Regarding the legitimacy of XTrend Speed forex brokers, it provides CYSEC, FSCA and WikiBit, (also has a graphic survey regarding security).

Is XTrend Speed safe?

Pros

Cons

Is XTrend Speed markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Rynat Trading Ltd

Effective Date:

2016-06-30Email Address of Licensed Institution:

info@rynattrading.comSharing Status:

No SharingWebsite of Licensed Institution:

www.rynattrading.com, www.thextrend.com, www.thextrend.eu, www.xtrend.eu, www.xtrendprime.com, www.xtrendprime.euExpiration Time:

--Address of Licensed Institution:

18 Monis Machera Street, 4th Floor, Office 401, 3020, LimassolPhone Number of Licensed Institution:

+357 25 258 020Licensed Institution Certified Documents:

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Rynat Capital (Pty) Ltd

Effective Date:

2007-02-13Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

96 RIVONIA ROAD 4TH FLOORSANDTONGAUTENG2196Phone Number of Licensed Institution:

10 0354261Licensed Institution Certified Documents:

Is XTrend Speed A Scam?

Introduction

XTrend Speed is an online trading platform that has gained popularity among forex traders, particularly for its mobile trading capabilities. Established in 2016 and registered in South Africa, it offers a range of financial instruments including forex, commodities, indices, and shares. However, as with any financial service, traders must exercise caution when selecting a broker. The forex market is rife with scams, and the potential for losing hard-earned money is significant if one does not conduct thorough due diligence. This article aims to provide a comprehensive evaluation of XTrend Speed, examining its regulatory status, company background, trading conditions, customer experiences, and overall safety. The analysis is based on recent reviews, industry reports, and user feedback, ensuring a balanced perspective on whether XTrend Speed is a legitimate trading platform or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in assessing its reliability. XTrend Speed claims to be regulated by the Financial Sector Conduct Authority (FSCA) of South Africa and the Cyprus Securities and Exchange Commission (CySEC). However, the legitimacy of these claims warrants scrutiny.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSCA | 23497 | South Africa | Active |

| CySEC | 303/16 | Cyprus | Suspicious Clone |

The FSCA is considered a tier-2 regulator, which means it has less stringent requirements compared to tier-1 regulators like the FCA in the UK or ASIC in Australia. While the FSCA provides some level of oversight, it does not enforce strict capital requirements or investor compensation schemes. On the other hand, the CySEC license has been flagged as suspicious, raising concerns about its validity. This discrepancy in regulatory status could potentially expose traders to higher risks, especially if issues arise during trading or withdrawal processes.

Company Background Investigation

XTrend Speed is operated by Ryn at Capital (Pty) Ltd, a company that has been in business since 2016. However, the lack of transparency regarding its ownership structure and management team raises questions about its credibility. The company claims to have a presence in multiple countries, including South Africa and Cyprus, but there is limited information available about its operational history or financial stability.

The management team's qualifications and experience are crucial in determining the broker's reliability. Unfortunately, details about the individuals behind XTrend Speed are scarce, which can be a red flag for potential investors. A reputable broker typically shares information about its leadership and their industry experience, demonstrating accountability and professionalism. The opacity surrounding XTrend Speed's management could lead to concerns about its operational integrity and long-term viability.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions, including fees and spreads, is essential. XTrend Speed offers a competitive trading environment, but potential traders should be aware of its fee structure.

| Fee Type | XTrend Speed | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.4 pips | 1.0 pips |

| Commission Model | None | $5 per lot |

| Overnight Interest Range | Varies | Varies |

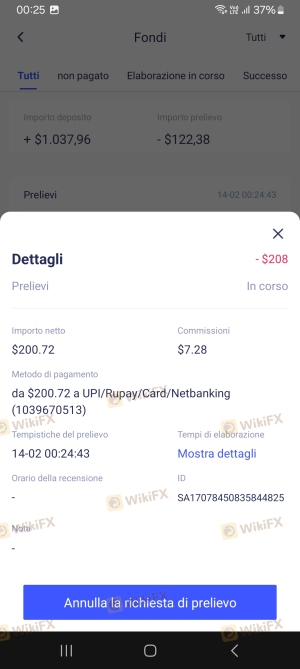

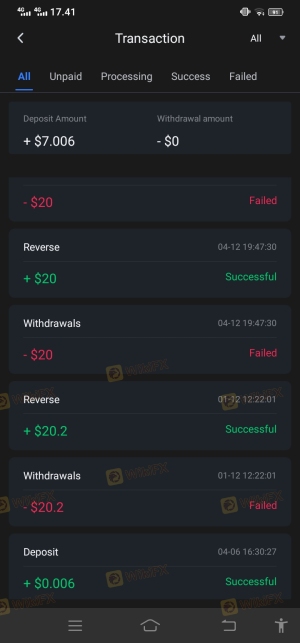

The spreads offered by XTrend Speed are relatively low compared to the industry average, which is a positive aspect for traders. However, the absence of a clear commission structure and the potential for hidden fees during withdrawals should be a cause for concern. Reports indicate that withdrawal fees can reach up to 3.5%, which is higher than the industry norm. Such fees can significantly impact profitability, especially for frequent traders.

Customer Funds Security

The security of client funds is paramount in the forex trading industry. XTrend Speed claims to maintain segregated accounts for client funds, which is a standard practice among reputable brokers. This means that client funds are kept separate from the broker's operational funds, providing an added layer of protection.

Additionally, XTrend Speed states that client assets are safeguarded by South Africa's largest insurance company, NNAC. This insurance coverage is a positive indicator of the broker's commitment to fund security. However, the absence of a compensation scheme for clients in the event of broker insolvency is concerning. Traders should be aware that if XTrend Speed faces financial difficulties, they may not have a safety net to recover their funds.

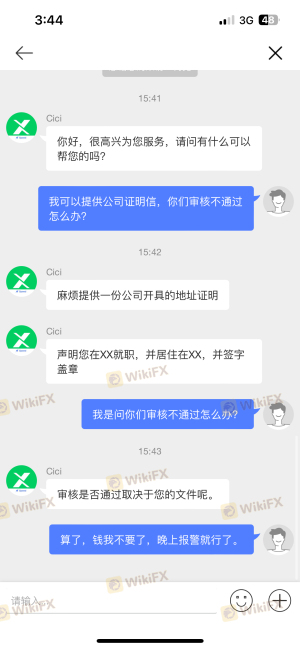

Customer Experience and Complaints

Customer feedback is invaluable when assessing the reliability of a broker. Reviews for XTrend Speed are mixed, with some users praising the platform's ease of use and mobile functionality, while others have raised serious concerns regarding withdrawal processes and customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow and Unresponsive |

| Customer Support | Medium | Limited Availability |

Common complaints include difficulties in withdrawing funds, with several users reporting that their withdrawal requests were delayed or denied without clear explanations. The company's customer support has also been criticized for being unresponsive, which can be frustrating for traders facing urgent issues. These complaints highlight potential operational weaknesses that traders should consider before engaging with XTrend Speed.

Platform and Trade Execution

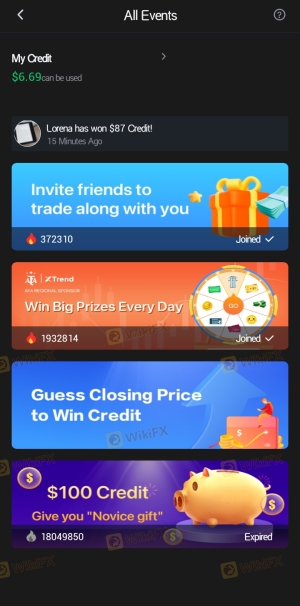

XTrend Speed offers a proprietary trading platform, Strader, alongside the widely-used MetaTrader 4 (MT4). The performance of a trading platform is crucial for successful trading, as it affects order execution speed and overall user experience.

Many users have reported satisfactory experiences with the Strader platform, noting its user-friendly interface and mobile compatibility. However, concerns about order execution quality, such as slippage and rejections, have also been voiced. A broker's ability to execute trades effectively can significantly impact a trader's profitability, making this an important factor to evaluate.

Risk Assessment

Engaging with XTrend Speed comes with inherent risks that traders should carefully consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Tier-2 regulation with potential compliance issues. |

| Financial Risk | High | Reports of withdrawal issues may indicate financial instability. |

| Operational Risk | Medium | Customer support and responsiveness may affect trading experience. |

To mitigate these risks, potential traders should conduct thorough research, consider starting with a small investment, and remain vigilant about the broker's performance and any regulatory changes.

Conclusion and Recommendations

In conclusion, while XTrend Speed presents itself as a regulated broker with competitive trading conditions, there are significant concerns regarding its regulatory legitimacy, customer service, and withdrawal processes. The combination of a tier-2 regulatory framework and reports of customer complaints raises questions about its reliability.

For traders considering XTrend Speed, it is crucial to weigh the potential benefits against the risks. Those who prioritize regulatory safety and robust customer support may want to explore alternative brokers with stronger reputations, such as those regulated by tier-1 authorities like the FCA or ASIC. Ultimately, conducting thorough research and remaining cautious is essential for anyone looking to trade with XTrend Speed or any other broker in the volatile forex market.

Is XTrend Speed a scam, or is it legit?

The latest exposure and evaluation content of XTrend Speed brokers.

XTrend Speed Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

XTrend Speed latest industry rating score is 1.70, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.70 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.