Regarding the legitimacy of Ultima forex brokers, it provides FCA, FSCA and WikiBit, .

Is Ultima safe?

Pros

Cons

Is Ultima markets regulated?

The regulatory license is the strongest proof.

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

ULTIMA MARKETS UK LIMITED

Effective Date: Change Record

2007-10-16Email Address of Licensed Institution:

yilu.wang@ultima-markets.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

https://www.ultima-markets.co.uk/Expiration Time:

--Address of Licensed Institution:

Regus New London House 6 London Street London City Of London EC3R 7AD UNITED KINGDOMPhone Number of Licensed Institution:

+4407920145175Licensed Institution Certified Documents:

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

ULTIMA MARKETS (PTY) LTD

Effective Date:

2022-12-14Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

18 CAVENDISH ROAD CLAREMONT CAPE TOWN 7708Phone Number of Licensed Institution:

021 0201540Licensed Institution Certified Documents:

Is Ultima Markets A Scam?

Introduction

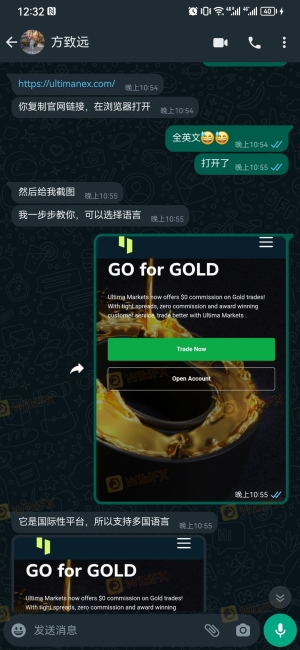

Ultima Markets is a forex and CFD broker that has positioned itself as a multi-asset trading platform, offering a variety of financial instruments including forex pairs, commodities, indices, and shares. Established in 2016, the broker claims to provide competitive trading conditions and a user-friendly experience. However, with the proliferation of online trading platforms, traders must exercise caution and thoroughly evaluate brokers before committing their funds. This is particularly important in the forex market, where the potential for scams and fraudulent activities is prevalent.

In this article, we will conduct a comprehensive review of Ultima Markets, focusing on its regulatory status, company background, trading conditions, customer safety, user experiences, platform performance, and associated risks. Our assessment will be based on a thorough analysis of available data, including regulatory information, customer feedback, and expert evaluations.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor in determining its legitimacy and reliability. Ultima Markets operates under multiple regulatory authorities, which is a positive aspect for potential traders. The following table summarizes the core regulatory information for Ultima Markets:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 426/23 | Cyprus | Verified |

| Financial Services Commission (FSC) | GB 23201593 | Mauritius | Verified |

| Financial Services Authority (FSA) | 26330 | St. Vincent and the Grenadines | Verified |

Ultima Markets is regulated by CySEC, which is known for its stringent regulatory framework, particularly in terms of investor protection and financial transparency. This regulatory oversight provides a level of assurance to traders that the broker adheres to established financial standards. However, the FSC in Mauritius is considered a tier-3 regulator, which means it has less stringent requirements compared to tier-1 regulators like the FCA in the UK or ASIC in Australia. While having multiple regulatory licenses is beneficial, the efficacy of these regulations varies significantly.

Historically, Ultima Markets has maintained compliance with the regulations imposed by these authorities. However, the presence of an offshore regulatory entity, such as the FSC and FSA, may raise concerns regarding the level of investor protection. Traders should be cautious and consider the implications of trading with a broker that is regulated in jurisdictions known for lax oversight.

Company Background Investigation

Ultima Markets was founded in 2016 and has since expanded its operations to serve clients globally. The company is registered in multiple jurisdictions, including Mauritius and Cyprus, which allows it to cater to a diverse client base. The ownership structure of Ultima Markets is not extensively detailed in public resources, which can be a point of concern for transparency.

The management team of Ultima Markets consists of professionals with backgrounds in finance and trading, although specific details about their experience and qualifications are not readily available. This lack of transparency about the management team can lead to skepticism regarding the broker's operational integrity.

In terms of information disclosure, Ultima Markets provides basic information on its website, including contact details and regulatory licenses. However, the absence of comprehensive details about the companys history and management could deter potential clients who prioritize transparency and accountability in their trading partners.

Trading Conditions Analysis

Ultima Markets offers a variety of trading conditions that are generally competitive within the industry. The broker provides different account types, including standard, ECN, and Pro ECN accounts, each tailored to the needs of various traders. The fee structure is a critical aspect of trading conditions, and it is essential to understand how Ultima Markets compares to industry averages.

The following table outlines the core trading costs associated with Ultima Markets:

| Fee Type | Ultima Markets | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 1 pip | From 0.6 pips |

| Commission Structure | $0 on Standard, $5 on ECN, $3 on Pro ECN | Varies, typically $3-$7 |

| Overnight Interest Range | Varies by position | Varies by broker |

Ultima Markets charges a spread starting from 1 pip on its standard account, which is on par with many competitors but higher than some brokers that offer spreads from 0.6 pips. The commission structure is competitive, especially for the Pro ECN account, which offers lower fees per lot. However, the presence of various fees, including potential withdrawal fees, may complicate the overall cost structure for traders.

While Ultima Markets appears to offer reasonable trading conditions, the higher spreads on certain accounts may not be favorable for all traders. It is crucial for potential clients to carefully consider their trading style and the associated costs before choosing to trade with Ultima Markets.

Client Fund Security

The security of client funds is paramount when selecting a forex broker. Ultima Markets claims to implement several measures to safeguard client funds, including the use of segregated accounts and adherence to regulatory requirements. Client funds are reportedly held in separate accounts, ensuring that they are not mixed with the broker's operational funds. This practice is essential for protecting traders' investments in the event of financial difficulties faced by the broker.

However, it is important to note that while Ultima Markets offers these security measures, the effectiveness of fund protection can vary based on the regulatory jurisdiction. The lack of an investor protection scheme in Mauritius raises concerns about the level of safety for client funds compared to brokers regulated by tier-1 authorities that offer compensation schemes in case of insolvency.

Historically, there have been no significant reports of fund security issues directly associated with Ultima Markets. Nonetheless, traders should remain vigilant and conduct their due diligence when it comes to fund security, especially with brokers operating in less stringent regulatory environments.

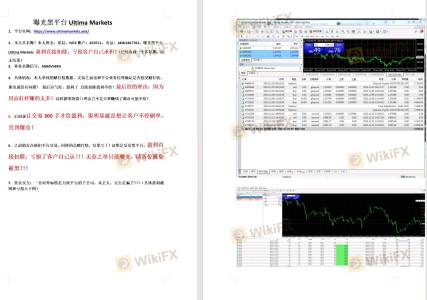

Customer Experience and Complaints

Customer feedback is a vital aspect of assessing a broker's reliability and service quality. Reviews of Ultima Markets indicate a mixed bag of experiences. While some clients commend the broker for its user-friendly platform and competitive trading conditions, others have raised concerns about withdrawal processes and customer support responsiveness.

The following table summarizes the primary types of complaints received about Ultima Markets:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed responses, some resolved |

| Customer Support Issues | Medium | Generally responsive but slow during peak hours |

| Account Verification | Low | Standard procedures followed |

One notable case involved a trader who experienced significant delays in withdrawing funds after a profitable trading period. Despite multiple attempts to contact customer support, the response was delayed, leading to frustration. This highlights the importance of a responsive customer service team and efficient withdrawal processes, which are critical for maintaining trust with clients.

Overall, while Ultima Markets has received positive feedback from some users, the complaints regarding withdrawal delays and customer support indicate areas for improvement. Traders should weigh these experiences against their own expectations and needs when considering this broker.

Platform and Trade Execution

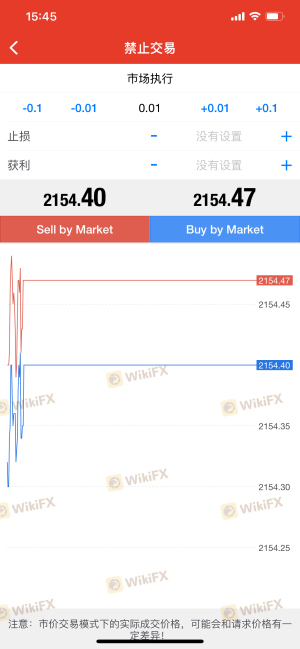

The performance of a trading platform is crucial for traders, as it directly impacts their ability to execute trades efficiently. Ultima Markets offers the popular MetaTrader 4 (MT4) platform, known for its reliability and range of features. The platform supports various trading tools, including technical indicators and automated trading capabilities, making it suitable for both novice and experienced traders.

In terms of execution quality, Ultima Markets claims to provide fast order execution times, with reports indicating execution speeds of less than 20 milliseconds. However, traders should be aware of potential slippage, which can occur during periods of high volatility. While Ultima Markets does not appear to have significant issues with slippage or order rejections, traders should remain cautious and monitor their execution quality.

There have been no widespread reports of platform manipulation or unethical practices associated with Ultima Markets. However, the broker's performance in this area should be continuously monitored, as trading conditions can change rapidly in the forex market.

Risk Assessment

Trading with Ultima Markets presents various risks that traders should carefully consider before engaging with the broker. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Dual regulation provides some safety, but offshore regulation may lack strict oversight. |

| Fund Security Risk | Medium | Segregated accounts enhance safety, but lack of investor protection schemes in Mauritius raises concerns. |

| Execution Risk | Low | Generally fast execution times, but slippage may occur during volatile market conditions. |

| Customer Support Risk | Medium | Mixed reviews on responsiveness and efficiency of support services. |

To mitigate these risks, traders should consider using smaller position sizes, diversifying their investments, and ensuring they fully understand the terms and conditions of trading with Ultima Markets. Additionally, maintaining open communication with customer support can help address any issues promptly.

Conclusion and Recommendations

In conclusion, while Ultima Markets presents itself as a legitimate forex broker with several positive attributes, there are notable concerns that potential traders should consider. The broker is regulated by multiple authorities, including CySEC and FSC, which adds a layer of legitimacy. However, the varying quality of regulation and concerns regarding fund security in offshore jurisdictions warrant caution.

Traders should be particularly mindful of the mixed customer feedback regarding withdrawal processes and customer support responsiveness. For those considering trading with Ultima Markets, it may be advisable to start with a demo account to familiarize themselves with the platform and assess its functionality without risking real capital.

For traders seeking more stringent regulatory oversight and a proven track record, alternatives such as brokers regulated by the FCA or ASIC may be more suitable. Overall, while Ultima Markets offers competitive trading conditions, potential clients should evaluate their risk tolerance and trading needs before making a decision.

Is Ultima a scam, or is it legit?

The latest exposure and evaluation content of Ultima brokers.

Ultima Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Ultima latest industry rating score is 7.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.