Belfrics 2025 Review: Everything You Need to Know

Executive Summary

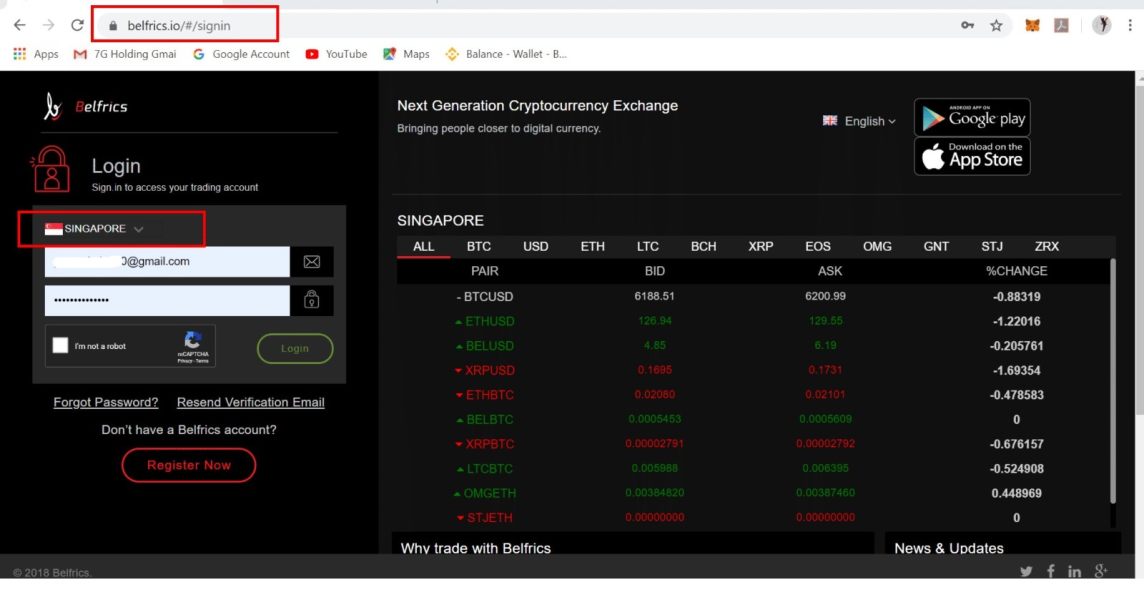

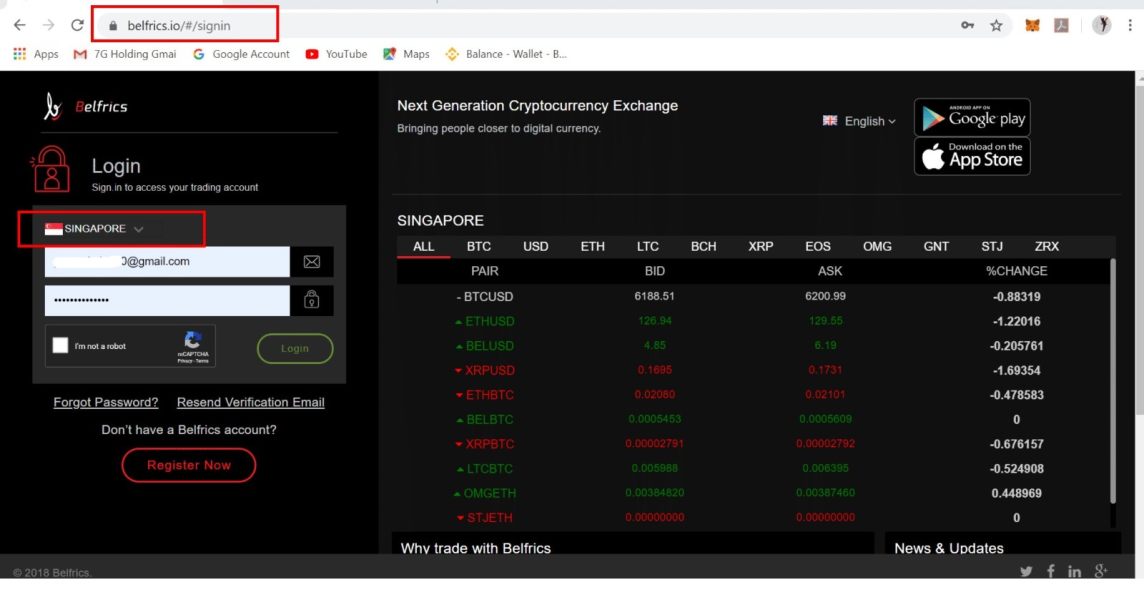

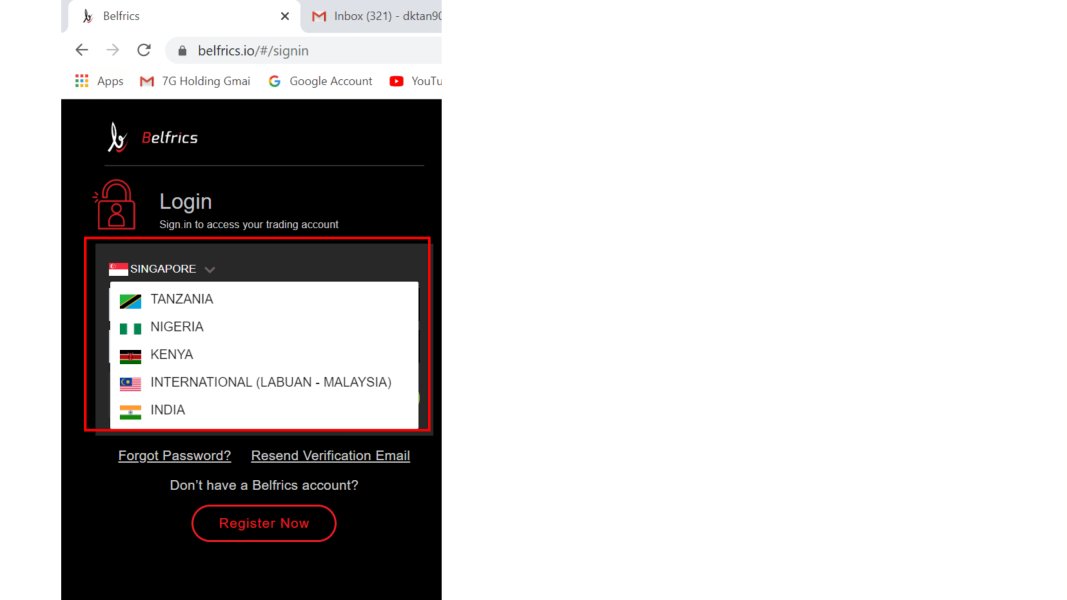

This comprehensive Belfrics review examines a digital asset trading platform that has been operating since 2014. The platform is headquartered in Bangalore, India, and Belfrics positions itself as Malaysia's most comprehensive bitcoin trading platform and digital wallet service, allowing users to buy and sell bitcoins at competitive rates. The platform operates across seven countries in Asia, Africa, the Middle East, and Europe. It offers a KYC-enabled trading environment focused on cryptocurrency and digital asset transactions.

Based on available user feedback and platform analysis, Belfrics receives mixed reviews from its user base. According to Trustpilot data, the platform holds a rating of 2 out of 5, while REVIEWS.io shows an average score of 0, indicating significant room for improvement in user satisfaction. However, some users have noted positive experiences with the platform's customer support services. This suggests that while there are challenges, the company does provide adequate assistance when needed.

The platform primarily targets investors interested in cryptocurrency trading and digital asset management. It offers services that include bitcoin trading, digital wallet functionality, and various cryptocurrency derivative products. As a smart digital asset trading platform, Belfrics aims to serve both novice and experienced traders looking to participate in the growing cryptocurrency market across multiple international jurisdictions.

Important Notice

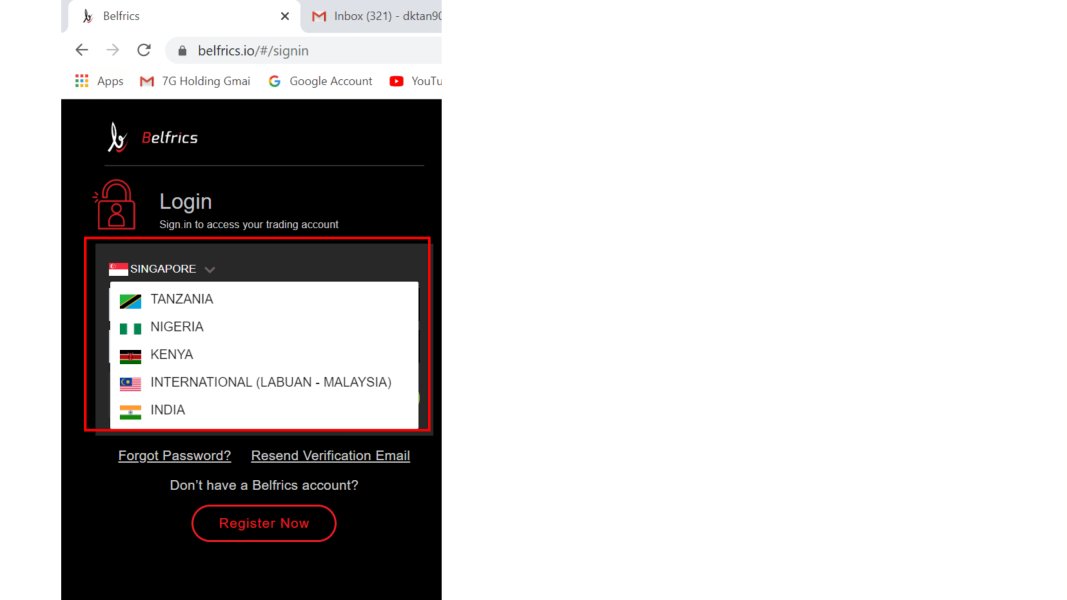

Regional Differences: Belfrics operates across multiple jurisdictions including Asia, Africa, the Middle East, and Europe, spanning seven different countries. Users should be aware that regulatory requirements, available services, and legal frameworks may vary significantly between these regions. It is essential to understand the specific regulations and compliance requirements in your jurisdiction before engaging with the platform.

Review Methodology: This evaluation is based on publicly available information, user feedback from various review platforms, and official company communications. Due to limited detailed information available in public sources, some aspects of the platform's services may require direct inquiry with the company for comprehensive understanding.

Rating Framework

Broker Overview

Belfrics emerged in the cryptocurrency trading landscape in 2014. The company established its headquarters in Bangalore, India, and has positioned itself as a comprehensive digital asset trading platform, with particular emphasis on serving markets across Asia, Africa, the Middle East, and Europe. As a KYC-enabled trading platform, Belfrics focuses primarily on bitcoin and other cryptocurrency transactions. It offers both trading and digital wallet services to its international client base.

The platform operates as a smart digital asset exchange, providing users with access to various cryptocurrency trading pairs and digital asset management tools. Belfrics has developed its own proprietary trading platform specifically designed for cryptocurrency transactions, moving beyond traditional forex offerings to focus on the rapidly evolving digital currency market. The company's business model centers around providing secure, regulated access to cryptocurrency trading while maintaining compliance with local regulations across its operational territories.

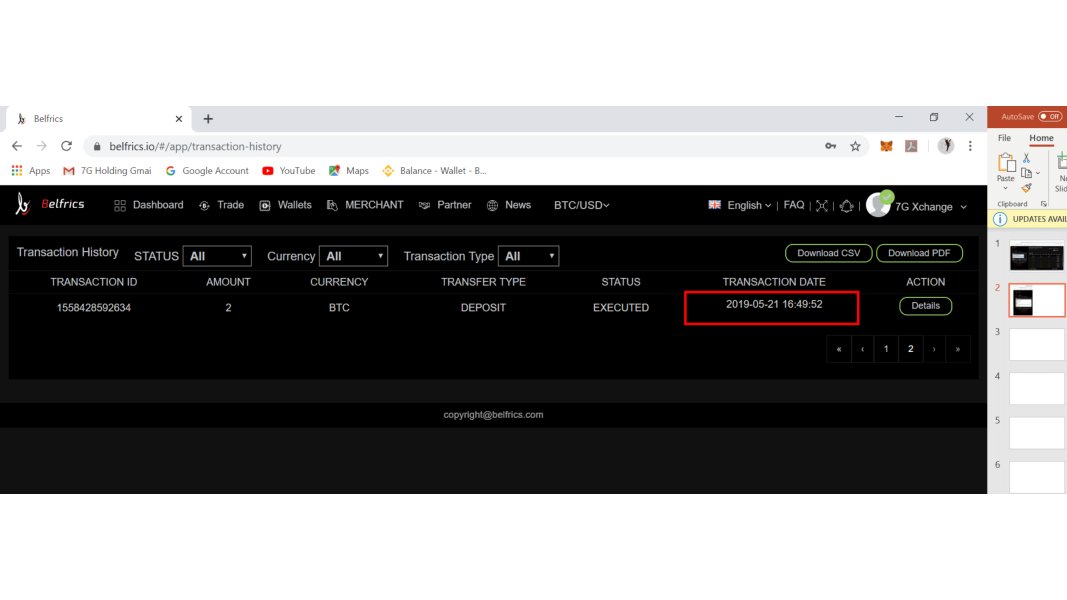

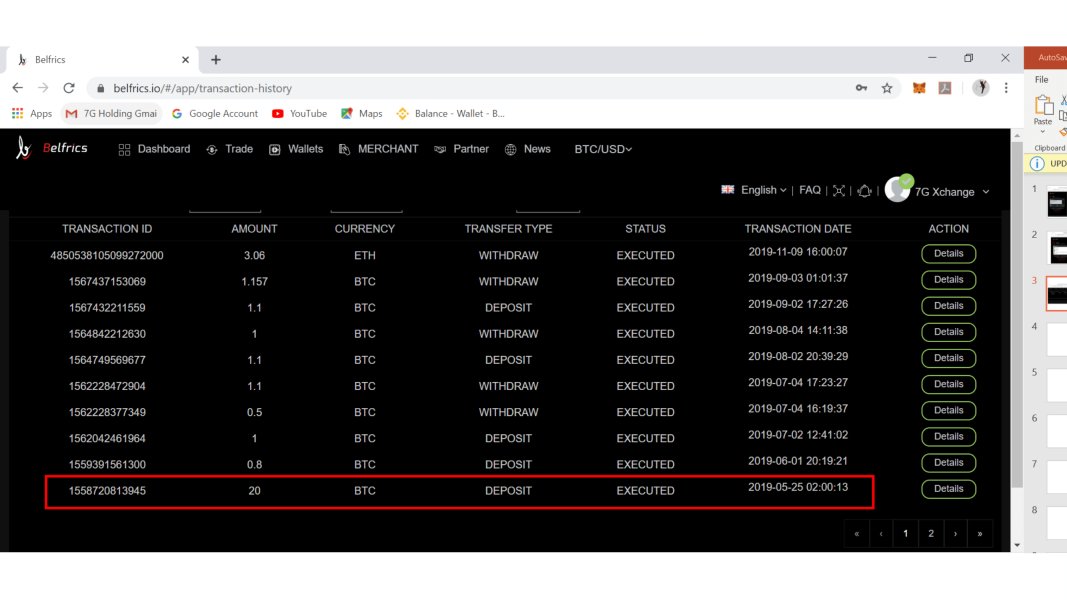

According to available information, Belfrics offers trading in major cryptocurrencies including Bitcoin, Ethereum, and Litecoin, along with various cryptocurrency derivatives and spot trading options. The platform also extends its services to include metal trading and some forex products, though the primary focus remains on digital assets. This diversification allows users to access multiple asset classes through a single platform. However, specific details about trading conditions and fee structures are not comprehensively detailed in publicly available sources.

Regulatory Status: Specific regulatory information for Belfrics is not detailed in available public sources. The platform operates across multiple jurisdictions and claims to maintain KYC compliance standards.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in current public sources. This would require direct inquiry with the platform.

Minimum Deposit Requirements: Minimum deposit information is not specified in available materials. It may vary by region and account type.

Bonuses and Promotions: Current promotional offerings and bonus structures are not detailed in publicly available information.

Tradeable Assets: The platform offers access to major cryptocurrencies including Bitcoin, Ethereum, and Litecoin. It also provides cryptocurrency derivatives, spot trading, and some metal trading options. Specific forex offerings are mentioned but not detailed in available sources.

Cost Structure: Detailed information about spreads, commissions, and fee structures is not comprehensively available in public sources. This requires direct platform inquiry for accurate cost analysis.

Leverage Options: Specific leverage ratios and margin requirements are not detailed in currently available public information.

Platform Options: Belfrics operates its own proprietary trading platform designed specifically for cryptocurrency trading. However, detailed platform features and capabilities are not extensively documented in public sources.

Geographic Restrictions: While the platform operates in seven countries across multiple continents, specific geographic restrictions are not detailed in available information.

Customer Support Languages: Specific language support information is not detailed in current public sources.

Detailed Rating Analysis

Account Conditions Analysis

The specific account conditions offered by Belfrics are not comprehensively detailed in publicly available sources. This makes it challenging to provide a thorough analysis of account types, minimum requirements, and special features. What is known is that the platform operates as a KYC-enabled trading environment, suggesting that account opening requires identity verification and compliance with know-your-customer regulations.

Given the platform's international presence across seven countries, it's likely that account conditions may vary by jurisdiction to comply with local regulatory requirements. The platform appears to cater to both individual and potentially institutional clients interested in cryptocurrency trading. However, specific account tiers or premium features are not detailed in available materials.

Users considering opening an account with Belfrics should directly inquire about minimum deposit requirements, account verification processes, and any special account features that may be available. The lack of detailed public information about account conditions represents a transparency concern. Potential users should address this through direct communication with the platform before committing to open an account.

Detailed information about the trading tools and resources available on the Belfrics platform is not extensively documented in publicly available sources. As a cryptocurrency-focused trading platform, it's reasonable to expect that the platform provides basic charting tools, market data, and trading interfaces suitable for digital asset transactions.

The platform's designation as a "smart digital asset trading platform" suggests the presence of some advanced features. However, the specific nature of these tools is not detailed in current public information. Users interested in comprehensive market analysis tools, educational resources, or automated trading capabilities would need to investigate these features directly through the platform.

The absence of detailed information about available trading tools and educational resources in public sources may indicate either limited offerings in this area or insufficient transparency in communicating these features to potential users. This represents an area where the platform could improve its public information availability. Better communication would help serve potential clients seeking to understand the full scope of available resources.

Customer Service and Support Analysis

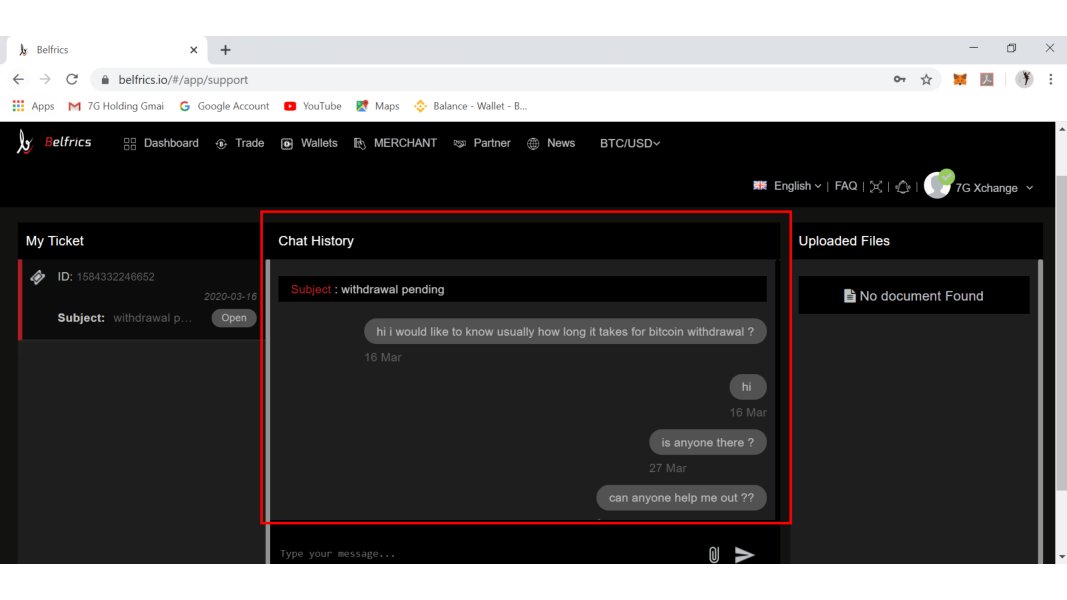

Customer service appears to be one of the stronger aspects of Belfrics' offering. User feedback indicates generally positive experiences with support quality. Despite the platform's overall low ratings on review sites, users have specifically noted that the support team provides good assistance when contacted, suggesting that the company prioritizes customer service even when other aspects of the platform may fall short of expectations.

The quality of customer support becomes particularly important in cryptocurrency trading, where technical issues or account problems can have significant financial implications. The positive feedback regarding support services indicates that Belfrics has invested in maintaining responsive customer assistance. This is crucial for user confidence and problem resolution.

However, specific details about support channels, response times, availability hours, and language options are not detailed in available public sources. Users should verify the availability of support in their preferred language and time zone. This is especially important given the platform's international operations across multiple regions with different time zones and language requirements.

Trading Experience Analysis

The trading experience on Belfrics cannot be comprehensively evaluated based on currently available public information. As a cryptocurrency-focused platform with its own proprietary trading system, the platform likely provides basic trading functionality suitable for digital asset transactions. However, specific details about platform stability, execution speed, and advanced trading features are not documented in public sources.

User feedback available through review platforms does not provide detailed insights into the day-to-day trading experience, order execution quality, or platform reliability. This lack of detailed user experience data makes it difficult to assess how the platform performs during high-volume trading periods. It also makes it hard to evaluate how effectively it handles order execution across different market conditions.

Potential users interested in understanding the platform's trading capabilities, mobile accessibility, charting tools, and order types would need to investigate these features through direct platform exploration or contact with customer support. The absence of comprehensive trading experience data in public reviews suggests that users should approach the platform with caution. They should thoroughly test its capabilities before committing significant trading capital.

Trust and Reliability Analysis

Trust and reliability represent significant concerns for Belfrics based on available user feedback and review data. The platform's Trustpilot rating of 2 out of 5 and REVIEWS.io average score of 0 indicate substantial user dissatisfaction and trust issues. Potential clients should carefully consider these ratings before engaging with the platform.

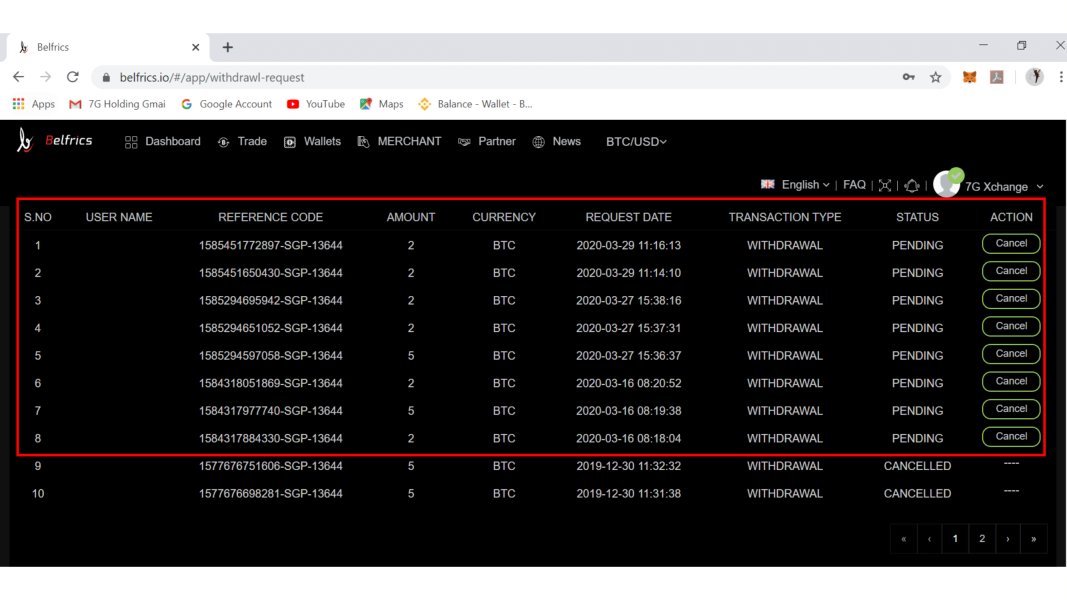

The low trust ratings raise questions about various aspects of the platform's operations, including fund security, withdrawal processing, customer service effectiveness, and overall platform reliability. While some users have reported positive experiences with customer support, the overwhelming negative sentiment in review scores suggests systemic issues. These issues affect user confidence and satisfaction.

The absence of detailed regulatory information in public sources further complicates the trust assessment. Without clear visibility into regulatory oversight, licensing, and compliance measures, users must rely primarily on user reviews and company communications to assess the platform's trustworthiness. This lack of transparency regarding regulatory status represents a significant concern. Users who prioritize security and regulatory compliance in their trading platform selection should be particularly cautious.

User Experience Analysis

The overall user experience on Belfrics appears to be problematic based on available review data and user feedback. The consistently low ratings across multiple review platforms suggest that users encounter significant challenges when using the platform. However, specific details about the nature of these problems are not comprehensively documented in available sources.

The disconnect between relatively positive customer support feedback and overall negative platform ratings suggests that while the company may be responsive to user problems, the underlying platform or service issues continue to affect user satisfaction. This pattern indicates potential systemic problems with platform functionality, service delivery, or user expectations management.

Users considering Belfrics should be aware of the general dissatisfaction indicated by review scores while also recognizing that individual experiences may vary. The limited detailed feedback about specific user experience issues makes it difficult to identify whether problems are related to platform functionality, fee structures, withdrawal processes, or other service aspects. Potential users should thoroughly research and potentially test the platform with minimal capital before making significant commitments.

Conclusion

This Belfrics review reveals a cryptocurrency trading platform with mixed performance across key evaluation criteria. While the platform offers access to major digital assets and maintains operations across multiple international markets, significant concerns about user satisfaction and trust levels cannot be ignored. The platform's strength in customer support services is noteworthy. However, this positive aspect is overshadowed by consistently low user ratings and limited transparency in platform details.

Belfrics may be suitable for users specifically interested in cryptocurrency trading who are willing to accept higher risk levels and conduct thorough due diligence before committing funds. However, the low trust ratings and limited publicly available information about platform features suggest that potential users should exercise considerable caution. They should consider alternative platforms with stronger user satisfaction records and greater transparency in their operations and regulatory compliance.