The broker's multi-jurisdictional regulatory oversight, NDD execution model, and flexible account conditions position it as a credible option for various trader segments.

The platform is particularly suitable for newcomers to forex trading due to its accessible US$50 minimum deposit requirement, as well as experienced traders seeking flexible leverage options up to 1:1000. The MT4 and MT5 platform offerings provide familiar and robust trading environments with comprehensive analytical tools and automated trading support.

Primary advantages include strong regulatory oversight, transparent NDD execution, low entry barriers, and flexible leverage options. Notable limitations involve limited detailed information about costs, specific trading instruments, customer service metrics, and comprehensive user feedback. This fibo group review recommends that potential clients verify current trading conditions, costs, and service quality directly with the broker before making trading decisions, as some information gaps exist in publicly available materials.