Regarding the legitimacy of Fidelis CM forex brokers, it provides VFSC, CYSEC and WikiBit, (also has a graphic survey regarding security).

Is Fidelis CM safe?

Business

License

Is Fidelis CM markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

FIDELIS CAPITAL MARKETS LIMITED

Effective Date:

2017-01-24Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

T Markets EU Limited

Effective Date:

2013-07-22Email Address of Licensed Institution:

compliance@trademarkets.euSharing Status:

No SharingWebsite of Licensed Institution:

www.trademarkets.euExpiration Time:

--Address of Licensed Institution:

Agias Zonis & Thessaloniki, 1, NICOLAOU PENTADROMOS CENTER, Floor 7, Office 701-704 3026, Limassol, CyprusPhone Number of Licensed Institution:

+357 25 262 626Licensed Institution Certified Documents:

Is Fidelis CM Safe or Scam?

Introduction

Fidelis CM, also known as Fidelis Capital Markets, is a forex broker that has carved a niche for itself in the online trading space since its inception in 2017. Operating primarily out of Saint Vincent and the Grenadines, the broker claims to offer a wide array of trading instruments, including forex pairs, commodities, and indices. However, the legitimacy and safety of such brokers have become a significant concern for traders, especially given the increasing number of fraudulent activities in the forex market. Traders must exercise caution when choosing a broker, as inadequate regulation and poor management can lead to substantial financial losses. This article aims to investigate whether Fidelis CM is safe or a potential scam by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors influencing its legitimacy. A well-regulated broker is more likely to provide a safe trading environment, as they are subject to stringent oversight and compliance requirements. In the case of Fidelis CM, the broker claims to be regulated by the Financial Services Commission (FSC) of Mauritius and the Financial Services Authority (FSA) of Saint Vincent and the Grenadines. However, the regulatory framework in these jurisdictions is often considered weak, especially regarding forex trading.

| Regulatory Body | License Number | Regulating Region | Verification Status |

|---|---|---|---|

| Financial Services Commission (FSC) | GB19024708 | Mauritius | Active |

| Financial Services Authority (FSA) | 24163 IBC 2017 | Saint Vincent and the Grenadines | Active |

Despite holding these licenses, it is essential to note that the FSA of Saint Vincent and the Grenadines does not regulate forex trading, which raises questions about the effectiveness of such oversight. Additionally, there have been reports indicating that the Vanuatu Financial Services Commission (VFSC) has revoked its license, further complicating the regulatory picture. This lack of robust regulation can be a red flag for potential investors, as it implies that Fidelis CM may not be safe for trading.

Company Background Investigation

Fidelis CM was founded in 2017, and its ownership structure is somewhat opaque, which is not uncommon among offshore brokers. The company operates under the name Fidelis Capital Markets Limited and claims to have a team of experienced professionals in the finance sector. However, the lack of transparency regarding its management team and their qualifications raises concerns about the broker's operational integrity.

The company's website does not provide comprehensive information about its corporate governance or the backgrounds of its key personnel, making it challenging for potential investors to assess the broker's credibility. Furthermore, the absence of detailed disclosures regarding its financial health and operational history can lead to skepticism among traders. In summary, while Fidelis CM presents itself as a legitimate broker, the lack of transparency and verifiable information about its management raises doubts about whether Fidelis CM is safe for traders.

Trading Conditions Analysis

Fidelis CM offers various trading accounts, each with different minimum deposit requirements, spreads, and commission structures. The broker claims to provide competitive trading conditions, including leverage of up to 1:400 and spreads starting from 0.0 pips on major currency pairs. However, it is essential to scrutinize the overall cost structure carefully.

| Fee Type | Fidelis CM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 1.0 pips |

| Commission Structure | Variable | Fixed or Variable |

| Overnight Interest Range | Varies | Varies |

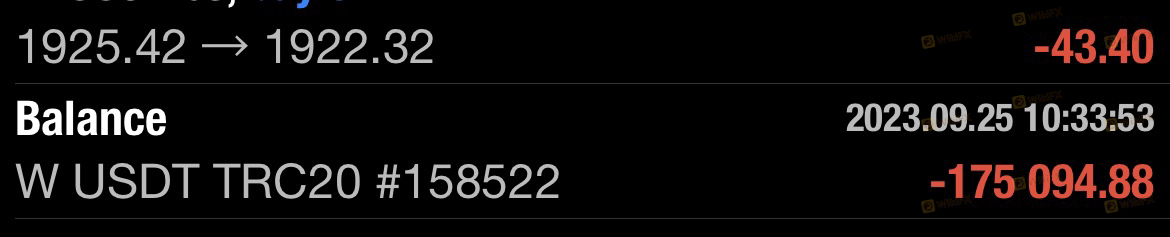

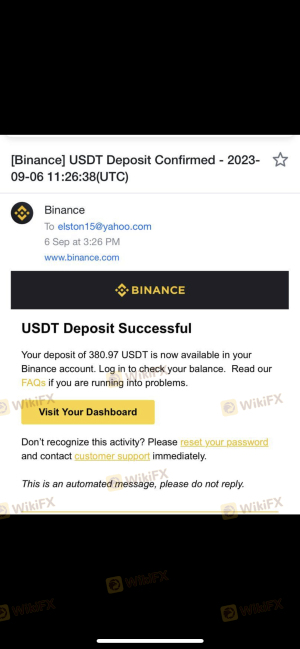

While the low spreads are attractive, traders should be cautious of hidden fees that may not be immediately apparent. For instance, some users have reported unexpected withdrawal fees and delays in processing requests, which can significantly impact overall trading costs. Such practices can indicate that Fidelis CM may not be safe, as they could lead to unexpected financial burdens for traders.

Customer Funds Safety

The safety of customer funds is paramount when evaluating a broker's credibility. Fidelis CM claims to implement several measures to protect client funds, including segregated accounts and industry-standard security protocols. However, the lack of robust regulatory oversight raises concerns about the effectiveness of these measures.

Traders should also consider whether the broker offers negative balance protection, which can safeguard clients from losing more than their initial investment. Unfortunately, there is little information available regarding Fidelis CM's policies on this front, leaving traders uncertain about the safety of their funds. Additionally, past reports of withdrawal issues and complaints about fund mismanagement further exacerbate concerns about whether Fidelis CM is safe for trading.

Customer Experience and Complaints

Customer feedback is invaluable when assessing a broker's reliability. Reviews of Fidelis CM reveal a mixed bag of experiences. While some users report satisfactory service and timely withdrawals, others have expressed frustration over delayed withdrawals and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Account Blocking | High | Poor |

| Customer Support Issues | Medium | Fair |

For instance, several traders have reported difficulties withdrawing their funds, with some stating that their accounts were blocked without explanation. Such issues raise significant concerns about the broker's operational integrity and its commitment to customer service, suggesting that Fidelis CM may not be safe for all traders.

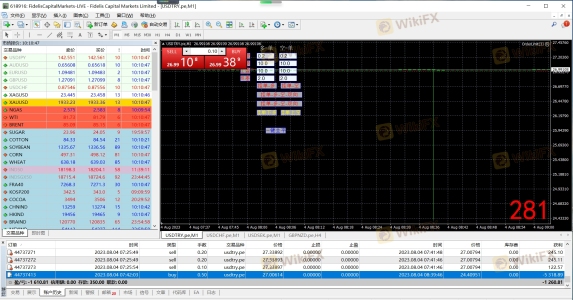

Platform and Execution

Fidelis CM offers trading through popular platforms like MetaTrader 4 and MetaTrader 5. Users have reported that the platforms are generally stable and user-friendly, providing essential tools for analyzing market trends. However, concerns about order execution quality persist, with some traders experiencing slippage and rejected orders during volatile market conditions.

The potential for platform manipulation is another area of concern. Reports of leverage changes during profitable trades have raised alarms about the broker's practices. Such actions could indicate that Fidelis CM is not safe, as they undermine the fairness and transparency expected in trading environments.

Risk Assessment

When considering whether Fidelis CM is safe, it is crucial to evaluate the overall risk involved. The following risk assessment provides a concise overview of the broker's risk profile:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Weak regulatory framework |

| Financial Risk | Medium | Withdrawal issues reported |

| Operational Risk | High | Complaints about account management |

Given these factors, traders should exercise caution when engaging with Fidelis CM. It is advisable to limit initial investments and thoroughly research the broker's practices before committing significant capital.

Conclusion and Recommendations

In conclusion, while Fidelis CM presents itself as a legitimate forex broker, several red flags warrant caution. The broker's regulatory status is questionable, its transparency is lacking, and numerous customer complaints regarding withdrawals and account management raise concerns about its reliability. Consequently, it is prudent for traders to approach Fidelis CM with skepticism and consider alternative brokers with stronger regulatory oversight and proven track records.

For traders seeking safer options, consider brokers regulated by reputable authorities such as the FCA or ASIC. These brokers typically offer more transparent operations, better customer service, and a higher level of investor protection. Ultimately, conducting thorough research and due diligence is essential for ensuring a safe trading experience in the forex market.

Is Fidelis CM a scam, or is it legit?

The latest exposure and evaluation content of Fidelis CM brokers.

Fidelis CM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Fidelis CM latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.