FXGrow 2025 Review: Everything You Need to Know

Executive Summary

FXGrow is a trusted broker in the forex market. The company has built a strong reputation as a reliable choice for international traders since it started in 2008. This fxgrow review shows that the broker works under the brand name Growell Capital and has its main office in Cyprus. It operates as an international online brokerage firm that focuses on CFD trading.

The broker stands out because it has complete regulatory oversight from the Cyprus Securities and Exchange Commission. CySEC supervises the company under license number 214/13, which helps create a solid user trust score of 85/100. FXGrow serves traders who want diverse investment opportunities across multiple asset classes. These include forex, indices, commodities, futures, and cryptocurrencies.

The platform mainly targets international traders who value regulatory compliance and want access to many financial instruments. FXGrow has an established presence in the market and focuses on providing multi-asset trading capabilities. This positioning makes it a good option for both new and experienced traders who want a regulated trading environment.

Important Notice

FXGrow operates across multiple jurisdictions, which may create different regulatory requirements and trading conditions based on where the trader lives. Different regional entities may offer unique terms of service, account types, and regulatory protections. Traders should check the specific regulatory framework that applies to their region before they open an account.

This review comes from a detailed analysis of available regulatory information, market standards, and publicly available data. The evaluation looks at multiple factors including regulatory compliance, available trading instruments, and overall market reputation to give an objective assessment of the broker's services.

Rating Overview

Broker Overview

Company Background and Establishment

FXGrow entered the financial services market in 2008. The company established itself as an international online brokerage company under the operational brand Growell Capital. FXGrow is based in Cyprus and has built its reputation over more than 15 years of operation in the competitive forex and CFD trading sector. The broker's long presence in the market shows its ability to adapt to changing regulatory requirements and market conditions while keeping operational stability.

The company's business model focuses on providing complete trading services across multiple financial markets. It positions itself as a multi-asset broker rather than specializing in a single trading category. This approach allows FXGrow to serve a diverse client base with different investment preferences and risk tolerances.

Trading Platform and Asset Coverage

FXGrow operates mainly as a CFD trading platform. The broker offers clients access to contracts for difference across various underlying assets. FXGrow's asset portfolio includes five major categories: foreign exchange pairs, global indices, commodities, futures contracts, and cryptocurrencies. This diverse offering lets traders implement complete trading strategies and portfolio diversification approaches.

The platform's focus on CFD trading gives clients leveraged exposure to multiple markets without requiring direct ownership of underlying assets. This fxgrow review shows that the broker's multi-asset approach serves traders seeking exposure to both traditional and emerging financial markets through a single trading account.

Regulatory Framework

FXGrow operates under the regulatory supervision of the Cyprus Securities and Exchange Commission. The company holds license number 214/13 from CySEC. This regulatory framework provides European Union-level oversight and ensures compliance with MiFID II regulations. It offers significant investor protections and operational transparency requirements.

Available Trading Assets

The broker provides access to foreign exchange markets. This coverage includes major, minor, and exotic currency pairs. Additionally, clients can trade global stock indices, precious metals, energy commodities, agricultural products, and various cryptocurrency CFDs. This complete asset selection supports diverse trading strategies and market exposure preferences.

Trading Platform Technology

FXGrow uses CFD trading platform technology to deliver its services. However, specific platform details regarding user interface, advanced charting tools, and technical analysis capabilities are not detailed in available sources. The platform supports multi-asset trading functionality across the broker's complete product range.

Cost Structure

Specific information about spreads, commissions, overnight financing rates, and other trading costs is not specified in current available data. Traders should contact the broker directly for detailed pricing information relevant to their intended trading activities.

Account Requirements

Current sources do not specify minimum deposit requirements, account tier structures, or specific account opening procedures. Detailed account condition information would need to be obtained directly from the broker's official channels.

Geographic Availability

Information about specific geographic restrictions or regional availability limitations is not detailed in available sources. This fxgrow review suggests that potential clients should verify service availability in their jurisdiction before proceeding with account opening procedures.

Account Conditions Analysis

The account structure and conditions offered by FXGrow require direct inquiry with the broker. Comprehensive details are not available in current market sources. This represents a significant information gap for potential clients seeking to evaluate account suitability before commitment.

Traders cannot properly assess whether FXGrow's offerings align with their capital allocation and trading strategy requirements without specific information about account types, minimum deposit requirements, or tiered account structures. The absence of publicly available account condition details may reflect either limited marketing transparency or regional variations in account offerings.

The account opening process, verification requirements, and timeline for account activation are similarly unspecified in available sources. This lack of clear procedures could present challenges for traders seeking efficient account establishment and trading commencement.

Special account features such as Islamic accounts, corporate account options, or managed account services are not detailed in current information sources. This fxgrow review shows that traders with specific religious, corporate, or investment management requirements should directly contact the broker for specialized account information.

FXGrow shows strength in its multi-asset trading capabilities. The broker offers complete access to forex, indices, commodities, futures, and cryptocurrency markets through its CFD platform. This diverse approach provides traders with significant flexibility in portfolio construction and risk management strategies.

The broker's tool offering spans traditional financial markets and emerging asset classes. This enables clients to implement both conservative and aggressive trading approaches within a single platform environment. The inclusion of cryptocurrency CFDs reflects the broker's commitment to providing access to contemporary market opportunities.

However, specific details about research resources, market analysis tools, educational materials, and advanced trading features are not specified in available sources. The absence of detailed information about charting capabilities, technical indicators, automated trading support, and market research provision represents a significant evaluation limitation.

Trading tools such as economic calendars, market sentiment indicators, risk management features, and portfolio analysis capabilities are similarly unspecified. Without complete tool documentation, traders cannot properly assess whether FXGrow's platform meets their analytical and strategic requirements.

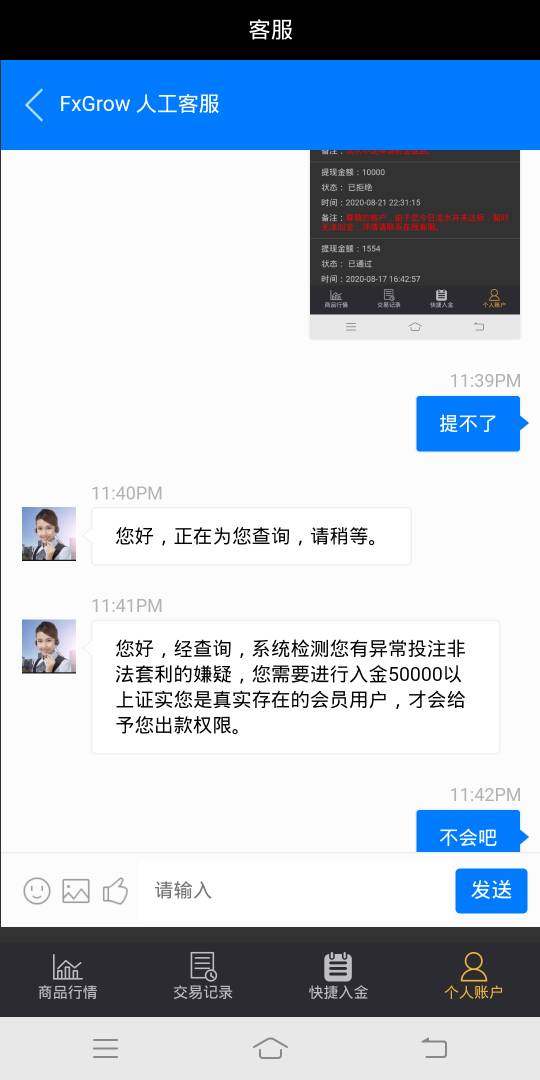

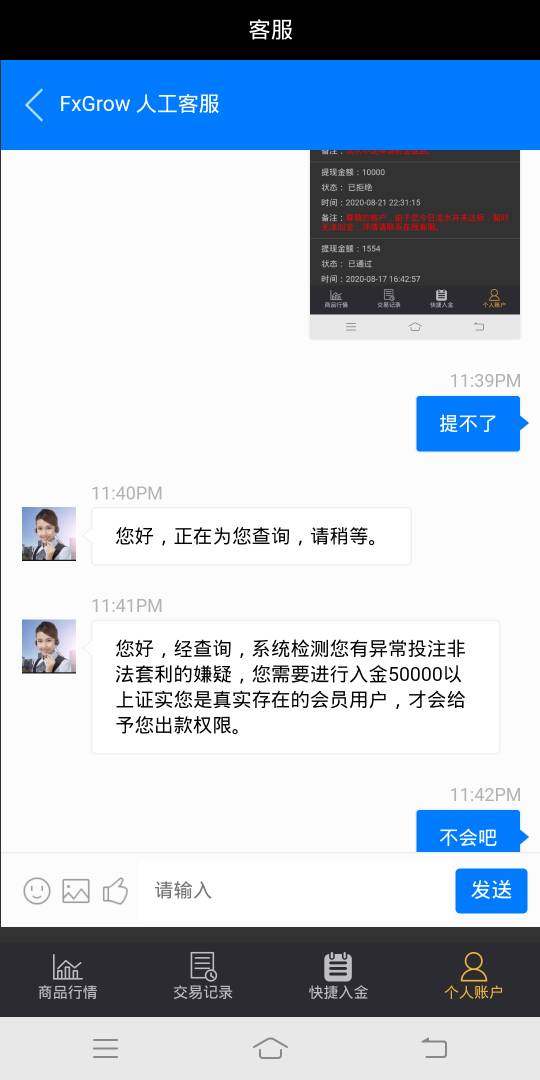

Customer Service and Support Analysis

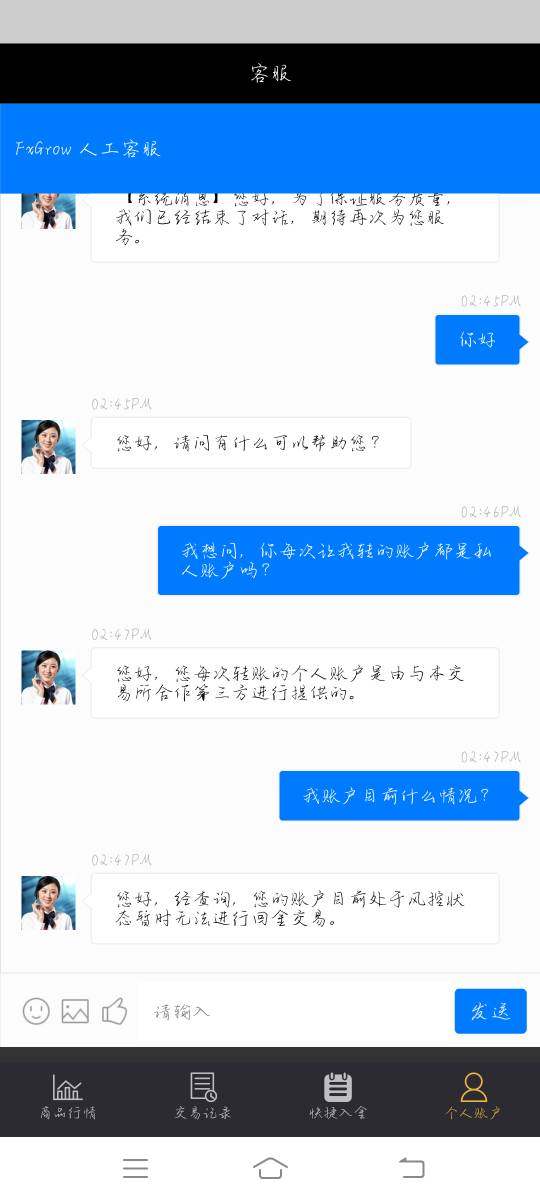

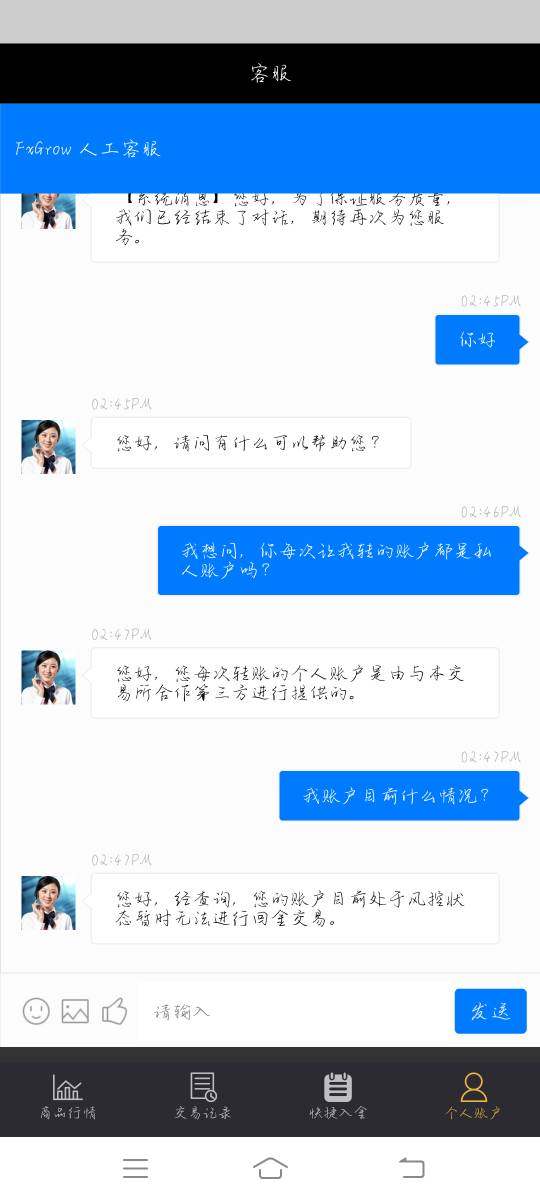

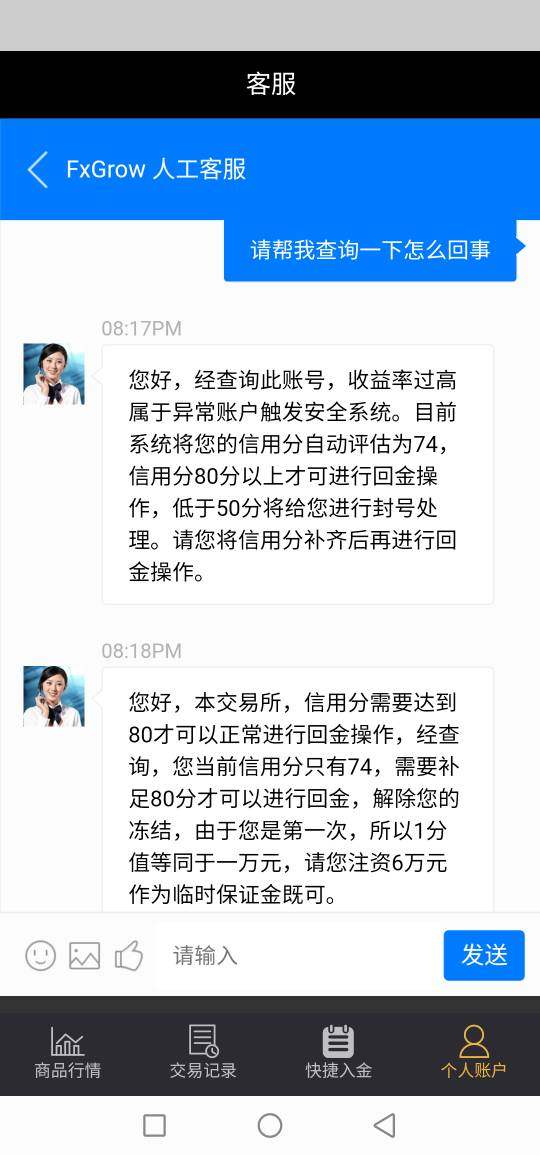

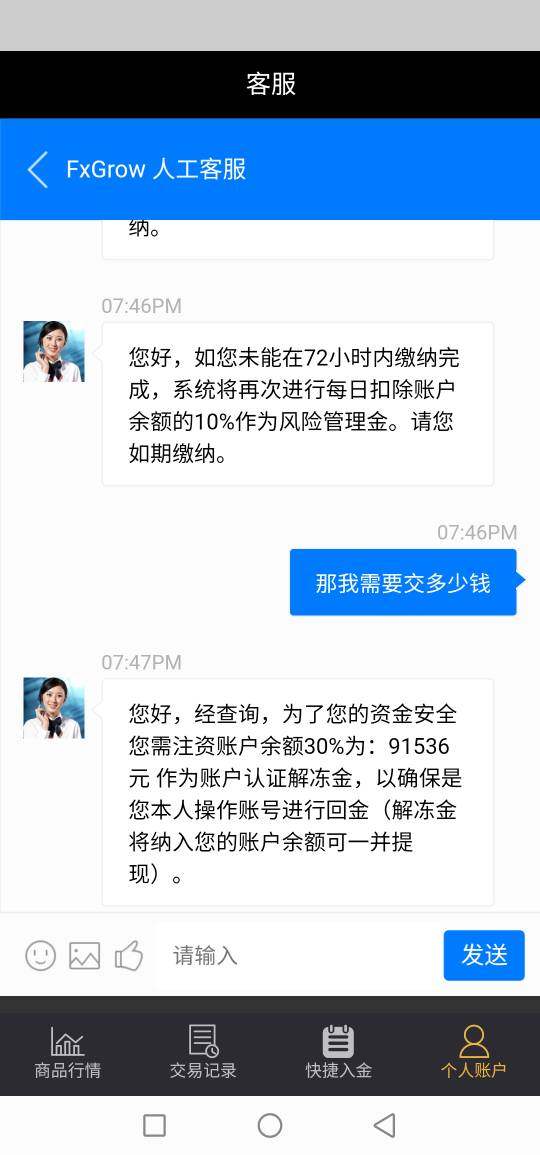

Customer service information for FXGrow is notably absent from available sources. This creates a significant evaluation challenge for potential clients. The lack of specified support channels, response time commitments, and service quality metrics prevents complete assessment of the broker's client support capabilities.

Available communication methods are not detailed in current information sources, whether they include phone support, live chat, email ticketing systems, or social media engagement. This absence of contact information transparency may concern traders who prioritize accessible customer support in their broker selection process.

Service availability hours, multilingual support capabilities, and regional support variations are similarly unspecified. Given FXGrow's international focus and Cyprus-based operations, support language options and timezone coverage would be particularly relevant for global clients.

The quality of technical support, account management services, and problem resolution procedures cannot be evaluated based on available information. This represents a critical information gap, as customer service quality significantly impacts overall trading experience and client satisfaction levels.

Trading Experience Analysis

The trading experience offered by FXGrow cannot be fully evaluated due to limited available information about platform performance, execution quality, and user interface design. This absence of detailed trading experience data represents a significant limitation for potential clients seeking to assess platform suitability.

Platform stability, order execution speed, and slippage characteristics are not documented in available sources. These technical performance factors are crucial for traders, particularly those implementing short-term strategies or trading in volatile market conditions.

Mobile trading capabilities, cross-device synchronization, and platform accessibility features are similarly unspecified. In today's trading environment, mobile platform quality and functionality significantly impact user experience and trading flexibility.

Advanced trading features such as one-click trading, advanced order types, algorithmic trading support, and risk management tools lack detailed documentation. Without complete platform feature information, this fxgrow review cannot properly assess whether the trading environment meets modern trader expectations and requirements.

Trust and Reliability Analysis

FXGrow shows strong regulatory credentials through its Cyprus Securities and Exchange Commission oversight under license number 214/13. This regulatory framework provides substantial investor protections and ensures compliance with European Union financial services standards. It contributes significantly to the broker's credibility.

The CySEC regulatory environment requires adherence to strict capital adequacy requirements, client fund segregation protocols, and operational transparency standards. These regulatory obligations provide meaningful protection for client assets and establish clear dispute resolution mechanisms through European regulatory channels.

The broker's user trust score of 85/100 shows positive market perception and suggests satisfactory client experiences across key trust factors. This rating reflects the combination of regulatory compliance, operational stability, and market reputation accumulated over the broker's operational history.

However, specific information about additional regulatory licenses, insurance coverage, fund segregation details, or third-party auditing arrangements is not available in current sources. The absence of complete risk management and client protection documentation limits the ability to fully assess the broker's safety measures beyond basic regulatory compliance.

User Experience Analysis

Complete user experience evaluation for FXGrow is significantly limited by the absence of detailed user feedback, interface design information, and usability assessments in available sources. This information gap prevents thorough analysis of client satisfaction levels and platform accessibility.

The overall user satisfaction metrics, beyond the general trust score of 85/100, are not specified in current data sources. Without detailed user feedback about platform navigation, account management processes, and overall service satisfaction, potential clients cannot properly assess expected user experience quality.

Registration and account verification procedures are not detailed in available information, including required documentation, processing timeframes, and verification complexity. These onboarding experience factors significantly impact initial client impressions and account establishment efficiency.

Deposit and withdrawal procedures lack complete documentation, including supported payment methods, processing times, and associated fees. The absence of detailed financial transaction information represents a significant user experience evaluation limitation, as funding convenience directly impacts trading accessibility and client satisfaction.

Conclusion

FXGrow presents itself as a regulated broker with solid regulatory foundations through CySEC oversight and a respectable operational history dating back to 2008. The broker's multi-asset approach covers forex, indices, commodities, futures, and cryptocurrencies, providing complete market access for diversified trading strategies.

The broker appears most suitable for international traders seeking regulated exposure to multiple asset classes through CFD trading. The combination of European regulatory oversight and multi-asset capabilities positions FXGrow as a viable option for traders prioritizing regulatory compliance and market diversification.

However, this fxgrow review reveals significant information limitations about account conditions, trading costs, platform features, and user experience details. Potential clients should conduct direct broker consultation to obtain complete information before making account opening decisions, as publicly available information lacks the detail necessary for complete broker evaluation.