Eddid Financial 2025 Review: Everything You Need to Know

Executive Summary

Our comprehensive eddid financial review reveals mixed results about this Hong Kong-based financial services provider. Eddid Financial presents itself as a complete financial group that focuses on fintech, with big plans to add cutting-edge artificial intelligence technologies into its business core. The company works across many different business areas from retail to institutional services, including fintech, internet finance, wealth management, asset management, investment banking, and virtual assets.

However, this review takes a neutral position because of major concerns about the lack of clear regulatory information and limited details about trading conditions. According to WikiFX reports, users have shared doubts about the broker's reliability, mainly because of poor regulatory disclosure and unclear operational transparency. The company's focus on technological innovation, especially AI integration, represents a possible strength for traders interested in modern investment solutions.

Eddid Financial appears most suitable for retail and institutional investors who value fintech innovation and are willing to deal with the uncertainties that come with newer market entrants.

Important Notice

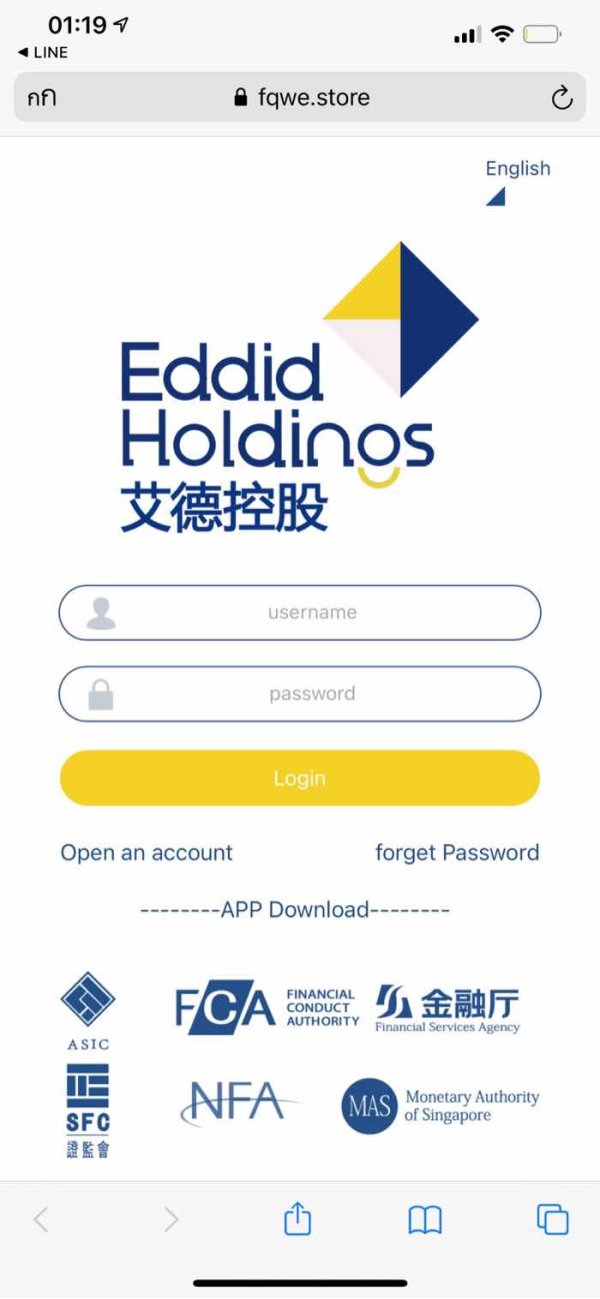

Regional Entity Differences: Eddid Financial keeps its headquarters in Hong Kong and operates through various subsidiaries including Eddid USA. Users should know that regulatory frameworks may differ greatly across jurisdictions, and the company's regulatory status varies by region.

According to available information, Eddid USA is registered with the Securities and Exchange Commission and holds memberships with FINRA, SIPC, NFA, and Nasdaq, while the Hong Kong entity's specific regulatory status requires further verification.

Review Methodology: This assessment is based on available public information and industry reports. Some data points may be incomplete due to limited disclosure from the company, and users are advised to conduct independent verification before making investment decisions.

Rating Framework

Broker Overview

Eddid Financial operates as a comprehensive financial services group with its primary base in Hong Kong's Central district. According to company information, the organization employs between 201-500 staff members and has established a following of over 1,250 professionals on LinkedIn.

The company's business model emphasizes technological innovation, particularly focusing on fintech solutions and the integration of artificial intelligence technologies into financial services delivery. The group's diversified business portfolio spans multiple financial sectors, encompassing retail and institutional services across fintech, internet finance, wealth management, asset management, investment banking, and virtual assets.

This broad operational scope positions Eddid Financial as a multi-service provider attempting to capture various segments of the financial services market. The company states its commitment to providing one-stop financial services and products through high-quality investment solutions, though specific details about trading platforms, asset classes, and regulatory oversight remain limited in publicly available documentation.

According to industry sources, members of the Eddid Financial Group hold various licenses and memberships across key financial jurisdictions, though the specific nature and scope of these authorizations require individual verification by prospective clients.

Regulatory Coverage: Available information indicates mixed regulatory status across different jurisdictions. While Eddid USA appears to maintain registration with major US financial authorities including SEC, FINRA, SIPC, NFA, and Nasdaq, the regulatory status of the Hong Kong parent entity requires further clarification from official sources.

Deposit and Withdrawal Methods: Specific information regarding funding options, processing times, and associated fees is not detailed in accessible company materials, requiring direct inquiry with the broker for comprehensive details.

Minimum Deposit Requirements: Entry-level funding requirements are not specified in available documentation, suggesting potential variation based on account types and client categories.

Bonus and Promotions: No specific promotional offers or bonus structures are detailed in reviewed materials, indicating either absence of such programs or limited public disclosure of incentive schemes.

Tradeable Assets: While the company mentions involvement in virtual assets and various financial instruments, specific asset categories, market coverage, and instrument availability are not comprehensively detailed in accessible sources.

Cost Structure: Trading fees, spreads, commissions, and other cost components are not transparently disclosed in available materials, representing a significant information gap for potential clients conducting eddid financial review assessments.

Leverage Ratios: Maximum leverage offerings and risk management parameters are not specified in reviewed documentation.

Platform Options: Specific trading platform technologies, mobile applications, and software solutions are not detailed in accessible company information.

Geographic Restrictions: Service availability and regional limitations are not clearly outlined in available materials.

Customer Support Languages: Multi-language support capabilities are not specified in reviewed sources.

Detailed Rating Analysis

Account Conditions Analysis

The assessment of Eddid Financial's account conditions faces major limitations due to poor public disclosure of account specifications. Available materials do not detail account type varieties, minimum deposit requirements, or special account features that might serve different trader categories.

This lack of transparency represents a big concern for potential clients seeking to evaluate the broker's suitability for their trading needs. Industry standards typically require clear disclosure of account tiers, associated benefits, and qualification criteria.

The absence of such information in accessible sources suggests either limited account variety or poor public communication of available options. Without specific details about Islamic accounts, institutional offerings, or premium account features, conducting a thorough eddid financial review becomes challenging for prospective clients.

The account opening process, verification requirements, and onboarding procedures are not described in available documentation, creating uncertainty about the client acquisition experience.

Evaluation of Eddid Financial's trading tools and educational resources encounters major limitations due to minimal public disclosure of platform capabilities. The company's emphasis on artificial intelligence integration suggests potential for advanced analytical tools, but specific offerings remain undisclosed in accessible materials.

Research and analysis resources, which are crucial for informed trading decisions, are not detailed in available documentation. Educational materials, market analysis, webinars, and training programs that typically support trader development are not described in reviewed sources.

This absence of information creates uncertainty about the broker's commitment to client education and skill development. Automated trading support, algorithmic trading capabilities, and API access for institutional clients are not specified in available materials.

Given the company's fintech focus, the lack of detailed information about technological tools represents a missed opportunity to showcase competitive advantages in the trading technology space.

Customer Service and Support Analysis

Assessment of Eddid Financial's customer service capabilities is limited by poor availability of specific support information in reviewed materials. Customer service channels, availability hours, and response time commitments are not detailed in accessible documentation, creating uncertainty about the quality and accessibility of client support.

Multi-language support capabilities, which are essential for international clients, are not specified in available sources. Given the company's Hong Kong base and apparent international aspirations, the absence of clear language support information represents a significant information gap for potential clients from diverse linguistic backgrounds.

Problem resolution procedures, escalation processes, and client complaint handling mechanisms are not described in reviewed materials. The lack of transparent customer service policies and procedures raises questions about the broker's commitment to client satisfaction and dispute resolution.

Trading Experience Analysis

Evaluation of the trading experience at Eddid Financial faces major limitations due to poor disclosure of platform specifications and performance metrics. Platform stability, execution speed, and order processing capabilities are not detailed in accessible materials, making it difficult to assess the technical quality of the trading environment.

Order execution policies, slippage management, and market access arrangements are not specified in available documentation. These factors are crucial for traders seeking reliable execution and fair pricing, particularly during volatile market conditions.

The absence of such information creates uncertainty about the broker's commitment to execution quality. Mobile trading capabilities, platform functionality, and user interface design are not described in reviewed sources.

In an era where mobile trading has become essential for many traders, the lack of specific information about mobile platforms represents a significant eddid financial review limitation for potential clients evaluating accessibility and convenience.

Trust and Safety Analysis

The trust and safety assessment of Eddid Financial reveals concerning gaps in regulatory transparency and operational disclosure. While some subsidiary entities appear to maintain regulatory relationships with established authorities, the overall regulatory framework and client protection measures are not comprehensively detailed in available materials.

Fund safety measures, segregation policies, and client asset protection protocols are not clearly outlined in accessible documentation. These elements are fundamental to broker trustworthiness and represent critical evaluation criteria for potential clients.

The absence of transparent safety information contributes to user concerns about reliability mentioned in industry reports. Company transparency regarding ownership structure, financial stability, and operational history is limited in available sources.

The lack of detailed corporate information and regulatory clarity creates challenges for clients seeking to verify the broker's legitimacy and long-term viability in the competitive financial services market.

User Experience Analysis

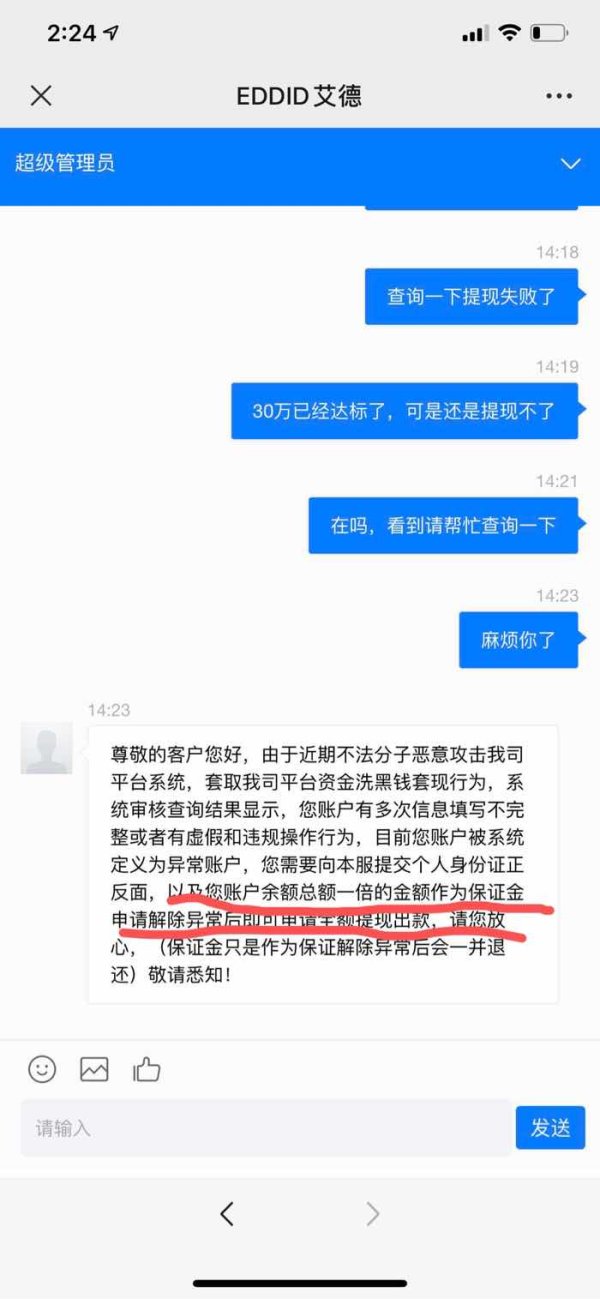

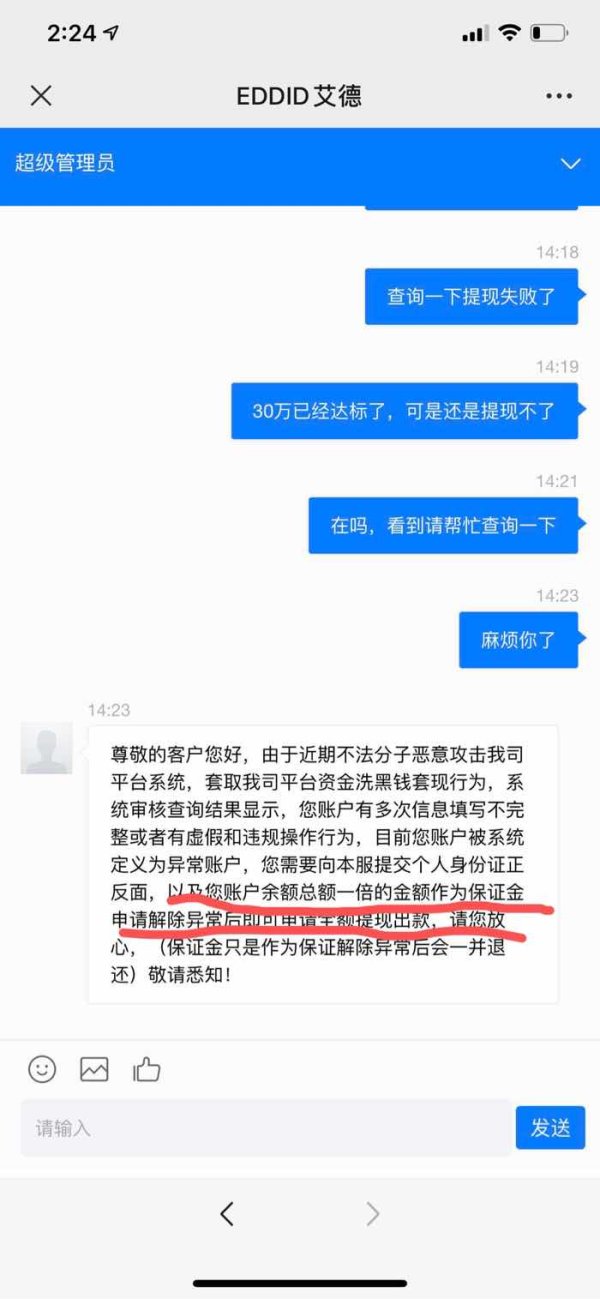

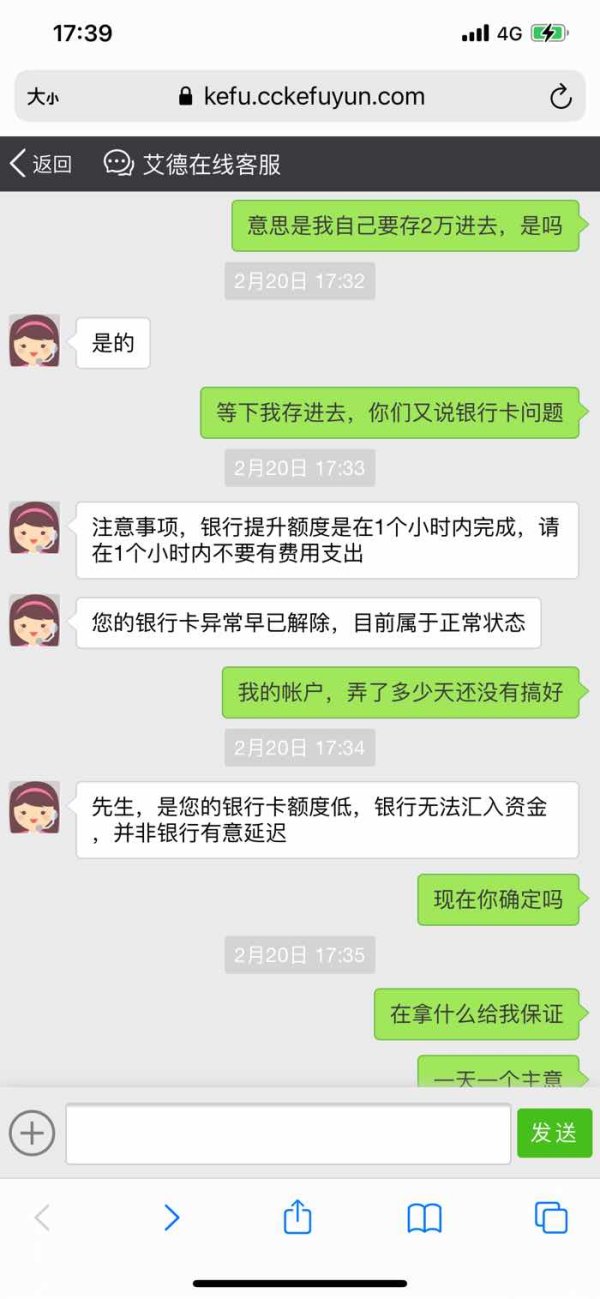

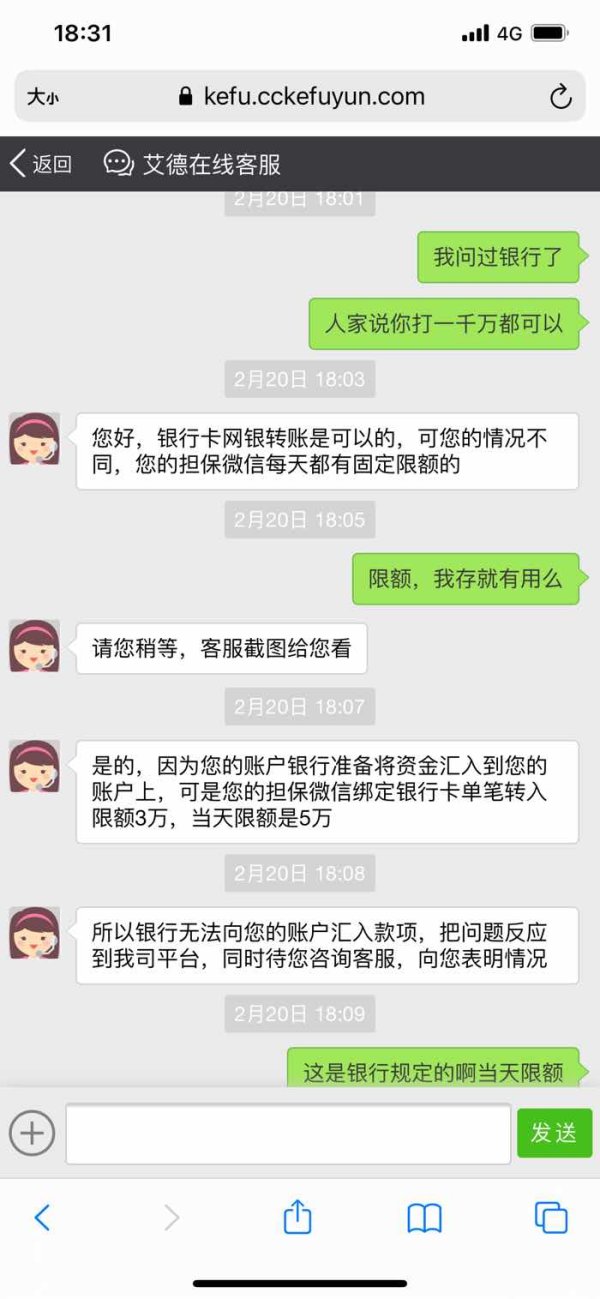

User experience evaluation for Eddid Financial encounters major limitations due to poor feedback data and limited operational transparency. According to WikiFX reports, users have expressed concerns about the broker's reliability, though specific user satisfaction metrics and detailed feedback are not extensively documented in available sources.

Interface design, platform usability, and overall user journey information are not detailed in accessible materials. The registration process, account verification procedures, and onboarding experience are not described, creating uncertainty about the client acquisition and setup process.

Common user complaints and satisfaction indicators are not comprehensively documented in reviewed sources, though general reliability concerns have been noted in industry reports. The limited availability of user feedback data makes it challenging to provide definitive assessments of client satisfaction and operational performance.

Conclusion

This eddid financial review concludes with a neutral assessment reflecting the major information gaps and transparency concerns identified throughout the evaluation process. While Eddid Financial demonstrates potential through its fintech focus and technological innovation aspirations, the lack of comprehensive regulatory disclosure and detailed operational information raises legitimate concerns about reliability and transparency.

The broker may appeal to traders specifically interested in fintech innovation and artificial intelligence integration in financial services. However, the absence of clear trading conditions, regulatory transparency, and detailed user feedback creates substantial uncertainty for potential clients.

Prospective users should conduct thorough due diligence and seek direct clarification from the company regarding regulatory status, trading conditions, and client protection measures before committing to services.