Is RSTFX safe?

Business

License

Is RSTFX Safe or Scam?

Introduction

RSTFX, an offshore forex broker based in Hong Kong, has emerged in the trading landscape, attracting attention from both novice and experienced traders. However, the question remains: Is RSTFX safe? In an industry rife with unregulated entities and potential scams, it's crucial for traders to conduct thorough evaluations of brokers before committing their funds. This article aims to provide an objective analysis of RSTFX, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. By utilizing various sources and reviews, we will offer a comprehensive picture of whether RSTFX is a trustworthy platform or a potential scam.

Regulation and Legitimacy

The regulatory environment is a cornerstone for determining the safety of a forex broker. RSTFX is notably unregulated, lacking oversight from any reputable financial authorities. This absence of regulation raises significant concerns about the broker's legitimacy and the safety of traders' funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Hong Kong | Not Verified |

The importance of regulation cannot be overstated; it serves as a safeguard against fraudulent activities and ensures that brokers adhere to strict operational standards. Unregulated brokers like RSTFX often operate in jurisdictions where regulatory oversight is minimal, making it easier for them to engage in questionable practices. Historical compliance records are vital in assessing a broker's reliability, and RSTFX's lack of any regulatory backing signifies potential risks for traders.

Company Background Investigation

RSTFX operates under the name Hong Kong Ritter Industrial Co., Limited, but detailed information about its history and ownership structure is scarce. The company's foundation appears to be relatively recent, with no substantial history to validate its operations or track record.

The management team behind RSTFX remains largely anonymous, which is a red flag for potential investors. A transparent company typically provides information about its leadership, including their backgrounds and professional experiences. The lack of such disclosures raises concerns about the broker's accountability and operational integrity.

Transparency is a key factor in establishing trust, and RSTFX's limited information hinders traders from making informed decisions. The absence of clear ownership details and management profiles further compounds the uncertainty surrounding this broker.

Trading Conditions Analysis

When evaluating a forex broker, understanding the cost structure is essential. RSTFX's trading conditions have been reported with various discrepancies, particularly regarding fees and spreads. Traders have expressed concerns over hidden charges and unclear withdrawal policies, which could lead to unexpected costs.

| Fee Type | RSTFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies | 1-3 pips |

| Commission Model | Not Clear | Competitive |

| Overnight Interest Range | High | Low to Moderate |

The overall fee structure at RSTFX appears to deviate from industry norms, with reports of unusually high overnight interest rates and vague commission policies. Such practices can erode trader profits and signal potential exploitation. It's essential for traders to scrutinize these aspects before engaging with the broker, as they could indicate a lack of transparency and fairness.

Client Funds Security

The safety of client funds is paramount in any trading environment. RSTFX has been criticized for lacking robust security measures, such as segregated accounts and investor protection mechanisms. The absence of these safeguards poses a significant risk to traders, as it leaves their funds vulnerable to mismanagement or potential loss.

Regrettably, there have been no documented instances of fund security breaches at RSTFX; however, the lack of protective measures raises concerns about the broker's commitment to safeguarding client assets. Traders should always prioritize brokers that implement stringent security protocols, including negative balance protection and secure fund segregation.

Customer Experience and Complaints

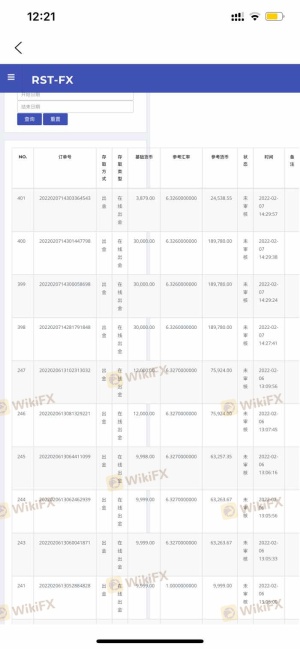

Customer feedback plays a crucial role in evaluating a broker's reliability. RSTFX has garnered a considerable number of negative reviews, with many users reporting issues related to fund withdrawals and customer service responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Unresponsive |

| Misleading Promotions | High | Ignored |

Common complaints include the inability to withdraw funds, with many traders claiming their requests were met with excuses or delays. The overall sentiment among users suggests a lack of accountability and support from RSTFX, which could deter potential clients from trusting the broker.

One notable case involved a trader who was unable to withdraw their funds after repeated attempts, leading to frustration and financial loss. Such experiences highlight the importance of choosing a broker with a solid reputation for customer support and transparency.

Platform and Execution

The trading platform's performance is another critical factor in assessing a broker's reliability. RSTFX offers a standard trading platform; however, user reviews indicate potential issues with execution quality, including slippage and order rejections.

Traders have reported experiencing significant delays in order executions, which can adversely affect trading outcomes. The lack of a user-friendly interface and stable performance further detracts from the overall trading experience.

Risk Assessment

Using RSTFX presents various risks that traders should consider before engaging. The lack of regulation, transparency issues, and negative customer feedback contribute to an overall high-risk profile.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential for fund mismanagement |

| Operational Risk | Medium | Issues with platform stability |

To mitigate these risks, it is advisable for traders to conduct thorough research and consider alternative brokers with established regulatory frameworks and positive customer reviews.

Conclusion and Recommendations

In conclusion, the evidence suggests that RSTFX is not a safe trading option. The lack of regulation, transparency issues, and negative customer experiences indicate potential red flags that traders should heed. For those seeking reliable trading environments, it is advisable to consider brokers regulated by reputable authorities, such as the FCA or ASIC.

Traders should prioritize their safety by opting for brokers with proven track records, transparent operations, and robust customer support. If you're considering entering the forex market, exploring regulated alternatives is crucial to safeguarding your investments and ensuring a positive trading experience.

Is RSTFX a scam, or is it legit?

The latest exposure and evaluation content of RSTFX brokers.

RSTFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RSTFX latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.