Is BIB safe?

Business

License

Is BIB A Scam?

Introduction

BIB, a forex broker based in Latvia, has recently garnered attention in the trading community. With the rapid growth of online trading platforms, it is crucial for traders to carefully assess the credibility of such brokers before committing their funds. The forex market is notoriously volatile, and the presence of unregulated or poorly regulated brokers can pose significant risks to investors. This article aims to investigate whether BIB is a legitimate trading platform or a potential scam. Our assessment is based on a comprehensive review of its regulatory status, company background, trading conditions, customer safety measures, user experiences, platform performance, and overall risk profile.

Regulation and Legitimacy

The regulatory environment in which a broker operates is paramount for ensuring the safety and security of client funds. BIB operates without any valid regulatory oversight, which raises significant concerns regarding its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Latvia | Unverified |

The absence of regulation means that BIB is not obligated to adhere to any industry standards or practices that protect traders. Regulated brokers are typically required to maintain a minimum capital reserve, segregate client funds, and provide transparency in their operations. Without such oversight, traders are left vulnerable to potential fraud and mismanagement of funds. Historical compliance records indicate that unregulated brokers often engage in practices that are detrimental to their clients, such as manipulating prices, imposing hidden fees, or refusing to honor withdrawal requests.

Company Background Investigation

BIB has been operational for approximately 5 to 10 years, but its history remains somewhat opaque. The company is registered in Latvia, a jurisdiction that has become a hub for various financial services, including forex trading. However, the lack of publicly available information regarding its ownership structure and management team is concerning.

The management teams background and professional experience play a crucial role in establishing a broker's credibility. Unfortunately, BIB has not provided sufficient details about its leadership, which raises questions about transparency and accountability. A reputable broker should openly disclose information about its executives and their qualifications, as this fosters trust among potential clients.

Furthermore, the overall transparency and information disclosure level at BIB appear to be lacking, which is a significant red flag for potential investors.

Trading Conditions Analysis

When evaluating a broker, the trading conditions they offer are critical. BIBs fee structure and trading policies must be scrutinized to understand the potential costs involved for traders.

| Fee Type | BIB | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Variable | 1.0 - 2.0 pips |

| Commission Structure | None | $5 - $10 per lot |

| Overnight Interest Range | High | Low to Moderate |

BIB's trading fees are reportedly higher than the industry average, particularly concerning overnight interest rates. Such high charges can significantly impact a trader's profitability, especially for those who hold positions overnight. Furthermore, the absence of a clear commission structure may lead to confusion among traders, as they could be unaware of the total costs incurred while trading. The potential for hidden fees and unclear pricing policies is a common tactic employed by less reputable brokers, further emphasizing the need for caution.

Customer Fund Safety

The safety of customer funds is a paramount concern when selecting a trading platform. BIB has not demonstrated adequate measures to protect client funds, such as segregating accounts or offering investor protection schemes.

The lack of segregation means that client deposits could be at risk in the event of the broker's insolvency. Additionally, without a regulatory body overseeing its operations, there is no assurance that BIB will adhere to any safety standards. Historical complaints and issues with fund security have plagued similar unregulated brokers, leading to significant financial losses for traders.

Customer Experience and Complaints

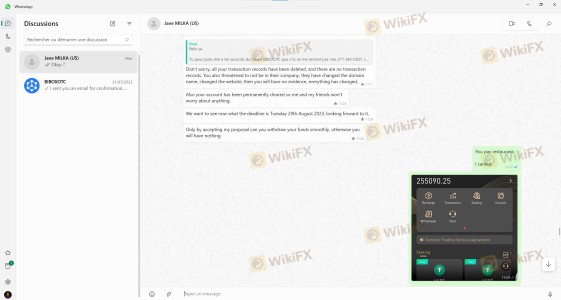

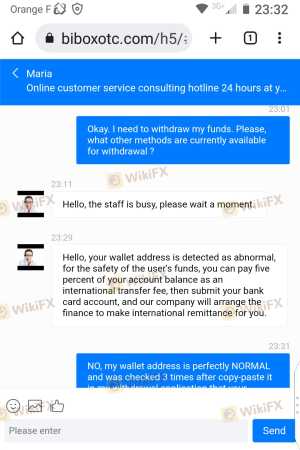

User feedback is a vital indicator of a broker's reliability. Reviews of BIB reveal a concerning trend of complaints, primarily regarding withdrawal issues and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Customer Support | Medium | Average |

Many users have reported difficulties in withdrawing their funds, with some claiming that their requests were either ignored or met with unreasonable demands for additional fees. Such practices are often indicative of a scam, as they suggest that the broker may be trying to retain funds under dubious pretenses. Case studies of affected traders reveal a pattern of frustration and loss, underscoring the importance of thorough due diligence before engaging with BIB.

Platform and Execution

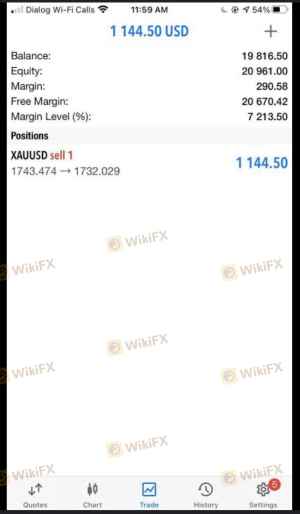

The performance and reliability of the trading platform are critical for successful trading. BIB's platform has received mixed reviews, with users reporting issues related to stability and order execution quality. Concerns have been raised about slippage and the frequency of order rejections, which can severely impact trading outcomes.

Traders have also reported instances of platform manipulation, where prices displayed on the platform did not align with market rates, raising questions about the integrity of the trading environment.

Risk Assessment

Using BIB as a trading platform presents several risks that potential clients should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety Risk | High | Lack of fund segregation |

| Withdrawal Risk | High | Frequent complaints regarding withdrawals |

| Transparency Risk | Medium | Insufficient information disclosure |

Given these risks, it is crucial for potential traders to consider alternative brokers that offer better security, regulatory oversight, and customer support.

Conclusion and Recommendations

In conclusion, the evidence suggests that BIB may not be a safe or trustworthy trading platform. The lack of regulation, high trading costs, and numerous customer complaints indicate significant potential risks for traders. Therefore, it is advisable for traders, especially those new to the forex market, to exercise caution and consider alternative, regulated brokers that provide a safer trading environment.

For those seeking reliable options, brokers with solid regulatory backing, transparent fee structures, and positive user feedback should be prioritized. Always conduct thorough research and due diligence before committing funds to any trading platform.

Is BIB a scam, or is it legit?

The latest exposure and evaluation content of BIB brokers.

BIB Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BIB latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.