Regarding the legitimacy of FIBOGROUP forex brokers, it provides FSC and WikiBit, (also has a graphic survey regarding security).

Is FIBOGROUP safe?

Pros

Cons

Is FIBOGROUP markets regulated?

The regulatory license is the strongest proof.

FSC Market Making License (MM)

British Virgin Islands Financial Services Commission

British Virgin Islands Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

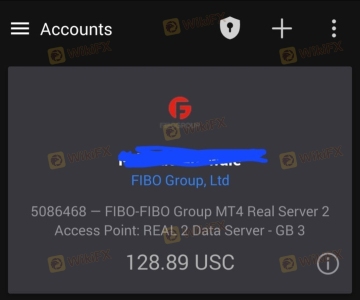

FIBO GROUP, LTD.

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is FIBO Group A Scam?

Introduction

FIBO Group, established in 1998, is a well-known player in the forex market, offering a range of trading services including forex, CFDs, and cryptocurrencies. With a presence in multiple regions, including Europe and Asia, FIBO Group has positioned itself as a reputable broker catering to both novice and experienced traders. However, the online trading landscape is fraught with potential pitfalls, and traders must exercise caution when selecting a broker. The importance of evaluating a broker's legitimacy cannot be overstated, as the wrong choice can lead to significant financial losses. This article aims to provide a comprehensive analysis of FIBO Group, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall safety. The assessment is based on a thorough review of available online resources, regulatory documents, and user feedback, aiming to present a balanced view of whether FIBO Group is a trustworthy broker or a potential scam.

Regulation and Legitimacy

The regulation of a forex broker is a critical factor that influences its legitimacy and reliability. FIBO Group operates under the supervision of multiple regulatory bodies, which is a positive sign for potential clients. Below is a summary of FIBO Group's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 118/10 | Cyprus | Regulated |

| British Virgin Islands Financial Services Commission (FSC) | SIBA/L/13/1063 | British Virgin Islands | Regulated |

FIBO Group is primarily regulated by CySEC, which is known for its strict regulatory framework that provides a higher level of investor protection compared to many offshore jurisdictions. The presence of a license from the British Virgin Islands FSC, while offering some level of oversight, raises concerns due to the relatively lax regulatory environment in that region. However, FIBO Group's dual regulation allows it to adhere to higher operational standards, especially for clients based in the European Union.

Historically, FIBO Group has maintained a clean compliance record with its regulatory obligations, which adds to its credibility. The company is also a member of the Investor Compensation Fund (ICF) in Cyprus, which provides additional protection for clients' funds in the event of insolvency. Overall, the regulatory framework under which FIBO Group operates appears robust, although potential clients should remain vigilant and conduct their own due diligence.

Company Background Investigation

FIBO Group has a rich history in the financial services industry, having been established in 1998 as an investment consulting firm. Over the years, it evolved into a full-fledged brokerage, specializing in forex and CFD trading. The company has expanded its operations globally, with offices in key financial hubs such as Vienna, Limassol, Munich, and Shanghai. This international presence enhances its ability to offer localized support and service to a diverse clientele.

The ownership structure of FIBO Group consists of multiple entities, including FIBO Group Ltd, registered in the British Virgin Islands, and FIBO Group Holdings Ltd, based in Cyprus. This multi-entity structure allows the broker to operate in various jurisdictions, catering to different regulatory requirements. The management team comprises experienced professionals with backgrounds in finance and trading, which contributes to the company's operational integrity and strategic direction.

Transparency is a vital aspect of FIBO Group's operations. The broker provides clear information regarding its services, trading conditions, and regulatory status on its website. Additionally, it offers educational resources to help traders understand the forex market better. However, while the company strives for transparency, potential clients should always verify the information independently to ensure they are making informed decisions.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value proposition. FIBO Group provides a variety of account types, each with its own fee structure and trading conditions. The overall cost structure is competitive, particularly for forex trading. Below is a comparison of FIBO Groups core trading costs:

| Fee Type | FIBO Group | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 0.3 pips | From 1.0 pips |

| Commission Structure | 0.003% per transaction (for certain accounts) | Varies by broker |

| Overnight Interest Range | Varies by position | Varies by broker |

FIBO Group offers competitive spreads, particularly on its NDD (No Dealing Desk) accounts, where spreads can start as low as 0 pips. This is significantly lower than the industry average, making FIBO Group an attractive option for traders who rely on tight spreads for their trading strategies. However, it is essential to note that some accounts charge commissions based on the trading volume, which can impact the overall trading cost.

In addition to spreads and commissions, traders should also be aware of any potential overnight fees or swap rates associated with holding positions overnight. FIBO Groups overnight fees vary depending on the asset type and market conditions, which is standard practice in the industry. Overall, FIBO Group's trading conditions appear favorable, but traders should carefully review the specific terms associated with their chosen account type.

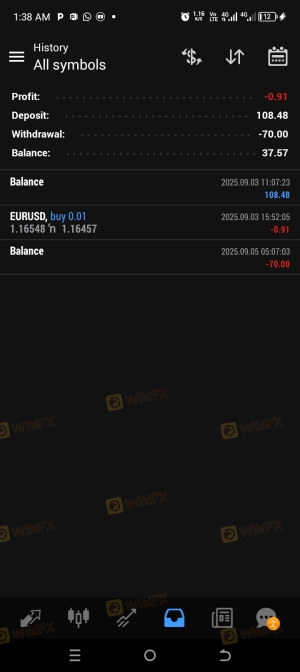

Client Fund Security

The safety of client funds is paramount when selecting a forex broker. FIBO Group implements several measures to ensure the security of client deposits. The broker maintains segregated accounts, meaning that client funds are kept separate from the company's operational funds. This practice is crucial for protecting traders' capital in the event of financial difficulties faced by the broker.

Additionally, FIBO Group is a member of the Investor Compensation Fund (ICF) in Cyprus, which provides coverage for client funds up to €20,000 in case of insolvency. This adds an extra layer of security for traders, particularly those based in the EU. Furthermore, FIBO Group offers negative balance protection, ensuring that clients cannot lose more than their deposited amount, which is a significant risk mitigation feature.

Despite these protective measures, there have been some historical concerns regarding fund safety and disputes with clients. However, FIBO Group has generally maintained a good reputation for fund security. It is advisable for potential clients to stay informed about any changes in the company's policies or regulatory status that may affect fund safety.

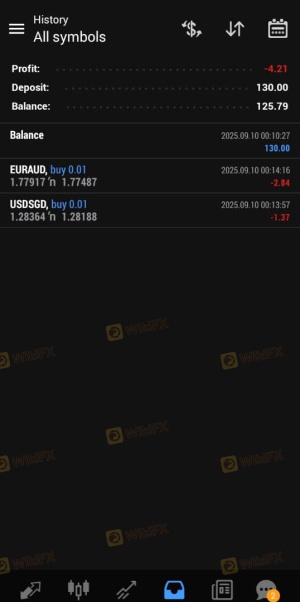

Customer Experience and Complaints

Customer feedback plays a crucial role in assessing a broker's reliability. FIBO Group has received a mix of reviews from clients, with many praising its trading conditions, customer support, and withdrawal processes. However, there are also notable complaints regarding execution issues and customer service responsiveness. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed responses; some resolved quickly, others took longer |

| Execution Issues | Medium | Acknowledged by the broker, but not consistently resolved |

| Customer Support Quality | Medium | Varies; some users report excellent service, while others faced delays |

Typical cases include traders reporting delays in withdrawals, particularly during high market volatility or after weekends. While many clients have successfully withdrawn their funds without issues, the inconsistency in experiences raises concerns. Additionally, some traders have reported execution problems, such as slippage or order rejections, which can impact trading performance.

FIBO Group's customer support is generally regarded as responsive; however, there are instances where clients experienced delays in receiving assistance. The broker offers support through multiple channels, including live chat, email, and phone, which is a positive aspect. Nevertheless, potential clients should be aware of the varying quality of service and consider testing the support channels before committing funds.

Platform and Execution

The trading platform's performance is a critical factor for traders, as it directly affects execution quality and overall trading experience. FIBO Group offers several popular trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. These platforms are known for their user-friendly interfaces and advanced trading tools.

In terms of order execution, FIBO Group generally provides reliable performance, with many users reporting fast execution speeds. However, there are occasional complaints regarding slippage, particularly during high volatility periods. It is essential for traders to understand that slippage can occur with any broker, especially in fast-moving markets.

While there are no widespread reports of platform manipulation, traders should remain vigilant and monitor their trading activity for any unusual occurrences. Overall, FIBO Group's platforms are well-regarded, but traders should ensure they are familiar with the specific features and functionalities of their chosen platform.

Risk Assessment

Using FIBO Group as a trading broker comes with inherent risks, as is the case with any financial service. Below is a summary of the key risk areas associated with trading through FIBO Group:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Dual regulation, but BVI oversight is less stringent |

| Execution Risk | Medium | Occasional slippage and execution issues reported |

| Customer Support Risk | Medium | Mixed feedback on support responsiveness |

| Fund Safety Risk | Low | Segregated accounts and compensation fund membership |

To mitigate these risks, traders are advised to start with a demo account to familiarize themselves with the trading environment and test their strategies without financial exposure. Additionally, maintaining a diversified trading portfolio and avoiding excessive leverage can help manage risk levels effectively.

Conclusion and Recommendations

In conclusion, FIBO Group presents a mixed picture as a forex broker. While it boasts a long history, robust regulatory oversight, and competitive trading conditions, there are areas of concern, particularly regarding customer service and execution quality. The presence of dual regulation adds a layer of credibility, but the BVI oversight may raise red flags for some traders.

Potential clients should be cautious and conduct thorough research before opening an account with FIBO Group. It is advisable to start with a smaller investment and utilize the demo account to assess the broker's services. For traders seeking alternatives, brokers with strong regulatory frameworks and positive customer feedback, such as Pepperstone or AvaTrade, may be worth considering.

Ultimately, while FIBO Group is not a scam, it is essential for traders to be aware of the potential risks and challenges associated with trading through this broker. By staying informed and exercising caution, traders can navigate the forex market more effectively.

Is FIBOGROUP a scam, or is it legit?

The latest exposure and evaluation content of FIBOGROUP brokers.

FIBOGROUP Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FIBOGROUP latest industry rating score is 3.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 3.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.