Seaprime 2025 Review: Everything You Need to Know

Executive Summary

This seaprime review looks at a multi-asset broker that started in 2022. The company offers trading services for different financial tools like CFDs, commodities, and cryptocurrencies. Based on information from many sources, Seaprime (also called Seaprimecapitals LLC) says it's a global financial service provider that helps international traders find different trading chances.

WikiFX monitoring data shows that Seaprimecapitals has received 8 positive user reviews. These reviews point out key strengths like fast trade execution, quick withdrawal processing, and helpful client service. The broker works as an unregulated company, which gives both chances for flexible trading conditions and possible worries about regulatory oversight.

The platform seems to target traders who want CFD trading, cryptocurrency markets, and commodity investments. User feedback shows people are happy with execution speeds and withdrawal efficiency, but the lack of complete regulatory framework may limit appeal to careful investors. The broker's transparency claims and multi-asset approach show an attempt to serve different trading preferences within the retail trading community.

Important Disclaimer

Risk Warning: Seaprime operates as an unregulated broker, which may present significant risks regarding fund security, transparency, and regulatory protection. Traders should be very careful when thinking about unregulated financial service providers, especially regarding capital protection and dispute resolution systems.

This review is based only on publicly available information and user reports found online. The analysis has not been checked through direct trading experience or independent regulatory verification. Potential clients should do thorough research and consider talking with financial advisors before working with any unregulated trading platform.

Overall Rating Framework

Broker Overview

Seaprimecapitals LLC started in the financial services sector in 2022. The company has positioned itself as a multi-asset broker with global goals. According to company information, the firm says it has been "one of the leading global financial service providers" since it started, though this claim needs careful thought given its recent establishment and unregulated status.

The broker's business model focuses on giving access to CFDs, commodities, and cryptocurrency markets. Seaprimecapitals LLC claims to serve traders worldwide while keeping what they call "full transparency" in watching economic activities and customer financial transactions. However, the lack of regulatory oversight raises questions about the enforcement and verification of these transparency claims.

This seaprime review finds that the company operates without specific regulatory authorization. This makes it different from traditionally regulated brokers in major financial areas. The firm's approach seems to target traders looking for alternative trading venues, especially those interested in cryptocurrency and CFD markets where regulatory frameworks may vary a lot across jurisdictions.

Regulatory Status: Seaprime operates as an unregulated entity without authorization from major financial regulatory bodies. This status greatly affects the level of consumer protection and regulatory oversight available to clients.

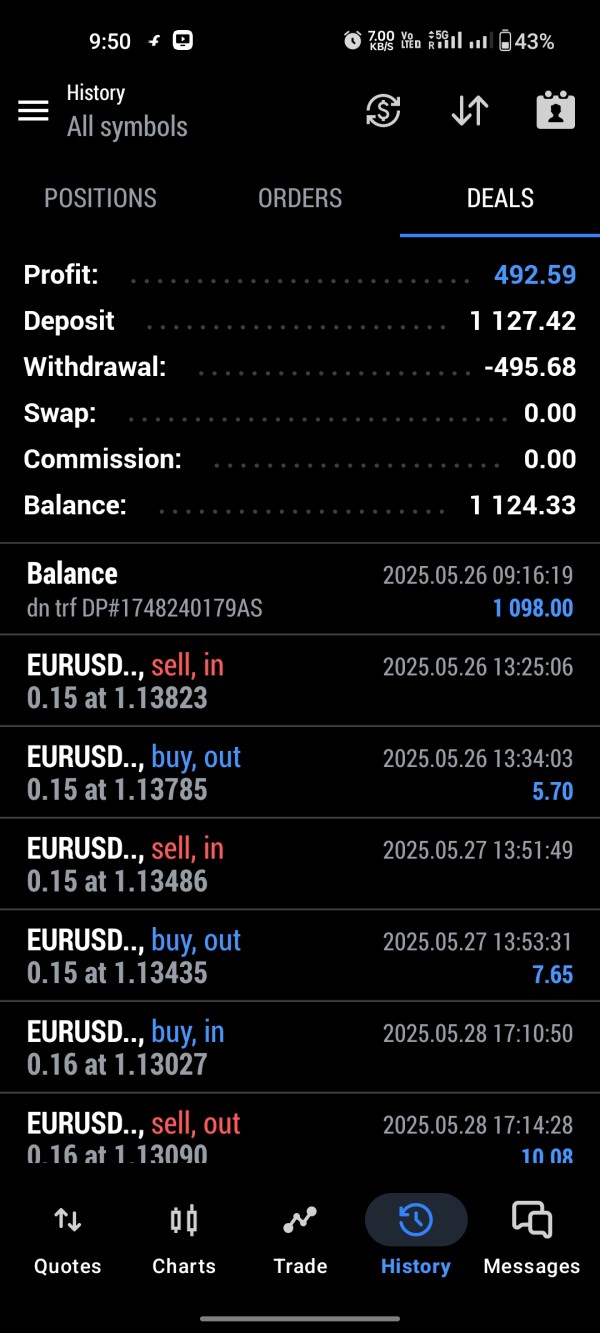

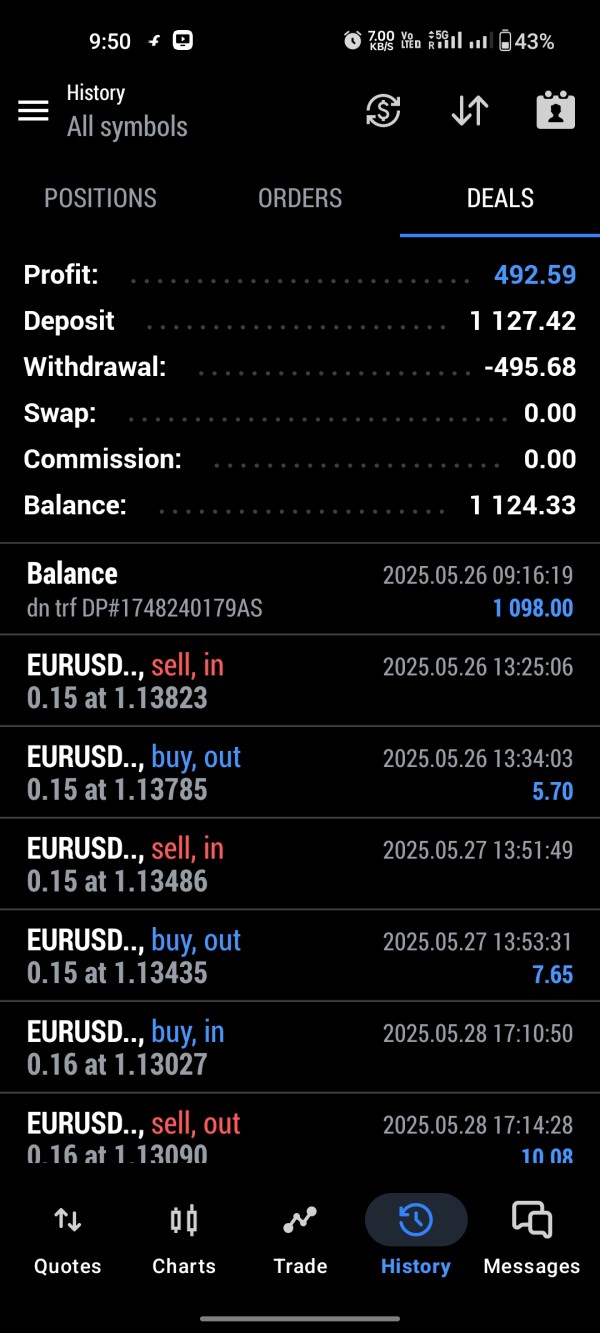

Deposit and Withdrawal Methods: Specific information about accepted payment methods, processing times, and associated fees was not detailed in available sources. However, user reviews highlight fast withdrawal processing as a positive feature.

Minimum Deposit Requirements: Concrete minimum deposit amounts are not specified in available documentation. This may indicate flexible entry requirements or lack of standardized account structures.

Promotional Offers: Information about welcome bonuses, deposit incentives, or promotional trading conditions was not found in the reviewed sources.

Tradeable Assets: The platform provides access to CFDs, commodities, and cryptocurrency markets. This multi-asset approach allows traders to diversify across different market segments within a single platform environment.

Cost Structure: Specific details about spreads, commissions, overnight fees, and other trading costs were not fully outlined in available materials. This limits cost comparison capabilities.

Leverage Options: While not clearly detailed in the sources reviewed, the platform appears to offer leveraged trading consistent with CFD and forex market standards.

Trading Platforms: The specific trading platforms used by Seaprime were not clearly identified in available information. However, references to MetaTrader VPS services suggest potential MT4/MT5 compatibility.

Geographic Restrictions: Specific jurisdictional limitations were not detailed in the reviewed sources. Unregulated brokers typically face restrictions in major regulated markets.

Customer Support Languages: Available support languages and communication channels were not specified in the information sources reviewed for this seaprime review.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

The account conditions evaluation shows significant transparency limitations that affect the overall assessment. Seaprimecapitals does not provide clear information about different account tiers, minimum deposit requirements, or specific account features. This makes it hard for potential clients to make informed decisions about their trading setup.

The absence of detailed fee structures creates uncertainty for traders trying to calculate their potential trading expenses. This includes spread information, commission rates, and other trading costs. This lack of transparency is especially concerning for cost-conscious traders who need to understand the full financial implications of their trading activities.

Account opening procedures, verification requirements, and special account types are not adequately documented in available sources. Islamic accounts for Sharia-compliant trading are also not mentioned. The limited information available suggests a simplified approach to account management, though this cannot be verified without more comprehensive documentation.

User feedback specifically about account conditions was not available in the reviewed sources. This makes it difficult to assess real-world experiences with account setup, management, and any potential issues that may arise during the account lifecycle.

Seaprimecapitals offers access to multiple asset classes including CFDs, commodities, and cryptocurrencies. This provides traders with diversification opportunities across different market segments. However, the specific quality, depth, and sophistication of available trading tools remain unclear from available documentation.

The platform's analytical resources, research capabilities, and market analysis tools are not detailed in the reviewed sources. For traders who rely on comprehensive market research, technical analysis tools, and fundamental analysis resources, this information gap represents a significant limitation. It makes it hard to evaluate the platform's suitability for their trading strategies.

Educational resources are crucial for trader development and platform adoption, but they are not mentioned in available materials. The absence of webinars, tutorials, trading guides, or other educational content may limit the platform's appeal to newer traders. These traders often seek to develop their skills through educational support.

Third-party integrations, API access for algorithmic trading, and advanced order types are not documented in the available information. However, references to MetaTrader VPS services suggest some level of professional trading tool compatibility.

Customer Service and Support Analysis (Score: 7/10)

User reviews highlight "fast client service" as one of Seaprime's notable strengths. This suggests responsive customer support when issues arise. This positive feedback indicates that the broker prioritizes client communication and problem resolution, which is crucial for maintaining trader satisfaction and trust.

However, specific details about support channels, availability hours, and multi-language capabilities are not provided in the reviewed sources. The lack of information about live chat, phone support, email response times, and other communication methods makes assessment difficult. It's hard to assess the comprehensive quality of customer service offerings without this information.

The professional competency of support staff cannot be evaluated based on available information. Their ability to handle complex trading issues and their knowledge of the platform's technical aspects are also unclear. While user feedback is positive, the limited scope of available reviews prevents a comprehensive assessment of support quality across different scenarios.

Response times for different types of inquiries, escalation procedures for complex issues, and dedicated account management services are not documented. These details are missing from the sources reviewed for this evaluation.

Trading Experience Analysis (Score: 7/10)

User feedback consistently highlights fast trade execution as a key strength of the Seaprime platform. This suggests that the broker's technical infrastructure supports efficient order processing. This is particularly important for active traders and those using strategies that require rapid market entry and exit capabilities.

The platform's stability, uptime statistics, and performance during high-volatility market conditions are not specifically documented. However, positive user reviews suggest satisfactory performance under normal trading conditions. The absence of detailed performance metrics limits the ability to assess platform reliability comprehensively.

Fast withdrawals are mentioned as another positive aspect of the trading experience. This indicates efficient back-office operations and payment processing systems. This feature is particularly valued by traders who require quick access to their funds and profits.

Mobile trading capabilities, order execution quality metrics, and platform customization options are not detailed in available sources. Slippage statistics and other performance data would strengthen this assessment. The overall seaprime review indicates positive user experiences, though comprehensive performance data would be helpful.

Trust and Reliability Analysis (Score: 3/10)

The most significant concern in this seaprime review relates to the broker's unregulated status. This fundamentally impacts trust and reliability assessments. Operating without regulatory oversight means clients lack the protection typically provided by financial regulatory authorities, including compensation schemes and regulatory dispute resolution mechanisms.

Fund security measures, segregation of client funds, and third-party auditing practices are not documented in available sources. The absence of this crucial information creates uncertainty about how client deposits are protected and managed. This is a primary concern for any trading relationship.

The company's claims of "full transparency" in monitoring economic activities and customer transactions cannot be independently verified. Without regulatory oversight or third-party auditing confirmation, these claims lack external verification. While these claims suggest good intentions, the lack of external verification limits their credibility.

Industry reputation, regulatory warnings, and third-party assessments are not available in the reviewed sources. This makes it difficult to assess the broker's standing within the broader financial services community.

User Experience Analysis (Score: 6/10)

Available user feedback suggests generally positive experiences with Seaprime's services, particularly regarding execution speed and withdrawal efficiency. However, the limited scope and number of available reviews prevent a comprehensive assessment. It's hard to evaluate user satisfaction across different trader types and usage scenarios.

Platform usability, interface design, and ease of navigation are not specifically addressed in available user feedback. The overall user experience encompasses many factors beyond execution speed, including platform stability, feature accessibility, and learning curve considerations.

Registration and verification processes, account funding procedures, and overall onboarding experience are not detailed in user reviews or company documentation. These elements significantly impact first impressions and initial user satisfaction with any trading platform.

The diversity of user feedback is limited in available sources. This makes it difficult to assess how the platform serves different trader profiles, experience levels, and trading strategies. A more comprehensive user feedback analysis would enhance this evaluation.

Conclusion

This seaprime review reveals a broker with notable strengths in execution speed and withdrawal processing, but significant concerns regarding regulatory oversight and transparency. While user feedback indicates satisfaction with core trading functions, the unregulated status presents substantial risks that potential clients must carefully consider.

Seaprime may appeal to experienced traders comfortable with unregulated environments and seeking fast execution capabilities. This is particularly true for those interested in CFD and cryptocurrency markets. However, the platform is not suitable for traders prioritizing regulatory protection, comprehensive transparency, or detailed cost structures. The limited available information about account conditions, fees, and platform features further complicates the evaluation process for potential clients seeking comprehensive broker comparisons.