Fidelis CM 2025 Review: Everything You Need to Know

Executive Summary

Fidelis Capital Markets shows major problems in the forex industry. This fidelis cm review finds mostly bad user experiences and poor service quality that raises serious concerns. The company claims "leading industry experts" founded it, and FIDELIS CM works as an offshore broker under Mauritius Financial Services Commission rules. But even with regulation, user feedback shows a troubling picture of bad customer service, weak support, and unhappy clients overall.

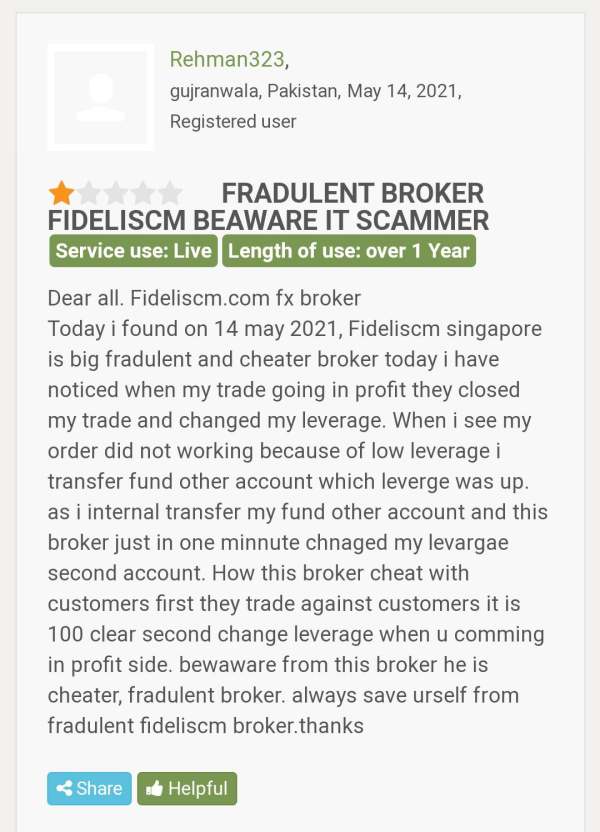

The broker targets forex traders but fails to meet basic service needs based on many user reports. With just 1 out of 5 stars across 65 reviews on platforms like Trustpilot, FIDELIS CM ranks among the worst brokers in the industry. The constant negative feedback raises serious questions about how the broker operates and whether it cares about keeping clients happy, making this review very important for traders thinking about using their services.

Important Disclaimer

This review uses public information and user feedback from many sources. FIDELIS CM operates offshore under Mauritius rules, which may have different risks than brokers in major financial centers. Potential clients should know that offshore rules may offer different levels of protection for investors. This assessment shows user experiences and industry data available when we wrote this, and future traders should do their own research before making trading decisions.

Rating Framework

Broker Overview

Fidelis Capital Markets started in 2017 with the goal of serving traders through industry knowledge. Company information says FIDELIS CM was founded by professionals who claimed to have a "clear understanding of what each trader needs." The company operates from Mauritius and positions itself as an offshore brokerage service that focuses mainly on forex trading. Despite these professional goals, real user experiences tell a very different story.

The broker's business plan centers on providing forex trading services through an offshore structure. Being registered in Mauritius means FIDELIS CM falls under the Mauritius Financial Services Commission, which watches over the company's operations. However, this oversight has not stopped the buildup of major negative user feedback, suggesting possible gaps between following rules and actually delivering quality service that future traders should think about carefully.

This fidelis cm review looks at how the broker's real operations match up with its stated goals and regulatory duties.

Regulatory Jurisdiction: FIDELIS CM operates under Mauritius Financial Services Commission regulation, providing basic oversight for the broker's operations.

Deposit and Withdrawal Methods: Specific information about available payment methods is not detailed in the available source materials.

Minimum Deposit Requirements: The exact minimum deposit amount required to open an account is not specified in the current documentation.

Bonus and Promotions: Details regarding promotional offers or bonus structures are not mentioned in the available information.

Available Trading Assets: Specific information about the range of tradeable instruments is not provided in the source materials.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not available in the current documentation.

Leverage Options: Specific leverage ratios offered by the broker are not mentioned in the available materials.

Platform Options: Details about trading platforms available to clients are not specified in the source information.

Geographic Restrictions: Information about regional limitations or restricted countries is not provided.

Customer Support Languages: Specific language support options are not detailed in the available materials.

This fidelis cm review shows the concerning lack of openness about basic trading conditions and service details.

Detailed Rating Analysis

Account Conditions Analysis

The lack of detailed information about FIDELIS CM's account conditions shows a major transparency problem that potential clients should think about carefully. Professional forex brokers usually provide complete details about their account types, minimum deposit needs, and specific features available to different client groups. The absence of such basic information in public materials raises questions about the broker's commitment to being open.

Without clear information about account opening steps, deposit needs, or special account features like Islamic accounts for Muslim traders, potential clients cannot make smart decisions about whether the broker's offerings match their trading needs. This information gap becomes especially concerning when combined with the constantly negative user feedback, suggesting that clients may find unfavorable account conditions only after committing to the platform.

The lack of easy-to-find information about account structures, benefits, and limits shows a potential red flag for traders who value openness and clear communication from their chosen broker. This fidelis cm review emphasizes how important complete information sharing is in the broker selection process.

The absence of detailed information about FIDELIS CM's trading tools and educational resources shows another area of concern for potential clients. Modern forex brokers usually offer complete sets of analytical tools, market research, educational materials, and automated trading support to help their clients make smart trading decisions and develop their skills.

Professional brokers usually provide access to technical analysis tools, economic calendars, market news feeds, educational webinars, and trading guides. The lack of information about such resources suggests either that FIDELIS CM does not prioritize these essential services or fails to communicate their availability effectively to potential clients.

Without good trading tools and educational resources, traders may find themselves at a major disadvantage in the competitive forex market. The absence of clear information about research abilities, analysis tools, and learning resources further adds to the concerns raised by negative user feedback about the broker's overall service quality.

Customer Service and Support Analysis

Customer service represents FIDELIS CM's biggest weakness based on available user feedback. The constantly poor ratings across multiple review platforms show systematic problems with the broker's support operations. Users have expressed widespread unhappiness with response times, service quality, and overall support experiences.

Good customer service is crucial in forex trading, where technical problems, account issues, or trading questions need prompt and knowledgeable responses. The negative feedback pattern suggests that FIDELIS CM fails to meet these basic service standards, potentially leaving clients without good support when they need it most.

The poor customer service ratings become especially concerning for traders who may need help with platform problems, account issues, or dispute resolution. The 1/10 rating reflects not isolated incidents but a pattern of service failures that potential clients should seriously consider before choosing this broker.

Trading Experience Analysis

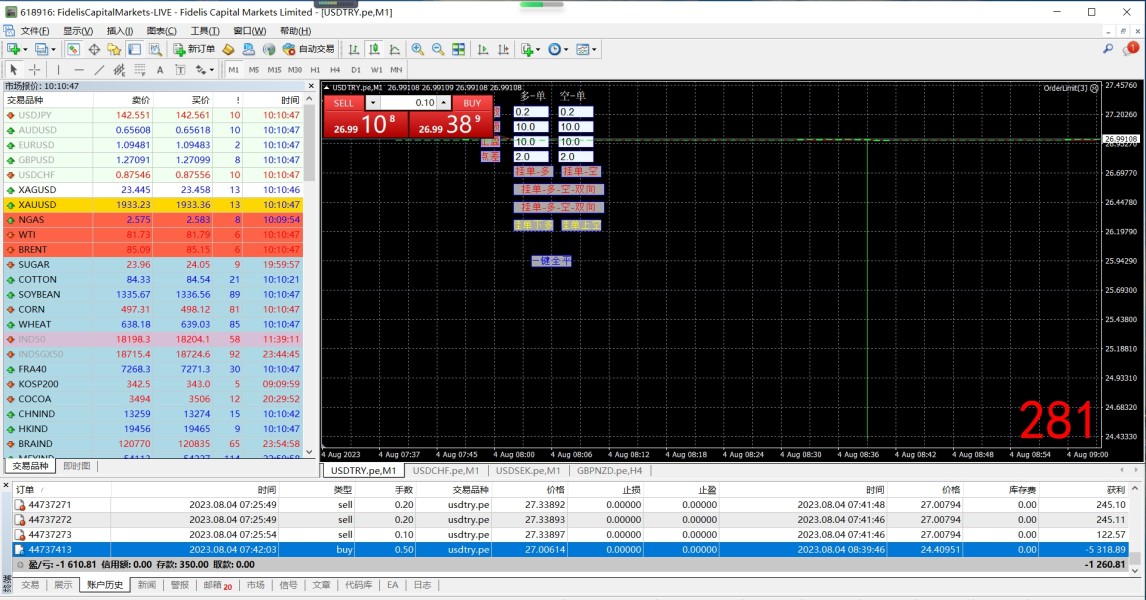

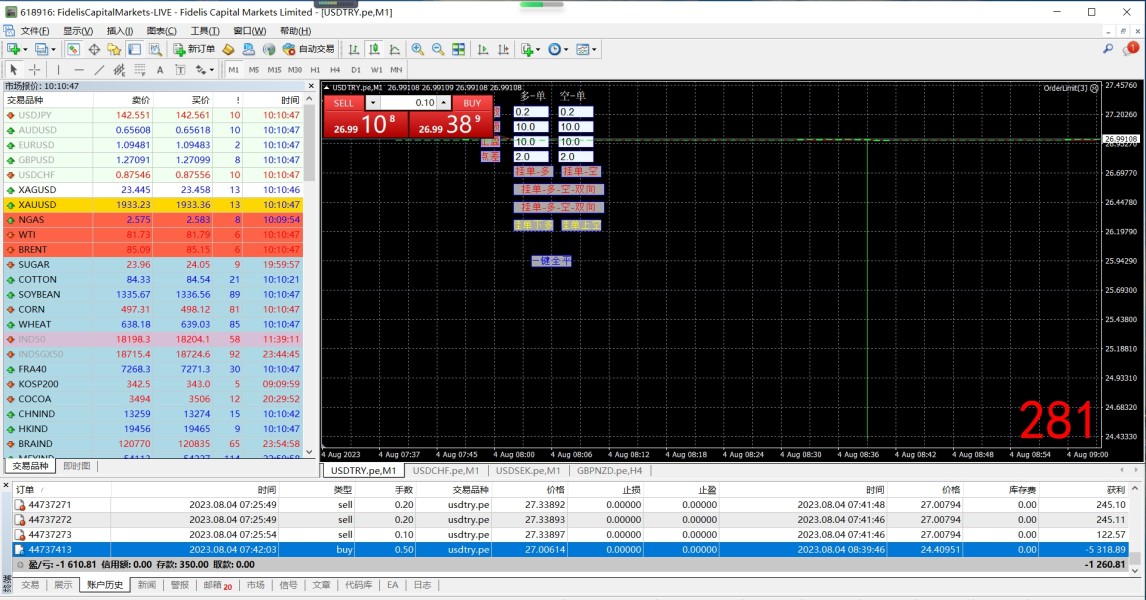

While specific details about platform performance and execution quality are not available in the source materials, the overall negative user sentiment raises concerns about the trading experience FIDELIS CM provides. Professional forex brokers must ensure platform stability, fast execution speeds, and reliable order processing to meet trader expectations.

The absence of detailed information about platform features, mobile access, and trading environment characteristics makes it difficult for potential clients to assess whether the broker can provide the technical infrastructure necessary for effective trading. Combined with poor customer service ratings, this suggests potential problems with overall operational quality.

Traders need reliable platforms, accurate pricing, and efficient order execution to implement their strategies successfully. The lack of positive user feedback about trading experiences, coupled with the overall negative sentiment, suggests that FIDELIS CM may not meet these basic requirements. This fidelis cm review highlights these concerns as critical factors in broker selection.

Trustworthiness Analysis

FIDELIS CM's trustworthiness presents a mixed picture, with regulatory status providing some foundation while user feedback raises major concerns. The broker operates under Mauritius Financial Services Commission regulation, which provides basic regulatory oversight and some level of institutional accountability.

However, regulatory status alone does not guarantee quality service or positive user experiences, as shown by the constantly negative feedback. Users have expressed concerns about various aspects of the broker's operations, suggesting that regulatory compliance may not translate into practical service quality or client satisfaction.

The combination of offshore regulation and poor user feedback creates questions about the broker's commitment to maintaining high operational standards. While regulation provides some framework for accountability, the negative user experiences suggest potential gaps between regulatory compliance and actual service delivery that affect client trust and confidence.

User Experience Analysis

User experience represents FIDELIS CM's most significant challenge, with overwhelmingly negative feedback across multiple review platforms. The average rating of 1 out of 5 stars across 65 reviews shows systematic problems with the broker's service delivery and client satisfaction.

The constantly poor ratings suggest widespread problems with various aspects of the broker's operations, from customer service to platform performance. Such uniform negative feedback is unusual in the forex industry and shows serious operational problems that potential clients should carefully consider.

The negative user experience pattern extends beyond isolated complaints to represent a basic problem with the broker's approach to client service and satisfaction. This level of negative feedback usually shows systemic problems that are unlikely to be resolved quickly, making the broker a risky choice for traders seeking reliable service and support.

Conclusion

This comprehensive fidelis cm review reveals a broker with major operational challenges and poor user satisfaction despite its regulatory status. While FIDELIS CM operates under Mauritius Financial Services Commission regulation, the constantly negative user feedback across multiple platforms raises serious concerns about service quality, customer support, and overall reliability.

The broker is not recommended for traders seeking high-quality service, reliable support, or transparent operations. The main advantage of regulatory oversight is substantially outweighed by poor user experiences, inadequate customer service, and lack of transparency regarding basic trading conditions. Potential clients should carefully consider these factors and explore alternative brokers with stronger track records of client satisfaction and service quality before making any trading decisions.