Autu Securities 2025 Review: Everything You Need to Know

Executive Summary

This autu securities review gives you a complete look at Autu Securities. This online trading platform started working on August 19, 2024. Based on user feedback and market research, Autu Securities gets a neutral rating because users have mixed experiences and the company doesn't share enough details about how it works.

The platform does well in two main areas. It offers many different financial tools across multiple types of investments, and users say it provides a stable and reliable place to trade. Autu Securities helps both regular people who invest money and big companies that need trading services.

The platform gives access to global financial markets through the popular MetaTrader 4 and 5 systems. According to Trustpilot ratings, the broker gets a 6/10 score from users. Clients like how stable the platform is, how fast trades happen, and how good the support team is.

However, the company just started recently and doesn't share enough information about account rules and fees. This is why the rating stays moderate. The broker follows rules from both the Vanuatu Financial Services Commission and the Australian Securities and Investments Commission.

This gives them a good foundation for following regulations in different countries.

Important Disclaimers

Your experience with Autu Securities might be very different depending on where you live. The broker works through different companies in various countries, and each one follows different rules and standards.

This review looks at user feedback, regulatory information, and market data. The broker started recently and doesn't share much public information, so some parts of their service are still unclear. You should research more before opening an account.

Rating Framework

Broker Overview

Autu Securities International Inc. started on August 19, 2024. It works as a complete online trading platform for both regular investors and big companies. Even though it just entered the competitive forex and CFD market, the company quickly built a trading environment that covers many types of investments and gives access to global financial markets.

The broker works as a CFD provider. This means clients can trade various financial tools without actually owning them. This business model lets Autu Securities offer leveraged trading opportunities across multiple investment types while keeping operations running smoothly.

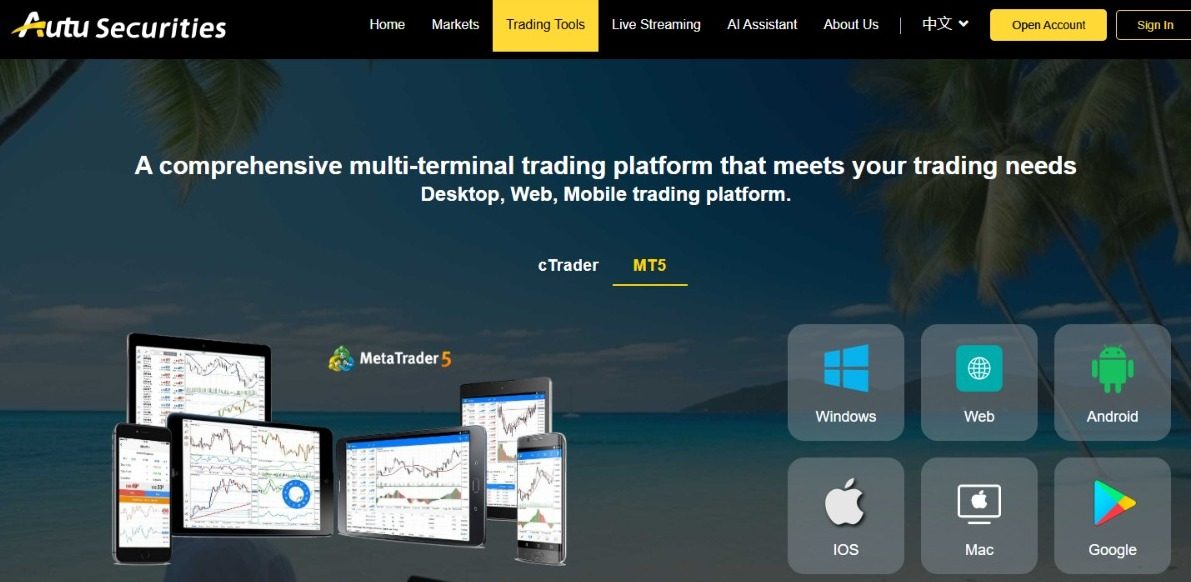

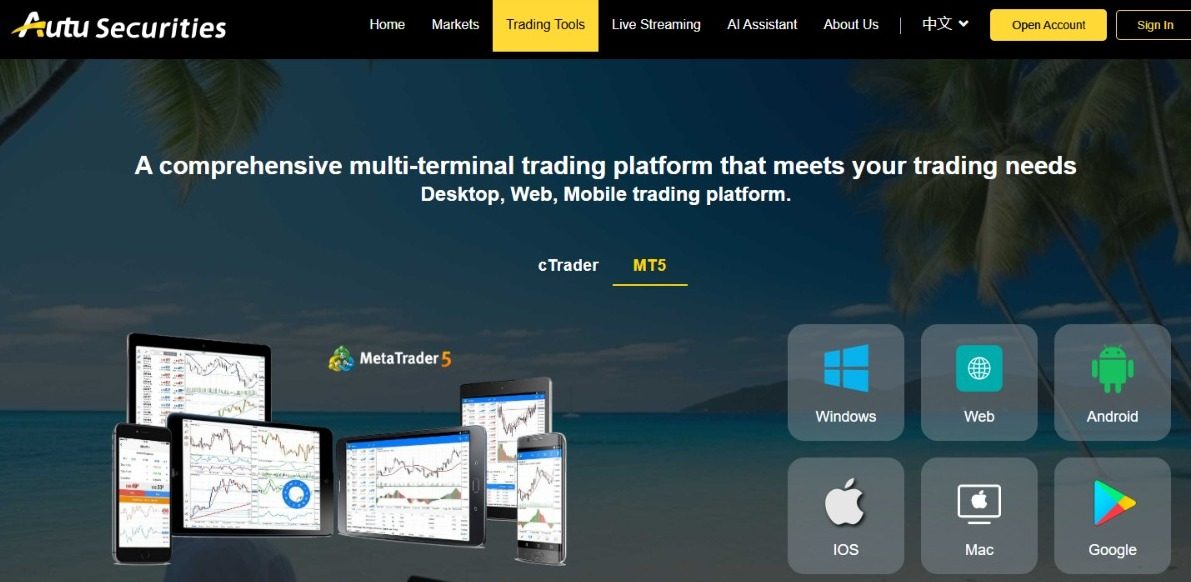

The company focuses on giving people many different investment choices. Autu Securities supports both MetaTrader 4 and MetaTrader 5 trading platforms, which are industry standards that give traders advanced charting tools, automated trading features, and complete market analysis options.

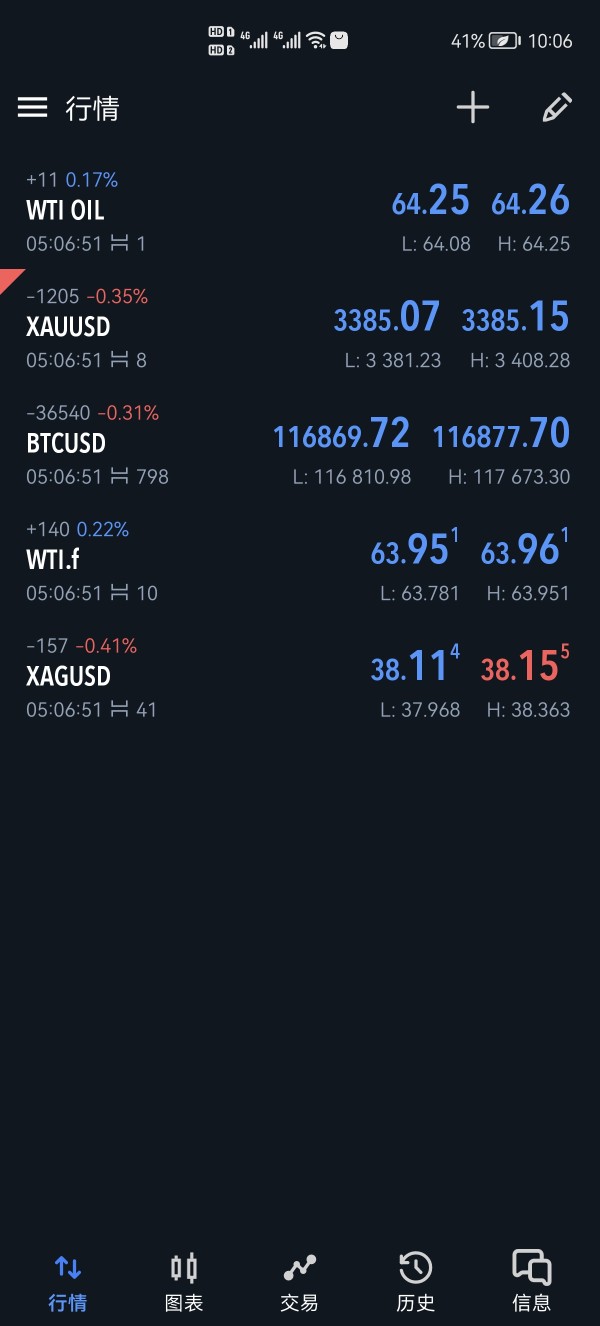

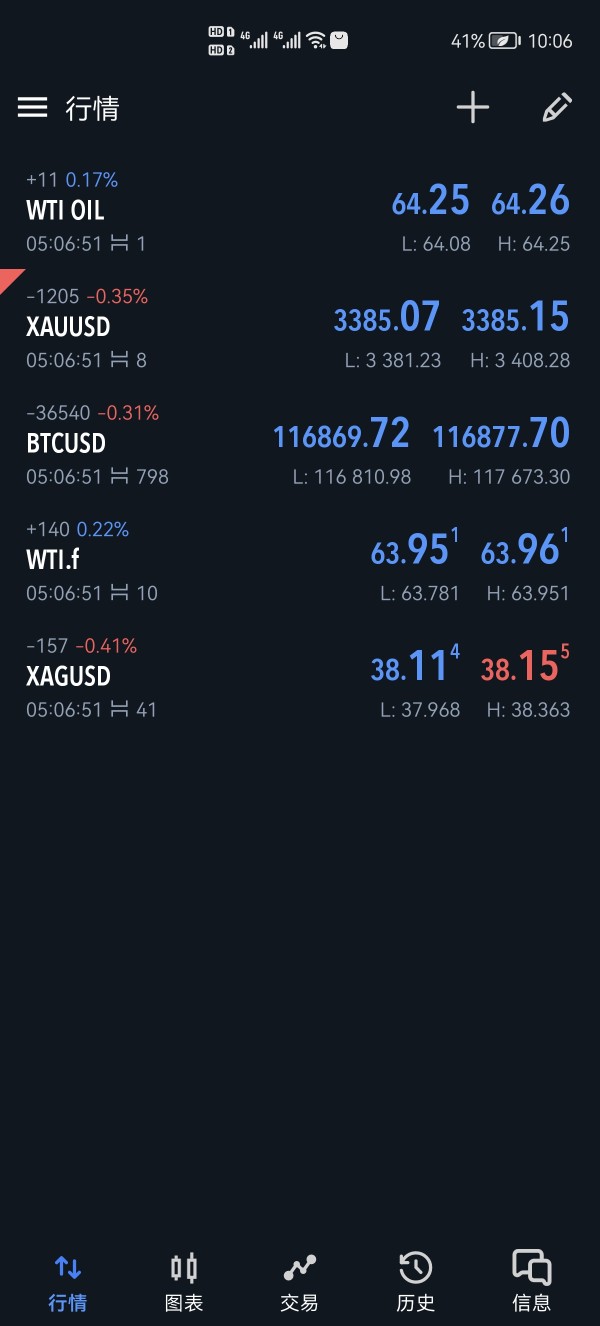

The platform lets you access many different assets you can trade. These include foreign exchange pairs, contracts for difference, individual stocks, futures contracts, commodities, market indices, and cryptocurrency tools. The broker follows rules from both the Vanuatu Financial Services Commission and the Australian Securities and Investments Commission.

This regulatory setup gives clients different levels of protection depending on where they live and which company manages their account.

Regulatory Jurisdictions: Autu Securities works under the watch of the Vanuatu Financial Services Commission and the Australian Securities and Investments Commission. This gives regulatory coverage across Pacific and Australian markets.

Deposit and Withdrawal Methods: The broker doesn't share specific information about payment methods, how long processing takes, or what fees you might pay. You need to ask them directly for this information.

Minimum Deposit Requirements: The broker hasn't told the public what the minimum deposit amounts are for different account types. This makes it hard for potential clients to know what they need to start trading.

Promotional Offers: Current bonus programs, welcome packages, or ongoing promotional campaigns aren't listed in available materials. This suggests either no such programs exist or the company doesn't share much marketing information.

Tradeable Assets: The platform gives you access to a wide range of financial tools. These include major and minor forex pairs, CFDs on various underlying assets, individual company stocks, commodity futures, precious metals, energy products, global stock indices, and popular cryptocurrency pairs.

Cost Structure: Detailed information about spreads, commission fees, overnight charges, and other trading costs isn't clear in public documents. This represents a big information gap for traders who care about costs.

Leverage Ratios: Maximum leverage options and margin requirements aren't listed in available materials. You need to contact the broker directly for specific leverage information.

Platform Options: Autu Securities gives access through both MetaTrader 4 and MetaTrader 5 platforms. These offer complete trading functionality and technical analysis tools.

Geographic Restrictions: Specific country restrictions or regional limitations aren't detailed in current autu securities review materials.

Customer Service Languages: Available customer support languages and communication preferences aren't listed in accessible documents.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

The account conditions category gets a below-average rating mainly because the company doesn't share enough information about basic account features. Autu Securities hasn't given clear information about what account types they offer, what features each type has, or what specific benefits come with different account levels.

They don't share minimum deposit requirements publicly. This creates uncertainty for potential clients who want to know if the broker fits their financial situation. This lack of transparency also applies to account opening procedures, required documents, and how long verification takes.

All of these are important factors when choosing an account. User feedback doesn't specifically talk about account condition satisfaction and focuses instead on trading experience and platform stability. The missing information about special account features makes the evaluation even harder.

For example, they don't mention Islamic accounts for Sharia-compliant trading or professional account options for experienced traders. Without detailed information about account-specific benefits, fee structures, or special features, potential clients can't make good comparisons with other brokers in the market. This autu securities review shows the need for more transparency in account condition information to help clients make better decisions.

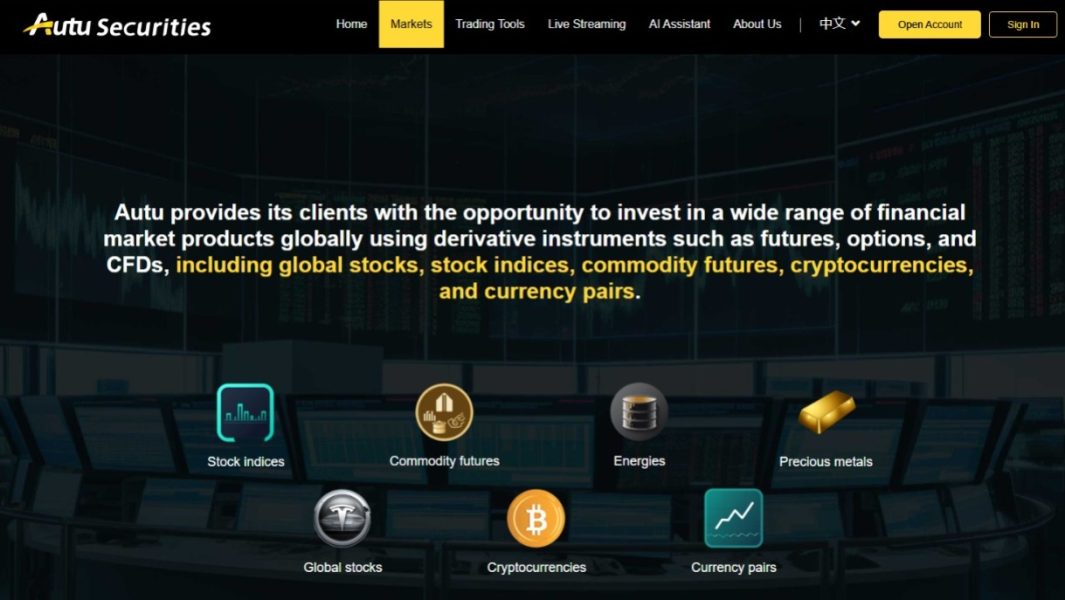

Autu Securities does well in the tools and resources category and earns a good rating based on the wide range of financial instruments available to traders. The platform gives access to contracts for difference, foreign exchange pairs, stock indices, commodity futures, energy products, precious metals, global stocks, and cryptocurrency trading opportunities.

Having both MetaTrader 4 and MetaTrader 5 platforms makes the tools available to traders much better. These platforms give access to advanced charting capabilities, technical indicators, automated trading systems, and complete market analysis features. These industry-standard platforms are well-known for being reliable and having extensive functionality.

However, the evaluation is limited because there's no information about proprietary research and analysis resources, educational materials, market commentary, or additional trading tools beyond the standard MetaTrader offerings. Many competitive brokers provide extra research services, economic calendars, and educational resources that make the overall trading experience better.

User feedback suggests platform stability and reliability, which supports the positive assessment of available tools. However, specific comments on tool quality and resource effectiveness aren't detailed in available reviews.

Customer Service and Support Analysis (7/10)

The customer service and support category gets a good rating based on user feedback that shows strong support services. However, specific details about how services are delivered and when they're available remain unclear. Users consistently report getting strong support from the Autu Securities team, which suggests effective problem solving and client help.

However, the evaluation is limited by missing information about specific customer service channels. For example, they don't share details about live chat availability, telephone support hours, email response times, or dedicated account management services. This lack of detail makes it hard to assess the complete quality and accessibility of support services.

The broker hasn't shared information about multilingual support capabilities. This could be important for international clients who want help in their preferred language. Also, specific customer service hours and timezone coverage aren't specified, which could affect clients in different geographical regions.

User feedback is generally positive about support quality but lacks specific examples of problem resolution, response time experiences, or detailed service quality assessments. These would give deeper insight into the customer service experience.

Trading Experience Analysis (7/10)

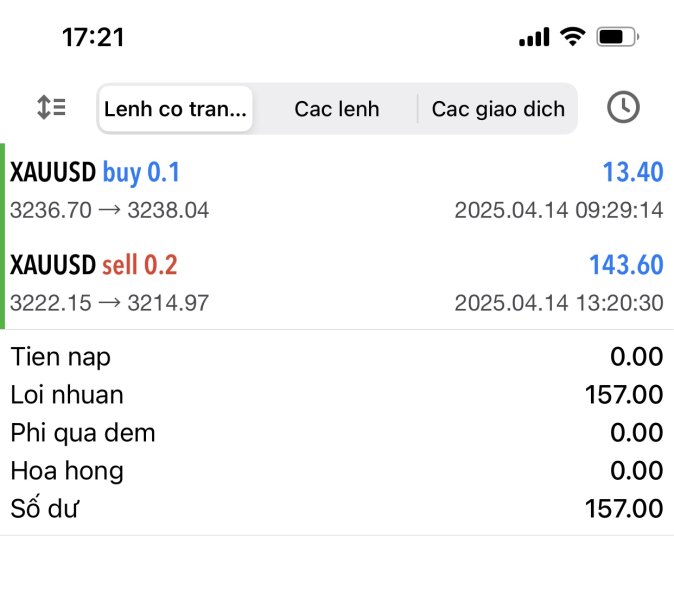

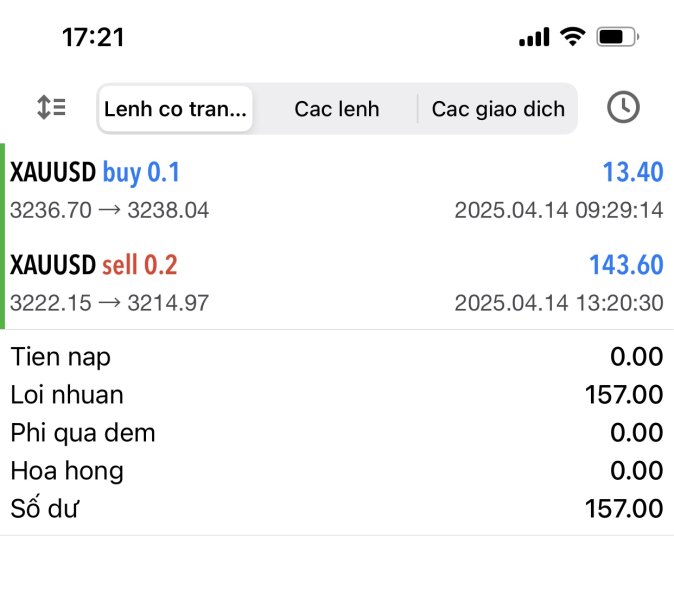

The trading experience category gets a good rating based on user reports of platform stability and fast trade execution. These are two critical parts of effective trading operations. Users consistently describe the platform as reliable, which suggests minimal technical problems and consistent access to trading services.

Fast execution speeds, as reported by users, show effective order processing and potentially competitive execution quality. However, specific data about slippage rates, execution speeds, or order fill statistics aren't available in current documentation.

The platform's support for both MetaTrader 4 and MetaTrader 5 makes the trading experience better. It gives traders familiar, feature-rich environments that support various trading strategies and analysis techniques. These platforms are known for their stability and complete functionality.

However, the evaluation is limited by missing detailed information about mobile trading capabilities, platform customization options, advanced order types, or specific trading environment features. These could make the broker's offering different from competitors in the market.

Trust and Safety Analysis (6/10)

The trust and safety category gets an average rating that reflects the broker's regulatory status balanced against limited transparency in key operational areas. Autu Securities works under licenses from both the Vanuatu Financial Services Commission and the Australian Securities and Investments Commission, which gives regulatory oversight across multiple jurisdictions.

The dual regulatory framework offers different levels of client protection depending on the specific entity and jurisdiction governing individual accounts. ASIC regulation generally provides stronger consumer protections compared to VFSC oversight, though both represent legitimate regulatory authorities.

However, the evaluation is limited by missing detailed information about client fund protection measures, segregated account policies, insurance coverage, or other safety mechanisms. Many brokers use these to protect client interests.

The company started recently in August 2024, which means limited operational history is available for assessment. This makes it hard to evaluate long-term reliability and stability. Also, the lack of detailed financial reporting, management team information, or third-party auditing disclosures limits transparency assessment.

User Experience Analysis (6/10)

The user experience category gets an average rating based on the 6/10 Trustpilot score, which reflects mixed client satisfaction levels. While users report positive experiences with platform reliability and execution speed, the moderate overall rating suggests areas that need improvement.

Missing detailed information about user interface design, account registration processes, verification procedures, and fund management operations limits the complete evaluation of user experience factors. These elements significantly impact overall client satisfaction and operational efficiency.

User feedback focuses mainly on platform stability and support quality, with limited comments on how easy navigation is, feature accessibility, or overall service satisfaction. The lack of detailed user testimonials or specific experience descriptions limits the depth of user experience analysis.

The broker's target market includes both individual investors and institutional clients. This suggests a platform designed to work for different experience levels and trading requirements, though specific user interface adaptations for different client types aren't detailed in available materials.

Conclusion

This autu securities review shows a broker with notable strengths in platform stability and trading tool availability, balanced against significant transparency limitations that affect overall assessment. Autu Securities shows competency in providing diverse financial instruments and maintaining reliable trading operations, which particularly appeals to traders seeking access to multiple asset classes through established MetaTrader platforms.

The broker appears most suitable for individual investors and institutional clients who prioritize platform stability and diverse trading opportunities over detailed fee transparency and comprehensive account information. However, potential clients should do thorough research about specific account conditions, costs, and service terms before committing to the platform.

The primary advantages include platform reliability, fast execution speeds, and strong customer support. The main drawbacks involve limited transparency about account conditions, fee structures, and detailed service information that would help people make informed broker comparison and selection decisions.