Regarding the legitimacy of Prospero forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is Prospero safe?

Pros

Cons

Is Prospero markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Prospero Markets Pty Ltd

Effective Date: Change Record

2012-12-19Email Address of Licensed Institution:

prosperomarkets@brifnsw.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2024-09-25Address of Licensed Institution:

--Phone Number of Licensed Institution:

1300291012Licensed Institution Certified Documents:

Is Prospero a Scam?

Introduction

Prospero is a forex broker that positions itself as a financial services provider in the competitive landscape of online trading. Established in 2012, it claims to offer a range of trading instruments including forex, commodities, and CFDs. However, the forex market is notorious for its volatility and the presence of unscrupulous brokers, making it imperative for traders to exercise caution when selecting a trading partner. This article aims to provide a comprehensive evaluation of Prospero by analyzing its regulatory status, company background, trading conditions, client safety measures, and user experiences. The assessment is based on a review of various sources, including regulatory disclosures, customer feedback, and comparative analyses of trading conditions.

Regulation and Legitimacy

The regulatory status of a broker is crucial for determining its legitimacy and the safety of client funds. Prospero claims to be regulated by the Australian Securities and Investments Commission (ASIC), which is known for its stringent regulatory framework. However, it has also been noted that the broker operates under an entity registered in Saint Vincent and the Grenadines, a jurisdiction often scrutinized for lax regulatory oversight.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 423034 | Australia | Active |

| FSA | 533 LLC 2020 | Saint Vincent | Active |

While ASIC offers a robust regulatory environment, the recent revocation of some licenses raises concerns about the broker's compliance history. It is essential to note that unregulated brokers often lack the necessary oversight, which could lead to potential risks for traders. In the case of Prospero, the dual registration presents a mixed picture; while it claims to be regulated, the presence of an offshore entity may indicate a strategy to exploit less stringent regulations.

Company Background Investigation

Prospero's history and ownership structure provide insight into its operational integrity. Founded in 2012, the broker has established a presence in the forex market, primarily targeting clients in Australia and the Asia-Pacific region. However, the company's ownership details remain somewhat opaque, with limited information available about its management team and their qualifications.

The lack of transparency regarding the management team raises questions about the broker's accountability. A reputable broker typically provides detailed information about its executives and their professional backgrounds. In Prospero's case, the absence of such disclosures may suggest a lack of commitment to transparency, which is a critical factor for potential investors.

Moreover, the companys information disclosure practices have been found wanting, with many users expressing concerns over the availability of essential information regarding trading conditions and fees. This opacity can lead to mistrust among potential clients, as they may feel that the broker is not forthcoming about its operations.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for assessing its suitability for traders. Prospero presents a competitive fee structure, with spreads starting from 0.1 pips on its VIP accounts and no commissions on standard accounts. However, the minimum deposit requirement of $100 for standard accounts and $3,000 for VIP accounts may be considered high compared to industry standards.

| Fee Type | Prospero | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.1 pips | From 0.2 pips |

| Commission Model | None for standard | Varies widely |

| Overnight Interest Range | Competitive | Competitive |

Despite the attractive spreads, there have been reports of hidden fees and complex withdrawal processes that could deter traders. Prospero's fee structure, while seemingly straightforward, may include unexpected costs that are not clearly communicated to clients. This lack of clarity can lead to dissatisfaction and mistrust among users, especially if they encounter difficulties when attempting to withdraw their funds.

Client Funds Safety

The safety of client funds is a paramount concern for any trader. Prospero claims to implement various safety measures, including segregated accounts to protect client funds. This practice ensures that client deposits are kept separate from the broker's operational funds, thereby reducing the risk of loss in the event of insolvency.

Additionally, the broker offers negative balance protection, which is a crucial feature that prevents traders from losing more than their deposited amount. However, the effectiveness of these measures is contingent upon the broker's regulatory compliance and operational integrity.

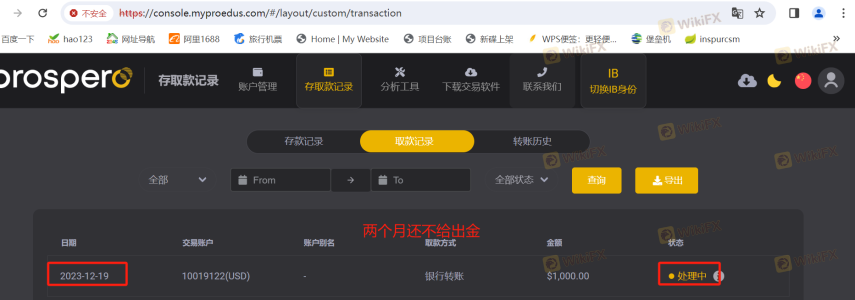

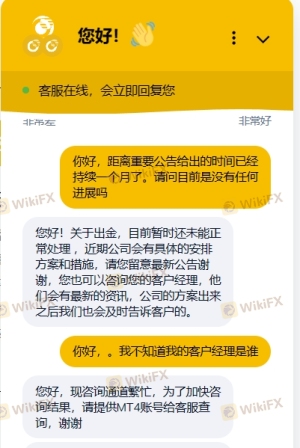

Past incidents involving fund security issues raise red flags regarding Prospero's reliability. Reports of delayed withdrawals and unresponsive customer service have surfaced, indicating potential vulnerabilities in their client fund management practices. It is essential for prospective clients to consider these factors when evaluating the broker's safety.

Customer Experience and Complaints

Customer feedback is a vital component in assessing the reliability of a broker. Reviews of Prospero reveal a mixed bag of experiences, with some users praising its trading conditions and platform usability, while others highlight significant issues, particularly related to withdrawals and customer service responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Average |

| Hidden Fees | High | Poor |

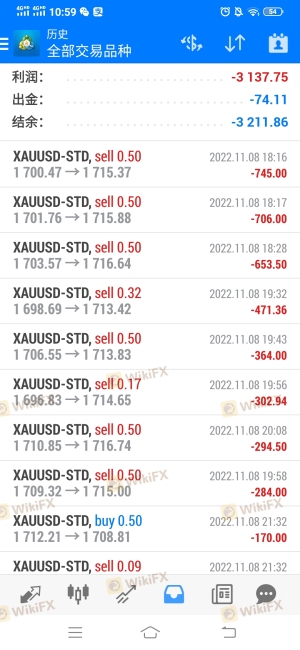

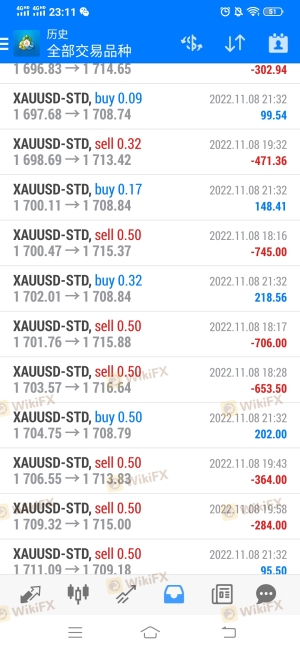

Common complaints include difficulties in withdrawing funds, with several users reporting extended delays and unfulfilled promises from customer service. These issues can significantly impact a trader's experience and raise concerns about the broker's operational reliability. A few case studies illustrate these challenges:

Case Study 1: A user reported waiting over a month for a withdrawal, only to receive vague updates from customer support. This lack of communication and transparency led to frustration and distrust.

Case Study 2: Another trader faced issues with hidden fees that were not disclosed during the account opening process, resulting in unexpected costs that diminished their trading capital.

Platform and Trade Execution

The trading platform's performance is critical for a seamless trading experience. Prospero utilizes the widely respected MetaTrader 4 (MT4) platform, known for its user-friendly interface and robust features. However, user reviews suggest that the platform may experience occasional stability issues, affecting order execution quality.

Traders have reported instances of slippage and rejected orders, which can be detrimental in fast-moving markets. Ensuring efficient order execution is vital for traders, as delays can lead to significant financial losses. The absence of evidence indicating platform manipulation is a positive sign, but the reported issues warrant caution.

Risk Assessment

Engaging with any broker carries inherent risks, and Prospero is no exception. A comprehensive risk assessment reveals several key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Dual regulatory status raises doubts |

| Withdrawal Issues | High | Frequent complaints about delays |

| Transparency | Medium | Limited information about management |

| Platform Stability | Medium | Occasional execution issues |

To mitigate these risks, potential clients should conduct thorough research, start with a demo account, and monitor their trading activity closely. Engaging with the broker for a limited time before committing significant funds can also help assess its reliability.

Conclusion and Recommendations

In conclusion, while Prospero markets itself as a legitimate forex broker with a range of trading options, several factors raise concerns about its overall trustworthiness. The dual regulatory status, history of withdrawal issues, and lack of transparency surrounding its management team indicate that potential traders should proceed with caution.

For inexperienced traders or those seeking a secure trading environment, it may be prudent to consider alternative brokers with stronger regulatory oversight and a proven track record of client satisfaction. Brokers such as IG, OANDA, and Forex.com offer robust regulatory frameworks and positive user experiences, making them safer choices for trading.

Ultimately, due diligence is essential when selecting a broker, as the forex market is fraught with risks and potential pitfalls.

Is Prospero a scam, or is it legit?

The latest exposure and evaluation content of Prospero brokers.

Prospero Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Prospero latest industry rating score is 1.70, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.70 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.