TriumphFX 2025 Review: Everything You Need to Know

Executive Summary

TriumphFX has operated in online trading since 2009. The company positions itself as a global forex and CFD brokerage that targets both retail and institutional investors. This triumphfx review reveals a broker that creates major controversy among users, with trust levels being a primary concern for potential clients.

The broker offers several competitive features including leverage up to 1:500 and spreads starting from 0.6 pips. These features are supported by the popular MetaTrader 4 trading platform. TriumphFX provides access to multiple asset classes including forex pairs, precious metals, commodities, and indices, utilizing NDD (No Dealing Desk) and STP (Straight Through Processing) execution models.

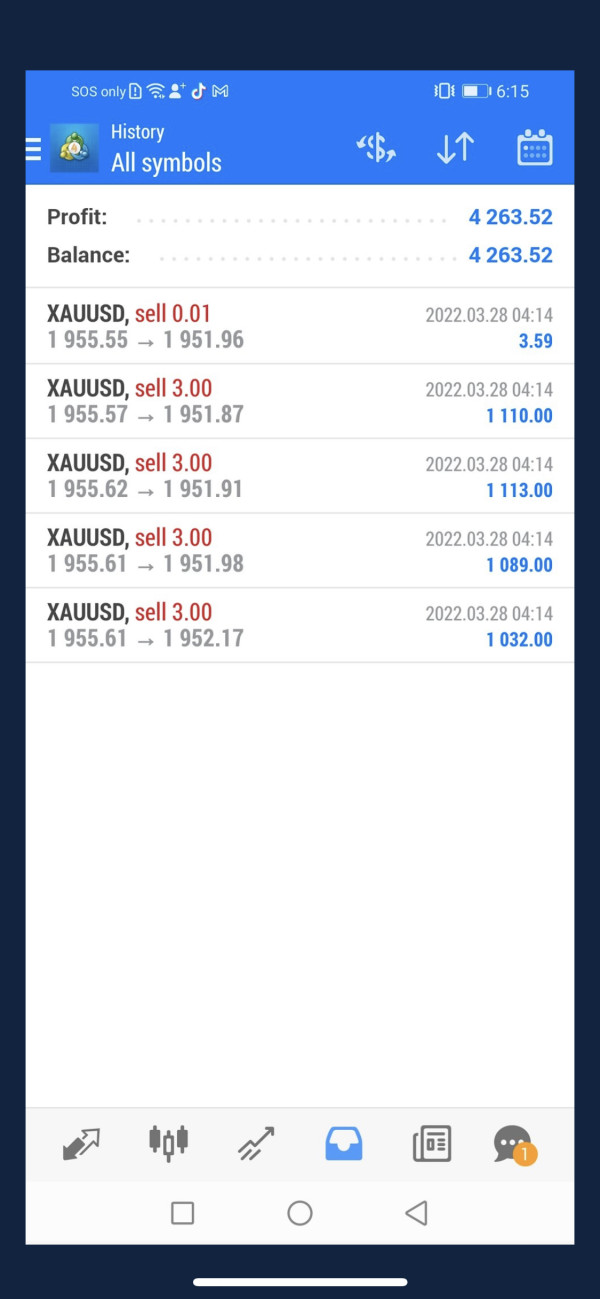

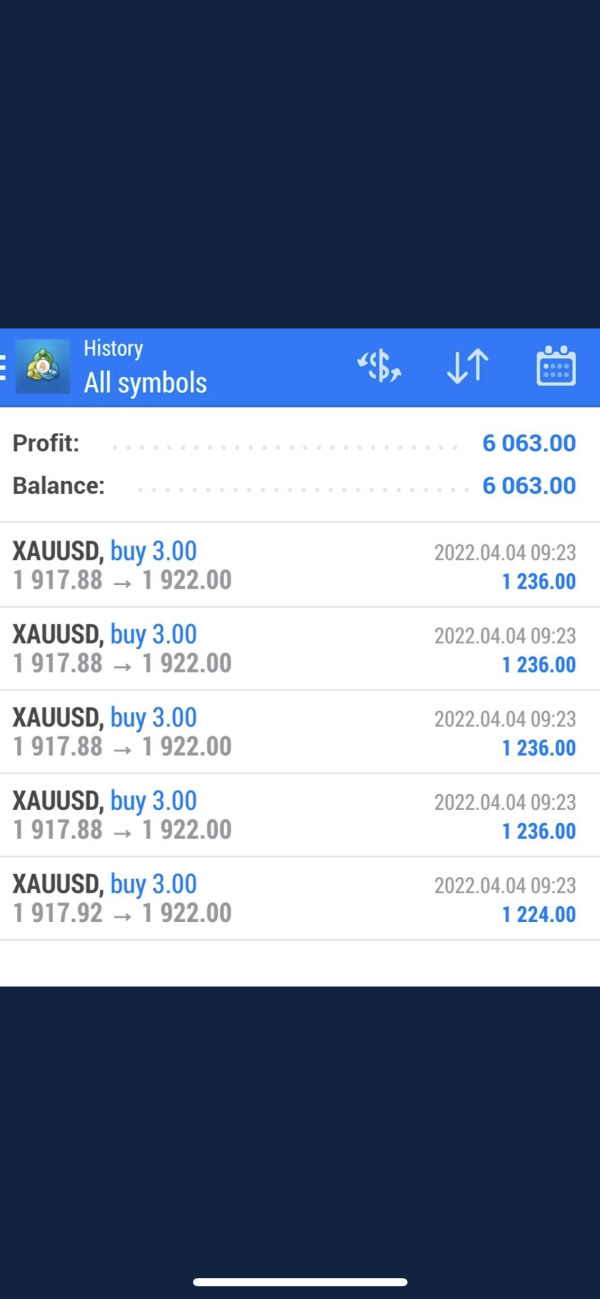

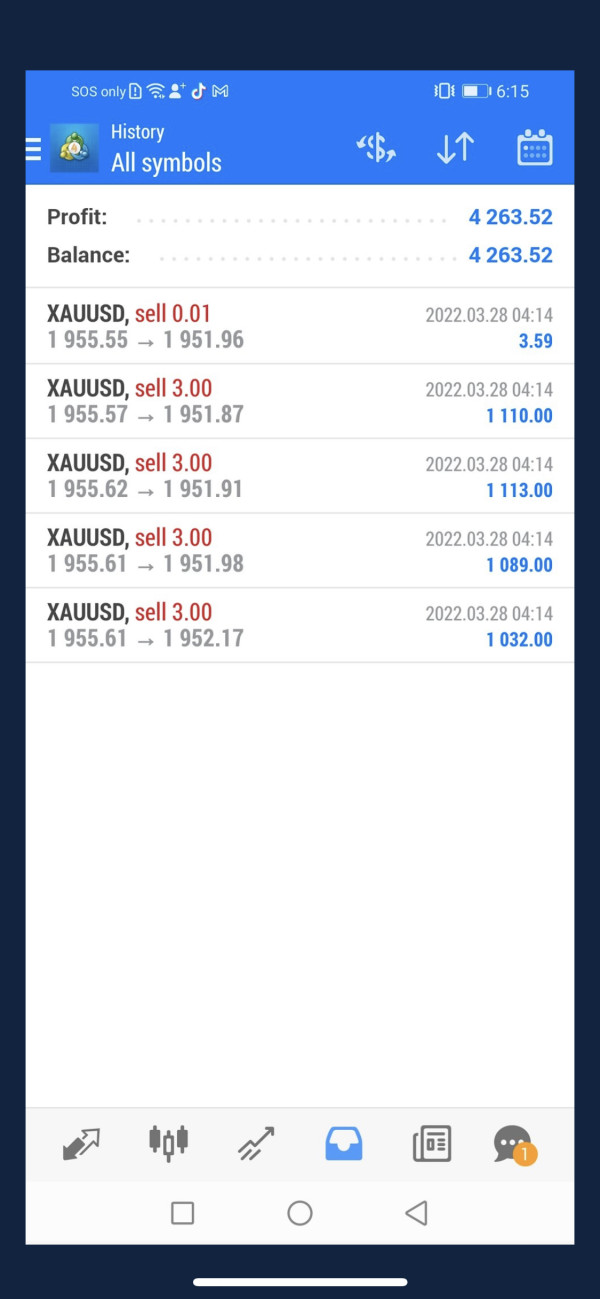

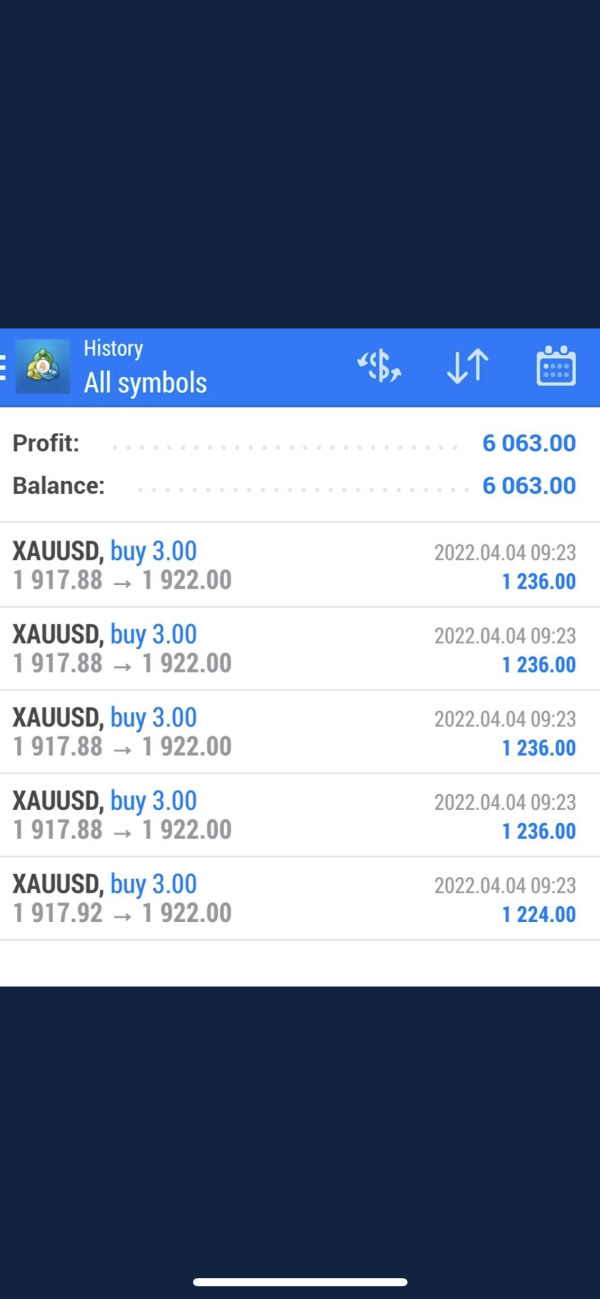

However, our analysis shows major user concerns about the broker's reliability. With 72 user complaints involving about $5.3 million in reported losses, TriumphFX faces serious trust issues within the trading community. While the broker claims regulation under CySEC and VFSC, the lack of clear licensing information and many negative user experiences suggest that experienced traders should be extremely careful. The platform may appeal to traders seeking high leverage and diverse asset access, but the risk factors greatly outweigh the potential benefits for most investors.

Important Notice

This review is based on publicly available information and user feedback collected from various sources. TriumphFX operates under claimed regulation from the Cyprus Securities and Exchange Commission (CySEC) and the Vanuatu Financial Services Commission (VFSC), though regulatory compliance and investor protection measures may vary greatly across different jurisdictions. Potential clients should independently verify all regulatory claims and consider the varying levels of investor protection available in different regions before engaging with this broker.

Rating Framework

Broker Overview

TriumphFX established its presence in the online trading industry in 2009. The company presents itself as a comprehensive forex and CFD brokerage service. The company focuses mainly on providing access to global financial markets through forex trading while expanding its offerings to include commodities, indices, and precious metals.

Operating under a No Dealing Desk (NDD) business model, TriumphFX claims to provide direct market access without intervention in client trades. The broker has positioned itself to serve both retail and institutional investors, emphasizing its longevity in the market and wide-reaching claims of regulation and transparency. According to available information, TriumphFX operates through the MetaTrader 4 platform, which serves as the primary trading interface for its clients.

The company's business model centers on providing competitive spreads and high leverage ratios to attract traders seeking enhanced market exposure. This triumphfx review indicates that while the broker has maintained operations for over a decade, its reputation within the trading community remains greatly challenged by user experiences and trust-related concerns.

Regulatory Jurisdictions: TriumphFX claims regulation under the Cyprus Securities and Exchange Commission (CySEC) and the Vanuatu Financial Services Commission (VFSC). However, specific license numbers are not clearly provided in available materials.

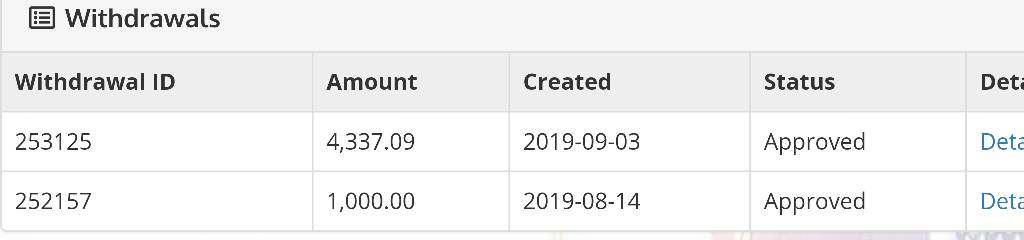

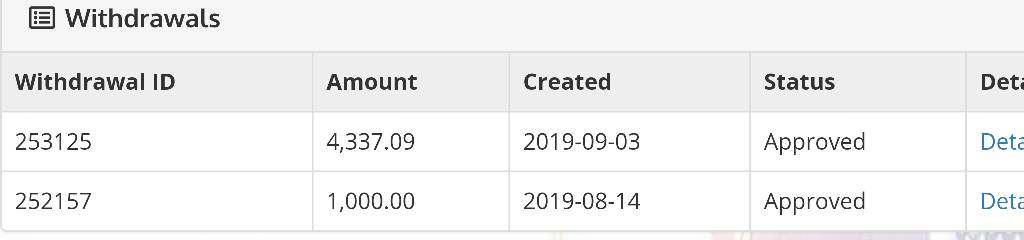

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods was not detailed in available sources. This requires direct verification with the broker.

Minimum Deposit Requirement: The broker requires a minimum deposit of $100. This makes it accessible to traders with limited initial capital.

Bonus and Promotions: Available information does not specify current bonus offerings or promotional campaigns.

Tradeable Assets: TriumphFX provides access to forex currency pairs, precious metals, commodities, and various market indices. This offers diversified trading opportunities.

Cost Structure: The broker advertises minimum spreads starting from 0.6 pips. However, commission structures and additional fees require clarification through direct inquiry.

Leverage Ratios: Maximum leverage of 1:500 is available. This provides significant market exposure potential for experienced traders.

Platform Options: Trading is conducted through the MetaTrader 4 platform. This supports various trading tools and automated trading capabilities.

Geographic Restrictions: Specific regional limitations were not detailed in available information sources.

Customer Support Languages: The range of supported languages for customer service was not specified in available materials. This triumphfx review emphasizes the need for direct verification of service details.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

TriumphFX offers account opening with a relatively modest $100 minimum deposit requirement. This makes the platform theoretically accessible to new traders entering the forex market. However, the specific account types and their distinctive features are not clearly detailed in available information, creating uncertainty about the range of options available to different trader categories.

The $100 minimum deposit appears competitive compared to many brokers requiring higher initial investments. This potentially attracts traders with limited capital. However, user complaints suggest that the account opening process and subsequent fund management have been problematic for many clients.

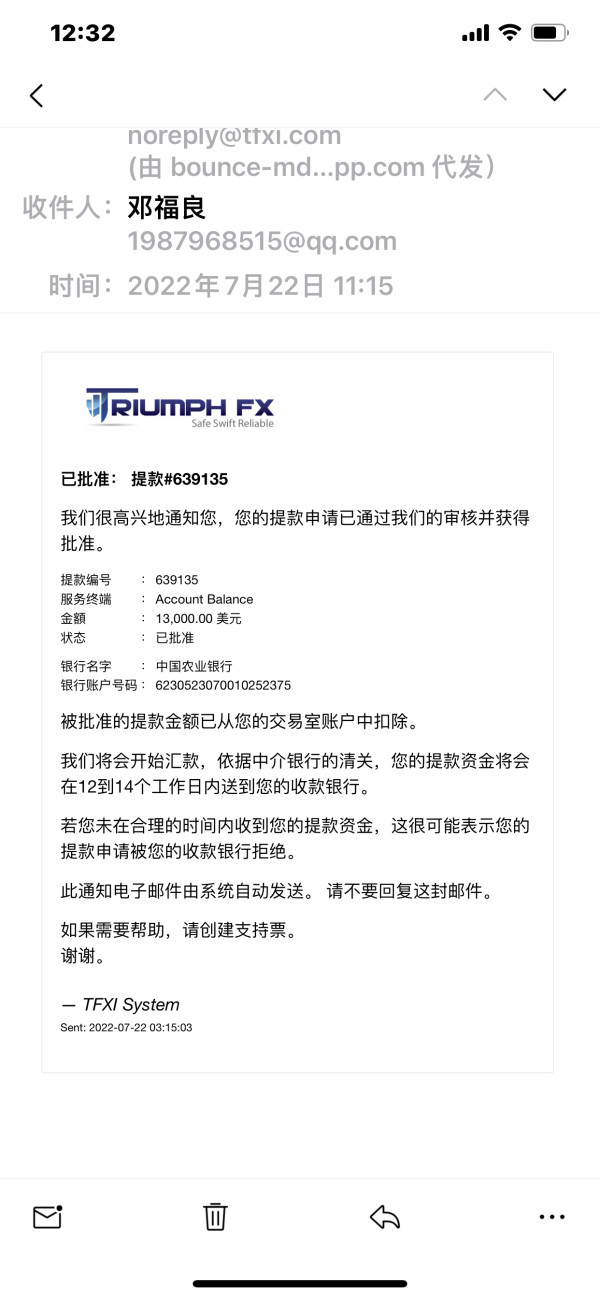

The lack of detailed information about account tiers, special features, or Islamic account availability raises concerns about transparency. User feedback indicates significant issues with account management and fund accessibility, with multiple reports of difficulties in withdrawal processes. The absence of clear information about account protection measures, such as negative balance protection or segregated client funds, further reduces the attractiveness of the account conditions.

While the low minimum deposit might appeal to beginners, the overall account experience appears compromised by service quality issues that affect the practical usability of trading accounts. This triumphfx review suggests that potential clients should carefully evaluate whether the apparent accessibility translates into genuine trading advantages.

TriumphFX provides trading services through the MetaTrader 4 platform. This offers a comprehensive suite of trading tools suitable for various trading strategies and experience levels. The MT4 platform includes standard features such as technical indicators, charting tools, and automated trading capabilities through Expert Advisors, providing traders with essential analytical resources.

The broker's asset diversity includes forex pairs, precious metals, commodities, and indices. This offers traders multiple market opportunities within a single platform. This range allows for portfolio diversification and various trading approaches, from currency speculation to commodity trading strategies.

However, available information suggests limited educational resources and market research materials. The absence of detailed research reports, market analysis, or comprehensive educational programs reduces the platform's value for traders seeking to enhance their knowledge and skills. While the MT4 platform itself provides robust technical analysis capabilities, the lack of broker-specific educational content and market insights limits the overall resource offering.

User feedback indicates general satisfaction with the platform's functionality, though some traders have noted limitations in advanced trading tools and research materials. The automated trading support through MT4 provides some value for algorithmic traders, but the overall tools and resources package appears standard rather than exceptional compared to leading industry competitors.

Customer Service and Support Analysis (Score: 4/10)

Customer service represents one of TriumphFX's most significant weaknesses. Substantial user complaints indicate poor service quality and inadequate response times. The 72 user complaints involving $5.3 million in reported losses suggest systemic issues in customer support and problem resolution capabilities.

Available information does not specify the range of customer service channels, operating hours, or multilingual support options. This creates uncertainty about service accessibility. User feedback consistently points to slow response times and ineffective problem resolution, particularly regarding withdrawal requests and account-related issues.

The volume and severity of user complaints indicate that customer service fails to meet basic industry standards. Reports suggest that clients experience significant difficulties in reaching support representatives and obtaining satisfactory resolutions to their concerns. The lack of transparent communication channels and response time commitments further compounds these service quality issues.

Multiple users have reported feeling ignored or receiving inadequate responses to serious concerns about fund access and account management. The pattern of complaints suggests that customer service issues are not isolated incidents but rather indicative of broader operational problems within the organization's support infrastructure.

Trading Experience Analysis (Score: 7/10)

The trading experience at TriumphFX benefits from competitive spreads starting at 0.6 pips and the utilization of NDD (No Dealing Desk) and STP (Straight Through Processing) execution models. These features generally contribute to improved order execution and reduced conflicts of interest between the broker and clients.

The MetaTrader 4 platform provides a stable and familiar trading environment for most forex traders. It includes standard functionality including real-time quotes, comprehensive charting tools, and automated trading capabilities. User feedback suggests that the platform operates with reasonable stability and acceptable execution speeds under normal market conditions.

The low spread offering enhances the trading environment's attractiveness, particularly for frequent traders and scalping strategies. The NDD/STP execution model theoretically reduces the likelihood of requotes and slippage, contributing to more transparent trading conditions.

However, the overall trading experience is significantly impacted by concerns about fund security and withdrawal processes. While the technical aspects of trade execution appear satisfactory, the broader trading experience suffers from trust-related issues that affect trader confidence. The platform's technical performance appears adequate, but the surrounding service quality issues substantially reduce the overall trading experience value.

This triumphfx review indicates that while execution quality may be acceptable, the complete trading experience includes significant risk factors that traders must carefully consider.

Trust and Reliability Analysis (Score: 3/10)

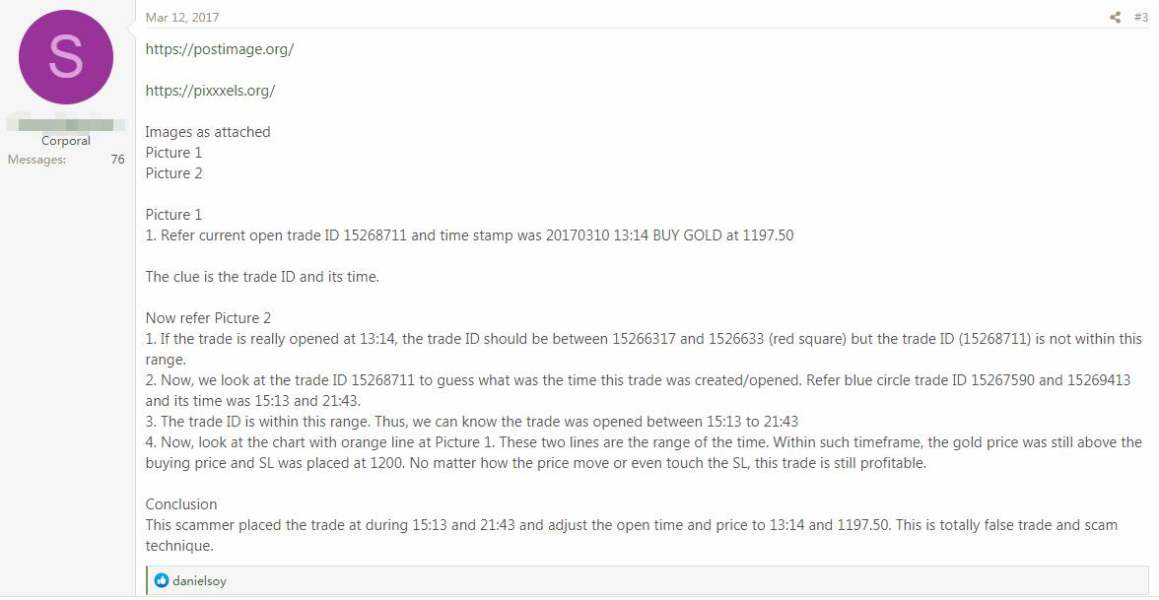

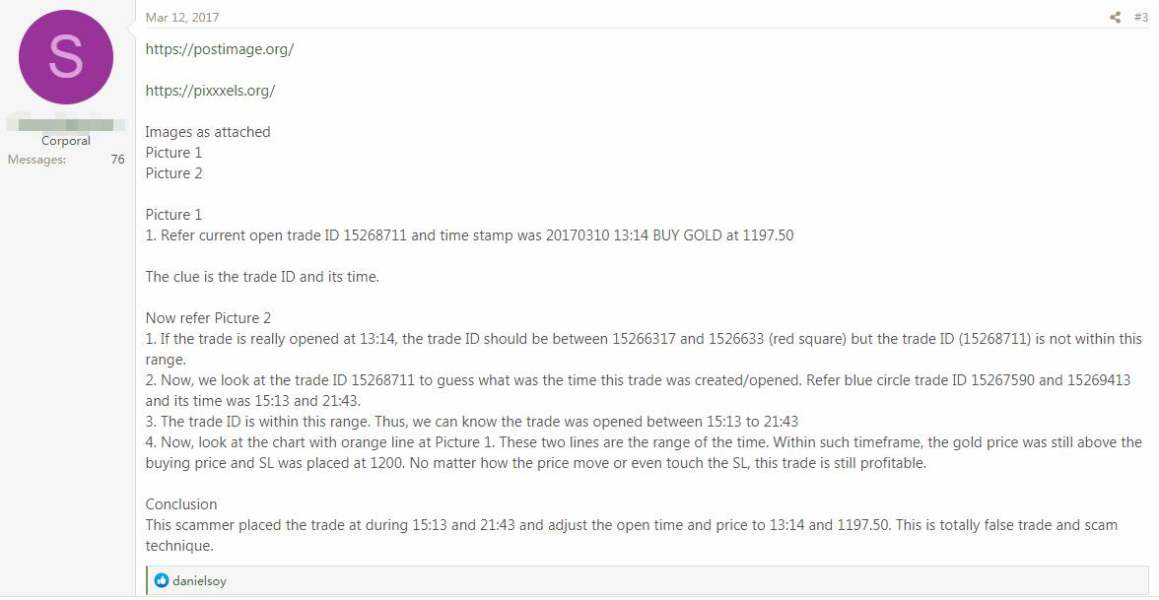

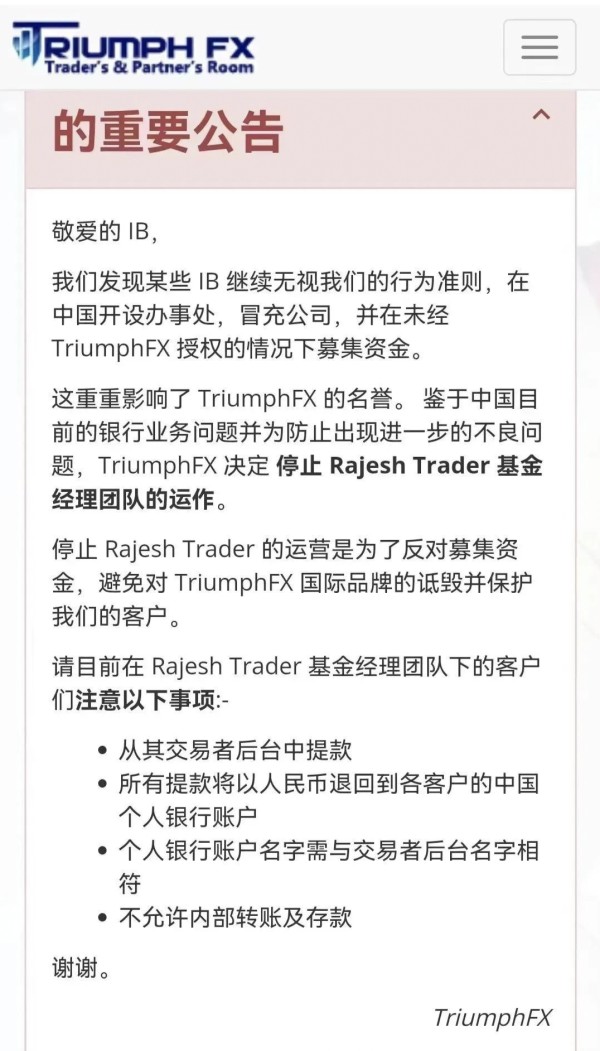

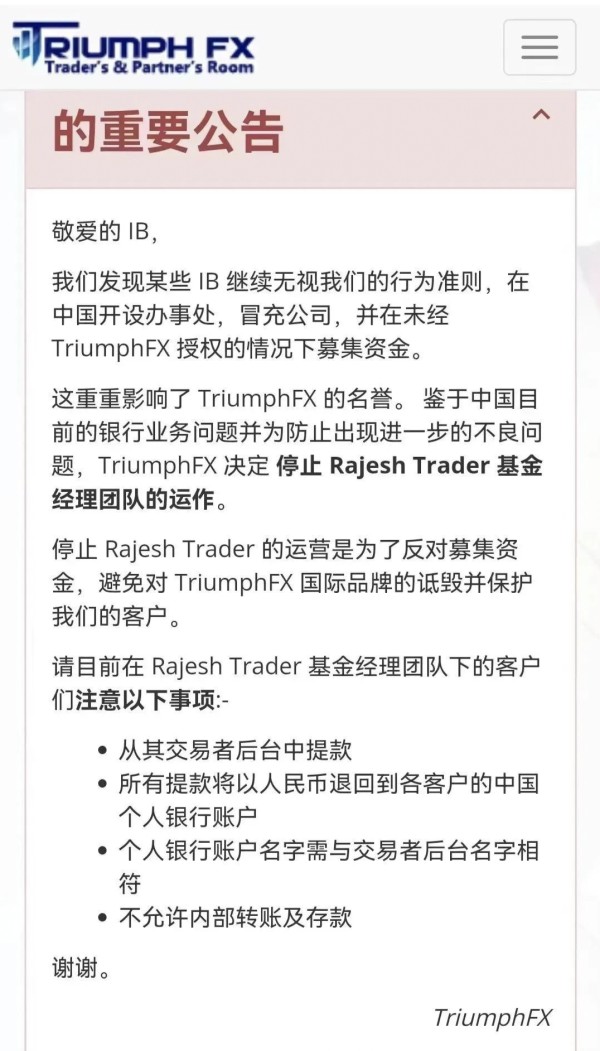

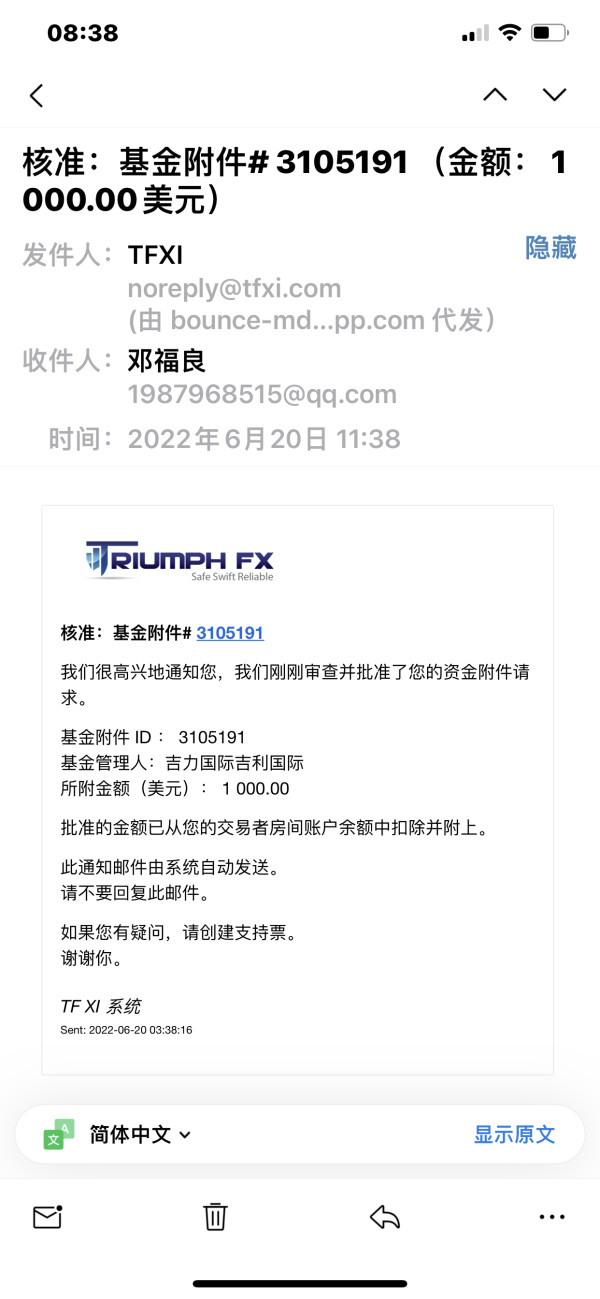

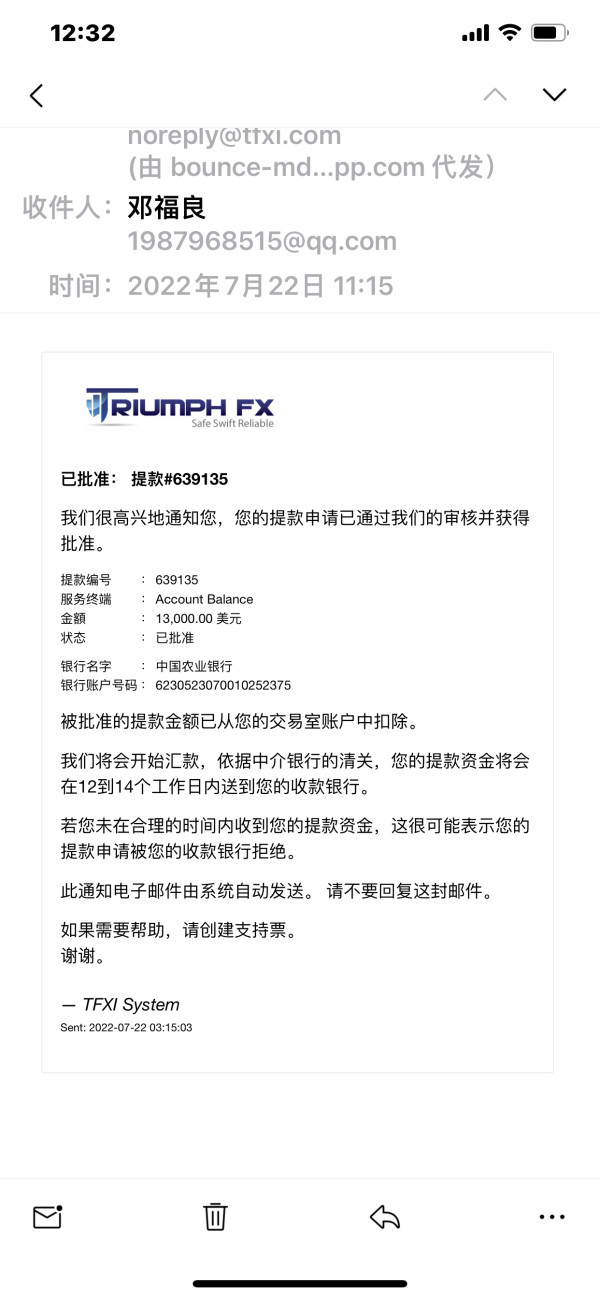

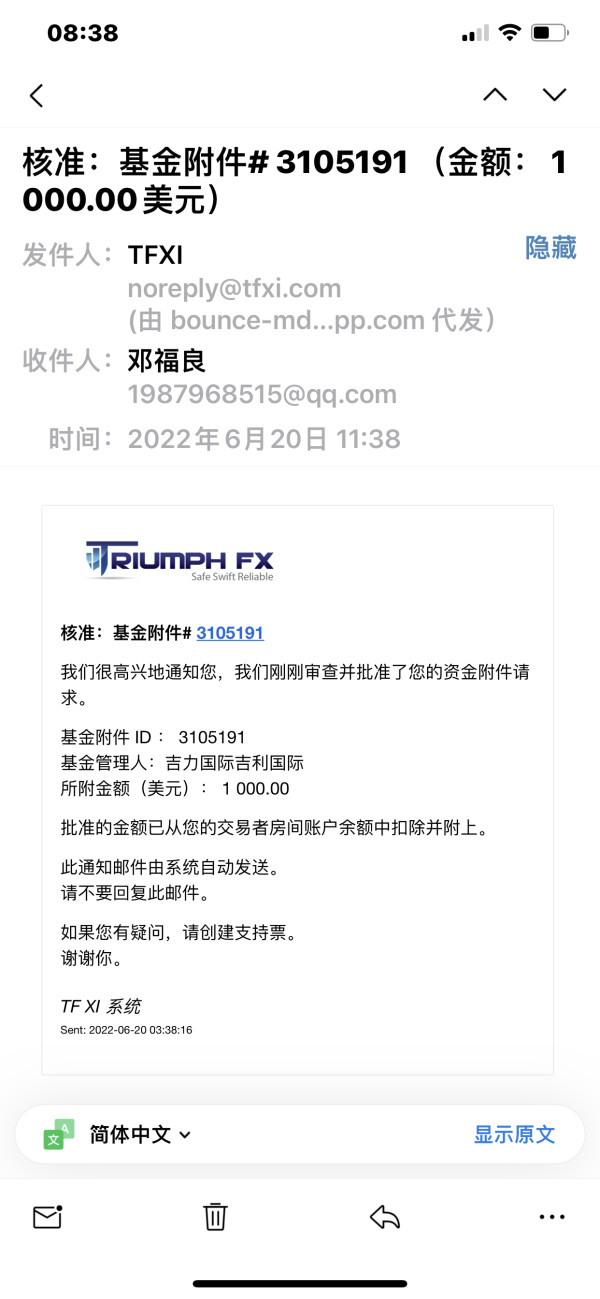

Trust and reliability represent TriumphFX's most critical weakness. Substantial evidence suggests significant concerns about the broker's credibility. The 72 user complaints involving approximately $5.3 million in reported losses indicate serious issues with fund security and operational transparency.

While TriumphFX claims regulation under CySEC and VFSC, the lack of clearly provided license numbers and transparent regulatory information raises questions about the actual extent and validity of regulatory oversight. The absence of detailed information about client fund segregation, deposit insurance, or other investor protection measures further compounds trust concerns.

The volume and consistency of negative user feedback suggest systemic problems rather than isolated incidents. Reports of withdrawal difficulties, unresponsive customer service, and fund access issues create a pattern that significantly undermines the broker's credibility within the trading community.

The broker's transparency regarding management information, financial reporting, and operational procedures appears limited. This makes it difficult for potential clients to conduct proper due diligence. The lack of clear information about company ownership, financial stability, and regulatory compliance status contributes to the overall trust deficit.

Multiple sources indicate that fraud-related complaints have not been adequately addressed, suggesting that the broker may lack effective mechanisms for handling serious client concerns. The combination of regulatory uncertainty, user complaints, and limited transparency creates a trust profile that falls well below industry standards for reputable brokers.

User Experience Analysis (Score: 5/10)

User experience at TriumphFX presents a mixed picture with significant polarization between different client experiences. While some traders report satisfactory technical performance from the MT4 platform, a substantial number of users express serious concerns about overall service quality and reliability.

The MetaTrader 4 interface provides a familiar and reasonably well-designed trading environment that most forex traders can navigate effectively. The platform's standard features and functionality contribute positively to the user interface experience, though advanced customization options may be limited.

However, the user experience is severely impacted by reported difficulties with account management, fund operations, and customer service interactions. Many users report frustration with withdrawal processes, communication difficulties, and unresolved account issues that significantly detract from the overall platform experience.

The registration and verification processes are not clearly documented in available information. This creates uncertainty about onboarding efficiency. User complaints frequently focus on fund-related operations, suggesting that while trading execution may be acceptable, the broader account management experience presents significant challenges.

The user community appears divided, with experienced traders generally expressing more caution and concern about the broker's reliability. The pattern of complaints suggests that user satisfaction decreases significantly when clients encounter problems requiring customer service intervention or fund-related operations beyond basic trading activities.

Conclusion

TriumphFX presents a complex profile that combines some competitive trading features with significant trust and reliability concerns. While the broker offers attractive technical specifications including high leverage up to 1:500, competitive spreads from 0.6 pips, and access to the popular MT4 platform, these advantages are substantially overshadowed by serious credibility issues.

The broker may theoretically appeal to experienced traders seeking high leverage and diverse asset access. However, the substantial volume of user complaints involving millions in reported losses makes it unsuitable for most traders. New traders should particularly avoid this broker due to the combination of trust issues and limited educational resources.

The primary advantages of low spreads and high leverage are significantly outweighed by customer service deficiencies, trust concerns, and the documented pattern of user difficulties with fund operations and problem resolution.