Regarding the legitimacy of CITIC SECURITTIES forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is CITIC SECURITTIES safe?

Business

Risk Control

Is CITIC SECURITTIES markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

CITIC Securities Futures (HK) Limited

Effective Date:

2004-03-05Email Address of Licensed Institution:

hk_licensing@clsa.comSharing Status:

No SharingWebsite of Licensed Institution:

www.citics.com.hkExpiration Time:

--Address of Licensed Institution:

香港中環添美道1號中信大廈26樓Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Citic Securities Safe or a Scam?

Introduction

Citic Securities, established in 1995, is one of the largest and most prominent brokerage firms in China, specializing in a wide range of financial services including securities brokerage, investment banking, and asset management. As the financial landscape continues to evolve, traders must exercise caution and diligence when evaluating forex brokers, as the risks associated with trading can lead to significant financial losses. This article aims to provide a thorough analysis of Citic Securities, exploring its regulatory status, company background, trading conditions, customer experiences, and overall safety. The assessment is based on a comprehensive review of multiple sources, including regulatory filings, user feedback, and industry reports, ensuring an objective evaluation of whether Citic Securities is a safe option for traders.

Regulation and Legitimacy

The regulatory status of a brokerage is a crucial factor in determining its legitimacy and safety. Citic Securities operates under the regulatory oversight of the China Securities Regulatory Commission (CSRC) and is also a member of the China Securities Investor Protection Fund (SIPF). This regulatory framework is essential for ensuring that the broker adheres to stringent operational standards and provides a level of protection for client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CSRC | N/A | China | Verified |

The CSRC is known for its rigorous regulatory environment, which is aimed at protecting investors and maintaining market integrity. Citic Securities has a long history of compliance with regulatory standards, although it has faced scrutiny in the past regarding insider trading allegations involving its executives. Despite these issues, the firm's overall regulatory compliance and membership in the SIPF provide a safety net for investors, indicating that Citic Securities is safe and legitimate.

Company Background Investigation

Citic Securities was founded as part of the Citic Group, a major state-owned conglomerate in China. Over the years, it has grown to become a leading player in the financial services sector, with a presence in both domestic and international markets. The company's ownership structure is transparent, as it is publicly traded on both the Shanghai and Hong Kong stock exchanges.

The management team of Citic Securities is comprised of experienced professionals with extensive backgrounds in finance and investment. This expertise is crucial for navigating the complex financial landscape and ensuring the firm's continued success. The company maintains a high level of transparency, regularly publishing financial reports and updates on its operations, which adds to its credibility.

Trading Conditions Analysis

When evaluating a broker's trading conditions, it is important to consider the overall fee structure and any unusual policies that may raise concerns. Citic Securities offers a competitive fee structure, with low trading commissions and no hidden fees for deposits or withdrawals. However, it is essential to analyze the specifics of its pricing model to understand the total cost of trading.

| Fee Type | Citic Securities | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.03% - 0.12% | 0.05% - 0.15% |

| Commission Model | $1 minimum | $5 minimum |

| Overnight Interest Range | Varies | Varies |

The spread for major currency pairs is competitive compared to industry averages, which indicates that Citic Securities is safe for traders looking for cost-effective trading options. However, the absence of negative balance protection is a notable concern, as it exposes traders to the risk of losing more than their initial investment.

Client Fund Security

The safety of client funds is paramount when evaluating a broker's reliability. Citic Securities employs several measures to protect client assets, including segregated accounts and participation in the SIPF, which provides compensation in the event of broker insolvency. This regulatory framework enhances the overall safety of trading with Citic Securities.

Furthermore, the firm has a robust internal compliance system designed to ensure that all transactions are conducted securely and transparently. While there have been no major historical incidents of fund mismanagement, traders should remain vigilant and conduct their own due diligence to assess the safety of their investments.

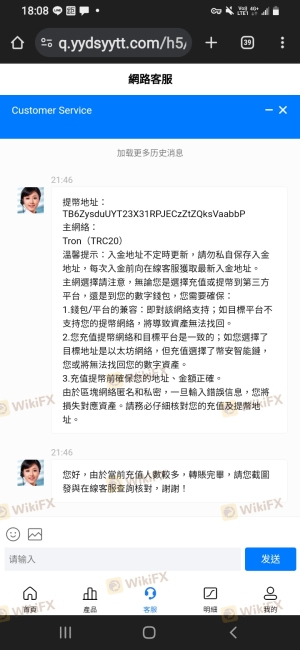

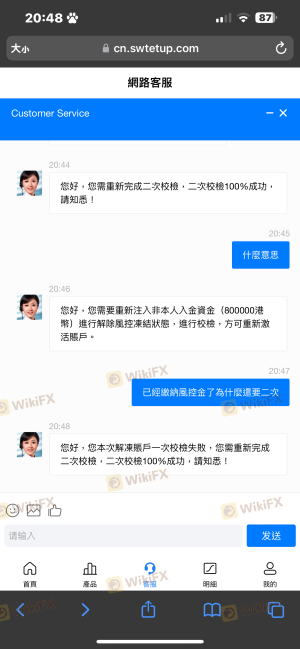

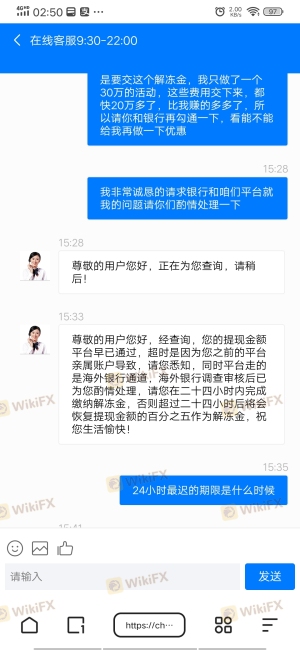

Customer Experience and Complaints

Customer feedback plays a significant role in evaluating a broker's performance. Citic Securities has received a mix of reviews from clients, with some praising its trading platform and customer service, while others have raised concerns about withdrawal processes and response times.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Service Availability | Medium | Moderate |

Typical complaints include difficulties in withdrawing funds and slow customer support responses. For instance, some users have reported delays in processing withdrawals, which can be frustrating for traders who need timely access to their funds. However, Citic Securities has made efforts to address these complaints, indicating a commitment to improving customer satisfaction.

Platform and Trade Execution

The performance of a trading platform is critical for a seamless trading experience. Citic Securities offers a variety of trading platforms, including desktop and mobile applications, which are generally well-received by users for their functionality and ease of use. However, issues such as slippage and order rejections have been reported, which can negatively impact trading outcomes.

Moreover, there are no significant indications of platform manipulation, but traders should remain cautious and monitor their trading performance closely to ensure a fair trading environment.

Risk Assessment

Engaging with any broker involves inherent risks, and Citic Securities is no exception. While the firm is regulated and offers several protective measures, traders should be aware of the potential risks involved in trading with Citic Securities.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Low | Strong regulatory oversight from CSRC |

| Fund Security | Medium | SIPF coverage, but no negative balance protection |

| Customer Service | Medium | Mixed reviews regarding support responsiveness |

To mitigate risks, traders are advised to start with a demo account (if available) or a small investment to gauge the platform's performance and customer service before committing larger amounts.

Conclusion and Recommendations

In conclusion, Citic Securities presents itself as a reputable broker with a solid regulatory framework and a long-standing history in the financial industry. While there are concerns regarding customer service and the absence of negative balance protection, the overall assessment indicates that Citic Securities is safe for traders who are well-informed and cautious.

For traders seeking reliable alternatives, it may be beneficial to explore other regulated brokers that offer similar services but with enhanced customer support and risk management features. Ultimately, conducting thorough research and understanding the trading conditions is crucial for making informed decisions in the forex market.

Is CITIC SECURITTIES a scam, or is it legit?

The latest exposure and evaluation content of CITIC SECURITTIES brokers.

CITIC SECURITTIES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CITIC SECURITTIES latest industry rating score is 5.87, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.87 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.