Regarding the legitimacy of Valbury forex brokers, it provides BAPPEBTI, JFX, FCA and WikiBit, (also has a graphic survey regarding security).

Is Valbury safe?

Pros

Cons

Is Valbury markets regulated?

The regulatory license is the strongest proof.

BAPPEBTI Forex Trading License (EP)

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

PT. VALBURY ASIA FUTURES

Effective Date:

--Email Address of Licensed Institution:

Legal.vaf@valbury.co.idSharing Status:

No SharingWebsite of Licensed Institution:

www.valbury.co.idExpiration Time:

--Address of Licensed Institution:

Menara Karya Lantait 9 dan Lantai 8 Unit B, C dan D, Jl. H.R. Rasuna Said Blok X-5, Kav 1-2, Kel. Kuningan Timur Kec. Setia Budi, Kuningan Timur, Jakarta Selatan 12950 DKI JAKARTA 12950Phone Number of Licensed Institution:

021 25533777Licensed Institution Certified Documents:

JFX Derivatives Trading License (AGN)

Jakarta Futures Exchange

Jakarta Futures Exchange

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

PT. VALBURY ASIA FUTURES

Effective Date:

--Email Address of Licensed Institution:

legal.vaf@valbury.co.idSharing Status:

No SharingWebsite of Licensed Institution:

valbury.co.idExpiration Time:

--Address of Licensed Institution:

Menara Karya Lt 9. Jl. H. R. Rasuna Said Blok X-5 Kav. 1-2, Kuningan, Jakarta SelatanPhone Number of Licensed Institution:

021 - 25533777Licensed Institution Certified Documents:

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Hibiscus Group Limited

Effective Date: Change Record

2011-06-21Email Address of Licensed Institution:

compliance@hibiscus.comSharing Status:

No SharingWebsite of Licensed Institution:

www.hibiscus.comExpiration Time:

--Address of Licensed Institution:

11th Floor 30 Crown Place London EC2A 4EB UNITED KINGDOMPhone Number of Licensed Institution:

+4407717794639Licensed Institution Certified Documents:

Is Valbury A Scam?

Introduction

Valbury, officially known as Valbury Asia Futures, is an Indonesian brokerage firm that specializes in forex and futures trading. Established in 2000, it has built a reputation as a significant player in the Indonesian financial markets, offering a range of trading products including forex, commodities, metals, and indices. However, the rise of online trading platforms has made it essential for traders to carefully evaluate the legitimacy and reliability of their chosen brokers. With numerous reports of scams and fraudulent activities in the forex industry, traders must exercise caution and conduct thorough research before committing their funds.

This article aims to provide an objective assessment of Valbury by examining its regulatory status, company background, trading conditions, customer fund security measures, client experiences, and potential risks. The analysis is based on a comprehensive review of various sources, including regulatory filings, user reviews, and expert opinions, to ensure a well-rounded perspective on whether Valbury is a safe trading option or a potential scam.

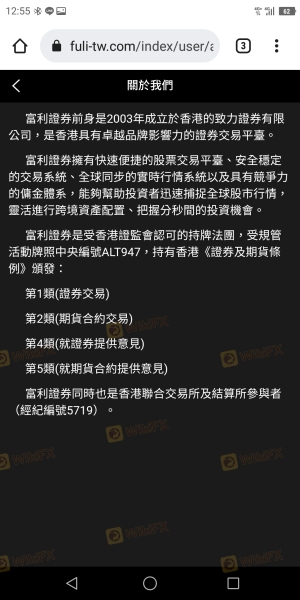

Regulation and Legitimacy

The regulatory environment in which a brokerage operates is crucial for determining its legitimacy and trustworthiness. Valbury is regulated by the Indonesian Commodity Futures Trading Regulatory Agency (Bappebti), which oversees the trading of commodities and futures in Indonesia. While Bappebti provides a level of oversight, it is important to note that its regulatory standards may not be as stringent as those of top-tier regulators such as the UKs Financial Conduct Authority (FCA) or the US Securities and Exchange Commission (SEC).

Here is a summary of Valbury's regulatory information:

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| Bappebti | 184/Bappebti/si/ii/2003 | Indonesia | Active |

| FCA | N/A | United Kingdom | Revoked |

Valbury was initially regulated by the FCA in the UK, which provided it with a strong reputation in the early years. However, this license was revoked, leaving Valbury regulated only by Bappebti. The lack of a top-tier regulatory license may raise concerns for potential traders, as it limits the protections available to clients in case of disputes or financial mismanagement.

In summary, while Valbury is a regulated entity, the quality of its regulation is not on par with more established regulatory bodies. Traders should approach with caution and conduct thorough due diligence before engaging with the broker.

Company Background Investigation

Valbury Asia Futures has a long history in the Indonesian financial market, having been founded in 2000. The brokerage is part of the Valbury Group, which encompasses multiple financial services, including asset management and investment advisory. The company's founder, Halim Danamas, is a notable figure in the Indonesian trading community and has played a significant role in establishing the Jakarta Futures Exchange.

The management team at Valbury consists of professionals with extensive backgrounds in finance and trading. However, specific details about their qualifications and experience are not readily available, which may raise transparency concerns. The company's website does provide some information about its services and offerings, but it lacks comprehensive disclosures regarding its financial performance and operational practices.

Transparency and information disclosure are critical factors in evaluating a broker's reliability. Potential clients should be wary of any brokerage that does not provide adequate details about its operations, management team, and financial health. In Valbury's case, while it has established itself as a reputable broker in Indonesia, the lack of detailed information can be a red flag for prospective traders.

Trading Conditions Analysis

Valbury offers a competitive trading environment, but it is essential to understand its fee structure and trading conditions. The broker primarily charges a fixed trading fee on transactions, along with spreads that vary depending on the asset class. Here is a comparison of Valbury's core trading costs:

| Fee Type | Valbury | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips | 1.2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

The average spread for major currency pairs at Valbury is reported to be 1.8 pips, which is higher than the industry average of 1.2 pips. This could indicate that trading costs at Valbury are relatively expensive compared to other brokers, potentially impacting profitability for frequent traders. Additionally, while there are no commissions on trades, the fixed trading fees and withdrawal fees (approximately $2 per transaction) can add up, making it essential for traders to consider these costs when evaluating their overall trading strategy.

Overall, while Valbury does provide a range of trading products and a user-friendly trading platform, the relatively high trading costs may deter some traders, particularly those looking for low-cost trading options.

Customer Fund Security

The security of client funds is a paramount concern for any trader. Valbury has implemented several measures to safeguard client capital, including fund segregation and adherence to local regulations. Client funds are held in segregated accounts, ensuring that they are kept separate from the company's operational funds. This practice is crucial in protecting clients in the event of the broker's insolvency.

However, it is important to note that Bappebti does not provide the same level of investor protection as some top-tier regulators. For instance, the FCA in the UK offers compensation schemes for clients in case of broker failure, which is not available under Bappebti's regulations. This limitation may pose a risk for traders who deposit substantial amounts with Valbury.

Furthermore, there have been historical concerns regarding fund withdrawals and delays in processing. Some users have reported difficulties in withdrawing their funds, which raises questions about the broker's operational transparency and reliability. While Valbury claims to process withdrawals promptly, potential traders should be vigilant and consider these factors before committing their capital.

Customer Experience and Complaints

Customer feedback is a vital component in assessing a broker's reliability. Reviews of Valbury indicate a mixed bag of experiences, with some clients praising the broker's customer service and trading platform, while others have raised concerns about withdrawal issues and high fees.

Common complaint patterns include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed |

| High Fees | Medium | Acknowledged |

| Poor Customer Support | Medium | Improved |

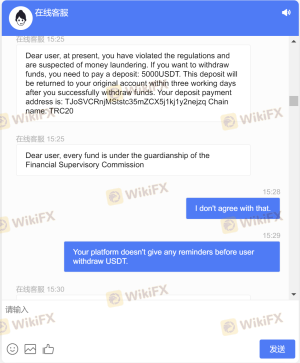

For example, some clients have reported that after making initial deposits, they faced difficulties when attempting to withdraw their funds. In some cases, clients were asked to deposit additional funds before their withdrawal requests were processed, leading to suspicions of unethical practices.

On the other hand, Valbury's customer support has received praise for being responsive and helpful, particularly in addressing technical inquiries and providing trading assistance. This mixed feedback suggests that while Valbury may have strengths in certain areas, significant issues remain that could affect a trader's experience.

Platform and Trade Execution

Valbury offers a proprietary trading platform along with access to the popular MetaTrader 4 (MT4) platform. The user interface is designed to be intuitive for both novice and experienced traders. However, the absence of the more advanced MT5 platform may disappoint some seasoned traders looking for enhanced features.

In terms of trade execution, Valbury aims to provide reliable and fast order processing. However, reports of slippage and rejections have surfaced, which could indicate potential issues with order execution quality. Traders should be cautious and monitor their orders closely, particularly during volatile market conditions.

Overall, while Valbury's platform offers essential trading functionalities, traders should be aware of the potential for execution issues and consider their trading style when choosing this broker.

Risk Assessment

When trading with Valbury, it is essential to evaluate the associated risks. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Limited regulatory oversight |

| Withdrawal Risk | High | Reports of withdrawal delays |

| Cost Risk | Medium | Higher trading costs compared to peers |

| Platform Risk | Medium | Potential execution issues |

To mitigate these risks, traders should conduct thorough research, maintain a diversified trading portfolio, and employ sound risk management strategies. Additionally, it is advisable to start with a demo account, if available, to familiarize oneself with the trading platform and conditions.

Conclusion and Recommendations

In conclusion, while Valbury is a regulated broker with a long-standing presence in the Indonesian market, several factors warrant caution. The broker's regulatory oversight is limited, and there have been reports of difficulties with fund withdrawals and higher-than-average trading costs.

For traders considering Valbury, it is essential to weigh these risks against their trading objectives and risk tolerance. If you are a novice trader or someone with limited capital, it may be wise to explore alternative brokers with stronger regulatory frameworks and better customer feedback. Reliable alternatives include brokers regulated by the FCA or ASIC, which offer higher levels of investor protection and more competitive trading conditions.

Ultimately, conducting thorough due diligence and remaining vigilant can help traders navigate the complexities of the forex market and make informed decisions regarding their trading partnerships.

Is Valbury a scam, or is it legit?

The latest exposure and evaluation content of Valbury brokers.

Valbury Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Valbury latest industry rating score is 5.93, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.93 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.