Is MORFIN FX safe?

Pros

Cons

Is Morfin FX A Scam?

Introduction

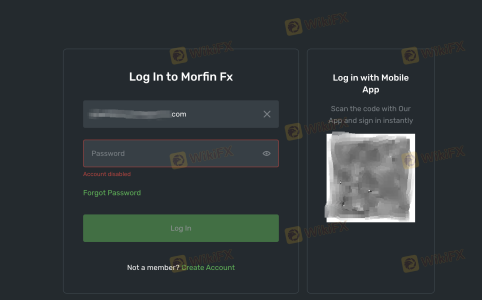

Morfin FX is a forex broker that has emerged in the financial market, offering a range of trading services to retail and institutional clients. Positioned as an offshore entity, Morfin FX claims to provide access to over 100 currency pairs, commodities, cryptocurrencies, and more through the MetaTrader 5 (MT5) platform. However, the rise of unregulated brokers in the forex market necessitates a cautious approach from traders. The potential for fraud and the lack of investor protection in offshore jurisdictions can expose traders to significant risks, making it vital to thoroughly assess the legitimacy and reliability of brokers like Morfin FX.

This article aims to provide an objective analysis of Morfin FX by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and overall risk profile. The assessment draws on multiple sources, including reviews from trusted financial websites, regulatory databases, and user feedback.

Regulation and Legality

The regulatory status of a forex broker is crucial for ensuring the safety and security of traders' funds. A well-regulated broker is subject to oversight by recognized financial authorities, which can offer protections such as segregated accounts and compensation schemes. Morfin FX claims to be registered in Saint Vincent and the Grenadines (SVG) and asserts that it operates under the jurisdiction of the SVG Financial Services Authority (FSA). However, the regulatory environment in SVG is known for its leniency, and the FSA has ceased issuing licenses for forex trading, raising concerns about the legitimacy of Morfin FX's claims.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SVG FSA | 1539 | Saint Vincent and Grenadines | Unverified |

The lack of a credible regulatory framework means that traders using Morfin FX do not have access to the same protections as those trading with brokers regulated by more stringent authorities like the FCA in the UK or ASIC in Australia. This absence of oversight significantly increases the risk of fraud and mismanagement, as there are fewer legal repercussions for unethical practices. Traders should be particularly wary of brokers operating in offshore jurisdictions, as they often lack transparency and accountability.

Company Background Investigation

Morfin FX operates under the ownership of AS Financial Services LLC, registered in Saint Vincent and the Grenadines. However, details regarding the company's history, development, and ownership structure are sparse. The lack of transparency around its establishment year and operational history raises red flags about the broker's credibility.

Furthermore, the management team behind Morfin FX remains largely anonymous, with little information available about their professional backgrounds or experience in the financial industry. A strong management team with relevant expertise is crucial for a broker's reliability, as it can significantly influence the quality of services and customer support. The absence of information about the team's qualifications and experience contributes to the overall opacity of Morfin FX, making it difficult for potential clients to assess the broker's trustworthiness.

Trading Conditions Analysis

Understanding a broker's trading conditions, including fees and spreads, is essential for traders looking to maximize their profitability. Morfin FX offers a variety of trading instruments, including forex, commodities, and cryptocurrencies, but the details surrounding its fee structure remain unclear. The broker does not specify its spreads, commissions, or overnight interest rates, which can be critical in determining trading costs.

| Fee Type | Morfin FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Specified | 1.0 - 1.5 pips |

| Commission Model | Not Specified | $5 - $10 per lot |

| Overnight Interest Range | Not Specified | 0.5% - 2.0% |

The lack of transparency regarding these costs is concerning, as it can lead to unexpected fees that may erode trading profits. Additionally, the absence of clear information about trading conditions can hinder traders' ability to make informed decisions. Traders should always seek brokers that provide clear and detailed information about their fee structures to avoid unpleasant surprises.

Client Fund Security

The security of client funds is paramount when evaluating a forex broker. Morfin FX claims to implement various measures to protect clients' funds; however, detailed information about these measures is lacking. The broker does not provide clarity on whether it offers segregated accounts, which are essential for ensuring that client funds are kept separate from the broker's operational funds.

Moreover, the absence of negative balance protection means that traders could potentially lose more than their initial investment, further increasing the risk associated with trading with Morfin FX. Historically, unregulated brokers have been known to engage in practices that jeopardize client funds, leaving traders vulnerable to financial loss without any recourse.

Customer Experience and Complaints

User feedback is a valuable indicator of a broker's reliability and the quality of its services. Reviews of Morfin FX reveal a mixed bag of experiences, with some users praising the broker's trading platform and customer support, while others express frustration over withdrawal issues and lack of transparency.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Transparency | Medium | Average |

| Customer Support Availability | Medium | Poor |

Common complaints include difficulties in withdrawing funds, with reports of delays and complications that can leave traders feeling trapped. Such issues are particularly alarming, as they highlight potential red flags regarding the broker's operations. The quality of customer support has also been criticized, with users reporting slow response times and inadequate assistance when issues arise.

Platform and Trade Execution

The trading platform offered by Morfin FX is the MetaTrader 5 (MT5), which is widely regarded for its advanced features and user-friendly interface. However, concerns have been raised regarding the platform's stability and performance. Users have reported instances of slippage and order rejections, which can significantly affect trading outcomes.

The quality of trade execution is critical for forex traders, as delays or errors can lead to missed opportunities and financial losses. If a broker exhibits signs of platform manipulation, such as frequent order rejections or unexplained slippage, it can indicate deeper issues with the broker's integrity.

Risk Assessment

Trading with Morfin FX presents several risks that potential clients should consider. The lack of regulation, transparency, and potential issues with fund security contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases fraud risk. |

| Fund Security Risk | High | Lack of segregated accounts and protections. |

| Withdrawal Risk | Medium | Complaints about delays and complications. |

To mitigate these risks, traders should conduct thorough research before committing to any broker, particularly those with unregulated status. Additionally, it is advisable to start with small amounts and to withdraw profits regularly to minimize potential losses.

Conclusion and Recommendations

In summary, Morfin FX raises several red flags that warrant caution. The absence of credible regulation, lack of transparency regarding trading conditions, and mixed customer feedback suggest that this broker may not be a safe choice for traders. While some users report satisfactory experiences, the overall risk profile and potential for issues with fund security and withdrawals make it a broker to approach with caution.

For traders looking for reliable alternatives, it is recommended to consider well-regulated brokers with a proven track record of transparency and customer service. Brokers regulated by authorities such as the FCA, ASIC, or NFA offer greater protections and a more secure trading environment. Always prioritize due diligence and choose brokers that align with your trading needs and risk tolerance.

Is MORFIN FX a scam, or is it legit?

The latest exposure and evaluation content of MORFIN FX brokers.

MORFIN FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MORFIN FX latest industry rating score is 2.03, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.03 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.