Regarding the legitimacy of Anzo Capital forex brokers, it provides ASIC, CMA and WikiBit, (also has a graphic survey regarding security).

Is Anzo Capital safe?

Pros

Cons

Is Anzo Capital markets regulated?

The regulatory license is the strongest proof.

ASIC Inst Deriv Trading License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Inst Deriv Trading License (STP)

Licensed Entity:

ANZO CAPITAL (AUST) PTY LTD

Effective Date: Change Record

2010-09-22Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

L 9 55 CLARENCE ST SYDNEY NSW 2000Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

CMA Forex Execution License (STP)

The Capital Markets Authority

The Capital Markets Authority

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

ANZO CAPITAL LIMITED

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.anzocapital.com/enExpiration Time:

--Address of Licensed Institution:

P.O Box 1043-00100 NairobiPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Anzo Capital A Scam?

Introduction

Anzo Capital is a forex and CFD broker that has positioned itself in the competitive landscape of online trading. Established in 2015, the broker claims to provide a range of trading options, including forex, commodities, and indices, while promising a user-friendly trading experience through popular platforms like MetaTrader 4 and 5. However, with the proliferation of online trading scams, it is crucial for traders to thoroughly evaluate the credibility and reliability of brokers before committing their funds. This article aims to provide an objective analysis of Anzo Capital's legitimacy by examining its regulatory status, company background, trading conditions, client fund safety, and user experiences. The assessment draws on multiple credible sources and user reviews to present a comprehensive overview of Anzo Capital's operations.

Regulation and Legitimacy

The regulatory framework governing a forex broker is a critical factor that determines its safety and legitimacy. Anzo Capital operates under the oversight of the International Financial Services Commission (IFSC) of Belize and the Financial Services Authority (FSA) of St. Vincent and the Grenadines. However, both of these regulatory bodies are often categorized as tier-3 regulators, which means they impose less stringent requirements compared to more recognized authorities like the FCA in the UK or ASIC in Australia.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| IFSC (Belize) | 000331/469 | Belize | Verified |

| FSA (SVG) | 308 LLC 2020 | St. Vincent | Verified |

The quality of regulation is paramount, as it ensures that brokers adhere to strict operational standards, including the segregation of client funds and participation in investor protection schemes. Anzo Capital's tier-3 regulation raises concerns, as these jurisdictions are known for their lax oversight, which may expose traders to higher risks. Historical compliance records are also essential; while there are no significant regulatory infractions reported for Anzo Capital, the lack of robust oversight can lead to potential risks for traders.

Company Background Investigation

Anzo Capital Limited was founded in 2015 and has since sought to establish itself as a reputable player in the forex market. The company is registered in Belize, a jurisdiction known for its favorable conditions for offshore brokers. Anzo Capital claims to prioritize client security and transparency, but the effectiveness of these claims is often scrutinized.

The management team behind Anzo Capital consists of experienced professionals from the financial industry. However, detailed information about their qualifications and past experiences is not readily available, which raises transparency concerns. A broker's transparency in disclosing information about its ownership and management is vital for building trust with clients.

Overall, while Anzo Capital presents itself as a well-capitalized firm, the lack of detailed disclosures about its management and operational history may lead potential clients to question its integrity and reliability.

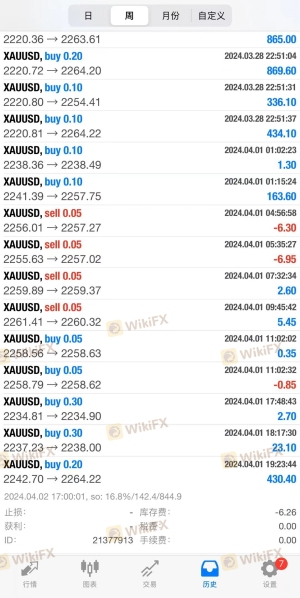

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value proposition. Anzo Capital provides two types of accounts: STP (Straight-Through Processing) and ECN (Electronic Communication Network). The minimum deposit for an STP account is $100, while an ECN account requires a minimum deposit of $500.

The fee structure for Anzo Capital appears competitive at first glance, but a closer examination reveals potential drawbacks. The spreads for major currency pairs can be higher than industry averages, particularly for the STP account, which may deter cost-sensitive traders.

| Fee Type | Anzo Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.6 - 2.2 pips | 1.0 - 1.5 pips |

| Commission Model | $0 (STP), $4 (ECN) | $3 - $5 (ECN) |

| Overnight Interest Range | -6.35 to 2.75 USD | Varies by broker |

The commission structure is relatively straightforward, with the STP account having no commission and the ECN account charging $4 per lot. However, traders have reported that spreads can be wider during periods of high volatility, which may not be adequately disclosed upfront.

Overall, while Anzo Capital offers a variety of trading conditions, the potential for higher costs and lack of clarity surrounding fees may pose challenges for traders seeking cost-effective options.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Anzo Capital claims to implement several measures to ensure the protection of client deposits. Notably, the broker maintains segregated accounts, which means that client funds are kept separate from the company's operational funds. This practice is essential for safeguarding investors' capital in case of financial difficulties faced by the broker.

Additionally, Anzo Capital offers negative balance protection, ensuring that clients cannot lose more than their deposited funds. This feature is particularly important in the volatile forex market, where sudden price swings can lead to significant losses.

However, there have been no significant incidents reported regarding fund safety or security breaches at Anzo Capital. Despite this, the offshore nature of its regulation raises questions about the effectiveness of these safety measures, as offshore jurisdictions may lack the stringent enforcement mechanisms found in more regulated environments.

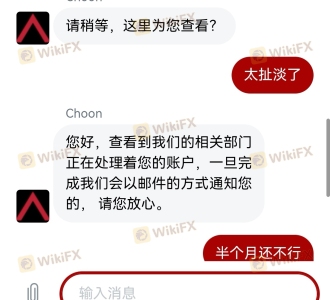

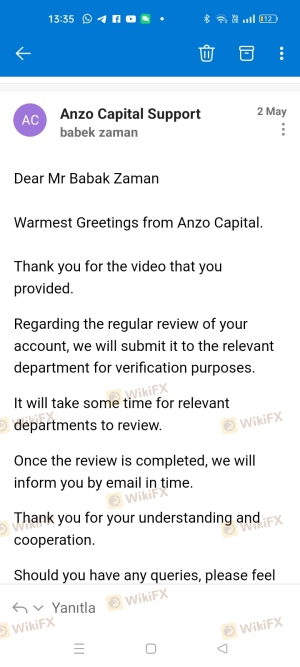

Customer Experience and Complaints

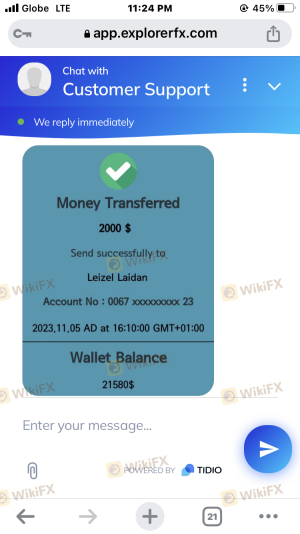

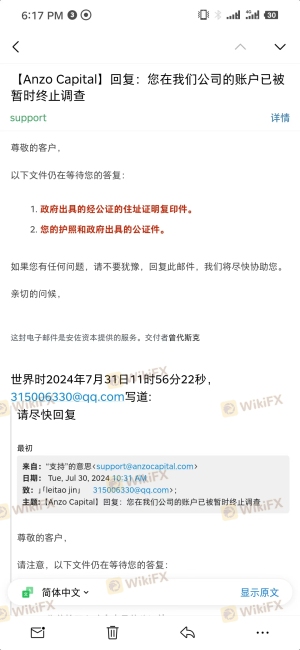

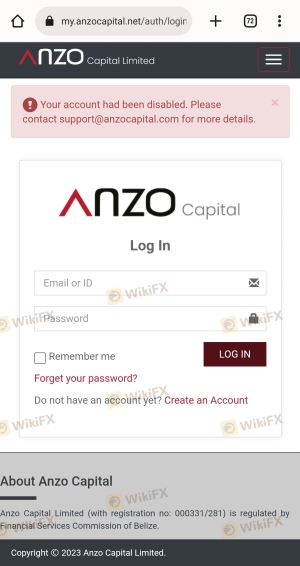

Analyzing customer feedback and experiences is crucial for understanding the operational reality of any broker. Reviews of Anzo Capital reveal a mixed bag of experiences. While some users report satisfactory trading conditions and timely withdrawals, others express frustration over withdrawal delays and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| High Spreads | Medium | Minimal Acknowledgment |

| Account Closure Without Notice | High | No Clear Explanation |

Common complaints include issues related to withdrawal processes, with some traders reporting that their accounts were closed abruptly after requesting withdrawals. This pattern raises red flags about the broker's reliability and operational integrity.

One user shared their experience of being unable to withdraw funds after a series of successful trades, only to face account closure without prior notice. Such incidents highlight the importance of due diligence when selecting a broker, as they can significantly impact a trader's experience.

Platform and Trade Execution

Anzo Capital offers its clients access to the widely used MetaTrader 4 and 5 platforms, which are known for their robust features and user-friendly interfaces. However, the performance of the trading platform, including order execution speed and slippage, is often a critical factor for traders.

Feedback regarding Anzo Capital's execution quality is varied. While some users report satisfactory execution speeds, others have noted instances of slippage and rejected orders during high volatility. This inconsistency can be detrimental, particularly for scalpers and day traders who rely on precise execution.

Overall, while the trading platforms are reputable, the mixed feedback on execution quality indicates that potential clients should be cautious and consider their trading strategies when evaluating Anzo Capital.

Risk Assessment

Using Anzo Capital comes with inherent risks that traders should be aware of. The combination of offshore regulation, mixed customer feedback, and potential issues with withdrawal processes contributes to a higher risk profile for this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation lacks stringent oversight. |

| Financial Risk | Medium | Potential for manipulation and poor execution. |

| Operational Risk | High | Complaints about withdrawal issues and account closures. |

To mitigate these risks, traders are advised to conduct thorough research, start with smaller deposits, and consider using demo accounts to assess the broker's performance before committing significant capital.

Conclusion and Recommendations

In conclusion, while Anzo Capital presents itself as a legitimate broker, several factors raise concerns about its reliability and safety. The lack of strong regulatory oversight, mixed customer experiences, and potential issues with fund withdrawals suggest that traders should exercise caution when considering this broker.

For traders seeking a more secure trading environment, it is advisable to consider brokers with robust regulatory frameworks, such as those regulated by the FCA or ASIC. Alternatives like IC Markets, Pepperstone, and OANDA offer more transparency and investor protection, making them safer options for forex trading.

In summary, while Anzo Capital may provide certain trading opportunities, the associated risks and concerns warrant careful consideration before proceeding with any investments.

Is Anzo Capital a scam, or is it legit?

The latest exposure and evaluation content of Anzo Capital brokers.

Anzo Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Anzo Capital latest industry rating score is 6.20, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.20 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.