Citibank 2025 Review: Everything You Need to Know

Executive Summary

This detailed Citibank review looks at the banking giant's forex and brokerage services for 2025. Citibank is mainly known for its traditional banking services, but it also offers trading through its Citi Self Invest platform, which gives clients a unique way to combine their financial services. Data shows that Citibank has gathered over 34,550 reviews across different platforms. This indicates substantial market presence.

The bank stands out for its competitive commission structure and extensive ATM network. This makes it especially attractive for clients who prefer integrated banking and trading services. Our analysis reveals certain limits in transparency about specific trading conditions and regulatory details. Citibank's target customers are mainly individual and institutional clients seeking comprehensive financial service integration rather than specialized forex trading features.

While Citibank offers a broad range of financial services and products to consumers, corporations, governments, and institutions, its trading platform may not satisfy professional forex traders. These traders seek advanced tools and ultra-competitive spreads.

Important Disclaimer

This Citibank review is based on publicly available information, user feedback, and market analysis as of 2025. Citibank operates across multiple jurisdictions. Specific services, regulations, and conditions may vary significantly by region. Potential clients should verify current terms, regulatory status, and available services in their specific location before making any trading decisions.

The evaluation method uses user reviews from platforms like WalletHub, official company information, and independent market analysis. Given the limited specific information available about certain trading conditions, prospective users should contact Citibank directly for detailed trading specifications and current promotional offers.

Rating Framework

Broker Overview

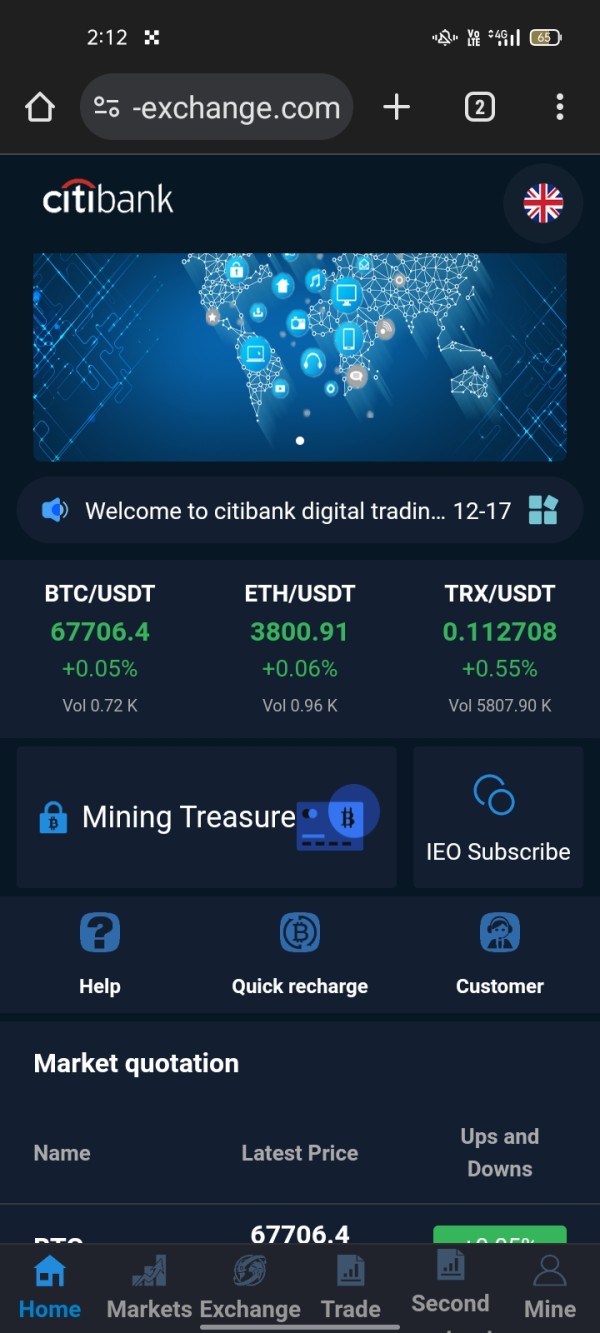

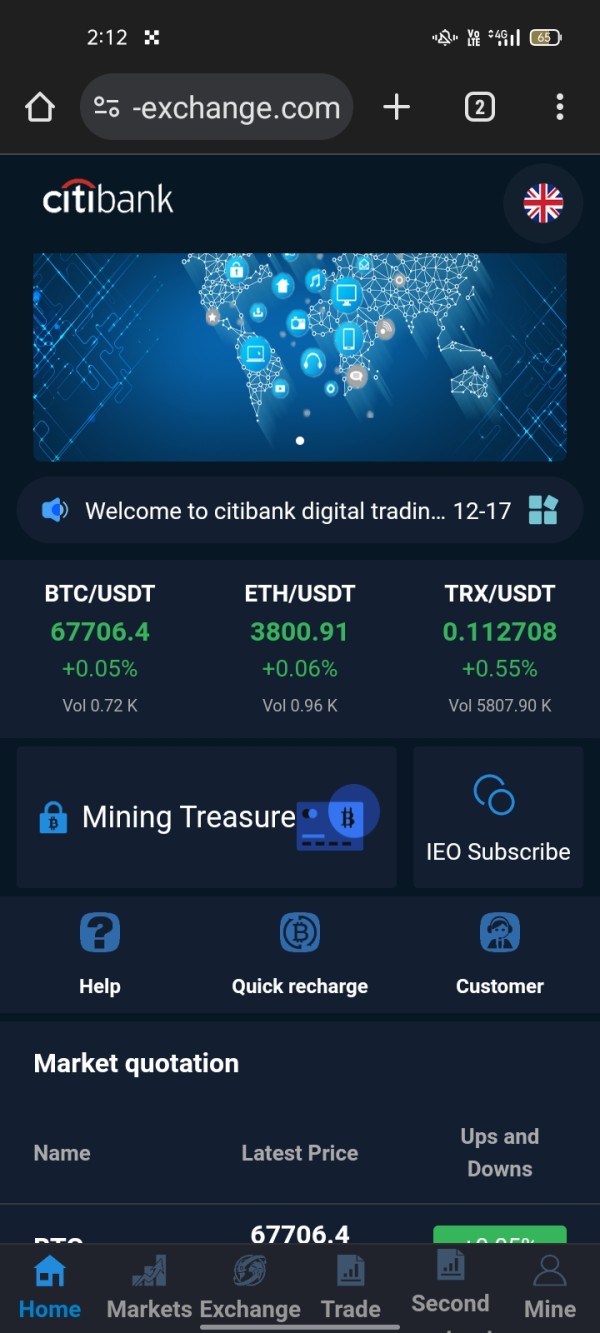

Citibank operates under the Citigroup umbrella and represents one of the world's largest financial institutions with a significant global presence. The company works tirelessly to provide consumers, corporations, governments, and institutions with a broad range of financial services and products. While primarily recognized for its retail banking services, credit cards, and corporate banking solutions, Citibank has expanded into brokerage services. This allows clients to access comprehensive financial management capabilities.

The institution's business model centers on providing integrated financial services. This allows clients to manage banking, investment, and trading activities within a single system. This approach particularly appeals to clients who value convenience and prefer consolidating their financial relationships with established institutions rather than specialized trading platforms.

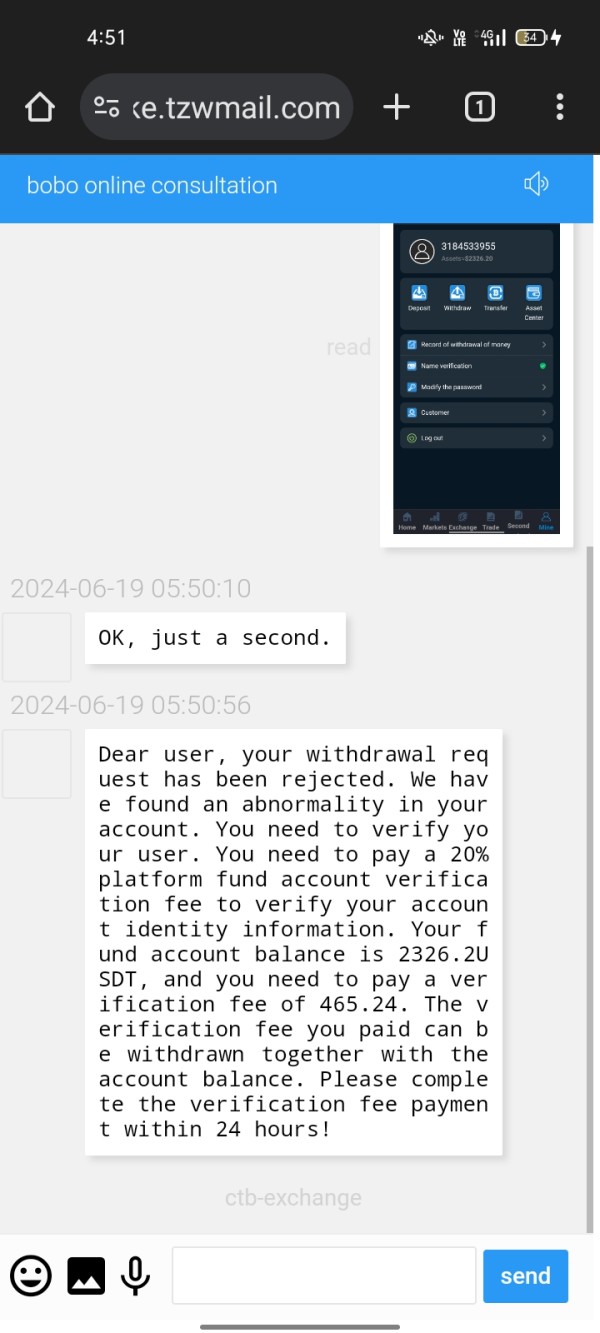

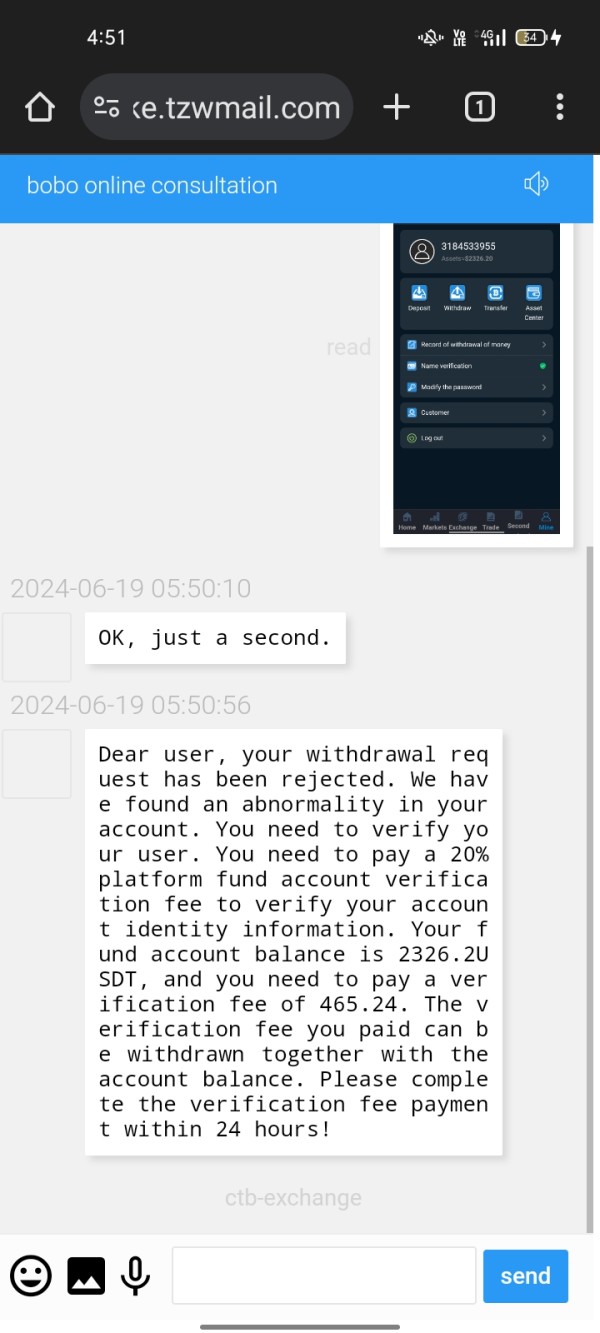

Citibank's trading services are delivered through the Citi E-Brokerage online trading platform, which provides access to various asset classes including stocks and ETFs. The platform is designed as part of Citibank's broader digital banking infrastructure. It offers integration with traditional banking services. However, specific details about regulatory oversight and licensing for trading services remain unclear in publicly available documentation. This may concern traders who prioritize regulatory transparency.

Regulatory Jurisdiction: Specific regulatory information for Citibank's trading services is not clearly detailed in available materials. This represents a significant information gap for potential traders.

Deposit and Withdrawal Methods: Concrete information about deposit and withdrawal options for trading accounts is not specified in current documentation.

Minimum Deposit Requirements: Minimum deposit amounts for opening trading accounts are not disclosed in available materials.

Promotional Offers: Current bonus structures or promotional campaigns are not detailed in accessible information.

Tradeable Assets: The platform provides access to stocks, ETFs, and other financial instruments through the Citi E-Brokerage system. However, the complete asset catalog requires further verification.

Cost Structure: Citibank advertises competitive commission rates for trading services. However, specific spreads, overnight fees, and detailed pricing structures are not transparently disclosed in readily available materials.

Leverage Ratios: Maximum leverage offerings and margin requirements are not specified in current documentation.

Platform Options: Primary trading access is provided through the Citi E-Brokerage online platform. It may include mobile application support.

Geographic Restrictions: Information about geographic service limitations is not detailed in available materials.

Customer Support Languages: Specific language support options for trading services are not clearly outlined in accessible documentation.

This Citibank review reveals significant information gaps in publicly available trading service details. These gaps may impact trader decision-making processes.

Comprehensive Rating Analysis

Account Conditions Analysis

Citibank's account structure reflects its position as a traditional banking institution moving into brokerage services. While the company advertises competitive commission rates, the lack of transparent information about account types, minimum deposits, and specific trading conditions creates uncertainty for potential clients. Unlike specialized forex brokers that typically offer multiple account tiers with clearly defined features, Citibank's approach appears more integrated with its broader banking services.

The account opening process likely follows traditional banking protocols. This may involve more extensive documentation and verification procedures compared to dedicated trading platforms. This could appeal to clients seeking institutional-grade oversight but may discourage traders looking for quick account activation. The absence of specialized trading account features such as Islamic accounts or professional trader classifications suggests Citibank targets mainstream retail investors rather than specialized forex trading communities.

Integration with existing Citibank banking services represents a potential advantage. This allows seamless fund transfers and consolidated financial management. However, this Citibank review identifies the need for greater transparency about trading-specific account conditions and requirements.

The Citi E-Brokerage platform serves as Citibank's primary trading interface, offering access to stocks, ETFs, and other financial instruments. As part of Citibank's digital infrastructure, the platform likely benefits from the institution's substantial technology investments and security protocols. However, detailed information about advanced trading tools, technical analysis capabilities, and research resources remains limited in available documentation.

Traditional banks entering the brokerage space often prioritize stability and security over advanced trading features. This may result in platforms that satisfy basic trading needs but lack sophisticated tools demanded by active traders. The integration with Citibank's broader financial services system could provide unique advantages, such as unified reporting and seamless account management across different financial products.

Educational resources and market analysis tools, common features among dedicated forex brokers, are not prominently highlighted in available materials. This suggests Citibank may focus more on execution services rather than trader education and market insights. This could potentially limit its appeal to novice traders seeking comprehensive learning resources.

Customer Service and Support Analysis

With over 34,550 reviews across various platforms, Citibank demonstrates substantial customer engagement. However, specific feedback about trading services quality remains unclear. Traditional banking institutions typically offer multiple customer service channels, including phone support, branch assistance, and online chat. This potentially provides more comprehensive support options than specialized online brokers.

The institutional nature of Citibank suggests established customer service protocols and escalation procedures. This could benefit clients experiencing complex issues. However, trading-specific support quality depends heavily on staff expertise in financial markets and platform functionality. These are areas where traditional banks may lack the specialization found at dedicated brokerage firms.

Response times, service quality metrics, and multilingual support capabilities for trading services are not detailed in available information. The integration of trading support with broader banking customer service could result in either enhanced comprehensive assistance or potential confusion when addressing specialized trading inquiries.

Trading Experience Analysis

The trading experience on Citibank's platform likely reflects the institution's emphasis on stability and security rather than cutting-edge trading features. Platform performance, order execution quality, and trading environment specifics are not detailed in available documentation. This makes it difficult to assess the actual trading experience quality.

Integration with Citibank's established technology infrastructure suggests reliable platform stability. However, execution speeds and order processing capabilities may not match specialized forex trading platforms optimized for high-frequency trading. The platform's design likely prioritizes ease of use for traditional banking customers rather than advanced functionality for professional traders.

Mobile trading capabilities, while not specifically detailed, would be expected given Citibank's comprehensive digital banking offerings. However, the sophistication of mobile trading tools and real-time market access features requires verification through direct platform evaluation.

This Citibank review indicates that while basic trading functionality appears available, advanced trading features and optimized execution may be limited compared to specialized forex brokers.

Trust and Regulation Analysis

The regulatory framework governing Citibank's trading services represents a significant concern in this evaluation. While Citibank operates as a major financial institution under various regulatory jurisdictions globally, specific oversight for its trading services is not clearly disclosed in available materials. This lack of transparency about trading-specific regulation could impact trader confidence, particularly among those prioritizing regulatory protection.

As a major banking institution, Citibank likely maintains substantial capital reserves and institutional safeguards. This potentially offers greater financial security than smaller specialized brokers. However, without clear disclosure of trading service regulation, client fund protection measures, and dispute resolution procedures, traders cannot fully assess the security of their trading capital.

The institution's broader reputation and established market presence provide some assurance. However, the absence of specific regulatory information for trading services represents a significant transparency gap that may concern risk-conscious traders.

User Experience Analysis

The overall user experience with Citibank's trading services appears to benefit from integration with the institution's broader digital banking infrastructure. Clients already familiar with Citibank's online banking interface may find the transition to trading services more intuitive. However, this advantage primarily applies to existing Citibank customers.

User feedback specific to trading services is not prominently featured in available reviews. This makes it difficult to assess satisfaction levels among active traders. The substantial review volume across various platforms suggests significant customer engagement. However, these likely encompass all Citibank services rather than trading-specific feedback.

Interface design, registration processes, and fund management procedures likely follow Citibank's established digital banking standards. This potentially offers a more polished experience than smaller brokers but possibly lacks the specialized features that active traders expect. The learning curve for new users may be influenced by their familiarity with traditional banking interfaces versus specialized trading platforms.

Conclusion

This Citibank review reveals an institution offering integrated financial services with trading capabilities that may appeal to clients seeking consolidated banking and investment management. While Citibank provides competitive commission structures and benefits from substantial institutional backing, significant information gaps about trading-specific conditions, regulatory oversight, and platform capabilities limit its appeal to serious forex traders.

The platform appears most suitable for existing Citibank customers seeking basic trading capabilities alongside traditional banking services. It is less suitable for dedicated forex traders requiring advanced tools, transparent pricing, and specialized market access. The lack of detailed regulatory information and trading-specific features suggests Citibank positions its trading services as supplementary offerings rather than core competitive products.

Primary advantages include institutional stability, potential service integration, and competitive commission structures. Notable limitations encompass limited transparency about trading conditions, unclear regulatory oversight, and absence of specialized forex trading features that characterize dedicated brokers in the market.