Is Belfrics safe?

Pros

Cons

Is Belfrics Safe or Scam?

Introduction

Belfrics is a cryptocurrency exchange and trading platform based in Malaysia, primarily focusing on Bitcoin transactions. Established in 2014, it aims to provide a secure and user-friendly environment for trading digital assets, particularly in Asian and African markets. As the cryptocurrency landscape continues to evolve, traders must exercise caution when selecting a trading platform. The potential for scams and fraudulent activities in the forex and cryptocurrency markets necessitates a thorough evaluation of any broker before committing funds. This article aims to investigate the safety and legitimacy of Belfrics by examining its regulatory status, company background, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

Belfrics operates under the regulatory framework of the Labuan Financial Services Authority (LFSA) in Malaysia. Regulatory oversight is crucial for ensuring that trading platforms adhere to established financial standards and protect investors' interests. The presence of a regulatory body can enhance a broker's credibility, making it essential for traders to consider when assessing whether "Is Belfrics safe?"

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| LFSA | Not disclosed | Malaysia | Verified |

The LFSA provides a regulatory framework that encompasses various financial activities, including cryptocurrency exchanges. Belfrics claims to comply with these regulations, which is a positive sign. However, the lack of a disclosed license number raises concerns about transparency. Additionally, while the company has not faced significant regulatory sanctions, user complaints regarding withdrawal issues and customer service response times have surfaced, which could indicate potential operational weaknesses.

Company Background Investigation

Belfrics was founded by a team of experienced professionals with a background in finance and technology. The company has expanded its operations across multiple countries, including Singapore, Kenya, and India. This global presence is indicative of its ambition to cater to a diverse clientele. However, the ownership structure remains somewhat opaque, as it is not entirely clear who the key stakeholders are beyond the founding team.

The management team's experience in the financial sector is a positive aspect, suggesting a level of expertise in managing a trading platform. Nevertheless, the company's transparency regarding its operations and governance could be improved. A lack of clear information about its leadership and corporate structure may lead potential investors to question, "Is Belfrics safe?" when considering their investment.

Trading Conditions Analysis

Belfrics has a relatively straightforward fee structure, charging a 0.50% trading fee on transactions. While this is competitive compared to some platforms, it is higher than the industry average. Additionally, users have reported a lack of clarity regarding other fees, such as withdrawal charges, which can lead to confusion and frustration.

| Fee Type | Belfrics | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | 0.2% - 0.3% |

| Commission Model | 0.50% | 0.1% - 0.2% |

| Overnight Interest Range | Not applicable | Varies |

The absence of a clear breakdown of fees and spreads raises concerns about potential hidden costs. Traders should be cautious and ensure they fully understand the fee structure before engaging in trading activities on the platform.

Customer Funds Security

Belfrics claims to implement stringent security measures to protect customer funds, including cold storage and multi-signature wallets. These practices are essential for safeguarding digital assets and ensuring that users' investments remain secure. However, the company has faced allegations regarding delayed withdrawals and unresponsive customer service, which could compromise the overall safety of funds.

The lack of a robust investor protection scheme, such as insurance for deposits, is another area of concern. While Belfrics has not reported any significant security breaches, the potential for operational mishaps could leave traders vulnerable. Therefore, it is crucial to consider whether "Is Belfrics safe?" in terms of customer funds security.

Customer Experience and Complaints

User feedback regarding Belfrics has been mixed, with some users praising the platform's ease of use and intuitive interface, while others have expressed frustration over withdrawal delays and poor customer service. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

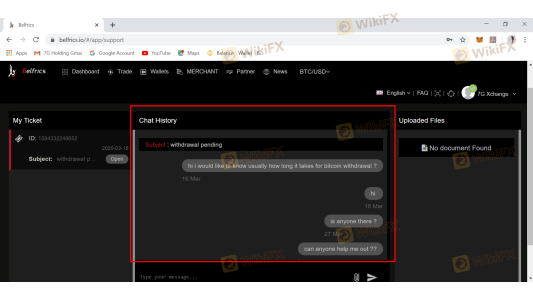

| Withdrawal Delays | High | Slow response |

| Lack of Customer Support | Medium | Unresolved tickets |

| High Fees | Low | Acknowledged |

For instance, several users have reported being unable to withdraw their funds, with some waiting for months without resolution. These issues raise significant concerns about the platform's reliability and responsiveness to customer needs. Consequently, potential users should weigh these factors carefully when considering if "Is Belfrics safe?" for their trading activities.

Platform and Execution

Belfrics offers a proprietary trading platform designed for high-frequency trading. While the platform is generally stable, user experiences suggest that execution quality can vary. Reports of slippage and rejected orders have emerged, leading to questions about the platform's overall reliability.

The potential for manipulation or technical issues raises additional concerns about whether "Is Belfrics safe?" for executing trades, especially during volatile market conditions.

Risk Assessment

Engaging with Belfrics presents several risks that traders should be aware of. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Regulatory status unclear in some regions |

| Customer Support | High | Slow response times to complaints |

| Withdrawal Issues | High | Significant delays reported |

| Platform Reliability | Medium | Occasional slippage and order rejections |

To mitigate these risks, traders should conduct thorough due diligence and consider diversifying their investments across multiple platforms.

Conclusion and Recommendations

In conclusion, while Belfrics presents itself as a legitimate trading platform, several factors raise concerns regarding its safety and reliability. The regulatory framework is in place, but transparency issues and user complaints about withdrawals and customer service cannot be overlooked. Therefore, potential investors should remain cautious and thoroughly evaluate their options.

For traders seeking safer alternatives, consider platforms with a proven track record of customer support and transparent fee structures. Options such as Binance or Kraken may provide a more secure trading environment. Ultimately, understanding whether "Is Belfrics safe?" involves weighing its strengths against the potential risks and challenges it presents.

Is Belfrics a scam, or is it legit?

The latest exposure and evaluation content of Belfrics brokers.

Belfrics Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Belfrics latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.