Regarding the legitimacy of TriumphFX forex brokers, it provides CYSEC, VFSC and WikiBit, (also has a graphic survey regarding security).

Is TriumphFX safe?

Business

License

Is TriumphFX markets regulated?

The regulatory license is the strongest proof.

CYSEC Forex Execution License (STP)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Shine Trades Limited (CY) Ltd

Effective Date: Change Record

2016-01-22Email Address of Licensed Institution:

compliance@shinetrades.comSharing Status:

No SharingWebsite of Licensed Institution:

www.shinetrades.comExpiration Time:

--Address of Licensed Institution:

Γωνία Σωτήρη Μιχαηλίδη και 28ης Οκτωβρίου, Lophitis International Center, 3035 ΛεμεσόςPhone Number of Licensed Institution:

+357 25 030 337Licensed Institution Certified Documents:

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

UnverifiedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Triumph Int. Limited

Effective Date:

2017-04-26Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is TriumphFX A Scam?

Introduction

TriumphFX, established in 2009, positions itself as an international brokerage firm offering forex and commodities trading services. With its headquarters in Limassol, Cyprus, TriumphFX aims to cater to a diverse clientele, including both retail and institutional traders. As the forex market continues to grow, traders are increasingly faced with a plethora of options when selecting a broker. This abundance of choices necessitates a careful evaluation of each broker's legitimacy, regulatory compliance, and overall reputation. Given the prevalence of scams in the financial sector, it is crucial for traders to conduct thorough research before committing their funds.

In this article, we will investigate TriumphFX's regulatory status, company background, trading conditions, customer fund safety, client experiences, platform performance, risk factors, and ultimately draw a conclusion about its legitimacy. Our assessment is based on a comprehensive analysis of available data, including user reviews, regulatory information, and industry standards.

Regulation and Legitimacy

The regulatory environment is one of the most critical aspects to consider when evaluating a forex broker. TriumphFX operates under multiple regulatory authorities, which adds a layer of credibility to its operations. Below is a summary of its regulatory status:

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 293/16 | Cyprus | Active |

| Vanuatu Financial Services Commission (VFSC) | 17901 | Vanuatu | Active (but historically problematic) |

| Seychelles Financial Services Authority (FSA) | SD 080 | Seychelles | Active |

TriumphFX is primarily regulated by CySEC, a reputable authority known for its stringent regulatory standards within the European Union. This licensing ensures that TriumphFX adheres to the European Markets in Financial Instruments Directive (MiFID), which provides essential protections for investors, including the segregation of client funds and participation in an investor compensation scheme.

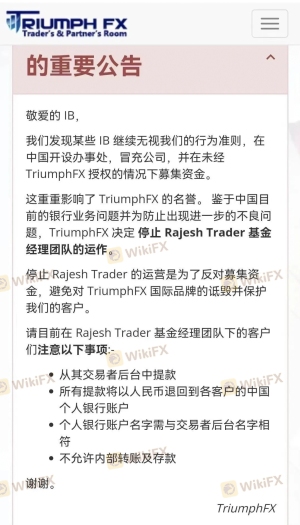

However, the broker also has entities registered in Vanuatu and Seychelles, which are known for less stringent regulatory requirements. The VFSC has previously faced criticism for its regulatory oversight, and TriumphFX's history of losing its CySEC license raises concerns about its compliance practices. Although the company has regained its license, potential investors should remain vigilant regarding its offshore operations, as these may not offer the same level of protection as the CySEC-regulated entity.

Company Background Investigation

TriumphFX has a relatively long history in the forex market, having been founded in 2009. Initially, it aimed to democratize forex trading by providing accessible trading solutions to individuals regardless of their experience level. The company has expanded its operations over the years, establishing a presence in several countries, including Malaysia and Australia.

The ownership structure of TriumphFX is somewhat opaque, with Triumph International Limited being the parent company. The management team comprises individuals with varying degrees of experience in the financial sector, but specific details about their backgrounds are not extensively disclosed. This lack of transparency can be a red flag for potential investors, as it raises questions about the company's accountability.

In terms of information disclosure, TriumphFX provides a basic overview of its services and regulatory status on its website. However, there is a noticeable lack of detailed information regarding its financial health, corporate governance, and internal policies. This limited transparency can hinder potential clients' ability to make informed decisions.

Trading Conditions Analysis

Understanding the trading conditions offered by TriumphFX is essential for evaluating its suitability for potential traders. TriumphFX provides a variety of account types, each with distinct features and fee structures. Overall, the broker's fee structure is competitive but has some areas of concern.

| Fee Type | TriumphFX | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 0.1 pips | 0.2 - 0.5 pips |

| Commission Structure | $3 - $6 per lot (for premium accounts) | Varies widely |

| Overnight Interest Rate | 2.5% | 2.0% - 3.0% |

TriumphFX offers spreads starting from 0.1 pips, which is competitive compared to industry standards. However, it is important to note that higher-tier accounts require larger minimum deposits and may incur additional commissions. The commission structure, particularly for premium accounts, may be seen as a drawback for traders who prefer lower fees.

One noteworthy aspect of TriumphFX's fees is the overnight interest rate, which is around 2.5%. This rate is in line with industry averages but can be a significant cost for traders holding positions overnight. Additionally, the broker has been reported to charge withdrawal fees, which can deter clients from accessing their funds promptly.

Customer Fund Safety

The safety of client funds is paramount when evaluating a broker. TriumphFX claims to implement several measures to protect its clients' investments. The broker segregates client funds from its operational accounts, ensuring that client capital is not used for business expenses. This practice is essential for safeguarding investors' money in the event of bankruptcy.

Furthermore, TriumphFX is a participant in the investor compensation fund (ICF) under CySEC regulation, which provides additional security for clients in case of insolvency. However, it is important to note that these protections may not extend to clients using the offshore entities in Vanuatu and Seychelles, where regulatory oversight is less stringent.

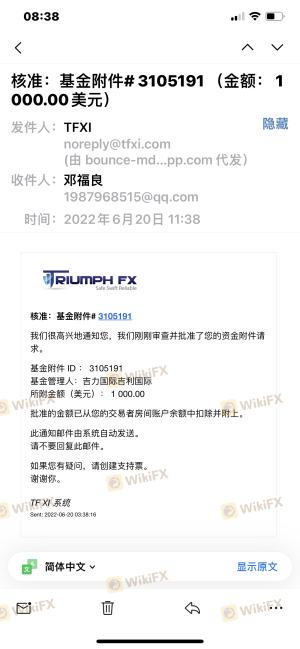

Historically, TriumphFX has faced scrutiny regarding its fund safety, particularly in relation to its offshore operations. Clients have reported difficulties in withdrawing funds, raising concerns about the broker's commitment to safeguarding client assets. Potential investors should consider these factors carefully before deciding to trade with TriumphFX.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. TriumphFX has received mixed reviews from clients, with some praising its competitive spreads and user-friendly platform, while others have raised concerns about withdrawal issues and customer support responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response, often unresolved |

| Account Verification Issues | Medium | Delays in processing |

| Customer Support Availability | Medium | Limited hours, ticket-based system |

Common complaints include delays in fund withdrawals, with some users reporting difficulties in accessing their money. While TriumphFX has a ticket-based support system, the response times can vary, often leading to frustration among clients. Additionally, the lack of 24/7 customer support can hinder timely assistance for urgent inquiries.

Two notable case studies illustrate these issues. One client reported a withdrawal request taking over two weeks to process, leading to significant frustration. Another user faced challenges during the account verification process, resulting in delays that prevented them from trading. These experiences highlight the need for improved customer service and operational efficiency.

Platform and Trade Execution

The trading platform offered by TriumphFX is MetaTrader 4 (MT4), a widely used platform known for its reliability and advanced features. While MT4 provides a user-friendly interface and robust analytical tools, some users have reported issues with order execution, including slippage and rejections during high volatility.

The overall performance of the platform is generally satisfactory, but traders should be aware of potential delays during peak trading hours. Furthermore, the absence of a proprietary trading platform may limit the broker's appeal to those seeking more advanced trading technologies.

Risk Assessment

Using TriumphFX comes with several risks that potential traders should consider. Below is a summary of key risk areas associated with trading through this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Involvement with offshore entities raises concerns. |

| Fund Safety Risk | High | Historical issues with fund withdrawals and offshore regulations. |

| Customer Support Risk | Medium | Limited support availability and slow response times. |

To mitigate these risks, potential traders should conduct thorough research, consider using only the CySEC-regulated entity, and be cautious when trading with the offshore branches. Additionally, maintaining realistic expectations regarding withdrawal times and customer service responsiveness can help manage potential frustrations.

Conclusion and Recommendations

In conclusion, while TriumphFX is a regulated broker with certain safeguards in place, there are significant concerns regarding its offshore operations and customer service. The mixed feedback from clients, particularly related to withdrawal issues and support responsiveness, indicates that potential traders should exercise caution.

For those considering trading with TriumphFX, it is advisable to use the CySEC-regulated entity to ensure the highest level of protection. However, if you are seeking a more reliable and transparent trading experience, consider alternative brokers with a stronger reputation and better customer service records.

Some reputable alternatives include brokers like IG, Pepperstone, and XM, which are known for their regulatory compliance, robust trading platforms, and responsive customer support. As always, conducting thorough research and due diligence is essential when selecting a broker in the forex market.

Is TriumphFX a scam, or is it legit?

The latest exposure and evaluation content of TriumphFX brokers.

TriumphFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TriumphFX latest industry rating score is 1.64, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.64 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.