Founded in 2023 and headquartered in Kingstown, St. Vincent and the Grenadines, Blue Ocean Financials operates under the name Blue Ocean Financials Limited. While the broker claims to offer a secure trading environment, its unregulated status raises serious questions about the safety of client funds and the legitimacy of its business practices. The lack of a regulatory framework not only poses risks to individuals considering trading through this platform but also casts a shadow over the companys intentions.

Blue Ocean Financials advertises a broad range of trading instruments, including forex, CFDs, stocks, commodities, and cryptocurrencies. The platform asserts that it caters to both casual and experienced traders through a selection of two account types: Classic and Premium. Despite the enticing claims of offering various trading assets and advanced tools, the brokers legitimacy is questionable, with user reports suggesting issues with actual asset availability and execution quality.

Blue Ocean Financials claims to be regulated by the FSA and falsely states membership in the NFA. However, a closer examination reveals that the broker lacks legitimate oversight and operates without valid licensing. This raises significant red flags about the platforms credibility and trustworthiness.

- Check the registration details on the regulatory websites, like the FSA of St. Vincent and the Grenadines.

- Look for reviews on independent platforms to gauge user experiences.

- Review any complaints or warnings documented by financial watchdogs.

Industry Reputation and Summary

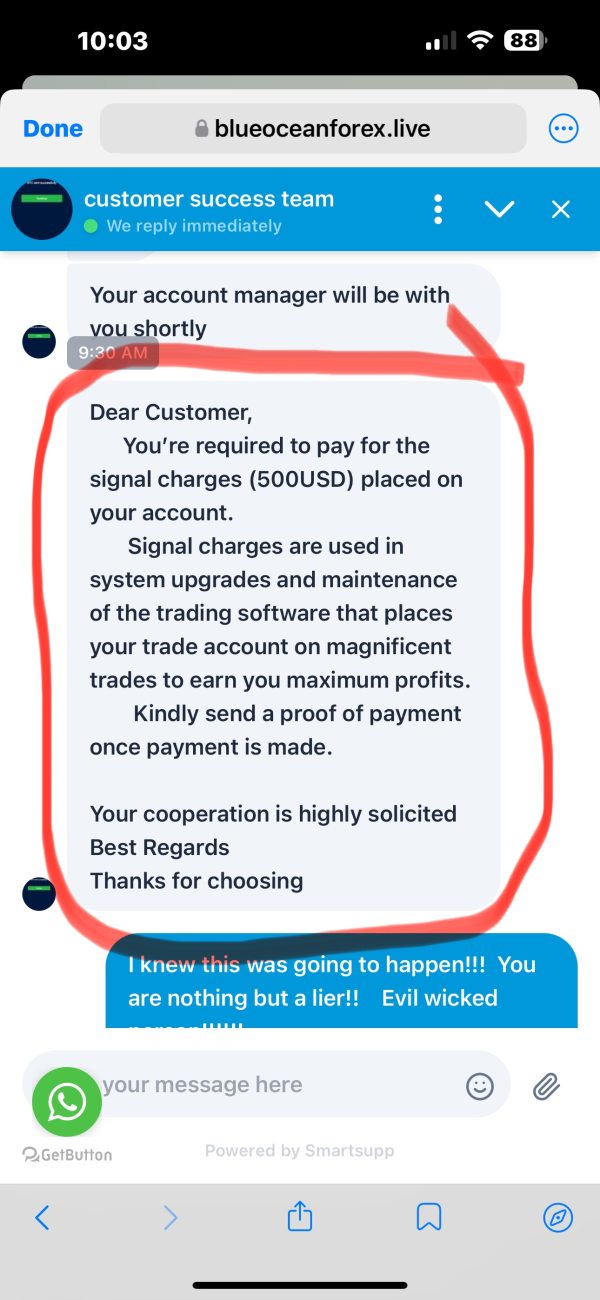

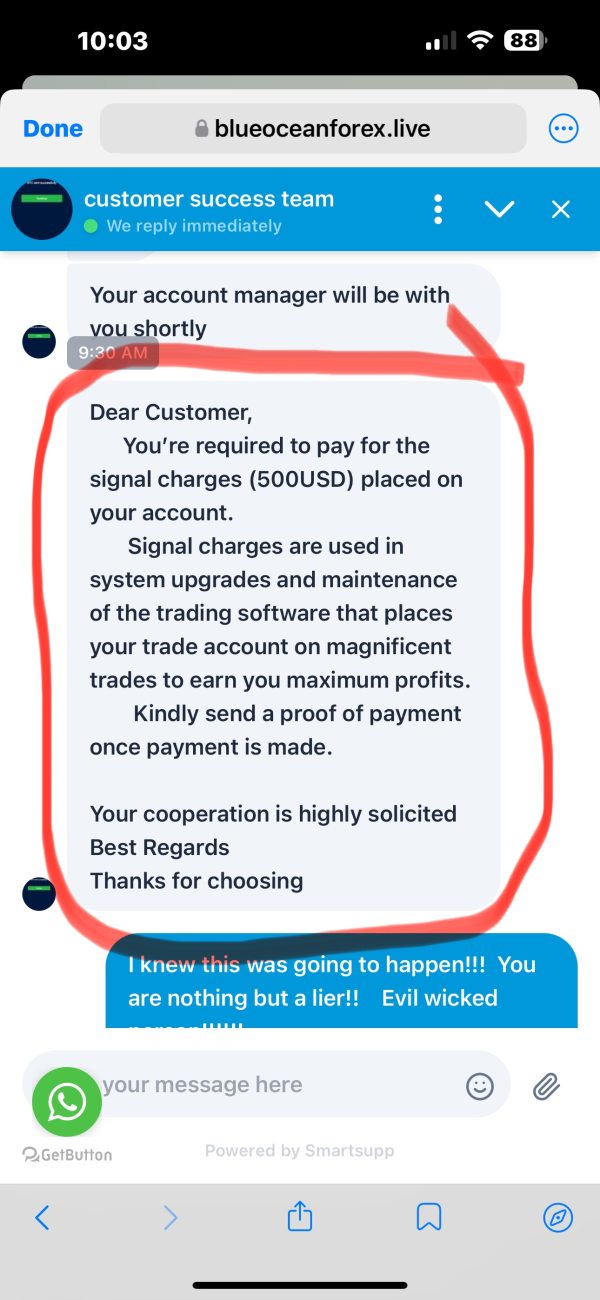

Users have raised concerns over fund safety; notable testimonials cite withdrawal difficulties, and many classify Blue Ocean Financials as a potential scam. As one user succinctly puts it, “Finding a legitimate broker is vital; otherwise, you risk losing your entire investment.”

“Its a mess trying to access my funds, with excuses made at every step.” — Former Client

Trading Costs Analysis

Advantages in Commissions

Blue Ocean Financials offers a cost-effective trading environment, promoting zero commission fees on trades. This model is appealing for cost-conscious traders aiming to maximize returns.

The "Traps" of Non-Trading Fees

However, the low cost of entry comes with potential hidden traps. Users report significant withdrawal fees, particularly a 1% charge on withdrawals through certain methods, creating frustrations for those wanting to access their funds without incurring costs.

“The withdrawal process is a nightmare, they keep taking fees with every request.” — User Review

Cost Structure Summary

While commission-free trading may initially seem attractive, the overall cost structure could lead to unfavorable outcomes for frequent traders. Those who prioritize fee transparency should exercise caution when opting to engage with this broker.

Blue Ocean Financials provides access to two widely recognized trading platforms, MT5 and cTrader, both of which offer a wealth of tools for market analysis and execution.

The platforms are designed to meet different trader needs; however, user experiences indicate potential issues such as slippage and execution delays, which detract from an overall competitive offering.

User feedback leans negative, highlighting usability issues and doubts concerning the brokerages ability to provide a reliable trading environment.

“I thought Id be safe on MT5, but execution kept failing during high volume.” — Disillusioned Trader

User Experience Analysis

Analytical Angle: "Perceptions vs. Reality"

The experience of trading with Blue Ocean Financials often contrasts sharply with expectations due to overwhelming complaints about withdrawal processes, slow responses from customer support, and general dissatisfaction with trading execution.

Positive and Negative Feedback Synopsis

While some traders enjoy the features offered, the overwhelming narrative is dominated by frustrations related to fund withdrawals and customer service responsiveness, leading to growing concern among potential users.

Customer Support Analysis

Support Availability and User Feedback

Blue Ocean Financials claims to provide 24/5 support via email and live chat; however, many user experiences reveal deep shortcomings, identifying slow response times and inefficacies in resolving issues as common themes.

“Reaching out to customer support feels futile; I often get no response.” — Frustrated Customer

Account Conditions Analysis

Accessing Account Types and Conditions

Blue Ocean offers two account types — Classic and Premium — with varying minimum deposit requirements of $100 and $5000, respectively. These accounts are advertised with enticing leverage options, but the lack of regulatory guarantees remains a worrying factor.

Summary of Account Offerings

While the compensating factors like low minimum deposit and high leverage aim to attract diverse traders, the unregulated nature and accompanying risks should be diligently considered when assessing account conditions.

Conclusion

In summary, Blue Ocean Financials presents a tempting trading environment with low costs and diverse assets. However, the lack of true regulatory oversight and concrete evidence of secure fund management present serious risks for potential investors. It is advisable for traders to proceed with caution, conduct thorough research, and consider regulated alternatives to safeguard their investments. Trust should be earned and never taken for granted—especially in the volatile landscape of online trading.

Frequently Asked QuestionsIs Blue Ocean Financials a regulated broker?

No, Blue Ocean Financials is not regulated by any legitimate financial authority.

How can I withdraw my funds from Blue Ocean?

Withdrawal has been reported as problematic, often subject to fees; therefore, full recovery of funds may not be guaranteed.

What should I consider before trading with Blue Ocean?

Research thoroughly and evaluate the risks associated with engaging significantly in unregulated trading platforms.