Is iFOREX safe?

Pros

Cons

Is iForex A Scam?

Introduction

iForex, established in 1996, is a forex and CFD broker that has positioned itself as a significant player in the online trading market. With a presence in over 100 countries and a diverse range of tradable instruments, iForex aims to cater to both novice and experienced traders. However, the forex market is notorious for its risks, and traders must exercise caution when selecting a broker. The importance of evaluating a broker's legitimacy cannot be overstated, as the consequences of choosing a fraudulent or poorly regulated broker can be severe, including loss of funds and lack of recourse. This article employs a comprehensive evaluation framework that encompasses regulatory status, company background, trading conditions, customer feedback, and overall risk assessment to determine whether iForex is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory environment in which a broker operates is crucial for ensuring the safety of client funds and the integrity of trading practices. iForex operates under the auspices of multiple regulatory authorities, including the British Virgin Islands Financial Services Commission (BVI FSC) and the Cyprus Securities and Exchange Commission (CySEC).

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| BVI FSC | SIBA/L/13/1060 | British Virgin Islands | Verified |

| CySEC | 143/11 | Cyprus | Verified |

While iForex holds licenses from these authorities, it is essential to note that the BVI FSC is considered a tier-2 regulator, which may not provide the same level of investor protection as tier-1 regulators such as the UK‘s FCA or Australia’s ASIC. Additionally, iForex has faced regulatory scrutiny in the past, including fines for providing unlicensed services. Such historical compliance issues raise concerns about the brokers commitment to adhering to industry standards, which is vital for establishing trust.

Company Background Investigation

iForex is operated by Formula Investment House Ltd., a company with a long history in the financial services industry. Founded in 1996, the company has evolved over the years, adapting to the changing needs of traders. However, the ownership structure and management team behind iForex are not transparently disclosed, which can be a red flag for potential clients.

Information about the management team is limited, and while the company claims to have a seasoned group of professionals, the lack of detailed biographies or public profiles makes it challenging to assess their qualifications. Furthermore, the level of transparency regarding the company‘s operations and financial health is crucial for potential investors. Clients should be able to access comprehensive information about the company’s financial practices, ownership, and regulatory compliance to make informed decisions.

Trading Conditions Analysis

When evaluating whether iForex is safe, understanding the broker's trading conditions is crucial. iForex offers competitive trading conditions, including a minimum deposit requirement of $100 and leverage up to 1:400. However, the spread structure can be a concern, particularly for active traders.

| Fee Type | iForex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips | 1.0 - 2.0 pips |

| Commission Model | 0% | 0% - 0.5% |

| Overnight Interest Range | Varies | Varies |

The spreads at iForex are higher than the industry average, which can significantly impact trading profitability, especially for high-frequency traders. Additionally, the broker has been criticized for hidden fees and unclear withdrawal processes, which can lead to frustration among clients. The lack of a clear commission structure and potential for unexpected fees may suggest a less-than-transparent pricing model, leading to questions about the broker's integrity.

Client Fund Safety

The safety of client funds is a paramount concern when determining if iForex is safe for trading. iForex claims to implement several measures to protect client funds, including segregating client accounts from company funds and providing negative balance protection. This means that clients cannot lose more than their initial investment, a policy that is crucial in protecting traders during volatile market conditions.

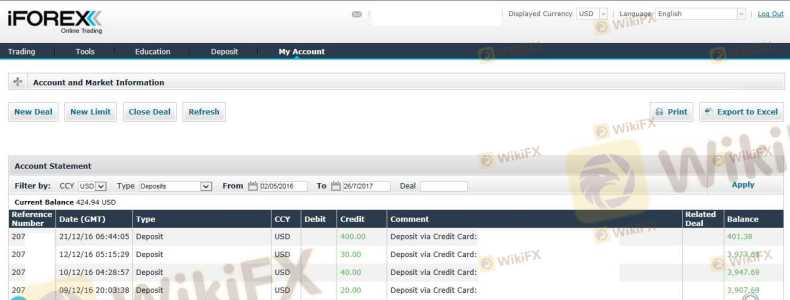

However, the effectiveness of these measures is contingent upon the broker's adherence to regulatory standards. Historical complaints from clients regarding difficulties in withdrawing funds and issues with account management raise concerns about the actual implementation of these safety measures. Past incidents of fund mismanagement or withdrawal delays can significantly impact the trustworthiness of a broker.

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding the real-world performance of a broker. iForex has received mixed reviews from clients, with many praising the user-friendly trading platform but expressing dissatisfaction with customer support and withdrawal processes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support Accessibility | Medium | Limited hours |

| Trading Platform Bugs | Medium | Addressed slowly |

Common complaints include difficulties in withdrawing funds, particularly for clients who have experienced delays of several weeks. Additionally, there are reports of unresponsive customer support, which can exacerbate frustrations for traders facing issues. While some users have had positive experiences, the prevalence of negative feedback suggests that potential clients should proceed with caution.

Platform and Trade Execution

The performance of a broker's trading platform is critical for ensuring a smooth trading experience. iForex offers a proprietary trading platform known as FXnet, which is designed to be user-friendly. However, users have reported issues with platform stability and execution quality, including instances of slippage and rejected orders.

The absence of popular trading platforms like MetaTrader 4 or 5 may deter some traders who prefer these established systems. Furthermore, concerns about potential platform manipulation have been raised, with users alleging that the broker may control trade execution in ways that disadvantage traders. Such claims, if substantiated, could indicate serious ethical concerns regarding the broker's operations.

Risk Assessment

Using iForex comes with a set of risks that potential traders must carefully consider.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Limited oversight from tier-2 regulators. |

| Withdrawal Risk | High | Historical issues with fund withdrawals. |

| Platform Risk | Medium | Reports of execution issues and potential manipulation. |

Given these risks, traders should implement robust risk management strategies, including setting limits on the amount invested and ensuring that they fully understand the trading conditions before committing funds.

Conclusion and Recommendations

In conclusion, while iForex has established itself as a long-standing broker within the forex and CFD market, significant concerns regarding its regulatory status, customer feedback, and trading conditions suggest that caution is warranted. The lack of tier-1 regulatory oversight, coupled with a history of compliance issues and numerous customer complaints, raises red flags about the broker's overall safety.

For traders considering iForex, it is essential to weigh these risks carefully and consider alternative brokers with stronger regulatory frameworks and better customer support records. Reputable options may include brokers regulated by the FCA or ASIC, which provide a higher level of investor protection and transparency. Ultimately, ensuring the safety of your investments should be the top priority when selecting a trading platform.

Is iFOREX a scam, or is it legit?

The latest exposure and evaluation content of iFOREX brokers.

iFOREX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

iFOREX latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.