XTrend Speed 2025 Review: Everything You Need to Know

Executive Summary

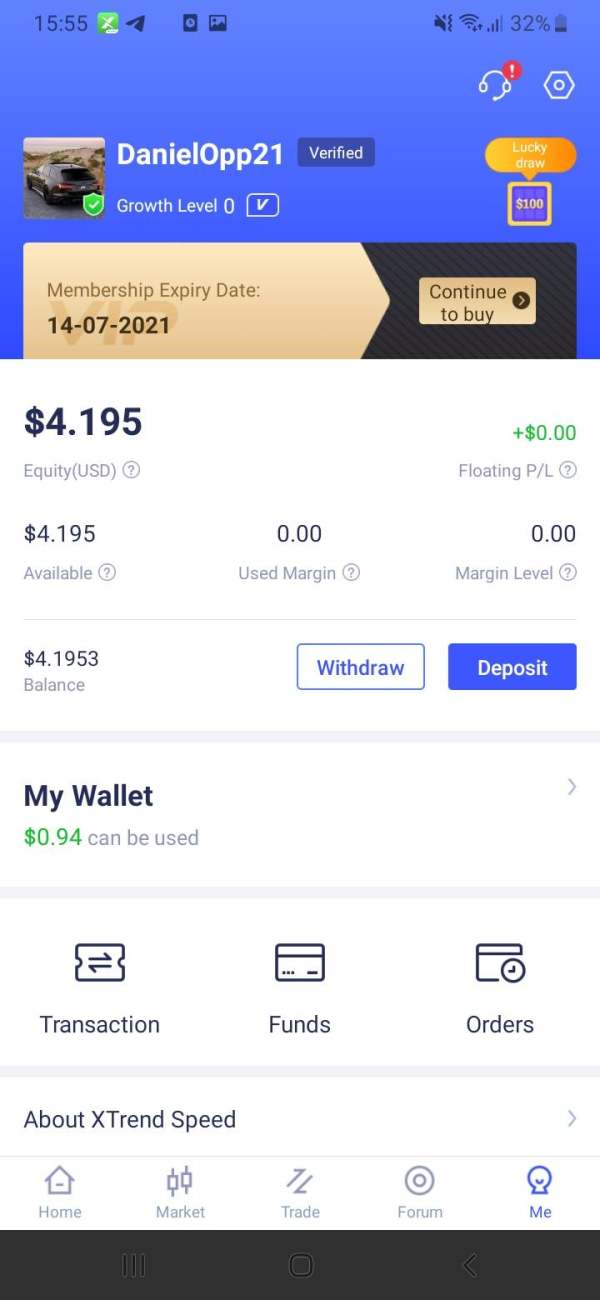

XTrend Speed is a South African-registered forex broker that shows mixed results in the trading industry. The platform offers some good trading conditions including spreads starting from 0 pips, a low minimum deposit of $50, and leverage up to 1:300, but user feedback shows serious problems, especially with withdrawals. This xtrend speed review looks at a broker that says it works well for traders who want low-cost trading and higher leverage options.

XTrend Speed operates under FSCA regulation with license number 23497 and started in 2016. User ratings show a troubling picture with scores ranging from 1.3 to 1.4 based on 51 and 49 reviews. The broker supports popular trading platforms including MetaTrader 4 and their own STrader platform, giving access to forex, stocks, indices, commodities, and cryptocurrencies.

The platform faces serious credibility challenges despite some competitive features. Different sources show conflicting opinions about the platform's legitimacy, with some users claiming positive experiences while others report major issues, including claims of scams. Some industry observers have flagged the broker as a suspicious clone broker, raising red flags about how it operates.

Important Notice

Regional Entity Variations: XTrend Speed operates different versions across various regions, potentially subject to different regulatory oversight in each jurisdiction. Users must know the specific legal risks and regulatory protections that apply in their region. The primary entity operates under FSCA regulation in South Africa, but the scope and effectiveness of this oversight may vary for international clients.

Review Methodology: This evaluation is based on user feedback analysis, market research, and official information from multiple sources. The assessment includes both positive and negative user experiences to provide a balanced view of the broker's services and reliability.

Rating Framework

Broker Overview

XTrend Speed was established in 2016 and operates as a market maker from its headquarters in South Africa. The company says it provides comprehensive trading solutions, offering access to multiple asset classes through popular trading platforms. According to [TradingBrokers.com], the broker operates under a business model that focuses on providing competitive spreads and accessible trading conditions for retail traders.

The company's regulatory framework centers around its FSCA license (number 23497), which provides oversight for its South African operations. However, industry analysts note that the broker's international operations and the extent of regulatory protection for overseas clients remain areas of concern for potential users.

XTrend Speed supports two primary trading platforms: the widely recognized MetaTrader 4 (MT4) and their own STrader platform. The broker provides access to a diverse range of tradeable assets including forex pairs, stocks, indices, commodities, and cryptocurrencies. The platform aims to serve both new and experienced traders through its varied account offerings and trading conditions.

The company's approach emphasizes low-cost trading with spreads starting from 0 pips and commission structures beginning at $0. However, as this xtrend speed review will explore, the practical implementation of these attractive conditions has generated mixed feedback from the user community.

Regulatory Region: XTrend Speed operates primarily under South African jurisdiction, regulated by the Financial Sector Conduct Authority (FSCA) with license number 23497. This regulatory framework provides oversight for the broker's operations, though the extent of protection for international clients may vary.

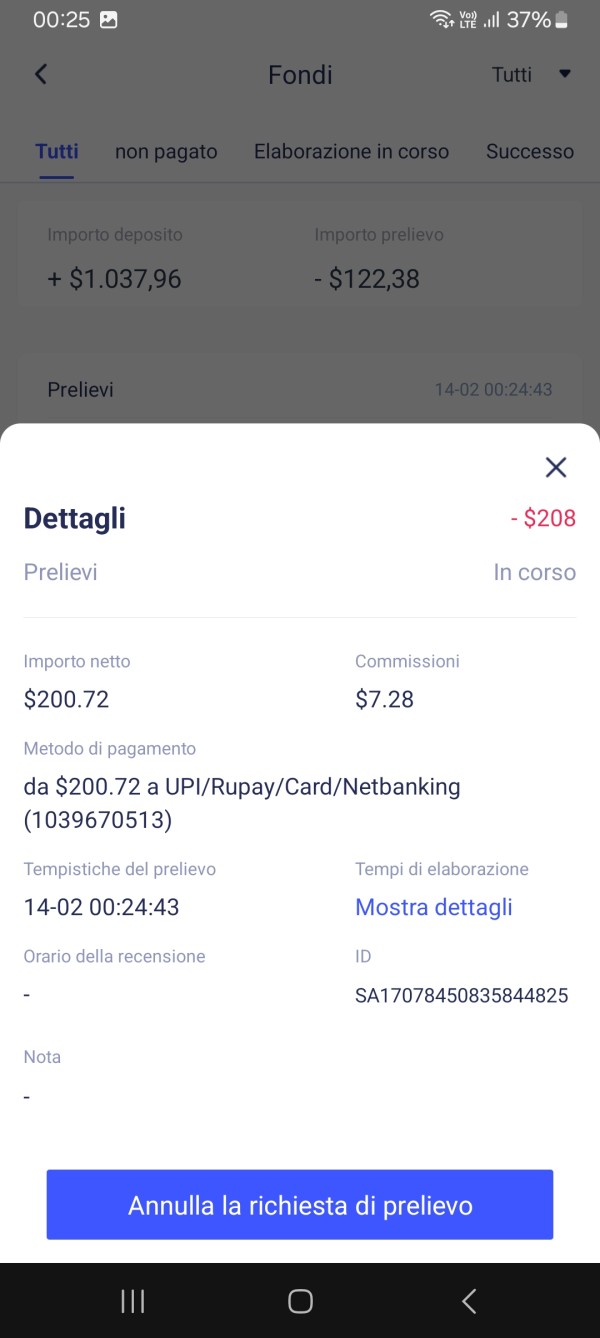

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods was not detailed in available sources, though standard industry practices typically include bank transfers, credit/debit cards, and electronic payment systems.

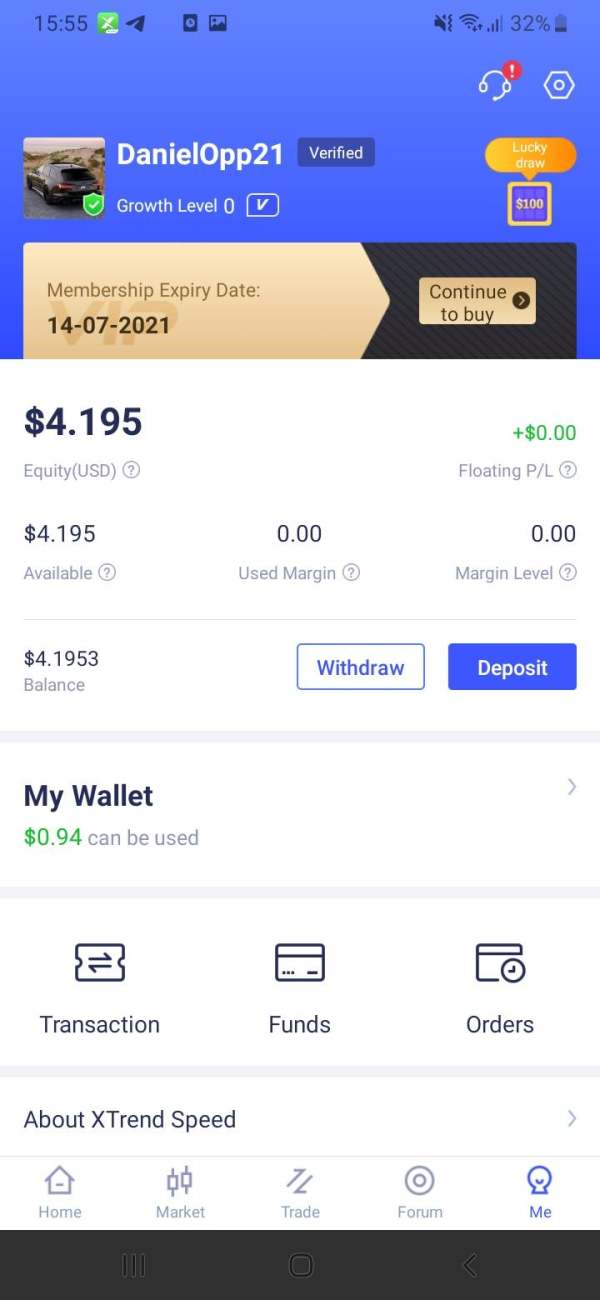

Minimum Deposit Requirements: The broker maintains an accessible entry point with a minimum deposit requirement of $50, making it relatively affordable for new traders entering the forex market.

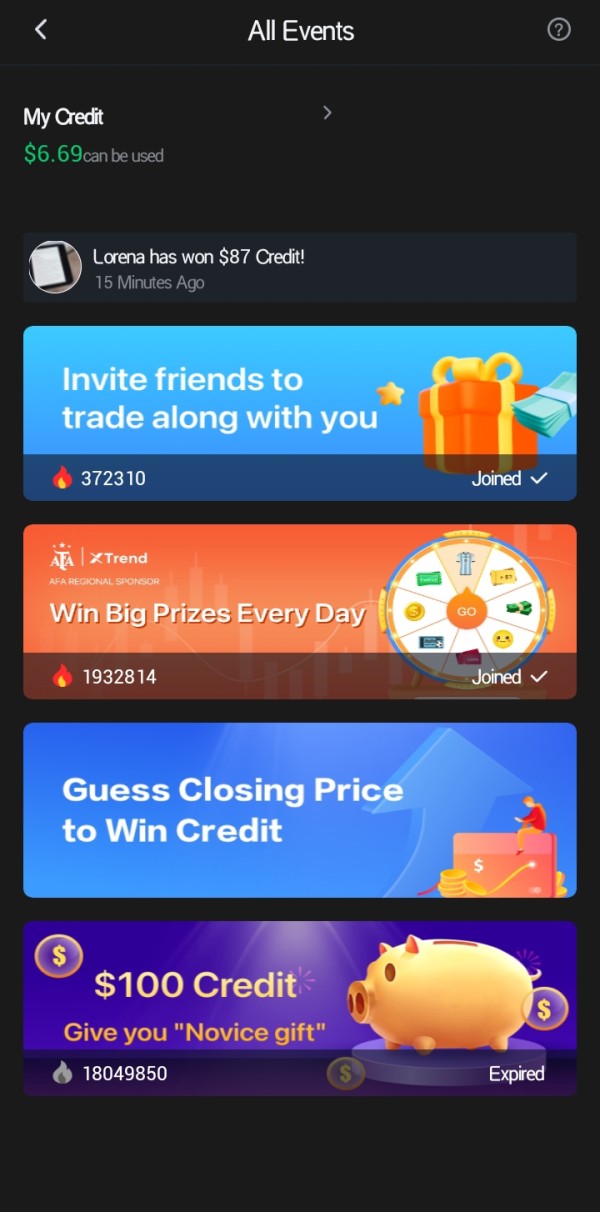

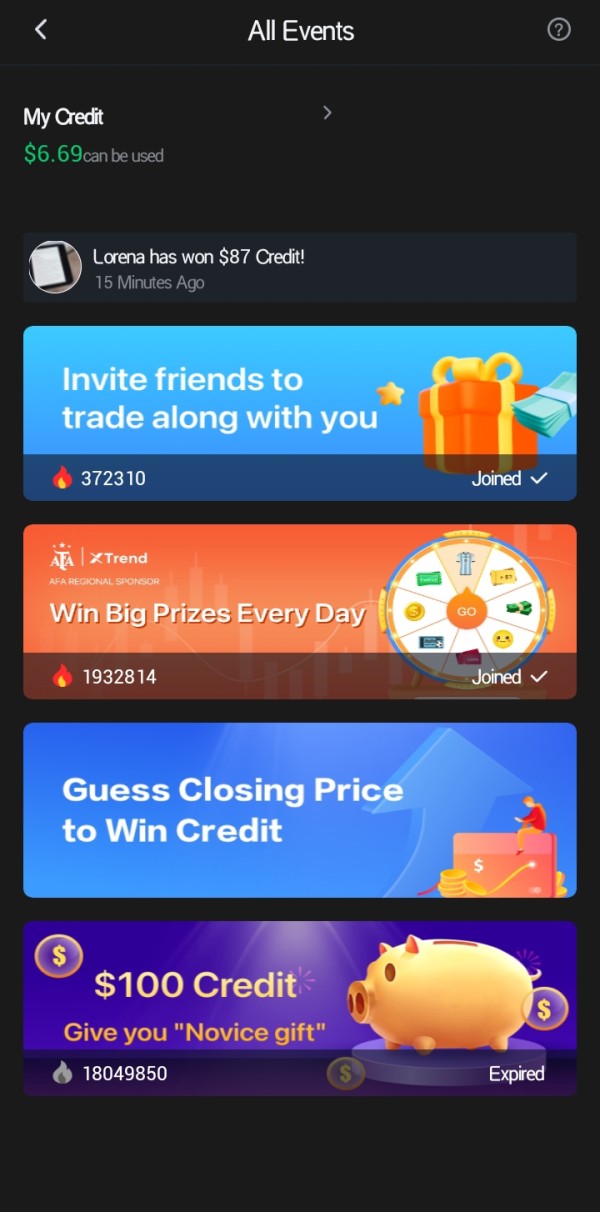

Bonus and Promotions: According to [XTrend Speed's official communications], the company has distributed $40,000,000 in credit rewards, though specific current promotional offers were not detailed in available sources.

Tradeable Assets: The platform provides access to a comprehensive range of financial instruments including major and minor forex pairs, stock indices, individual stocks, commodities such as gold and oil, and various cryptocurrencies.

Cost Structure: XTrend Speed advertises spreads starting from 0 pips on major forex pairs during normal market conditions, with commission structures beginning at $0. However, detailed information about the complete fee schedule and potential additional costs requires further clarification.

Leverage Ratios: The broker offers leverage up to 1:300, providing significant amplification potential for traders, though this also increases risk exposure accordingly.

Platform Options: Traders can access markets through MetaTrader 4 (MT4) and the STrader platform, both offering standard trading functionalities and analytical tools.

Regional Restrictions: Specific geographical limitations were not detailed in available sources and would require direct confirmation from the broker.

Customer Service Languages: Information about supported languages for customer service was not specified in available materials. This xtrend speed review notes this as an area requiring clarification for international clients.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

XTrend Speed's account conditions present a mixed picture of accessibility and competitiveness. The broker offers standard MT4 accounts alongside STrader accounts, though detailed specifications for different account tiers were not outlined in available sources. The $50 minimum deposit requirement stands as one of the more attractive features, making the platform accessible to traders with limited initial capital.

According to [TradingBrokers.com], the broker's spread structure starting from 0 pips represents a competitive advantage in the current market environment. However, the practical implementation of these spreads and their availability during different market conditions requires closer examination. The commission structure beginning at $0 adds to the appeal for cost-conscious traders.

User feedback about account conditions shows mixed responses. Some traders appreciate the low entry barriers, while others have raised concerns about the practical trading costs once active trading starts. The account opening process and verification requirements were not detailed in available sources, representing a gap in transparency that potential clients should address directly with the broker.

The absence of detailed information about Islamic accounts, VIP tiers, or specialized account features suggests either limited offerings or poor communication of available options. This xtrend speed review finds the account conditions moderately attractive but lacking in comprehensive detail and transparency.

The trading tools and resources offered by XTrend Speed appear to focus on platform functionality rather than comprehensive market analysis and educational support. The broker provides access to MetaTrader 4, which includes standard analytical tools, indicators, and expert advisor support. The STrader platform adds an additional option, though detailed comparisons of its capabilities were not available in source materials.

Research and analysis resources appear limited based on available information. Unlike established brokers that provide daily market analysis, economic calendars, and research reports, XTrend Speed's educational and analytical offerings seem underdeveloped. This limitation particularly affects traders who rely on broker-provided market insights for their trading decisions.

Educational resources represent a significant gap in the broker's service offering. New traders typically benefit from comprehensive educational materials, webinars, and trading guides, but such resources were not prominently featured in available information about XTrend Speed's services.

The platform does support automated trading through expert advisors on the MT4 platform, which appeals to algorithmic traders. However, the quality of execution and any specific support for automated trading strategies requires further verification from actual user experiences.

Customer Service and Support Analysis (Score: 4/10)

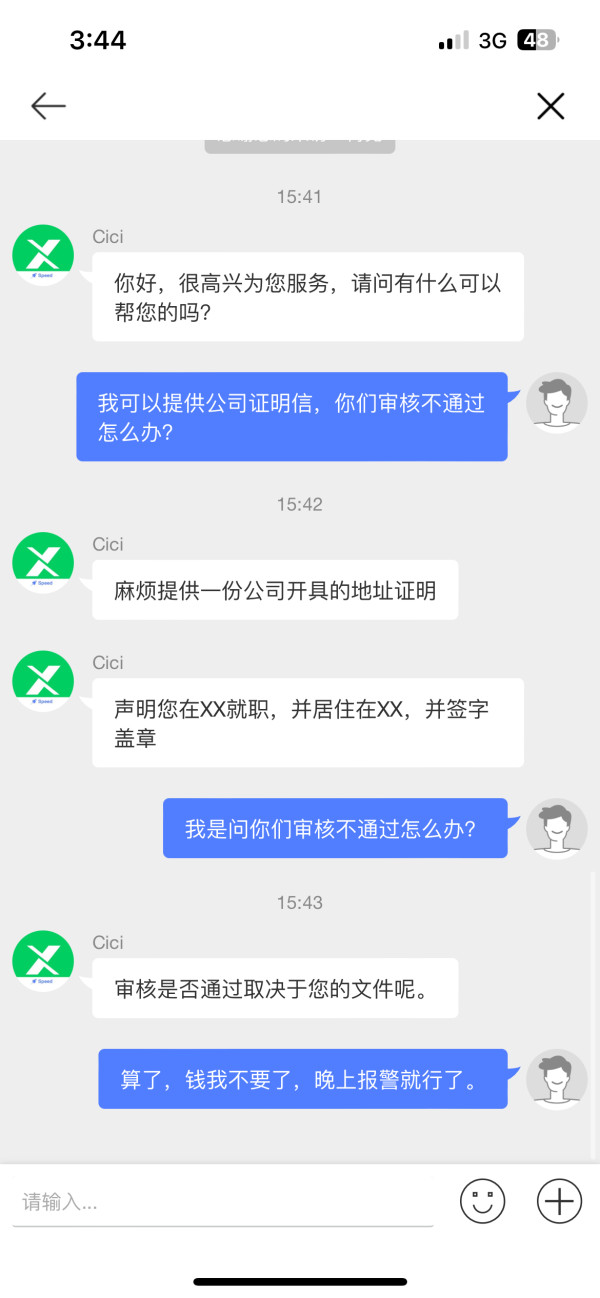

Customer service represents one of the most concerning aspects of XTrend Speed's operations based on user feedback and available reviews. The broker provides online chat and email support channels, though the quality and responsiveness of these services have generated significant user complaints.

Response times appear inconsistent according to user reports, with some clients experiencing delays in receiving support for critical issues, particularly those related to account funding and withdrawals. The professional competency of support staff has also been questioned by some users, suggesting potential training or resource limitations within the customer service department.

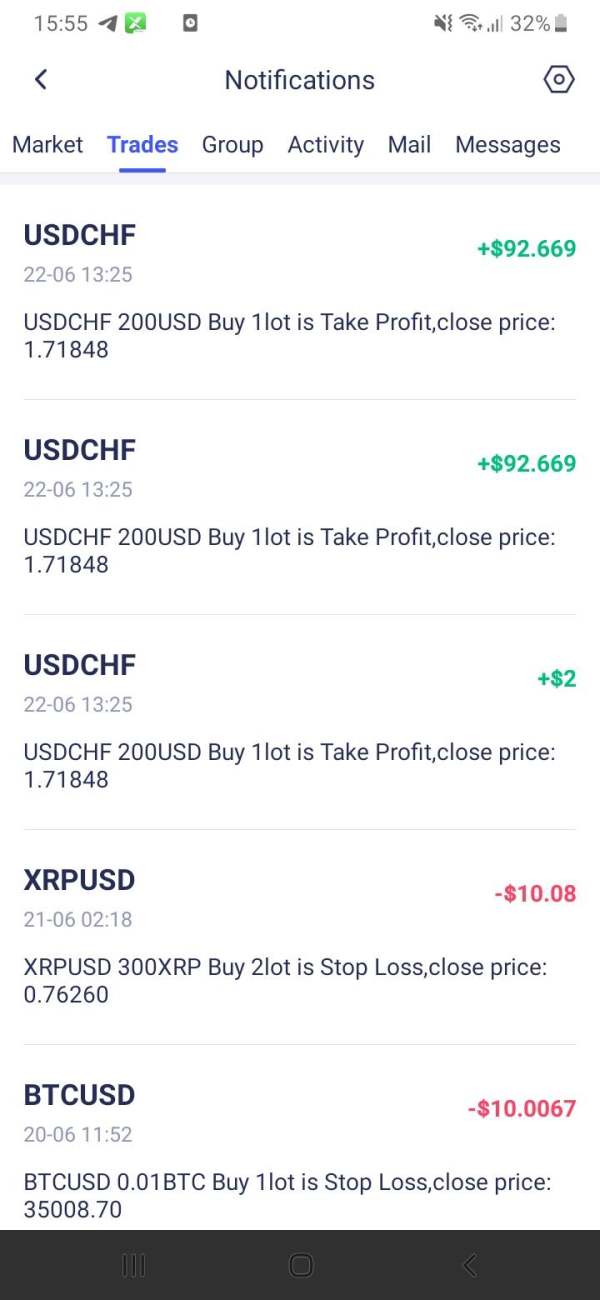

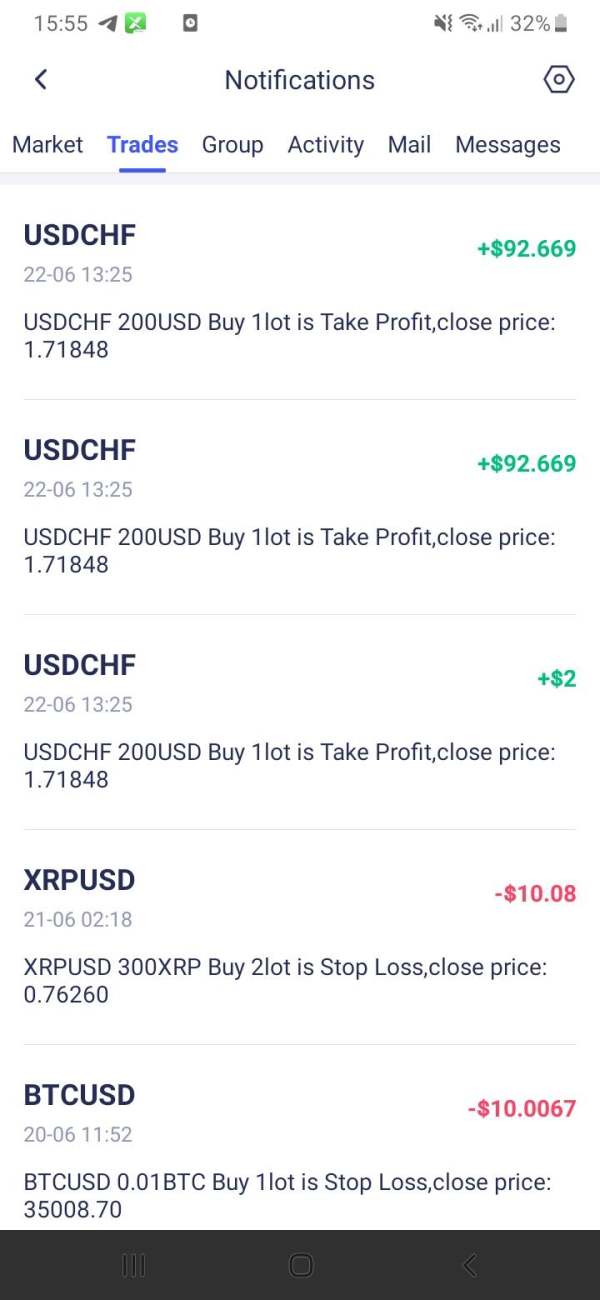

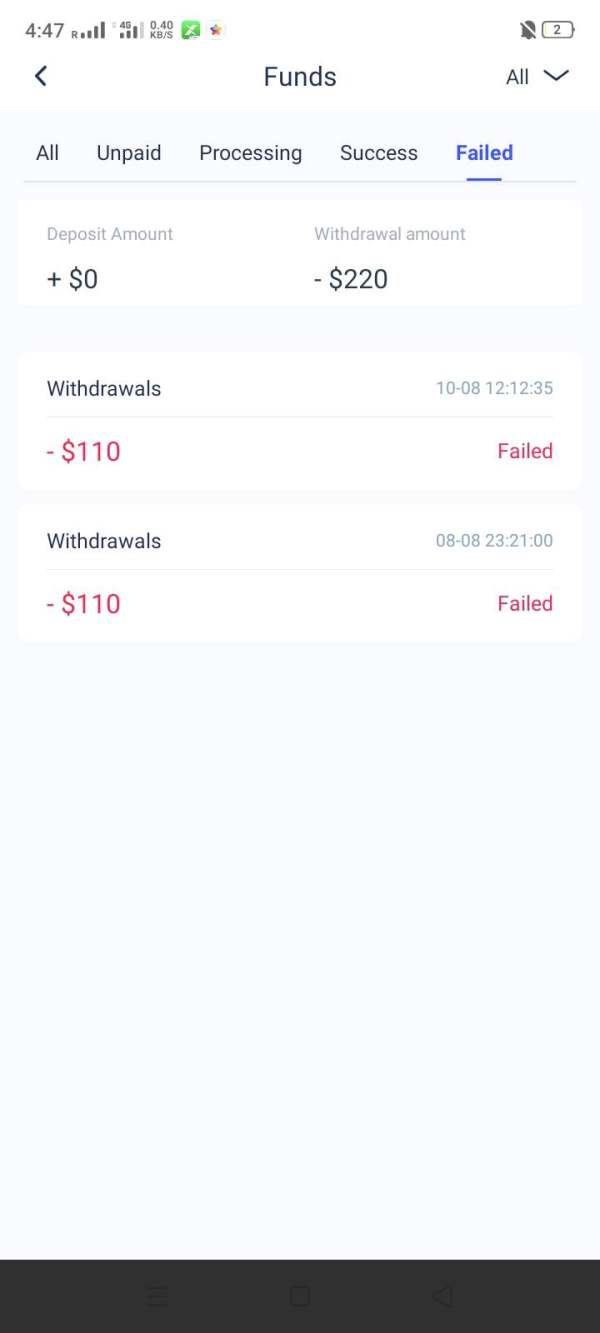

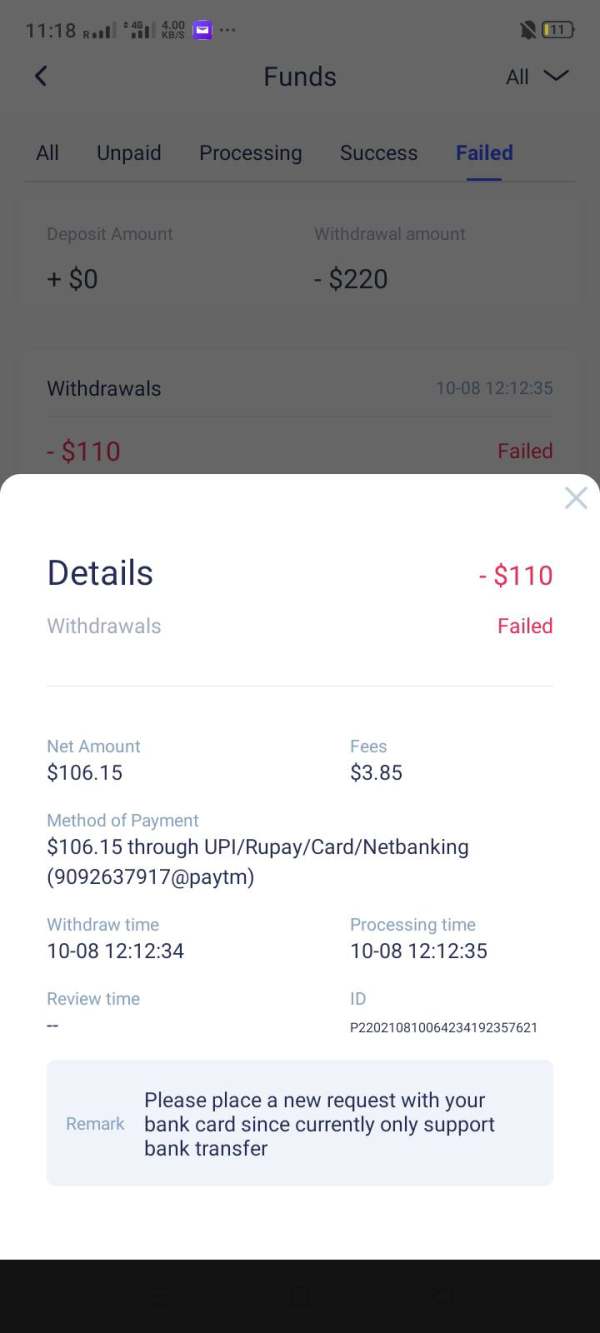

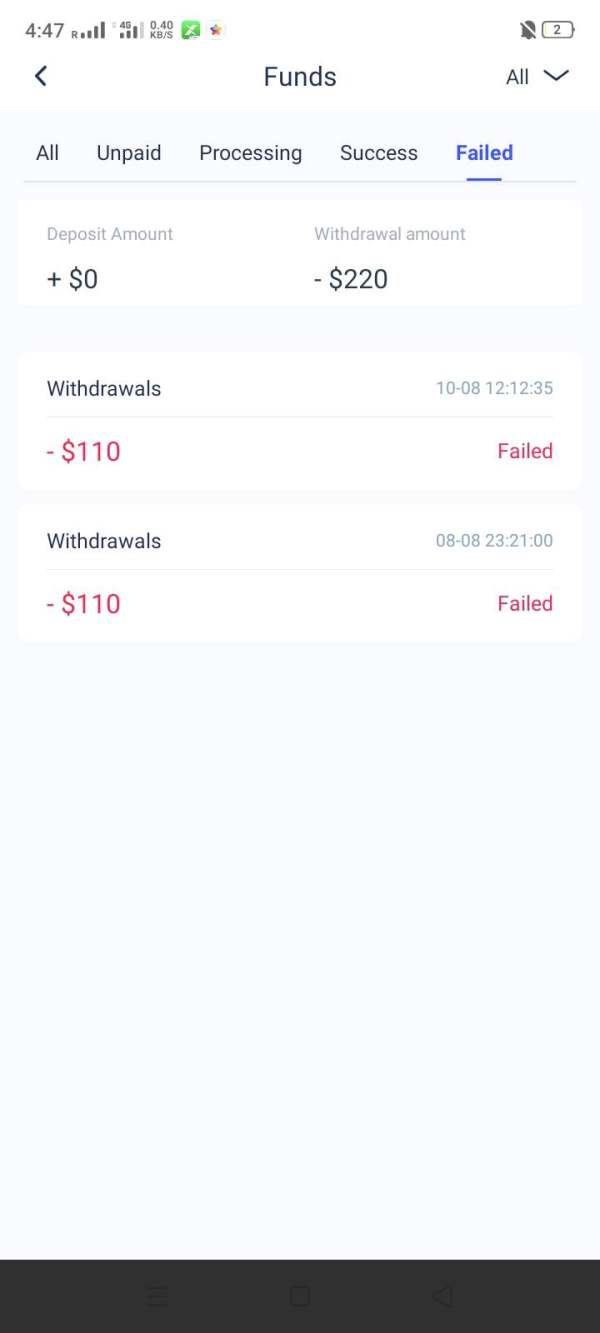

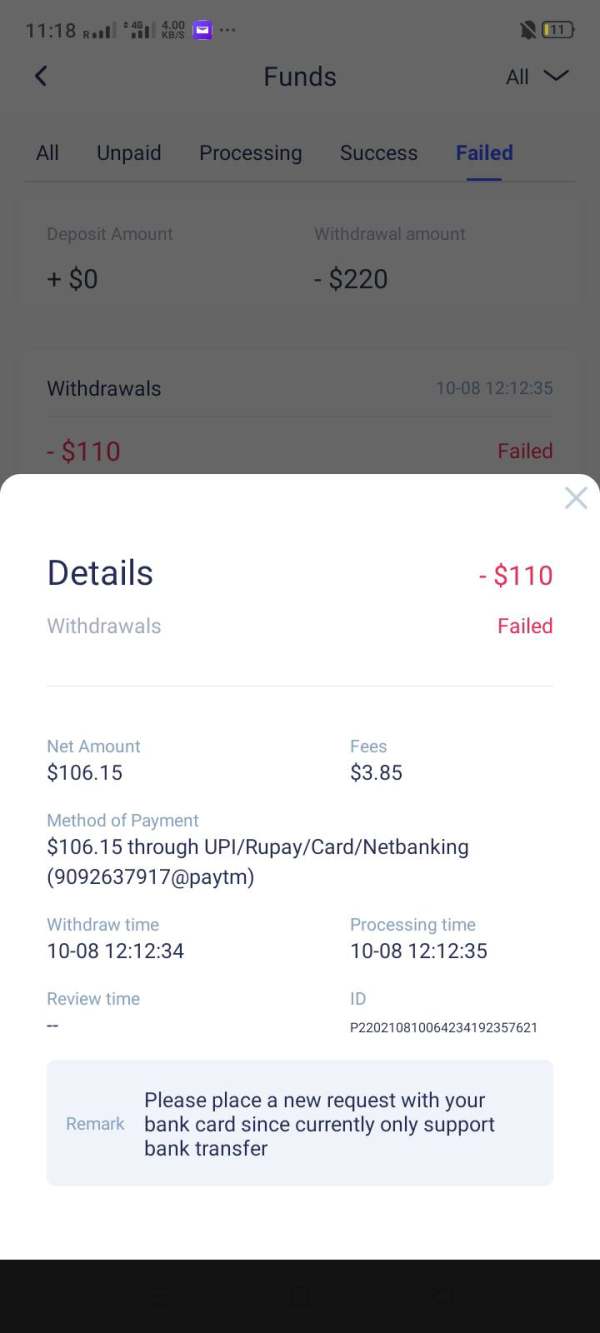

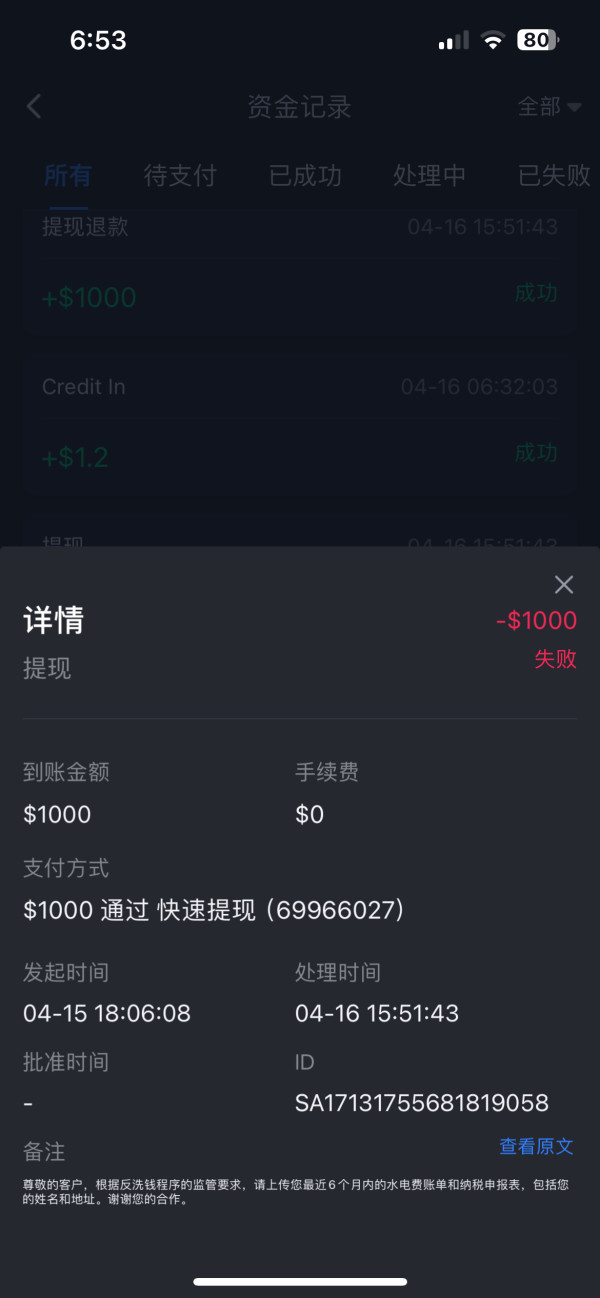

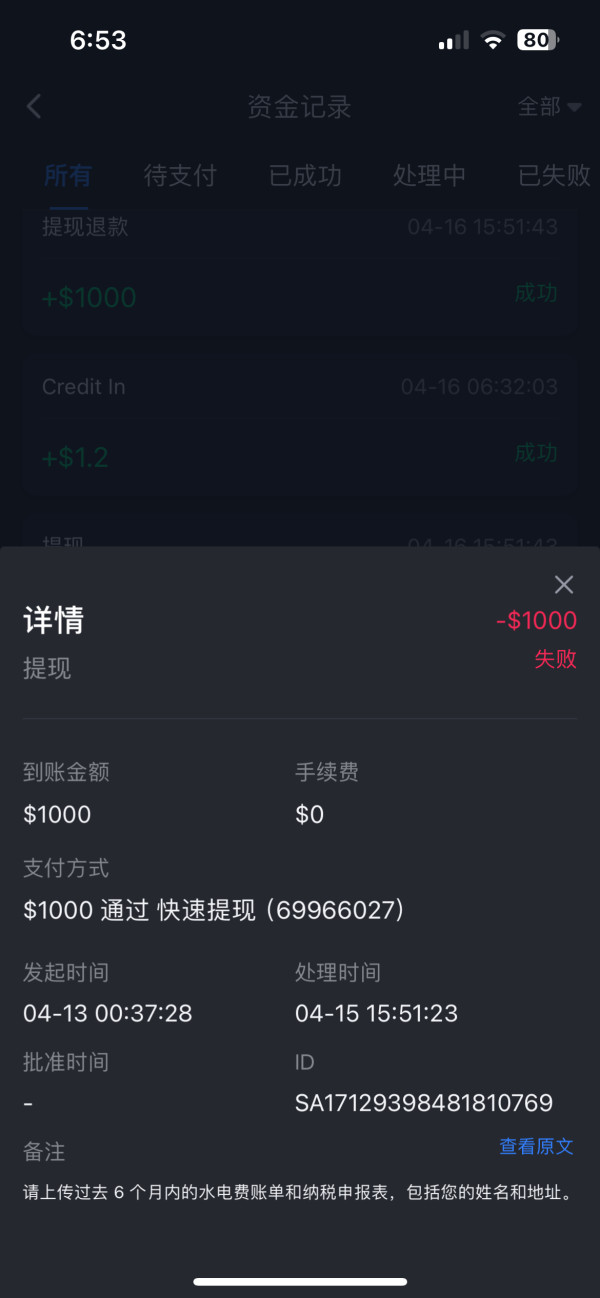

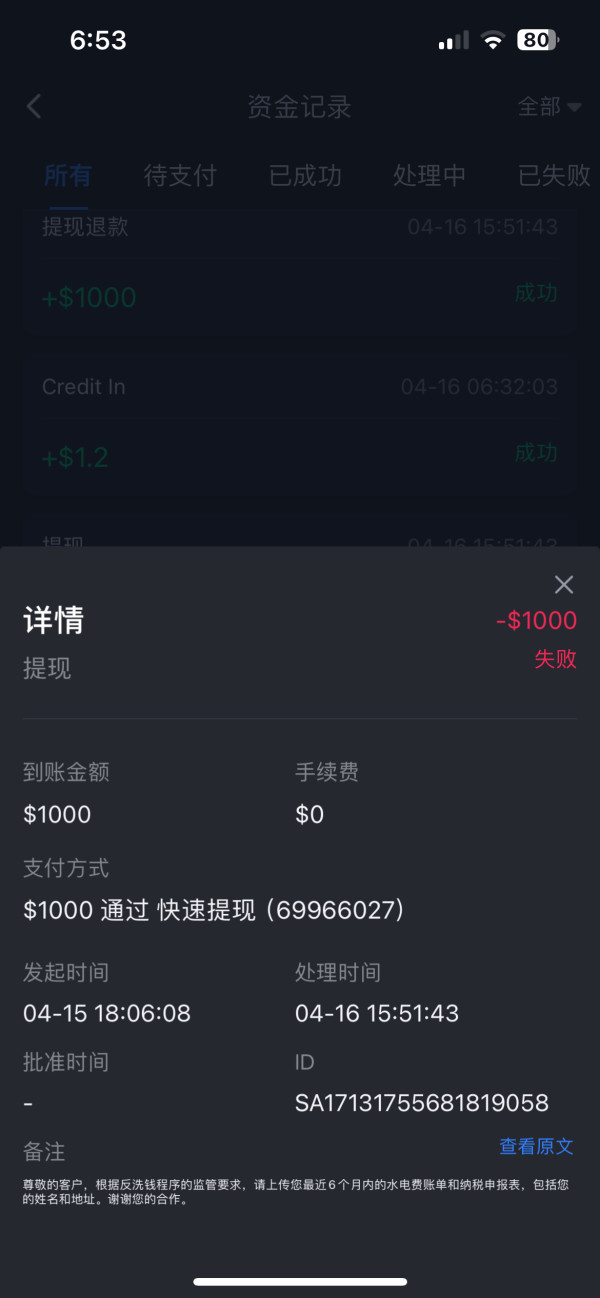

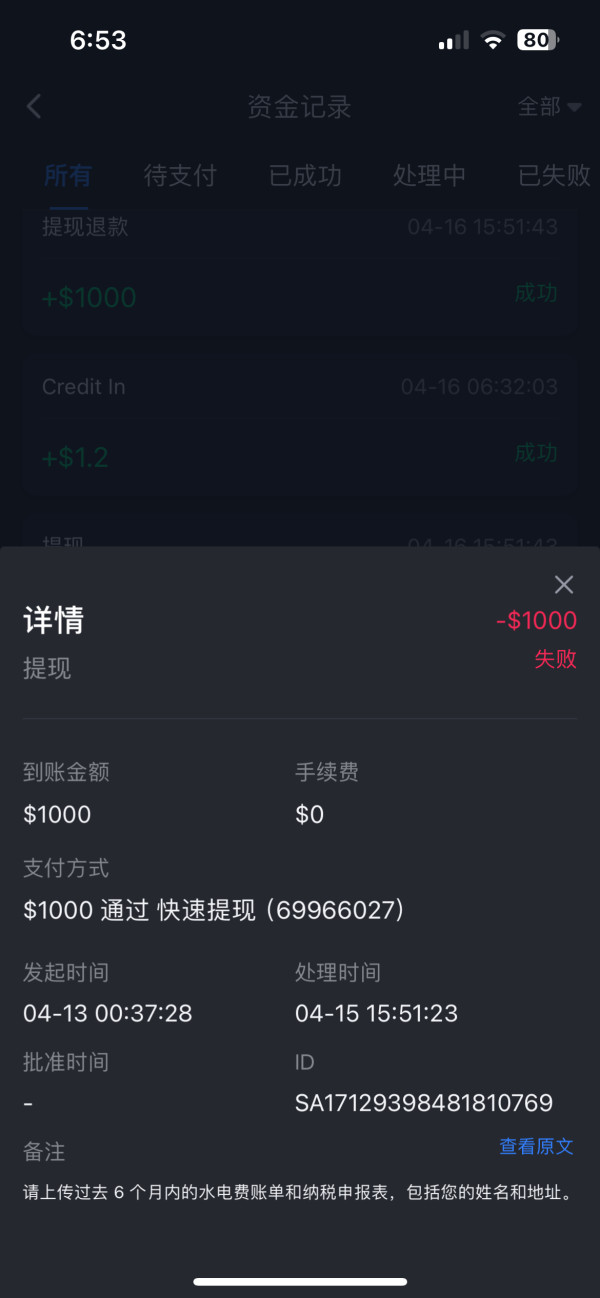

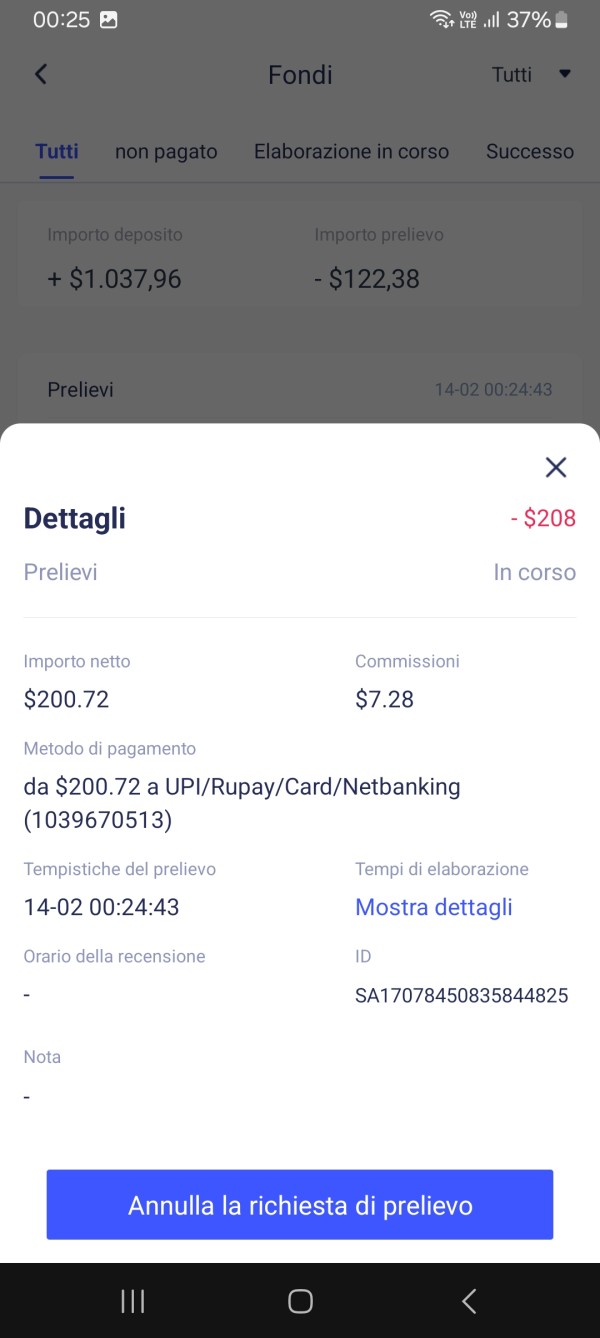

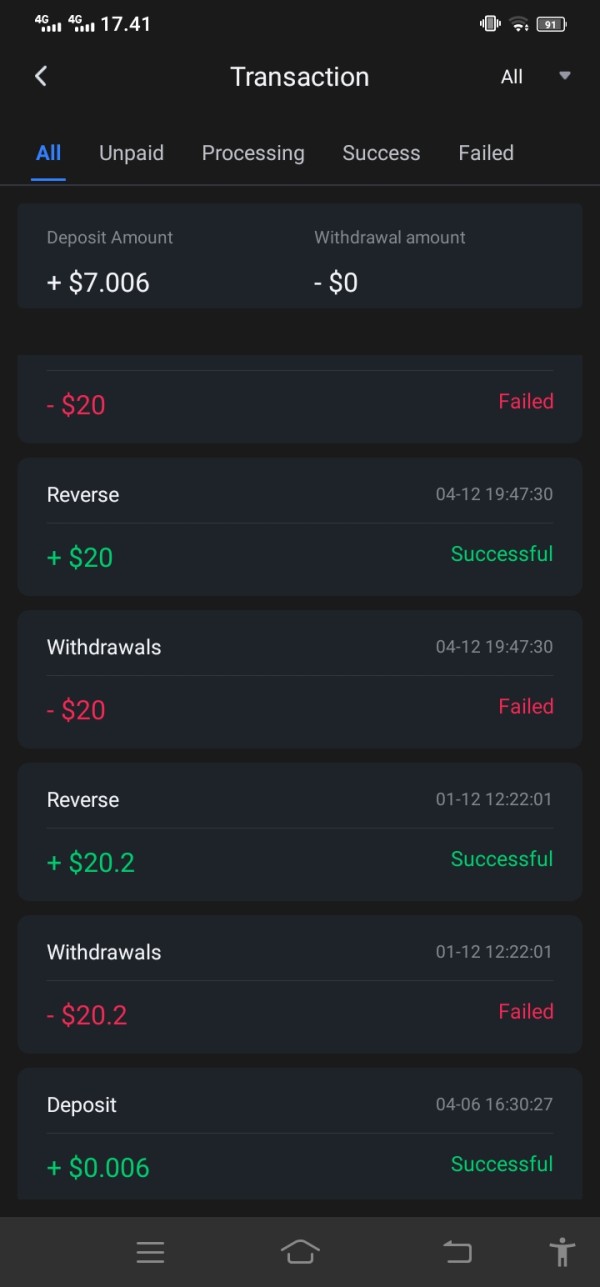

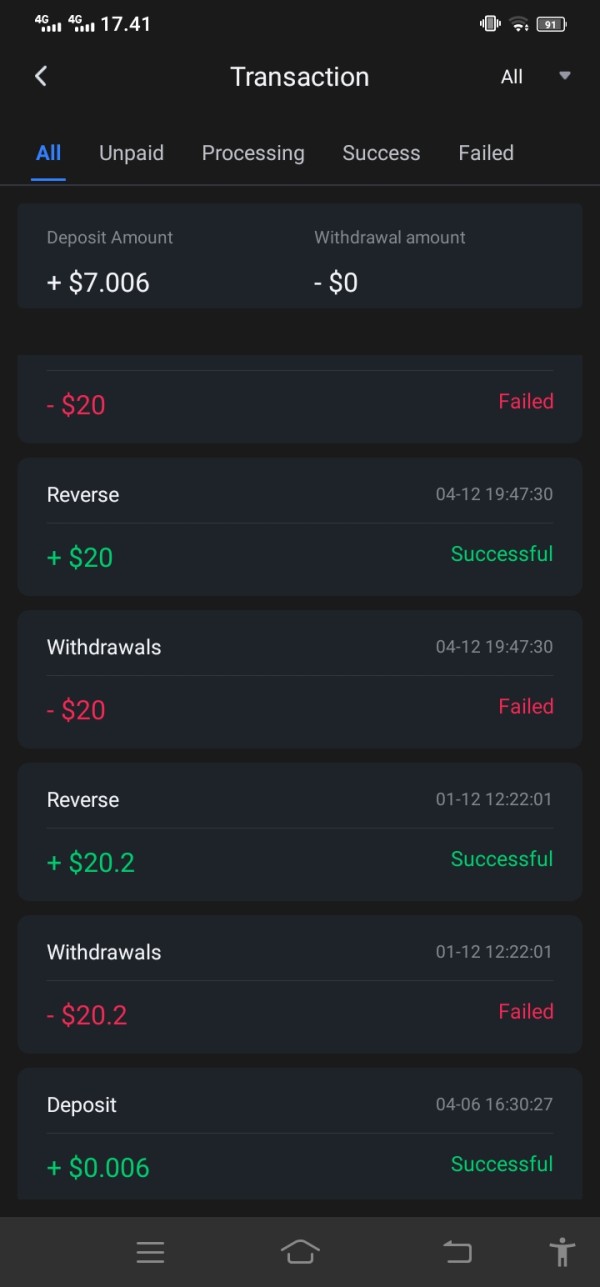

The most significant concern relates to withdrawal support, where multiple users have reported difficulties in processing withdrawal requests. According to user feedback compiled from various sources, some clients have experienced prolonged delays or complications when attempting to access their funds, which represents a serious operational concern.

Multilingual support availability was not specified in available sources, potentially limiting accessibility for international clients. The absence of clear information about support hours and escalation procedures further compounds concerns about the overall customer service framework.

Trading Experience Analysis (Score: 5/10)

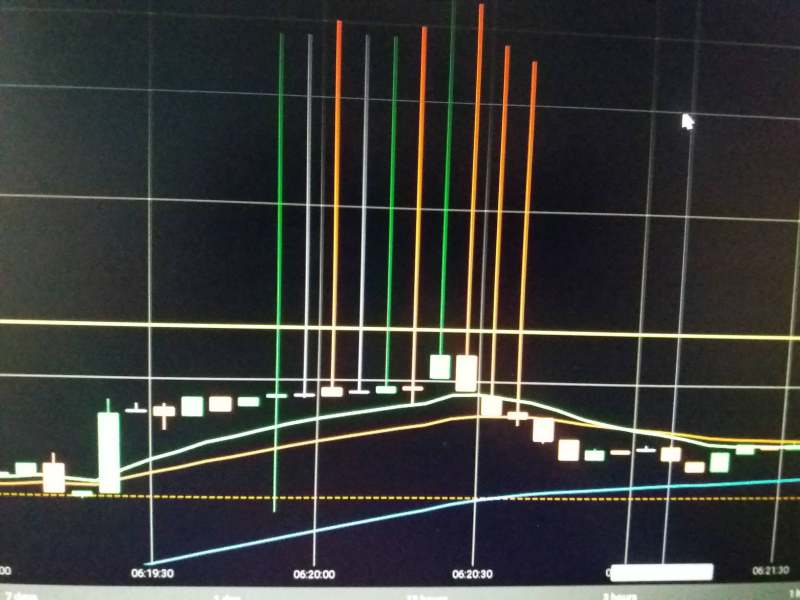

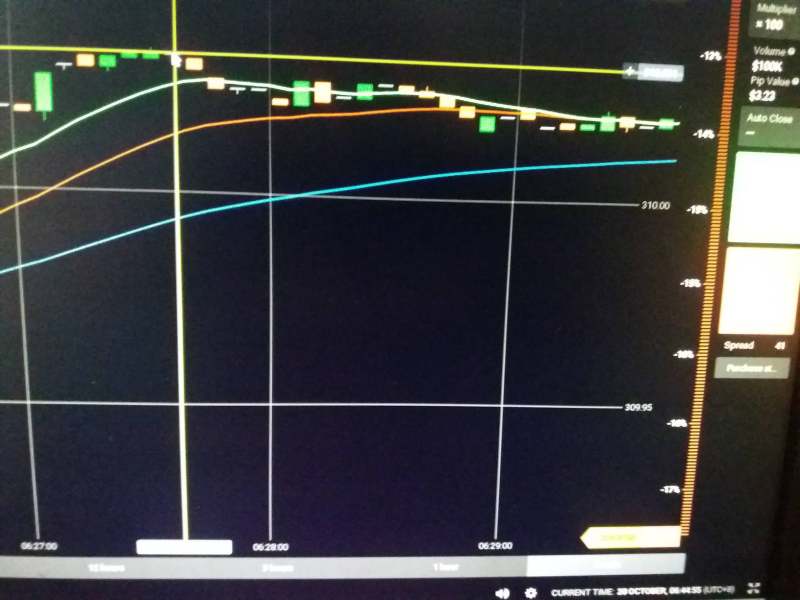

The trading experience on XTrend Speed's platforms presents a mixed picture based on user feedback and available information. Platform stability appears to be a concern, with some users reporting technical issues that affect their trading activities. The reliability of order execution has also generated mixed reviews, with reports of slippage and requotes during volatile market conditions.

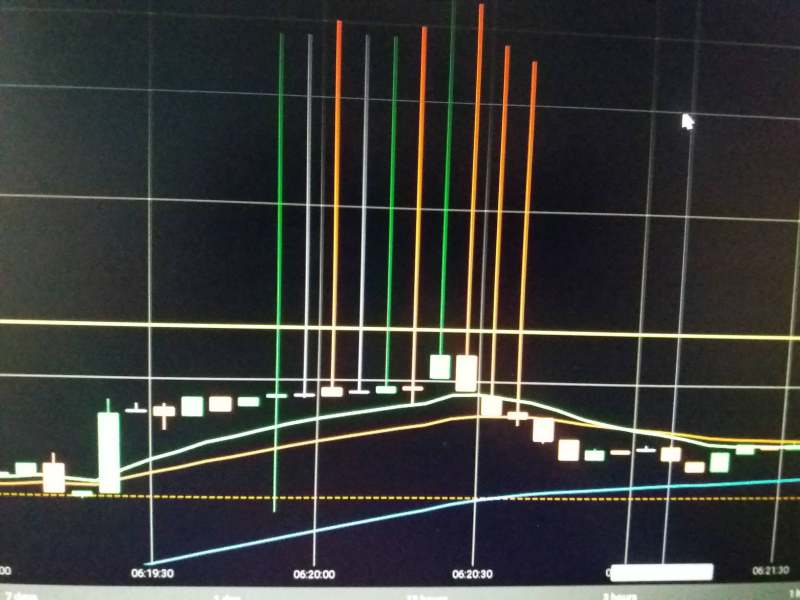

The MetaTrader 4 platform provides standard functionality that most forex traders expect, including charting tools, indicators, and order management features. However, the STrader platform lacks detailed user reviews and feature comparisons, making it difficult to assess its competitive advantages or limitations.

Mobile trading experience was not covered in available sources, though MT4 typically provides mobile applications. The quality of mobile execution and platform stability on mobile devices requires verification through direct user experience.

Trading environment quality, including spread stability and liquidity provision, appears adequate but not exceptional based on available feedback. Some users have noted that while advertised spreads are competitive, actual trading costs during active market periods may vary from promotional materials.

The overall trading experience reflects a platform that meets basic requirements but lacks the polish and reliability that traders expect from established brokers. This xtrend speed review finds the trading experience adequate for basic needs but potentially frustrating for active traders requiring consistent performance.

Trustworthiness Analysis (Score: 3/10)

Trustworthiness represents the most significant concern in this XTrend Speed evaluation. The broker operates under FSCA regulation with license number 23497, which provides some regulatory oversight. However, several factors raise serious questions about the platform's overall reliability and operational integrity.

Industry sources have flagged XTrend Speed as a suspicious clone broker, suggesting potential concerns about its operational legitimacy. This designation typically indicates that the broker may be operating under questionable circumstances or mimicking legitimate operations without proper authorization.

Fund safety measures were not detailed in available sources, representing a significant transparency gap. Established brokers typically provide clear information about client fund segregation, insurance coverage, and other protective measures, but such details were not readily available for XTrend Speed.

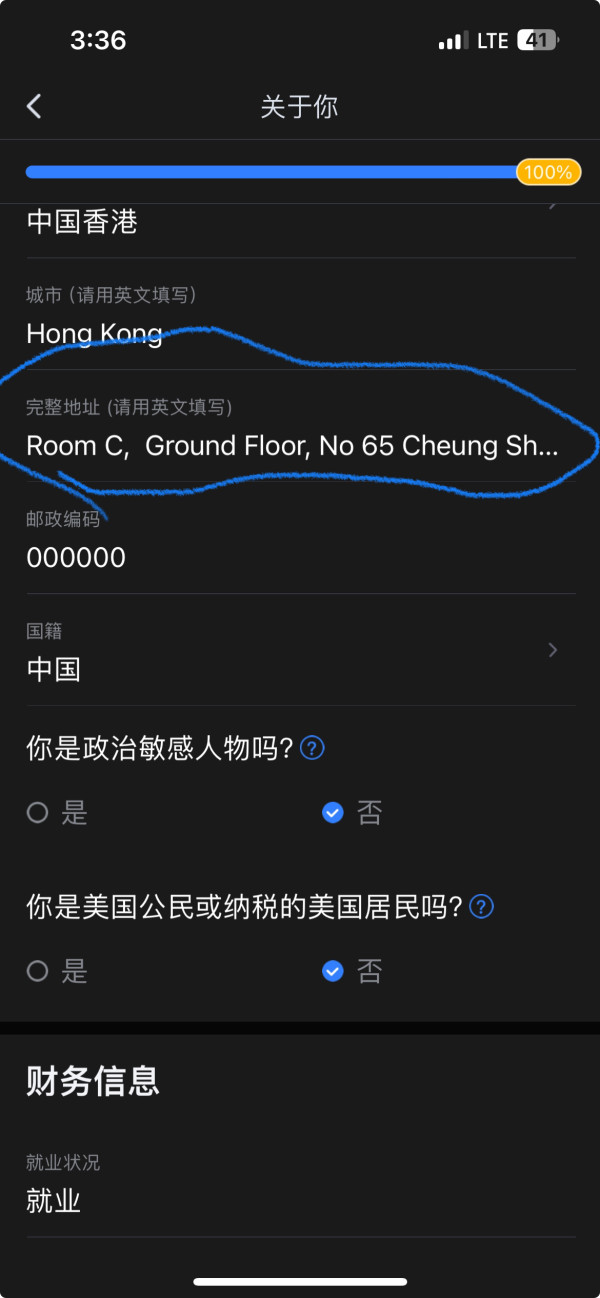

Company transparency remains problematic, with limited information available about corporate structure, ownership, and operational procedures. Users have expressed concerns about the broker's communication practices and the clarity of its business operations.

The handling of negative events and user complaints appears inadequate based on available feedback. Multiple user complaints about withdrawal issues and customer service problems suggest systemic operational challenges that undermine user confidence in the platform's reliability.

User Experience Analysis (Score: 4/10)

Overall user satisfaction with XTrend Speed reflects significant concerns about platform reliability and service quality. User ratings averaging between 1.3 and 1.4 based on multiple review sources indicate widespread dissatisfaction among the client base.

Interface design and usability appear functional but basic, with users reporting that the platform meets minimum requirements without providing exceptional user experience features. The registration and verification processes were not detailed in available sources, though user complaints suggest potential complications in account setup and management procedures.

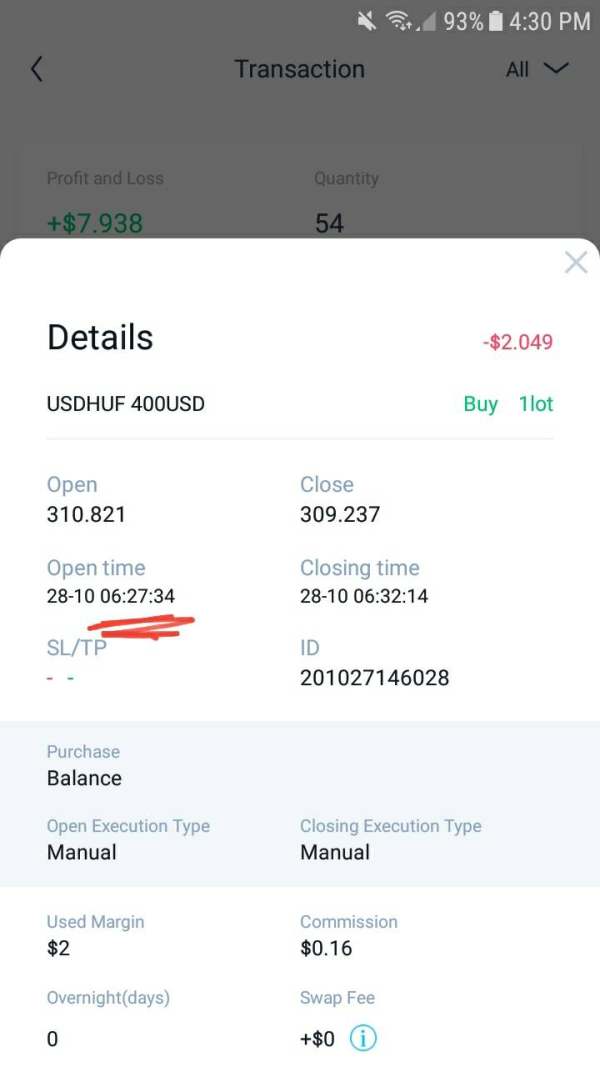

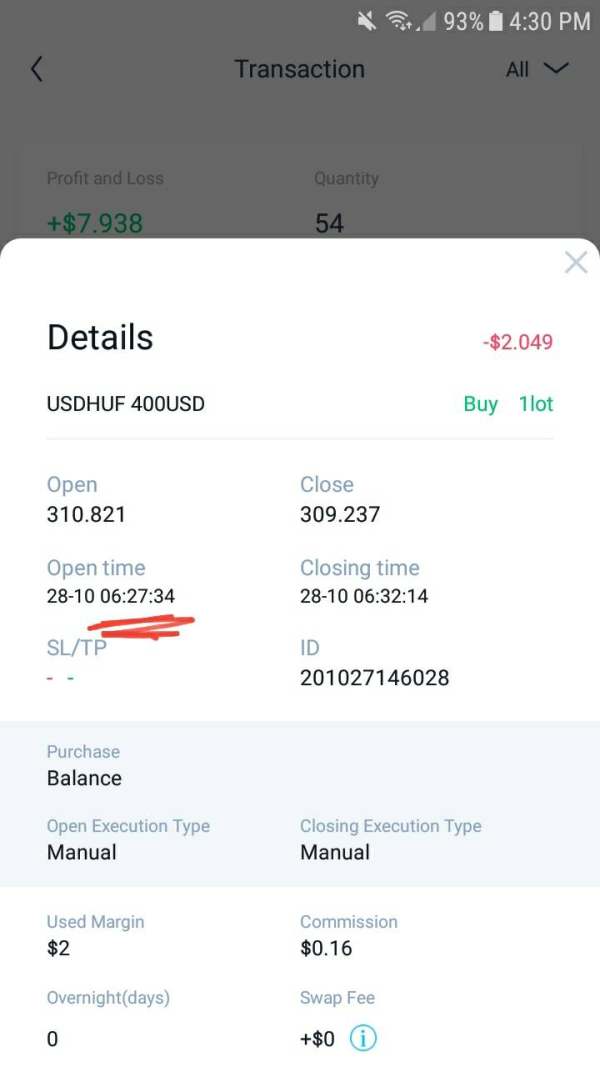

Fund operation experience represents the most significant user concern, with withdrawal difficulties being the primary complaint across multiple review platforms. Users have reported delays, complications, and in some cases, inability to access their deposited funds, which represents a critical operational failure.

Common user complaints center around withdrawal processing, customer service responsiveness, and platform reliability. The frequency and severity of these complaints suggest systemic issues rather than isolated incidents, indicating fundamental operational challenges.

The user profile that might find XTrend Speed suitable appears limited to traders willing to accept significant risks in exchange for low-cost trading conditions. However, the severity of user complaints suggests that even cost-conscious traders should exercise extreme caution when considering this platform.

Conclusion

XTrend Speed presents a complex picture of attractive trading conditions overshadowed by significant operational and trustworthiness concerns. The broker offers competitive features including low spreads, accessible minimum deposits, and high leverage ratios, but the persistent user complaints about withdrawal issues and the platform's questionable industry reputation make it a high-risk choice for traders.

The platform may appeal to traders seeking low-cost entry into forex markets, but the withdrawal problems and poor customer service quality represent unacceptable risks for most trading scenarios. The broker's designation as a suspicious clone operation by industry observers further compounds concerns about its long-term viability and client fund safety.

Primary advantages include competitive spreads and low minimum deposits, while critical disadvantages include poor customer service quality, withdrawal processing problems, and questionable operational transparency. Based on this comprehensive analysis, traders are advised to exercise extreme caution and consider more established alternatives with proven track records of reliable service and fund security.