Regarding the legitimacy of FXGROW forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is FXGROW safe?

Pros

Cons

Is FXGROW markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 20

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Growell Capital Ltd

Effective Date:

2013-09-17Email Address of Licensed Institution:

info@fxgrow.comSharing Status:

No SharingWebsite of Licensed Institution:

www.fxgrow.comExpiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is FxGrow A Scam?

Introduction

FxGrow is a forex broker established in 2008, headquartered in Limassol, Cyprus. The broker positions itself as a reliable trading partner for both retail and institutional clients, offering a range of financial instruments, including forex, commodities, and cryptocurrencies. Given the prevalence of scams in the forex market, it is crucial for traders to conduct thorough evaluations of brokers before committing their funds. This article aims to assess the credibility of FxGrow by examining its regulatory status, company background, trading conditions, customer fund safety, and user experiences. Our investigation is based on comprehensive research from various reputable sources, including regulatory filings, user reviews, and industry analyses.

Regulation and Legitimacy

The regulatory landscape is a critical factor in determining the safety and reliability of a forex broker. FxGrow is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Vanuatu Financial Services Commission (VFSC). Below is a summary of the key regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 214/13 | Cyprus | Verified |

| VFSC | 40308 | Vanuatu | Verified |

The importance of regulation cannot be overstated; it serves as a safeguard for clients, ensuring that brokers adhere to strict operational standards. CySEC, a tier-1 regulator, imposes rigorous compliance requirements, including the segregation of client funds and participation in an investor compensation fund, which protects clients up to €20,000 in case of broker insolvency. However, the VFSC is considered a tier-3 regulator, which may raise concerns about the level of oversight. Overall, FxGrow's regulatory status is a positive indicator, but the dual regulation raises questions about the quality of oversight provided by the VFSC.

Company Background Investigation

FxGrow is owned by Growell Capital Ltd., a company with a solid track record in the forex industry. The broker has expanded its operations globally, serving clients in over 100 countries. The management team consists of experienced professionals with backgrounds in finance and trading, contributing to the broker's credibility. Transparency is a core value for FxGrow, and the company provides detailed information about its services, trading conditions, and regulatory compliance on its website. This level of transparency is essential for building trust with clients, especially in an industry often marred by fraud.

Trading Conditions Analysis

The trading conditions offered by FxGrow are competitive, with a focus on providing a transparent fee structure. The broker offers three account types: ECN, ECN Plus, and ECN Elite, each designed to cater to varying trading needs. Below is a comparison of core trading costs:

| Fee Type | FxGrow | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.1 pips | 1.0 pips |

| Commission Model | $6 - $8 per lot | $3 - $5 per lot |

| Overnight Interest Range | Standard | Standard |

While the spreads are competitive, the commission structure for the ECN accounts is slightly above the industry average. This could be a concern for high-frequency traders, as higher costs can erode profits. Overall, FxGrow's trading conditions are generally favorable, but potential traders should closely evaluate their trading strategies against the broker's fee structure.

Customer Fund Safety

The safety of client funds is a paramount concern for any trader. FxGrow employs several measures to ensure the security of its clients' funds. Client deposits are held in segregated accounts at top-tier banks, which helps protect them in case of financial difficulties faced by the broker. Additionally, FxGrow offers negative balance protection, ensuring that clients cannot lose more than their initial investment. However, it is worth noting that there have been no significant historical issues regarding fund security or disputes, which is a positive sign for potential clients.

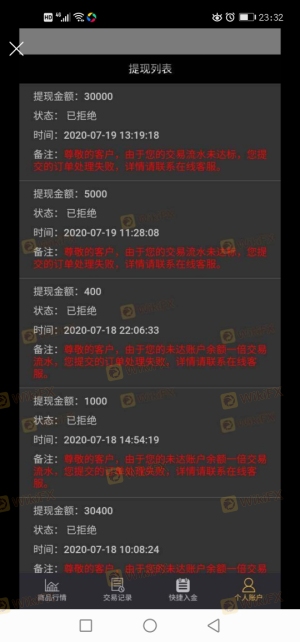

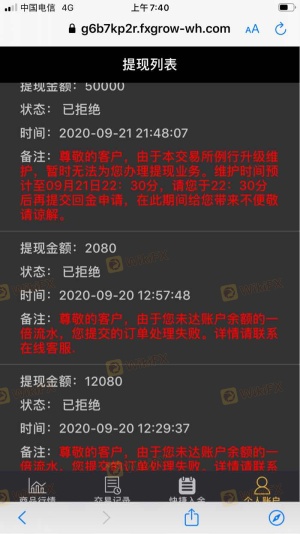

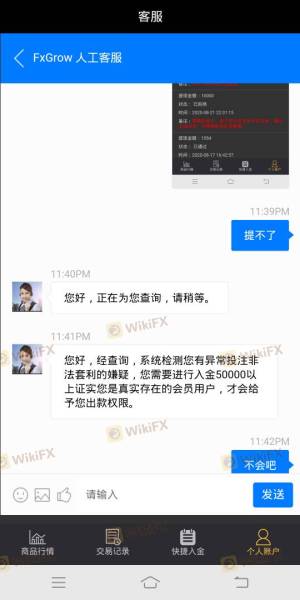

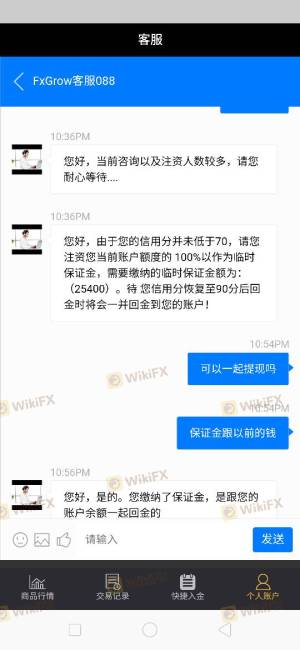

Customer Experience and Complaints

User feedback is invaluable in assessing a broker's reliability. Reviews of FxGrow reveal a mixed bag of experiences. While many users praise the broker for its fast execution and low spreads, some have reported issues with withdrawal delays and customer support responsiveness. Below is a summary of common complaint types:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Slow response |

| Customer Support Quality | High | Mixed reviews |

One typical case involves a trader who experienced delays in fund withdrawals, resulting in frustration and poor customer service interactions. While these complaints are not uncommon in the industry, they highlight areas where FxGrow could improve.

Platform and Trade Execution

FxGrow primarily utilizes the MetaTrader 5 (MT5) platform, known for its robust performance and user-friendly interface. The platform is equipped with advanced charting tools and supports automated trading strategies. However, there have been reports of occasional slippage during high volatility, which can affect trade execution quality. Overall, the platform's stability is commendable, and it offers a solid user experience for both novice and experienced traders.

Risk Assessment

Using FxGrow comes with inherent risks, as is the case with any forex broker. Below is a summary of the key risk areas associated with trading with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Dual regulation raises concerns |

| Execution Risk | Medium | Reports of slippage and delays |

| Customer Service Risk | High | Mixed feedback on support responsiveness |

To mitigate these risks, traders should ensure they fully understand the trading conditions, utilize demo accounts to practice, and maintain open communication with customer support.

Conclusion and Recommendations

In conclusion, FxGrow is not a scam; it operates under regulation from CySEC and VFSC, providing a generally safe trading environment. However, traders should exercise caution due to the dual regulatory status and some reported issues with customer support and withdrawal processes. For novice traders or those seeking a broker with tier-1 regulation, it may be prudent to consider alternatives like eToro or IG, which offer robust regulatory oversight and excellent customer service. Overall, while FxGrow has its strengths, potential clients should weigh their options carefully and ensure they are comfortable with the broker's trading conditions and risk factors.

Is FXGROW a scam, or is it legit?

The latest exposure and evaluation content of FXGROW brokers.

FXGROW Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXGROW latest industry rating score is 6.25, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.25 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.