CITIC SECURITTIES Review 9

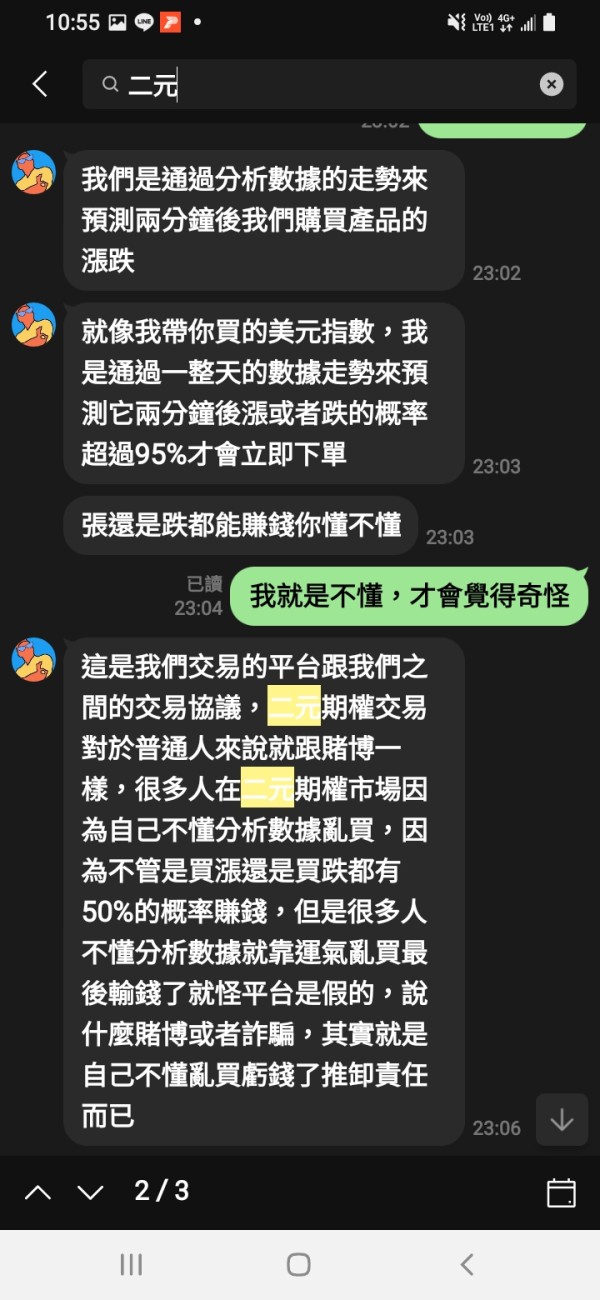

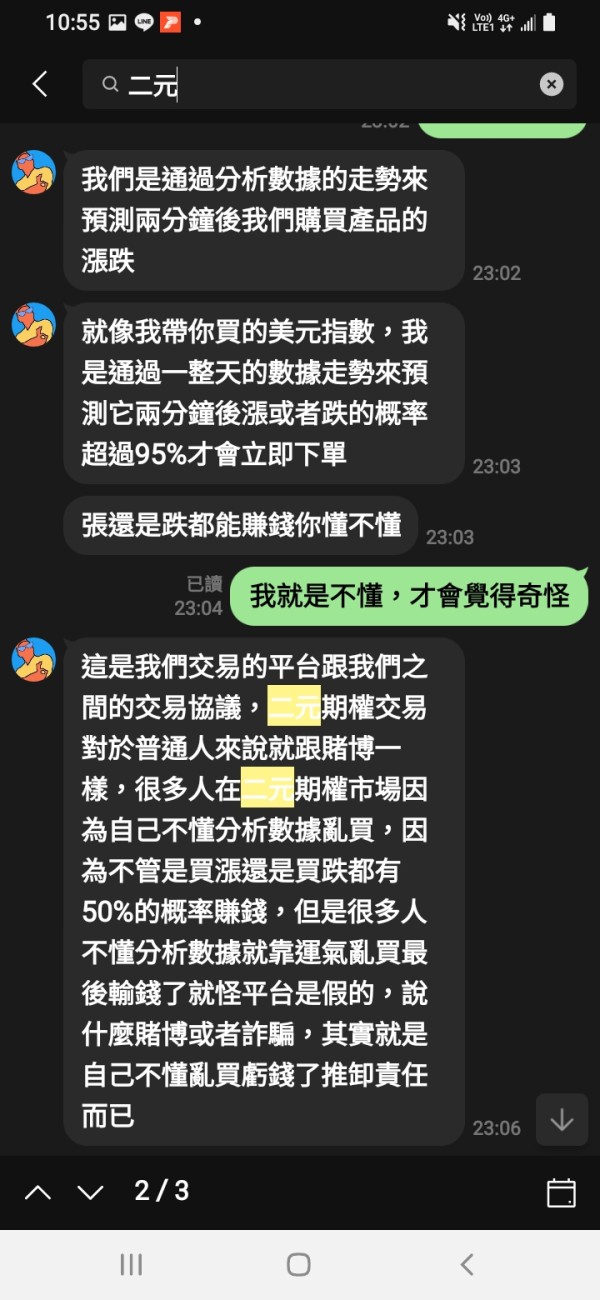

On IG, I met someone who claimed to be Taiwanese but stayed in Hong Kong. The person cultivated a relationship with you first, and then told you about investment channels. The person asked you to download some apps and let you start with small amounts of money. After a large amount of money is deposited, they refuse to allow withdrawals, claiming that the new user tasks have not been completed. If the tasks are not completed within the deadline, they will require payment of risk control fees and report credit defaults.

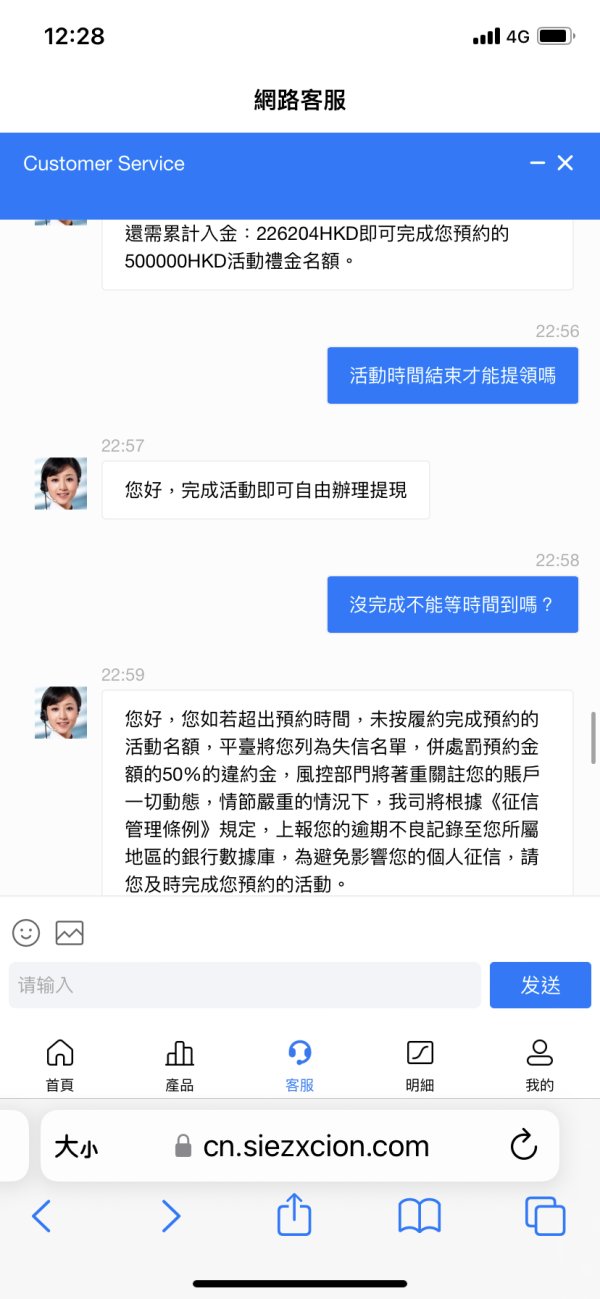

I met a man on IG who runs a decoration company in Hong Kong. He claims to be Taiwanese but has stayed in Hong Kong since he was a child. He first added my friend on IG, making me think that I was a friend of a friend, so I agreed to his invitation to be friends! After chatting online for a while, he started to mention the topic of investment! First it was stocks and then it was foreign exchange. He said that he had insider information in the bank and his professional judgment, and he could make 95% profit. At first, I was dubious and only made a small deposit and followed the order. After a few operations, I made a small withdrawal of 500u. The next day he asked me to ask customer service if there was any new activity, and it turned out that there was indeed an activity for new customers. He asked me to make an appointment with a gold member (if you deposit 50,000u, you will receive a gift of 5,888u). At first, I refused and said that I didn’t have that much spare money to spare. But he said he would help me and immediately put 10,000u in. I thought he had already put it in, so it should be fine! Later, he suggested that I borrow a loan to store value... and told me that he also had a loan, and he could withdraw it and pay it back after the activity was completed. After that, he helped me save another 10,000u. After the event was completed, there was indeed a gift. The man immediately asked me to withdraw 2000u, and I could actually withdraw it! But a few days later, I wanted to withdraw it myself but was blocked for a whole day. When I asked customer service, they said they wanted me to wait because there were so many people withdrawing! Now that I think about it, they should be operating behind the scenes...

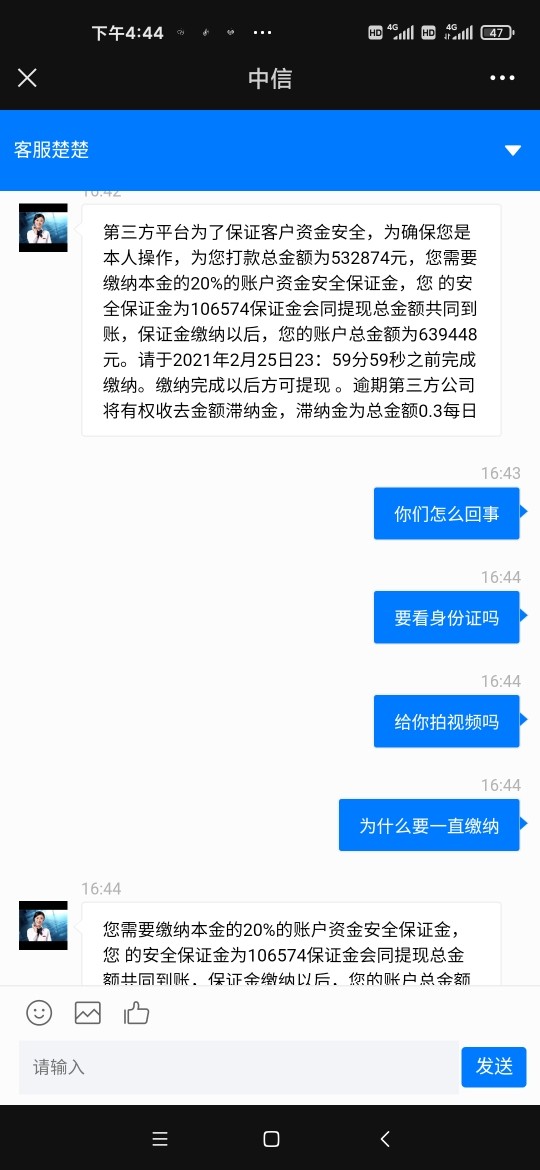

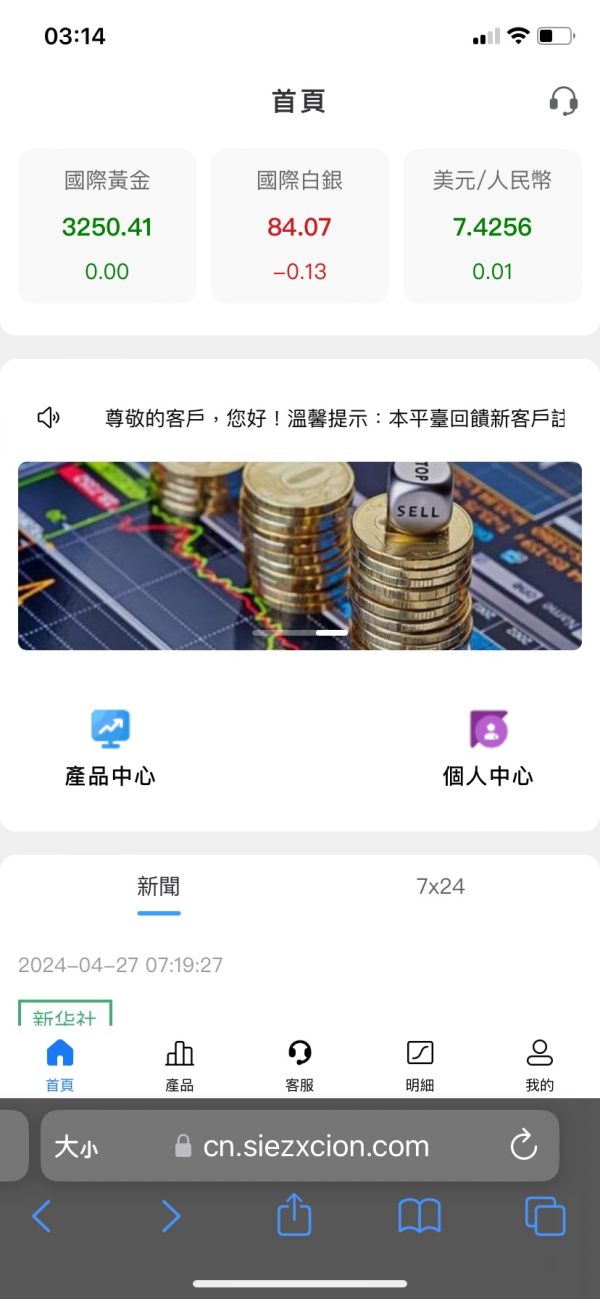

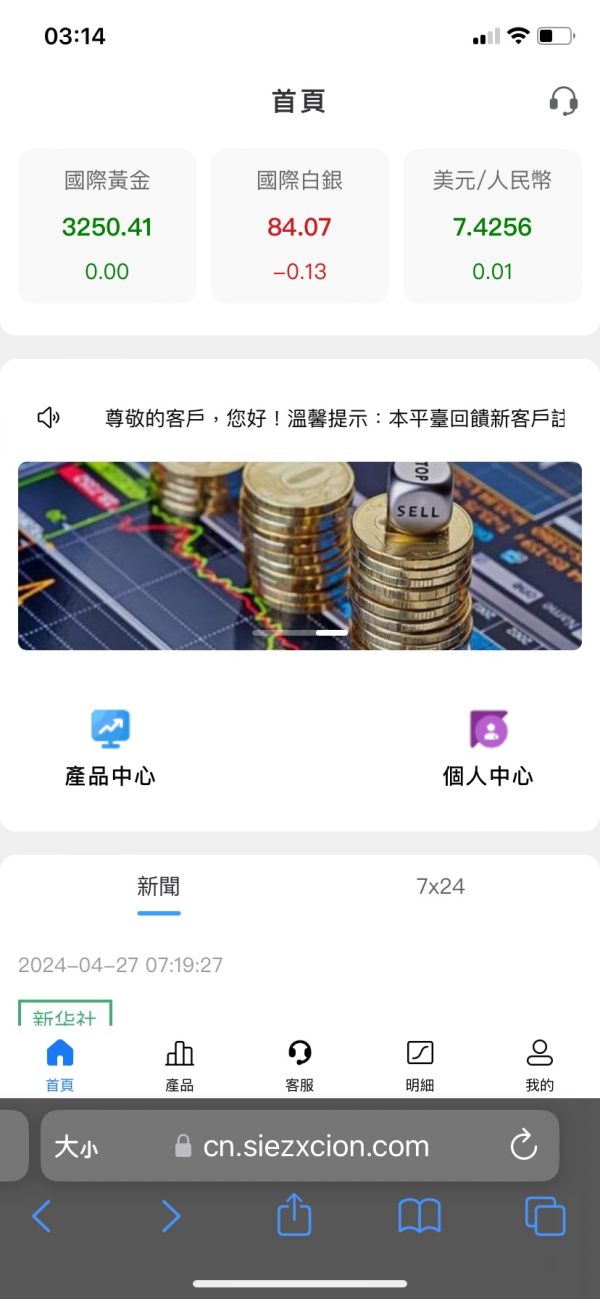

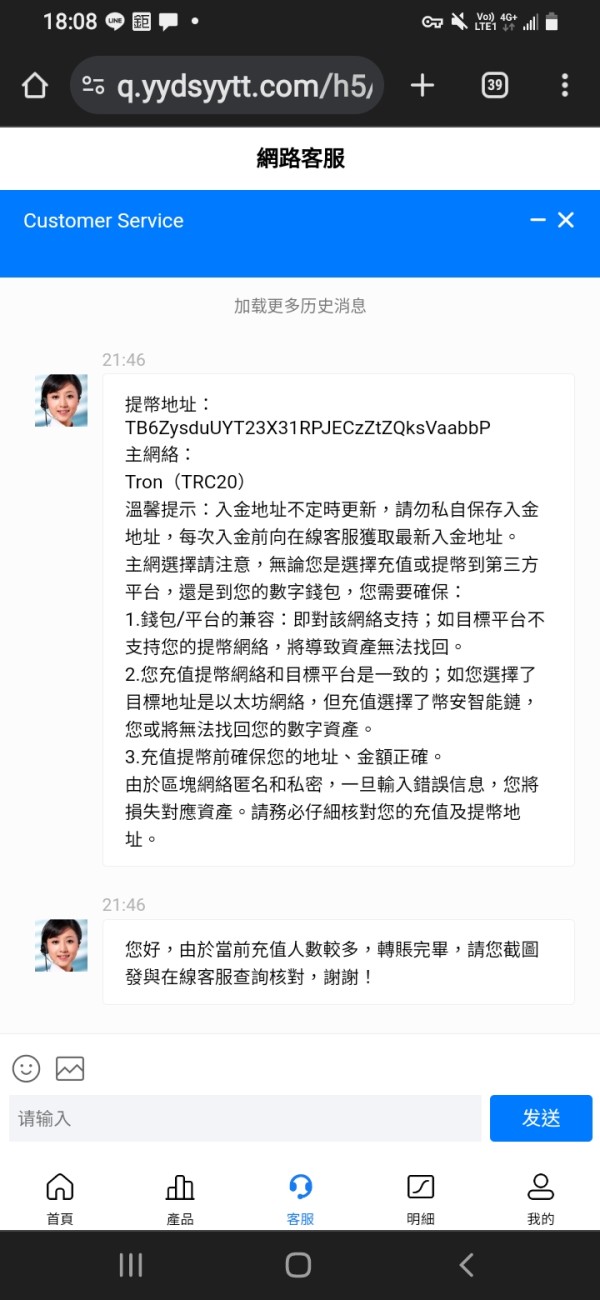

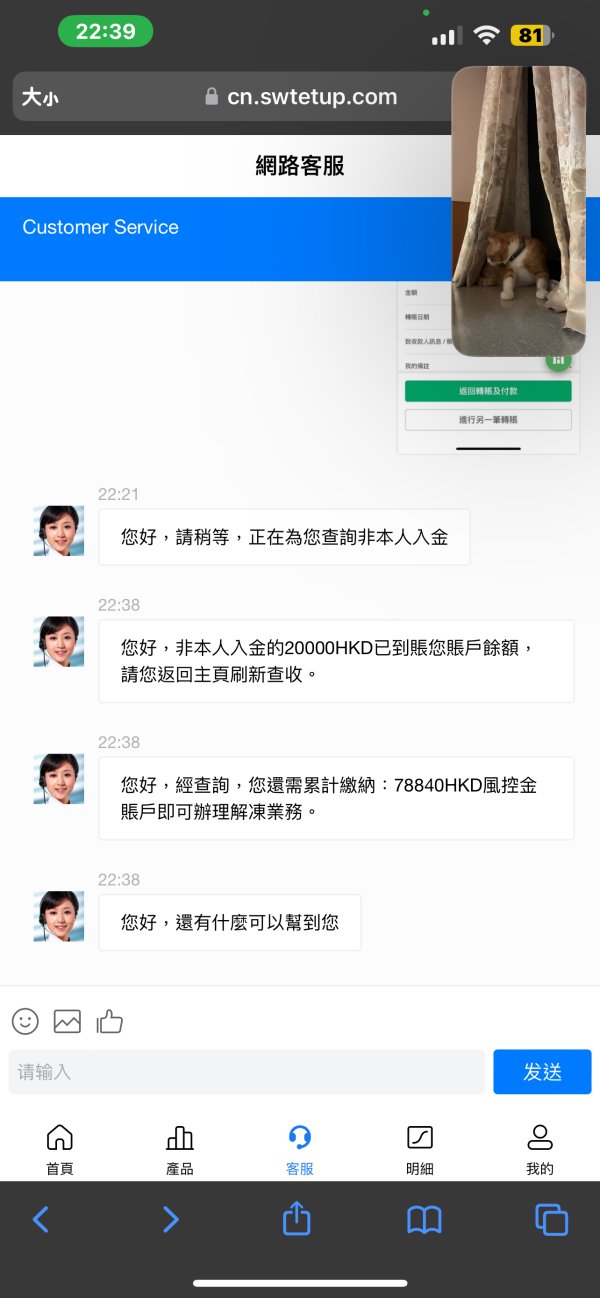

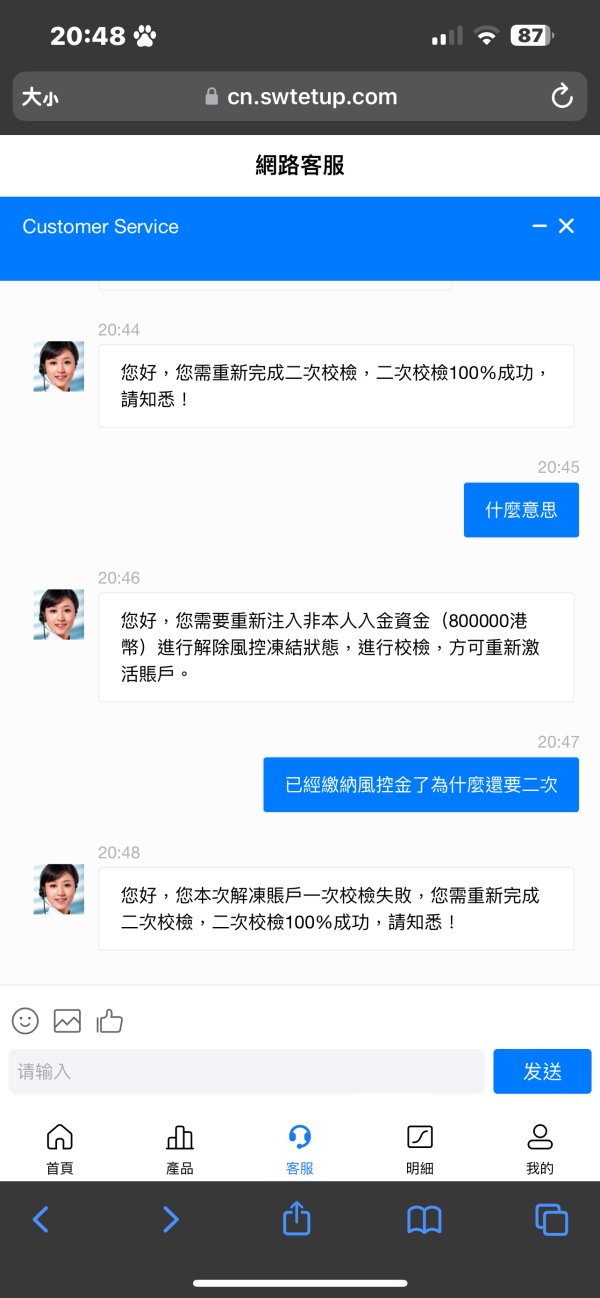

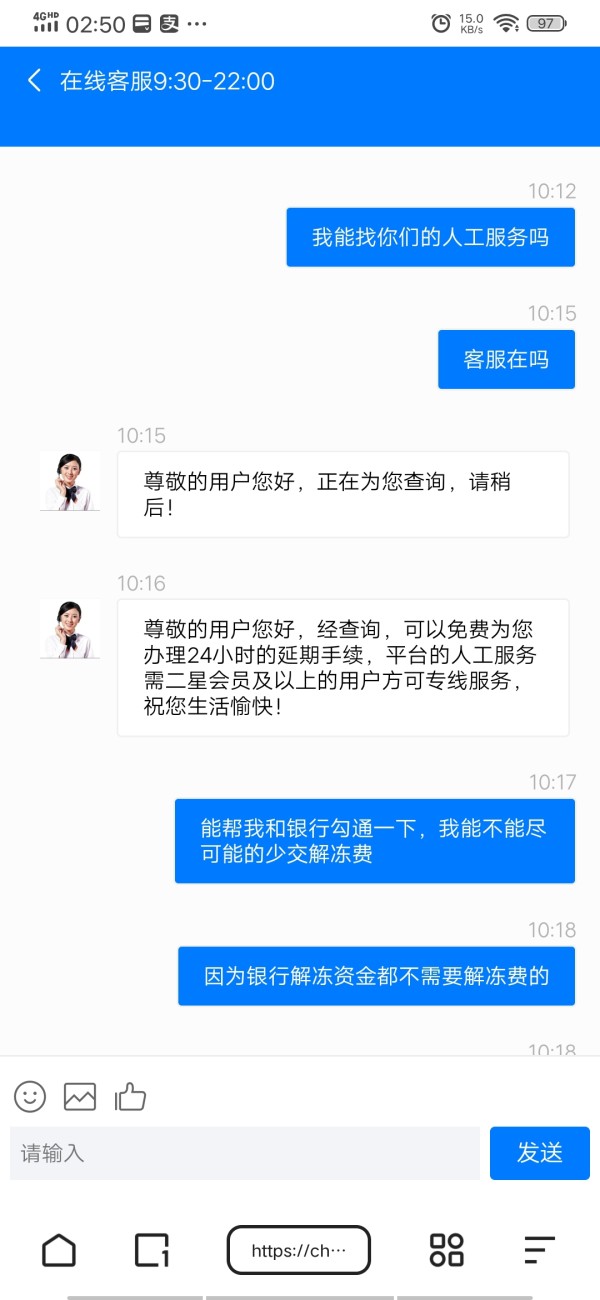

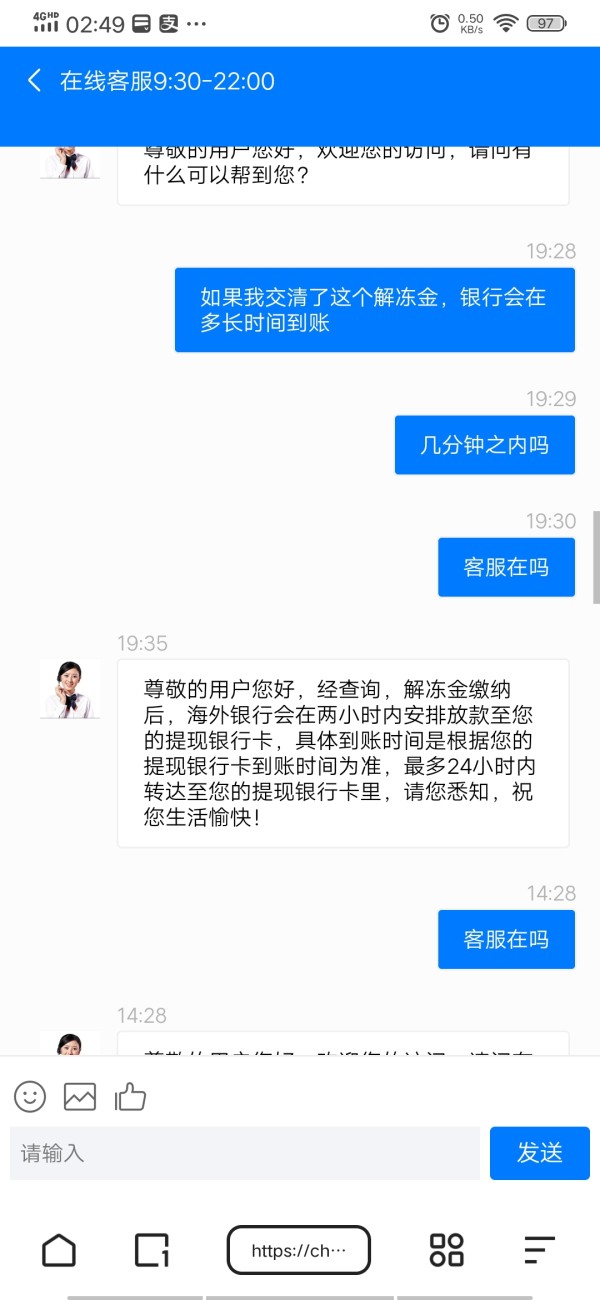

I met a businessman on the Internet who said he lived in Hong Kong. He expressed his affection for me at first and started teaching me how to make money and invest with him. He asked me to download the OKX, MAX app and then gave me a URL https:// cn.swtetup.com/h5/#/ After asking me to register an account, it said it was a foreign exchange account. At first, he asked me to swipe my card to recharge money to operate the foreign exchange difference, and I successfully withdraw cash into the account. Later, he thought that my principal was not large enough and the profit was too small, so he remitted NT$1 million and put it into my foreign exchange account and told me to make more money. Later, he asked me to collect the 1 million recharge gift from the customer service (after remitting the money, he asked me to ask the customer service for all the recharge gift at once). The next day, I felt something was wrong and I wanted to withdraw the money from my account and return it to him. At that time, I found that I couldn't withdraw the cash and I couldn't pay him back. The customer service explained that I had to complete the recharge bonus activity before I could cash it out successfully, which meant that I had to put in more funds to complete the activity before I could withdraw the cash. Later, inexplicably, my account was said to be frozen. The Hong Kong man also said that he would help me solve the problem together and put money into this foreign exchange account. Indeed, he also gave me his transfer information, and the money he transferred was also displayed in the foreign exchange account. I also transferred money into it just to complete the recharge activity successfully. withdraw! However, after completing the activity, withdrawals were still not allowed due to various reasons...

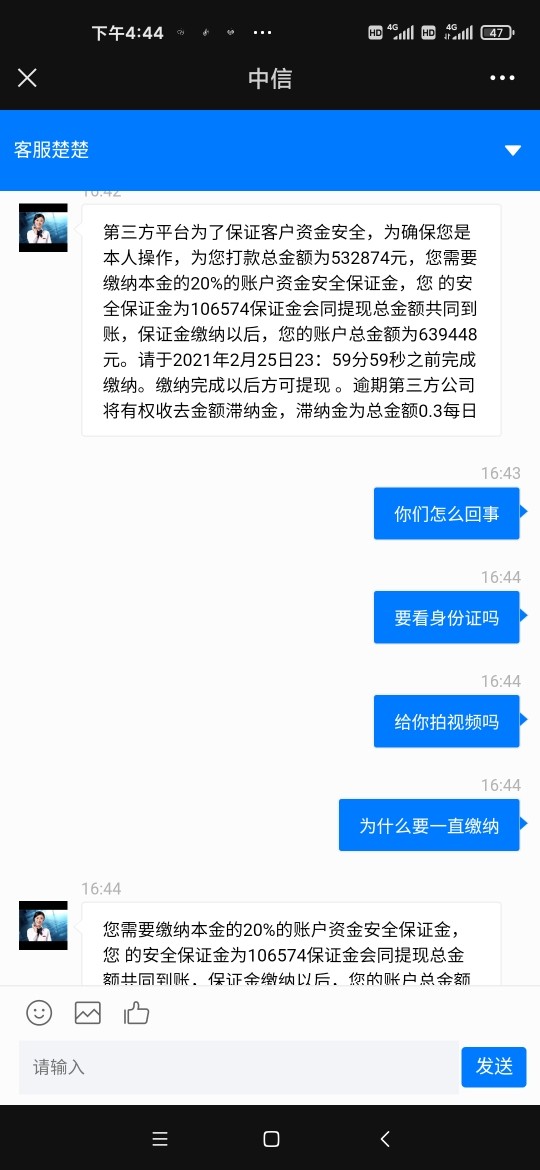

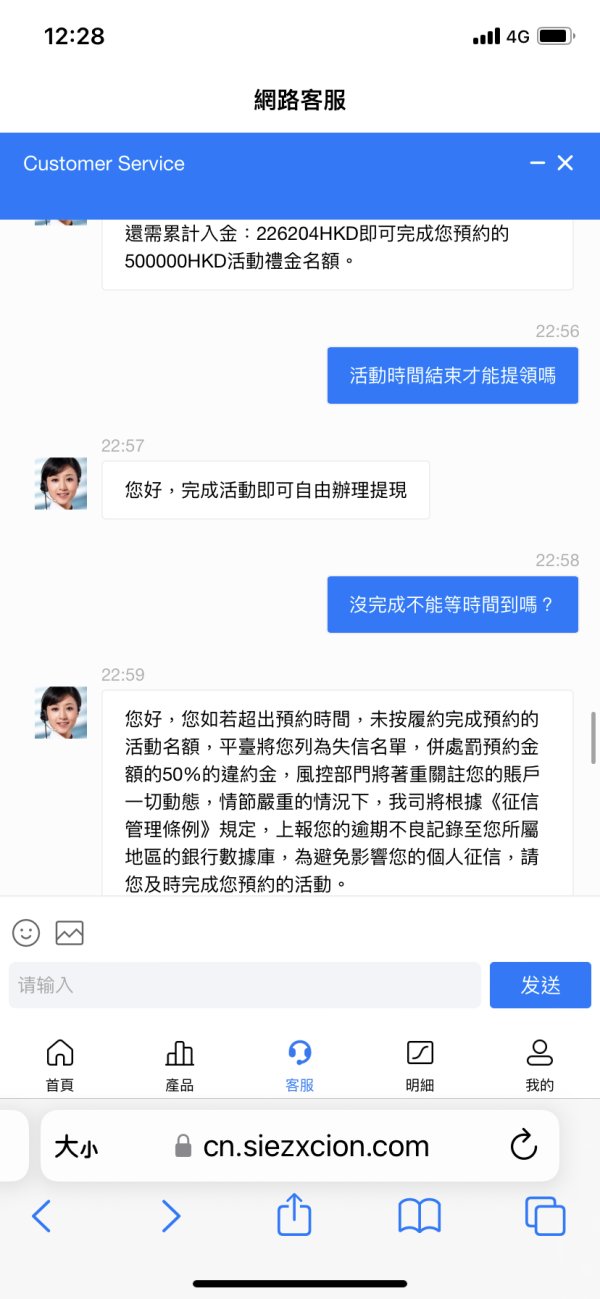

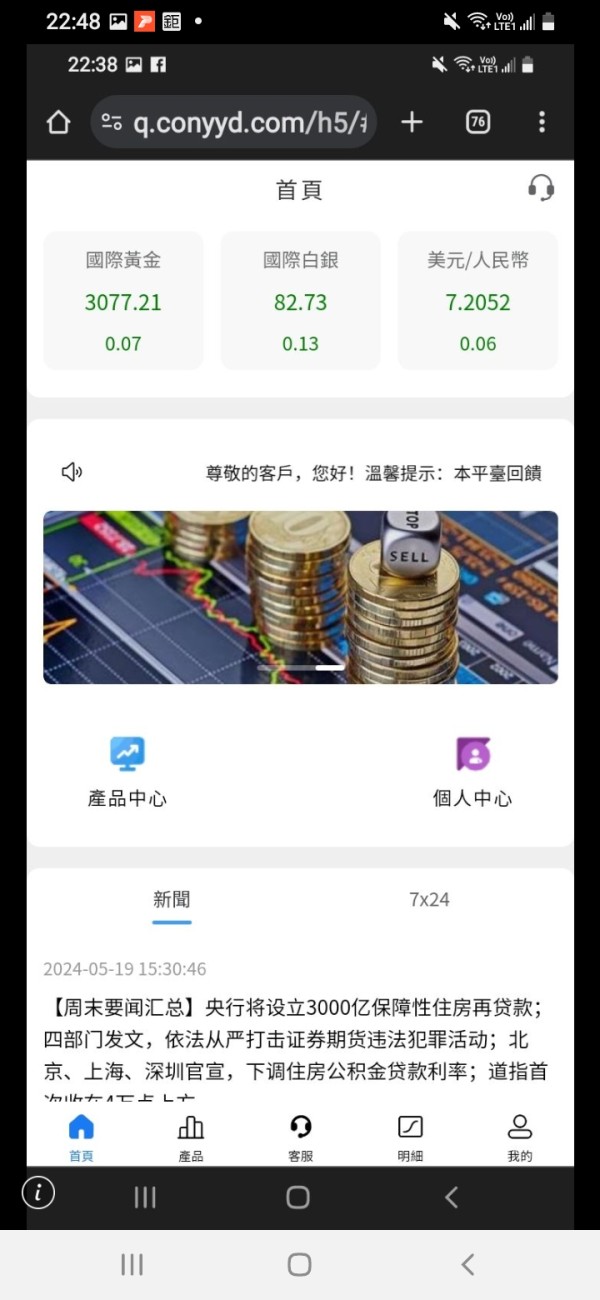

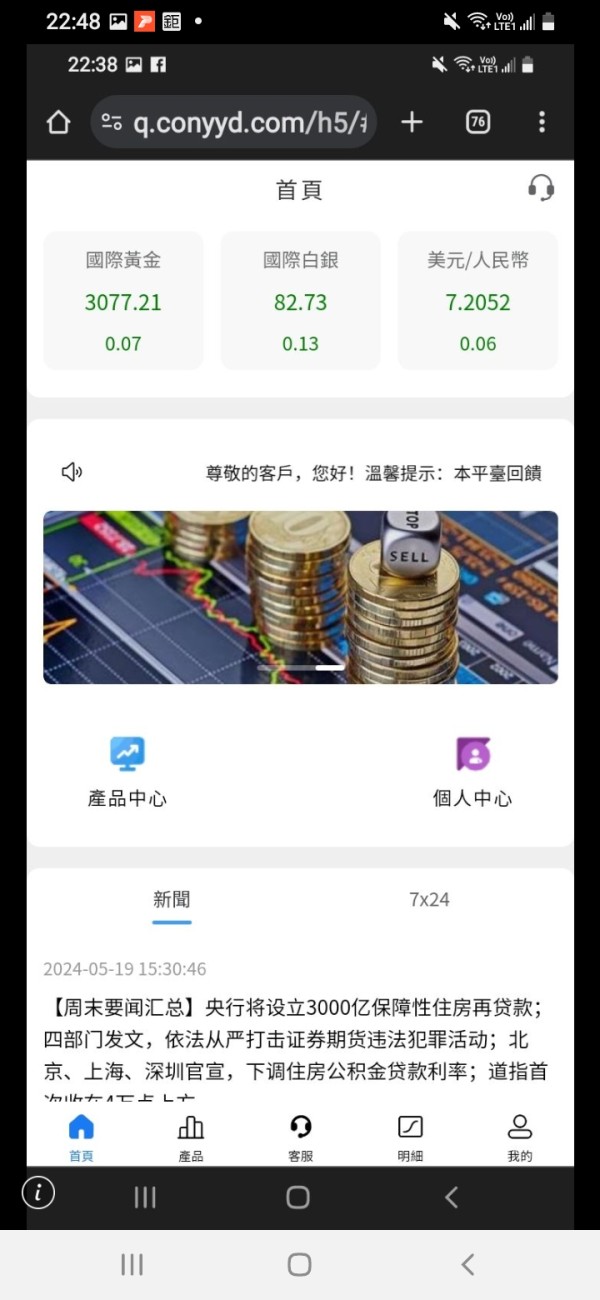

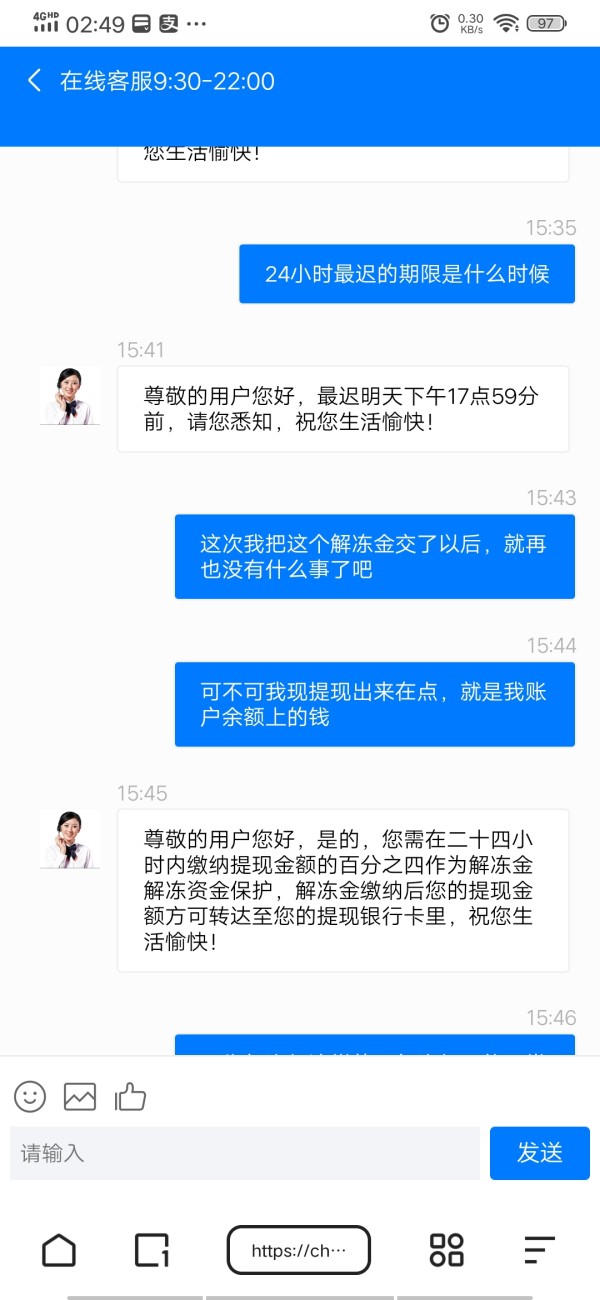

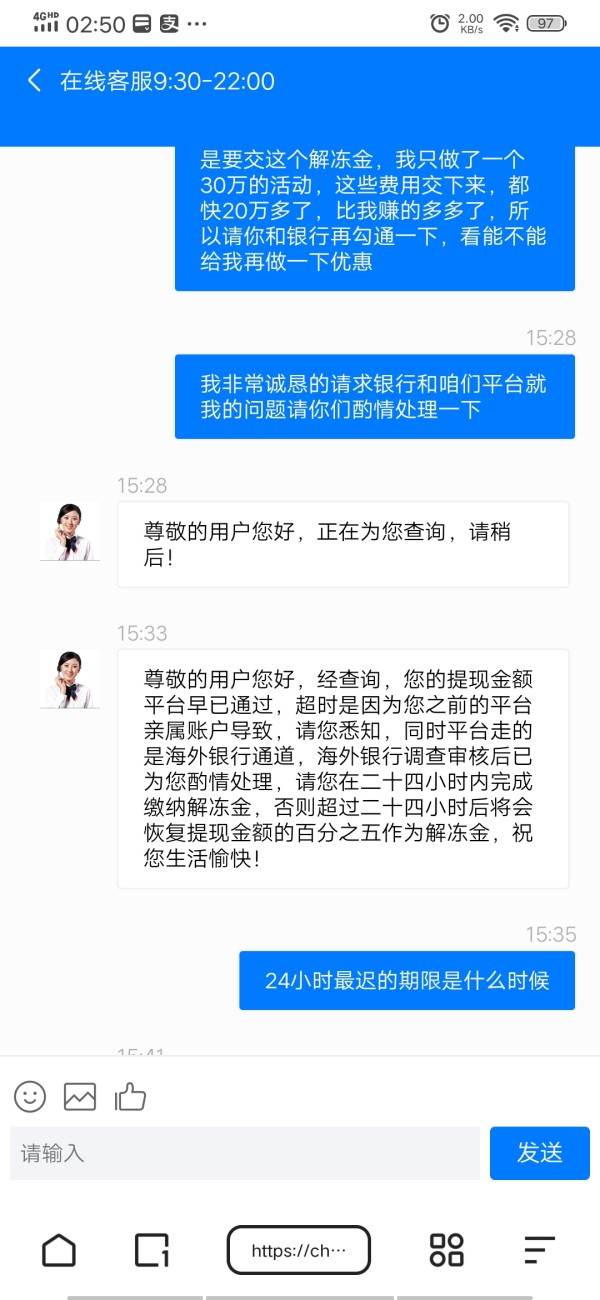

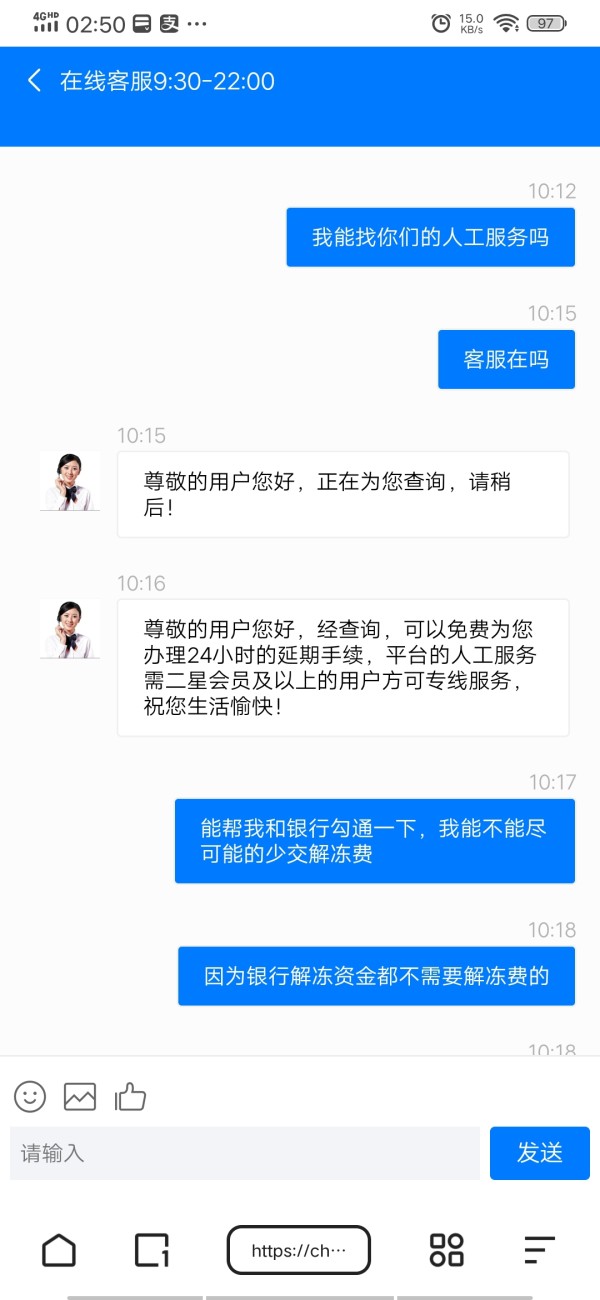

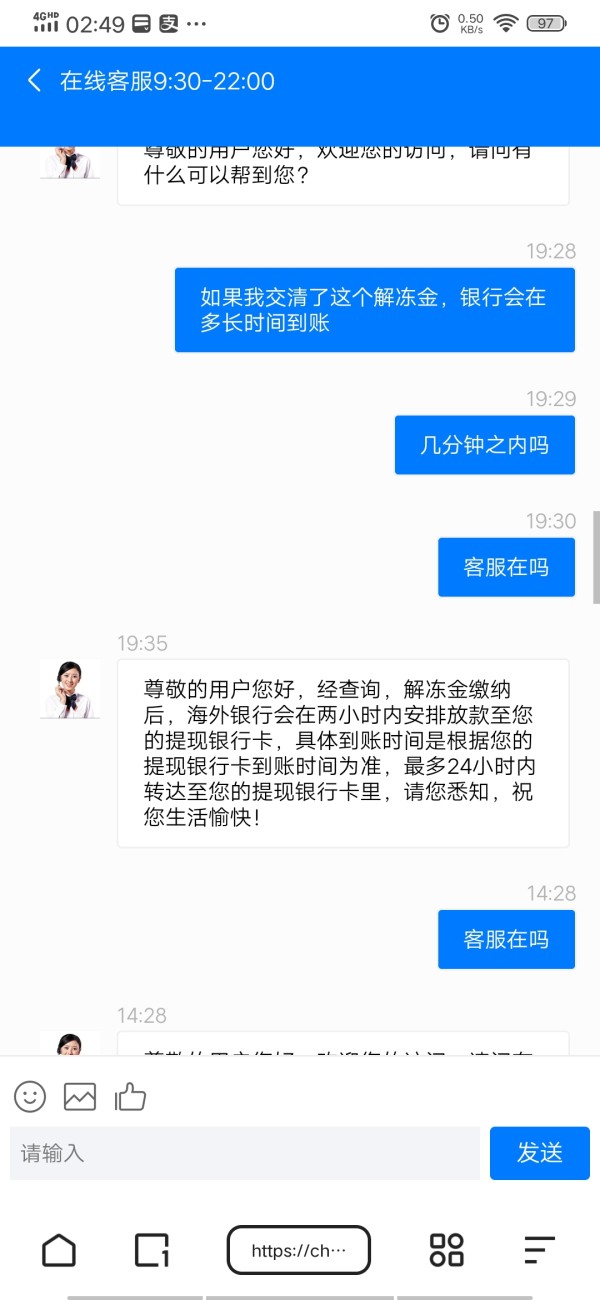

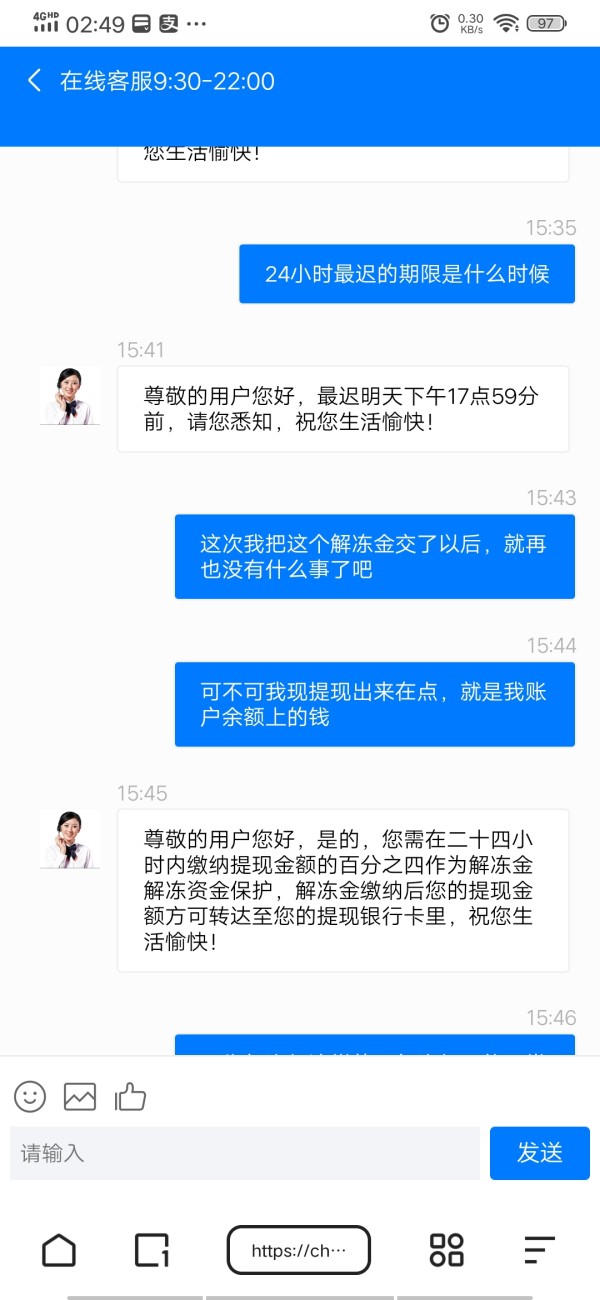

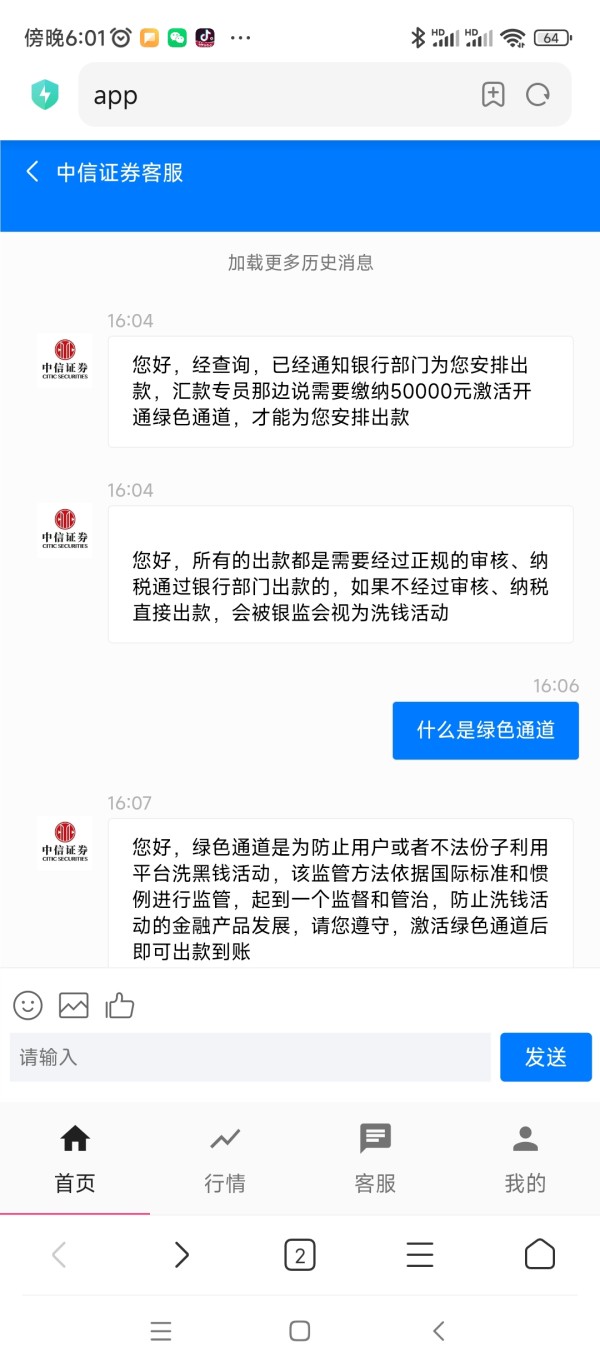

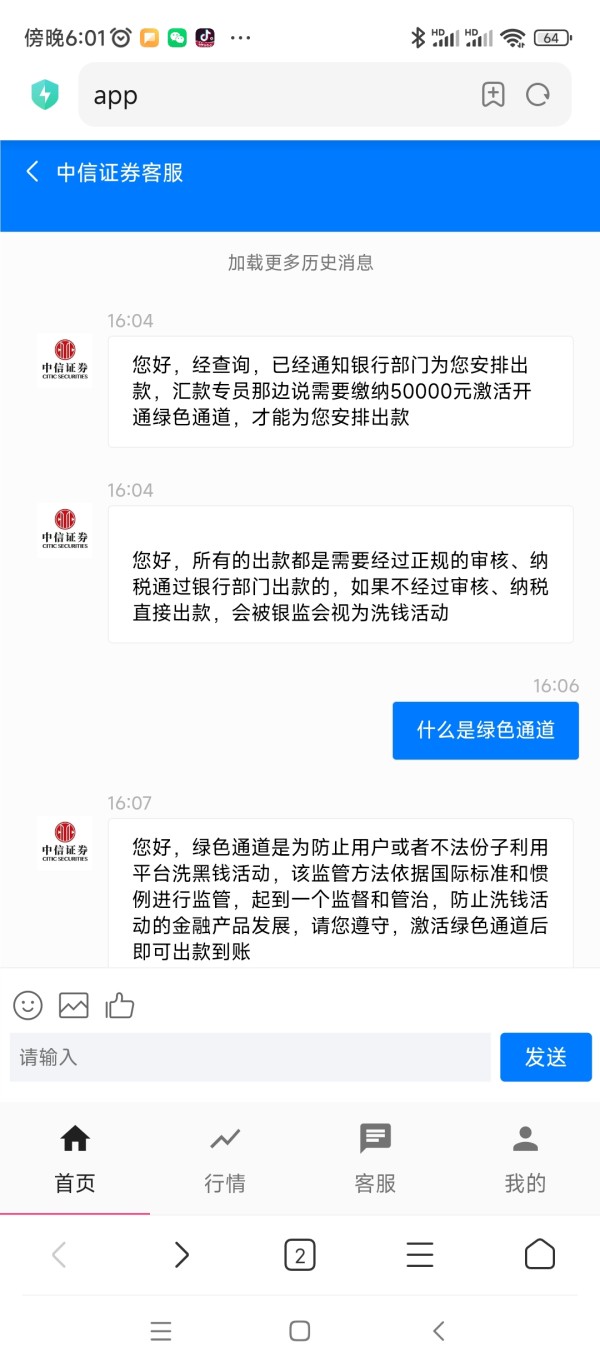

The BYFX platform under CITIC Securities uses various reasons to ask customers to pay fees, and the reason is that the funds are frozen in the bank and the unfrozen funds are handed over. Just do not withdraw money to customers. This is a scam.

Hope to help me to solve the problem that fund does not arrive. It is a lesson. Do not trust others easily.

For the first time I was asked to pay the deposit, and then again, i was asked to pay the money for Green Channel. Not sure whether they were cheating on me.

They said the system was under maintenance.

Unable to withdraw. Ask for money with various reasons