Anzo Capital Review 2025: Everything You Need to Know

Executive Summary

This comprehensive anzo capital review evaluates a broker that has established itself as a regulated player in the forex and CFD trading space since 2015. Anzo Capital operates under regulatory oversight from the International Financial Services Commission (IFSC) with license number IFSC/60/482/TS/19. This provides traders with a legally compliant trading environment.

Our analysis reveals a neutral assessment of Anzo Capital's services. The broker offers a comprehensive suite of trading tools with 94 tradeable instruments and maintains regulatory compliance. However, certain transparency issues regarding leverage information and fee structures diminish its overall appeal. According to multiple trader reports, the platform receives particular praise for its mobile application experience. Overall user satisfaction remains moderate with ratings averaging ★★★☆☆ (3/5).

The broker primarily targets beginner to intermediate traders seeking a regulated environment with diverse trading options. Anzo Capital's dual account structure (STP and ECN) accommodates different trading preferences. The lack of comprehensive cost disclosure may concern more experienced traders seeking full transparency.

Key highlights include the well-received mobile trading application and access to 94 different trading instruments across forex, CFDs, commodities, and metals. However, the absence of clear leverage specifications and detailed fee structures represents notable areas for improvement in this anzo capital review.

Important Notice

Regional Entity Differences: Anzo Capital operates through multiple jurisdictions, with registration in both the United Kingdom and Saint Vincent and the Grenadines. Traders should be aware that regulatory protections and policies may vary depending on their geographic location and the specific entity serving their region. The International Financial Services Commission (IFSC) regulation applies to certain operations. Clients should verify which regulatory framework governs their specific trading relationship.

Review Methodology: This evaluation is based on comprehensive analysis of publicly available company information, user feedback from multiple platforms, and regulatory documentation. Our assessment methodology prioritizes factual accuracy and objective analysis. Individual trading experiences may vary significantly based on personal trading styles and expectations.

Rating Framework

Broker Overview

Company Background and History

Anzo Capital Limited was established in 2015 as an online forex and CFD broker. The company maintains dual registration in the United Kingdom and Saint Vincent and the Grenadines, operating under a business model that focuses on providing retail traders access to global financial markets. According to regulatory filings, Anzo Capital has maintained continuous operations for nearly a decade. The company has built its presence primarily through digital marketing and competitive trading conditions.

The broker's business model centers on providing direct market access through STP (Straight Through Processing) and ECN (Electronic Communication Network) execution models. This approach allows Anzo Capital to cater to different trader segments, from beginners seeking simple market access to more sophisticated traders requiring institutional-grade execution. The company's operational structure emphasizes technology-driven solutions. Significant investment has been made in mobile and web-based trading platforms.

Trading Infrastructure and Asset Coverage

Anzo Capital supports trading through industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. This ensures traders have access to familiar and robust trading environments. The platform selection demonstrates the broker's commitment to providing proven trading technology rather than developing proprietary solutions that might introduce unnecessary complexity or reliability concerns.

The broker's asset coverage spans multiple financial markets, offering 94 tradeable instruments across foreign exchange, contracts for difference (CFDs), commodities, and precious metals. This diversification allows traders to build varied portfolios and pursue different trading strategies within a single account structure. Regulatory oversight is provided by the International Financial Services Commission (IFSC), which adds a layer of institutional credibility to the broker's operations. Traders should understand the specific protections this regulation provides compared to tier-one regulatory frameworks.

Regulatory Framework: Anzo Capital operates under International Financial Services Commission (IFSC) regulation with license number IFSC/60/482/TS/19. This regulatory framework provides basic operational oversight and compliance requirements. Traders should research the specific investor protections available under IFSC jurisdiction compared to other regulatory environments.

Account Structure: The broker offers two primary account types - STP accounts requiring a minimum deposit of $100 and ECN accounts with a $500 minimum deposit requirement. This tiered approach allows traders with different capital levels to access appropriate execution models. Specific details regarding spread differentials and commission structures between account types are not comprehensively disclosed in available materials.

Trading Instruments: Access to 94 different trading instruments covers major and minor currency pairs, commodity CFDs, precious metals, and additional derivative products. This selection provides reasonable diversification opportunities for retail traders. The specific breakdown of instruments across categories requires further verification through direct broker contact.

Platform Technology: Support for both MT4 and MT5 ensures compatibility with popular trading strategies and expert advisors. The platforms are available across desktop, web-based, and mobile formats. Particular user satisfaction has been noted for the mobile application experience according to trader feedback.

Cost Structure: Specific information regarding spreads, commissions, overnight financing charges, and other trading costs requires direct inquiry with the broker. Comprehensive fee schedules are not readily available in public materials. This lack of transparency represents a significant consideration for cost-conscious traders in this anzo capital review.

Operational Limitations: Geographic restrictions, maximum leverage ratios, and specific terms of service details are not comprehensively outlined in available public information. Potential clients must verify these critical details directly with the broker before account opening.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

Account Type Diversity and Structure

Anzo Capital's account structure provides reasonable flexibility through its STP and ECN offerings. The $100 minimum deposit for STP accounts positions the broker competitively for entry-level traders. The $500 ECN minimum remains accessible for intermediate traders seeking potentially better execution conditions. However, the lack of detailed information regarding the specific differences between these account types beyond minimum deposits creates uncertainty for traders attempting to make informed decisions.

The absence of clearly disclosed leverage ratios represents a significant transparency gap that impacts the overall account conditions assessment. Modern traders expect comprehensive information about maximum leverage, margin requirements, and risk management parameters before committing to a trading relationship. According to trader feedback, this information opacity has created frustration among potential clients seeking to compare Anzo Capital's offerings with more transparent competitors.

The account opening process details are not comprehensively outlined in available materials, though industry standards suggest online application procedures. The lack of information regarding Islamic account availability, professional trader classifications, or specialized account features limits the broker's appeal to diverse trader segments. This anzo capital review finds that while basic account access is reasonably structured, the overall transparency and feature set require improvement to meet contemporary broker standards.

Competitive Positioning and User Experience

Compared to industry peers, Anzo Capital's minimum deposit requirements are competitive, particularly for the STP account tier. However, without clear commission structures, spread information, or leverage details, traders cannot effectively evaluate the true cost of trading with the broker. User ratings of 3/5 stars reflect moderate satisfaction levels. This suggests that while basic account access is functional, the overall value proposition may not meet trader expectations for transparency and comprehensive service delivery.

Trading Instrument Diversity and Quality

Anzo Capital's offering of 94 tradeable instruments provides solid diversification opportunities across major asset classes. The selection spans foreign exchange pairs, CFD products, commodities, and precious metals. This gives traders access to various market sectors and trading strategies. This breadth of instruments supports portfolio diversification and allows traders to pursue different market opportunities within a single account structure.

However, the quality of execution and liquidity for these instruments remains unclear due to limited disclosure about liquidity providers, average spreads, and execution statistics. Professional traders typically require detailed information about market depth, typical slippage levels, and execution speed metrics to evaluate whether a broker's instrument offering meets their trading requirements. The absence of this technical information limits the ability to fully assess the practical utility of the 94 available instruments.

Research and Educational Resources

Available information does not provide comprehensive details about research capabilities, market analysis resources, or educational materials offered by Anzo Capital. Modern traders increasingly expect brokers to provide market commentary, technical analysis, economic calendars, and educational content to support trading decisions. The lack of detailed information about these value-added services suggests either limited offerings in this area or insufficient marketing of available resources.

Technology and Automation Support

Support for MT4 and MT5 platforms ensures access to extensive automated trading capabilities, expert advisors, and third-party tools that enhance the trading experience. These platforms provide robust charting, technical analysis, and strategy development capabilities that partially compensate for any limitations in proprietary research tools. The positive user feedback regarding mobile application functionality indicates competent technology implementation. Comprehensive platform performance data would strengthen this assessment.

Customer Service and Support Analysis (6/10)

Service Channel Availability and Accessibility

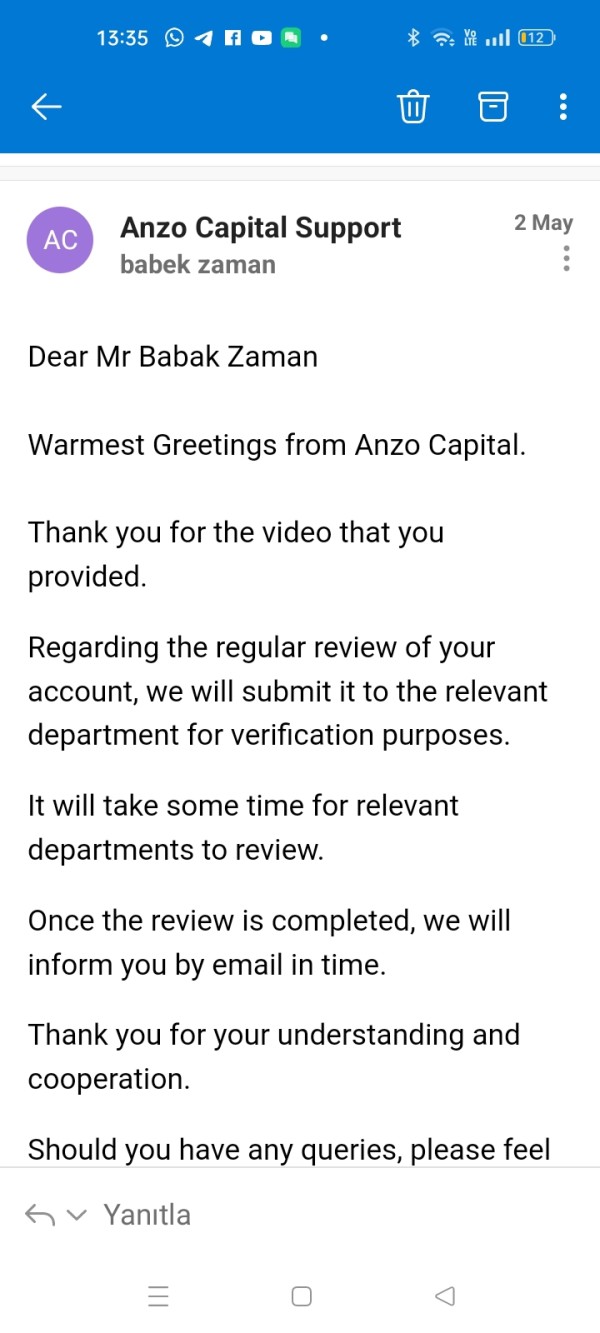

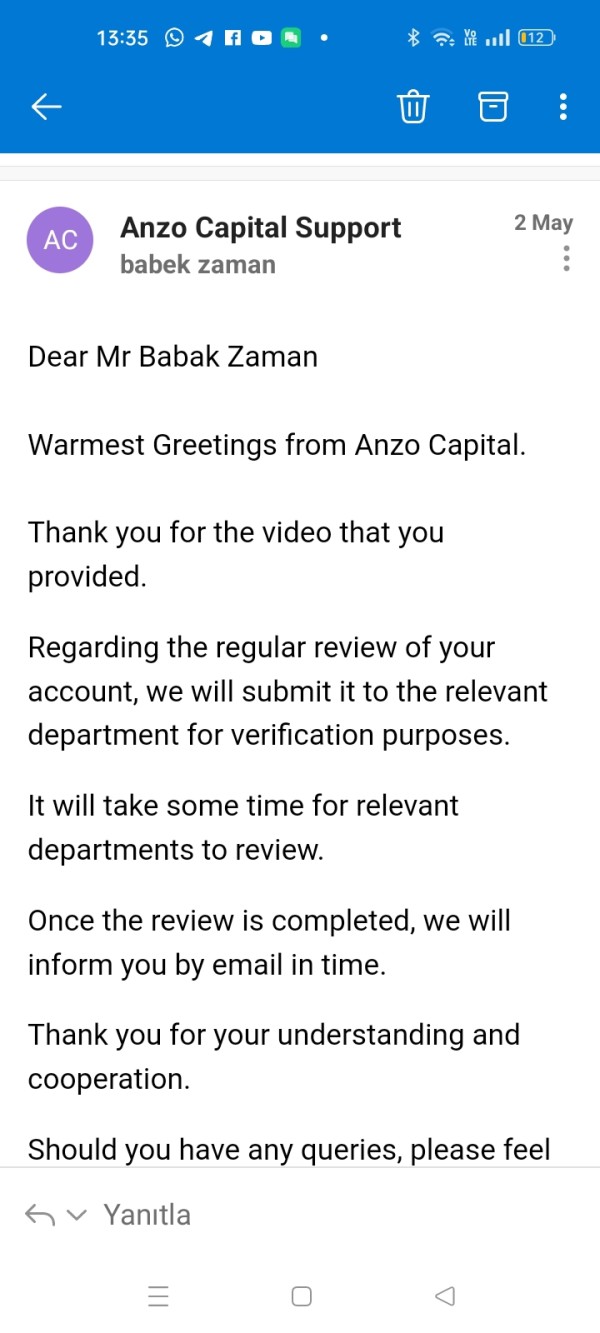

Specific information regarding customer service channels, availability hours, and response time commitments is not comprehensively detailed in available materials. Modern traders expect multiple contact methods including live chat, email, phone support, and potentially social media engagement. The absence of clear service level commitments or detailed contact information creates uncertainty about the quality and accessibility of customer support services.

Service Quality and User Satisfaction

Available user feedback does not provide detailed commentary on customer service experiences, response times, or problem resolution effectiveness. The moderate user satisfaction rating of 3/5 stars may reflect service quality issues. Without specific feedback, it's difficult to identify particular strengths or weaknesses in the customer support operation. Industry standards suggest that responsive, knowledgeable customer service is essential for trader satisfaction, particularly for newer traders requiring guidance.

Multilingual Support and Global Service

Information about language support capabilities and regional service variations is not available in current materials. Given Anzo Capital's international operations across multiple jurisdictions, comprehensive language support would be expected to serve diverse client bases effectively. The lack of detailed information about service localization may indicate limitations in global service delivery capabilities.

Technical Support and Platform Assistance

With MT4 and MT5 platform offerings, traders require reliable technical support for platform-related issues, account access problems, and trading execution concerns. The absence of detailed information about technical support capabilities, including availability hours and expertise levels, represents a significant information gap. Potential clients need this information when evaluating the broker's service infrastructure.

Trading Experience Analysis (7/10)

Platform Performance and Reliability

User feedback highlighting satisfaction with the mobile application suggests competent platform implementation and user interface design. The support for both MT4 and MT5 platforms provides traders with proven, stable trading environments that have demonstrated reliability across the industry. However, specific performance metrics such as uptime statistics, execution speeds, and system stability data are not available in current materials.

Order Execution Quality and Market Access

The broker's STP and ECN account structures suggest different execution models that should provide varying levels of market access and execution quality. However, without detailed information about slippage statistics, requote frequency, or execution speed metrics, traders cannot effectively evaluate the practical quality of order execution. According to industry analysis, execution quality represents one of the most critical factors in trader satisfaction. This makes this information gap particularly significant.

Trading Environment and Market Conditions

Information about typical spread ranges, market depth, and trading condition variations during different market sessions is not comprehensively available. Professional traders require detailed understanding of trading costs and market access quality to evaluate whether a broker's environment suits their trading strategies. The lack of transparent cost disclosure limits traders' ability to accurately assess the total cost of trading with Anzo Capital.

Mobile and Multi-Platform Experience

The positive user feedback regarding mobile application functionality represents a significant strength in the overall trading experience assessment. Mobile trading capabilities are increasingly important for modern traders who require flexibility and constant market access. The availability of desktop, web, and mobile platforms provides comprehensive access options. Specific feature comparisons across platforms would enhance this evaluation in our anzo capital review.

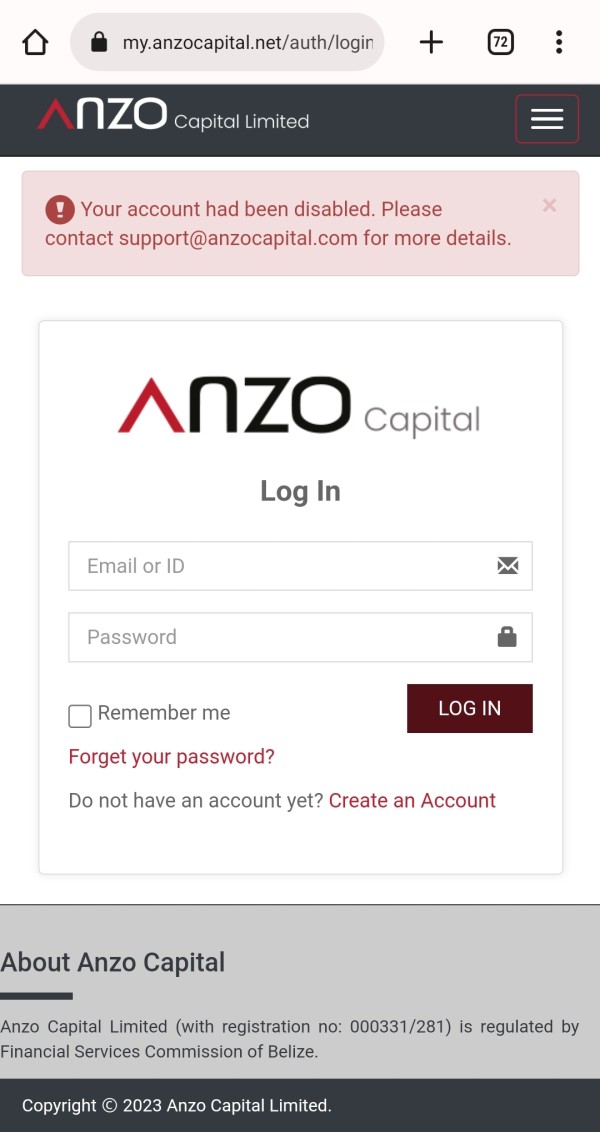

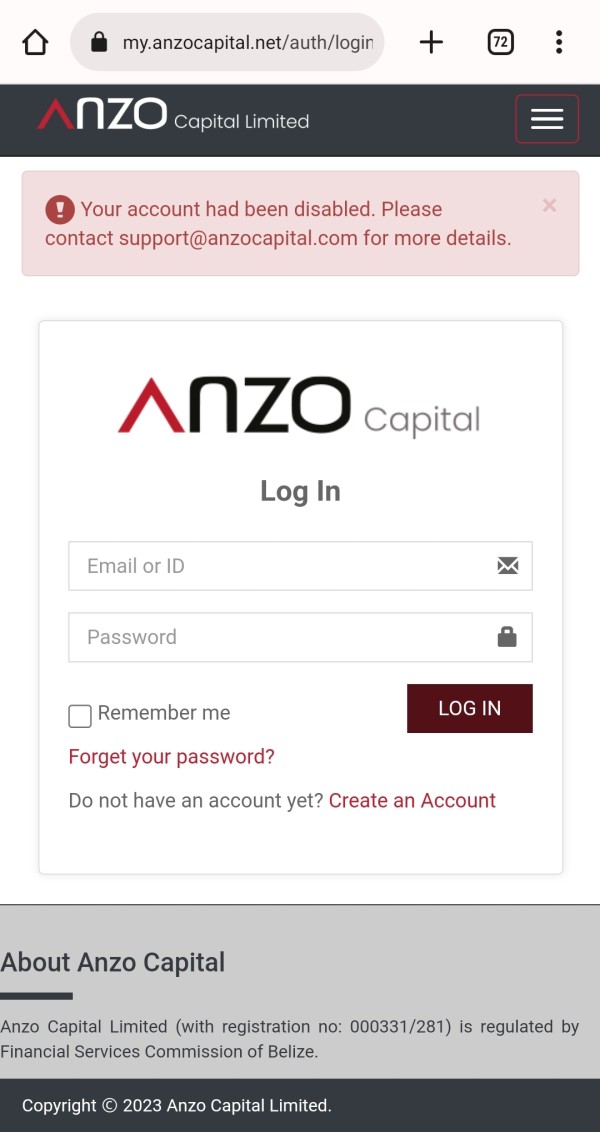

Trust and Security Analysis (6/10)

Regulatory Compliance and Oversight

Anzo Capital's regulation by the International Financial Services Commission (IFSC) under license number IFSC/60/482/TS/19 provides basic regulatory oversight and compliance framework. However, IFSC regulation may not offer the same level of investor protection and operational oversight as tier-one regulatory frameworks such as FCA, ASIC, or CySEC. Traders should understand the specific protections and compensation schemes available under IFSC jurisdiction.

Client Fund Protection and Security Measures

According to available information, client funds are held in segregated accounts, which represents a fundamental security measure that protects trader capital from operational risks. This segregation ensures that client funds remain separate from company operational capital. This provides basic protection in case of business difficulties. However, detailed information about the specific banks holding these funds, insurance coverage, or additional security measures is not readily available.

Corporate Transparency and Governance

Limited information is available regarding company management, corporate structure, or governance practices. Modern traders increasingly expect comprehensive disclosure about company leadership, ownership structure, and business operations to evaluate the stability and reliability of their chosen broker. The absence of detailed corporate information may concern traders seeking maximum transparency in their broker relationships.

Industry Reputation and Track Record

With operations since 2015, Anzo Capital has maintained continuous business operations for nearly a decade, suggesting basic operational stability. However, information about industry awards, third-party recognition, or independent assessments of the company's reputation is not available in current materials. The moderate user satisfaction ratings suggest adequate but not exceptional service delivery that has maintained client relationships. The company has not achieved standout industry recognition.

User Experience Analysis (6/10)

Overall Satisfaction and User Feedback

The 3/5 star user rating reflects moderate satisfaction levels that suggest functional but not exceptional service delivery. This rating indicates that while basic trading needs are being met, there may be opportunities for improvement in service quality, transparency, or feature offerings. User feedback specifically highlights positive experiences with the mobile application. This suggests competent technology implementation in this critical area.

Interface Design and Platform Usability

Positive feedback regarding the mobile application indicates successful user interface design and functionality implementation. The use of industry-standard MT4 and MT5 platforms ensures familiar trading environments for experienced traders while providing comprehensive functionality for strategy development and market analysis. However, detailed user feedback about platform customization, ease of use, or specific feature satisfaction is limited in available materials.

Account Management and Operational Efficiency

Information about account opening procedures, verification processes, and ongoing account management efficiency is not comprehensively detailed in available materials. Modern traders expect streamlined onboarding, efficient document verification, and responsive account management services. The absence of specific information about these operational aspects limits the ability to fully assess the user experience quality.

Deposit and Withdrawal Experience

Detailed information about funding methods, processing times, fees, and withdrawal procedures is not available in current materials. Efficient, cost-effective funding operations represent critical components of the overall user experience, particularly for active traders requiring regular account management. The lack of transparent information about financial operations may concern traders seeking predictable, efficient account funding processes.

Common User Concerns and Feedback Patterns

Available materials do not provide comprehensive analysis of common user complaints, recurring issues, or systematic feedback patterns that could inform potential clients about typical user experiences. Industry best practices suggest that transparent handling of user feedback and continuous service improvement based on client input are essential. These practices are necessary for maintaining competitive service quality in the modern brokerage environment.

Conclusion

This comprehensive anzo capital review reveals a broker that maintains regulatory compliance and provides basic trading services but falls short of contemporary transparency and disclosure standards. While Anzo Capital offers legitimate trading access through established platforms and maintains IFSC regulatory oversight, the lack of detailed information about costs, leverage, and service quality creates significant evaluation challenges for potential clients.

The broker appears most suitable for beginner to intermediate traders who prioritize regulatory compliance and basic platform functionality over comprehensive service transparency. The positive mobile application feedback and diverse instrument selection represent genuine strengths. The moderate user satisfaction ratings suggest adequate but unremarkable service delivery.

Primary advantages include the well-received mobile trading experience, access to 94 trading instruments, regulatory compliance, and segregated client fund protection. Key limitations encompass insufficient cost transparency, limited disclosure about service quality metrics, and absence of comprehensive educational or research resources. Potential clients should conduct direct broker consultation to obtain critical information about trading costs, leverage options, and service terms before making account opening decisions.