IMF Review 2025: Everything You Need to Know

Executive Summary

This imf review presents an analysis of the International Monetary Fund's Economic Review. The publication serves as the organization's official research journal, offering detailed coverage of global economic research, financial crisis analysis, and policy responses to economic challenges. Published by Palgrave Macmillan, the IMF Economic Review maintains a strict peer-review process and targets academics, policymakers, and financial professionals.

The publication focuses on critical areas including macroeconomic effects of financial crises, economic and financial spillovers, policy responses to crises, fiscal policy and stabilization measures, commodity price movement responses, and monetary and macroprudential policies. With its focus on data and high-level economic analysis, the journal provides valuable insights for understanding global economic trends. However, as an academic publication rather than a traditional financial services provider, specific information about trading conditions, user feedback, and operational details remains limited in available materials.

Important Notice

This evaluation is based on available information about the IMF Economic Review as an academic publication. Unlike traditional forex broker reviews, this assessment does not include user trading experiences, specific account conditions, or regulatory compliance data typically associated with financial service providers. The review method relies on publicly available information about the journal's scope, content, and academic positioning. Readers should note that this publication serves primarily educational and research purposes rather than direct trading services.

Rating Framework

Broker Overview

The IMF Economic Review represents the International Monetary Fund's official research publication. It focuses on high-level economic analysis and policy research, publishing articles that examine macroeconomic effects of financial crises, economic spillovers, and policy responses to various economic challenges. As a peer-reviewed academic journal, the publication maintains strict analytical standards and serves as a platform for sharing research on fiscal policy, stabilization measures, and monetary policies.

The journal's scope covers critical economic topics including policy responses to commodity price movements and macroprudential policy analysis. With its focus on data, the IMF Economic Review engages a broad audience spanning academic institutions and policy-making organizations. The publication's March 2025 issue, Volume 73, includes specialized content such as keynote speeches and analysis of sovereign borrowing costs and consequences. This demonstrates its commitment to addressing contemporary economic challenges.

However, specific information about trading platforms, asset classes, and regulatory oversight remains unavailable in the source materials. This is because the publication functions primarily as an academic research journal rather than a direct financial services provider.

Regulatory Regions: Source materials do not specify particular regulatory jurisdictions or oversight mechanisms for trading-related activities.

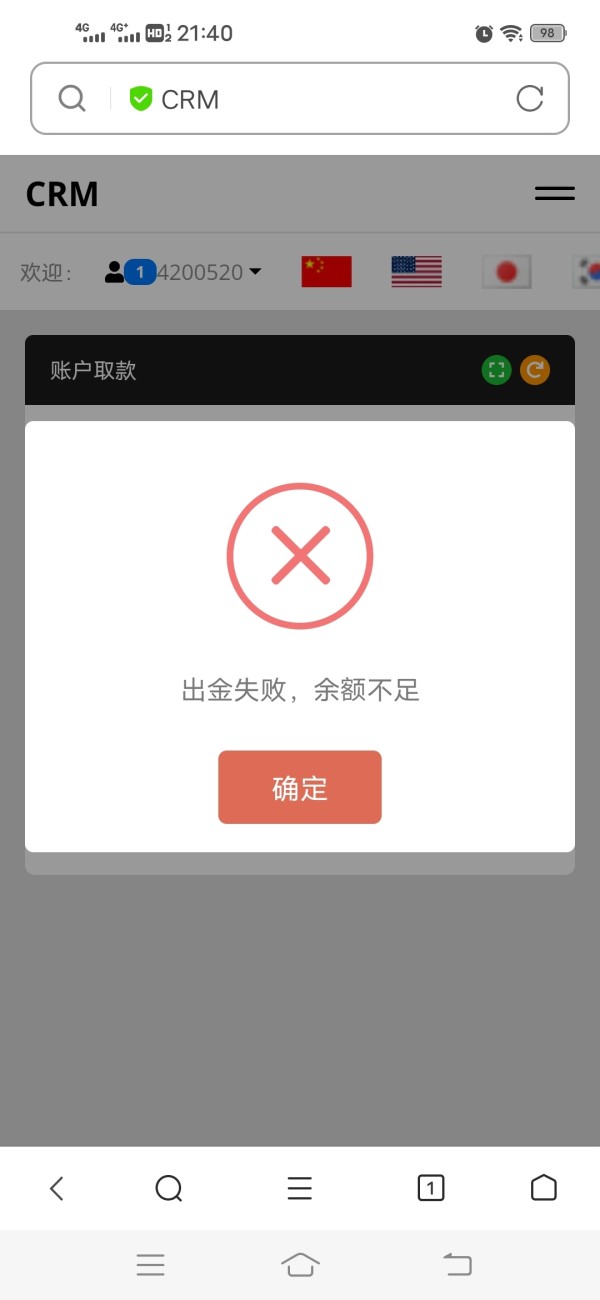

Deposit and Withdrawal Methods: No information about deposit or withdrawal methods is available in the provided materials.

Minimum Deposit Requirements: Specific minimum deposit requirements are not mentioned in available source documentation.

Bonuses and Promotions: The source materials contain no information about promotional offers or bonus structures.

Tradeable Assets: Available materials do not specify particular tradeable asset categories or investment instruments.

Cost Structure: Information about spreads, commissions, or fee structures is not provided in the source materials. This reflects the publication's academic rather than commercial nature.

Leverage Ratios: No leverage ratio information is available in the provided documentation.

Platform Options: Specific trading platform details are not mentioned in available source materials.

Regional Restrictions: The materials do not specify any geographical limitations or restrictions.

Customer Service Languages: Information about customer service language support is not available in the source materials.

This imf review highlights the limited availability of traditional broker-related information. It emphasizes the publication's academic focus rather than commercial trading services.

Detailed Rating Analysis

Account Conditions Analysis

The imf review reveals limited information about traditional account conditions typically associated with financial service providers. Source materials do not specify account types, opening procedures, or minimum balance requirements. This absence of conventional account structure information reflects the publication's academic orientation rather than commercial trading services.

Without specific account-related data in available materials, it becomes challenging to assess the accessibility and flexibility of potential user engagement options. The lack of information about account opening processes, verification requirements, or special account features suggests that the IMF Economic Review operates primarily as a research publication rather than a platform offering traditional financial accounts. The academic nature of the publication means that user engagement typically involves subscription access to research content rather than financial account management.

However, the absence of detailed operational information limits the ability to provide comprehensive analysis of user accessibility and engagement mechanisms.

Available source materials provide limited insight into specific tools and resources that might be accessible through the IMF Economic Review platform. The publication's focus on rigorous economic analysis suggests that research methods and analytical frameworks constitute primary resources, though specific details about research tools remain unspecified in available documentation. The journal's focus on data indicates that subscribers likely gain access to comprehensive economic data analysis and policy research findings.

However, information about educational resources, automated analysis tools, or interactive research platforms is not detailed in the source materials. Given the publication's academic positioning, resources likely emphasize scholarly research access rather than traditional trading tools. The absence of specific tool descriptions in available materials reflects the publication's research-focused mission rather than direct financial service provision.

Customer Service and Support Analysis

Source materials do not provide specific information about customer service channels, response times, or support quality measures. The absence of detailed customer service information in available documentation makes it difficult to assess the level of subscriber support or assistance mechanisms. Traditional customer service metrics such as availability hours, multilingual support, or response time standards are not specified in the provided materials.

This information gap reflects the publication's academic focus, where subscriber support likely differs significantly from commercial financial service customer care. Without specific customer service data, it remains unclear how subscriber inquiries, technical issues, or content access problems are addressed. The lack of detailed support information suggests that assistance mechanisms may follow academic publication standards rather than commercial service models.

Trading Experience Analysis

The imf review indicates that source materials contain no specific information about trading experience, platform stability, or order execution quality. This absence of trading-related data aligns with the publication's academic research focus rather than direct trading service provision. Traditional trading experience metrics such as platform speed, execution reliability, or mobile trading capabilities are not addressed in available materials.

The lack of user feedback about trading performance or technical functionality reflects the publication's scholarly orientation. Without specific trading experience data, assessment of user satisfaction with transactional capabilities remains impossible based on available source materials. The absence of trading-related information emphasizes the publication's role as a research resource rather than a trading platform.

Trust and Reliability Analysis

Available materials do not specify regulatory oversight, safety measures, or transparency mechanisms typically associated with financial service providers. The absence of detailed regulatory information in source documentation limits assessment of institutional credibility and oversight standards. Information about fund safety measures, regulatory compliance, or third-party auditing is not provided in available materials.

This information gap reflects the publication's academic nature, where trust factors may relate more to scholarly integrity than financial security. Without specific regulatory or safety information, evaluation of institutional reliability relies primarily on the IMF's established international reputation rather than detailed operational transparency data. The lack of specific trust-related metrics in available materials emphasizes the publication's research-focused mission.

User Experience Analysis

Source materials provide insufficient information about overall user satisfaction, interface design, or accessibility features. The absence of detailed user experience data makes it challenging to assess subscriber satisfaction levels or platform usability. Information about registration processes, content navigation, or user interface design is not specified in available documentation.

This information gap reflects the limited scope of available materials rather than comprehensive user experience analysis. Without specific user feedback or satisfaction metrics, assessment of overall user experience remains incomplete based on available source materials. The lack of detailed user experience information suggests that subscriber engagement follows academic publication models rather than commercial platform standards.

Conclusion

This imf review reveals that the IMF Economic Review serves primarily as an academic research publication focused on high-level economic analysis rather than a traditional financial services provider. The publication offers valuable scholarly content for academics and policymakers interested in macroeconomic research, policy analysis, and financial crisis studies. The main strength lies in the publication's academic credibility and comprehensive coverage of critical economic topics.

However, the absence of specific trading conditions, user feedback, and operational details reflects its research-oriented mission rather than commercial service provision. The publication appears most suitable for academic researchers, policy analysts, and professionals seeking rigorous economic research rather than direct trading services.