Binary Options Review 2025: Everything You Need to Know

Summary

The binary options trading landscape in 2025 remains a mixed bag, with numerous brokers offering varying levels of service, regulation, and user experience. While some platforms like IQ Option and Pocket Option are praised for their user-friendly interfaces and high potential returns, others face scrutiny due to regulatory concerns and user complaints regarding withdrawal issues. Key features include the availability of demo accounts, a wide range of assets, and the potential for high returns, but traders must navigate the risks associated with unregulated brokers.

Note: Its essential to consider that the regulatory environment can differ significantly across regions, making it vital for traders to choose brokers that comply with local laws and regulations.

Rating Box

How We Rate Brokers: Our ratings are based on comprehensive research, including user reviews, expert opinions, and factual data from multiple sources.

Broker Overview

Founded in the early 2010s, binary options trading has gained traction as a popular trading method. The platforms typically allow traders to speculate on the price movements of various assets, including currencies, commodities, and stocks. While many brokers offer proprietary platforms, some also provide access to established trading software like MT4 or MT5.

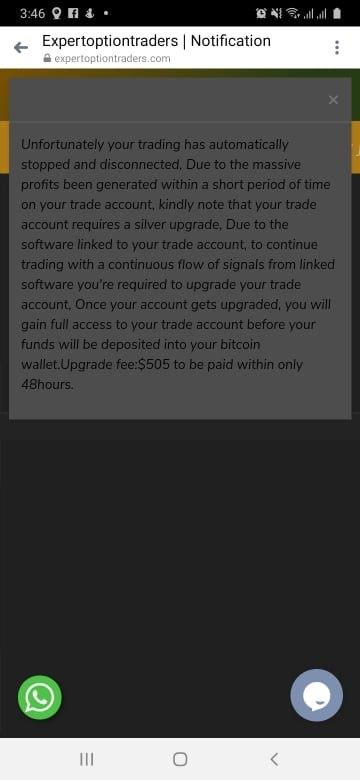

Regulatory oversight varies widely; while some brokers are regulated by authorities like the Cyprus Securities and Exchange Commission (CySEC) or the Financial Conduct Authority (FCA), many operate without any regulatory framework, raising concerns about their legitimacy and the safety of traders' funds.

Detailed Section

Regulated Regions

Binary options trading is largely unregulated in several countries, leading to a proliferation of unlicensed brokers. However, countries like the United States have strict regulations in place, with the Commodity Futures Trading Commission (CFTC) overseeing operations. In the EU, brokers must comply with regulations set by CySEC or the FCA to ensure fair trading practices.

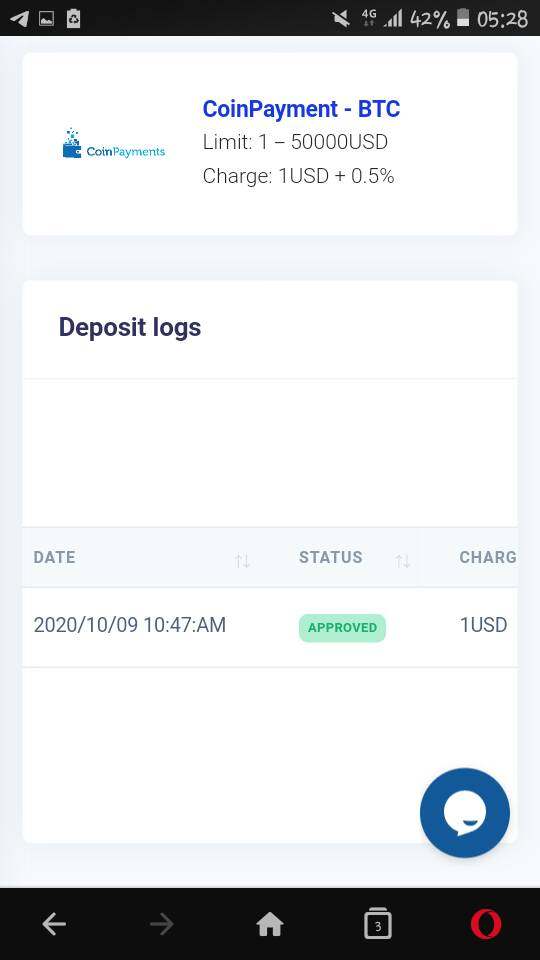

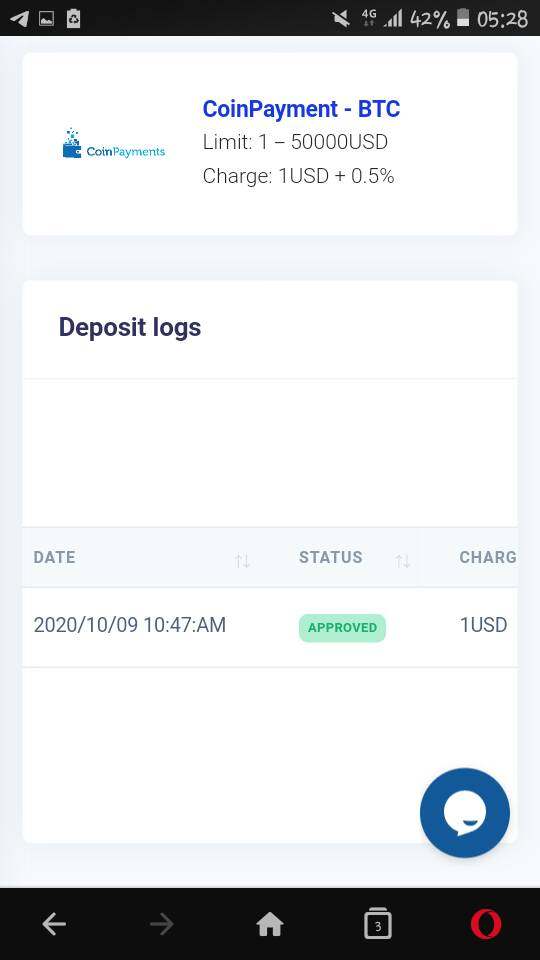

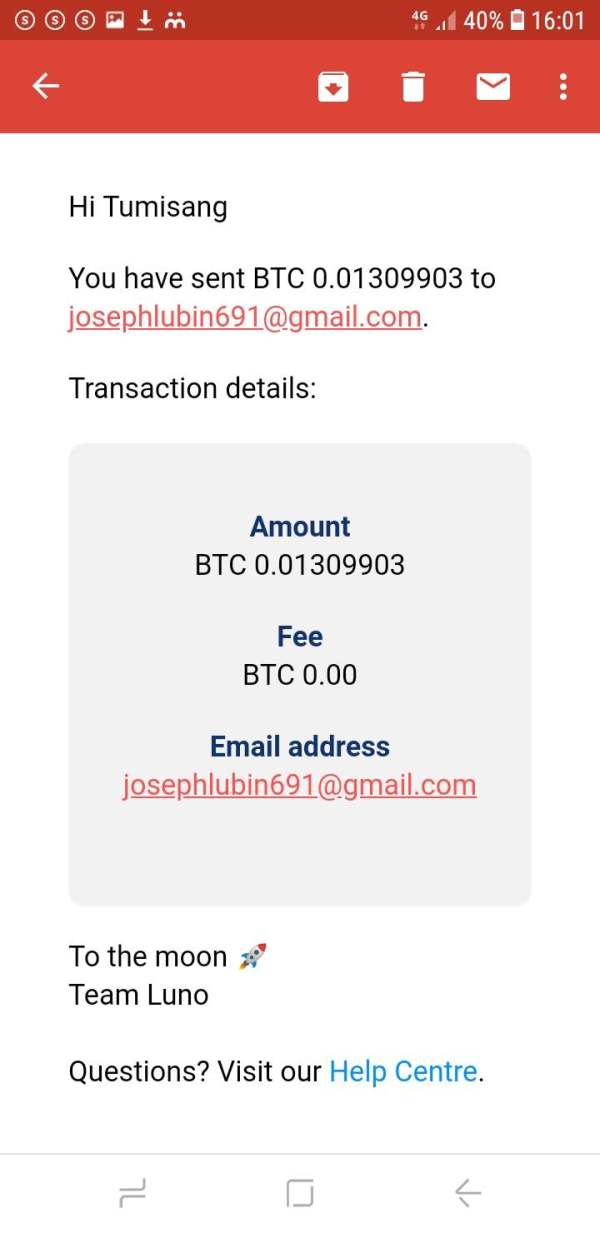

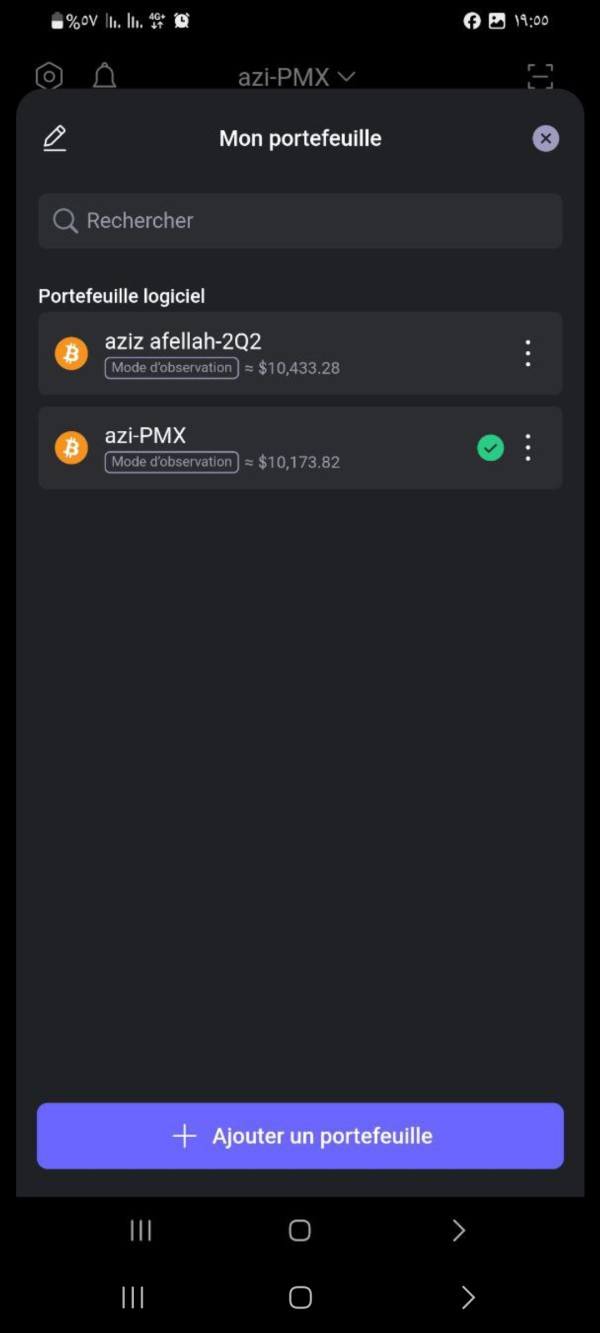

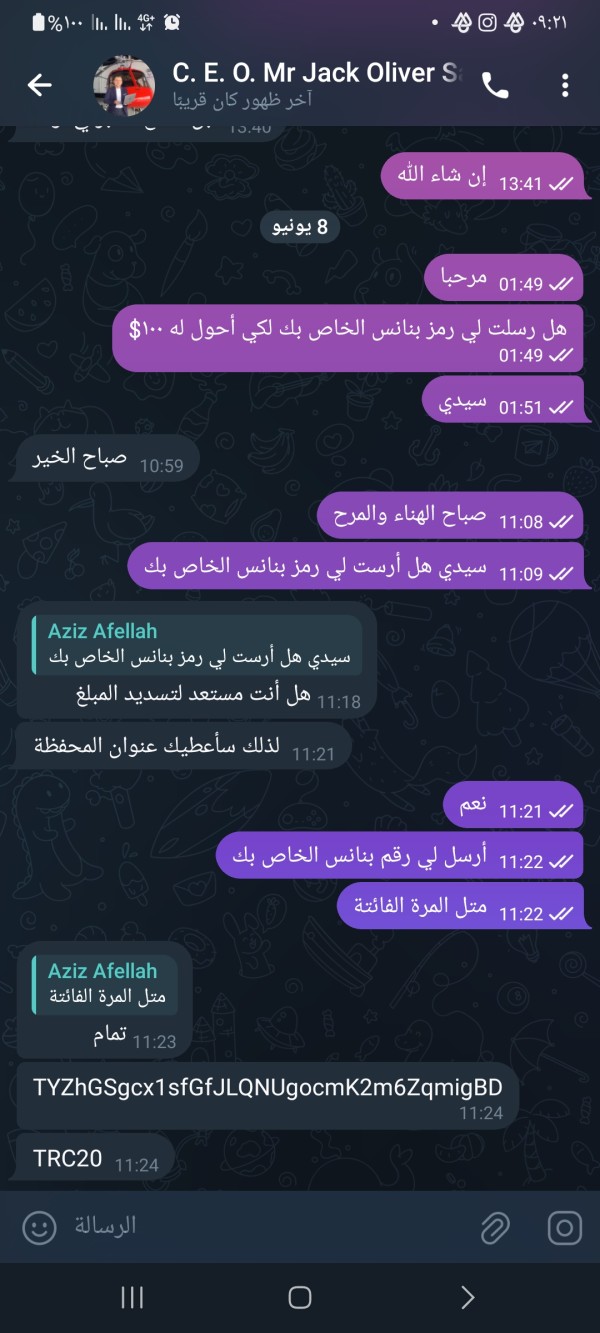

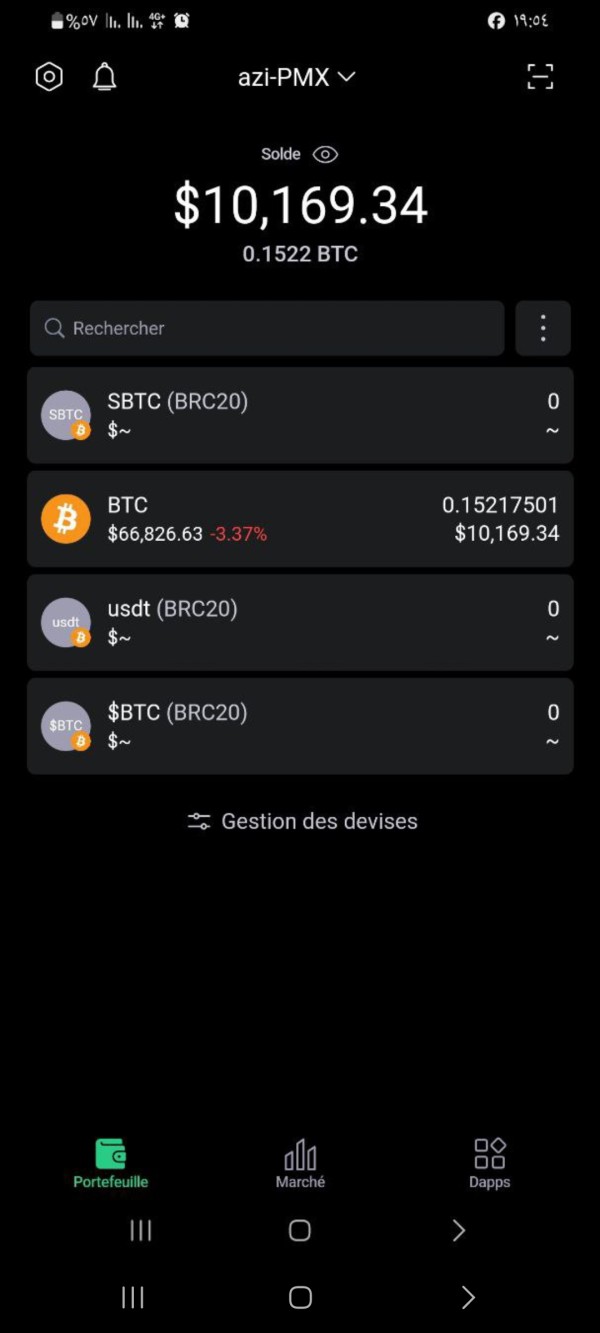

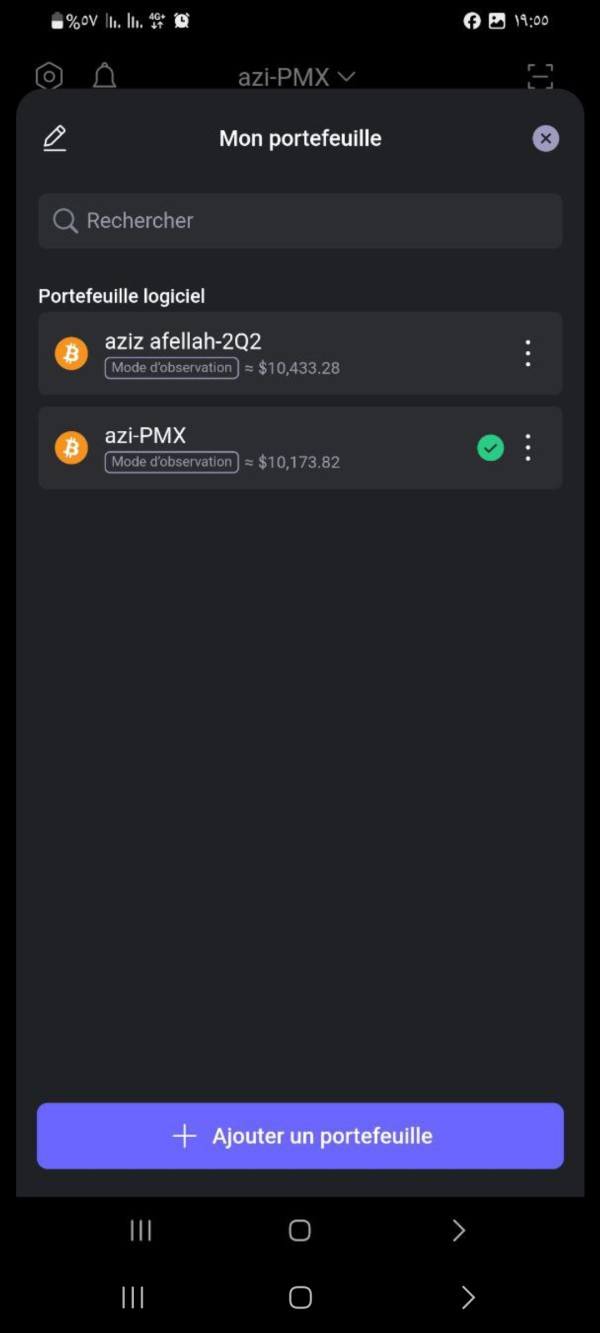

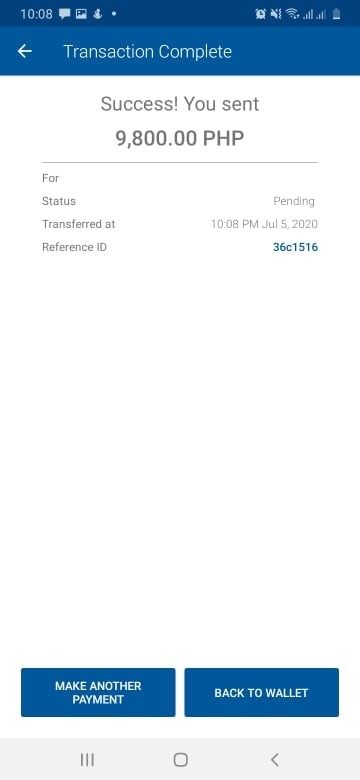

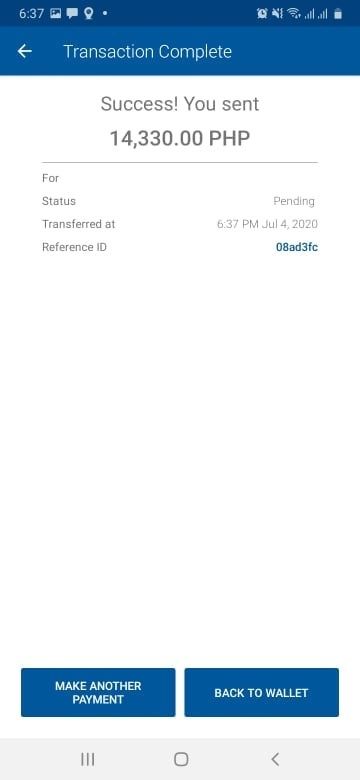

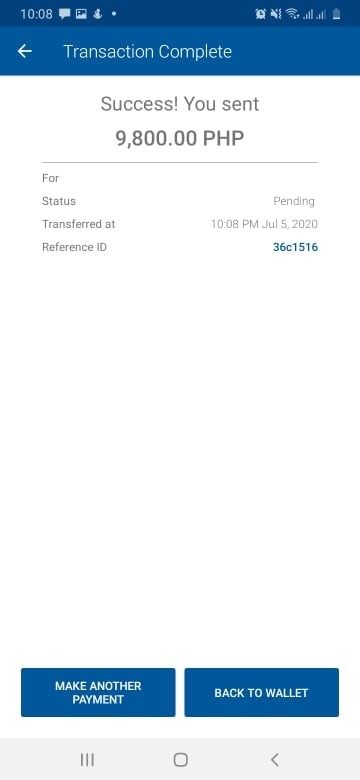

Deposit/Withdrawal Currencies/Cryptocurrencies

Most binary options brokers accept a range of currencies, including USD, EUR, and GBP. Some platforms are beginning to accept cryptocurrencies like Bitcoin for deposits and withdrawals, reflecting the growing trend in the financial markets.

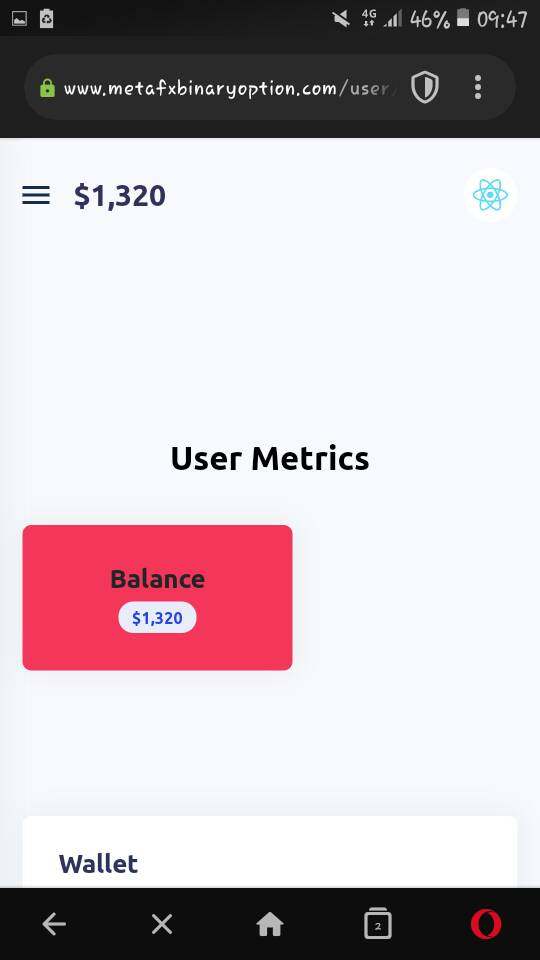

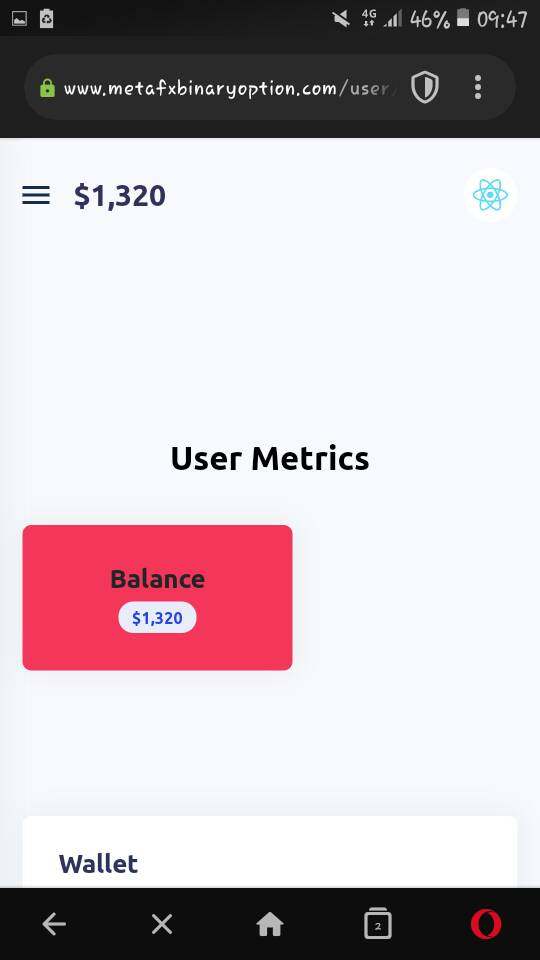

Minimum Deposit

Minimum deposits can vary significantly among brokers. Some platforms like Quotex allow entry with as little as $10, while others may require $250 or more. This variance can impact a trader's ability to start trading, especially for beginners.

Many brokers offer enticing bonuses to attract new clients. These can range from deposit matches to risk-free trades, but traders should read the fine print, as these bonuses often come with stringent withdrawal conditions.

Tradable Asset Categories

Binary options brokers typically provide access to a diverse range of assets, including forex pairs, commodities (like gold and oil), indices, and stocks. This variety allows traders to diversify their portfolios and manage risk more effectively.

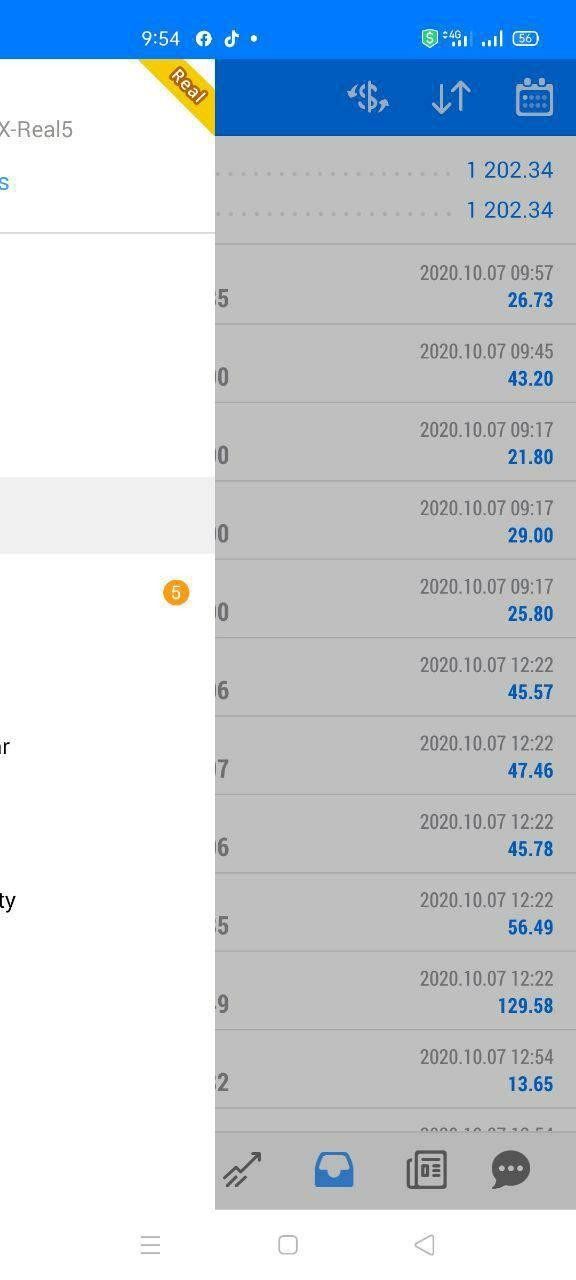

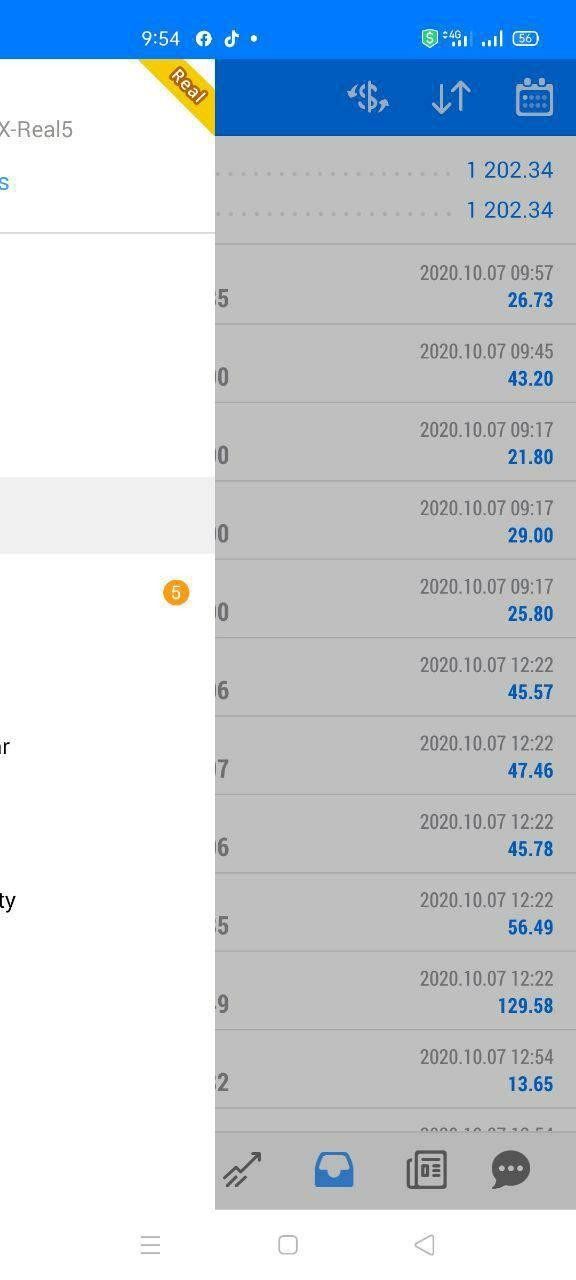

Costs (Spreads, Fees, Commissions)

Cost structures vary widely. Some brokers offer low spreads and no commissions, while others may charge fees for withdrawals or impose higher spreads. Understanding these costs is crucial for effective trading.

Leverage

Most binary options brokers do not offer leverage in the traditional sense, as trades are typically all-or-nothing propositions. However, some may allow traders to engage in leveraged trading on other instruments like CFDs.

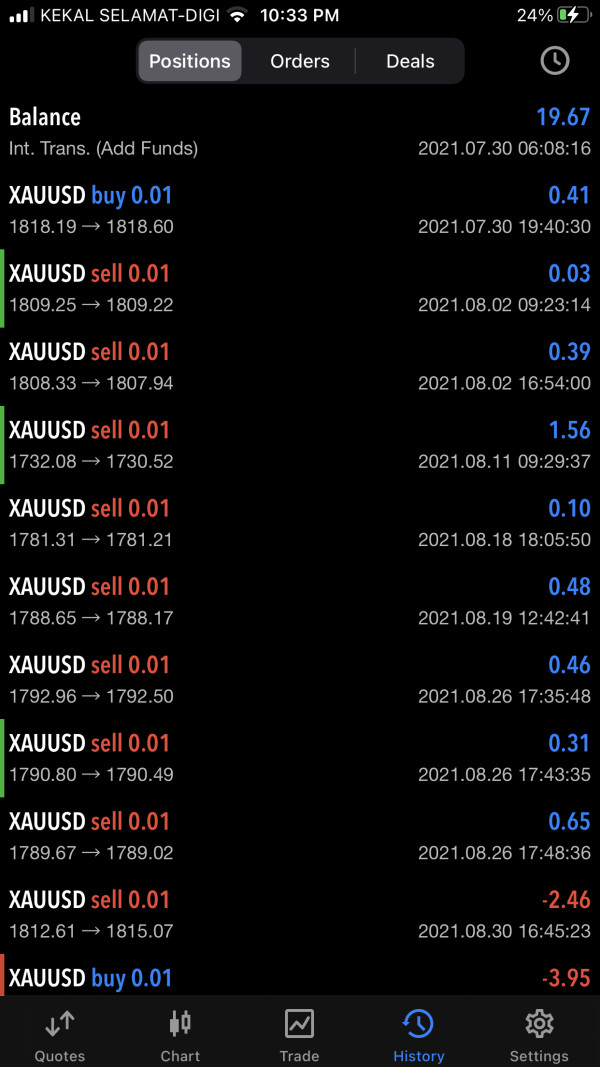

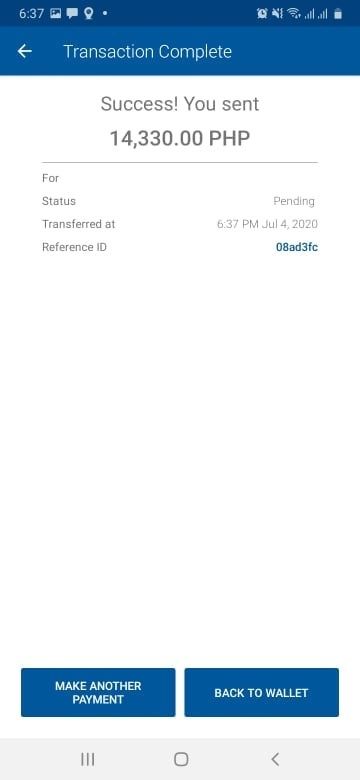

Many brokers provide proprietary trading platforms, while others offer access to established platforms like MT4 or MT5. The choice of platform can significantly affect the trading experience.

Restricted Regions

Certain brokers may restrict access to traders from specific countries, particularly those with stringent regulations on binary options trading. This is an important consideration for international traders.

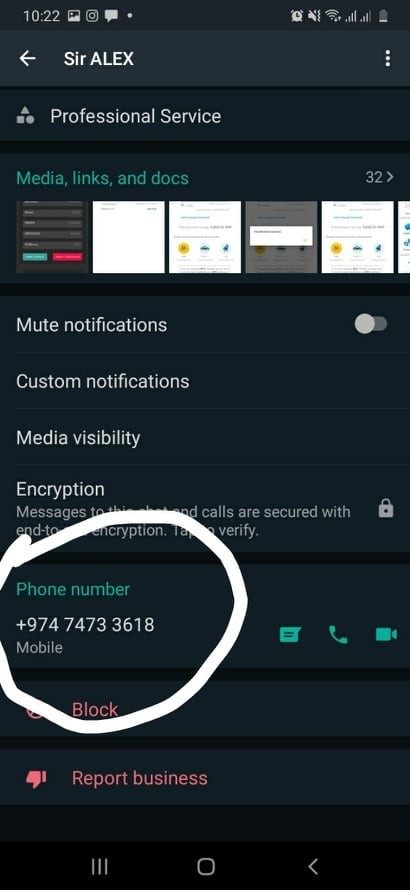

Available Customer Service Languages

Customer service is a critical aspect of any trading platform. Most brokers offer support in English, but many also provide services in other languages, catering to a global audience.

Repeated Rating Box

Detailed Breakdown Section

Account Conditions

Most brokers provide a range of account types, allowing traders to choose based on their experience level and investment capacity. For instance, platforms like IQ Option offer demo accounts with virtual funds, which are beneficial for beginners. According to Traders Union, this feature allows users to practice without financial risk.

The availability of educational resources varies by broker. Some, like Olymp Trade, provide comprehensive tutorials and market analysis tools, while others may offer minimal support. As noted in Public Finance International, traders should seek brokers that prioritize education to enhance their trading skills.

Customer Service and Support

Customer service is often a pain point for many traders. Reviews indicate that while some brokers offer responsive support, others may have long wait times or limited availability. According to Investopedia, effective customer support can significantly enhance user experience.

Trading Setup (Experience)

The trading experience can differ based on the platform's design and functionality. Brokers like Pocket Option are praised for their intuitive interfaces, while others may have clunky systems that hinder trading efficiency. As highlighted in Forex Consulting, a smooth trading experience can lead to better trading outcomes.

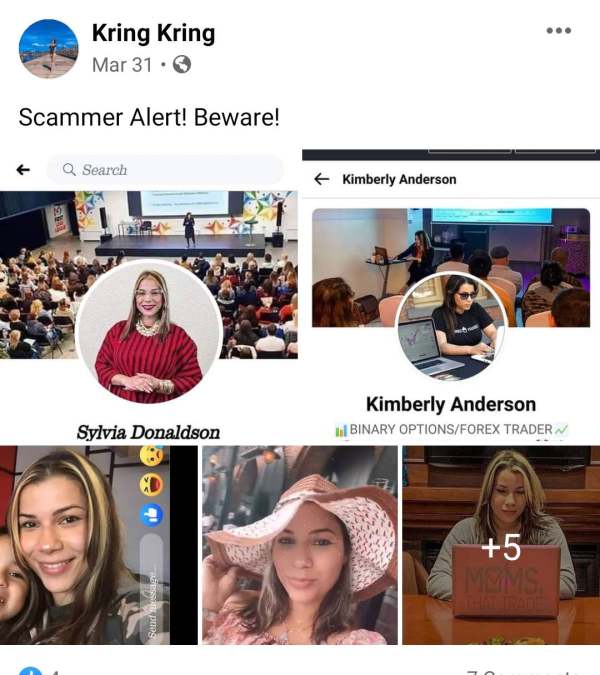

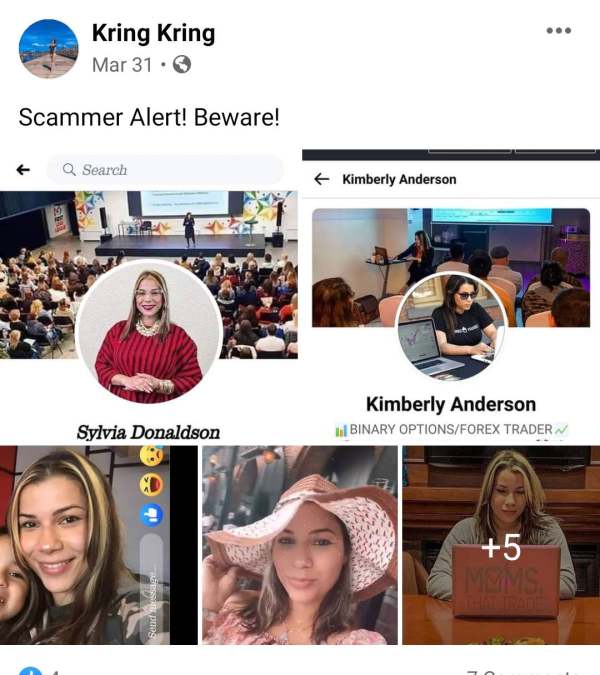

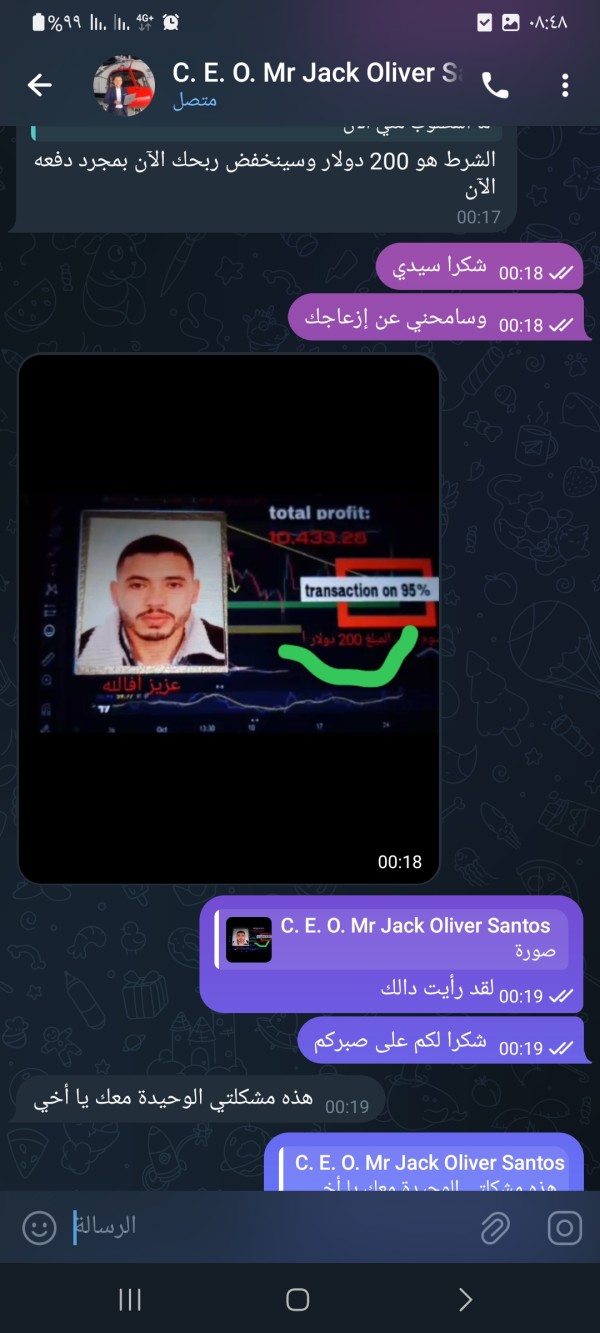

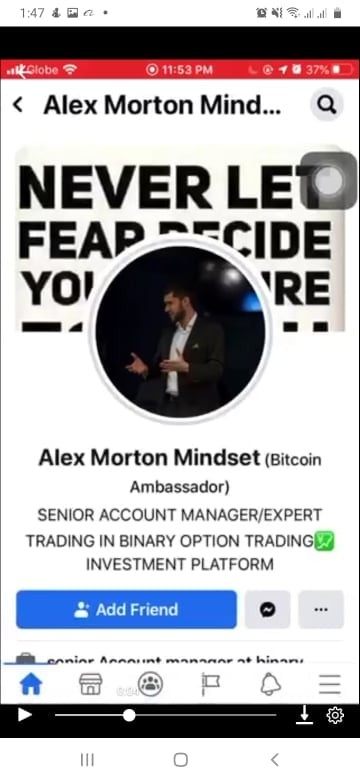

Trustworthiness

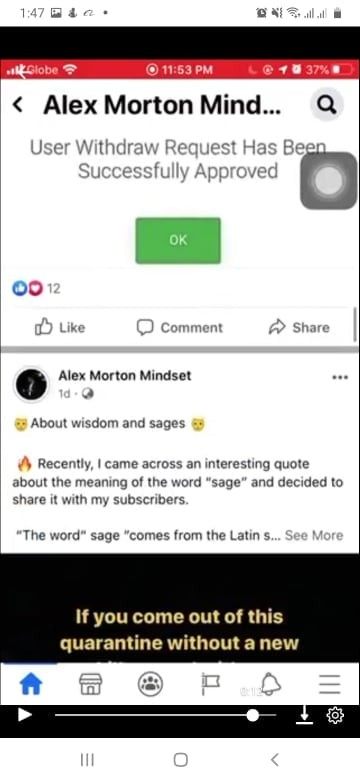

Trustworthiness remains a significant concern, especially with many brokers operating without regulation. As outlined in Trading Masters, traders should conduct thorough research and select brokers with a positive reputation and regulatory oversight.

User Experience

User experience is influenced by several factors, including platform usability, customer service, and educational resources. According to Public Finance International, a positive user experience can lead to more successful trading outcomes.

(Optional) Educational Resources

Educational resources are crucial for both novice and experienced traders. Brokers offering comprehensive training materials can help users navigate the complexities of binary options trading more effectively.

In summary, while binary options trading presents opportunities for high returns, it also involves significant risks. Traders must conduct thorough research, choose regulated brokers, and understand the intricacies of the trading environment to ensure a safer trading experience.