Regarding the legitimacy of VICTORY INTERNATIONAL FUTURES forex brokers, it provides ICDX, BAPPEBTI and WikiBit, .

Is VICTORY INTERNATIONAL FUTURES safe?

Risk Control

License

Is VICTORY INTERNATIONAL FUTURES markets regulated?

The regulatory license is the strongest proof.

ICDX Derivatives Trading License (EP)

Indonesia Commodity and Derivatives Exchange

Indonesia Commodity and Derivatives Exchange

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Victory International Futures, PT

Effective Date:

--Email Address of Licensed Institution:

victory@vifx.co.idSharing Status:

No SharingWebsite of Licensed Institution:

http://www.vifx.co.id/Expiration Time:

--Address of Licensed Institution:

Pakuwon Center- Superblok Tunjungan City Office Building Lt. 15 Unit 5,6,7, Jl. Embong Malang 1,3,5 -, Surabaya 60261Phone Number of Licensed Institution:

(031)992448699Licensed Institution Certified Documents:

BAPPEBTI Forex Trading License (EP)

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

PT. Victory International Futures

Effective Date:

--Email Address of Licensed Institution:

victory@vifx.co.idSharing Status:

No SharingWebsite of Licensed Institution:

www.vifx.co.idExpiration Time:

--Address of Licensed Institution:

PAKUWON CENTER – SUPERBLOK TUNJUNGAN CITY OFFICE BUILDING LANTAI 15 UNIT 5, 6, 7 JL. EMBONG MALANG NO. 1, 3, 5 SURABAYA 60261 KEDUNGDORO TEGALSARI SURABAYA JAWA TIMUR 60261Phone Number of Licensed Institution:

031 – 9924 8699Licensed Institution Certified Documents:

Is Victory International Futures A Scam?

Introduction

Victory International Futures (VIF) is an online brokerage firm that operates primarily in the Forex market, offering a range of trading services and products. Established in Indonesia, VIF has positioned itself as a player in the competitive landscape of online trading, catering to both novice and experienced traders. Given the proliferation of online brokers, it is crucial for traders to conduct thorough evaluations of these platforms to ensure they are reliable and trustworthy. The integrity of a broker can significantly impact a trader's experience and financial safety. Therefore, this article aims to provide an objective analysis of VIF by examining its regulatory status, company background, trading conditions, and customer experiences. The evaluation is based on a comprehensive review of available information, including regulatory filings, customer feedback, and expert analyses.

Regulation and Legitimacy

The regulatory framework within which a broker operates is a fundamental aspect that determines its legitimacy and the level of protection afforded to traders. Victory International Futures is regulated by the Indonesian Commodity Futures Trading Regulatory Agency (BAPPEBTI) and holds a license from the Indonesia Commodity and Derivatives Exchange (ICDX). Below is a table summarizing the core regulatory information for VIF:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| BAPPEBTI | 558/BAPPEBTI/SI/XII/2004 | Indonesia | Verified |

| ICDX | 041/SP KB/ICDX/DIR/IX/2010 | Indonesia | Verified |

While VIF is regulated, it is important to note that the regulatory environment in Indonesia is not as stringent as in other jurisdictions such as the UK or the EU. Brokers operating under BAPPEBTI may not be subject to the same level of oversight and investor protection measures found in more developed markets. For instance, there is no investor compensation scheme in place, which could leave traders vulnerable in the event of broker insolvency. Furthermore, the absence of negative balance protection raises concerns regarding the safety of client funds, especially given the high leverage offered by the broker. Therefore, while VIF is legally registered, the regulatory quality and investor safety measures warrant caution.

Company Background Investigation

Victory International Futures has been operational since 2003, indicating a significant presence in the market. The company is headquartered in Surabaya, Indonesia, and is structured as a private entity. The management team consists of individuals with experience in finance and trading, but detailed information about their backgrounds is limited. The company has made efforts to establish a transparent operational framework, providing contact details and customer support channels, but there is a noticeable lack of comprehensive information regarding its ownership structure and the qualifications of its leadership team. This opacity can be a red flag for potential investors, as transparency is a critical factor in assessing the reliability of a brokerage firm.

In terms of information disclosure, VIF provides basic details about its services and trading conditions on its website. However, there is limited access to educational resources or detailed reports on its financial performance. The absence of such information can hinder traders' ability to make informed decisions, as they may lack insights into the brokers operational integrity and financial health.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions, including fees and spreads, is essential. Victory International Futures offers a minimum deposit requirement of $1,000 for its mini account and $10,000 for its regular account. The broker provides a spread starting at 3 pips for major currency pairs, which is relatively high compared to industry standards. Below is a comparative table of core trading costs:

| Cost Type | Victory International Futures | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3 pips | 1-2 pips |

| Commission Model | $25 per lot | $10-15 per lot |

| Overnight Interest Range | Not specified | Varies widely |

While VIF's trading conditions may appeal to some traders, the high spreads and commissions could deter others, especially those looking for cost-effective trading options. The lack of clarity regarding overnight interest rates also raises concerns, as traders may be unaware of potential costs associated with holding positions overnight. Overall, while VIF provides a structured trading environment, the associated costs may not be competitive.

Client Funds Safety

The safety of client funds is a paramount concern for any trader. Victory International Futures claims to implement measures to safeguard client funds, including segregated accounts. However, the absence of a specific investor protection fund raises questions about the overall security of deposited funds. Traders should be aware that, in the event of financial difficulties faced by the broker, recovering funds may be challenging. Furthermore, the lack of negative balance protection means that traders could potentially lose more than their initial deposits, particularly when trading with high leverage.

Historically, there have been no significant reports of fund security issues or controversies associated with VIF. However, the lack of transparency regarding its financial practices and the absence of robust regulatory oversight in Indonesia could pose risks for traders. It is advisable for potential clients to consider these factors carefully before depositing funds.

Customer Experience and Complaints

Customer feedback is a vital component in assessing a brokers reliability. Reviews of Victory International Futures reveal a mixed bag of experiences. Many users report satisfactory trading conditions and prompt customer support, while others express dissatisfaction with high fees and limited asset offerings. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| High Fees | Moderate | Addressed |

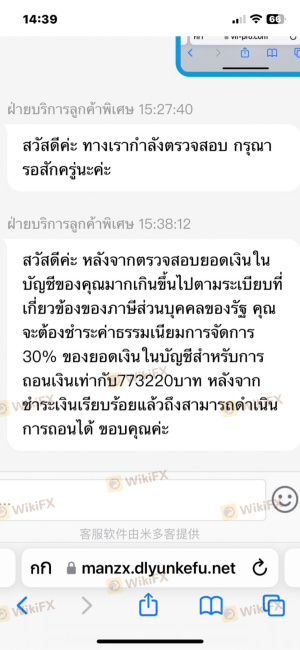

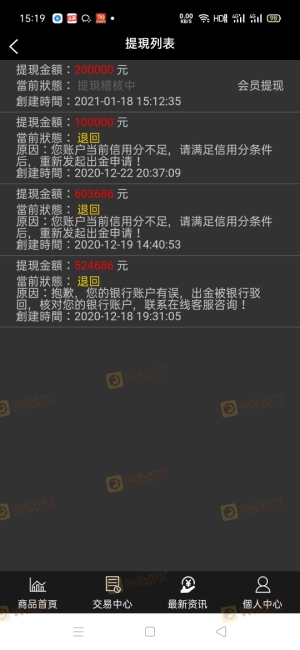

| Withdrawal Issues | High | Unresolved |

| Limited Asset Selection | Low | Not addressed |

A typical case involves a trader who faced challenges withdrawing funds after a significant profit. Despite multiple attempts to contact customer support, the trader reported delays and a lack of clear communication regarding the withdrawal process. This highlights the potential issues that may arise when dealing with VIF, particularly concerning the handling of client funds.

Platform and Execution

Victory International Futures offers the MetaTrader 5 platform, known for its advanced trading capabilities and user-friendly interface. The platform supports automated trading and provides various analytical tools. However, users have reported occasional stability issues and concerns regarding order execution quality, including slippage and rejections. These factors can significantly impact trading performance, particularly for those employing high-frequency trading strategies.

While VIF claims to provide rapid order execution, the reported instances of slippage raise questions about the reliability of their execution environment. Traders should be cautious and consider these factors when evaluating their trading strategies on this platform.

Risk Assessment

Engaging with Victory International Futures entails various risks that traders should consider. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Weak regulatory framework in Indonesia |

| Financial Risk | Medium | High fees and potential for losses |

| Operational Risk | Medium | Issues with platform stability and support |

| Withdrawal Risk | High | Difficulties in fund recovery |

To mitigate these risks, traders are advised to conduct thorough research, maintain realistic expectations, and consider diversifying their trading activities across multiple brokers. Engaging with regulated brokers in more stringent jurisdictions may provide additional security and peace of mind.

Conclusion and Recommendations

In conclusion, while Victory International Futures is a regulated broker in Indonesia, various factors suggest that traders should exercise caution. The regulatory environment lacks the stringent protections found in more developed markets, and the high costs associated with trading may deter potential clients. Additionally, customer feedback indicates mixed experiences, particularly regarding fund withdrawals and platform stability.

For novice traders or those seeking a more secure trading environment, it may be prudent to consider alternative brokers with stronger regulatory oversight and more favorable trading conditions. Brokers regulated by authorities such as the FCA or ASIC are recommended for their robust investor protection measures. Ultimately, potential clients should carefully weigh the risks and benefits before engaging with Victory International Futures.

Is VICTORY INTERNATIONAL FUTURES a scam, or is it legit?

The latest exposure and evaluation content of VICTORY INTERNATIONAL FUTURES brokers.

VICTORY INTERNATIONAL FUTURES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VICTORY INTERNATIONAL FUTURES latest industry rating score is 7.21, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.21 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.