Regarding the legitimacy of Eddid Financial forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is Eddid Financial safe?

Pros

Cons

Is Eddid Financial markets regulated?

The regulatory license is the strongest proof.

SFC Market Making License (MM)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Eddid Securities and Futures Limited

Effective Date:

2016-12-14Email Address of Licensed Institution:

compliance@eddid.com.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.eddid.com.hk/sf/, www.eddidsfl.comExpiration Time:

--Address of Licensed Institution:

香港中環添美道1號中信大廈21樓Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Eddid Financial A Scam?

Introduction

Eddid Financial is a brokerage firm based in Hong Kong that offers a range of trading services, primarily focusing on forex and contracts for difference (CFDs). Established in 2015, the company has positioned itself within the competitive landscape of the forex market, attracting traders with promises of advanced trading platforms and diverse financial instruments. However, potential investors must exercise caution when evaluating forex brokers, as the industry is rife with scams and unregulated entities that can jeopardize traders' investments. This article aims to provide a thorough investigation into the legitimacy of Eddid Financial, analyzing its regulatory status, company background, trading conditions, customer safety measures, user experiences, and overall risk profile. By employing a structured evaluation framework, we will determine whether Eddid Financial is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in assessing its legitimacy. Eddid Financial is regulated by the Securities and Futures Commission (SFC) in Hong Kong, which is known for its stringent regulatory framework designed to protect investors. The presence of a regulatory body can provide some assurance to traders regarding the broker's compliance with financial standards and practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities and Futures Commission (SFC) | BHT 550 | Hong Kong | Verified |

Eddid Financial holds a license for dealing in futures contracts and leveraged foreign exchange trading, which signifies that it is subject to oversight by the SFC. This regulatory body has been operational since 1989 and is recognized for its role in maintaining the integrity of Hong Kong's financial markets. Despite this regulatory oversight, it is essential to consider the quality of regulation and the broker's historical compliance. Reports indicate that while Eddid Financial is regulated, there have been complaints regarding its withdrawal processes and customer service, raising questions about its operational integrity. Therefore, while Eddid Financial holds a valid license, potential clients should remain vigilant and conduct thorough research before investing.

Company Background Investigation

Eddid Financial Holdings Limited was established in 2015 and operates out of its headquarters located in Central Hong Kong. The firm has expanded its operations to include a variety of financial services, including asset management and investment banking, alongside its core forex trading activities. The ownership structure of the company is not explicitly detailed in public records, which can be a concern for potential investors seeking transparency.

The management team of Eddid Financial comprises professionals with extensive backgrounds in finance and investment. However, the lack of detailed information regarding the qualifications and experiences of these individuals can lead to apprehension about the company's operational transparency. A broker's credibility often hinges on the expertise of its management, and without clear disclosures, it becomes challenging for traders to gauge the firm's reliability.

Overall, while Eddid Financial has established itself in the market, the opacity surrounding its ownership and management raises some red flags. This lack of transparency can lead to concerns about trustworthiness, especially for traders who prioritize clear communication and accountability in their financial dealings.

Trading Conditions Analysis

Eddid Financial offers various trading conditions, including competitive spreads and different trading platforms. However, a thorough examination of its fee structure reveals that some aspects may not align with industry standards, potentially leading to unexpected costs for traders.

| Fee Type | Eddid Financial | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 1.5 pips | 1.0 pips |

| Commission Structure | None | Varies (up to $10 per lot) |

| Overnight Interest Range | 3% | 2% |

The spreads offered by Eddid Financial appear to be higher than the industry average, which could impact the profitability of trades, especially for high-frequency traders. Additionally, while the broker does not charge a commission, the presence of overnight interest fees can accumulate and erode profits over time. It is crucial for traders to fully understand the cost implications of trading with Eddid Financial before committing their funds.

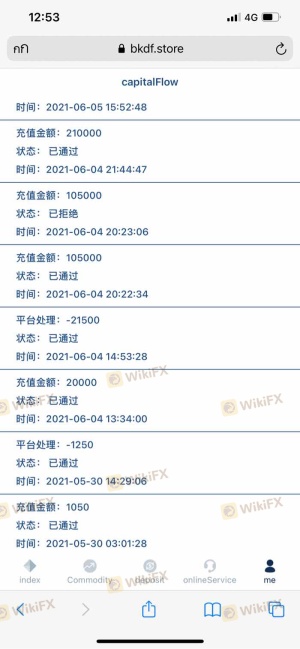

Moreover, traders have reported issues with withdrawal fees and processing times, which could be seen as a tactic to discourage withdrawals. Such practices can be a significant concern for traders evaluating whether Eddid Financial is safe or a scam. Transparency in fee structures is vital for building trust, and the ambiguity surrounding certain charges can lead to a negative trading experience.

Customer Funds Safety

The safety of customer funds is a paramount concern for any forex trader. Eddid Financial claims to implement various measures to ensure the security of client funds, including segregation of accounts and adherence to local regulatory requirements. However, the effectiveness of these measures can be called into question.

Eddid Financial is expected to separate client funds from the company's operational funds, which is a standard practice aimed at protecting clients in the event of financial difficulties. Additionally, the broker may offer negative balance protection, ensuring that clients cannot lose more than their initial deposit. However, reports of clients facing difficulties in withdrawing their funds raise concerns about the actual implementation of these safety measures.

Historically, there have been instances where clients have reported being unable to access their funds, leading to allegations of mishandling and potential fraud. Such incidents can severely damage a broker's reputation and raise alarms for potential investors. Therefore, while Eddid Financial may tout its safety protocols, the reality of customer experiences suggests that traders should proceed with caution.

Customer Experience and Complaints

Analyzing customer feedback is crucial in assessing a broker's reliability. Eddid Financial has received mixed reviews from users, with many expressing dissatisfaction regarding withdrawal processes, customer support responsiveness, and overall trading experiences.

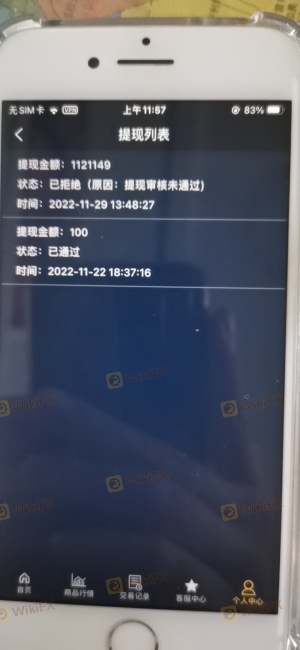

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response, unresolved |

| Customer Support | Medium | Delayed replies, unhelpful |

| Platform Stability | Low | Occasional outages reported |

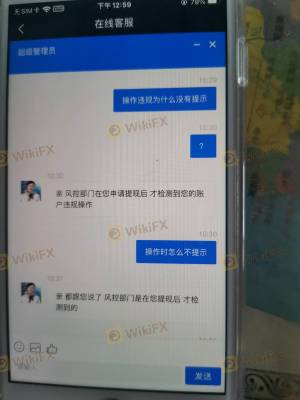

Common complaints include difficulties in withdrawing funds, with users often citing slow response times from customer support when attempting to resolve issues. In some cases, clients have reported being asked to pay additional fees or taxes before being allowed to withdraw their funds, which raises serious concerns about the legitimacy of these requests.

For instance, one user reported being unable to withdraw their capital after multiple attempts, leading them to suspect that Eddid Financial might be employing tactics to retain client funds. Such experiences can create a perception of distrust and may indicate potential fraudulent practices, prompting traders to question whether Eddid Financial is safe or a scam.

Platform and Trade Execution

The trading platform offered by Eddid Financial plays a vital role in the overall trading experience. Users have reported that the platform is generally user-friendly, with various features designed to assist traders. However, issues with execution quality, such as slippage and order rejections, have also been noted.

A stable trading platform is essential for executing trades efficiently, and any signs of manipulation or poor performance can significantly impact traders' confidence. Some users have reported experiencing delays in order execution during high volatility periods, which could lead to missed trading opportunities or unexpected losses.

Moreover, the lack of transparency regarding the platform's underlying technology and its operational reliability can be concerning for traders who prioritize a seamless trading experience. If Eddid Financial's platform exhibits signs of instability or manipulation, it could further exacerbate doubts about the broker's integrity.

Risk Assessment

Engaging with Eddid Financial involves several risks that traders should be aware of. While the broker is regulated, the presence of numerous complaints and negative user experiences raises questions about its overall reliability.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Regulated but with complaints about practices |

| Fund Withdrawal | High | Reports of difficulties and delays |

| Trading Costs | Medium | Higher spreads and potential hidden fees |

To mitigate these risks, traders should conduct thorough due diligence before investing with Eddid Financial. It is advisable to start with a small investment and closely monitor the trading experience. Additionally, maintaining an awareness of potential withdrawal issues and being prepared to escalate complaints to regulatory authorities can help protect against potential scams.

Conclusion and Recommendations

In conclusion, the evidence surrounding Eddid Financial presents a mixed picture. While the broker is regulated by the SFC in Hong Kong, concerns regarding its withdrawal processes, customer service, and overall transparency cannot be overlooked. The presence of numerous complaints and negative user experiences raises significant doubts about the broker's integrity, leading to the conclusion that Eddid Financial may not be a safe option for traders.

For those considering trading with Eddid Financial, it is crucial to weigh the risks carefully. If you decide to proceed, start with a cautious approach, investing only what you can afford to lose. Alternatively, consider seeking out more reputable brokers with positive track records and transparent practices, such as [insert recommended brokers here]. Ultimately, ensuring the safety of your investments should be the top priority when choosing a forex broker.

Is Eddid Financial a scam, or is it legit?

The latest exposure and evaluation content of Eddid Financial brokers.

Eddid Financial Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Eddid Financial latest industry rating score is 5.98, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.98 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.