Is NovaTech safe?

Pros

Cons

Is NovaTech A Scam?

Introduction

NovaTech FX, established in 2019, positions itself as a digital asset trading platform that offers forex and cryptocurrency trading. With the growing popularity of online trading, it has attracted a significant number of traders. However, the influx of investment opportunities also brings with it a heightened risk of encountering scams. As such, it is crucial for traders to conduct thorough evaluations of any forex broker they consider engaging with. This article aims to assess the legitimacy of NovaTech FX by examining various aspects such as regulatory compliance, company background, trading conditions, client fund safety, customer experiences, platform performance, and overall risks. Our investigation is based on a review of multiple credible sources, including trader feedback and regulatory warnings.

Regulation and Legitimacy

The regulatory status of a broker is a significant determinant of its legitimacy. Brokers that operate under stringent regulations are generally considered safer for trading. NovaTech FX is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lack of robust financial regulations. This raises questions about the broker's legitimacy and the safety of client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Unregulated |

The absence of a regulatory body overseeing NovaTech FX means that traders have limited recourse in case of disputes or issues related to fund withdrawals. Historical compliance issues have been reported, including warnings from regulatory authorities in Canada, indicating that NovaTech is operating without the necessary licenses to offer trading services. This lack of regulation is a significant red flag for potential investors.

Company Background Investigation

NovaTech FX was founded by Cynthia Petion and Eddy Petion, who have previously been associated with AWS Mining, a company that has faced allegations of fraudulent activities. The company claims to provide a variety of trading services, including forex and cryptocurrency trading, but its ownership structure and management history raise concerns.

The leadership's previous involvement in a questionable business adds to the skepticism surrounding NovaTech FX. Transparency is essential for building trust, and the lack of detailed information about the company's operations and financial standing further complicates the trustworthiness of NovaTech. The companys website has also undergone domain changes, which is often a tactic used by fraudulent entities to evade scrutiny.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for assessing its reliability. NovaTech FX claims to provide competitive trading conditions; however, the lack of transparency in its fee structure raises concerns.

| Fee Type | NovaTech FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.2 pips | 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spread for major currency pairs at NovaTech is significantly higher than the industry average, which can erode potential profits for traders. Additionally, the absence of clear information regarding commission structures and overnight interest rates makes it difficult for traders to gauge the overall trading costs. This lack of clarity may indicate an attempt to obscure higher costs, which is a common tactic among less reputable brokers.

Client Fund Safety

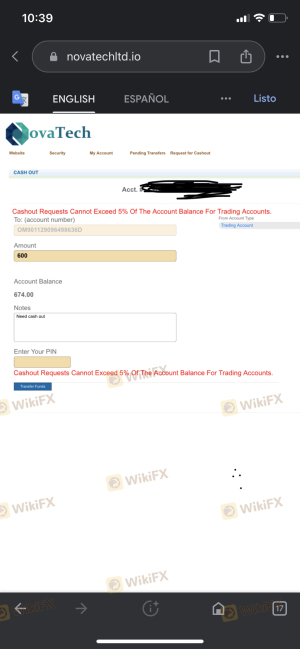

The safety of client funds is paramount when choosing a broker. NovaTech FX operates without regulatory oversight, which means that there are no guarantees related to fund protection. The company does not provide clear information on whether client funds are kept in segregated accounts, nor does it offer any investor protection schemes.

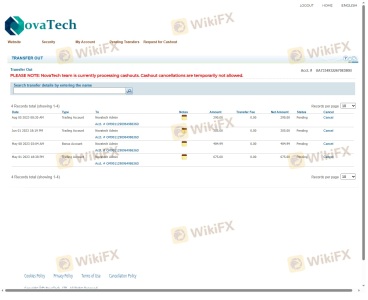

Historically, there have been complaints regarding fund withdrawal issues, with some users reporting difficulties in accessing their funds. The absence of negative balance protection is another significant concern, as it exposes traders to the risk of losing more than their initial investment. Overall, the lack of safety measures raises serious questions about the security of client funds at NovaTech FX.

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into the operational integrity of a broker. NovaTech FX has received numerous negative reviews, particularly concerning withdrawal issues and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

Common complaints include delayed withdrawals, unresponsive customer support, and issues with account access. Many users have reported that their funds were inaccessible, and attempts to contact customer service often went unanswered. These patterns of complaints suggest a troubling trend and indicate that the company may not prioritize customer satisfaction or support.

Platform and Execution

The trading platform provided by NovaTech FX is based on MetaTrader 5, a widely used trading software known for its advanced features. However, user experiences have reported issues with platform stability and execution quality.

Traders have raised concerns about order execution speed, slippage, and instances of rejected orders. Such performance issues can significantly impact trading outcomes, especially in fast-moving markets. The lack of transparency regarding potential platform manipulation further exacerbates these concerns.

Risk Assessment

Engaging with NovaTech FX involves several risks, particularly due to its unregulated status and the reported issues surrounding fund safety and customer service.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, increasing the risk of fraud. |

| Financial Risk | High | Potential for loss of funds without protection. |

| Operational Risk | Medium | Issues with platform stability and customer service. |

To mitigate these risks, it is advisable for potential traders to conduct thorough research, consider using demo accounts to test the platform, and only invest amounts they can afford to lose.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that NovaTech FX exhibits several characteristics commonly associated with scam brokers. The lack of regulation, historical compliance issues, high trading costs, and numerous customer complaints raise significant concerns about the legitimacy and safety of this broker.

Traders should exercise extreme caution when considering NovaTech FX for their trading activities. For those seeking reliable trading platforms, it may be prudent to explore alternatives that are well-regulated and have a proven track record of customer satisfaction. Reputable brokers typically offer transparent fee structures, robust customer support, and regulatory oversight, which are essential for a secure trading experience.

Is NovaTech a scam, or is it legit?

The latest exposure and evaluation content of NovaTech brokers.

NovaTech Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

NovaTech latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.